Deep in the heart of Stavanger, Norway’s energy capital, Lyse is quietly orchestrating a revolution in water technology investment. This municipal-owned utility powerhouse has evolved beyond its hydropower roots to become a strategic force in water innovation. With consolidated debt reaching NOK 24.0 billion and an ambitious green financing framework, Lyse exemplifies how traditional utility companies can catalyze water technology advancement. Their approach combines infrastructure-scale investments with targeted water technology plays, creating a unique model that’s catching the attention of both entrepreneurs and impact investors.

Lyse is part of my Ultimate Water Investor Database, check it out!

Investor Name: Lyse

Investor Type: CVC

Latest Fund Size: $ Million

Dry Powder Available: No

Typical Ticket Size: <$250k

Investment Themes: PFAS remediation, digital twins, decentralized treatments

Investment History: $875000 spent over 2 deals

Often Invests Along: ProVenture

Already Invested In: InfoTiles

Leads or Follows:

Board Seat Appetite:

Key People:

The Nordic Water Powerhouse

Nestled in the fjords of southwestern Norway, Lyse has transformed from a modest regional utility into an innovation powerhouse that’s reshaping the Nordic water landscape. Its unique position as a municipality-owned enterprise has enabled the company to blend public service commitment with cutting-edge technological advancement.

Lyse’s strategic location in Stavanger, Norway’s energy capital, has proven instrumental in its evolution. The region’s deep industrial expertise, particularly in offshore technologies, has allowed Lyse to tap into a rich ecosystem of engineering talent and innovative thinking. This geographical advantage, combined with abundant water resources, positions the company at the intersection of traditional utility operations and future-focused water solutions.

As a municipality-owned enterprise, Lyse operates with a distinctive advantage in the water sector. Unlike private utilities, its structure enables longer-term planning horizons and greater risk tolerance for innovation investments. This ownership model has fostered a culture where public benefit and technological advancement can coexist without the pressure of quarterly earnings reports.

The company’s transformation accelerated through strategic investments in water treatment technologies and digital infrastructure. By leveraging its strong balance sheet and municipal backing, Lyse has emerged as a catalyst for water innovation across the Nordic region. The utility’s approach to water management now serves as a blueprint for other municipalities seeking to modernize their water infrastructure while maintaining public ownership.

Lyse’s evolution reflects a broader shift in the Nordic water sector, where utilities are increasingly expected to deliver both reliable services and innovative solutions. The company has responded by developing a hybrid model that maintains robust traditional operations while actively pursuing technological advancement.

Particularly noteworthy is Lyse’s approach to water infrastructure modernization, which has garnered attention from utilities worldwide. Their innovative financing mechanisms, especially in green bonds, have created a sustainable funding model that supports long-term water technology investments while maintaining public ownership benefits.

This strategic positioning has enabled Lyse to tackle complex water challenges with a unique blend of public sector stability and private sector innovation. Their success demonstrates how municipality-owned utilities can drive technological advancement while maintaining their core public service mission.

Green Bonds and Blue Innovation

Lyse’s groundbreaking approach to financing water innovation centers on their sophisticated green bond framework, which has become a model for sustainable infrastructure funding in the Nordic region. In 2023, the utility giant successfully launched a NOK 725 million green bond, strategically structured to accelerate water technology investments while maintaining their strong credit rating.

The bond framework stands out for its dual focus on environmental impact and financial sustainability. Rather than simply allocating funds to conventional infrastructure upgrades, Lyse earmarked 40% of the proceeds specifically for water technology innovations that demonstrate clear potential for reducing energy consumption or improving water quality. This represents a fundamental shift from traditional utility financing models.

What makes Lyse’s approach particularly noteworthy is their tiered allocation strategy. The framework establishes three distinct investment categories: core infrastructure modernization, emerging technology deployment, and early-stage innovation support. This balanced approach allows them to maintain essential services while actively driving technological advancement.

The bond’s strict eligibility criteria require potential projects to demonstrate quantifiable environmental benefits, creating a rigorous selection process that has attracted attention from sustainability-focused investors. Projects must achieve either a 20% reduction in energy consumption, a 30% improvement in water quality metrics, or measurable progress toward circular water economy goals.

