with 🎙️ Antoine WALTER – Podcaster in Chief @ GF Piping Systems

💧 Let’s dive into the last 8 months of the SUEZ Vs. Veolia battle that apparently came to an end on the 12th of April 2021!

This episode is part of my series on the Suez – Veolia Merger – Check it out! 😀

Table of contents

The end of the Battle?

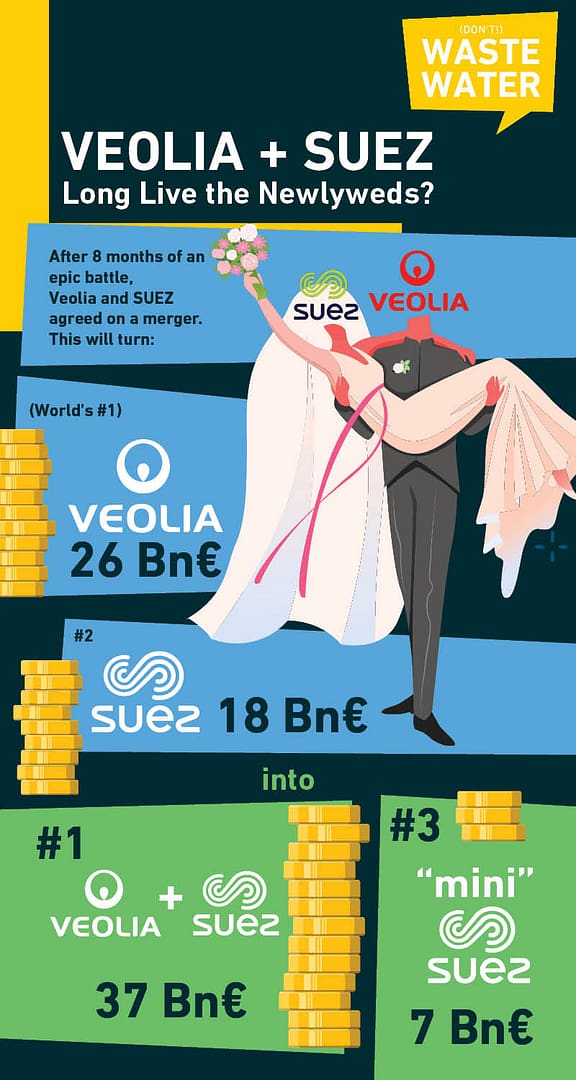

After 8 months of an epic Battle, VEOLIA and SUEZ finally announced this Monday that they agreed on a merger.

Well, technically, on a merger and a split. Because the new giant will reach a 37 billion euro turnover. But it will also create a tiny little “new SUEZ,” consisting of just… 7 billion euros. Well, probably still the world’s n°2 or 3, now that you mention it.

So what’s inside this deal? What does this imply for the Water Industry, both groups’ Employees, and the General Population?

We’ll study that in a minute. But to better understand what’s just about to happen, we’ll have to go back a bit in time.

(If you’re new to the topic, let a much more clever Sebastien Mouret enlighten you on the topic here!)

Veolia + SUEZ: A long Story!

