In the heart of Boston’s Innovation District, MassVentures stands as a unique force in the water technology landscape. As a quasi-public venture capital firm, it combines the mission-driven focus of a state agency with the agility and market savvy of a private investor. For water entrepreneurs and impact investors, MassVentures represents more than just capital – it’s a gateway to Massachusetts’ rich ecosystem of research institutions, industry partners, and technological innovation. With typical investments ranging from $250,000 to $500,000 in early-stage companies, the firm has established itself as a critical catalyst for water technology startups looking to bridge the gap between breakthrough ideas and market impact.

MassVentures is part of my Ultimate Water Investor Database, check it out!

Investor Name: MassVentures

Investor Type: Gov. Fund

Latest Fund Size: $ Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: In-situ water quality monitoring, industrial/process water recovery, environmental water innovation

Investment History: $3471249.5 spent over 2 deals

Often Invests Along: Burnt Island Ventures

Already Invested In: Aclarity

Leads or Follows: Lead

Board Seat Appetite: Not specified

Key People:

The MassVentures Investment Thesis

MassVentures takes a distinctive approach to water technology investments, operating at the critical intersection of early-stage funding and Massachusetts-based innovation. The organization’s investment thesis centers on identifying and supporting breakthrough water technologies that can drive both environmental impact and economic growth within the Bay State.

At the core of their strategy lies a focus on pre-seed and seed-stage companies developing solutions for pressing water challenges. These enterprises typically have proven their technological concepts but require capital and strategic guidance to scale. MassVentures specifically seeks companies with defensible intellectual property and clear paths to commercialization, particularly those emerging from Massachusetts’ renowned research institutions and innovation ecosystem.

The firm’s sweet spot encompasses investments ranging from $100,000 to $2 million, strategically deployed to help companies navigate the challenging transition from laboratory success to market validation. This funding range reflects a deliberate focus on the capital gap that often exists between initial research grants and larger institutional investment rounds.

Beyond pure financial returns, MassVentures evaluates potential investments through a dual lens of economic development and environmental impact. They prioritize technologies that can create high-quality jobs within Massachusetts while addressing critical water-related challenges such as infrastructure efficiency, water quality monitoring, and resource recovery.

Strategically, MassVentures maintains tight alignment with the state’s broader economic development goals, particularly in strengthening Massachusetts’ position as a global hub for water technology innovation. This alignment enables them to leverage an extensive network of industrial partners, research institutions, and public sector stakeholders to support portfolio companies.

The investment approach emphasizes active involvement with portfolio companies, providing not just capital but also strategic guidance, industry connections, and operational support. This hands-on strategy has proven particularly valuable in helping early-stage water technology companies navigate the complex regulatory landscape and extended commercialization timelines typical in the water sector.

In evaluating potential investments, MassVentures particularly values technologies that demonstrate scalability and can address multiple market applications. They seek solutions that can be deployed across municipal, industrial, and commercial settings, maximizing both impact potential and market opportunity.

This focused investment strategy has helped establish MassVentures as a crucial catalyst in the water technology ecosystem, bridging the gap between innovative solutions and market implementation. Their approach not only supports individual companies but also strengthens the broader water innovation landscape in Massachusetts.

Water Technology Focus Areas

MassVentures’ water technology portfolio reflects Massachusetts’ position as a hub for breakthrough innovations addressing critical water challenges. The organization focuses its investments across several key domains where local entrepreneurs are making significant advances.

In water quality monitoring, MassVentures supports technologies that provide real-time analysis capabilities far beyond traditional lab-based methods. These include advanced sensors that can detect contaminants at the parts-per-trillion level and AI-powered systems that predict water quality issues before they become crises. The emphasis is on solutions that make sophisticated monitoring accessible and cost-effective for utilities and industrial users.

Industrial water recovery represents another major focus area, where MassVentures backs technologies that help manufacturers reduce their water footprint while improving operational efficiency. The portfolio includes membrane innovations that enable high-recovery water reuse, electro-chemical treatment systems that selectively remove problematic contaminants, and smart process control platforms that optimize industrial water circuits. These solutions are particularly relevant for Massachusetts’ strong biotech, microelectronics, and food & beverage sectors.

