😮 Anaergia’s flagship asset, the Rialto Bioenergy Facility, just filed for Chapter 11 Bankruptcy. What happened? What are the problems? What’s next? Let’s review ⬇

with 🎙️ Antoine Walter, Podcaster in Chief at GF Piping Systems

Anaergia’s Rialto Bioenergy Facility is in Trouble

Table of contents

- Anaergia’s Rialto Bioenergy Facility is in Trouble

- Anaergia’s Rialto Bioenergy Facility in 5 Key Information:

- Chapter 11 Bankruptcy for Anaergia’s Rialto Plant

- Anaergia’s Rialto hardly ramps up its intake

- Who is Anaergia?

- The Rialto Bioenergy Facility has 3 Problems

- These delays in market take-offs are pretty common in the Water Sector

- It’s harder to take off a market on the wastewater side (aka the Dark Side)

- Anaergia’s Rialto Subsidiary needs the Regulator to step in

- What’s next for Anaergia?

- Andrew Benedek, Anaergia’s CEO conclusion:

- Other Episodes:

Anaergia’s Rialto Bioenergy Facility in 5 Key Information:

- Anaergia’s Rialto Bioenergy Facility is a Zero-Waste, renewable energy production plant in California.

- The facility uses organic waste to produce renewable energy and high-value products such as biochar, compost, soil amendment and animal feed supplements.

- The facility is able to recover over 90% of the incoming organic waste and convert it into renewable energy, helping reduce greenhouse gas emissions.

- Anaergia’s Rialto Bioenergy Facility is expected to generate 6 megawatts of renewable power and annually process more than 250,000 tons of organic waste materials.

- It filed out Chapter 11 Bankruptcy on May 27 and is now awaiting for SB 1383 to get enforced to hopefully recover from there

Chapter 11 Bankruptcy for Anaergia’s Rialto Plant

Anaergia just announced that one of its subsidiaries, Rialto Bioenergy Facility initiated voluntary Chapter 11 restructuring proceedings in the U.S. Bankruptcy Court for the Southern District of California.

Now that’s big news, as Rialto is not only Anaergia’s flagship asset but also North America’s largest organic waste-to-energy facility. And quite ironically, that’s also the reason why they’re in trouble.

Anaergia’s Rialto hardly ramps up its intake

Indeed, the plant can process 700 tons of food waste and 300 tons of biosolids per day. And if it slowly ramps up its feedstock sourcing, it’s still far from its full capacity, which severely impacts its income.

But how can Anaergia, an acclaimed company, praised by everyone in the water and sustainable World, recently awarded “Net Zero Carbon Champion” and “Wastewater Project of the Year” at the Global Water Awards, be in so much trouble?

Well, because of one clear weakness it shares with most of the Water Industry: strong dependence on regulations.

Who is Anaergia?

If you don’t know Anaergia, well, shame on you because that means you missed my interview with the legendary Andrew Benedek, their CEO, and my in-depth exploration with Kunal Shah, their Chief Growth Officer.

Anaergia leverages anaerobic digestion to turn wastes (with an “S”) into energy through its technology suite and a differentiated approach.

Anaergia blends Solid Municipal Waste, Agricultural Waste and Wastewater to turn it into Energy and Biosolids

I say “wastes with an S” because that’s actually a clear USP of the company; they can blend solid municipal waste, agricultural waste, and of course, wastewater and its by-products.

Now they could “just” sell those technologies, and to a certain extent, they do. But they rather go for the differentiated approach of DBFOM, standing for Design, Build, Finance, Operate, and Maintain.

The Rialto Bioenergy Facility has 3 Problems

How did Anaergia’s Rialto turn from a flagship to a struggling asset? Well, it looks like an alignment of all the wrong planets.

The enforcement of SB 1383 got delayed

First, the plant was designed to leverage a Californian-State law, SB 1383, that targets a 75% cut in organic waste disposal by 2025. Would the law be enforced, organic waste disposal in a landfill would be fined, creating a strong incentive to divert the waste flux and find a way to valorize it. And so, the Rialto Bioenergy Facility would get its feedstock, ramp up to capacity, and California would transform an environmental burden into a sustainability asset. Win-win-win!

