I dived into 23 years of M&A records in the Water Industry (and sat down with a bunch of first-hand experts 😉): 3 major trends stand out:

1️⃣ The most active players are American utility consolidators. Within the top 10 M&A fanatics, 6 respond to this description, and a 7th is also consolidating utilities (although not in the US).

2️⃣ There’s a new wave of “Water Tech Aggregators” that’s rising under the lead of SKion Water, Nijhuis Saur Industries and Evoqua Water Technologies.

3️⃣ 12 companies are playing the “Wayne Huizenga” game – super actively consolidating a very specific section of the water food chain.

with 🎙️ Tom Rooney – Chairman at Sciens Water

with 🎙️ Alex Buehler – CEO at Integrated Water Services

with 🎙️ Damian Georgino – Partner at Womble Bond Dickinson

Resources:

🔗 Have a look at Integrated Water Services‘ website

🔗 Check out today’s sponsor: Sciens Water

is on Linkedin ➡️

Full Video:

Table of contents

- Resources:

- Full Video:

- American Water: the World’s most M&A active water company

- The US water utility market is profoundly fragmented

- Could M&A consolidation lead to monopolization of water?

- The scale issue on the water technology side

- The water sector needs a roll-up AND a roll-down

- How to aggregate water technologies through M&A in concrete steps

- Building an Acquisition Pipeline

- How to score the targets in your acquisition pipeline?

- There is high competition for attractive M&A targets in the Water Sector

- Competition is a confirmation your strategy is right

- The (infamous?) example of US Filter

- Could a “Dick Heckman” M&A strategy work in 2023?

- The 12 water companies that follow a “Wayne Huizenga” acquisition strategy

- Water M&A – My Conclusion

- Other Episodes:

American Water: the World’s most M&A active water company

In 2011, American Water acquired two companies: Wildcat Park Corporation and Roark Water & Sewer. Two M&A moves in one year would already be a significant activity for most companies, yet for American Water and for at least the past 25 years, that’s their lowest M&A activity on record.

Indeed, since the year 2000, American Water has closed 245 water acquisitions, with a record of 20 deals in 2020 alone. Just to stress how crazy that is, we’re talking of an average of one deal per month over the past two decades.

With its 245 M&A moves, American Water is the most active water company over that period of time yet, that may change pretty soon in the future, because of a fast-rising challenger: Central States Water Resources.

CSWR: a fast-rising challenger

Indeed, CSWR has been, in turn, and by far, the most active company in the past five years, as Josiah Cox, its founder and CEO, told me in 2022:

“Last year, there were 208 M&A water utility transactions. We were 80 of those.”

Josiah Cox – CEO & Founder @ Central States Water Resources

By my count, based on my own cleaning and interpretation of Global Water Intelligence‘s excellent M&A tracker, it’s even 83 moves in 2021 alone. That’s seven deals a month. Crazy, right?

American Water Utility consolidators are the most active M&A players

Now, if we zoom out and look at the 10 most active companies in water M&As since the beginning of this century, there’s a clear pattern that reveals: 7 of them are water and wastewater utility companies active in the US.

But why?

The US water utility market is profoundly fragmented

“They’re just way too many systems of water and wastewater utilities in the United States.”

Alex Loucopoulos – Partner @ Sciens Water

“We have these 50,000+ water utilities and 35,000 wastewater systems”

Seth Siegel – Best-selling author

“Water in the US is profoundly fragmented”

Tom Rooney – Chairman @ Sciens Water

“… every time I still say the fact that there are 70,000+ systems in the US, people even in the industry don’t believe me!”

Alex Loucopoulos – Partner @ Sciens Water

Yet it is a fact, and the problem with that is summarized by Josiah Cox in CSWR’s ESG report:

This fragmentation has water quality consequences

“Water utilities serving under 2,500 people comprise only 10 percent of all water utilities in the US but make up 80 percent of the EPA’s acute human health violations.”

The US have far too many small-scale utility systems, and they’re becoming hazards. But why would consolidating them solve that?

