With over ¥620 billion in targeted investments and a laser focus on water infrastructure, Marubeni Corporation stands as a compelling force in the global water sector. The Japanese trading giant’s strategic approach combines traditional infrastructure plays with cutting-edge water technologies, making it a fascinating study for water entrepreneurs and impact investors alike. From massive desalination projects in the Middle East to innovative wastewater resource recovery solutions, Marubeni’s diverse portfolio reflects both the challenges and opportunities in the evolving water landscape. Let’s dive deep into their investment strategy, examining how they’re addressing critical water needs while generating sustainable returns.

Marubeni Corporation is part of my Ultimate Water Investor Database, check it out!

Investor Name: Marubeni Corporation

Investor Type: PE

Latest Fund Size: $4666 Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: Desalination, wastewater resource recovery (e.g. PFAS elimination), decentralized treatments

Investment History: $4575000 spent over 2 deals

Often Invests Along:

Already Invested In: AquaGreen, Sourcewater, Inc.

Leads or Follows: Both

Board Seat Appetite: Moderate

Key People:

Investment Scale and Strategic Focus

Marubeni Corporation’s ambitious water infrastructure investment strategy centers on an impressive ¥620 billion target allocation, backed by ¥440 billion in available capital ready for deployment. This substantial financial commitment positions the Japanese trading giant as a formidable force in shaping global water infrastructure development.

The company’s investment approach follows a carefully calibrated strategy that balances risk and opportunity across different water sector verticals. A significant portion targets municipal water infrastructure upgrades and expansions in developing markets, where aging systems and rapid urbanization create pressing needs. For instance, Marubeni has deployed over ¥80 billion in Southeast Asian water utilities modernization projects, focusing on reducing water losses and improving operational efficiency.

In the industrial water space, Marubeni demonstrates particular strategic interest in water recycling and zero liquid discharge (ZLD) facilities. These investments align with growing industrial demand for sustainable water management solutions, especially in water-stressed regions. The corporation’s portfolio includes several landmark projects, including a ¥40 billion investment in advanced treatment facilities serving industrial parks across China’s water-scarce northern provinces.

Desalination represents another key focus area, with Marubeni taking significant stakes in major seawater reverse osmosis (SWRO) facilities. These investments typically range from ¥30-50 billion per project and often involve long-term concession agreements with municipal authorities. The company’s experience in structuring complex project finance deals has proven particularly valuable in this capital-intensive segment.

Marubeni’s strategic allocation also extends to digital water infrastructure and smart metering systems. While these investments tend to be smaller in scale, typically ¥5-15 billion per initiative, they offer attractive growth potential given the accelerating digitalization of water utilities worldwide. Can private capital change the world of water for the better? Marubeni’s targeted investments suggest it can, particularly when deployed with strategic focus and technical expertise.

The corporation maintains strict investment criteria, prioritizing projects that demonstrate clear pathways to operational efficiency improvements and sustainable returns. This disciplined approach, combined with deep sector expertise and strong local partnerships, has enabled Marubeni to consistently execute complex water infrastructure projects while managing risks effectively. Their remaining dry powder of ¥440 billion positions them well to capitalize on emerging opportunities across the global water infrastructure landscape.

Water Technology Innovation Portfolio

Marubeni’s technological innovation strategy centers on building a diverse portfolio of advanced water treatment solutions that address emerging global challenges. The corporation has demonstrated particular expertise in resource recovery and digital water management systems, positioning itself at the forefront of next-generation water infrastructure.

A cornerstone of Marubeni’s innovation approach is its investment in advanced treatment technologies. The corporation has strategically backed solutions that combine traditional treatment methods with cutting-edge processes to handle increasingly complex contamination challenges. Their support of membrane-based systems and electrochemical treatment processes showcases their commitment to efficiency and sustainability in water treatment.

In the resource recovery domain, Marubeni has pioneered investments in circular economy solutions that transform waste streams into valuable resources. Their strategic stake in AquaGreen exemplifies this approach – the technology converts wastewater biosolids into energy and nutrient-rich biochar, simultaneously addressing waste management and resource recovery challenges. This investment aligns perfectly with their vision of creating sustainable water infrastructure that generates multiple value streams.

Digital water management represents another crucial pillar in Marubeni’s technology portfolio. The corporation has heavily invested in smart water solutions that leverage artificial intelligence and machine learning to optimize treatment processes, predict maintenance needs, and reduce operational costs. These digital platforms enable real-time monitoring and control of water infrastructure, dramatically improving efficiency and reliability.

