With over $50 billion in assets under management, Hostplus stands as a titan in Australia’s superannuation landscape. While traditionally known for its broad infrastructure and private equity investments, the fund has increasingly turned its attention to water sustainability and innovation. As global water challenges intensify, Hostplus’s investment approach offers unique insights into how institutional capital can drive positive change in the water sector. From infrastructure projects to venture investments in water technology, their strategy represents a compelling case study in balancing member returns with environmental impact.

Hostplus is part of my Ultimate Water Investor Database, check it out!

Investor Name: Hostplus

Investor Type: PE

Latest Fund Size: $50000 Million

Dry Powder Available: No

Typical Ticket Size: >$75M

Investment Themes: Water Sustainability, Water Infrastructure, Industrial Water

Investment History: $27798899.59 spent over 2 deals

Often Invests Along:

Already Invested In: ElectraLith, Gradiant Corporation

Leads or Follows: Follow

Board Seat Appetite: Rare

Key People: Sam Sicilia, Greg Clerk, Susan Orr, Chris Williams

The Investment Philosophy: Scale Meets Sustainability

With assets under management exceeding $50 billion, Hostplus has positioned itself at the intersection of large-scale institutional investing and sustainable water solutions. The fund’s investment philosophy in the water sector reflects a sophisticated understanding that financial returns and environmental stewardship need not be mutually exclusive.

Hostplus approaches water investments through a dual lens of risk mitigation and opportunity capture. The fund recognizes water scarcity as both a systemic risk to their broader portfolio and a chance to generate sustainable returns through innovative solutions. Their strategy harmonizes with the insights shared in sustainable investing approaches detailed in how to mitigate 4 shades of water risk through impact investing.

The fund’s ESG integration in water investments operates on multiple levels. At the portfolio level, Hostplus conducts rigorous water risk assessments across all holdings, examining physical risks like drought and flooding, regulatory risks from evolving water policies, and reputational risks tied to water usage. This comprehensive approach ensures that water considerations are not siloed but integrated into the broader investment decision-making process.

In direct water investments, Hostplus prioritizes technologies and infrastructure that deliver both commercial returns and measurable environmental benefits. The fund has developed sophisticated metrics to evaluate potential investments, considering factors such as water efficiency gains, ecosystem impacts, and community benefits alongside traditional financial indicators.

A distinguishing feature of Hostplus’s approach is its long-term investment horizon, which aligns naturally with water infrastructure and technology development timeframes. This patient capital perspective allows the fund to support projects through their full development cycle, from early-stage innovation to full-scale implementation.

The fund has also pioneered innovative financing structures that help scale water solutions. By leveraging its significant capital base, Hostplus can participate in larger projects that smaller investors might find prohibitive. This scale advantage enables the fund to influence project design and implementation, ensuring strong sustainability credentials while maintaining commercial viability.

Hostplus’s investment committees maintain a careful balance between financial discipline and impact objectives. They evaluate opportunities through a framework that considers both quantitative metrics like water savings and qualitative factors such as technological innovation and scalability potential. This balanced approach has helped the fund build a water portfolio that delivers consistent returns while contributing to water security solutions.

Infrastructure’s Hidden Water Play

Hostplus’s infrastructure portfolio represents a strategic approach to water management that extends far beyond traditional water utilities. Through carefully selected investments in airports, ports, and industrial facilities, the fund has built an impressive network of assets where water efficiency and innovation play a crucial but often overlooked role.

The fund’s airport holdings showcase this approach particularly well. Modern airports require sophisticated water management systems to handle everything from terminal facilities to aircraft maintenance and de-icing operations. Hostplus has prioritized investments in airports implementing closed-loop water recycling systems and smart monitoring technology to minimize waste and optimize usage patterns.

In the maritime sector, Hostplus’s port investments demonstrate how water management intersects with operational efficiency. Their portfolio includes facilities that have pioneered ballast water treatment systems and developed innovative approaches to handling industrial runoff. These ports serve as proving grounds for new water technologies while generating steady returns for the fund’s members.

Perhaps most intriguing is Hostplus’s strategy regarding industrial facilities. The fund has actively sought out manufacturing and processing plants that incorporate advanced water recovery systems. These investments often yield a double benefit: reduced operational costs through water efficiency and the ability to monetize recovered resources from wastewater streams.

