It all started in July 2020, when Engie publicly announced, they were considering divesting from Suez. 18 months later, we’ve seen the birth of a new giant, as a result of the Veolia Suez Merger!

But that wasn’t a straight line – at all! There were crises, challenges, triumphs, and shenanigans. (and it’s not over!)

Here are the 4 Key Chapters of that story!

(I thought this example would be interesting, within my deep dive on Water Entrepreneurship)

Table of contents

- Veolia Suez Merger: Chapter 1 – A Bomb on a Sunday

- Engie considers divesting from SUEZ

- … And Veolia considers Buying a Stake in SUEZ!

- Mergers and Acquisition discussions were already ongoing

- What would be the consequences of a merger?

- But come on, a Suez Veolia Merger, that’s old news, no?

- What would a merger mean for the Water Industry?

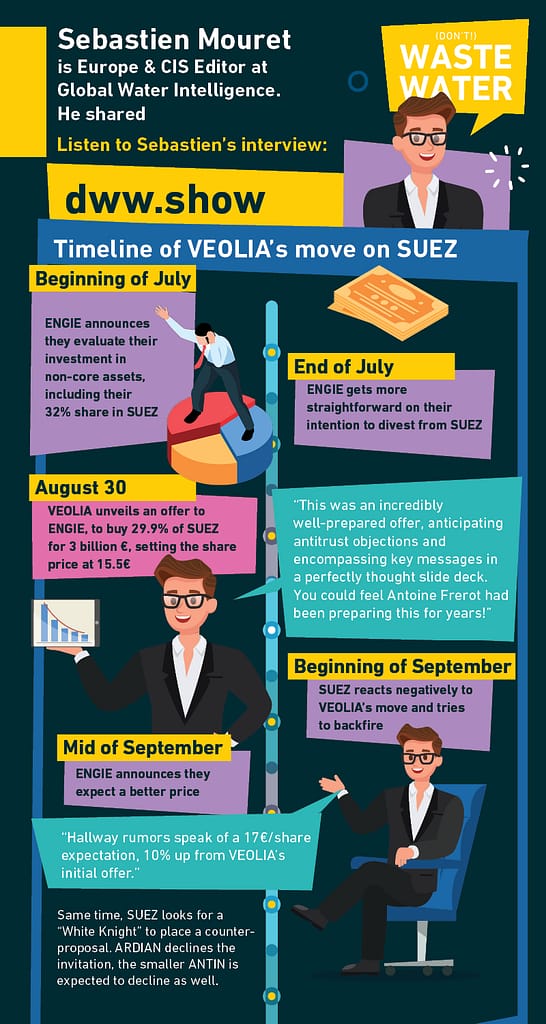

- Infographic: Behind the Scenes of the Veolia Suez Merger bomb

- Veolia Suez Merger: Chapter 2 – A long Road

- Veolia Suez Merger: Chapter 3 – The last Hurdle?

- Veolia Suez Merger: Chapter 4 – 2 new Heads!

- Sabrina Soussan – Estelle Brachlianoff: perfect opposites?

- They both started in infrastructure

- Introducing: Sabrina Soussan

- Introducing: Estelle Brachlianoff

- Veolia: Challenges ahead!

- Suez: Crossing Roads

- Two women in charge of the Water Industry’s n°1 (Veolia) and n°3 (Suez)

- My bet: How will the story of the Veolia and Suez Merger end?

- Veolia, Suez, Mergers, Leadership and Path Forward – Conclusion

Veolia Suez Merger: Chapter 1 – A Bomb on a Sunday

It’s a Sunday, the last of August 2020. The news is quite calm so far, markets are closed and business is on hold – come on, again, it’s Sunday!

And there comes the bomb: the number one company in the world – Veolia – intends to buy its runner up, SUEZ.

Actually, behind the scenes, it all started a bit earlier. So, to understand the roots of this multi-billion € move, which would create a 45-billion € turnover per year environmental giant, we have to go a bit back in time.

Engie considers divesting from SUEZ

End of July, Engie had announced they would review the group’s financial positions in all their non-core assets.

