with 🎙️ Christopher Gasson – Owner of Global Water Intelligence and authority on water finance and markets

💧 Global Water Intelligence is the leading publisher and events organizer serving the international water industry.

What we covered:

💰 How there are two international things in water: money and technology.

👬 How taking off Global Water Intelligence involved focusing on those two ends of the market

🤑 How still, it is quite controversial to associate water and money (and why it is not a positive sign)

🤪 How people associate a list of terrible mental models to that very water-finance link

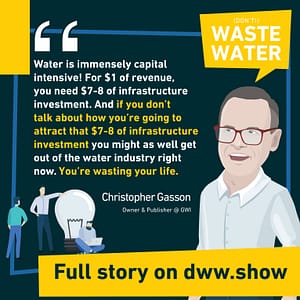

💧 How water is capital intensive, and how much you’ll have to invest to get $1 of revenue

☠️ How this water industry feature leads to innovation inhibition and major hurdles for water entrepreneurs

🤯 What drives utilities in their infrastructure investment approach

😕 Why SDG 6 targets are stranded for exactly this same missing link between water and finance

🤝 How we shall tell the World about water’s profitability (and try to shine the right light on sanitation to make it look the same)

🍏 How the ESG investment wave can be a blessing, assuming we create the opportunities for ESG money to finance the right projects

🧱 The challenges utilities have to overcome, so finance trust them and bets on their future development plans

💧 How it is about time to connect the dots in the scattered water industry to power a triple win

🍎 How a whole load of people talks about saving the world while skipping the thing which really matters: the money to save it

🍎 How climate change brings a third international compound in water

⭕ How describing water consumers as stakeholders is wrong (and why)

💸 How the link between money and water can be proven by the absurd, whenever you deprive the latter of the former

📗 How GWI was a 162-subscriber struggling magazine 20 years ago, how it evolved into today’s world reference, and what that changes and enables

👏 Predicting the future and how it’s impossible, being catastrophically wrong, needing the sound of two hands clapping to be successful, the SUEZ-Veolia drama, desalination… and much more!

🔥 … and of course, we concluded with the 𝙧𝙖𝙥𝙞𝙙 𝙛𝙞𝙧𝙚 𝙦𝙪𝙚𝙨𝙩𝙞𝙤𝙣𝙨 🔥

Teaser: Global Water Business Blocks

Resources:

🔗 Have a look at Global Water Intelligence’s website

🔗 Come say hi to Christopher on Linkedin

is on Linkedin ➡️

Infographic: Global Water Business Blocks

Infographic-Christopher-Gasson-Global-Water-IntelligenceQuotes: Global Water Intelligence

Quotes-Christopher-Gasson-Global-Water-IntelligenceTable of contents

- What we covered:

- Teaser: Global Water Business Blocks

- Resources:

- Infographic: Global Water Business Blocks

- Quotes: Global Water Intelligence

- Full Transcript:

- Introducing: Christopher Gasson

- Two things are global in water: Money and Technology

- What is Global Water Intelligence?

- How accurate are water market studies?

- Water Markets can be CAPEX or OPEX – one is easier to predict than the other!

- Who is Global Water Intelligence for?

- We are water consumers, not stakeholders!

- Having opinions comes with the risk to speak against someone else’s opinion

- Safe water pays for itself…

- Water isn’t actually global

- Money, Water Technologies and Climate Change are Global

- Key Figures on GWI

- The Water Industry’s consolidation shall provide shareholders with better values

- GWI as a global source in the the Water Industry

- What may be the next pivot ahead for Global Water Intelligence?

- Rapid fire questions:

- Other Episodes:

Full Transcript:

These are computer-generated, so expect some typos 🙂

Antoine Walter: Hi, Christopher. Welcome to the show.

Christopher Gasson: Hi.

Antoine Walter: I am now in that game for 80 episodes. Discussing water topics and interviewing people in the water industry. But there is one godfather of all of that. And somehow that’s whom I’m receiving today, Christopher, to me, you’re a godfather. So I’m a bit, you know, in my small shoes and wondering if I’m going to raise good questions to the specialist of jind of edgy question sometimes.

So there’s a lot I’d like to discuss with you today about yourself, about Global Water intelligence, but that all starts with my good old traditions. And that is the postcard. And you’re sending a postcard today from Oxford. So what can you tell me about Oxford, which I would ignore by now?

A Global Water postcard from Oxford

Christopher Gasson: What can we say about Oxford? Well, it’s obviously old and full of universities and it’s incredibly expensive. So during the lockdown, all my staff have found excuses to leave Oxford. Some have gone to South Africa, some to Norway, we’ve become a very spread out company, and maybe one or two others have been soldiering on here coming into the office every day.

But, uh, otherwise we’ve become a very dispersed company. And Oxford is much less part of it.

Introducing: Christopher Gasson

Antoine Walter: So we’ll come back to the disperse aspect of the company because I think that’s also something which I like to understand about your company. But right before that, I’d like to get to know you a bit better, know your path.

Because when I was preparing for that discussion, I found out that you’ve been publishing 670 articles on global watch intelligence. And that is just probably the emerged part of the iceberg. There must be some others, which are. Hidden or which are in other parts of your galaxy. I found also that you’ve acquired as global water intelligence in 2002, but what I don’t know, as what you’ve been doing before.