The law was signed in 2016, but its enforcement got delayed by the pandemic, and further so this May when an independent state oversight agency recommended pausing it and accepting California wouldn’t reach its 2025 target. In between, the city of Los Angeles waited until late 2022 to take an implementation ordinance that shall enable law enforcement in January 2024.

So regulation, that’s the first of our wrong planets aligned in… let’s call it a perfect storm of problems.

Rialto, California, is not doomed with Europe’s Energy Prices

Ok so the second planet in our perfect storm of problems is location. Natural Gas is a relatively cheap commodity in the US, currently trading at $2.24 per million British thermal units.

Wait. What’s that with all these numbers?

I had no clue either what a British Thermal Unit is, so I googled it. It is the quantity of heat required to raise the temperature of one pound of liquid water from 39 to 40 degrees Fahrenheit. Great, I’m even more confused now, so let me just convert that to what I understand: Natural Gas in the US trades at $7.72 per MWh.

Right now in Europe, Natural Gas trades at $25.43 for that same MWh, so roughly 3.3 times more.

Hence, would the Rialto bioenergy facility be in Europe, its renewable natural gas would not only be a sustainability asset but probably also a cost-competitive energy source.

But hey, the US has shale gas! (and screw the environment, I guess?)

Anaergia is in a relatively uncomfortable position

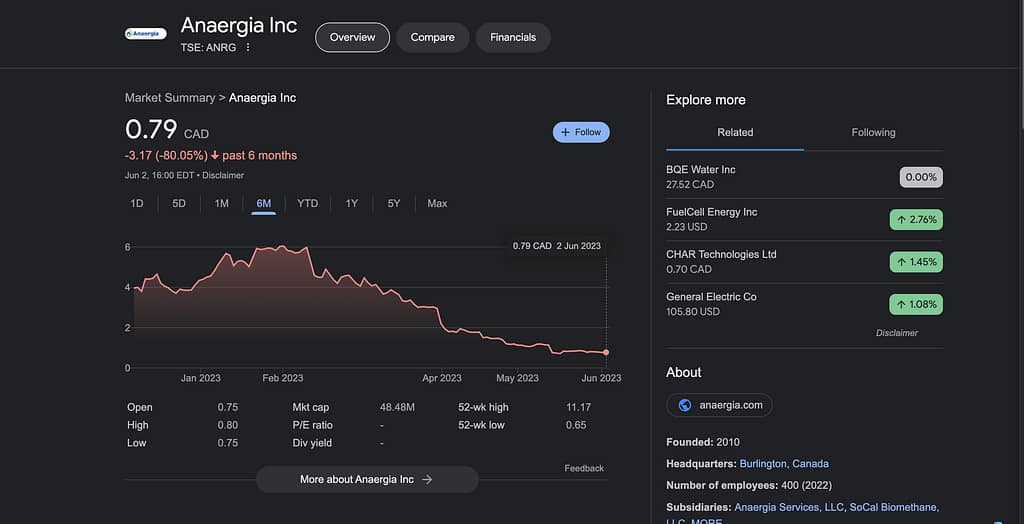

Third and last planet in this alignment, we have to address Anaergia’s general shape. In February, the company’s stock traded at $4.5 per share. Today, it’s been divided by 8, at $0.57 per share.

If Anaergia was printing cash overall, it could afford to cover Rialto’s losses in waiting for better days and regulation enforcement. But that wrongly aligned planet in California is unfortunately not so much of an exception.

The dichotomy and delay between political announcements and actual action

That’s where I want to highlight a huge dichotomy. On the one hand, there’s what we hear and read in the press. Big political announcements, like the REpowerEU plan announced by Ursula Von Der Leyen in May 2022, they even made a thrilling video with epic music to show how we’re acting now.

And in the same time, you find that Anaergia’s assets in Italy experience delayed electrical utility connections and other permitting issues.