Environmental solutions form the third key pillar, with investments targeting both acute challenges and chronic issues. Technologies range from PFAS remediation approaches that destroy these ‘forever chemicals’ to nature-based systems that restore watershed health. MassVentures has shown particular interest in solutions that help communities build climate resilience through better stormwater management and coastal protection.

Across all these domains, MassVentures prioritizes scalable technologies that can deliver measurable impact. The focus is on innovations that not only solve technical challenges but also make economic sense for end users. This dual emphasis on technical excellence and commercial viability has helped establish Massachusetts as a leader in water technology commercialization.

Notably, the organization maintains strong connections with the state’s research institutions, helping translate promising academic work into viable businesses. This creates a robust pipeline of opportunities in emerging areas like resource recovery from wastewater, decentralized treatment systems, and digital water solutions.

The concentration on these strategic domains has created valuable synergies within the MassVentures portfolio, with companies often collaborating to deliver more comprehensive solutions. This ecosystem approach has proven particularly effective in accelerating the adoption of new water technologies in Massachusetts and beyond.

Investment Strategy and Partnership Approach

MassVentures employs a strategic dual approach to water technology investments, positioning itself as both a lead investor and collaborative co-investor depending on the opportunity. This flexible strategy allows the organization to maximize its impact while managing risk effectively in the water innovation sector.

As a lead investor, MassVentures typically takes an active role in early-stage water technology companies where its deep sector expertise and extensive network can add significant value beyond capital. The organization focuses on initial investments ranging from $250,000 to $2 million, strategically reserving capital for follow-on rounds to support portfolio companies through their growth journey.

Their co-investment partnerships represent a cornerstone of their approach, having developed strong relationships with both traditional venture capital firms and strategic corporate investors in the water sector. These partnerships enable MassVentures to participate in larger funding rounds while providing portfolio companies access to complementary expertise and market channels. The organization has demonstrated particular success in bridging the gap between academic research and commercial applications through these collaborative investments.

What sets MassVentures apart is their long-term commitment to portfolio companies. Rather than pursuing quick exits, they maintain a patient capital approach that aligns with the typically longer development cycles in water technology. This methodology includes structured support through multiple funding rounds, with clear milestones and performance metrics guiding each subsequent investment decision.

Their support extends beyond just financial backing. Portfolio companies receive ongoing strategic guidance, access to MassVentures’ network of industry experts, and assistance in securing additional funding sources. This comprehensive support system has proven particularly valuable for water technology startups navigating the complex regulatory landscape and extended adoption cycles characteristic of the water sector.

Recognizing the unique challenges of water technology commercialization, MassVentures has developed specialized investment criteria that consider not just financial returns but also technological innovation and potential environmental impact. This approach allows them to support breakthrough technologies that might be considered too risky for traditional venture capital, while maintaining a sustainable investment model.

The organization’s track record in successful exits demonstrates the effectiveness of this strategy. Several of their water technology investments have achieved successful acquisitions or IPOs, providing returns that enable continued investment in new innovations. As detailed in how to take mid-market green tech companies to the next level, this approach has established MassVentures as a crucial catalyst in scaling promising water technologies from laboratory concepts to market-ready solutions.