What sets Hostplus apart is their holistic view of water infrastructure. Rather than treating water management as an environmental compliance cost, they view it as an opportunity to enhance asset value. This approach has led them to favor facilities that incorporate features like rainwater harvesting, greywater recycling, and smart metering systems.

For example, one of their industrial investments reduced water consumption by 40% through the implementation of a membrane bioreactor system, generating both cost savings and environmental benefits. Read more about innovative membrane technologies.

The fund’s infrastructure strategy also reflects an understanding of climate resilience. Their assets increasingly incorporate features like permeable surfaces, bioswales, and constructed wetlands – natural infrastructure that helps manage stormwater while providing additional ecosystem services.

This multifaceted approach to water management in infrastructure assets has positioned Hostplus well for a future where water scarcity and regulatory pressures are likely to increase. By embedding water innovation into their infrastructure portfolio, they’ve created a resilient investment strategy that delivers both financial returns and environmental benefits.

Venture Capital: Betting on Water Innovation

Hostplus’s venture capital strategy in water technology represents a bold push into early-stage innovation, with the superannuation fund taking calculated risks to capture emerging opportunities in the water sector. The fund has developed a sophisticated approach to identifying and nurturing water technology startups that show promise in addressing critical water challenges.

Central to Hostplus’s venture strategy is their partnership model with specialized water technology accelerators and incubators. Rather than making direct investments, they leverage the expertise of these partners to identify promising ventures and provide crucial early-stage support. This approach helps mitigate risks while ensuring startups receive both capital and strategic guidance.

The fund maintains a particular focus on technologies that address water scarcity, quality monitoring, and infrastructure efficiency. Their investment thesis prioritizes scalable solutions that can demonstrate clear pathways to commercialization and market adoption. This includes innovations in digital water management, advanced treatment processes, and smart infrastructure systems.

Hostplus has structured their venture investments to provide patient capital, recognizing that water technology startups often require longer development cycles than traditional tech ventures. They typically participate in Series A and B funding rounds, providing capital injections ranging from $2 million to $10 million. This approach allows them to support companies through critical growth phases while maintaining the potential for significant returns.

A key differentiator in Hostplus’s venture strategy is their emphasis on solutions that can scale across Australia’s unique water challenges. They prioritize technologies that can address issues like drought resilience, agricultural water efficiency, and sustainable urban water management. This local focus helps create a competitive advantage while contributing to national water security.

The fund’s venture portfolio reflects a balance between breakthrough technologies and proven solutions ready for market expansion. They maintain active involvement with portfolio companies, often facilitating connections with their broader infrastructure investments to create testing and deployment opportunities. This synergistic approach helps accelerate the commercialization of promising water technologies.

Hostplus has also pioneered innovative funding structures that align with the unique characteristics of water technology ventures. They’ve implemented flexible investment terms that account for longer development cycles and regulatory approval processes common in the water sector. This approach has helped them attract promising startups that might otherwise struggle to secure traditional venture funding.

Looking ahead, Hostplus continues to evolve their venture strategy to capture emerging opportunities in water technology. Their focus increasingly includes solutions that address climate resilience and environmental sustainability, recognizing these as critical growth areas in the water sector.

Future Horizons: Water Investment Trends

The water investment landscape is undergoing a dramatic transformation as digital solutions, recycling technologies, and climate resilience measures take center stage. Hostplus recognizes these emerging opportunities and is strategically positioning its $50 billion portfolio to capture value across multiple innovative fronts.

Digital water solutions represent a key focus area, with artificial intelligence and machine learning capabilities revolutionizing infrastructure management. Smart sensors and predictive analytics enable precise leak detection and optimize treatment processes, driving both operational efficiency and sustainability. Hostplus has identified this convergence of water and technology as a crucial investment theme, aligning with growing evidence that digital transformation could unlock over $500 billion in value for the water sector.

Recycling technologies present another compelling opportunity as water scarcity concerns intensify globally. Advanced treatment processes that enable water reuse in industrial applications and agriculture are gaining traction. These solutions not only address environmental challenges but also offer attractive financial returns through reduced operational costs and regulatory compliance. Hostplus is increasing its exposure to companies developing breakthrough recycling technologies, particularly those demonstrating commercial viability at scale.

