From university laboratories to commercial success, IP Group has carved a unique niche in the water technology investment landscape. As a publicly-listed company managing over £4 million in portfolio value, IP Group brings scientific breakthroughs to market by combining deep technical expertise with patient capital. Their investment thesis centers on early-stage water innovations emerging from academic research, typically deploying £5-10 million per deal in companies valued between £100-500 million. With a focus on water scarcity solutions and sustainable technologies, IP Group exemplifies how institutional investors can bridge the gap between scientific discovery and real-world impact in the water sector.

IP Group is part of my Ultimate Water Investor Database, check it out!

Investor Name: IP Group

Investor Type: VC

Latest Fund Size: $0 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Scarcity and access to fresh water, digital water technologies, decentralized water treatment

Investment History: $2258409.09 spent over 2 deals

Often Invests Along:

Already Invested In: 8power Ltd., ElectraLith

Leads or Follows: Lead

Board Seat Appetite: High

Key People:

From Lab to Market: IP Group’s Investment Philosophy

IP Group’s approach to identifying and commercializing water technology innovations follows a rigorous yet flexible framework built on decades of experience bridging academia and industry. At its core, the firm’s investment philosophy centers on finding transformative technologies that address major water challenges while demonstrating clear paths to market adoption.

The process begins with deep relationships across leading research institutions, where IP Group’s technology scouts actively engage with scientists and research groups working on promising water innovations. Rather than passively reviewing pitch decks, the firm embeds itself in the academic ecosystem to identify breakthrough technologies before they even reach the commercialization stage.

When evaluating potential investments, IP Group applies a comprehensive set of criteria focused on both technical and commercial viability. The technology must demonstrate meaningful advantages over existing solutions – whether in performance, cost, or sustainability impact. Equally important is the intellectual property position, with IP Group carefully assessing patent landscapes and freedom to operate.

But technical excellence alone is insufficient. The firm’s due diligence process heavily weights market validation and customer pull. This involves extensive interviews with potential end users, detailed analysis of competitive dynamics, and rigorous assessment of regulatory pathways. IP Group looks for technologies that solve clear pain points and where customers signal strong willingness to pay.

What truly sets IP Group’s approach apart is its hands-on support in bridging the commercialization gap. Rather than simply writing checks, the firm actively helps shape business models, build management teams, and establish partnerships. This includes leveraging IP Group’s extensive corporate relationships to facilitate pilot projects and strategic collaborations.

An example of this philosophy in action can be seen in how IP Group approaches de-risking technologies. The firm often structures early investments around specific technical and commercial milestones, providing tranched capital as startups validate key assumptions. This disciplined approach allows promising innovations to advance while maintaining rigorous standards.

Crucially, IP Group takes a long-term view, recognizing that water technology commercialization often requires patience and persistence. The firm is willing to support portfolio companies through multiple rounds of funding, helping them navigate the challenges of scaling novel technologies in conservative water markets.

This comprehensive approach to identifying, validating and nurturing water innovations has helped IP Group build one of Europe’s strongest portfolios of water technology companies. By combining deep technical expertise with commercial acumen and hands-on support, the firm has established a proven model for bringing university research to market.

Capital Deployment Strategy

IP Group employs a systematic approach to deploying capital across water technology ventures, leveraging its deep university relationships and scientific expertise to structure deals that support long-term value creation.

The firm’s investment thesis centers on taking significant early-stage positions, typically investing £500,000 to £5 million in initial rounds. These investments often secure IP Group 20-30% ownership stakes, providing meaningful influence while leaving room for future dilution. Rather than pursuing quick exits, IP Group takes a patient capital approach, prepared to support portfolio companies through multiple funding rounds over 5-10 year horizons.

Structuring flexibility is a hallmark of IP Group’s strategy. While straight equity investments are common, the firm also utilizes convertible instruments, milestone-based tranching, and other creative mechanisms to align incentives and manage risk. This adaptability helps accommodate the diverse needs of early-stage water technology companies while protecting IP Group’s interests.

Beyond capital, IP Group provides hands-on support through dedicated investment managers who often take board seats. These professionals leverage the firm’s extensive network to help portfolio companies recruit key talent, establish industry partnerships, and navigate regulatory hurdles. IP Group also facilitates connections across its portfolio, enabling companies to share learnings and explore collaboration opportunities.

