with 🎙️ Antoine Walter, Podcaster in Chief at GF Piping Systems – happy to share the Water Industry Insights he collected for you over the past 6 months!

💧 19 guests shared 1’114 minutes of Wisdom in this Season 4. I dived a bit deeper into 17 of these learnings to add my pinch of salt!

Infographic: 17 Decisive Water Industry Insights

17-Decisive-Water-Industry-InsightsTable of contents

- Infographic: 17 Decisive Water Industry Insights

- 17 Decisive Truths that could change the Water Industry’s Path

- #1 – We are building New York every month between now and 2050

- #2 – The Water Industry underuses one of its most powerful tools: Hydraulic Modeling

- #3 – PFAS are a 110€/Year Health Cost for each Human on Earth

- #4 – There’s a 4th phase of Water, and the Water Industry could leverage it

- #5 – SuperCritical Water Oxidation: the Future of Wastewater Treatment?

- #6 – There are 6 Strong Drivers for Water Sector Growth in Sub-Saharan Africa

- Depriving people from Safe Drinking Water is an economical non-sense

- 1. There’s a Win-Win in ramping up the Water Infrastructure

- 2. Urbanization is galloping in the region

- 3. Industrialization creates new Water needs

- 4. Water regulations are strengthening

- 5. Demographics (more people need more water and better treatments)

- 6. Rising GDP means more money to invest in Water Management

- Depriving people from Safe Drinking Water is an economical non-sense

- #7 – Water can belong to strange market players

- #8 – Are UV Disinfection Systems at Regulatory Risk?

- #9 – There are billions of Water Assets that could reveal much about our Water Behavior

- #10 – Green Algae could disrupt Activated Sludge Wastewater Treatment (for the better)

- #11 – You can Cut Water Treatment Costs with Expensive Materials

- #12 – Groundwater Trading could preserve the resource and increase its Yield

- #13 – Green Hydrogen is not a game-changing opportunity for the Water Industry

- #14 – Industrial Wastewater gets (astoundingly too often) still incinerated!

- #15 – New Business Models open New Water Opportunities

- #16 – Specialized Water SaaS can outperform horizontal behemoths (here’s why)

- What’s in it for you: why shall you subscribe to the podcast right now?

- #17 – 2023 will be a Crucial Year for Water

- Other Episodes:

17 Decisive Truths that could change the Water Industry’s Path

These are computer-generated, so expect some typos 🙂

Let’s jump straight into it, with a first element which was actually shared twice on that microphone by Aaron Tartakovsky and Ramzi Bouzerda.

#1 – We are building New York every month between now and 2050

I guess you get the Idea: the World is urbanizing fast, and when I say fast, we have this impressive pace, of Manhattan or New York being built every month from now to 2050 or 2060.

So we get the image, and I’ll fact-check it in a minute; to get a very clear idea of what we’re discussing here.

Why does that insight matter for the Water Industry?

You might be wondering: why shall we care, as the Water Industry, about this urbanization pace? Well, in the end, it’s an infrastructure question.

Our water infrastructure is designed for a certain amount of people living in certain places. The water network is designed that way, and the water and wastewater treatment plants are designed that way.

So, if suddenly we have new skyscrapers and a denser settlement in those exact same cities, or if we start to have large amounts of urban dwellers like that’s often the case in the developing world, it creates a new burden on that infrastructure.

This leaves us with roughly two choices:

Solution 1: Rebuild our Water Infrastructure

We could dig out that said existing infrastructure and rebuild it larger. That would work, but it would also be very expensive.

Solution 2: Supplement our Water Infrastructure

We could supplement and augment that infrastructure with decentralized solutions across the cities, in industrial parks, and in all new build areas.

And we could also use process intensification to turn our treatment infrastructure into stronger powerhouses within the same surface and often the same concrete tanks.

What is the best solution for the Water Sector?

You might have guessed from the way I just explained that, but there’s one option that sounds more appealing than the other, both in terms of costs and efficiency. So, we’ll probably see an increased distributed (slash) decentralized approach on the road towards 2050 or 2060, so the horizon Ramzi and Aaron were giving us.

Are we building Manhattan or New York?