Christopher Gasson: Okay. So I, I started here in Oxford at the university. I studied politics and economics, and I spent a long time trying to figure out what to do with that and ended up in journalism. And actually I was working for a publication on the publishing industry, which got me interested in publishing. From there I got into, you could call us a boutique investment bank, which did buying and selling sort of media businesses.

And I actually wrote a book called the media equities evaluation and trading.

Essentially what happened was I sort of split up where the other people who were in this, M&A business and decided to go off on my own.

Acquiring Global Water Intelligence

And from there, I, I thought I was just going to do this as a sort of side job. Well, you know, working as X of consultant is, is, or the media area valuing businesses on the side. And I managed to lose all my money on it quite quick.

Because what I discovered was that:

And our main selling point was tracking projects for. Private investors in water and all of our project date updates were project canceled or project delayed because, you know, after this sort of fantastic time during the 1990s, when there’d been this idea that sort of material utilities in Europe should recycle their cash flows into fast growing utilities in emerging markets, the sort of east Asia crisis followed by the Argentine peso crisis had actually completely reversed the cash flows.

The time when Global Water Intelligence was in deep trouble

By the time I bought global water intelligence in 2002, so the subscriptions kept falling.

The next thing which I did was I went to the international desalination association conference in The Bahamas. And I discovered that this was also an international business, desalination, where the supply chain was incredibly international. And there was also some private finance involved and unlike the sort of international private water market, which was going backwards, this market was really going forward.

Leveraging desalination as the first proxy to Global Water

So I went back from that conference. We launched our desalination project tracker. And from that, we then sent it out to the a thousand or so people who had been at the international desalination association conference and we got a hundred subscribers just like that.

Antoine Walter: So doubling your subscriptions, roughly.

Christopher Gasson: Exactly. We were then sort of in the business and we launched a report on the desalination market, which sold incredibly well. We used the money from that to buy. Database of desalination plants from class Vang neck, which became Desal data. And we used the money from that to buy water salination report and became so completely dominant in sort of desalination, which I guess is the most international part of the water industry because it’s high technology and something where the contractors are working all over the world.

Two things are global in water: Money and Technology

And also it involves money and

And if you’re going to run a magazine called global water intelligence is global water stupidity not to focus on those things. That’s what we’re about.

And we’ve been building out, you know, from desalination into other areas of advanced technology areas. I mean, initially it was water reuse and wastewater treatment and then slides and then digital, and basically been following the money and following the technology around the world.

Now I’d say we’re, we’re really pushing forwards on sort of those three different themes to sort of bring the water well together so that it works better.

It is still a challenge to connect money and water

Antoine Walter: There’s really a lot. I’d like to unpack in what you just said, which is good. A lot of the meat will have on the bone for the deep dive. But right before I like to explore a bit, this aspect of money, which you you’ve just mentioned, I can share you something which happened to me.

I was giving a conference in a French university. My conference was about economy and water, and I was expecting lots of questions at the end, but at the end, what I received as questions were more like critics, like. Qualified as serving the big capital by compromising water, with money and a water with economics.

And I thought we had passed that point, but I was wrong. I was absolutely wrong. And when preparing for our discussion, I read your very first paper on global water intelligence, which is from 2002. And you are saying exactly that’s, you’re saying there is this problem between water and money, which is always tricky and people have.

Some difficulties to wrap their heads around the link between water and money. So does that mean nothing has changed for 20 years?

Christopher Gasson: I dunno.

I mean, essentially:

Water is capital intensive

And for me, that’s the main reason why water doesn’t work. Yeah, actually:

Antoine Walter: It’s the first time I hear that figure.

Christopher Gasson: It’s one of these things that we do. I mean, it, it’s obviously a compilation of both water and wastewater infrastructure. If you’ve got a utility, which is doing both, that makes sense. And it’s also an issue of how that money. Is actually invested and charged for.

So there are a number of variables in it, but that’s the sort of ballpark thing. If you’re looking at an advanced utility with water and wastewater, you’ve got massive infrastructure investment take, for example, in Japan.

So there’s a big variation on it. I mean, Japan is a bit of an outlier because. Extraordinarily sort of efficient networks, you know, they have earthquake proof piping and things like that, but there is some variation there, but if you’re talking about a top end thing, you need a lot of capital in this.

Achieving SDG 6 is a Global Water challenge – and even before that a finance question

And you know, this is the reason why SDG 6 has been so difficult to achieve. If you’re going to have. The whole world’s with a piped potable water source in their home. And you’re going to have safe sanitation, you know, with a safe waste disposal. You’re talking about significant infrastructure investment.

And if you have a whole load of people dancing around and say, we don’t like talking about capital and water, anyone who talks about capital is on the wrong side. Those people are actually killing people.

Antoine Walter: You mentioned a significant investment. I had this discussion with David Lloyd Owen, which you know, very well on that microphone about his book, global water funding.

And in his book is citing a global water intelligence figure, which is if I recall, right, 4,000 billion dollars of investment, which is what represents water and sanitation for all, some of it is new infrastructure. Some of it is refurbishing the existing infrastructure, but that is the size of the bill we are discussing.