Marubeni’s water technology investments notably emphasize scalability and commercial viability. Rather than pursuing purely experimental technologies, they focus on solutions that demonstrate clear paths to market adoption and can be integrated into existing infrastructure. This pragmatic approach has helped them build a portfolio of technologies that deliver immediate value while positioning them for future growth opportunities.

The corporation’s innovation strategy extends beyond individual technologies to encompass entire treatment systems. By investing in complementary solutions, Marubeni creates synergistic effects that enhance overall system performance. Their holistic approach to water technology innovation ensures that individual components work together seamlessly to deliver comprehensive water management solutions.

Looking ahead, Marubeni continues to explore emerging technologies that could reshape the water industry. Their investment strategy reflects a deep understanding of global water challenges and a commitment to developing solutions that combine environmental sustainability with economic viability. Through their water technology portfolio, Marubeni is not just investing in individual solutions but building an integrated platform for next-generation water infrastructure.

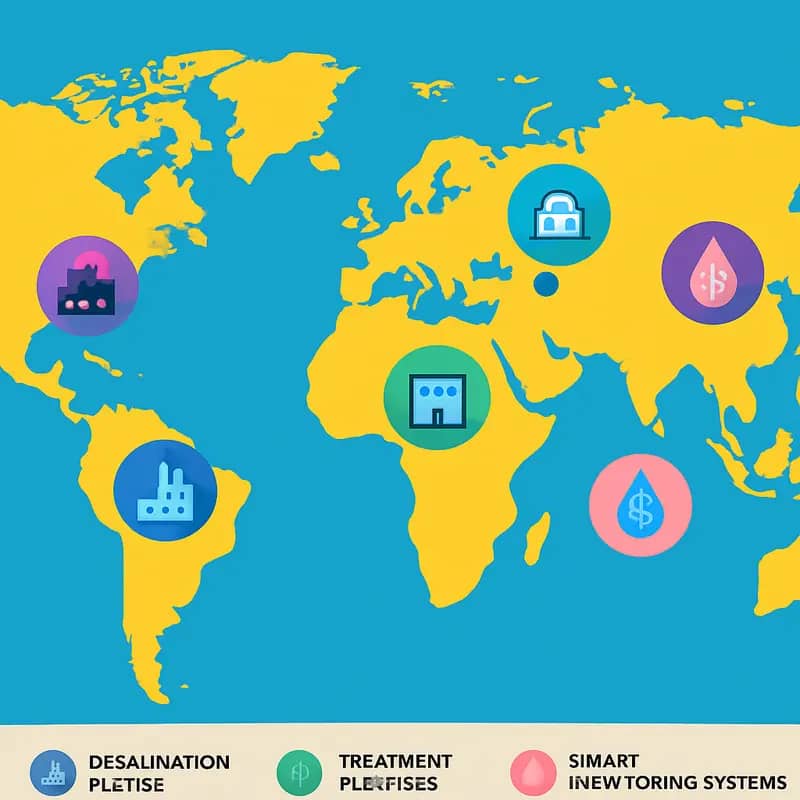

Global Investment Footprint

Marubeni Corporation has strategically positioned itself across key water markets worldwide, deploying capital with a nuanced understanding of regional needs and opportunities. The trading giant’s investment approach reflects a clear geographical diversification strategy while maintaining focus on high-growth potential markets.

In Asia, Marubeni has established a commanding presence in Southeast Asian markets, particularly in the Philippines and Indonesia. These investments primarily target municipal water infrastructure and industrial water treatment facilities. The corporation’s flagship investment in Manila Water exemplifies its commitment to improving urban water infrastructure while generating stable returns through long-term concession agreements.

The Middle East represents another crucial pillar in Marubeni’s investment portfolio, with significant stakes in desalination projects across Saudi Arabia, UAE, and Oman. The region’s water scarcity challenges have created opportunities for the company to leverage its technological expertise in seawater desalination and wastewater treatment. Marubeni’s involvement in the Shuqaiq 3 Independent Water Project in Saudi Arabia demonstrates its capability to execute large-scale infrastructure projects in challenging environments.

In Europe, Marubeni has adopted a more selective approach, focusing on advanced technology investments and innovative water management solutions. The corporation’s strategy here emphasizes partnerships with established utilities and technology providers, particularly in markets like the UK and Spain. These investments typically involve smaller stakes but provide access to cutting-edge water treatment technologies and digital solutions.