There’s what’s announced, and there’s what’s done. And unfortunately, there’s a delay between those two, and the delay’s length is almost unpredictable.

These delays in market take-offs are pretty common in the Water Sector

And that’s a trouble we’re well aware of in the Water Industry; let me take an example.

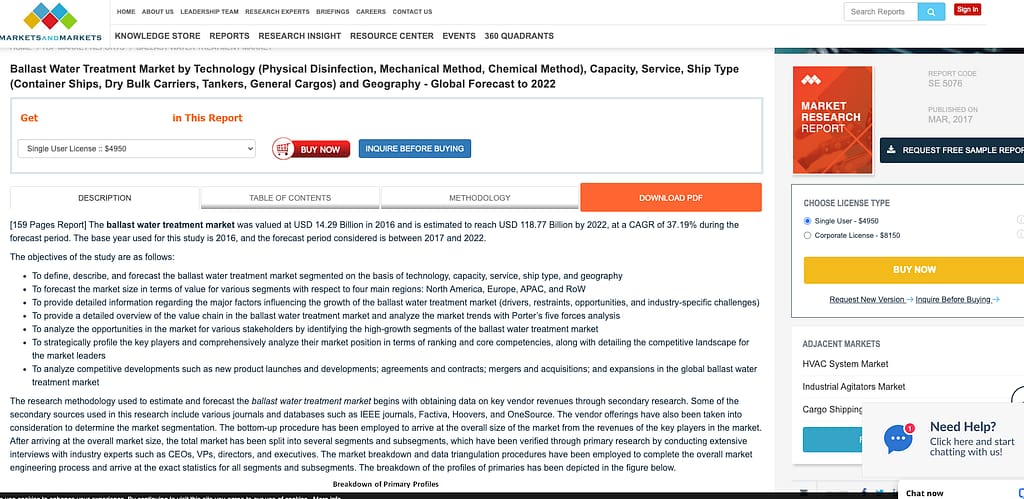

Example 1: Ballast Water Treatment

At the beginning of the 2010s, the International Maritime Organization and the US Coast Guards adopted new regulations that pushed for the adoption of ballast water treatment on ships, because that was the right thing to do to protect the ocean’s biosphere!

As a result, market research companies were blooming with reports like this one, expecting a 118 Billion dollar market for water technology companies by 2022 at a nice 37% compound annual growth rate, instead of what the Ballast Water Treatment market weights today, 5.8 billion dollars, which is about 20 times less.

What happened? Well, the enforcement of regulations got delayed and watered down; it never got extended from new builds to existing ships, and so on and so on.

Do you think that’s a one off? All right, let’s look at another example

Example 2: European Water Framework Directive

In the year 2000, the European Commission adopted the Water Framework Directive. It was supposed to achieve good qualitative and quantitative status for all water bodies by 2015.

Wastewater specialists hence interpreted this as a clear sign tertiary and quaternary treatment would be installed at scale in Europe to better treat phosphorus and nitrogen, but also micropollutants. And I can tell you that, as a young water professional about ten years ago, working on the first wastewater treatment plant to eliminate micropollutants in France, the first in Switzerland, and later the first in Sweden, I was absolutely sure I was contributing to a wave that would take Europe by storm by the end of the decade!

But again, the regulation got watered down when adopted by the various european countries, and its enforcement date was made negotiable and possible to push back, so that one decade later, there’s barely a hand full more good pupils outside of Switzerland and Germany.

Do you see a pattern emerging?

It’s harder to take off a market on the wastewater side (aka the Dark Side)

Indeed, I’m discussing regulation. But do you notice one more red threat between Anaergia’s story and my two Ballast Water and Advanced Sewage Treatment examples? They are all on the wastewater side.

And I would hypothesize it’s not a coincidence.

Paul O’Callaghan has theorized how crisis-driven innovation gets adopted twice faster in the Water Sector.