As companies mature, IP Group maintains pro-rata rights and often participates in follow-on rounds to protect its ownership position. The firm typically reserves 2-3x the initial investment for follow-on funding in successful portfolio companies. This controlled scaling approach helps promising technologies bridge the critical gap between university research and commercial adoption.

While IP Group’s strategy emphasizes thorough due diligence and disciplined valuation assessment, it maintains flexibility to move quickly when compelling opportunities arise. The firm’s deep scientific expertise enables rapid evaluation of complex water technologies, while its permanent capital structure supports conviction-based investing without artificial time constraints.

This balanced approach to capital deployment has enabled IP Group to build one of Europe’s leading water technology portfolios while maintaining strong relationships with both universities and co-investors. The strategy continues evolving to address emerging opportunities in digital water, resource recovery, and other high-potential segments of the water innovation landscape.

Water Technology Focus Areas

IP Group has strategically positioned itself at the forefront of water technology investment by focusing on three key sectors that address critical global water challenges. These areas represent both immediate needs and long-term opportunities for transformative innovation.

Water scarcity solutions form a cornerstone of IP Group’s investment thesis. The firm targets technologies that enhance water availability through advanced desalination, atmospheric water generation, and water reuse systems. A particular emphasis lies on energy-efficient processes that can operate at various scales, from industrial applications to distributed community systems. This aligns with the growing recognition that water sustainability requires both technological innovation and careful resource management.

Digital water technologies represent another crucial focus area. IP Group actively seeks innovations in smart monitoring, predictive analytics, and automated control systems. These solutions enable better asset management, reduce water losses, and optimize treatment processes. The emphasis extends beyond basic monitoring to encompass advanced AI applications that can predict maintenance needs, detect contamination events, and manage complex water networks in real-time.

In treatment technologies, IP Group prioritizes breakthrough approaches that address emerging contaminants while improving operational efficiency. This includes novel membrane technologies, advanced oxidation processes, and biological treatment systems. The firm shows particular interest in solutions that can tackle persistent challenges like PFAS contamination, pharmaceutical residues, and industrial pollutants while maintaining cost-effectiveness.

Across these focus areas, IP Group maintains strict investment criteria centered on scalability and commercial viability. They seek technologies that demonstrate clear advantages over existing solutions, whether through improved performance, reduced energy consumption, or lower operational costs. The firm’s approach recognizes that successful water technologies must balance innovation with practical implementation considerations, including regulatory compliance and market acceptance.

Notably, IP Group favors technologies that create synergies across multiple applications or can be adapted for different market segments. This strategic approach helps maximize the potential impact and return on investment while providing portfolio companies with multiple paths to market success. Their investment decisions are guided by deep technical expertise and market understanding, ensuring that funded technologies address real-world water challenges effectively.

Value Creation and Portfolio Support

IP Group’s approach to portfolio support goes far beyond traditional venture capital investment. The firm takes an active role in shaping its water technology companies’ trajectories through comprehensive strategic guidance and hands-on operational support.

At the core of their value creation model is deep board-level engagement. IP Group typically maintains significant board representation in portfolio companies, allowing them to provide ongoing strategic direction and governance oversight. Their board members bring decades of water industry expertise and help companies navigate complex regulatory environments, technology validation processes, and market entry strategies.

The firm has developed a structured approach to strategic planning and milestone achievement. Portfolio companies benefit from regular strategy sessions where IP Group’s sector specialists help refine business models, identify key growth opportunities, and establish clear commercialization roadmaps. This systematic process ensures companies remain focused on their most promising market opportunities while maintaining sufficient runway to achieve critical milestones.

One of IP Group’s most valuable contributions is facilitating access to their extensive network of industry connections. Through years of water sector investing, they’ve built relationships with major utilities, industrial end-users, engineering firms, and other strategic partners. These connections prove invaluable for portfolio companies seeking pilot opportunities, commercial validation, and strategic partnerships. The firm actively brokers introductions and helps structure meaningful collaborations that accelerate market adoption.