Climate resilience investments form the third pillar of Hostplus’s forward-looking water strategy. With extreme weather events becoming more frequent, infrastructure that can withstand and adapt to climate impacts is essential. The fund is targeting innovations in flood management, drought mitigation, and coastal protection. These investments serve a dual purpose – protecting existing assets while generating returns from the growing demand for climate-adaptive solutions.

Beyond individual technologies, Hostplus recognizes the value of integrated approaches that combine multiple solutions. The fund is exploring investment opportunities in comprehensive water management platforms that leverage both natural and engineered systems. This holistic strategy acknowledges that future water challenges require coordinated solutions across the entire water cycle.

Hostplus’s commitment to water innovation extends beyond direct investments. The fund actively participates in water-focused investment networks and collaborates with research institutions to identify emerging trends. This approach ensures early access to promising technologies while contributing to the broader development of sustainable water solutions.

As water stress intensifies and technology advances, Hostplus’s strategic focus on these key trends positions the fund to generate both financial returns and positive environmental impact. The future of water investment lies in solutions that are not only commercially viable but also environmentally transformative.

The Hostplus Investment Philosophy

At the core of Hostplus’s water technology investment strategy lies a sophisticated approach that seamlessly interweaves innovation-seeking with prudent risk management. The fund’s philosophy centers on identifying transformative water technologies while maintaining the careful stewardship expected of a major superannuation fund.

Hostplus employs a multi-layered due diligence process that sets it apart in the water investment landscape. Rather than relying solely on traditional financial metrics, the fund’s evaluation framework incorporates technological validation, market potential assessment, and sustainability impact measurements. This comprehensive approach allows Hostplus to identify opportunities that others might overlook, particularly in emerging water technology subsectors.

The fund’s portfolio construction strategy reflects a deliberate balance between established water infrastructure investments and early-stage technology ventures. By allocating approximately 15% of its water-focused investments to innovation-driven companies, Hostplus maintains exposure to potentially disruptive technologies while preserving portfolio stability through more conventional water assets.

Risk mitigation takes center stage in Hostplus’s investment approach, with a particular focus on technology validation. The fund has developed strategic partnerships with leading water research institutions and testing facilities, enabling thorough vetting of new technologies before significant capital deployment. This approach, while sometimes extending the investment timeline, has proven crucial in avoiding costly missteps in an industry where technology failure can have far-reaching consequences.

In constructing its water technology portfolio, Hostplus employs a thematic investment approach that aligns with global water challenges. The fund strategically focuses on technologies addressing water scarcity, quality improvement, and infrastructure efficiency. This alignment ensures that investment decisions not only serve financial objectives but also contribute to solving pressing water-related challenges.

The fund’s commitment to innovation is further exemplified by its unique approach to scaling portfolio companies. Rather than pursuing a traditional hands-off investment strategy, Hostplus actively facilitates connections between portfolio companies and its extensive network of water utilities and industrial water users. This approach accelerates commercial adoption while providing valuable market feedback for technology refinement.

Hostplus has particularly distinguished itself through its patient capital approach, recognizing that water technology commercialization often requires longer development cycles than other sectors. This philosophy, which acknowledges the complexities of water technology development and market adoption, has proven crucial in supporting companies through the challenging ‘valley of death’ between innovation and commercial success.

Integrating environmental, social, and governance (ESG) considerations has become increasingly central to Hostplus’s water technology investment strategy. The fund applies sophisticated sustainability metrics to assess potential investments, ensuring alignment with both financial returns and positive environmental impact.

Breaking Down the Water Tech Portfolio

Hostplus’s water technology portfolio represents a strategic blend of established solutions and breakthrough innovations addressing critical water challenges. The fund’s investments span three core areas: water infrastructure optimization, resource recovery, and advanced treatment technologies.

In the infrastructure optimization space, Hostplus has pioneered investments in smart monitoring systems and predictive analytics platforms. One notable success story involves backing a digital twin technology that reduced non-revenue water losses by 42% across a major urban utility network. This technology now serves over 50 million customers globally, delivering both environmental benefits and strong financial returns.

The resource recovery vertical showcases Hostplus’s commitment to circular economy principles. A significant investment in wastewater nutrient recovery has yielded impressive results, with one portfolio company developing a process that transforms wastewater streams into valuable agricultural inputs while reducing treatment energy consumption. This dual-benefit approach exemplifies Hostplus’s focus on solutions that deliver both environmental and financial returns.