Christopher Gasson: It’s one of these things that, that sort of waters work is never done. I mean, if you look at America, for example, where they’re getting concerned about PFAS or apparent Polyflor alcohol substances, you know, there’s a huge amount that you can put in to stop those sorts of things, getting in your water. We are talking big money.

You need a mechanism to bring money in the Water Sector

However you look at it. And what I would say is that some countries have got mechanisms for getting that money in, we in the UK have a mechanism which happens to involve the private sector in a general. The Netherlands have mechanisms which involve municipalities, being able to charge cost recovery pricing for their tariffs.

And then there are a lot of countries which just don’t have a financial mechanism to get money in towards. That’s the problem. I mean,

You get what you pay for and you need to have that mechanism.

Don’t shout ping said, you know, it doesn’t matter whether the cat’s black or white, what matters is whether it catches mice.

What is Global Water Intelligence?

Antoine Walter: The way you’re expressing all of that. We can already feel that you’re not just an observer of that markets. You try to have your, your tone of voice and to have your opinion, and to bring that across to quote you, you’re saying that a magazine without values is very dry thing, which brings me to a very simple question is global water intelligence still a magazine?.

Christopher Gasson: It’s currently a magazine, but I think that over sort of lockdown, fear and fear people have actually been reading it as a magazine because they’re not going into offices and so forth. They’re reading it much more as something which is online and we are going to be. Changing the way we present things to reflect that, uh, you know, over the next couple of years, but really, I guess

And we don’t just do it in the magazine. We also do it in our events. And so we’re sort of restarting our sort of global water summit series in may. And, you know, we’d been setting up sort of, uh, GWI networks and, uh, you know, online meetings and say, But it’s there it is. It is, it’s both a mouthpiece or a soap box as well as a new source in it, an information source.

I mean, actually now a water data business is in fact bigger than our global wash intelligence business. And it’s also bigger than our events business. So we are quite a substantial seller of data to the water industry.

How does GWI gather (reliable) data?

Antoine Walter: That’s what exactly what. My company, GF piping systems is a customer of Global Water Intelligence.

And I guess much more a customer of GWI water data then of the magazine. The magazine is very interesting as always lots of interesting stories inside. Nevertheless, when you in doing due diligence in M&A, or you’re trying to do business development, then decide what’s the next country you want to focus on?

The data brings even more value. So that is a bit more of the products that we are using. And that’s not just my, my personal use case. I’m wondering in this data, how did you gather that data? And what’s your methodology without revealing the secret sauce, but what feeds this database?

Christopher Gasson: We talked to a lot of people.

I mean, I think that that’s the most important thing, but you know, obviously there’s data out there and you know, some of it just needs to be collected and turned into data. So for example, you know, with desalination.

Tracking and Forecasting the Global Water Market

And we keep track of those things on a, on a weekly basis. This builds into a forecast of the future of that market. And we also track, you know, wastewater treatment projects and other, other things. So you can see there that the information is out there. It’s just, we’re investing in, collecting it.

Then there’s other things where. For example, we’ve this week been sort of slightly battling with the UK competition or authority or competitions or market or authority in that the Veolia and Suez merger has been objected to by the competition and markets authority. And they have. But one of our reports, which says that Veolia and Cirrus have a 60% market share of the industrial water outsourcing market in the UK.

And this is something that we sort of determined as a result of talking to people. In the market, you know, you talk to the competitor and say, well, how much do you think their market share is? And then you’ve talked to the others and you say how you know, and you, you triangulate something like that. It’s quite time consuming and difficult.

And you know, now we find that this thing that we were researching a few years ago has become incredibly important for this merger. But, uh, you know, that’s the way life goes.

And we have insights of our own from talking to insiders

How accurate are water market studies?

Antoine Walter: when you’re giving big numbers, big market estimates or a technology’s potential, or the development of a technology. How accurate or inaccurate are those numbers? I know you’re going to say they’re accurate,

Christopher Gasson: I’m not going to say that accurate. No, no.

All I’m saying is the market needs forecasts and data, but at the same time,

So, for example, somewhere in water data, you’ll find a full market forecast for the Ukraine that market’s forecast is almost certainly wrong, but when it was made, it was made on the basis of the data that we had about investment going into the sector and commitments that were being made and whatever official sources of information about spending on water, uh, that there were in the country and so forth that then.

You won’t find, for example, a forecast for sort of plastic type cells in the Ukraine, but you may on the basis of various, you know, rules of thumb and you know how these things typically break down, be able to come up with an idea of if this is the total spend, and this is what they’re spending it on.

This might be the spend total spend on pipe in that kind of.

Can water industry players bend the numbers?

Antoine Walter: You mentioned that you’re triangulating the data. So I guess that gives you a bit more accuracy, but I can share you my personal example some years ago. I think it wasn’t GWI. It was another market research company. I can’t remember the name now, but they were calling me every quarter.

And then we’re like, okay, you were in the business of selling, ozone treatment systems. What’s the size of the market. How much did you sell what’d you expect to sell in the next month? And, you know, I was a very optimistic sales guy. I was taking all my projects and I was giving myself a 100 person win rate, of course.

And on top of which I was expecting all the projects I was working on to. Into truth, which means I was probably overestimating the markets by a three to five factor. So how do you factor out?

Christopher Gasson: Oh yeah, exactly. So we’ve had that problem. So as I say, we started off in this forecasting business, in the desal area.

