The Massachusetts Clean Energy Center (MassCEC) stands as a pivotal force in water technology innovation, wielding a $50 million investment fund that’s reshaping the future of water solutions. From PFAS remediation to digital twins, their strategic focus on seed and early-stage water tech startups is creating ripples across the industry. With typical investments ranging from $100,000 to $1.5 million, MassCEC isn’t just writing checks – they’re architecting a new era of water technology advancement. Their unique position as both catalyst and collaborator makes them an essential player for water entrepreneurs and impact investors alike.

MassCEC is part of my Ultimate Water Investor Database, check it out!

Investor Name: MassCEC

Investor Type: Gov. Fund

Latest Fund Size: $50 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

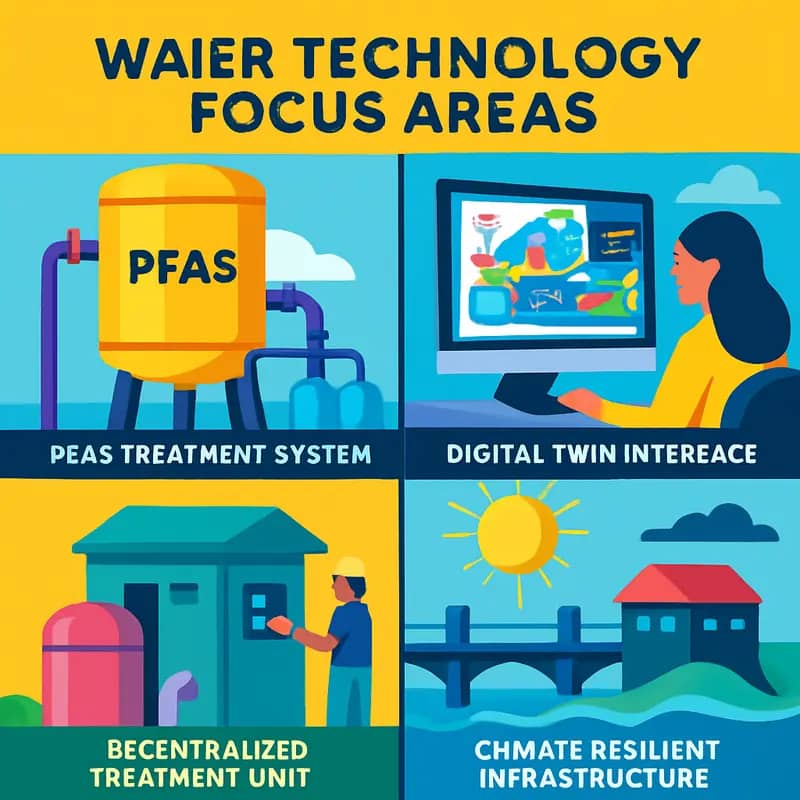

Investment Themes: PFAS, digital twins, decentralized treatments

Investment History: $2000000 spent over 2 deals

Often Invests Along:

Already Invested In: Lithios, VODA.ai

Leads or Follows: Follow

Board Seat Appetite: Rare

Key People: MassCEC CEO

The Investment Strategy: Following Smart Money into Water Tech

MassCEC’s approach to water technology investment embodies calculated pragmatism, positioning itself as a strategic follower rather than taking the lead investor role. This methodology allows the organization to leverage its $50 million fund more effectively while minimizing risk exposure.

At the core of MassCEC’s strategy lies a co-investment model that typically involves contributing between $250,000 to $1 million per deal, but only after established venture capital firms or strategic investors have already committed. This follow-on approach serves multiple purposes – it validates the commercial viability of technologies through the due diligence of experienced investors while extending the fund’s reach through capital multiplication.

The organization has developed a sophisticated framework for evaluating potential investments, focusing on companies that have already secured initial funding and demonstrated market traction. Rather than competing with private investors, MassCEC positions itself as a complementary force, often providing the additional capital needed to help promising water technologies bridge critical development phases.