Talent acquisition represents another crucial area where IP Group adds value. Their reputation and network enable portfolio companies to attract top technical and commercial talent. The firm assists with executive searches, helps structure compensation packages, and provides guidance on building effective organizational structures as companies scale.

Beyond strategic support, IP Group helps companies optimize their operational execution. Their in-house specialists advise on everything from supply chain optimization to quality management systems. This operational expertise proves particularly valuable as early-stage companies transition to commercial-scale manufacturing and delivery.

IP Group’s patient capital approach allows them to support companies through multiple growth phases. Rather than pushing for quick exits, they focus on building sustainable businesses that can deliver meaningful impact in the water sector. This long-term orientation aligns well with the extended development and adoption cycles often required for breakthrough water technologies.

The firm’s track record in helping portfolio companies secure follow-on funding further demonstrates their value-add capabilities. Their stamp of approval and ongoing support give other investors confidence, while their market intelligence helps companies position themselves optimally for future funding rounds.

The IP Group DNA: Science-Backed Investment Philosophy

At the core of IP Group’s investment strategy lies a distinctive approach that bridges the gap between academic research and commercial viability. Unlike traditional venture capital firms, IP Group embeds scientific rigor into every investment decision through a methodical evaluation process that begins in university laboratories.

The firm’s scientific due diligence starts with a deep technical assessment conducted by their in-house team of PhDs and subject matter experts. These specialists work closely with research institutions to identify promising water technologies that demonstrate both scientific merit and commercial potential. This evaluation encompasses not just the core technology, but also its scalability, environmental impact, and ability to address critical water challenges.

IP Group has cultivated long-term partnerships with leading research institutions through a unique model that goes beyond simply funding research. They actively participate in the technology development process, providing expertise in intellectual property protection, market validation, and commercial strategy. This hands-on approach helps accelerate the transition from laboratory breakthrough to market-ready solution.

In water technology specifically, IP Group has developed specialized criteria for evaluating potential investments. They prioritize innovations that demonstrate clear advantages in energy efficiency, operational costs, or treatment effectiveness compared to existing solutions. The firm’s track record shows a particular interest in technologies addressing water scarcity, quality monitoring, and resource recovery.

What sets IP Group apart is their patient capital approach, recognizing that water technology commercialization often requires longer development cycles than traditional software or consumer products. This understanding is reflected in their investment horizons, typically spanning 5-10 years, allowing sufficient time for thorough technology validation and market entry.

The firm’s investment philosophy has proven particularly effective in the water sector, where technical complexity and regulatory requirements demand a deep understanding of both scientific principles and market dynamics. As explored in their approach to fostering innovation, IP Group has successfully guided multiple water technologies from concept to commercialization.

Crucially, IP Group maintains a balanced portfolio strategy that combines early-stage investments in breakthrough technologies with later-stage funding for more mature solutions. This approach helps manage risk while maintaining exposure to potentially transformative innovations. Their portfolio companies benefit from cross-pollination of ideas and technologies, creating a collaborative ecosystem that accelerates development and adoption.

IP Group’s success in water technology investment demonstrates that deep scientific understanding, combined with patient capital and active support, can effectively bridge the commercialization gap that often challenges university-born innovations. Their model continues to evolve, incorporating lessons learned from both successes and setbacks in bringing water technologies to market.

Portfolio Deep Dive: Water Technology Success Stories

IP Group’s water technology portfolio showcases several breakthrough innovations that are reshaping water management worldwide. The company’s scientific evaluation process has yielded investments in technologies addressing critical challenges across the water value chain.

A standout example is their early backing of membrane treatment innovations that radically reduce energy consumption in desalination and wastewater treatment. By identifying novel materials and manufacturing approaches developed in university labs, IP Group helped commercialize solutions that cut operational costs by over 40% compared to conventional technologies.

The company’s portfolio also demonstrates success in digital water solutions, particularly in leak detection and network optimization. Through partnerships with academic institutions, they’ve supported the development of advanced sensors and AI-powered analytics platforms that enable utilities to predict and prevent infrastructure failures. These systems now monitor thousands of kilometers of water networks globally, helping utilities save millions in non-revenue water losses.