So, that’s why we shall matter as water professionals, but now, beyond the strong image both shared, what’s the exact fact-checked figure you shall use to shine during your next dinner in town?

The united nations project a growth in urban population, which shall reach 68% of the World’s population by 2050. One century before, in 1950, about 750 million people were living in cities, while currently, there are about 4.2 billion people in those cities. So six times more, and 55% of humanity.

Most of the projected growth to go from 55 to 68% over the next 30 years will be concentrated in three countries: India, China, and Nigeria.

And maybe even more important when it comes to infrastructure, the fastest-growing agglomerations are cities with fewer than 1 million inhabitants. Why does that matter? Well, simply because while the design margin on urban networks in big cities might be able to absorb a little increase, that’s clearly not possible if you’re doubling the dimension of a mid-sized agglomeration.

But you might be wondering: are we talking of one Manhattan a month, or rather one New York City? Well, the united nations don’t go to that figurative analogy, so I had to dig a bit further.

Every mention I found online always linked back to Aaron and Epic Cleantec, one way or the other. Kudos, Aaron; it’s good to see the Water Industry figuring its communication right!

The back-of-the-envelope calculation to estimate the rate at which the World is Building

So I tried to do the maths myself, and if we take the UN figure of 2.5 billion more people living in cities by 2050, divide it by the roughly 350 months between now and 2050, that makes for monthly growth of 7 million urban inhabitants.

Manhattan is about 1.6 million habitants, and New York, 8.5. So, I’d say that Ramzi’s analogy sounds a bit closer to the actual number. Yet there would be a lot to factor in, such as the decrease in population in places like eastern Europe or Japan, and the impossibility to take a building in Tokyo or Warsaw and transfer it to Lagos or Delhi.

So if anyone has a better study than my back-of-the-envelope calculation, I’d be very curious; please reach out to me!

That leads me to my learning number two, shared by Luke Butler on that microphone.

#2 – The Water Industry underuses one of its most powerful tools: Hydraulic Modeling

Let’s face it: while almost everyone has a hydraulic model of the water network we were discussing with this urbanization element, almost no-one uses it to its real potential today.

Actually, we’ve just assumed that we’ll need to revamp our infrastructure if more people live in cities. But what if that was simply wrong? What if there was untapped potential just because we don’t use the right tool to look for more, inside what’s existing?

We discussed on this microphone a while ago, how digitization could find up to 80% untapped potential in water and wastewater treatment plants. That was back in season 1, and is still as accurate as it was by then.

But this presence of untapped potential is also very true on networks, as we’ve covered with Olivier Narbey from the notorious GF Piping System on that microphone by Season 3.

Simple actions at decisive stages can ignite tremendous benefits for our Water Networks

I was discussing with Olivier a couple of days ago, and he shared with me a figure that showed how you could reduce burst rates by as much as 75% on your water network by just better-balancing pressure.

If you bear in mind that the world loses an estimated 136 trillion liters of water every year in non-revenue Water, aka, most of the time, leaks, you get why this is particularly interesting.

You can act on it today, and reach out to Luke or Olivier to hear their solutions, or you can have a look at the Webcast, Olivier has been putting together with his team.

Now if you like numbers, let’s continue with my next learning, and we’re leaving water networks to now explore water and wastewater treatments to discuss the hot topic of PFAS.

#3 – PFAS are a 110€/Year Health Cost for each Human on Earth

You maybe remember that number, that Henrik Hagemann shared with us:

Actually, further studies in the US tended to similar results, with an estimated impact on health costs of about 37 to 59 billion dollars.

This is very interesting because that’s a bit what Alice Schmidt explained on that microphone a while ago: we’re no longer talking of the cost of remediation, but rather of avoided cost if we correct the problem.

PFAS Removal is cheaper than the cost of inaction

We all know that most PFAS removal technologies nowadays are still quite young and that the limited places around the World that actually decided to tackle the problem, offer so far a limited path to scale.

So, to be blunt, removing PFAS today is expensive. But what these studies show is that not removing those forever chemicals is even more costly. Is it about time to act?

Well, even more, if you consider that the studies I just cited all add two points to that reflection.