… Consolidation could help solve water quality issues

“These are operating assets, and so scale does matter.

Operators of those water providers don’t have the ability to digest cutting-edge technologies that aren’t even cutting-edge anymore.

So being larger potentially gives you the opportunity or the ability to perform better, to deploy uniform technologies and things like that.”

Tom Rooney

And that’s what the likes of American Water, Essential Utilities, and CSWR are aiming for with these frantic rates of acquisition: using their scale to turn lost assets into performing ones.

American utility groups are running large-scale roll-ups

“We’re experiencing massive high-paced roll-ups, because, yeah, we do enjoy and like the scale element that we got from it!”

Tom Rooney

That’s what these consolidators in the US water and wastewater utility space are doing: rolling up small systems to benefit from scale effects and get people safer water. Win-win.

Could M&A consolidation lead to monopolization of water?

Well, win-win… unless you’re concerned by the potential monopolization of water. Because the big guys acquiring 200 to 250 smaller guys every year might be concerning if you’re unsure about their intentions. First, I’d stand my point: they can’t possibly do worse than the more or less absence of care most small systems face today. But maybe more decisively, if you’re concerned, we’re still far, far, far away from a monopolistic situation.

Assuming the dozen utility consolidators keep their pace, it will take about 700 years to simply have less than a thousand active players. When you recall that there are just 30 in the entire United Kingdom, it sounds like the United States is safe from monopolization for now.

And that’s a problem.

The scale issue on the water technology side

Because that means that for the next seven centuries or so, the observation Tom Rooney makes will stay true:

“If you look at, at the tens of thousands of water utilities in the United States, for every New York City or Los Angeles or Chicago, there’s a thousand, quite literally, there’s a thousand small players.

Who are underserved. There are big engineering firms, big manufacturers, big consulting firms, big banks that are targeted at that top layer because that top layer, say the city of New York, they can afford to have a five-year plan to bring membrane bioreactor technology into play where they can take X number of years to deal with the big banks and talk about financing or bonds or whatever it might be.

But if you’re not at that big level, at that high tier, what happens with the rest of the ecosystem, which is composed of small owner utility regulated operators and a profoundly fragmented ecosystem of contractors, vendors wanna. So the technologies exist, but Really only if you want to buy that technology in large scale, take five years, but those, those water utility owner operators, they’re not sophisticated enough to create sort of bespoke solutions.”

Tom Rooney

The water quality gap will only widen (if we don’t act)

What that means is that the quality gap Josiah Cox highlighted between people served by large utilities and others living in more scattered areas will only widen.

“There is an untended gigantic part of the U. S. Water space where you have water and sewage. Providers who simply don’t have a support ecosystem that is suitable for their scale.”

Tom Rooney

Case Study: deploying water technologies at small scale

Let’s take an example. Let’s assume you’d like to mitigate water stress by implementing water reuse: Membrane Bio-Reactors do a great job at that, so you may want to upgrade your wastewater treatment plant for an MBR.

But that’s easier said than done. As standard as MBRs have become for several tens of thousands of population equivalent, they’re still a bit less common in small sizes. And even if you were to find a tech supplier in the right size, you’d still need to run the detailed engineering, installation, control strategy, and so on, and while that’s too complex for your local plumber or electrician, you’re still too small to be interesting for a large specialized players.

So you’re stuck in this middle-size, no-man’s land where technologies are too large and service providers too small. Hence Tom Rooney’s call for a roll-up and a roll-down.

The water sector needs a roll-up AND a roll-down

“Take the now proven MBR technologies, digital technologies, data, sensors, remote telemetry, all these other things, and package those, so roll them down into packages that are digestible by these smaller and medium sized water utilities.

The only way to do that is to consciously create bundles of services. Technologies and products that are somewhat modular in nature that could be digested, if you will, by the smaller players, but then also roll up the service providers. So right now, you have concrete construction companies and electrical providers and sensor manufacturers and whatnot, but they tend to be what I’ll call a mom-and-pop scale too small.