And we looked at this and he thought, okay, right. There must be a lot of projects that exist that we’re not seeing. And therefore we must add in this sort of idea of that sort of what we call the anticipated additional. And we built a model it on an iterative basis, we thought, okay, right.

Projections can be wrong, but they always improve

This is why we were wrong last time. So we need to get right this next time. And each time the market was vaguer than we could imagine. Then, 2010 came, which was the year that the desal market changed.

And we had to completely rethink our approach to this forecasting business because previously we had taken it on the view that, okay, if these things are on the drawing board, this is sort of what’s happened in the past and so forth. And we had two. Just a lot more critical and sort of fast-moving on these things.

Water Markets can be CAPEX or OPEX – one is easier to predict than the other!

And we also, you know, one of the things that people often sort of don’t understand is that there’s a huge difference between. A market, which is essentially a capital expenditure market, and a market, which is an operating expenditure market and an operating expense market is generally one, which you can expect to sort of roll forward in one way or another.

Let’s say you’re selling sort of ion exchange resins. There’s a certain number of those installations already there. And most of your business is going to be about selling into those installations. And then the market will grow as more people install on the exchange systems, but it will also be affected by.

Taking away systems that say replacing an iron exchange system, or at least an extensive own exchange system with a sort of RO system with a, maybe just a mixed bed polishing step or something like that. So with an operating sort of expanded share market, There’s always an amount of momentum in it, which makes it relatively easy to say, oh, it’s going to carry on like last year, but it might move in this way or that way.

And one of the things that, you know, we sort of had assumed about the desal market was that because the world is running out of water. It will not actually run out of water, but because more people are living in places where there is water stress and know the quality of available water is declining and so forth.

The example of global desalination market projections

And it’s very difficult to say to people. Yeah. Desalination is a great market when. Actually you’re looking at is fooling. Yeah. Yeah.

And when, when there is a priority, then the spending will have. For example in California with the, you know, the big drought that didn’t actually lead to spending on desalination, but it did lead to spending on water reuse, for example.

Utilities are driven by priorities

And one has to sort of have a model of the way you think about these different kinds of customers. Generally the way that utilities work is that they’re driven by priorities. And this is why, why so many people find it difficult to sell into that market because they think I’ve got this really.

Piece of technology. Everyone should want it, but actually, unless the boss, man, or the mayor, or whoever it is, is saying, right, this is what we need to be doing, then you’re not going to be able to do it. So for example, you might have one minute people. Panicking about PFAS and you can sell them a whole, you know, the treatment system to deal with that.

And the next minute somebody will say, well, actually we’ve got to reduce our carbon footprint. And you know, that, you know, probably goes completely against taking PFAS because taking PFAS, this is a very energy intensive thing to do. So you get these things going backwards and forwards and understanding how these utilities work and how decisions are made is really important to them.

Who is Global Water Intelligence for?

Antoine Walter: But that means that’s most of what you’re monitoring is the Utility’s World. So you’re trying to follow because that’s how the water sector is designed. But I guess that’s your customer in turn is maybe not the utility. So who’s your typical user?

Christopher Gasson: Well, I mean, I guess this is, this is slightly the way that we’ve sort of set things up.

However, we have also got a not-for-profit arm of the business. It’s actually a separate company. It’s called the global water leaders group. And this was a sort of initiative we set up because we felt that. If we were in the business of trying to make the world work better, we really needed to be working with these leaders, the end users, much more closely, and that this sort of extraordinary sort of way things work in water, where there are a few really good utilities.

You know, here, I’m talking about, say Singapore or Amsterdam or. Los Angeles or whatever, who are completely on top of their job. And they can sort of wake up in the morning and they can think, wow, how can we be even better? But there’s a mass of terribly unfortunate underperforming utilities who. Sort of wake up in the morning and you know, the best they can hope for is to solve the main Sprake before the six o’clock news that they’re really struggling.

How can GWI help both water industry ends to better collaborate?

And the same is true also in the developing world where

And then other utilities who, you know, donors and lenders look at and they say, If we give these guys money, it’s just going to leak out.

You know, they’re just losing money on everything that their customers are robbing them. Their staff are robbing them. The management, uh, incompetent makes no sense to give them money. So we set up this global water leaders group with a guy called William, who used to run one of these sorts of super successful utilities in Uganda as the executive director, essentially.

Bringing together the top-performing utilities and then building out their experience for the rest of the world. And so after a few years, we, we then launched this concept to their leading utilities of the world, which is, those are the top-performing utilities there are about, I think 54 of them are. Chosen by their peers on the basis of their performance and so forth.

And that’s how we engage with the end-user. And I guess we’re also been doing the same thing on the industrial side with our corporate water leaders group, where we’re looking for people on the industrial water side who are committed to water, positive or ideas of really getting water stewardship.

We are water consumers, not stakeholders!

Antoine Walter: But if I want to be blunt and to simplify everything, what you just explained is your way of giving back to this utility and to support generally speaking the water community, but where you’re making your money.

And every company has to be profitable. It’s really on this supply chain support and on this data that you’re gathering ‘

Christopher Gasson: cause you could say that, but I’d say, you know, it is, I mean, you know, quite cynically, I mean, you can’t run a successful conference, like the global water summit without having. The sound of two hands clapping.