We saw that very clearly with the adoption of ultrafiltration membranes in the early 1990s, the outbreak of cryptosporidium in places like Milwaukee and the UK drove rapid regulation of the need to deal with cryptosporidium. And that drove rapid adoption of ultrafiltration membranes and drinking water treatment. If you hadn’t had that cryptosporidium outbreak in 1987 in Milwaukee, you would not have seen that level of uptake. And we see similar things with, for example, PFAS at the moment.

Crisis being here pretty one-to-one understood as there’s a problem that’s serious enough to trigger a regulation that also promptly gets enforced.

Zenon used to be a great example of that theory applied

Andrew Benedek, the CEO of Anaergia, is a key stakeholder in Paul’s thesis. Indeed, his involvement in the take-off and adoption of Membrane Bioreactors through his previous company, Zenon, is another example of Crisis-Driven market adoption, as the take-off happened when water scarcity urged water reuse, MBRs being the best vehicle for exactly that.

So what’s different this time with Wastewater in general and Renewable Natural Gas in particular?

All these extreme events are arguably part of the same story: Climate Change. This should be a Crisis big enough for us to overcome, and it should drive the adoption of virtuous approaches such as turning agricultural, municipal, and water waste into renewable net-zero energy. Yet the reason it’s difficult to take off without the right regulatory nudge is well summarized by George McGraw:

The reason that has continued is because we have a wrong pockets problem. What economists would call this wrong pockets problem. You know, the societal benefits don’t accrue to the same folks that would necessarily make the investment to solve the problem.

Anaergia’s Rialto Subsidiary needs the Regulator to step in

In the Rialto case, if the waste producers were to take their waste streams to Anaergia’s facility instead of a landfill, it would for sure be the right move from a sustainability perspective. But the windfalls of acting right wouldn’t end in the right pocket, from a purely financial perspective, so it doesn’t happen as long as government fines don’t bring a balance in the force.

Gonzalo: Unless you understand this reason why we make those bad decisions, unless you change the incentive. Nothing’s going to change. If you don’t create three markets, one for water to be reused, another one for nutrients and another one for biogas. This never delivers, no matter how smart you are in terms of technology, so you can have the best technology in class and still being unable to deliver on circular economy grounds.

What’s next for Anaergia?

If Anaergia was playing Monopoly, their move in Rialto would be a kind of Mortgage.

As their press release states: The Company expects it to have a positive impact on its 2023 cash flows, as Anaergia would cease supporting the plant with further loans or equity contributions.

And if SB 1383 finally gets enforced by early 2024, their other statement will probably hold true:

Anaergia anticipates that with future adequate feedstock to allow ramp up, the asset will retain long-term value for all stakeholders.

In the meantime, the company will slightly pivot its strategy to reduce its risk exposure by only developing assets with equity partners or providing more CAPEX sales like their recent project in South Africa.

Will they succeed in bringing their growth back on track and turning profitable? Well, let me reframe that one.

I personally hope they recover and return on their rocket-track!

Look me in the eye and answer that question. Is it the right move to turn waste into recovered resources and zero-carbon energy?

So you see, I guess we all somewhat root for Anaergia on this one. And you know what, I’ll even leave the final words to Andrew Benedek. Just before that, if you like this kind of content, you can at the same time support me and ensure you won’t miss future releases by subscribing to this channel. So I’ll see you next time, and Andrew, the scene is yours:

Andrew Benedek, Anaergia’s CEO conclusion:

I just want you to know Antoine, that it is really your future and I’m working for your future. Because if you don’t solve this, you won’t have one! What I’m going to tell you is that the older I get, the more ambitious I get, because the problem is so big.

I really want to find a solution. I’m not doubting that I have the right solution.

I am very nervous about speed, whether or not it can be done in time to avoid major catastrophe if you’re having to get the answers every day. But I’m worried about billions of people dying.

Nothing ever happens the way you think it should. If you have any doubts whatsoever, you won’t make it.

One, you have to absolutely believe that whatever it is that you want to do, you can do. Two, you have to be persistent. But if you are a believer and you’re persistent you’re willing to work at it miracles happen!