This implied of course questioning the 32% participation in SUEZ, the water, and waste service company that was created from the merger between Gaz De France and the former SUEZ company (including at the times also all activities in the field of energy) in 2008.

Possible outcomes of this questioning were twofold. Whether Engie would buy back the other shares and regain complete control over SUEZ, or they would divest from it. Indeed, they already had for several large energy assets, especially in North America or for the Liquified Natural Gas activities they sold to Total.

But it was said, regaining complete control would be perceived by Engie as a sign, they were not able to grow in their core energy fields and markets. So this option was quite unlikely.

… And Veolia considers Buying a Stake in SUEZ!

Fast forward to Sunday evening: in case Engie decides on the sales option, someone is eager to buy, Veolia.

Veolia’s CEO, Antoine Frérot, announced that they offered Engie to buy 29.9% of SUEZ. So almost all of the 32% that Engie owns!

The stock price would be fixed at 15.5 € per share, which is 50% up from the stock price when Engie announced reviewing their ownership in late July, and 27% up from the stock price by the close of the market on Friday.

This move would cost Veolia about 3-billion euros and would be followed – if successful – by a take-over bid on the stock market, in order to get a majority of the shares.

That should tap into the free-float shareholders of SUEZ which hold about 46% of the company. The full operation should cost Veolia about 10 billion.

Mergers and Acquisition discussions were already ongoing

Suez and Veolia have a history of mergers and acquisitions with market players around them, but often also between them.

This takeover move happens, while the two groups were already working together on the sales of SUEZ’s subsidiary OSIS, dedicated to wastewater pipe maintenance, to VEOLIA, for an estimated 300 million€.

What would be the consequences of a merger?

It was clear from day one, that a takeover from SUEZ by Veolia, would affect the anti-trust policies.

The newly constituted group would have at least to sell SUEZ’s water operation activities in France. Aka, SUEZ Water France, the former Lyonnaise des Eaux, in order to comply with the policies.

But Veolia had thought this through. They announced, straight off the bat, that they already had an investor to take out this piece of the cake. Its name? Meridiam, an investment company specializing in utilities.

But come on, a Suez Veolia Merger, that’s old news, no?

It is not the first time, a merger between the two water majors makes the news. Activism from the French authorities in 2012 already almost pushed them to marriage.

But since then, the boards of both companies were swearing this was a story from the past, that would not come back. SUEZ just launched a program, which is supposed to allow them to overtake VEOLIA and gain the leading position in the environmental sector. And VEOLIA’s investment program was always backed by the saying by their CEO that every external growth move made it less probable and desirable to merge with SUEZ.

It was even said, that VEOLIA intended to focus more on its waste activities, with the word “water” slowly disappearing from their annual reports, while it increased in SUEZ’s one. If people were to bet, they’d rather say that a trade-move within the asset-rotation program of both companies, could allow the first to really focus on waste, while the second would do the same with water.

What would a merger mean for the Water Industry?