You need to have the customers and the supply chain there, although it may look like this is us giving back. And I, I know I, as I say, I have reasonably strong ideas about giving back in water. I, you know, I feel that actually it’s part of this idea that water should be a gift rather than a, you know, it should be something which is a commercial.

Antoine Walter: I’m trying to be the devil’s advocate. I agree with you said differently, but I need to be a bit scratching. So that’s why I was asking me, there’s still this element of, of giving back.

Having opinions comes with the risk to speak against someone else’s opinion

You have strong opinions and I’ve been even contacted in between the time where we set up for this interview and the time where we’re actually recording, I’ve been contacting other people. And I mentioned that I was going to discuss with you and all of them say, oh, that guy has strong opinions. So you’re really known for that.

But out of the 670 papers, which you’ve published, would you say that there’s one where you were wrong. Like really wrong?

Christopher Gasson: I mean, I think that we have been wrong about a number of things. I’ve certainly changed my mind about things. I mean, there’s one where I think it was a bit outspoken. But if you read the article, you can see where I’m coming from.

I’m going to say something like when I hear the word stakeholder I reached for my gun, uh, which that was a little bit sort of tasteless, but, you know, basically what I was trying to say is that in that particular instance was that

If you just think that the stakeholders who are there for example, justice receive the benefit of water without ever making any contribution to it.

People’s involvement is the first step to getting money into the Water Industry

That is part of the problem. There has to be a mechanism to get money into the sector. And if you just say. These people are stakeholders because the beneficiaries of this and somebody else across the ocean has to put up the money to make it work. I mean, it’s just completely wrong, you know, it’s absolutely going to fail.

We need to believe that water is worth paying. Because if you just say to people, right, the only way you, you know, 1 billion people in the world who don’t have, uh, you know, uh, access to safe water, you guys, you’ve got to wait until the rich world remembers that they ought to give you a give money to support you getting water before you get it.

Safe water pays for itself…

It’s completely disempowering and it’s not going to get them anywhere. There has to be this feeling. Water is worth paying for. And is it good? And actually, I mean, I did some work for the world economic forum a few years ago called sort of newer models for water access. You know, we looked at the cost of good water and we looked at the cost of bad water.

And when I say the cost of bad water, I mean, not the direct costs, but the costs in terms of the time it takes to sort of go off and fill a container from a river. And unimproved distance source or

Antoine Walter: those two hours a day, probably also the sicknesses.

Christopher Gasson: Exactly. And we added up all these costs and, you know, we used the world bank methodology for pricing these things.

You know, a pipe is a sort of iconic invention for moving fluids in the same way that the wheel is an iconic invention for moving solids.

And if you’re not using pipes, I mean, this is an advert for GF. I guess if you’re not using pipes, as I say, you’re using a lot of extra energy in the whole system, we should have confidence. Water is worth it, but the customers who get it will actually be better off overall as a result of it. And if that involves contributing financially to it, then they should do so because it’s got a value.

… but improved wastewater treatment doesn’t always!

Now, the trouble we came to, which just quite interesting on this study with the world economic forum was actually

because the sort of health costs and the time saving and so forth is calculated on the basis that income you’re actually better off emptying a septic tank or doing good fecal sludge management than having a.

Sewer system, which is very expensive to lay and then has a sort of a wastewater treatment plant on the end of it that actually wastewater treatment only pays for itself. When you have an average income per head of about $3,500, which is quite an interesting problem, paying for wastewater is an interesting choice.

How to collect the benefit from doing good?

Antoine Walter: But on the drinking water side of things, I guess the problem that we are meeting here is that you say it pays for itself yes. If you zoom out and you take the overall society as the stakeholder, sorry for the term. But if you go down to the utility. It’s more difficult because they won’t be directly benefiting from the fact that people don’t have to travel two hours to get some water.

They won’t be directly benefiting that the hospital is half empty because people stopped dying from waterborne diseases. So there is a social cost, but if you can grab the benefits of your action of bringing water, then it’s more difficult to collect the money, which is associated even if economically speaking and on the zoomed out picture, it makes a lot of sense.

Christopher Gasson: Yeah. I think what I’d say is that

You could say it’s just culturally specific, what people are prepared to pay. So for instance, in Africa, it’s quite common for tariffs to be in the sort of, I mean, I can’t remember the exact figures, but you’re probably talking about an average tariff of around 60 cents, a cubic meter in Africa.

Whereas in south Asia, you’re probably talking about an average tariff of closer to 10 cents a cubic meter. And then you think actually India is a reasonably rich country compared to a number of these. I mean, it’s somewhere like Uganda and you might be paying sort of 80 cents or 90 cents cubic in, in Uganda.

Um, and then you ask why is it that the Uganda national water service company is actually. A hell of a lot more effective at serving all of its catchment area than, uh, you know, some of these Indian utilities, which completely fail. And, you know, you have to come to the conclusion that the fact that in Uganda, there is a tradition of paying for water has got an awful lot to do with the fact that they have a better water system that a lot of Indian cities.

Water isn’t actually global

Antoine Walter: you’re called global water intelligence. But that features global water. And you’ve explained how there are some things which are really global. Is water really a global topic because you’re comparing now in general Ganda and those situations are by many aspects, very different. And it’s not because we have now I’m really making cliches, but it’s not because we have more water on that end of the word and less on the other end of the words, that’s the other balance would show that we have an equilibrium, but at the end of the day, you have people with too much water.