The PFAS Challenge will keep increasing

First, the benefits of PFAS use are quite concentrated in a few hands. But, the societal cost of their impact is nicely diluted and externalized among individuals, communities, and governments. Which is quite unfair, to use an understatement.

The second point, is that all of this is the estimated cost today. But we’re talking of long-term consequences, and we’re probably still underestimating this long-term effect.

So, with regulations starting to pop up left and right, like the recent move in California, I’d say, that’s for sure a topic to closely monitor as water professionals in the months and years to come.

And honestly, you can count on me for exactly that – if you’re reading this by coincidence, consider subscribing to the podcast, so you won’t miss the next releases (remember, it’s free).

#4 – There’s a 4th phase of Water, and the Water Industry could leverage it

For my fourth learning, I’ll take the most outside-of-the-box discussion I had on that microphone in this Season four, and it’s all about four, with the Fourth Phase of Water, Gerald Pollack introduced to us.

How can I synthesize all of this in a few words? Well, there’s a list of behaviors of Water, which are hardly explained with what we all commonly know of H2O.

Why is ice slippery? Why do waves persist over long distances? How do diaper hold 50 times their weight in Water? Why does warm Water freeze faster than cold Water? And why can you build a tiny water bridge between two glasses? Why do droplets of Water exist in Water?

And actually, all of that may have a simple explanation which, according to Ockham’s razor’s principle, tends to indicate, that’s the right one. And that explanation is, that there is a fourth phase of Water, somehow between liquid and solid, a semi-crystalline one, which could be named H3O2.

What shall you know about this Fourth Phase of Water?

That fourth phase would form at the interfaces of liquid Water, in what Gerald calls exclusion zones.

I won’t redo you the deep dive of how Gerald and his team came to the observation and explanation of that fourth phase, I’ll just give you two hot prospects for us, water professionals, to maybe leverage this EZ Water’s properties.

Two properties that could be appealing for the Water Industry

The first one, is everything around a water battery, and the potential low-tech application it could represent, with only Water, sunlight and simple apparatus around it.

But probably even more sexy, if you allow me that term, the property of exclusion zones to actually exclude everything that’s not Water from them, could be leveraged for desalination purposes. Gerald’s team works on it within Fourth Phase incorporated and triggered several additional start-ups around the World that actually look at it.

And at least from an intellectual exercise point of view, exploring that rabbit hole was pretty fascinating – and I’m still on the edge of it, as next steps would involve exploring the likes of Schauberger, Derjagin, or Steiner.

I’m not saying everything those people have written is right – and there’s a good proportion that’s a bit esoteric. But I think it’s always good to stay open-minded in such a field as Water.

That was learning number four and involved the fourth phase of Water. So guess what learning number five will be all about? Exactly, the fifth phase of Water.

Ok, nobody calls it like that, so let’s use the name you probably already heard: supercritical Water.