In the industrial water treatment space, IP Group recognized the growing challenge of emerging contaminants like PFAS. Their investment in destructive treatment technologies has yielded processes that break down these “forever chemicals” without generating hazardous waste streams. This technology is now being deployed at major industrial facilities and military bases.

Resource recovery represents another key focus area where IP Group’s scientific expertise has driven commercial success. Their portfolio includes companies that have pioneered methods to extract valuable materials from wastewater streams, including nutrients, rare earth elements, and energy. One venture has successfully scaled up biogas production from sewage treatment, generating renewable energy while reducing plant operating costs.

What sets these success stories apart is IP Group’s deep technical understanding and patient capital approach. Rather than seeking quick exits, they’ve provided sustained support through multiple development stages – from proof-of-concept to full commercial deployment. This has enabled portfolio companies to optimize their technologies for real-world conditions and build robust business models.

The impact extends beyond financial returns. Their portfolio companies collectively treat billions of gallons of water annually while reducing energy consumption, chemical usage, and waste generation. This aligns with how to make water technologies more attractive than the Apple and Samsungs of this world by delivering measurable environmental benefits alongside strong commercial performance.

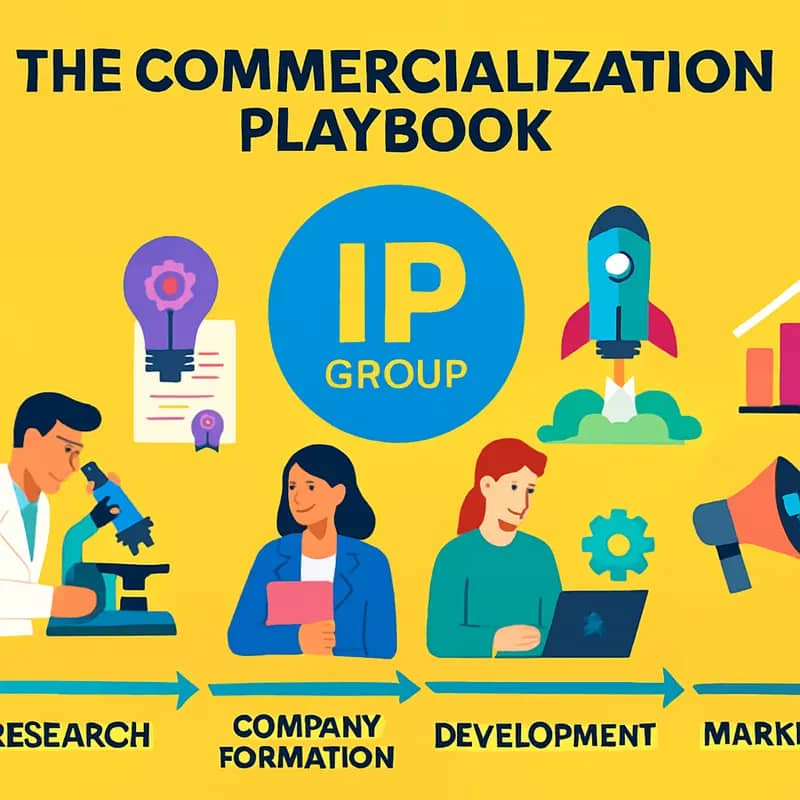

The Commercialization Playbook

IP Group’s systematic approach to commercializing water technologies rests on three foundational pillars: comprehensive support infrastructure, rigorous market validation, and strategic scaling pathways. This methodology has emerged from decades of taking university innovations to market.

The journey begins with IP Group’s unique support infrastructure. Rather than simply providing capital, they surround promising technologies with experienced sector specialists who understand both technical water challenges and commercial realities. These specialists help refine the technology while building robust business models that address real market needs. Early-stage companies receive dedicated workspace, access to testing facilities, and crucially, connections to IP Group’s network of industry partners.

Market validation follows a structured yet flexible framework that examines how ideas come to life in water & wastewater treatment. The process begins with extensive customer discovery interviews to verify problem-solution fit. IP Group’s teams work closely with potential end-users to understand their specific requirements, pain points, and willingness to pay. This feedback loop helps refine both the technology and business model before significant resources are committed to scaling.