In other words, too few water, but isn’t it somehow a fallacy to look at water as a global thing?.

Christopher Gasson: Well, Antoine, this is it. This is why I say, you know, Money is global, Technology is global, Water isn’t! most people drink the water that falls in their head and, you know, it’s a sort of rather sort of crazy idea, this sort of global water in that.

I mean, I, so think about this sometimes when you hear about these people, like, you know, Singapore or other countries setting up these water hubs, you know, the idea that everyone’s going to come to them to find out about water technology and so forth as if there some parts of the world, which have never thought about water, where is it?

Everywhere in the world has had to come up with a solution to water from the very beginning, because that’s what it means to live in society. The problem is that this is completely sort of fragmented anatomized.

And you know, what they need to do is actually understand how other people do things and how they might learn from them. But they always need. Adapt, those sort of learning points to their own culture. Singapore has got a, quite a unique situation. I mean, it’s obviously very urban and it’s got, um, I mean, I remember going there once and being told that they’d had a terrible drought and then I saw some that say, how long has it been going on for.

It hasn’t rained for nearly a month.

As you say, these things are very, very local and say, you know, but people can pick these things up. You know, I can see somebody doing something in one place and take it elsewhere.

Money, Water Technologies and Climate Change are Global

Antoine Walter: So talking of these elements, which are this time global, you have the money and we’ve discussed the money. I have a last question on the money aspect.

It sounds to me like something’s happening over the past. You will tell me five years, 10 years, maybe with all this ESG investment impact investment, which is now sometimes even flooding some areas of the water industry. Is that something that has some rationale for you, or do you also look with a puzzled look at some of the valuation of some water companies?

Christopher Gasson: I don’t know when you say ESG money coming into water. I mean, I guess there’s two ways of looking at. One is funds like, uh, the, uh, climate to fund or water equity, which are essentially impact funds, which they’re looking at putting money to work in water infrastructure in the sort of SDG six countries.

We shouldn’t turn ESG investors away…

And then on the other side of things, Things like the share price of Veolia and so forth, which, you know, is an ESG stock to invest in. You know:

I mean, I guess the, what I find most interesting is actually the former thing, the sort of impact investment coming into, or wanting to get into the water sector, because this is sort of.

Uh, you know, although these people are trying to do good in the world, they are essentially private investors. And, you know, historically there’s been this big, as you’ve said to yourself, this big, who far about, you know, having capital and private capital, getting into water when it’s too important for that and so forth.

But I think that this is a completely different approach and I think that it would be wrong. Sort of turn these people away because they happen to be raising private funds as well as public plans, because, you know, ultimately all money comes from the capital markets, whether it comes from the world bank or government borrowing or whatever, you know, you have bonds and people buy bonds, or they have shares and people buy shares and we have investment products and for people to put money into that and you know, all money is just churning around in the financial markets.

… but rather help them to invest in the right assets

And it’s just a rarely a mash of the instruments to get you there. But the big issue. In this sort of SDG six finance thing is how do you actually increase the number of opportunities to deploy this capital? Because there’s a lot of money, one who get in, but there they’re very few, as I mentioned earlier, bankable utilities, utilities, you think, Hey.

We could give them some money and there do a lot with it. And that’s something which we’re working on trying to expand with the global water leaders group. We worked with the GIS ed people in Germany to help them set up this, uh, urban water catalyst fund, which aims to essentially turn around utility so that they become bankable.

We’re actually running a workshop on sort of bankability and how to. How to turn utilities around. Um, I think the IFC or another organization who an interest in that, and I think that that’s an important priority. It’s all very well getting the ESG money interested. It’s creating the opportunities for ESG money as well that we need to do.

Key Figures on GWI

Antoine Walter: Let me come back to GWI as a company. How big are you today? How many people are working for GWI?

Christopher Gasson: We have about 70 people in total.

Antoine Walter: And you said you’re dispersed because of it not because of COVID because of a combination of

both.

Christopher Gasson: I mean, it’s, it’s, uh, I mean, some of these things, I mean, our sales has been in the Czech Republic for some time and I, you know, as I say, our editorial director moved to Norway during lockdown, you know, we also have an office in Shanghai and in Austin, Texas, although our lady runs the office.

Shang HAI has actually been relocated. Couldn’t Ming, and we have a sort of correspondents around the place and, and other sorts of friends who help us out. So yeah, we are pretty global.

From what side on can you afford to piss your clients off?

Antoine Walter: And given your global size. Can you afford to have a water company, which is mad at you?

Christopher Gasson: Um, let me just say one of the reasons why I got into this publishing back into publishing from M and a was when you’re doing sort of investment banks.

You can’t afford to piss people off. You know, you only do sort of five or six deals in a year. And if you piss off one of these clients, it’s really bad news. Whereas we’ve got thousands of clients now and we can piss them off. And I think that obviously, There are some times when we say things that other people don’t like.

I think that we probably created a few enemies that Veolia in our coverage of the Veolia and SUEZ merger. I think that, uh, what we are saying, we’ll see how it’s born out. Personally, I think both the alien series today are great companies and they’re both going in very different directions.