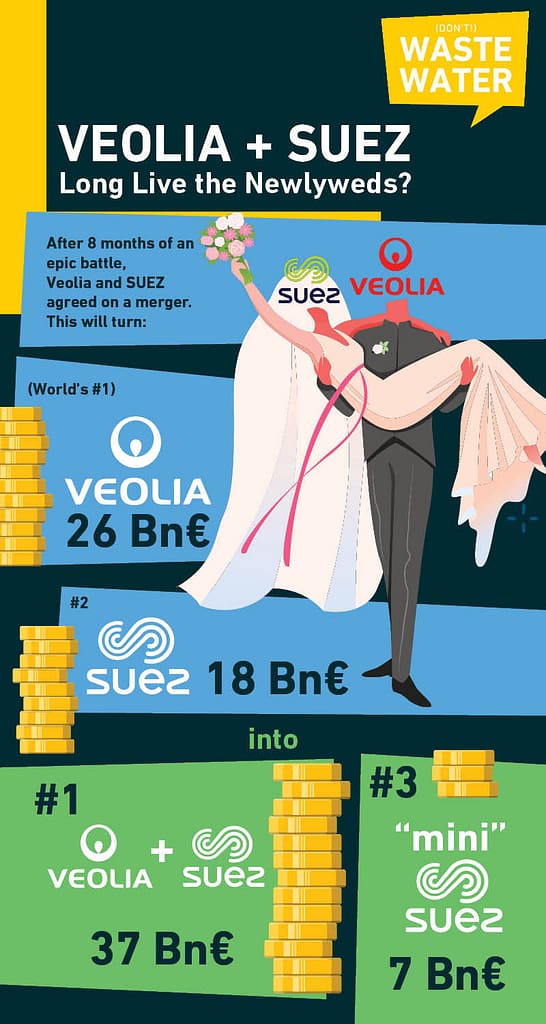

Suez and Veolia coming together would not only create a new titan in the water sector – we’re talking here of a 45-billion turnover company, with a 20-billion market capitalization and about 260’000 people working within it – but it would also significantly reshape that said water sector.

Sure, significant pieces of the cake will have to be cut out to comply with anti-trust policies, and following who might take over what will already keep everyone on their toes.

That was also a clear sign that we were about to shape a new future for our sector. VEOLIA backed their move with the saying that it would create an “ecological transformation giant.”

This also happened right in the season that saw Saur acquire Unidro, Econvert, and Nijhuis, Suez acquire Lanxess, Danaher buy into Aquatic Informatics, Grundfos take over Eurowater, Dupont Water doing the same with Inge and Desalitech or Element Solutions buying DMP Corporation – and I am still forgetting many more.

I have to say, I saw that as a sign, the water industry sets itself in working order to achieve the environmental, ecological and societal transition!

Infographic: Behind the Scenes of the Veolia Suez Merger bomb

I synthesized what we knew of the merger story as of September 2020 ⬇️

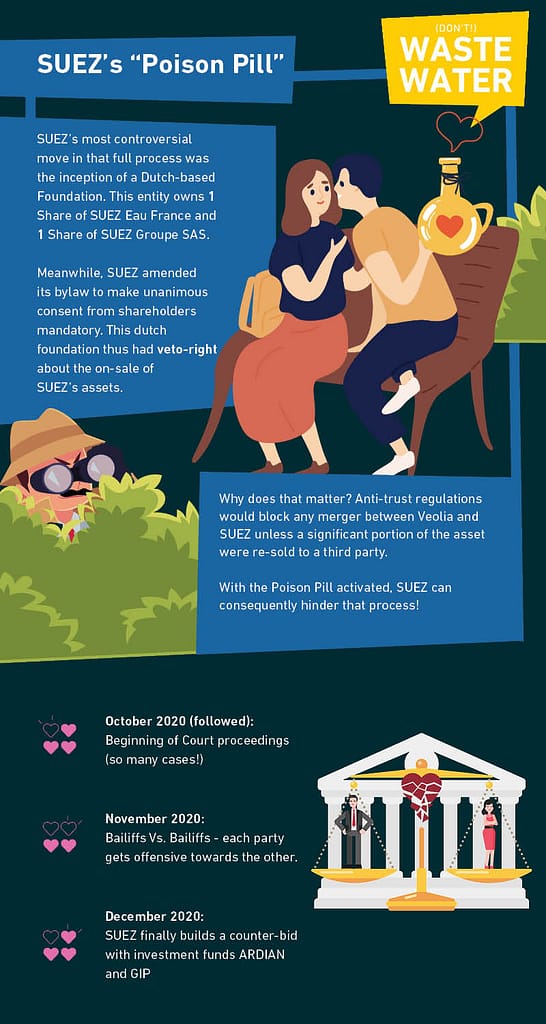

Veolia Suez Merger: Chapter 2 – A long Road

So the bomb is out. Veolia will keep pushing, and won’t have a rest until they’ve acquired Suez.

But GOD wasn’t it that easy!