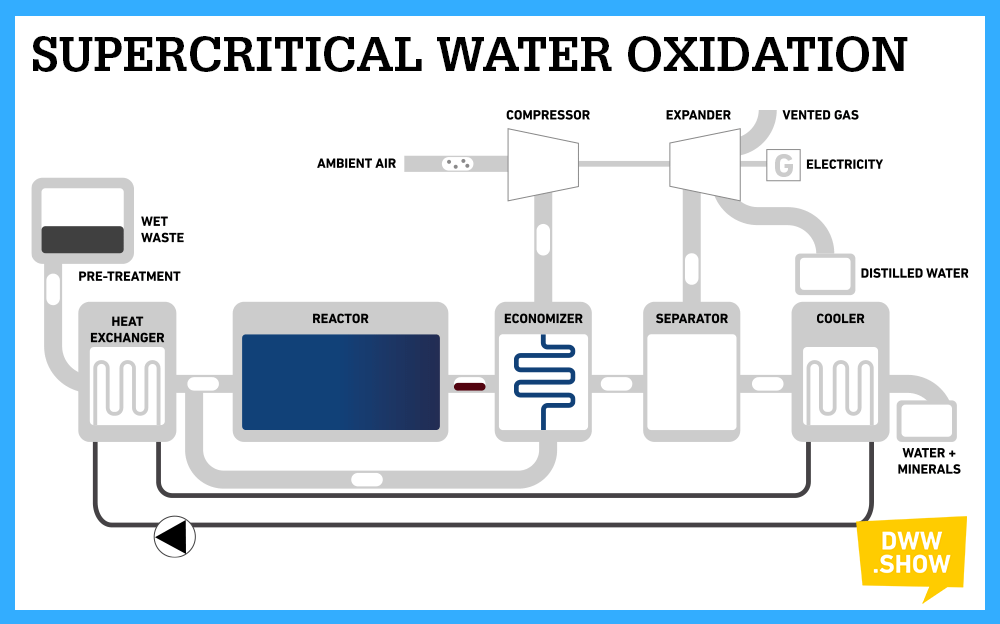

#5 – SuperCritical Water Oxidation: the Future of Wastewater Treatment?

Water reaches its critical point at 374 degrees celsius, and 221 bar. And whenever it crosses that point, it starts to behave weirdly, as Kobe Nagar shared on that microphone

Supercritical water oxidation is indeed a very promising prospect to remove hard-to-treat pollutants from Water.

But if you ask me, there’s something much more interesting about the technology: it allows to tap into the chemical energy trapped in wastewater.

Unleashing Wastewater’s Energy

There’s actually a direct correlation between the chemical oxygen demand of wastewater, and the energy it contains. Theoretically, there’s 16.1 kilo Joule per gram of COD.

Now so far, it’s been a riddle for us, water professionals, to unleash this energy. And instead of turning wastewater treatment into an energy positive process, we’re wasting energy on it, to destroy that trapped energy which we call pollution.

Don’t get me wrong; it is pollution. But, it is pollution with potential!

A potential supercritical oxidation would allow tackling into, a bit like microbial fuel cells and microbial electrolysis cells we’ve discussed in Season 1 and 2.

SuperCritical Water Oxidation 101 (made even easier)

How does that translate into concrete steps? Well, when you pass wastewater through the supercritical oxidation reactor, the reaction it triggers is exothermic.

So, you capture a portion of the chemical energy of wastewater as heat, which you can turn into electricity by operating your supercritical oxidation plant as a thermic power plant.

Of course, there are technical limits today. Treating wastewater at nearly 400 degrees Celsius and over 221 bars is a challenge, which involves a bit more complications than stating the physical principle in a podcast.

But as Kobe reminded us in our deep dive on the technology, that’s still lower values than what you would find in diesel engines that equip a good portion of the cars you cross in the streets.

SCWO is still in its early steps

Another limit is that today, like with the microbial fuel cells and electrolysis cells I mentioned before, we would first aim at being energy neutral. So, the power plant element of it is still theoretical, and the seven times more energy inside wastewater than the energy needed to depollute that wastewater only exists on paper and chemical calculations so far.

Yet, that’s a common trait of all technologies in their early steps. Go compare an iPhone before it had numbers, fresh out of the hands of Steve Jobs in 2007 with the no-name cheap smartphone we all have in our pockets today, that’s more powerful than NASA’s computers that brought men on the moon, and it’s night and day.

And beyond the energetical aspect of it, Supercritical Water Oxidation comes with another incredible feature: the entire treatment involves a residence time of… four seconds. So, there’s a CAPEX benefit as well, as it involves much much much smaller facilities.

In a nutshell, yes, Supercritical Water Oxidation or SCWO is still in baby pants. But there’s a reason why 374Water has a half a billion market capitalization, with only a few references.

#6 – There are 6 Strong Drivers for Water Sector Growth in Sub-Saharan Africa

That leads us already to learning number six, and I’ll keep the trend of having corresponding insights with Walid Khoury’s six strong drivers for growth in Sub-Saharan Africa.

That is really a potent take-home message he shared: whatever preconceived idea you have of Africa, it’s probably wrong. Not fully wrong because, yes, it is scattered and politically challenging.

But still, Africa is an interesting market to look at as water professionals.

Indeed, it is starting from a quite low infrastructure level.

- Only 42% of the population is served with safely managed Water,

- 23% with safely managed sanitation,

- and only 7% with at least secondary wastewater treatment.