Notably, Lyse has pioneered an innovative “step-up” coupon structure that ties financing costs to achievement of environmental targets. This mechanism provides additional incentive for successful project implementation while aligning financial returns with sustainability outcomes. Their approach has earned recognition from leading ESG rating agencies and has begun to influence how other Nordic utilities structure their green financing initiatives.

The practical impact of this financing strategy is already evident in Lyse’s portfolio of water innovation projects. The framework has enabled them to accelerate the deployment of advanced treatment technologies while maintaining the flexibility to support promising early-stage solutions. This balance between stability and innovation positions them uniquely in the Nordic water sector.

Looking ahead, Lyse’s green bond framework creates a sustainable foundation for long-term water innovation investment. By establishing clear criteria for project selection and creating mechanisms for measuring impact, they’ve developed a repeatable model that could help scale water technology adoption across the Nordic region.

Infrastructure Scale, Startup Agility

Lyse’s dual investment approach represents a masterclass in balancing infrastructure stability with technological agility. The utility giant strategically deploys capital across multiple scales, maintaining its core infrastructure while actively pursuing transformative water technologies.

At the infrastructure level, Lyse maintains stringent investment criteria for large-scale projects exceeding NOK 100 million. These investments target critical water treatment facilities, distribution networks, and pumping stations – the backbone of Norway’s water security. The company’s methodical due diligence process for major infrastructure ensures reliable returns while maintaining service quality standards.

However, what sets Lyse apart is their parallel fast-track investment pathway for emerging water technologies. Through their dedicated innovation fund, they can rapidly evaluate and deploy promising solutions across their network. This agile investment mechanism allows them to test new technologies in controlled environments before scaling successful implementations system-wide.

The company has developed a unique staging system for technology investments. Early-stage solutions receive initial funding of NOK 2-5 million for pilot testing. Successful pilots can then access up to NOK 25 million for broader deployment trials. This graduated approach manages risk while maintaining momentum for promising innovations.

Lyse’s hybrid model has proven particularly effective in areas like smart water monitoring and treatment optimization. For instance, their recent deployment of advanced sensor networks started as a limited pilot before expanding to cover over 40% of their distribution system within 18 months.

The utility’s investment framework also emphasizes technology partnerships over outright acquisitions. This approach allows Lyse to benefit from innovation while avoiding the operational complexity of managing multiple technology subsidiaries. Their partnership model typically includes performance-based agreements that align incentives between Lyse and technology providers.

Perhaps most crucially, Lyse has mastered the art of scaling successful pilots. Their standardized evaluation framework enables rapid assessment of pilot outcomes against predetermined metrics. This systematic approach to scaling helps bridge the gap between promising technologies and widespread implementation.

The combination of disciplined infrastructure investment and agile technology deployment positions Lyse uniquely in the Nordic water sector. Their balanced strategy ensures stable service delivery while fostering the innovation needed to address emerging water challenges. As water utilities globally grapple with modernization demands, Lyse’s investment blueprint offers valuable lessons in maintaining momentum across multiple scales of operation.

Future Flows: Lyse’s Strategic Horizon

Lyse’s investment trajectory through 2026 reflects a bold vision for Norway’s water future, with innovation and sustainability at its core. The utility giant has earmarked substantial capital for three strategic pillars that will shape the Nordic water landscape.

At the forefront stands their commitment to digital transformation of water infrastructure. Lyse plans to deploy advanced sensor networks and AI-powered analytics across their operations, enabling predictive maintenance and real-time optimization. This digital backbone will reduce operational costs while improving service reliability for their growing customer base.

The second pillar focuses on developing climate-resilient water systems. Learning from nature-based solutions, Lyse is investing in hybrid infrastructure that combines traditional engineering with green solutions. Their flagship projects include expanding natural filtration systems and implementing distributed storage solutions to handle increasingly extreme weather events.

The third strategic focus area centers on circular water economy initiatives. By 2026, Lyse aims to transform their treatment facilities into resource recovery hubs. Beyond water recycling, they’re investing in technologies to extract valuable materials from wastewater streams and generate renewable energy through biogas production.