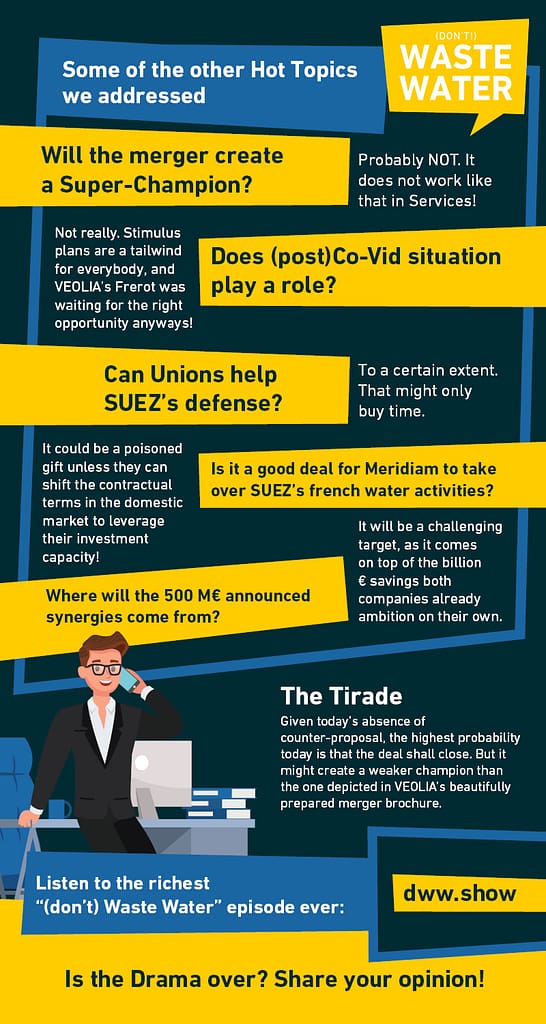

Infographic – How Veolia ended up Acquiring (a portion of) Suez

SUEZ and Veolia will merge, what does that imply?

What was the road towards the SUEZ and Veolia Merger?

It wasn’t a straightforward process – and it involved investment funds

What are the open questions left in this merger story?

That would have been too long of a story to feature it here! So I rather prepared you a deep dive that goes into all the fine details of the story.

Veolia Suez Merger: Chapter 3 – The last Hurdle?

So everything was calmly coming to an end: Veolia would acquire Suez and spin-off a section of it to three investors: Meridiam, GPI and the “Caisse des Dépots.”

End of the story.

A new contender in the ring: the French Financial Justice.

We’re in October 2021. And there’s some news that could reshuffle the cards!

The party under the spot is neither SUEZ nor VEOLIA specifically: it’s no less than the French Presidency, represented by the general secretary of the Elysée Palast, Alexis Kohler.

The lawsuit was initiated by SUEZ’s unions and tried to clarify if VEOLIA, ENGIE, and MERIDIAM’s top management colluded, with the french presidency as a catalyst, to initiate and facilitate the sale of 29.9 percent of ENGIE’s shares in SUEZ to VEOLIA.

All that lawsuit started just before the summer of 2021, but it was widely under the radar until it leaked in the french press. Can it have consequences? That’s hard to tell; let me come back to that.

Shall we pretend to be surprised?

But honestly, is it unexpected, that the French Presidency got involved in the potential merger of two of the largest french companies? One of which was partially under the direct control of the State as a shareholder?

Because beyond the relative size of the groups, that’s not tremendous, on the global scale of things, SUEZ and VEOLIA together manage the water of 60% of the French inhabitants. And we all know how political the topic of water can be.

Plus, if you recall the former episodes of the drama, we’ve covered how Prime Minister Jean Castex and the Minister of Finance Bruno Lemaire had influenced the beginning of the story.

A potential merger between Suez and Veolia was always political

And if we look a bit further in the rich history of both rivals, every single time their merger was in the air, you could trace it back to an influent member of the government, somehow advocating for it!

The first example that comes to mind, is when Jean-Louis Borloo almost became the CEO of VEOLIA instead of Antoine Frérot, after having worked, through his various government roles, at a possible take over of VEOLIA by SUEZ.

I do know, I’m making a long story very short but it’s such a rich drama!

So back to our lawsuit: will it have consequences? Well, if it has, it has to come fast.

Because the teams in charge of the merger are not sitting on their hands.

Despite the lawsuit, the merger is ongoing

Following VEOLIA’s tender offer on SUEZ end of July, the European Commission’s Competition Authorities have given a provisional deadline that expects to rule the case by the end of November, which could lead to closing the deal year-end.