The Americas present a diverse investment landscape for Marubeni, with distinct approaches for North and South America. In North America, the focus lies on acquiring strategic stakes in water technology companies and specialized treatment solutions providers. Meanwhile, in Latin America, Marubeni targets infrastructure development projects, particularly in Chile and Brazil, where water scarcity and aging infrastructure create compelling investment opportunities.

Examining Marubeni’s investment partnership strategy in these regions reveals a sophisticated approach to risk management and value creation. The corporation typically seeks controlling stakes in Asia-Pacific projects while opting for minority positions with strong governance rights in Western markets. This differentiated approach allows Marubeni to balance risk exposure while maintaining significant influence over operational decisions.

The geographical spread of investments also reflects Marubeni’s understanding of varying regulatory environments and market maturity levels. In developing markets, investments often focus on basic infrastructure and capacity building, while developed markets see more emphasis on efficiency improvements and technological innovation. This strategic alignment with local market needs has enabled Marubeni to build a resilient global water portfolio while contributing to water security across diverse regions.

Partnership and Governance Approach

Marubeni Corporation’s success in water infrastructure investments stems from a carefully crafted partnership and governance framework that emphasizes strategic alignment and active management participation. The trading giant has developed a distinctive approach to structuring deals and managing relationships with co-investors and portfolio companies.

At the core of Marubeni’s partnership strategy lies a preference for significant minority stakes, typically ranging between 20-40%. This ownership level enables the corporation to secure board representation while maintaining operational flexibility for local partners. The company consistently seeks board seats to actively shape strategic direction and provide oversight of its investments.

Marubeni frequently partners with regional infrastructure funds, pension investors, and strategic industry players who bring complementary capabilities. These co-investment relationships often extend across multiple deals, building trusted networks that facilitate deal sourcing and risk sharing. The corporation has demonstrated particular success in forming consortiums with European and Asian infrastructure investors who share its long-term investment horizon.

In terms of governance, Marubeni implements a multi-layered structure that balances central oversight with local autonomy. The corporation typically places senior executives on portfolio company boards while maintaining dedicated investment management teams that provide operational support. This hands-on approach enables Marubeni to transfer technical expertise and management best practices across its water infrastructure portfolio.

Stakeholder alignment receives special attention in Marubeni’s governance framework. The corporation develops detailed shareholder agreements that clearly define roles, responsibilities, and decision rights. These agreements often include provisions for technology transfer, operational support, and future capital commitments. Management incentive structures are designed to align with long-term value creation rather than short-term metrics.

Risk management features prominently in Marubeni’s partnership approach, as highlighted in their approach to mitigating water risk through impact investing. The corporation maintains dedicated teams for monitoring regulatory compliance, environmental performance, and stakeholder relationships. This comprehensive oversight helps identify and address potential issues before they impact investment performance.

Marubeni’s partnership model has proven particularly effective in emerging markets where relationships with local stakeholders are crucial. The corporation’s ability to balance global expertise with local market understanding has enabled successful entries into challenging jurisdictions while managing political and regulatory risks effectively.

From Textile Trade to Water Tech

Marubeni Corporation’s transformation from a humble textile trading company into a global water infrastructure powerhouse represents one of the most remarkable pivots in corporate history. Founded in 1858 as a linen trading operation in Osaka, Japan, Marubeni exemplifies how strategic foresight and calculated diversification can redefine a company’s future.

The seeds of Marubeni’s water industry evolution were planted in the post-war period of the 1950s, when Japan’s rapid industrialization created unprecedented demand for infrastructure development. Rather than remaining solely focused on textiles, Marubeni’s leadership recognized the strategic importance of expanding into heavy industry and infrastructure projects. This prescient decision laid the groundwork for the company’s future water initiatives.

By the 1970s, Marubeni had established itself as a key player in industrial plant exports, particularly in Southeast Asia. The company’s experience in managing complex infrastructure projects provided crucial insights into the growing importance of water management systems in industrial development. This understanding catalyzed Marubeni’s strategic entry into the water sector.

The turning point came in the late 1990s when global water scarcity emerged as a critical challenge. Marubeni moved decisively, leveraging its extensive network and project management expertise to secure major water infrastructure contracts. The company’s approach was methodical yet bold – focusing initially on water supply projects before expanding into wastewater treatment, desalination, and water reuse technologies.