So if the technologies are too big, the service providers are too small. So we need to roll up the service providers and roll down the. The technology providers so that they’re meeting between”

Tom Rooney

Sounds great on paper, right? You take the mom-and-pop service providers and scale them up. Meanwhile, you take the large-scale proven technologies and scale them down. Then you marry the two, and off you go, problem solved. But how does one do that in concrete steps?

How to aggregate water technologies through M&A in concrete steps

Alex Loucopoulos, you heard in the beginning, and Tom Rooney, whom I’m now sitting with, are respectively Partner and Chairman at Sciens Water. If you recall my 2022 New York interview series or my 2021 sit down with Alex – it’s a long-term relationship – Sciens is the investment fund that enables CSWR to top the World’s M&A leaderboard for five years in a row.

But on top of that, they also acquired a company called “Integrated Water Services” in 2020.

Water M&A case study: Integrated Water Services

“We’re serving the middle market. These are typically suburban or ex-urban communities, and they’re admittedly not the biggest urban centers in the country.

What we’re doing is kind of serving them through a bundled product and service offering, offering turnkey solutions for that space.”

Alex Buehler – CEO @ Integrated Water Services

But how do you build that bundle and turnkey solution for this middle-market?

The first acquisitive step to building a water technology portfolio

“We had to purchase certain, uh, technologies that we could then make scale appropriate. We purchased a team that had formerly been with OVIVO, we brought them on board and created our own manufactured product.”

Tom Rooney

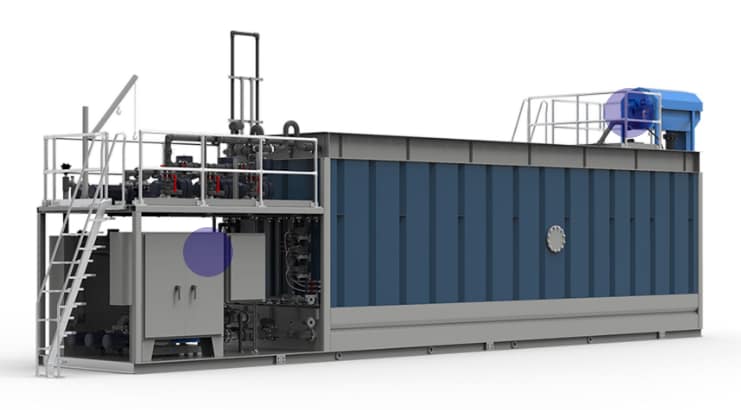

“We spawned a product a few years ago called the Blue Box, which is a modular, packaged, scalable, MBR system, a membrane bioreactor, so kind of a treatment plant in a box, if you will. So that was kind of our entree into product solutions.”

Alex Buehler

So, the Blue Box was Integrated Water Services’ starting point, but then also the product platform on which they built.

Building a portfolio around a foundation stone

“What we’re focused on is kind of acquiring products, differentiated products that we like in and around biological. Treatment as a process. We’re very acquisitive. We bought two companies over the last six months, both of which were vertical integration or backward integration strategies. So we were buying the engineering component as well as the electrical and control panel component of the blue box manufacturing.”

Alex Buehler

“It’s not just vertical integration. We’ve done some backward integration, but there’s also horizontal integration as well. So you’re looking at complimentary products and services that are offered alongside the blue box.”

Alex Buehler

To roll-out an M&A strategy it’s easier to scratch your own itches

To define what’s a complimentary product, IWS and its investor have kind of an unfair advantage:

“at Sciens, we’re fortunate that on some days we could put a hat on and think about ourselves because we are a water utility by virtue of CSWR. So we know how we think and we know how we have to operate. With that knowledge of being in effect our own customer, we can then step outside of that and become our service provider and put together packages that we know would marry up well with what the needs are in the marketplace.”

Tom Rooney

This defines the roadmap, as it lays out what technologies and services shall be aggregated and gives an overall direction to follow. But how does it roll out in concrete terms? First, you need to build an acquisition pipeline.