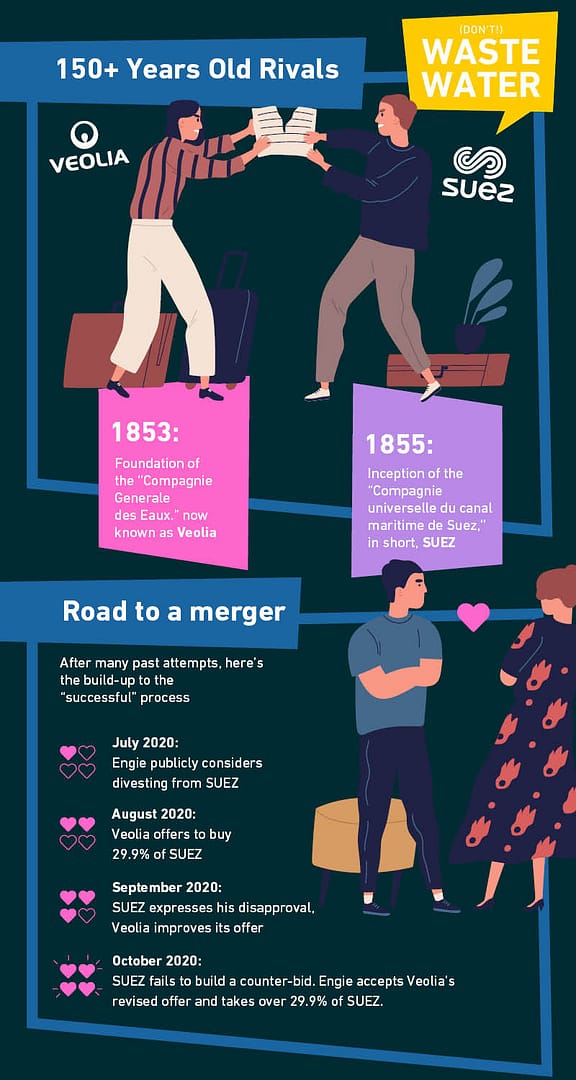

Founded in 1853, the “Compagnie Generale des Eaux” that we now know as VEOLIA might finally take over its best enemy, the “Compagnie universelle du canal maritime de Suez”, founded in 1855 and simply called SUEZ today.

Over the course of their 150 years long history, both groups have regularly been quite close to a merger. And while both build for the worldwide renowned “French Water School,” their relationship to eachother can be easily compared to a football derby. From the inside, you’re whether green or red.

So when Engie announced by the end of July 2020, that they might be divesting from SUEZ, and when VEOLIA made a public offer to buy most of Engie’s stakes and takeover 29.9% of SUEZ on the 30th of August, it all had this light touch of “Deja Vu”. And many were wondering if that might close this time.

Probably one of the first to wonder, the French Government swiftly took sides, with the Economy Minister Bruno LeMaire slightly heading towards SUEZ’s defense position, while prime minister Jean Castex publicly told that a merger would be making a lot of sense.

SUEZ & Veolia: A tight matchpoint?

This dissonance is not only funny; it really reminds us that this full deal is somewhat similar to this tennis ball on the edge of the net in Matchpoint. It could fall on both sides, and it’s going to be a tight decision.

At that point in time, the French Government still owns one-third of Engie’s voting rights, thus having quite a lot of skin in the game!

By the way, Engie doesn’t want to be down to VEOLIA only, they would praise some competition to raise the auction. But the rumored Ardian and Antin, that were supposedly preparing a counter-bid never did so. And another investment fund, Meridiam, was rather siding with VEOLIA to get a share of the merger’s spin-off.

So SUEZ started to fight back with what they had: announcing sales of waste management subsidiaries in Germany, Poland and BeNeLux, promising huge windfall for their shareholders and igniting backfires with their “AlwaysSuez” campaign, mobilizing their employees against the merger.