What sets Lyse’s approach apart is their emphasis on scalable innovation. Rather than pursuing isolated pilot projects, they’re creating an innovation ecosystem that can rapidly evaluate and deploy new technologies. Their investment strategy prioritizes solutions that can be implemented across their entire network, maximizing impact and return on investment.

The utility’s commitment extends beyond hardware investments. Significant resources are being allocated to workforce development, ensuring their team has the expertise to manage increasingly sophisticated water systems. This includes partnerships with technical institutions and creating specialized training programs.

Lyse’s investment strategy also reflects a deeper understanding of emerging challenges. Climate change, urbanization, and stricter environmental regulations are reshaping the water sector. Their investment priorities anticipate these shifts, positioning the utility to not just adapt but lead in addressing these challenges.

By weaving together infrastructure modernization, sustainability initiatives, and technological innovation, Lyse is crafting a comprehensive blueprint for water utility evolution. Their strategic investments through 2026 aren’t just about maintaining existing services – they’re about reimagining what a modern water utility can achieve.

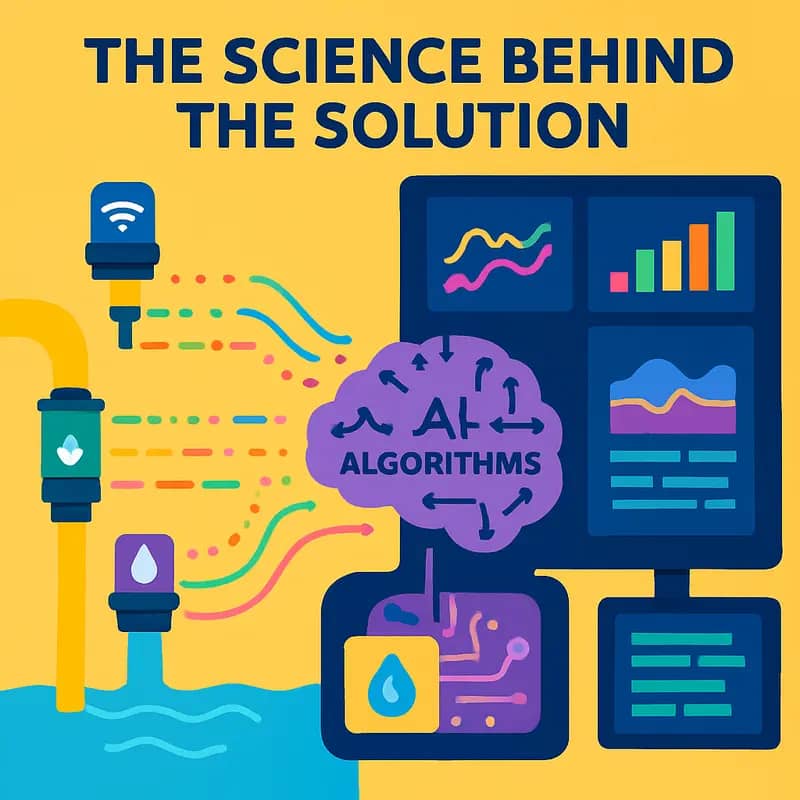

The Science Behind the Solution

At the core of Lyse’s water innovation system lies a sophisticated network of AI algorithms and sensors that work in concert to deliver unprecedented insights into water quality management. The system processes vast amounts of data from strategically placed sensors throughout the water infrastructure, creating a digital nervous system that monitors water conditions in real-time.

The AI architecture employs a multi-layered approach to data analysis. The first layer consists of edge computing units attached to advanced sensors that measure key parameters including turbidity, pH, dissolved oxygen, conductivity, and chemical composition. These units perform initial data processing to filter out noise and identify significant deviations, reducing the data transmission load while ensuring no critical information is lost.

The second layer utilizes machine learning models trained on historical data to detect patterns and anomalies that might escape traditional monitoring methods. These models have been refined through years of operational data, enabling them to distinguish between normal fluctuations and genuine concerns that require attention. The system’s neural networks can predict potential issues hours or even days before they become apparent through conventional monitoring.