Building an Acquisition Pipeline

“It’s not hard to do that, whether it’s primary or secondary research. You can build a proprietary pipeline of 100 or 200 targets. It’s probably harder to advance those targets through the pipeline. Some of the magic is these companies are typically not Banked. They’re not dressed up for sale.

In many ways, you’re dealing with entrepreneurs, owners, sole proprietors who have never thought about selling their business. And those conversations take some work, right? That could have a prolonged courting period when the business is not ready for sale. It’s you got to work with them to understand the underlying fundamentals, financial commercial operating of the business so that you put a value and structure on it as well.”

Alex Buehler

Secondary sources in the Water M&A market

That’s one source for the acquisition pipeline, but not the only one. If you recall my conversation with Karl Michael Millauer – who’s himself representing several dozens of companies looking for an acquiror:

“in most cases there’s a succession problem that the founders have no kids or nobody who success, therefore they want to sell. But this is the major part of the sales site mandates, which I have. But sometimes I have also companies who have reached a limit. They need a strategic partner to continue to grow.”

Karl Michael Millauer

Succession issues or glass-ceilings are great opportunities for M&A moves in the water sector

“Those are great situations. We face them all the time. We’ve got three on the table right now. It’s a great way for them to, to again, take some cash off the table, de risk their investment, in certain cases transfer it to the next generation of ownership with some outside capital, growth capital if you will, but uh, that is a key differentiator in terms of private equity.

Positioning itself with owners to say, what can we do for you? How can we help you? And we face that all the time.”

Alex Buehler

Growth capital to raise from one ladder to the other

“We’re trying to service an unserviced sector of the water market, rolling up those small-ish, medium-ish service and technology providers.

The reason that they kind of get stuck at that level is because there’s a big jump from there to being a national player and there’s no middle ground. There’s no ladder to climb. It’s like there are five rungs on the ladder to this level, then you’re stuck. And then 50 feet above you is another ladder.

And so how do you make that jump? We’re entering that space and we’re looking at those service providers, technology providers, and we’re saying we’re going to aggregate a lot of those, assuming that they fit our strategic roadmap.”

Tom Rooney

So that’s how you establish your acquisition pipeline, but once you’ve got a list of several hundred potential targets, you need to decide where to start:

How to score the targets in your acquisition pipeline?

“We have a scorecard for every acquisition opportunity that’s kind of got financial and, and commercial attributes, which are weighted and ultimately ranked or indexed on a score of a hundred.

What’s the size? Do they have the right regulation in place? Is there limited competition in that area, etcetera? Are they touching the right geomarkets? Are they touching the right end markets? Do they have complimentary products? Technologies are high value services that we like. Some of the financial metrics, is it accretive, margin accretive, would it be accretive from an earnings or EBITDA perspective.

So you got to go down all of that list, kind of rank them high, medium and low versus the weight and then index them on that score and say, okay, this is what pops up to the top. Through all stages of the process too, as you’re advancing, you’re learning more about the company. And we’re constantly revisiting that score.”

Alex Buehler

So, at that stage, you’ve got a pipeline of potential targets, ranked by interest and fit to the strategy; you got to roll up your sleeves and progress them towards closing a deal. Which can be easier said than done!

How to progress potential deals in your M&A pipeline?

“I get worried, you know, at times where you have too many late-stage deals, too many early-stage deals, nothing in the middle.

The middle is where it gets hard. Like I said before, it’s easy to source things. It’s hard to move them into the middle. It’s often complicated and it’s a heavy negotiation, but closing is a pretty mechanical process. It’s the middle that’s hard.”

Alex Buehler

Now, as much as I’d believe Alex when he explains that this middle part is tough, I’d like to challenge his assumption that closing is a pretty mechanical process.

There is high competition for attractive M&A targets in the Water Sector

Indeed, taking 2020, the year Integrated Water Services got acquired by Sciens Water, as a starting point, I had another look at Global Water Intelligence’s still excellent M&A database.

This time, I ruled out the American Water / CSWR type of M&A move, so I excluded the utility system deals. Then, I arbitrarily placed a cut-off for the number of deals over these last four years and looked up the 18 companies that closed seven M&A moves or more.