SUEZ’s brilliant yet controversial move

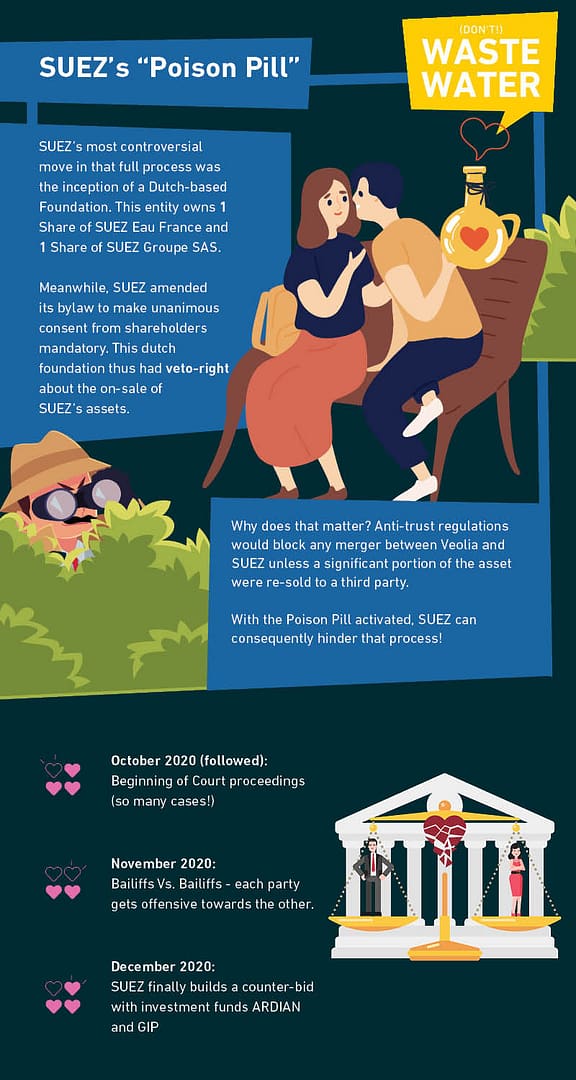

But behind the Scenes, SUEZ was preparing a brilliant, controversial and – who knows – maybe illegal move, called the “Poison Pill”.

Its principle was to create a non-profit foundation in the Netherlands – for the sake of speed, and give it one share of SUEZ Eau France, and one share of SUEZ Groupe SAS. SUEZ then combined that with an amendment in the group’s bylaw, making all shareholders’ unanimous consent mandatory to close a sale. Said differently, that dutch foundation now had the power to veto any on-sale of SUEZ’s French water business.

Why does that matter: well, VEOLIA and SUEZ have clearly dominant positions in France. So any merger between both would be blocked by anti-trust regulations unless a significant portion of the asset would be re-sold to a third party, which in VEOLIA’s scenario is the Investment Fund Meridiam.

But with the Poison Pill activated, VEOLIA could not sell any part of SUEZ Eau France, and would be forced to sell a portion if not all of its own french subsidiary. That’s possible, for sure. But everyone understands that VEOLIA would be very reluctant to do that.

That Poison Pill also backfired against SUEZ. Because Engie really wanted to cash out of SUEZ, and they knew that this veto element made selling more difficult.

Bye Bye, Engie!

So, when VEOLIA came by the end of September with a revised offer at 18€ per share, Engie was willing to accept that and not wait for an illusory counteroffer from SUEZ or their allies.

On the 5th of October, it became official: Engie formally accepted VEOLIA’s offer to take over 29.9% of SUEZ for 3.4 billion euros, and VEOLIA followed on by exposing their plans to make a public buying offer for the remaining 70.1%.

That’s the point when the debate between the two engaged transfers to Court.

The time of Court Proceedings

On the 9th of October, the deal get’s suspended, as long as SUEZ’s employee representatives have not been formally consulted on the takeover. That doesn’t change much on the sale, it just slows the whole process down.

In the meantime, SUEZ Shareholders, such as the CIAM Investment Fund, push for the poison pill’s deactivation. The power games at work can be caricatured at this stage as shareholders taking sides with VEOLIA, and employees and customers siding with SUEZ.

End of October, the Court sends VEOLIA and SUEZ back to back on the poison pill by freezing it, so neither allowing SUEZ to enforce it right away nor suspending it as VEOLIA was asking for.

SUEZ Vs. Veolia: Bailiffs Vs. Bailiffs

End of November, the full drama escalates further, with SUEZ sending court-appointed bailiffs to investigate computers and servers in the Veolia, Engie, and Meridiam offices. They were looking for proof that there were a pre-arrangement and a potential distortion of competition in the SUEZ shares’ buy-out.

The story doesn’t tell yet if they found anything. Still, as bailiffs were already hanging around, VEOLIA retaliated and hired them to visit some academics that had taken positions in favor of SUEZ. VEOLIA wanted to prove they had links to SUEZ. And there again, it turned out they did not find much if anything.

I’m not going into the full court details, because as you might expect, each decision led each time to formal challenges.

Finance in for the save?

On the financial side of things, SUEZ finally managed to put an alternative offer together, backed by the French investment fund ARDIAN and the New-York-based Global Infrastructure Partners. This new offer aligned with VEOLIA’s, offering 18€ per share. Unsurprisingly VEOLIA declined!