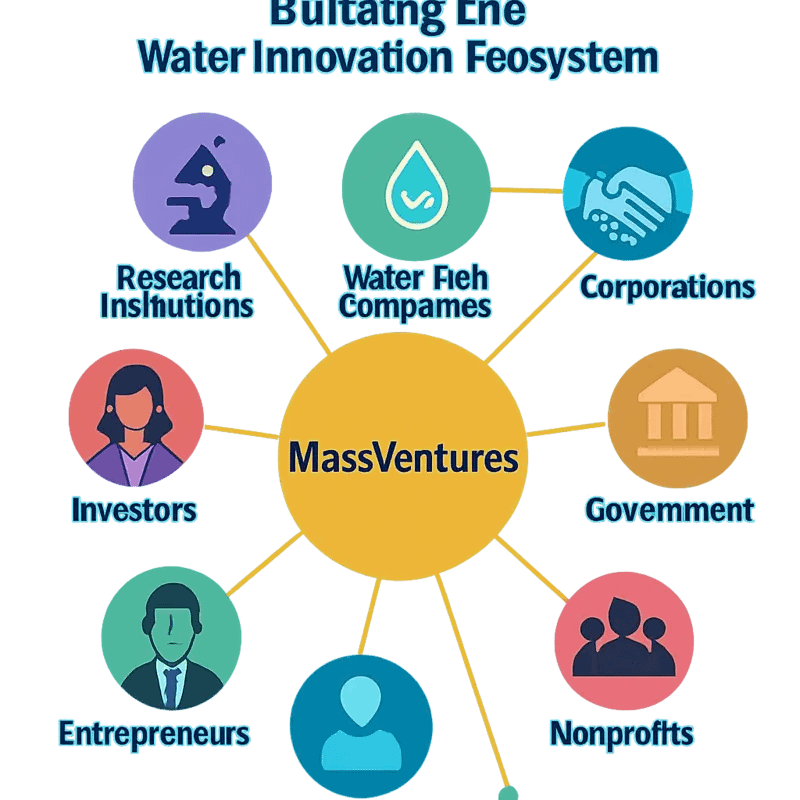

Building the Massachusetts Water Innovation Ecosystem

MassVentures stands as a cornerstone in Massachusetts’ thriving water technology ecosystem, extending far beyond its role as a funding source. Through strategic ecosystem development initiatives, the organization has created a self-reinforcing network that amplifies innovation across the Commonwealth.

At the heart of MassVentures’ ecosystem-building approach lies its commitment to fostering connections between startups, established companies, research institutions, and public sector entities. The organization regularly convenes roundtable discussions and networking events that bring together diverse stakeholders from across the water sector. These gatherings serve as catalysts for collaboration, often resulting in unexpected partnerships that accelerate technology development and adoption.

Particularly noteworthy is MassVentures’ role in bridging the gap between academic research and commercial applications. By maintaining close relationships with the state’s prestigious universities, the organization helps identify promising water technologies at their earliest stages. This early engagement allows MassVentures to guide researchers toward market-oriented development paths, significantly increasing the likelihood of successful commercialization.

The organization’s impact on economic development extends throughout Massachusetts’ gateway cities and beyond. Through targeted outreach programs, MassVentures actively seeks water technology innovators in traditionally underserved communities. This approach not only broadens the innovation pipeline but also creates high-quality jobs in areas that need them most.

MassVentures has also pioneered a mentor network that pairs experienced water industry executives with emerging entrepreneurs. This knowledge transfer mechanism helps young companies avoid common pitfalls while accelerating their path to market. The mentor network has proven particularly valuable in helping startups navigate the complex regulatory landscape of the water sector.

Beyond direct support, MassVentures serves as a powerful advocate for water technology innovation at the policy level. The organization regularly provides insights to state legislators about the challenges and opportunities in the water sector, helping shape regulations that encourage innovation while protecting public interests.

Like Israel’s remarkable water innovation journey, Massachusetts has created a robust ecosystem that continues to attract talent and capital. As explored in “The Two Surprising Pillars That Support Israel’s Water Miracle”, success in water innovation requires both technological excellence and ecosystem support – principles that MassVentures has effectively adapted to the Massachusetts context.

The organization’s ecosystem-building efforts have created a multiplier effect, where each successful water technology company becomes a nucleus for further innovation. Former portfolio company employees often become founders themselves, while successful exits provide both capital and experienced investors who understand the sector’s unique characteristics.

Through these multifaceted efforts, MassVentures has helped establish Massachusetts as a global hub for water technology innovation, creating an environment where technical expertise, entrepreneurial spirit, and capital converge to address critical water challenges.

The MassVentures Advantage: Beyond Traditional VC

MassVentures stands apart in the venture capital landscape through its distinctive approach to water technology investment. While traditional VCs often chase quick returns, MassVentures operates with a longer-term perspective that particularly benefits water startups navigating the complexities of commercialization.

At the core of MassVentures’ philosophy lies the concept of patient capital. The organization recognizes that water technology innovations typically require extended development cycles, rigorous testing periods, and methodical scaling processes. Rather than pushing for rapid exits, MassVentures provides sustained support throughout these critical phases, enabling entrepreneurs to focus on perfecting their solutions without sacrificing long-term potential for short-term gains.