Partnership development stands as another crucial element of MassCEC’s investment strategy. The organization actively cultivates relationships with leading water industry investors, accelerators, and strategic corporate partners. These connections not only provide deal flow but also create valuable networking opportunities for portfolio companies. The multiplier effect of these partnerships enables MassCEC to participate in deals that might otherwise be beyond its direct investment capacity.

MassCEC’s investment terms typically align with those of the lead investors, though the organization maintains specific requirements around Massachusetts presence and job creation. This approach ensures that while the fund supports promising water technologies, it simultaneously fulfills its mandate to strengthen the Commonwealth’s water technology ecosystem.

By maintaining discipline in following established investors and focusing on co-investment opportunities, MassCEC has built a portfolio that balances innovation support with prudent risk management. This strategy has proven particularly effective in the water sector, where technology adoption cycles tend to be longer and capital requirements more substantial than in many other technology sectors.

Water Technology Focus Areas: From PFAS to Digital Twins

MassCEC’s investment portfolio reflects the most pressing challenges facing the water sector today, with a strategic focus on technologies that can deliver both environmental and economic returns. At the forefront is PFAS remediation technology, addressing what many consider the defining water contamination crisis of our time. The fund actively seeks solutions that can detect, remove, and destroy these ‘forever chemicals’ through innovative approaches like electrochemical oxidation and specialized filtration materials.

Digital transformation represents another key investment theme, as utilities and industrial users increasingly embrace smart water solutions. MassCEC supports the development of digital twins, AI-powered analytics, and advanced sensor networks that enable predictive maintenance and optimize treatment processes. These technologies help water managers make data-driven decisions while reducing operational costs and improving system reliability.

The fund recognizes that centralized infrastructure alone cannot meet future water demands, especially in rapidly growing urban areas. This drives significant investment in decentralized and distributed treatment systems – from building-scale water recycling to modular treatment units that can be deployed where needed. These solutions enable water reuse at the point of need while reducing strain on aging municipal infrastructure.

Climate resilience forms a critical lens through which MassCEC evaluates water technology investments. The fund prioritizes solutions that help water systems adapt to extreme weather events, rising seas, and shifting precipitation patterns. This includes flood monitoring and prediction tools, drought-resistant treatment processes, and technologies that reduce the water-energy nexus. The emphasis on climate tech aligns with Massachusetts’ broader sustainability goals while creating exportable solutions for global markets.

Innovative water quality monitoring represents another key focus area. MassCEC backs technologies that can detect contaminants in real-time, measure microbiological parameters with greater accuracy, and provide early warning of system anomalies. These advances in monitoring and diagnostics help utilities maintain compliance while protecting public health more effectively.

Across all focus areas, MassCEC seeks technologies that demonstrate commercial viability alongside environmental benefits. This dual mandate helps create sustainable businesses while addressing critical water challenges. The fund’s portfolio companies leverage Massachusetts’ deep technical expertise and innovation ecosystem to develop and scale solutions with global impact.

The Massachusetts Advantage: Local Focus, Global Impact

Massachusetts’ unique concentration of academic institutions, research facilities, and technology companies creates a powerful innovation ecosystem that MassCEC strategically leverages to accelerate water technology development. By focusing its $50M investment fund within state borders, MassCEC cultivates a self-reinforcing cycle of innovation that extends far beyond Massachusetts.

The state’s dense network of over 30 universities and research institutions provides a steady pipeline of cutting-edge water technologies and talented entrepreneurs. MassCEC amplifies this advantage by connecting academic innovators with industry partners and manufacturing capabilities within the state. This hyperlocal approach enables rapid prototyping, testing, and commercialization cycles that would be impossible in a more dispersed ecosystem.

Massachusetts’ established water technology cluster, including over 300 companies, offers natural partnership opportunities for startups in MassCEC’s portfolio. These connections help young companies validate their solutions in real-world applications while providing established firms early access to innovative technologies. The result is an accelerated path to market for breakthrough solutions.

While MassCEC’s investments stay local, their impact resonates globally. The fund’s portfolio companies regularly export their technologies to address water challenges worldwide. This international reach attracts additional private capital to Massachusetts, creating a virtuous cycle of investment and innovation. Learn more about how local innovation ecosystems drive global water technology adoption.