Still, SUEZ was making everything to look even sexier to investors, which implied increased asset rotation plans – another way to say divestment. While VEOLIA, of course, condemned this strategy, Court would once more step in, with the UK competition and market authority ordering to freeze asset disposal.

Long story short here: the full merger started to look like a draw, and the repeated efforts on both sides seemed to keep it stalling.

Veolia accelerates to Take Over

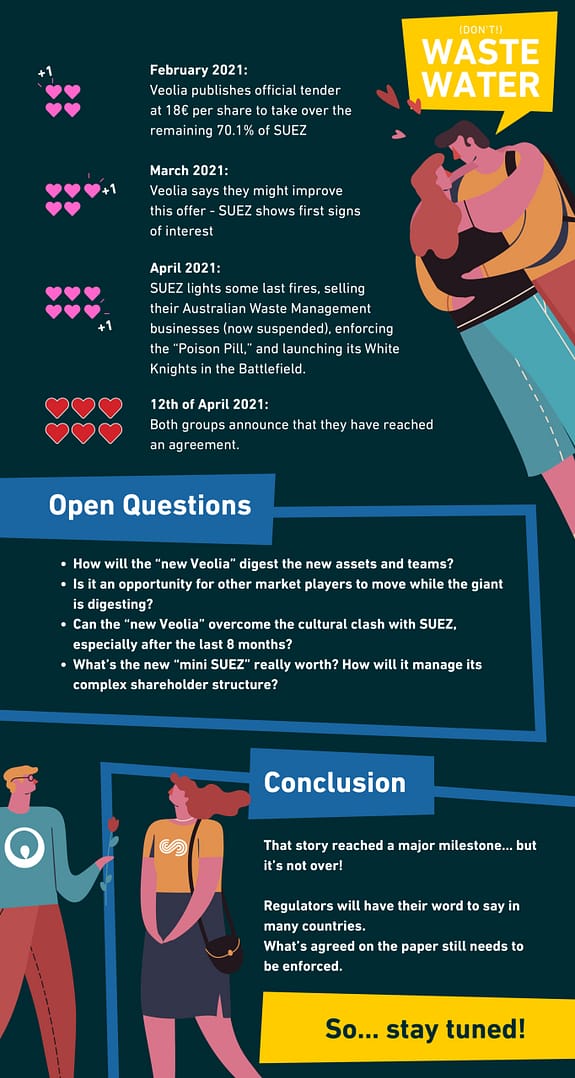

But VEOLIA was about to escalate the dispute. On the 8th of February, they officially issued an offer at 18€ per share for the 70.1% of SUEZ they didn’t own yet. SUEZ’s replica would take some hours: they got the offer suspended in front of the Nanterre commercial court and received support from France’s Minister of the Economy, who commissioned an investigation from the financial market’s regulator.

Still, VEOLIA doesn’t let go of its prey and confirms its tender filling. Courts also bring some tailwind: in France, it ensures VEOLIA’s right to own 29.9% of SUEZ, and in Europe, it confirms VEOLIA has not done anything illegal with regards to anti-trust regulations so far.

And if you’re still into improbable twists and turns, here’s a good one. Remember that Nanterre commercial court that suspended VEOLIA’s tender? Well, it turned out that yes, it is the proper jurisdiction for SUEZ, which is based in La Defense – so outside Paris. But as VEOLIA’s headquarters are based in Paris, that Court had no power to suspend that tender. And so the suspension was lifted!

Beginning of March, Veolia announced they were ready to make a new proposal – not higher in terms of money, but with better guarantees towards SUEZ’s employees.

SUEZ shows first positive signs…

And SUEZ’s response was a bit more open than the previous ones. Sure, they still demanded a better price, but they also lay down the path to a successful outcome. Veolia shall maintain jobs for a guaranteed four years, and the future “Mini-SUEZ” resulting from the anti-trust sales shall still have a worldwide R&D competitiveness. One might be tempted to translate this as SUEZ, wanting to keep its CIRSEE laboratories no matter the cost.

VEOLIA answered this constructive move with another one: offering to keep SUEZ France untouched, and especially without cuts on the waste management side.