And I think. One does have to put the past behind us and that the old Suez no longer exists. Veolia has a great future. And the new also has a great future, but they’re going to be going in different directions. The new SUEZ has got a lot of capital behind it and it can kind of afford to be investing in infrastructure and so forth.

The new Veolia has got a extraordinary mission. As the leader in this ecological transition, linking together, both waste and energy and doing it with a fully global footprint. And I think they’re both exciting to journeys to be on. And I hope that the people at Veolia we’ll let bygones be bygones. I mean, it’s water on the bridge and this is what happened.

Side Track: Veolia acquires SUEZ… because it could!

Antoine Walter: You mentioned Suez and Veolia, which is one of my recurring topics. It’s also the other occasion where it had someone from GWI on that microphone with Sebastien Mouret . So I have a one sentence question for you, which is aiming for a one sentence answer because I couldn’t do it myself. So maybe you can, why did Veolia acquire SUEZ?.

Christopher Gasson: Because it could.

Antoine Walter: Okay. Then we have the same answer. It’s interesting.

Christopher Gasson: I mean, I think that we can go through all the different arguments and so forth. I can see where they’re coming from. I think that they will create an interesting asset. The sheriff holds us a very much behind the whole thing, so I can’t read.

So, you know, because it could, and you know, it has increased the, uh, shareholder value. I mean, that’s it, I mean, okay. You want me to say when I’ve been wrong? Well, I’ll say are wrong in three years time, it will be vindicated in my. Merger coverage. If the Veolia share price is actually below the acquisition price in three years time, I will not be vindicated.

The Water Industry’s consolidation shall provide shareholders with better values

If it continues upwards, it has done. And you know, this is the nature of being a pundit. Sometimes you get things, right. Sometimes you get things wrong and what needs to have good reasons and, you know, get people to understand that, you know, once not God, all one can do is pontificate as my wife says.

Antoine Walter: We are recording that at the beginning of March, 2022.

So if you’re listening to that in the future that you have a, a set point of where that engagement of three years ahead, it’s going to grow is starting, but that wasn’t my aim with that question in the February release of GWI magazine, you are talking about Saur, which would be up for sales. And I’m wondering, how do you come up with such a story?

Is someone from EQT, giving you a call and say, by the way, yeah.

Christopher Gasson: Sorry. That was just one of these things was which sort of got out there. I mean, you know, writers did the hard work on that and we have our ear to the ground on a number of other things. We can’t claim credit for that one. And you know, it may be, it may turn out not to be true.

I mean, When writers first came up with it, they suggested that this, uh, Reitman group was going to buy it. And then they realized it was Rathmann group. I Raimondo and they, they, and they changed their story between the morning and the afternoon. So one doesn’t, but they must’ve felt there was something there.

I mean, I had understood that were going to be in there for a bit longer, but, you know, I can certainly see. This might be a good time to sell. So because they’re just doing fantastically well, you know, men are Holtzman on the industrial side is an absolute dynamo. And, um, you know, they’d done fantastically well in Saudi Arabia winning to the, what is it?

Three of the contracts there. So they are something that a private equity person might say, Hmm, this is starting to ripen quite nicely

GWI as a global source in the the Water Industry

Antoine Walter: on the two first seasons of that podcast. I’ve been asking. In my rapid for our questions at the end, a simple question. What is your source that you recommend to keep up with the water trends and water news, and even thought it was for the full two seasons.

Sometimes some maybes are, they didn’t ask the questions. So I had 38 guests, which got the question and out of these 38 31 cited GWI, which makes you actually the second source, which they recommend the first being LinkedIn. But I would say. Dedicated a water source, which they recommend, how is that good or bad, dangerous, or an opportunity as an, as a position in the market to be like this go-to source because many eyes are on you.

And do you have any competition?

Christopher Gasson: We didn’t really have a competition, the magazine area. I mean, I guess though that we still, in some ways, just so scratch the surface of the market. Was that an awful lot of people who still don’t subscribe to GWI? So that’s the way it is. I mean, it does mean that we have to.

Work hard to maintain our reputation. I mean, when, when we started out, there was another publication called global water report, which had been published by the financial times. And I think it then means sold onto plats. And when we started out and we try to sell subscriptions, people would say, oh, global water.

Yes. We get global water. Um, and, uh, Be subscribers to global wash report and not global washed intelligence, and nobody had heard of us and it was incredibly hard. And we just spent a long time sort of banging our heads on a brick wall to try and get some kind of recognition for this. But I think this is the thing that.

Then not that many people are prepared to talk about water and money. There’s a number of people who will talk about technology, but they won’t necessarily get on the markets and sort of finance angle of it that are whole load of people.

So, I mean, I guess this is it. I, you know, as I said, I started off. Sort of studying politics and economics. And that’s really what the water industry is about. For me, it is this sort of interaction of politics and economics.

Is BlueTech Research competition for GWI?

Antoine Walter: So to ask you, uh, a quite direct question here, you know, I had Paul O’Callaghan from BlueTech research on that microphone to discuss his thesis on the dynamics of water innovation.

To some extent, one could see BlueTech research as a competition to global water intelligence. And to another extent we could also say they probably don’t address the same persona than you address.

Christopher Gasson: I think in the technology side, there are a number of people. I mean, I’d say that I’ll utilities is probably the leader in the sort of technology space.