The validation phase also includes thorough technical due diligence, often involving pilot projects with strategic partners. These pilots serve dual purposes – proving the technology’s effectiveness while establishing relationships with potential customers. IP Group’s expertise in structuring these partnerships helps prevent common pitfalls that can derail promising technologies.

When scaling, IP Group employs a staged approach that balances growth with risk management. Initial commercialization typically focuses on beachhead markets where the technology can demonstrate clear value. Success in these markets builds credibility for expansion into adjacent sectors. The scaling strategy emphasizes sustainable growth through strategic partnerships rather than pursuing rapid scaling at all costs.

Throughout the process, IP Group maintains active involvement in key decisions while empowering management teams to drive day-to-day execution. They leverage their extensive network to help portfolio companies secure additional funding, establish commercial partnerships, and recruit key talent. This hands-on approach has proven particularly valuable in the water sector, where commercialization timelines can be longer and market dynamics more complex than in other technology sectors.

The playbook also emphasizes intellectual property protection and regulatory compliance from the outset. Early attention to these areas prevents future obstacles and creates valuable barriers to competition. This strategic foundation-building has helped numerous water technology companies navigate the challenging path from university innovation to commercial success.

Future Focus: IP Group’s Vision for Water Innovation

IP Group’s strategic vision for water technology investment centers on addressing critical global challenges while capturing emerging market opportunities. The firm has identified several key focus areas that will shape their investment priorities in the coming years.

A core pillar of IP Group’s forward-looking strategy involves advancing solutions for water scarcity and quality issues. They’re particularly interested in technologies that can help utilities and industries significantly reduce their water footprint through enhanced treatment processes and smart resource management. This includes backing innovations in water reuse, desalination efficiency, and contaminant removal – especially emerging pollutants like PFAS.

The investor sees enormous potential in the convergence of digital technologies with traditional water infrastructure. Their thesis aligns with growing evidence that artificial intelligence and advanced analytics can transform water operations. IP Group is actively seeking startups developing predictive maintenance systems, smart metering solutions, and data-driven optimization tools that can dramatically improve infrastructure performance while reducing costs.

Climate resilience represents another strategic priority, with IP Group focusing on technologies that help water systems adapt to intensifying weather extremes. This includes innovations in flood management, drought mitigation, and sustainable urban drainage. The firm believes climate adaptation solutions will see accelerating demand as municipalities worldwide grapple with infrastructure vulnerabilities.

IP Group’s vision extends beyond individual technologies to encompass systemic changes in how water resources are managed. They’re exploring opportunities in circular water economy models, decentralized treatment systems, and nature-based solutions that can transform traditional approaches to water management.

Resource recovery and energy efficiency innovations remain high on IP Group’s agenda. They see significant value creation potential in technologies that can extract valuable materials from wastewater streams while minimizing energy consumption. This includes advances in nutrient recovery, biogas optimization, and low-energy treatment processes.

The firm’s investment strategy increasingly emphasizes scalable solutions that can be rapidly deployed across multiple markets and sectors. They’re particularly interested in platform technologies that can address multiple water challenges simultaneously while offering clear paths to commercial adoption.

This forward-looking approach reflects IP Group’s conviction that water technology innovation will play a crucial role in addressing global sustainability challenges. Their investment priorities align with major market drivers including regulatory pressures, climate change impacts, and growing corporate focus on water stewardship.

Final words

IP Group stands as a cornerstone investor in the water technology sector, distinguished by its unique approach to nurturing university-born innovations. Their investment model, combining substantial capital deployment with deep technical expertise, has proven effective in bridging the often-challenging gap between academic research and commercial success. With typical investments ranging from £5-10 million and a focus on early-stage opportunities, IP Group demonstrates how institutional investors can effectively support water technology development while maintaining commercial viability. Their emphasis on water scarcity solutions and sustainable technologies positions them well to address growing global water challenges. For water entrepreneurs and fellow investors, IP Group’s approach offers valuable lessons in how patient capital, technical expertise, and strong university relationships can combine to drive innovation in the water sector. As water challenges continue to grow globally, IP Group’s model of investment and support may become increasingly relevant for bringing crucial water technologies to market.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!