If we forget the consequences of this low infrastructure level, this shows in marketing terms a broad business opportunity. It is not sustainable to deprive populations of their right to affordable and safe Water. And – that’s a spoiler for Season 5 – as Christopher Gasson will share on that microphone, it is not profitable either.

Depriving people from Safe Drinking Water is an economical non-sense

Let me make it even more blunt and direct. Regardless of how much of a shame it is, that by 2022 we still have such a low level of access to safe drinking water, it is an economic non-sense. So:

1. There’s a Win-Win in ramping up the Water Infrastructure

The benefit is clear, and hence so is the win-win to find there as the Water Industry.

You already know the second driver, Walid shared, which is the urbanization rate in the region.

2. Urbanization is galloping in the region

Remember what I said minutes ago: this New York we’re building every month between now and 2050 will mostly happen in three countries, China, India, and Nigeria. And as much as I recall, Nigeria is in Sub-Saharan Africa.

3. Industrialization creates new Water needs

First, for good and bad reasons, sub-Saharan Africa was ahead of the World regarding relative industrial independence. The World somehow refused to play with Africa as a full-blown player in the global value chain, and as a consequence, its industry is less specialized and more generalist.

Now, when you couple that with a localization drive, that means that a full ecosystem is feeding the growth of the area, with also very specific needs. And it’s really not only multinationals playing there, it’s a local foodchain with a lot of young companies. And you would have guessed, they need Water to operate, which is where it connects with our Industry.

That also leads us to the fourth driver:

4. Water regulations are strengthening

Increasing and strengthening water discharge, water treatment, and water management regulations are being rolled out. Because industrials are not that different in sub-Saharan Africa compared with the rest of the World! If you don’t push them a bit, well, treating Water sustainably is a cost to be in business, at least in the short term. Hence the importance of the incentive.

5. Demographics (more people need more water and better treatments)

That’s at the same time a driver and a challenge, but sub-Saharan Africa’s population will double in the next 30 years. And it will triple before the end of this century. And unless we find a way for people to live without Water, directly and indirectly, that’s an obvious driver.

6. Rising GDP means more money to invest in Water Management

Sub-Saharan Africa is rising in terms of GDP by about 4% a year, which as Walid shared, means higher prosperity and disposable income. Again, probably against our western preconceptions.

What shall we do with these six drivers? Well, for Walid it’s straightforward. Multinationals are reluctant to enter that market for the reasons which are on the other side of the same coin, meaning, the political instability and the scattered nature of the market.

But that should not prevent more agile players, like start-ups and SMEs, from striving in that region.

#7 – Water can belong to strange market players

Let’s switch to learning number seven, and I promise you I’ll go a bit faster on the next ones – remember, if you want the long-form of it, there are 19 other episodes in this Season 4 which are full of gems; just jump into it.

So number seven: Water doesn’t always belong to the ones you’d expect, as Scott Hamilton revealed

A Canadian pension fund owns 200 billion water liters in Australia

Indeed, Canada’s Public Sector Pension Investment Board (PSP Investments), which is the pension fund for the country’s armed forces, public servants, police, and firefighters, now owns roughly 2% of all the Murray-Darling Basin’s available water rights.

To put that into perspective, we’re talking here of over 200 billion liters of Water, on a market that’s quite special: it is an awesome playground for water trading and arbitrage, with ever-increasing valuations.

But don’t worry, you can leverage that trend even if you don’t sit in Australia – and don’t take me wrong, I’m not implying you should.

Why can you? Well first, because everybody can play on the Australian market, as you’ve seen with that Canadian pension fund. Then also, because Australia is not alone on that path.

Harvard’s endowment fund massively invests in Water

Ever heard of the tiny little university of Harvard? Well, like most of the universities, it features an endowment fund. You can donate to the foundation, deduct it from your taxes, and that money will, for instance, fund scholarships. But not only.

Harvard’s endowment fund has a nice 39 billion dollars to play with and uses at least a portion of it to invest… in Water! That’s how the university’s fund has been buying vineyards in California, maybe for their grape and wine production, but also, if not above all, for the water rights they feature.