These 18 frantic acquirers can be further clustered into two groups, one we’ll talk about later with 12 members, and one that’s very relevant here, with 6 companies.

A 6-companies cluster of water tech aggregators

These six companies all resemble Integrated Water Services in that they pursue a similar goal of aggregating water technologies and services to externally build a coherent portfolio.

Not all over the same scope, as a United Flow Technologies and its 9 deals would be rather on the bottom of the food chain, or Gradiant and its 7 deals really focused on the industrial area, but if we’re looking at the type of target that would probably be a fit for Integrated Water Services, we’ve got gluttonous players hunting in the same park, especially the top two ones: Nijhuis Saur Industries and its 13 deals:

“We are building what we call our one stop shop for water on demand, where we are very critically looking, which technologies really have the future in order to deal with all those challenges.”

Menno Holterman – CEO @ Nijhuis Saur Industries

The world champion: SKion Water

and the world champion in that specific category, SKion Water and its 20 moves:

“This is how it would define us. We still happen to have a strategy where we an organically grow. We still buy more companies, but the focus is on serving our customer what and solar treatment solutions We don’t want to become another large, yeah. Corporate we want to stay a little bit more decentral and closer to the market to the end customers.”

Reinhard Huebner – CEO @ SKion Water

Sounds familar right? Wouldn’t that be a threat to Sciens and IWS’s strategy?

Competition is a confirmation your strategy is right

“It’s primarily confirmation. And I would say it’s maybe the opposite of a threat!

I love the idea that smart money is seeing that we’re making money in the water space. I, we love the idea that smart venture money is coming in and saying, Hey, let’s create the proving ground for this advanced technology. Love it. Terrific. Actually.”

Tom Rooney

Of course, you don’t have to blindly believe Tom. I guess if Sciens were to have to pay a premium on a future deal because they were in one-to-one competition with SKion or Nijhuis, they might find that a bit less terrific, hence my challenge to Alex’s assumption.

There are enough fish for every aggregator to catch

But to be fair, a bit like with my estimation, it would take seven centuries for utility consolidators to start feeling a drying up source of targets, there’s still a long way to go to see IWS and its 6 peers in my tech aggregators cluster experiencing harsh competition on every deal.

So as much as I love that other Reinhard Hübner quote: “Too much stupid money is chasing too little good targets,” I’d credit all the examples I gave to rather be on the smart money end, the type that can take tech or service companies stuck on the small ladder and bring them to the other one Tom mentioned.

That being said, I need to take a minute here to talk about the third most active company in my tech aggregators cluster, which is Evoqua.

If it’s not your first time around here, you probably heard me discussing that company a couple of times, for its US Filter history, especially its failed mergers with Veolia and then Siemens, but also for its recent takeover by Xylem.

The (infamous?) example of US Filter

Yet from the very beginning, Evoqua, or the late US Filter was a tech aggregated company. And if they closed 10 deals since 2020, that’s still no match to their incredible frenzy in the last decade of the twentieth century.

“Our company back in the nineties was the consolidator. We did 240 acquisitions in eight and a half years. What we created was a company that was alpha to omega. Everything from water as a natural resource to point of use, with everything in between primarily industrial. One stop shop was a term we used, I hate that term, but it is a one stop shop.”

Damian Georgino – Partner @ Womble Bond Dickinson

Dick Heckmann was the architect of that one-stop-shop, turning – and I quote – a “crappy little company” doing 1.6 million dollars a year into a US leader with a 5.2 billion dollars yearly revenue.

But, in light of the huge challenges the company faced under its successive ownerships, is that really a path anyone would like to follow in 2023?

Could a “Dick Heckman” M&A strategy work in 2023?

“Dick Heckman, as you were referring to it, was an interesting story because brilliant man did, did well financially and whatnot. But a lot of people would look back and say that that was bolting together a patchwork quilt without integrating. Right. And there wasn’t necessarily what I would call a common theme, a common sort of laser focused service offering or whatnot that that drew all those in.