This patient approach is reinforced by MassVentures’ deep sector expertise in water technology. The team combines technical knowledge with extensive industry connections, offering portfolio companies more than just financial backing. Through strategic guidance and networking opportunities, they help startups navigate regulatory requirements, pilot programs, and customer acquisition – critical challenges specific to the water sector.

Perhaps most significantly, MassVentures has developed a hybrid investment model that bridges the gap between public and private funding sources. By leveraging relationships with state agencies, research institutions, and industry partners, they create robust support ecosystems around their portfolio companies. This collaborative approach helps de-risk investments while accelerating the path to market adoption.

The organization’s investment criteria reflect their commitment to sustainable impact alongside financial returns. They seek out technologies that address pressing water challenges – from infrastructure modernization to water quality monitoring – while demonstrating clear paths to scalability. This dual focus ensures their portfolio advances both environmental and economic objectives.

Unlike conventional VCs, MassVentures maintains flexibility in deal structures, adapting to the unique needs of water technology startups. They might provide smaller initial investments with options for follow-on funding, or structure milestone-based financing that aligns with technology development phases. This adaptability helps preserve founder equity while ensuring adequate capitalization throughout the commercialization journey.

Through this comprehensive approach, MassVentures has established itself as more than just a funding source – it serves as a true catalyst for water innovation in Massachusetts. Their model demonstrates how strategic patient capital, combined with sector expertise and flexible support structures, can effectively nurture water technology startups through the challenging journey from concept to market success.

From Lab to Market: The START Program

MassVentures’ START program stands as a cornerstone initiative bridging the critical gap between laboratory innovation and market-ready water technologies. The program addresses a fundamental challenge in the water sector – the arduous journey of translating promising research into commercially viable solutions.

At its core, START provides staged funding through a three-year process that systematically de-risks water technology ventures. The first phase offers $100,000 in seed funding, enabling entrepreneurs to validate their technology’s commercial potential. Companies demonstrating clear market traction can progress to Phase II with up to $200,000 in funding, while Phase III provides an additional $500,000 for scaling operations.

What sets START apart is its hands-on approach to commercialization. Beyond capital, the program provides intensive mentoring and technical assistance tailored to water technology’s unique challenges. This includes guidance on regulatory compliance, pilot testing protocols, and establishing industry partnerships – critical elements often overlooked by traditional accelerators.

The program’s impact on Massachusetts’ water innovation ecosystem has been substantial. In the past decade, START has helped launch over 20 water technology companies, with an impressive 80% survival rate after five years. These companies have collectively raised more than $150 million in follow-on funding and created hundreds of high-skilled jobs in the Commonwealth.

One particularly notable aspect of START is its focus on water technologies that address pressing environmental challenges. The program has supported innovations ranging from advanced membrane systems for water reuse to smart monitoring solutions for infrastructure management. This strategic emphasis aligns with growing market demand for sustainable water solutions while advancing the sectors environmental goals.

The program’s success metrics extend beyond traditional venture metrics. START evaluates potential investments based on their capacity to solve critical water challenges, create sustainable jobs, and generate long-term economic value for Massachusetts. This balanced approach has proven effective in building resilient water technology companies that can weather market fluctuations while delivering meaningful environmental impact.

Through START, MassVentures has established a replicable model for technology commercialization that addresses the unique challenges of the water sector. The program’s combination of staged funding, sector-specific support, and focus on environmental impact has created a pipeline of innovative solutions ready to address global water challenges.

Strategic Partnerships: Building the Water Innovation Ecosystem

At the heart of Massachusetts’ thriving water technology sector lies a carefully orchestrated network of strategic partnerships fostered by MassVentures. Building on the momentum of its START program, the venture catalyst has established deep collaborative relationships that amplify the impact of water innovation across the Bay State.

The cornerstone of this ecosystem is the tight integration between research institutions and industry partners. MassVentures works closely with leading universities like MIT, Harvard, and UMass to identify promising water technologies emerging from academic labs. Regular technology scouting sessions and collaborative research initiatives ensure early visibility into breakthrough innovations. These partnerships help bridge the notorious ‘valley of death’ between laboratory discovery and commercial viability.