Will that end up fully turning Water into a commodity? That’s the golden ticket question. But there might be interesting new ways to explore there, and you’ll see by Season 5 with Katrina Donaghy, that those new ways don’t only exist on paper but are currently rolled out.

#8 – Are UV Disinfection Systems at Regulatory Risk?

A 2.6 billion dollars a year water industry segment might well quite soon be in trouble. UV Disinfection is indeed the second largest disinfection technology after Chlorine, it’s nicely spread across Water and wastewater treatment, and it’s a dominant solution in market verticals like ballast water treatment or water reuse.

But, UV disinfection system have a problem, and it’s their lamps.

The mercury of mercury-vapor UV Lamps could soon be banned

Here’s the problem, as Wayne Byrne highlights, UV disinfection features Mercury Vapor lamps. That use of mercury in light sources, which is a hazardous substance, is restrained by multiple regulations Wayne just cited, such as the EU RoHS directive for electrical and electronic equipment, as well as similar regulations in a growing number of countries and regions like for instance the UN Minamata Convention.

In simple words, mercury is only allowed in special applications under special exemptions. So far, the Water Industry is one of these exemptions because it struggled to find an efficient alternative to mercury vapor lamps.

But that might be history, with UV LED and its continuous improvement, following Haitz’s law. So for sure, that’s an area to watch in the next months and years!

Let’s switch to the rapid-fire learnings for the next six ones.

#9 – There are billions of Water Assets that could reveal much about our Water Behavior

There are at least 36 billion water assets beyond the Water Meter, which can deliver meaningful data that are not captured today. If you combine this with the fact Ramzi Bouzerda shared on that microphone, that Water takes suddenly much more value around its point of use; that opens interesting avenues for optimization and new business approaches.

#10 – Green Algae could disrupt Activated Sludge Wastewater Treatment (for the better)

You might have fought green algae in your wastewater plant for a while, yet Cesar Narvaez shared how it could improve the energetical balance of sewage treatment by one to one replacing activated sludge. One step further, if you turn these green algae into biogas, you can make your entire process carbon negative and potentially energy neutral.

By the way, green algae is a hot topic that may lead to bioplastic and large scale applications in brine treatments – I’m looking for a speaker to address that point on my microphone, if you’re that person or if you know someone, just reach out to me: I’d be pleased to feature you!

#11 – You can Cut Water Treatment Costs with Expensive Materials

The intuitive approach to reducing the overall cost of a water system is quite logically to cut the material expenses. Well, Sebastian Andreassen shared with us how he did the exact opposite, by leveraging a very expensive material – silicon carbide – to replace polymeric membranes for the better.

Beyond just the case of membrane treatments, it’s an interesting tip from an innovation perspective. That’s a bit of a mix of two strategies Fridolin Beisert shares in his “Creative Strategies” book: shifting perspectives and pattern breaking. And if you want a refresher on Design Thinking, go back to Season 3 and listen to my discussion with Lea Im Obersteg.

#12 – Groundwater Trading could preserve the resource and increase its Yield

Groundwater was the theme of this year’s World Water Day. It is a sadly depleting resource, which is often seen as something free you can just pump out of the soil, and screw your neighbors and future generations. Well, to try to solve this, California adopted the Sustainable Groundwater Management Act in 2014 – don’t worry, it’s still not enforced.

But that regulation could finally see a roll-out of groundwater tariffs and prices. That would be a first best practice. But Ellen Bruno and her team went the extra mile and studied how to even improve it. They found out that groundwater trading may result in increased prices by 70% in those areas that would already feature a tariff.

And yet, as it would incentivize Water to flow to its best use, it could still save water-scarce areas like California half a billion dollars per year.

#13 – Green Hydrogen is not a game-changing opportunity for the Water Industry

Green Hydrogen won’t be the tailwind in our water sails that we sometimes dream of. It will be an interesting side-business for the water industry, but not a tidal wave. The biggest impact will probably reside in desertic countries with an ocean to the west and will be an opportunity for the desalination players, that could see their installed base jump by a 25% factor.

I’m not going too deep in this recap on that topic, because with the full trilogy we just concluded, you have plenty of materials to explore – including a massive 19 pages infographic.