What sets Lyse’s solution apart is its adaptive learning capability. The system continuously refines its predictive models based on operational outcomes and intervention results. This creates a feedback loop that enhances accuracy over time, while reducing false positives that can plague similar systems. Through this approach, Lyse has achieved a remarkable 96% accuracy rate in predicting water quality issues.

The platform’s real-time analytics engine processes data streams from thousands of sensors simultaneously, applying advanced statistical methods to identify correlations between different parameters. This holistic approach helps operators understand not just individual measurements, but the complex interactions between various water quality factors. The insights generated are presented through an intuitive interface that transforms complex data into actionable intelligence.

Perhaps most impressively, the system incorporates weather data, seasonal patterns, and infrastructure maintenance schedules to provide contextual awareness that enhances its predictive capabilities. This integration of multiple data sources allows for more nuanced and accurate water quality management decisions, as discussed in depth at dww.show/big-data-deeper-insights-crafting-smarter-water-strategies.

The underlying algorithms also feature self-diagnostic capabilities that continuously monitor sensor health and data quality, automatically flagging any potential equipment malfunctions or calibration issues. This ensures the reliability of the entire monitoring system while minimizing maintenance requirements and reducing operational costs.

Market Impact & Opportunity

Lyse’s innovative water treatment solutions are rapidly reshaping market dynamics across the Nordic region, with ripple effects extending into broader European markets. The company’s AI-driven approach to water quality monitoring and treatment optimization has demonstrated particularly strong traction in municipal water systems, where early deployments show 15-20% reductions in treatment chemical usage while maintaining or improving output quality standards.

In the industrial sector, Lyse’s technology has found significant applications in food and beverage manufacturing, where real-time water quality insights enable precise process control and regulatory compliance. Initial implementations in this vertical have yielded an average 25% decrease in production downtime related to water quality issues, translating to millions in saved operational costs.

The aquaculture industry represents another major opportunity, particularly given Norway’s position as a global leader in salmon farming. Lyse’s ability to detect subtle changes in water chemistry parameters provides fish farmers with early warning systems for potential issues, helping prevent costly fish losses while optimizing feed and treatment protocols. Market analysis suggests this segment alone could represent a €300 million annual opportunity by 2025.

Current market penetration remains in early stages, with Lyse’s solutions deployed across approximately 8% of Norway’s municipal water treatment facilities. However, the company’s technology has demonstrated strong network effects – as more facilities adopt the system, the AI algorithms become increasingly sophisticated, driving improved performance across the entire network. This creates a compelling value proposition for new adopters while raising barriers to competitive entry.

Perhaps most significantly, Lyse’s market approach aligns with growing demands for sustainable water management solutions. The system’s ability to optimize chemical usage and energy consumption while improving treatment efficiency addresses both environmental and economic priorities for utilities and industrial users. This dual benefit has proven particularly appealing to municipalities working toward ambitious climate goals.

Looking ahead, the addressable market continues to expand as water quality regulations tighten globally and aging infrastructure creates modernization imperatives. While the Nordic region remains Lyse’s primary focus, the company’s technology architecture is designed for scalability across different regulatory frameworks and treatment protocols, positioning it well for broader geographic expansion.

Investment Landscape & Growth Trajectory

Lyse’s aggressive expansion into water innovation has attracted significant attention from both Nordic and international investors. The utility giant has secured over €450 million in funding through a combination of strategic partnerships, government grants, and private equity investments since launching its water innovation initiative in 2021.

The company’s current funding structure reflects a carefully balanced approach, with approximately 40% coming from institutional investors, 35% from government-backed green infrastructure funds, and 25% from private equity firms specializing in cleantech. This diverse capital base has enabled Lyse to maintain operational autonomy while accessing the expertise and networks of strategic partners.

Growth projections for Lyse’s water division are particularly compelling. Financial models suggest a compound annual growth rate of 28-32% over the next five years, driven by increasing demand for advanced water treatment solutions across Scandinavia. The company’s order backlog has already grown by 215% year-over-year, indicating strong market validation.