The fund’s Massachusetts focus also enables deep involvement in portfolio companies beyond just capital. MassCEC leverages its intimate knowledge of the local ecosystem to provide hands-on support, including:

- Facilitating pilot projects with municipal utilities

- Connecting startups with specialized manufacturing partners

- Providing access to testing facilities and demonstration sites

- Building relationships with potential customers and channel partners

This high-touch approach, possible only through geographic concentration, significantly improves the success rate of portfolio companies. The model has proven so effective that other regions now look to replicate elements of the Massachusetts water innovation ecosystem.

By creating a dense, interconnected network of water technology innovators, MassCEC demonstrates how strategic local focus can drive outsized global impact. Their approach not only accelerates the development of critical water solutions but also strengthens Massachusetts’ position as a world leader in water technology innovation.

Beyond the Initial Investment: Supporting Growth and Scale

MassCEC’s investment philosophy extends far beyond the initial capital injection, embodying a comprehensive approach to nurturing water technology companies through their growth phases. The organization’s strategic reserve policy ensures portfolio companies have access to follow-on funding when they need it most, typically allocating 40-50% of their investment capacity for subsequent rounds.

This measured approach to capital deployment reflects a deep understanding of the water sector’s unique challenges. Water technology companies often face longer commercialization timelines than their peers in other sectors, requiring patient capital and sustained support. MassCEC addresses this reality by maintaining flexible funding structures that can adapt to various growth scenarios.

Beyond financial support, MassCEC has developed a robust ecosystem of resources that help portfolio companies scale effectively. Their network includes seasoned industry veterans who serve as mentors, providing strategic guidance and opening doors to potential customers and partners. This mentorship program has proven particularly valuable for first-time founders navigating the complex landscape of utility partnerships and regulatory compliance.

The organization’s commitment to supporting scale is perhaps best illustrated through their pilot project facilitation program. MassCEC leverages relationships with Massachusetts utilities to create testing grounds for promising technologies, addressing one of the water industry’s most significant barriers to entry. These pilot opportunities often serve as crucial reference projects, enabling companies to demonstrate real-world performance and accelerate market adoption.

MassCEC also takes an active role in helping portfolio companies build their operational capabilities. Through targeted workshops and customized support programs, they assist with everything from talent acquisition to supply chain optimization. Their deep connection to the Massachusetts innovation ecosystem enables them to connect portfolio companies with specialized expertise when needed.

Demonstrating remarkable parallels to how Imagine H2O built the world’s leading water innovation accelerator, MassCEC’s approach combines hands-on support with strategic network access. The organization regularly facilitates introductions to potential corporate partners, customers, and fellow investors, creating opportunities for commercial partnerships and future funding rounds.

This comprehensive support system has proven particularly effective in helping companies navigate the critical valley between initial technology validation and widespread market adoption. By providing both the capital and capabilities needed for growth, MassCEC has established itself as more than just a funding source – it’s become a true partner in building successful water technology companies.

The MassCEC Advantage: A Unique Model for Water Innovation

The Massachusetts Clean Energy Center (MassCEC) stands apart from traditional funding organizations through its innovative hybrid structure that bridges public policy objectives with private sector dynamism. This unique positioning enables MassCEC to deploy $50 million in ways that maximize impact across the water technology landscape.

At the core of MassCEC’s advantage is its flexible funding model that combines state appropriations with revenue from renewable energy initiatives. This dual funding stream allows MassCEC to take calculated risks on early-stage water technologies while maintaining long-term program stability. The organization can provide various financial instruments – from non-dilutive grants to equity investments – calibrated to each venture’s specific stage and needs.

Beyond capital, MassCEC has built an extensive technical support infrastructure that addresses the water sector’s unique commercialization challenges. Their network includes specialized testing facilities, pilot sites, and engineering expertise that help validate new technologies in real-world conditions. This technical backbone significantly de-risks innovations before market entry.