#14 – Industrial Wastewater gets (astoundingly too often) still incinerated!

Despite technological advances and sustainability concerns, there’s still an alarmingly high amount of industrial wastewater that gets incinerated. It’s the kind of thing one can rationalize and understand, as industrials hence control their liabilities. But, on-site treatments often cost a fraction of incineration, and under new business model approaches, they offer similar control of those liabilities to these industrial actors.

So it might be about time to stop seeing these trucks on the roads, just conveying something that doesn’t burn easily to places sufficiently far away to not be in an industrial’s backyard anymore.

And that leads us to number fifteen:

#15 – New Business Models open New Water Opportunities

Do you remember how the Water Industry likes acronyms? Well, we’ve lived for a while in a world of DB – Design, Build, DBO – Design, Build, Operate, and BOT – Build, Operate, Transfer.

And if you remember Season 3, we’ve seen how Design, Build approaches offer a 39% average capital saving over the traditional three-step approach of someone designs, someone bids, and hopefully then only builds.

When you add operation into the pot, so you turn DB into DBO, you add an additional 26% saving on the overall plant’s life cycle cost.

Now, what we see more and more is a growing share of PPPs in the Water Industry. That’s Private-Public Partnerships. This deal structure enables faster roll out of infrastructure by leveraging private capital, and is extensively used these days in countries like Brazil or Saudi Arabia.

If you’re afraid of acronyms, you should take a paracetamol tab, because there are new kids on the block.

After DB, DBO, BOT, or PPP, here come DBFOM and WaaS!

Software has SaaS, you know, Software as a Service. Well, the Water Industry has WaaS! Water as a Service – which also works with Wastewater treatment as a Service.

Along the same lines, we have DBFOM, Design, Build, Finance, Operate & Maintain, and many, many shades of grey in between.

But in concrete terms, what does that change for the Water Industry? Well, it might be a path to faster innovation, as we heard from Jonathan Rhone or Steven De Laet in this Season, and from Matthew Silver for instance in Season 2. Indeed, a company can assume the risk of rolling out its technology. And at the same time, the end-user controls its liability to reuse the point I made a minute ago on industrial wastewater management.

For suppliers, it brings back arguments of total lifetime cost or total cost of ownership. Because now, the integrator bringing a process to life is also responsible for its operation and directly benefits from a first-time-right or quality approach.

Digitization is an enabler for new Business Models

And overall, it uses digitization as an enabler, something we’ve seen with Jacob Bossaer in Season 2 and with Jonathan and Steven in this Season 4. Remote operation, preventive maintenance, all these buzzwords now become realities under the new realm of a new buzzword: Water as a Service.

#16 – Specialized Water SaaS can outperform horizontal behemoths (here’s why)

We have two learnings left, and for this number sixteen, we’ll stay on this WaaS or SaaS trend to underline how against all the odds, there is a tremendous win-win business opportunity for specialized vertical SaaS in industries like the Water Sector.

That’s an insight David Lynch shared with us this season and that I wanted to dig a bit further. David builds with Klir, something he calls the operating system for Water.

Honestly, Klir is very successful with that approach. But why? Why does the Water Industry prefer Klir over ASANA, Rippling or Monday.com. Is it an exception?

How do vertical SaaS companies specialized in an Industry compete with very powerful giants?

Well first, no. Vertical SaaS companies, so software as a service companies that address one specific industry, are quite successful these days. Think of Doctolib for healthcare, Toast for restaurants, or Procore for construction. All of those became multi-billion companies.

And that’s the path Klir, and the other digital water companies I had the pleasure to host on that microphone are following to gain a share of the expected 20 billion dollars digital water market by 2030.

So, if this is not an exception, it leaves us with three questions. Question number one:

1. Why are vertical water industry SaaS superior?

How do they compare to horizontal ones that could go across many sectors and leverage scale effects?

Well first, for a simple reason. They have the potential to deliver a superior product, with features really catered to the water industry. It also offers them a higher market penetration potential – what David just underlined with his aim at becoming the Water Operating System.

And a higher penetration opens doors for further expansion of the business model, as a SaaS-enabled marketplace.