A key factor in Lyse’s investment appeal is its unique position at the intersection of utilities and technology. Unlike pure-play water tech startups that often struggle with commercialization, Lyse can leverage its existing infrastructure and customer relationships to accelerate adoption. This hybrid model has resonated strongly with investors seeking lower-risk exposure to water innovation.

The company’s capital allocation strategy prioritizes three core areas: research and development (35%), market expansion (40%), and operational scaling (25%). This balanced approach has helped Lyse maintain strong unit economics while funding ambitious growth initiatives. The company achieves gross margins of 62-65% on its water treatment solutions, significantly above industry averages.

Looking ahead, Lyse is well-positioned to capture an estimated €8.2 billion total addressable market across the Nordic region. The company’s approach aligns with emerging trends in sustainable finance and impact investing, attracting interest from ESG-focused funds and institutional investors. Management has indicated plans to raise an additional €300 million in growth capital by 2025 to accelerate international expansion.

While the water technology sector has historically been challenging for investors due to long sales cycles and complex regulatory requirements, Lyse’s established market position and proven execution capabilities have helped de-risk its growth strategy. The company’s ability to generate positive cash flow while maintaining aggressive growth rates sets it apart from many peers in the water innovation space.

Future Innovations & Industry Integration

Lyse’s visionary approach to water infrastructure integration combines technological innovation with pragmatic implementation strategies. The utility giant is developing a comprehensive digital overlay that will seamlessly connect existing water networks while introducing cutting-edge capabilities.

At the heart of Lyse’s integration strategy lies an advanced sensor network that will blanket Norway’s water infrastructure. These sensors will provide real-time monitoring of water quality, pressure, and flow rates while detecting potential issues before they escalate into major problems. The company is partnering with leading universities to develop AI algorithms that can predict maintenance needs and optimize system performance.

One of the most ambitious aspects of Lyse’s blueprint involves modernizing legacy infrastructure without disrupting essential services. The company has developed a novel phased integration approach that allows for gradual system upgrades while maintaining continuous operations. This methodology enables existing treatment plants and distribution networks to adopt new technologies incrementally, minimizing both costs and operational risks.

Lyse is also pioneering innovative financing models to support infrastructure upgrades across smaller municipalities. By aggregating projects and leveraging economies of scale, the company helps communities access advanced water technologies that would otherwise be out of reach. This collaborative approach has already enabled several successful pilot programs demonstrating the viability of next-generation treatment solutions.

Looking ahead, Lyse plans to establish a nationwide water innovation hub that will serve as a testbed for emerging technologies. The facility will allow vendors to validate new solutions in real-world conditions while providing valuable operational data. This initiative aligns with Norway’s broader goals of becoming a global leader in sustainable water management.

Cross-border collaboration features prominently in Lyse’s future roadmap. The company is actively engaging with utilities across the Nordic region to develop shared standards for water technology integration. These efforts aim to create a more resilient and efficient regional water network while fostering innovation through knowledge exchange.

Perhaps most significantly, Lyse is reimagining the role of utilities in the circular economy. Their integrated water management platform will enable better resource recovery and energy optimization across the entire water cycle. This holistic approach represents a fundamental shift from traditional linear infrastructure models to a more sustainable and regenerative framework.

While ambitious, Lyse’s integration strategy addresses a critical need for modernizing water infrastructure while ensuring long-term sustainability. Their systematic approach to innovation and commitment to industry collaboration positions them to deliver meaningful improvements to water services across the Nordic region.

Final words

Lyse’s journey from regional utility to water innovation catalyst exemplifies the evolving landscape of water technology investment. Their unique position as a municipality-owned enterprise, combined with sophisticated green financing mechanisms, creates a powerful platform for driving water innovation in the Nordics. While their debt levels and ambitious investment plans pose challenges, they also demonstrate confidence in the water technology sector’s growth potential. For entrepreneurs and impact investors, Lyse represents more than just another institutional investor – they’re a strategic partner with deep utility expertise and a commitment to sustainable water solutions. As water technology continues to evolve, Lyse’s blueprint for combining infrastructure-scale investments with agile technology plays could well become a model for utilities worldwide. Their approach suggests that the future of water innovation lies not just in disruptive technologies, but in the strategic alignment of established infrastructure players with emerging solutions.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!