What truly sets Marubeni’s water sector transformation apart is its integrated approach to water infrastructure development. Rather than merely acting as a project contractor, the company positioned itself as a comprehensive solutions provider, offering everything from initial planning to long-term operation and maintenance services. This strategic positioning has proven particularly valuable in emerging markets where end-to-end water infrastructure solutions are in high demand.

Marubeni’s evolution also demonstrates the power of strategic partnerships and acquisitions. The company has consistently sought out collaborations with leading technology providers and acquired strategic assets to strengthen its water portfolio. This approach has enabled Marubeni to stay at the forefront of water technology innovation while maintaining strong operational capabilities.

Perhaps most notably, as explored in “How to Solve a Global Challenge in an Easy, Affordable, Innovative and Efficient Way“, Marubeni’s transformation exemplifies how traditional trading companies can successfully pivot into specialized infrastructure sectors through strategic vision and patient capital deployment.

Today, Marubeni’s water division stands as a testament to the company’s successful transformation, managing projects across multiple continents and serving millions of people. The journey from textile trader to water infrastructure giant offers valuable lessons about the importance of strategic foresight, adaptability, and long-term commitment in building sustainable business success.

Global Water Portfolio Deep Dive

Marubeni Corporation has strategically positioned itself as a dominant force in global water infrastructure through a diverse portfolio of high-impact projects. The company’s approach combines innovative technologies with sustainable business models that provide valuable lessons for the water sector.

A cornerstone of Marubeni’s strategy is its focus on membrane-based water treatment facilities. The corporation has developed large-scale desalination plants in drought-prone regions, utilizing advanced reverse osmosis technology to provide reliable water access to millions. These facilities demonstrate how cutting-edge engineering can be scaled sustainably when backed by sound financial planning.

In Southeast Asia, Marubeni has pioneered a unique public-private partnership model for municipal water management. By implementing smart metering systems and predictive maintenance protocols, the company has achieved remarkable reductions in non-revenue water while improving service reliability. This success showcases how infrastructure investments can generate both social impact and commercial returns.

Marubeni’s industrial water treatment portfolio particularly stands out for its innovative approach to wastewater recycling. The company has developed closed-loop systems for manufacturing facilities that not only minimize environmental impact but also create new revenue streams through resource recovery. This circular economy approach has proven especially valuable in water-stressed industrial zones.

Leveraging its trading company roots, Marubeni has excelled at creating flexible financing structures that make advanced water infrastructure accessible to emerging markets. The company’s build-operate-transfer (BOT) arrangements have enabled municipalities to upgrade their water systems without massive upfront capital requirements.

Perhaps most notably, Marubeni has mastered the art of risk management in water infrastructure projects. Through careful project selection, thorough due diligence, and innovative risk-sharing mechanisms, the company has maintained a remarkable track record of successful implementations across diverse geographies and regulatory environments.

The corporation’s emphasis on digital transformation has yielded significant operational efficiencies. By integrating IoT sensors, artificial intelligence, and advanced analytics across its portfolio, Marubeni has created a data-driven approach to infrastructure management that sets new industry standards for performance optimization.

Perhaps the most valuable lesson from Marubeni’s portfolio is how to balance innovation with reliability. While the company actively pursues cutting-edge solutions, it maintains strict criteria for technology validation and scaling, ensuring that experimental approaches don’t compromise essential services. This methodical innovation process offers a proven template for entrepreneurs seeking to introduce new technologies to the water sector.

These strategic elements combine to create a robust portfolio that delivers consistent returns while advancing global water security. For entrepreneurs and investors in the water sector, Marubeni’s approach demonstrates how technological innovation, creative financing, and operational excellence can converge to create sustainable competitive advantages in the water infrastructure market.

Innovation Through Partnership

Marubeni Corporation has strategically positioned itself at the forefront of water technology innovation through a carefully orchestrated ecosystem of partnerships and investments. The company’s approach combines traditional trading expertise with venture capital acumen, creating powerful synergies between established infrastructure and emerging solutions.

The corporation’s partnership model revolves around three core pillars: early-stage technology investments, pilot project collaborations, and strategic acquisitions. Through its dedicated water innovation fund, Marubeni identifies promising startups developing breakthrough water treatment and monitoring technologies. Rather than pursuing purely financial returns, the company leverages these investments to gain early access to transformative solutions that can be integrated into its global water infrastructure portfolio.