Meanwhile, on the future “Mini SUEZ,” things are moving as well. MERIDIAM, VEOLIA, and SUEZ have officially signed the agreement that will create a “New SUEZ” roughly 40% the size of the former one, with water assets in France, Italy, Central Europe, Africa, Australia, and parts of Asia, on top of a couple of additional activities in France.

Some top managers have left SUEZ, like Christophe Cros, Kevin Kassidy or Jean-Marc Boursier, and the soon to leave CEO Bertrand Camus, has a rumored replacement ready to take over, in the person of Sabrina Soussan, the current CEO of Dormakaba.

In conclusion, that lawsuit seems to pop up a bit late. It sounds like something that, at worst, may have personal repercussions on some of the actors of the drama.

Veolia Suez Merger: Chapter 4 – 2 new Heads!

Well, talking of personal repercussions… I swear it is not related, but Suez and Veolia will have two new heads!

Sabrina Soussan will take over the new Suez, at the beginning of 2022. And Estelle Brachlianoff will take over from Antoine Frérot by July 2022!

Shall we present our two new protagonists?

Sabrina Soussan – Estelle Brachlianoff: perfect opposites?

One is a company insider who climbed the corporate ladder for the past 17 years; the other is brand new to the organization and joining from a totally different industry.

One developed a long-lasting relationship with Paris, the other happily avoided as much as possible working there.

One is the incarnation of a typical french success story; the other is more of a german characteristic success path.

Estelle Brachlianoff, Veolia’s next CEO, starting in July, and Sabrina Soussan, SUEZ’s next CEO, starting anytime soon, have quite different paths and profiles.

But they’ll soon also have quite a bunch of things in common: leading two groups with a wealth of challenges to overcome, taming, and appeasing new executive committees, and being two women in charge of the n°1 and n°3 companies in a Water Industry where men still represent 83% of the workforce, and often even more in executive roles.

Will they succeed? I’ll share my bet in a minute.

They both started in infrastructure

Ironically, in a different world, they could have worked together.

Indeed, both are roughly the same age, and while Sabrina Soussan started her career at Renault then worked in the automotive industry for almost the entire next 20 years, Estelle Brachlianoff started in the infrastructure divisions of the Val d’Oise Department, then Paris Prefecture.

So one was building cars, trucks, and trains, while the other was building motorways and tramway lines.

It doesn’t stop there: when Estelle Brachlianoff took over Veolia UK, her teams developed some resource recovery routes that turned wastes into automotive industry feedstock. Here again, one could have been the supplier of the other – just the other way round.

Introducing: Sabrina Soussan

Born in 1969 in Paris, the future CEO of SUEZ grew up in Dole, where she was known to be an outstanding pupil and an athlete. She then studied maths in Lyon then mechanical and aeronautical engineering in Poitiers before getting an MBA from Dublin’s University.

Sabrina Soussan started her professional career working for Renault in Paris, and was swiftly sent to Finland for three months to run some R&D on motors. In 1997 she formed a 23 years relationship with Siemens, which would take her to Toulouse, London, Regensburg, Tokyo, Zug and finally Erlangen, this last role as CEO Mobility.

In 2021 she took over the CEO role at Dormakaba, where SUEZ came to hunt her one year later. On a side, she also sits on the ITT board and is said to be a turnaround specialist with a growth track record.

Introducing: Estelle Brachlianoff

The future CEO of Veolia was born in 1972. She graduated from one of the most prestigious school combinations there is in France, with Polytechnique and l’Ecole des Ponts. If you get asked, you can shorten it that way: she’s an X-Ponts.

She then worked in infrastructure, as I already alluded to, before joining Veolia in 2005. Her 17 years – and counting – journey there would take her through rising roles in Paris before getting appointed CEO of Veolia UK and Ireland.

Antoine Frérot called her back to Paris in 2018 to become the group’s n°2 as COO, a role she still holds for a couple of months, before climbing the last step on the ladder next July.

She’s said to have proven her worth and gained her promotion during her outstanding management of the SUEZ-Veolia merger discussions. And on a side, she’s sitting on the board of Hermes.

Veolia: Challenges ahead!

Now that we better know both of them, what are these challenges they have to overcome?