Equally critical are MassVentures’ relationships with established water industry players. Through formal partnership programs, large utilities and engineering firms provide real-world testing grounds for emerging technologies. This arrangement creates a win-win scenario – startups gain invaluable validation data while industry partners get early access to innovative solutions. The feedback loop helps entrepreneurs refine their technologies to meet actual market needs.

On the government front, MassVentures maintains strategic alignment with key agencies including the Massachusetts Clean Energy Center, the Department of Environmental Protection, and the Executive Office of Energy and Environmental Affairs. This coordination ensures that innovation efforts support state-level water quality and infrastructure goals while leveraging public funding effectively. How to build the world leading water innovation accelerator – Imagine H2O provides interesting parallels to this ecosystem building approach.

Beyond individual partnerships, MassVentures plays a vital role in fostering broader ecosystem collaboration. Regular convenings bring together researchers, entrepreneurs, investors, industry leaders and policymakers to share insights and explore synergies. These gatherings have sparked numerous joint initiatives addressing pressing water challenges.

The collaborative framework extends to shared facilities and resources. Partner organizations open their laboratories, pilot facilities and technical expertise to promising startups. This shared infrastructure model helps entrepreneurs conduct critical proof-of-concept work without massive capital investments.

MassVentures’ ecosystem-building efforts have created a uniquely supportive environment for water innovation. The dense network of strategic partnerships accelerates technology commercialization while ensuring solutions address real market needs. This collaborative approach has established Massachusetts as a leading hub for water technology development and implementation.

Impact Metrics: Measuring Success Beyond Returns

MassVentures has pioneered a dual-impact framework that measures both financial returns and environmental benefits across its water technology portfolio. This innovative approach reflects the organization’s commitment to driving sustainable water solutions while ensuring economic viability.

The framework tracks key performance indicators across three core dimensions. First, water impact metrics measure gallons of water saved, treated, or reused through funded technologies. Portfolio companies must report quarterly on their solutions’ direct water conservation outcomes. Several ventures have demonstrated water savings exceeding 100 million gallons annually through deployment of their innovations.

Second, environmental benefit indicators assess broader ecological impacts, including energy efficiency gains, chemical use reduction, and carbon emissions avoided. One standout example is a wastewater treatment technology that cut energy consumption by 60% while improving effluent quality at municipal facilities.

Third, economic sustainability metrics evaluate traditional venture metrics like revenue growth and return on investment alongside job creation and market expansion in Massachusetts’ water sector. This holistic view ensures funded companies build lasting businesses while maximizing positive impact.

The data shows promising results. Portfolio companies have collectively raised over $200 million in follow-on funding while creating hundreds of cleantech jobs in the Commonwealth. More importantly, their solutions now protect millions of gallons of water resources daily through commercial deployments.

MassVentures has embedded impact evaluation into all stages of its investment process. During due diligence, companies must demonstrate clear pathways to measurable environmental benefits. Post-investment, quarterly reviews track progress against impact targets alongside business milestones. This accountability helps portfolio companies optimize both financial returns and sustainability outcomes.

Beyond individual investments, these metrics inform MassVentures’ broader strategy by identifying high-potential impact areas and guiding resource allocation. The data also helps attract additional capital to promising water technologies by clearly communicating environmental and social returns to co-investors.

As water challenges intensify globally, MassVentures’ dual-focus approach offers a model for catalyzing innovations that deliver strong financial performance while advancing critical sustainability goals. The framework demonstrates how strategic capital can drive both business growth and measurable environmental impact in the water sector.

Final words

MassVentures stands as a crucial bridge between innovative water technology solutions and market implementation in Massachusetts. Their strategic position as both a lead investor in early rounds and a supportive follow-on investor has helped numerous water technology startups navigate the challenging path from concept to commercialization. The firm’s focus on in-situ monitoring, water recovery technologies, and environmental solutions aligns perfectly with current market needs and future opportunities in the water sector. For water entrepreneurs, MassVentures offers more than just capital – it provides a gateway to one of the world’s most dynamic water technology ecosystems. For impact investors, the firm represents a proven model of how public-private partnership can catalyze meaningful innovation in the water sector. As water challenges continue to grow globally, MassVentures’ approach to nurturing early-stage water technology companies offers valuable lessons for other regions looking to build their own water innovation ecosystems.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!