Perhaps most distinctive is MassCEC’s ecosystem approach to water innovation. Rather than operating as an isolated funding body, they actively cultivate connections between entrepreneurs, utilities, regulators, research institutions, and investors. This coordinated network accelerates technology adoption by ensuring innovations align with market needs while navigating regulatory requirements.

MassCEC’s hybrid structure also enables them to take a longer-term view than purely private investors, recognizing that water technology development often requires extended timelines. They can support promising solutions through multiple development stages – from proof-of-concept through pilot testing to commercial scale-up.

The organization’s deep understanding of both public sector priorities and private market dynamics allows them to identify and support technologies that deliver both environmental benefits and commercial potential. This dual-impact focus helps ensure funded innovations achieve meaningful adoption and sustainable business models.

MassCEC’s model has proven particularly effective at addressing market gaps that neither pure public funding nor private investment alone can fill. Their ability to provide patient capital, technical resources, and ecosystem connections helps promising water technologies bridge the critical valley between R&D and commercial success.

From Lab to Market: MassCEC’s Support Pipeline

MassCEC’s technology commercialization pathway represents a carefully orchestrated journey that transforms promising water innovations into market-ready solutions. At its core lies a multi-stage support system that combines technical validation, market assessment, and deployment assistance.

The journey typically begins in MassCEC’s world-class testing facilities, where innovators can validate their technologies under real-world conditions. These facilities offer controlled environments for both drinking water and wastewater applications, allowing developers to fine-tune their solutions while gathering crucial performance data. This initial phase proves particularly valuable for early-stage companies that would otherwise struggle to access such sophisticated testing infrastructure.

Beyond technical validation, MassCEC provides crucial market intelligence and business development support. Their expert team helps innovators identify specific market opportunities, understand regulatory requirements, and develop go-to-market strategies. This comprehensive approach ensures that technical excellence translates into commercial viability.

What sets MassCEC’s pipeline apart is its emphasis on building connections within the water technology ecosystem. Technology developers gain access to a network of potential customers, investors, and industry partners. These relationships often prove instrumental in securing pilot projects and initial commercial deployments. The organization’s strong ties with utilities, industrial users, and municipalities help bridge the notorious “valley of death” between innovation and market adoption.

A distinctive feature of MassCEC’s approach is its flexible funding mechanisms, which adapt to different development stages. Early-stage grants support proof-of-concept work, while larger investments help scale promising technologies. This tiered funding model ensures sustained support throughout the commercialization journey, particularly during critical transition points.

Through this comprehensive pipeline, MassCEC has helped numerous water technologies achieve market success. Their support extends beyond individual innovations to strengthen Massachusetts’ position as a global water technology hub. As detailed in this exploration of innovation culture, such systematic approaches to technology development create lasting impact.

The organization’s impact metrics reveal impressive outcomes: technologies supported through their pipeline demonstrate significantly higher commercialization rates compared to industry averages. Many graduates of their program have secured substantial follow-on funding, created high-value jobs, and delivered solutions that address critical water challenges. This track record validates MassCEC’s model and its role in accelerating water technology innovation.

Investment Opportunities and Impact Metrics

MassCEC’s $50M water technology fund operates through a sophisticated investment framework designed to maximize both financial returns and environmental impact. The organization’s co-investment model provides crucial risk mitigation while catalyzing private capital into promising water technologies.

The fund’s investment strategy focuses on three key stages: seed funding of $50,000-250,000 for early validation, Series A investments of $500,000-2M for commercial scale-up, and growth capital of up to $5M for market expansion. This tiered approach allows MassCEC to support water innovations across their full development cycle while managing risk exposure.

To evaluate potential investments, MassCEC employs a comprehensive metrics framework that assesses both commercial viability and environmental impact. Key commercial metrics include market size, competitive advantage, team capabilities, and path to profitability. The environmental impact assessment examines water savings potential, energy efficiency gains, and contributions to climate resilience.

Notably successful in this approach is MassCEC’s requirement for matched private investment, which typically ranges from 1:1 to 1:3 ratios depending on the stage. This has proven highly effective in validating market interest while extending the fund’s reach. As explored in this insightful analysis of water technology investment strategies, such co-investment models help de-risk early-stage water technologies.