That’s important because the limit of the vertical approach is the market size. The path to scale for ASANA when they roll out a feature is much easier than for Klir, Kando, or Qatium. But if now, our water specialists can enlarge the deal size, it compensates for that disadvantage.

Water SaaS companies also have the edge over generalists in terms of sales. Your acquisition team can develop catered content and approaches in a Water World that’s arguably a unique beast.

So, on the product and go-to-market side of things, it sounds like our vertical Water SaaS stands a chance against the horizontal behemoths.

2. Why is “Now” the best moment to be in the Water Business?

But question number two: why now, why would they be successful today, and start making a dent in the Water Industry when they kind of struggled in the past years to do so?

There as well, the answer is straightforward. CoVid just leap-frogged our path towards digital transformation. And the “why now” question rather transforms into a “why didn’t we do it before” one!

The other aspect is that money also starts to flow into those companies. Klir, for instance, just raised 16 million dollars. In the past, investors were a bit reluctant because of the limited total addressable market, but that’s history now that the “Operating System” argument beats that concern.

So that leads us to the golden third question:

3. What does it take to be successful in building a Water Industry vertical SaaS?

Ok, let’s be humble here; I’m no one to have the golden recipe. But I’ll still try to nail it down to what I’ve observed working among my previous guests.

First, you still need to think of your Total Addressable Market. So your long-term game must be to offer more than just a piece of software. You must embed yourself on the critical path of your users and build upon that once you’re installed.

Therefore, think of your positioning as well. To start with, you must build upon a brick that’s just too good to be ignored. For Qatium, that’s the modeling of a water network in a couple of clicks. For Transcend, it’s the design of a full plant in a matter of seconds. And flor Klir, it’s breaking down any stupidly annoying process in simple, actionable tasks.

As cool as those are, they’re not sufficient to build a long-term successful company; that’s why all of these companies have roadmaps. But these features are solid foundation stones to build upon.

The next asset you need is a strong “why now.” For Qatium again, that could be like urbanization is galloping, and your investment sheet goes through the roof. Right now, you have an opportunity to better the picture thanks to digitization, but you have to act now.

Who makes for the best water entrepreneurs?

And then honestly, there’s the part where I’m not sure. Some of the panel companies I looked at are built by people that come from another industry, so is that a criterion to challenge everything? But at the same time, we also have examples of water professionals scratching their own itches and hence building an appealing Water SaaS.

So I’d say the critical trait here is rather open-mindedness and willingness to challenge the status quo.

I told you, I’m no one to have the best recipe, so let’s say we’ll have to keep on improving the algorithm in the next seasons!

What’s in it for you: why shall you subscribe to the podcast right now?

Just before we move to our learning number seventeen, which will close this summary, let me remind you of some housekeeping.

If you like what you’ve been reading so far, please share that episode around you, grab the phone of your friends and subscribe them to the podcast.

Why should you? Well, because the growth of this show enables me to keep attracting incredible guests. That’s how we’ll kick-off Season 5 next week with Reinhard Hübner, the CEO of the Water Company of the Year, aka SKion Water. That’s also how we’ll continue the week after with the Water Industry’s Godfather, namely Christopher Gasson, the Owner of Global Water Intelligence.

There will be many more incredible guests in that Season 5, and hopefully the next ones as well. And that’s how I can extract for you valuable insights and learnings from all these fantastic speakers.

So you see that as a team effort, and please again, share this episode around you. (and that being said, let’s swiftly conclude with learning number seventeen!)

#17 – 2023 will be a Crucial Year for Water

… And this for a simple reason: it will be the year of the UN Water Decade Conference.

Why so? And why does something happening in 2023 matter right now? Well, Mina Gulli makes it crystal clear:

We have an opportunity at that time to say: “enough talk,now act!”. And the only way that that will happen is if we spend the next 18 months moving together in a unified way to deliver on these three solutions. And to say by the time we hit the steps of that United nations, where that conference is going to happen with world leaders and corporate leaders from across the world, by the time we get there, there must be no option, but to take meaningful, serious, bold action forward.

Mina Gulli

I think she said it all, so enough talk, now act.

And I’ll see you next week for the first episode of Season 5.