… but fights VEOLIA back in a last big move!

But things would escalate a last time. Ardian and GIP – SUEZ’s white knights – issued an offer to buy out a significant “mini-SUEZ” at the cost of 20€ per share. And if VEOLIA weren’t to agree with this within 6 months, the consortium would extend this offer to the entire SUEZ.

Simultaneously, SUEZ activated its “poison pill” mechanism we covered moments ago, with the dutch foundation now having irrevocable veto rights until September 2024. Well irrevocable, unless VEOLIA agreed on the Ardian / GIP offer and improved its price per share for the rest of SUEZ at 22.5€ or more.

VEOLIA wasn’t willing to be dictated to the terms of a deal. Not only did they decline this new proposal, but also did they threaten to sue any SUEZ board member that would endorse the activation of the “poison pill.” This was slightly supported by the french financial markets’ policeman announcement that SUEZ’s strategy breached some rules and principles.

But that wouldn’t stop SUEZ, that announced beginning of April having found a deal to sell 2.5 billion Australian dollars worth of waste management assets in Australia – VEOLIA having a clause to repurchase them.

SUEZ + Veolia: End of the Story.

Was that the final turning point of this drama? Future will tell, probably in the memories of Antoine Frerot or Bertrand Camus in some decades. The fact remains that, this Monday, 12th of April 2021, both groups announced having reached a merger agreement.

VEOLIA increases its price per share to 20.5€ – which is an all-time high for SUEZ. A “New SUEZ” will be created later, and built around the full SUEZ France as existing, some additional municipal water assets, and the Smart Water division. Its estimated 7 billion € turnovers will be owned by a pool of investors consisting of Meridiam and the French Caisse des Depots on one end (VEOLIA’s partners), ARDIAN, and GIP on the other (SUEZ’s partners).

VEOLIA reiterates its social commitments for a period of 4 years, while SUEZ deactivates its dutch poison pill.

Veolia + SUEZ: Well, End of the Story?

Now, the deal might be more or less sealed, yet many questions are left open. And the first that comes is probably why. Why did VEOLIA push so hard for a merger? A SUEZ-sponsored study had shown in February that bigger is not better. That scale effects no longer apply when you’re talking of such giants. Sure, the study is biased by its sponsorship, but yet it’s a legitimate question.

So why? I’ll leave that question to the Antoine Frerot memory book I previously alluded to. And that microphone is open anytime to anyone on both sides that would like to step in and explain the “New VEOLIA” and “New SUEZ’s” ambitions. Antoine, Bertrand, or your board members, just drop me a direct message.

But besides, I’ve seen many concerns expressed by water professionals regarding the size of the new giant. First, let’s put that in perspective. The newly created VEOLIA would surely be an even larger market leader, but its shares of the Water Industry will hardly exceed 4%.

To digest such a beast meal, the giant will also have to settle and take some time. So, I would question the short-term agility of the new group – which might be an opportunity for smaller players – aka everyone else.

There are still many questions open

It also questions a potential clash of cultures. Are the reds compatible with the greens and conversely? Will the past 8 months, and the tension between both teams leave after-effects?

And now I’ll conclude with the golden question. What is the “mini-SUEZ” really worth? Isn’t it a bit curious to let, for the sake of anti-trust policies, a market leader choose his competition? Isn’t it a bit strange to have a financial round table where the power is so dispersed?

When the first VEOLIA project was released 8 months ago, the future “Mini-SUEZ” had a strong direction. It was foreseen to belong to MERIDIAM, and MERIDIAM had a plan – whatever you think of that plan. Now, it’s hard to tell. Won’t they suffer from being deprived of their rockstars, like WTS? More than ever future will tell.

That’s the point in time where I’d love to catch your brains. What do you think of that full drama coming to an end? Will it have any impact on you? Do you see perspectives I might have missed? Or open questions seeking answers? Please, share them with me wherever you’d like – on social media or in direct messages.

I’d love to follow on this story with testimonies, Q&A, or panel discussions. And again, if you watch this, Antoine, Bertrand, drop me a message!

1 thought on “SUEZ + VEOLIA: Long Live the Newlyweds?”