A prime example is Marubeni’s collaboration with an advanced membrane technology startup, where the trading giant provided not just capital but also access to its extensive network of municipal and industrial customers. This partnership enabled rapid real-world validation of the technology while giving Marubeni a competitive edge in membrane-based water treatment solutions.

The company’s innovation strategy extends beyond traditional water treatment. By partnering with digital technology providers, Marubeni has successfully integrated smart monitoring systems and predictive analytics across its water asset portfolio. These partnerships have enabled the company to optimize operations, reduce energy consumption, and improve infrastructure reliability while generating valuable data insights.

Marubeni’s approach to partnership innovation is notably different from typical corporate venture capital models. Instead of maintaining arm’s length relationships with portfolio companies, the corporation actively facilitates connections between innovators and its established business units. This creates a powerful feedback loop where operational expertise informs technology development, and new solutions enhance existing infrastructure.

The success of this strategy is evident in the performance metrics of Marubeni’s water infrastructure projects. Partner technologies have helped reduce operational costs by up to 30% while improving treatment efficiency and reliability. These improvements have made Marubeni’s water solutions more competitive and strengthened its position as a trusted infrastructure partner globally.

Looking ahead, Marubeni is embracing radical collaboration principles to accelerate water innovation. The company continues to expand its partnership network, focusing on technologies that address emerging challenges like micropollutant removal, energy efficiency, and digital transformation. This forward-thinking approach ensures Marubeni remains at the cutting edge of water infrastructure development while contributing to the advancement of the entire water sector.

Future Waters: Investment Opportunities

Marubeni Corporation stands poised to capitalize on transformative opportunities emerging across the global water sector. Digital water solutions present a particularly compelling frontier, with the integration of artificial intelligence and machine learning enabling unprecedented operational efficiencies. The company’s strategic focus likely centers on advanced analytics platforms that optimize treatment processes while reducing energy consumption and operational costs.

Resource recovery represents another key investment vector aligned with Marubeni’s sustainability goals. Advanced biosolids processing and nutrient harvesting technologies are gaining traction as utilities seek to transform waste streams into valuable products. The company’s deep expertise in commodity trading positions it perfectly to develop new markets for recovered resources like phosphorus, nitrogen, and bio-based materials.

Perhaps most significantly, climate resilience projects offer massive growth potential as communities worldwide grapple with intensifying weather extremes. Marubeni’s infrastructure development capabilities make it an ideal partner for implementing innovative flood control systems, drought mitigation solutions, and coastal protection measures. The company’s established presence in vulnerable regions positions it to deploy both traditional gray infrastructure and emerging green solutions.

A particularly promising area lies in decentralized water technologies that enhance system redundancy and local resilience. Small-scale, modular treatment systems allow communities to maintain critical services even when centralized infrastructure is compromised. Marubeni’s manufacturing and project finance capabilities could accelerate adoption of these distributed solutions.

The nexus between water and renewable energy presents another compelling opportunity. As utilities pursue carbon neutrality, technologies that reduce treatment energy demands or generate clean power from water processes become increasingly valuable. Marubeni’s expertise in both sectors enables it to develop innovative hybrid solutions.

Cross-sector convergence will likely drive many of Marubeni’s future water investments. The company’s diverse portfolio allows it to identify synergies between water management and other infrastructure systems. Smart city initiatives integrating water, energy, and transportation data could unlock new efficiencies and services.

Marubeni’s investment strategy will need to balance proven technologies that can scale quickly with early-stage innovations that could reshape the industry. By leveraging its global network and deep sector expertise, the company is uniquely positioned to accelerate adoption of transformative water solutions.

Final words

Marubeni Corporation’s water investment strategy represents a masterful blend of traditional infrastructure expertise and forward-thinking technology adoption. Their substantial financial commitment – targeting ¥620 billion in investments – demonstrates both the scale of their ambition and their recognition of water as a critical investment sector. The company’s balanced approach, combining large-scale infrastructure projects with innovative technology investments like AquaGreen, positions them uniquely in the water investment landscape. For water entrepreneurs, Marubeni offers not just capital, but also global reach and deep industry expertise. Impact investors will find their focus on sustainable solutions and resource recovery particularly appealing, as exemplified by their investments in circular economy approaches to wastewater treatment. As water stress intensifies globally and regulation around water quality tightens, Marubeni’s strategic positioning and investment capacity make them an increasingly important player in shaping the future of water infrastructure and technology. Their continued expansion across diverse geographies and technologies suggests exciting opportunities for collaboration and co-investment in addressing global water challenges.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!