I mean, I think that they’re probably bigger than both us and BlueTech. There’s also, I mean, you know, uh, bookie Oren, who we work with, uh, has a sort of a technology service in his own. And, you know, they’re, they’re they’re, as I say, they’re people like Jay Z back and, you know, there are a number of people who are technology.

But as I say, what we tend to be looking at is from the sort of markets and money ankle, rather than just, this is a super interesting piece of kit. And I guess the other thing to say. We are completely sort of dominant in terms of desalination. And anyway, Tom Pankratz, who’s the editor of deep water desalination report is really the world’s sort of leading pundit on what desalination related or membrane related technology is likely to work.

And what’s likely to fail.

What may be the next pivot ahead for Global Water Intelligence?

Antoine Walter: I have a last question for you in this deep dive. We’ve went through some of the milestones of your 20 years journey. The GWI horse, if I might say so, but you have a lot of pivots and transformations that’s happened through those 20 years. So I would say that transformation is not only on your presentation as one of your key values, but somehow you’re walking the talk.

So now if you look in my crystal ball and it’ll get GWI in, in five or 10 years, what do you see?

Christopher Gasson: I have a sort of saying about vision in business, that it’s not just about seeing the Oak tree in the acorn. It’s about seeing the ship in the Oak tree and the new world in the ship. You know, it is about having this vision beyond what you currently are to see transformation, vision beyond.

We have gone far beyond the original acorn. That was the original GWI, which I bought back in 2002. I think, you know, we we’ve formed ourselves. We’d grown into an Oak tree and I think that we are now on the verge of moving into the ship and you’ll have to sort of wait and see what that means. But at some stage that, you know, the ship’s going to set sail for the new world.

Water is our thing. And we’ll, we’ll always be on water, but there’s a huge opportunity, not least, because there’s so much to do in water. You know, it isn’t like we’ve solved water. You know, we’ve got, you know, SDG 6 to deliver and, um, you know, new challenges coming along with climate change and environmental protection and so forth.

And there’s so many different ways that a. Communications and information business can have an impact on, on the speed at which these objectives are delivered,

Could a water investment fund be a nice little side business?

Antoine Walter: which leads me to a bonus question. Somehow. Were you never tempted to have like a GWI investment fund? You’re probably the most informed source in that sector.

You have this unique positioning on the edge of water and money. So wouldn’t that be an opportunity?

Christopher Gasson: We used to have to have a partnership with them on advisors. And, you know, we, we got involved with, uh, resonance, uh, asset management. I mean, I was the person who advocated, uh, um, on advisors, investing in that and, and, you know, we were partners in that.

I think it’s an interesting thing. And I think a lot of people are tempted by that, but personally, as an investor, I actually, I’m not that much good, you know? I tried it myself. I have a portfolio, and I only actually invest in water through the Pictay waterfront, but then, you know, I, I, you know, have ideas, but they never turn out to be any good.

So I think I’m so counter. Intuitive in the way that I like to think that I just don’t have that herd instinct that you need. If you’re going to be a successful investor, you need to feel that momentum in something. And it I’m much more keen on challenging the status quo than saying, yeah, this has got momentum is going to carry on forever.

Just put our money in this and we’ll go to heaven.

Antoine Walter: Very clear. Well, I have to be cautious of your time. So I think that’s makes for a good close for this deep dive. Nevertheless, I have to tell you that over the past hour we’ve been scratching the surface on many topics. So probably at some point in the future, I’d be really happy to have some sequels on some of those directions, which would just opens, like we just kind of opened the door. Didn’t go through.

If it’s fine with you, I propose we switch to the rapid for questions.

Rapid fire questions:

Antoine Walter: My first rapid fire question is what is the most exciting project you’ve been working on?

Christopher Gasson: I guess the thing I did with the world economic forum on the new models for water access, where we were actually discovering that, uh, you know, what were the economics of solving water for?

SDCG six.

Antoine Walter: Can you name one thing that you’ve learned the hard way?

Christopher Gasson: Um, I’m not much of a salesman.

Antoine Walter: Is there something you are doing today in your job that you will not be doing?

Christopher Gasson: Probably publishing a print magazine.

Antoine Walter: What is the trend to watch out for in the water sector? And people are going to listen to you for that.

Christopher Gasson: I think that the impact of inflation is probably going to be the most important thing over the next two years or so. It’s going to completely reshape the capital flows in the market. I mean, there are the things, you know, obviously around sort of climate change and so forth, but the single thing I think is going to have the biggest impact is actually the cost of money.

Antoine Walter: If you were a word political leader, what would be your first action to influence the fate of the words? Water challenge.

Christopher Gasson: Tell people that pay for water.

Antoine Walter: And will you have someone to recommend me that it should definitely invite on that microphone?

Christopher Gasson: Uh, Laurent Auguste, the former marketing director of Veolia he’s now a consultant.

Antoine Walter: By Christopher, I’m sorry, I’ve been French too. To that extent, I’ve been using more time than what you had located me, so sorry for that. But it was a fascinating journey and I would have so many sidetracks, which I could have opened again with the rapid fire questions to I, my point, if you have some time in the future, which I’ll tend for SQL and it’s been a pleasure.

So talk to you soon.

2 thoughts on “These 2 Global Water Business Blocks Will Help to Mitigate the 3rd One”