Let’s start with Estelle Brachlianoff. She’ll be heading a 230’000 head’s giant, with a 37 billion euros annual turnover. But she’ll also have to integrate the teams and managers jumping over from SUEZ. Plus she needs to do all of that fast enough to keep Veolia’s ability to further transform into a circular economy company.

And if her relationship with Antoine Frérot is said to be excellent, she will nevertheless have to manage his legacy and shadow, as he’ll keep leading Veolia’s board. A situation Sabrina Soussan knows very well, as it is more or less what she experienced, leading Dormakaba under the close watch of its former CEO.

Suez: Crossing Roads

But her challenges as head of SUEZ might well be of a fully different magnitude: first, there’s a kingdom to rebuild on the remains of an empire. If the new SUEZ keeps its french assets almost untouched, 40% of these contracts are set to be renewed in the next years.

Abroad, the challenge is even wider, with only 2 billion euros of turnover remaining in quite scattered geographies, from Australia to India through Africa. Will SUEZ’s new shareholders help the group to invest in its regrowth? That’s going to be a central question.

Then, Sabrina Soussan will have to leverage the competencies of Ana Giros and Maximilian Pellegrini. You know, those competencies could have earned them her job, so, if you know what I mean…

If she manages to navigate all of that, the new SUEZ, pruned down to 45’000 employees and 7 billion euros turnover, could be much more agile than Veolia and regain parts of what it just lost.

Two women in charge of the Water Industry’s n°1 (Veolia) and n°3 (Suez)

Now, before sharing my bets on the future of both companies, I’d like to take on the elephant in the room.

Estelle Brachlianoff and Sabrina Soussan are two women. When she takes over Antoine Frérot’s position, Estelle Brachlianoff will only be the second woman among all the CEOs of France’s CAC 40 companies. 2 out of 40, that’s 5%. Yeah, I’m a man, so I’m good at maths.

SUEZ won’t be public anymore, but the symbolism is equally strong here, especially if we figure Sabrina Soussan as somehow following in the path of Isabelle Kocher – the former CEO of Engie, the company that sold its stakes in SUEZ to Veolia.

I have to say, that’s the kind of occasion where I’m proud of our Water Industry. It’s not much, but it’s something!

But will it last?

My bet: How will the story of the Veolia and Suez Merger end?

The one with the hardest task from our two new protagonists may well be Estelle Brachlianoff. Indeed, she has to welcome 45’000 new employees in one delivery and demonstrate synergies to justify the entire move.

Even if these synergies exist, there’s an execution challenge to make them come to life. The analogy that comes to mind, is the building of the Death Star in Star Wars. And I am not even remotely comparing Estelle Brachlianoff to Darth Vader.

Once built, the Death Star may well be the strongest weapon there is. But as long as it’s still in the building phase, more agile players can hover around and end up destroying it.

We live in a fast-transforming world, and groups the size of Veolia have to keep changing to adapt. And Estelle Brachlianoff’s ability to replicate what she’s done in the UK on a broader scale will be closely observed.

Contracts to be renewed, regrowth, dealing with investment funds…

On Sabrina Soussan’s end, the challenge is very different. She will have to be defensive in France, and fight to keep its water and waste contracts. Keep in mind that 2022 is an election year in France, and that within the long cycle of private-public shifts, we’re rather in a period where public water management is the trend.

But if Meridiam and GIP insisted so much on having Sabrina Soussan, it’s probably because of her international and outsider profile. So it would be surprising not to see SUEZ be quite offensive, especially in Asia and Africa.

There are synergies to leverage with Meridiam’s direct investments in Africa, and a critical scale to rebuild to double on the mid-term the current 2 billion international turnover that’s left in the new SUEZ.

The questions are: do SUEZ’s new shareholders have this endeavor of regrowth, and if yes, how much are they ready to dive into their pockets to sustain this ambition.

Veolia, Suez, Mergers, Leadership and Path Forward – Conclusion

I’m reasonably optimistic for both of them, but I also have many questions open. So please pardon me if I’m direct, but Estelle, Sabrina, I’d be thrilled to raise these questions directly on my podcast microphone. I’m available whenever you are!