He was smart enough in the day to realize that you have this profoundly fragmented sector called water and he just did a whole lot of acquisitions. And then along came a giant international player and took him out and, you know, the guy’s incredibly wealthy and a great story. I think the difference between that and what we want to do at Integrated Water Services is we have a target in mind, which is the underserved water providers.

And we have a set of value propositions. That we want for that. So we are hand picking the acquisitions such that they can fit that and highly integrated, ergo the name integrated war services.

There is a premium in the investor world for creating size and bulk. We’re aware of that. That’s not our strategy. Our strategy is to meet the needs of an unmet sector that we’re very well aware of”

Tom Rooney

Yes… but it’s probably not the best approach

In a nutshell, it doesn’t mean a Dick Heckman strategy could not work in 2023 because “Too much stupid money is chasing too little good targets” – yeah I love that quote, but a hand-picked acquisition scheme rather than an “all you can eat” approach sounds much more adapted to 2023 if you’re in the tech aggregator cluster.

Now remember, in the list of 18 frantic M&A companies I have identified since 2020, there’s another cluster with 12 companies inside and an absolutely crazy leader that closed 80 deals.

They’re actually following the strategy of another famous businessman.

The 12 water companies that follow a “Wayne Huizenga” acquisition strategy

“Do you know Wayne Huizenga? When I was a boy, the garbage collection, uh, out your back door was from mom and pop garbage collectors. Okay. Right? Fifteen years later, I woke up and there was this company called Waste Management, which was a global powerhouse.

Basically, Wayne Huizenga is one of the founders of Waste Management, and he just went around and bought up all of the service providers in garbage collection and created an international powerhouse that provides better More cost effective service. Is that a perfect company? No, but compare that to 10, 000 garbage collectors with various, uh, levels of integrity and whatnot.

By the way, Wayne Hezinga was also famous for having rolled up a company called Blockbuster. 25 years ago, when Netflix didn’t exist you wanted to rent a video. You went to a mom and pop video store where he did a roll up of all those mom and pops and created something called Blockbuster.

The point is, oftentimes you’ll find smart, small scale players that can’t get any traction. And a player can come in, who actually have a vision that all of those small-ish players, if bolted together in a common fabric and a smart scheme, can provide better service, more cost-effectively.”

Tom Rooney

Culligan is concentrating all the small players in the company’s niche

That sounds like exactly what the company I alluded to earlier, Culligan, is doing, whether directly or through its subsidiaries Quench, Waterlogic, or Acquajet. And yes, 80 deals in under 4 years, that’s massive!

If you’re interested in a deep dive on that third strategy, beyond utility roll-up and tech aggregation, the “Wayne Huyzenga style” drop me a message, I might explore it at some point in the future.

Water M&A – My Conclusion

For today, while taking into account some Damian Georgino wisdom:

“Everybody wants to do M& A. There are very few who can actually pull it off and obtain the benefits that are derived from a spreadsheet.”

Damian Georgino

Integrated Water Services’ ambitious end-goal

I’d like to close with Integrated Water Services’ outlook for the near future:

“My end goal is to build a giant. By giant, I mean we’re at 70 million, we’re looking to 10x that over a period of four years. And obviously you can’t do that organically. So about two thirds of that growth will be acquisitive.

About one third of that growth will be organic. Hence the need for this corporate development or M& A proficiency because it’s so heavily reliant on M& A. We’ve got to have that process. Very well structured and very smooth. So I want to build something. We want to create a masterpiece here, right? Sort of the quintessential water or wastewater treatment and water reuse platform.

National coverage, offering turnkey solutions, and covering the middle market space. Which we believe is largely overlooked and uncontested.”

Alex Buehler

We will see much more water M&A moves in the future

Which makes you think, Tom Rooney’s prediction is right:

“I think the future is going to see more and more consolidation. What’s interesting is, I think you’re also going to see consolidation on the ecosystem that surrounds those. water providers, service providers, technology providers.”

Tom Rooney

1 thought on “How to Buy a Water Company (and Turn in a Profit)”