The fund tracks impact through a standardized measurement framework that captures both quantitative and qualitative outcomes. Quantitative metrics include gallons of water saved/treated, kilowatt-hours reduced, and greenhouse gas emissions avoided. Qualitative assessments evaluate factors like technology adoption rates, market transformation effects, and ecosystem development.

Portfolio companies must report quarterly on these metrics, allowing MassCEC to aggregate impact data and demonstrate the collective effect of its investments. This data-driven approach has helped the organization maintain an impressive success rate, with over 70% of portfolio companies achieving key commercialization milestones.

Beyond direct investments, MassCEC leverages its metrics framework to inform policy recommendations and identify market gaps requiring additional support. This feedback loop between investment activities and market intelligence helps the organization continuously refine its strategy while supporting the broader water innovation ecosystem.

The combination of strategic co-investment, comprehensive due diligence, and rigorous impact measurement has established MassCEC as a model for public investment in water technology. Their framework demonstrates how public funds can effectively catalyze private investment while ensuring measurable progress toward water sustainability goals.

Future Horizons: MassCEC’s Strategic Vision

MassCEC’s vision for the future of water technology innovation centers on three interconnected pillars: climate resilience, equity in access, and economic growth through technological advancement. Looking ahead, the organization plans to significantly expand its role in shaping tomorrow’s water solutions, building on its established $50M foundation.

A key strategic focus involves accelerating the development and deployment of climate-adaptive water technologies. The organization recognizes that Massachusetts’ water infrastructure faces unprecedented challenges from climate change. In response, MassCEC is prioritizing innovations that enhance system resilience while reducing energy consumption and carbon emissions. This includes supporting breakthrough technologies in water reuse, energy-efficient treatment processes, and smart infrastructure solutions.

The organization’s commitment to equity manifests through targeted support for solutions addressing underserved communities. Future funding will increasingly prioritize projects that demonstrate potential for improving water access and quality in disadvantaged areas, while maintaining economic viability. This balanced approach ensures that innovation serves both social impact and market sustainability.

MassCEC’s economic development strategy focuses on positioning Massachusetts as a global water technology hub. The organization plans to strengthen its ecosystem-building initiatives through expanded partnerships with research institutions, industry leaders, and international collaborators. This includes developing new funding mechanisms that bridge the gap between early-stage innovation and commercial deployment.

Technology focus areas for the coming years include advanced materials for water treatment, artificial intelligence applications in system optimization, and decentralized treatment solutions. MassCEC sees particular promise in technologies that integrate multiple benefits – such as water treatment processes that simultaneously generate renewable energy or recover valuable resources.

The organization is also evolving its support model. Beyond traditional grant funding, MassCEC is exploring innovative financing mechanisms like outcome-based funding and blended capital approaches. These new models aim to better align incentives and accelerate the path to market for promising technologies.

Stakeholder engagement remains central to MassCEC’s future strategy. The organization plans to deepen its collaboration with utilities, municipalities, and private sector partners to ensure innovations address real-world needs and can scale effectively. This includes creating new platforms for knowledge sharing and technology validation.

Final words

MassCEC represents more than just another institutional investor in the water technology space – it embodies a unique hybrid model that combines the strategic discipline of venture capital with the mission-driven focus of public sector innovation. Their $50 million investment fund, while significant, is merely the tip of the iceberg in terms of their impact on water technology advancement. By strategically positioning themselves as co-investors rather than lead investors, they’ve created a multiplication effect that extends far beyond their direct capital deployment. Their focus on Massachusetts-based companies has created a thriving ecosystem that attracts global talent and capital, while their strategic investment themes – from PFAS remediation to digital twins – address some of water technology’s most pressing challenges. For water entrepreneurs and impact investors, MassCEC represents not just a potential capital source, but a partner in building the future of water technology. Their approach to follow-on funding and growth support demonstrates a long-term commitment to success that extends beyond initial investments. As the water technology sector continues to evolve, MassCEC’s model offers valuable lessons in how public sector investment can catalyze private sector innovation while maintaining focus on critical environmental and social impacts.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!