Advanced treatment technologies form the third pillar of the portfolio, with particular emphasis on membrane technology and decentralized treatment systems. These investments target emerging contaminants and water quality challenges while reducing energy intensity. The fund’s early-stage investment in a novel membrane technology has led to commercialization across three continents, demonstrating Hostplus’s ability to identify and scale promising innovations.

Beyond individual investments, Hostplus employs a portfolio synergy approach, creating valuable connections between complementary technologies. This strategy has accelerated commercialization timelines and enhanced returns. For instance, the fund facilitated collaboration between its smart monitoring and membrane technology investments, resulting in a 30% improvement in operational efficiency.

The portfolio’s geographic diversity spans Australia, North America, and Europe, with increasing attention to emerging markets in Southeast Asia. This global perspective allows Hostplus to identify and scale solutions across different regulatory and market contexts while managing risk through diversification.

Risk management remains central to portfolio construction, with investments structured to balance early-stage opportunities with more mature technologies. The fund typically maintains a 70-30 split between established and emerging technologies, ensuring stable returns while capturing upside potential from breakthrough innovations.

Hostplus’s water technology investments demonstrate that environmental impact and financial returns need not be mutually exclusive. The portfolio’s performance validates the fund’s thesis that water technology solutions addressing critical challenges can deliver compelling returns while contributing to water security and sustainability.

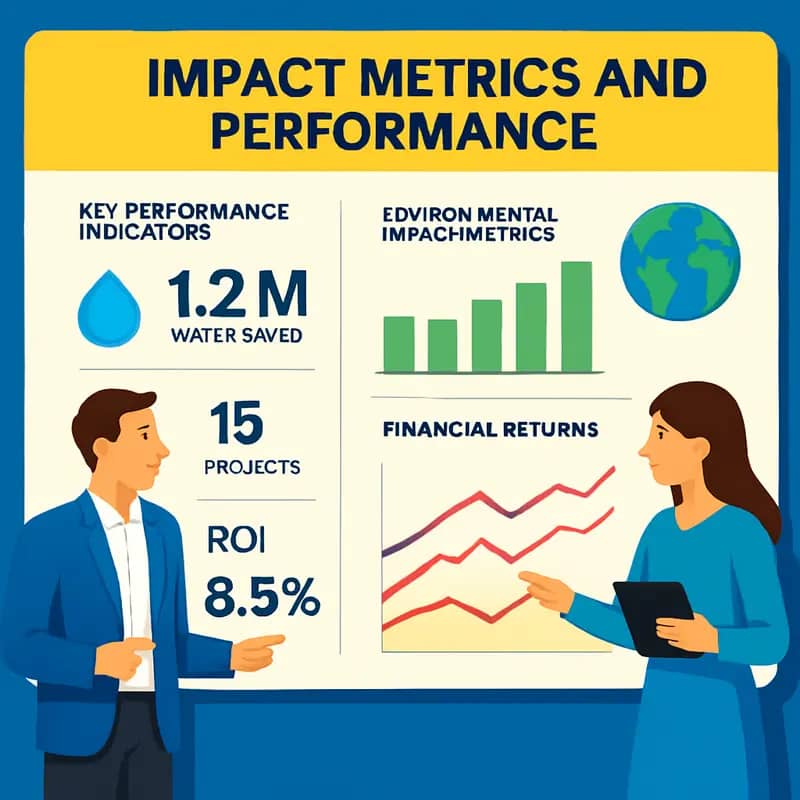

Impact Metrics and Performance

Hostplus has developed a sophisticated dual-track measurement framework to evaluate both financial returns and environmental impact across its water technology investment portfolio. This integrated approach allows the fund to maintain its fiduciary responsibilities while advancing its sustainability goals.

On the financial side, Hostplus employs traditional metrics like internal rate of return (IRR) and cash-on-cash multiples to assess investment performance. However, the fund has augmented these with water-specific indicators that capture operational efficiency gains. These include metrics like cost per cubic meter of water treated, energy intensity reduction percentages, and operational cost savings achieved through innovative technologies.

The environmental impact assessment framework draws heavily on the United Nations Sustainable Development Goals (SDGs), particularly SDG 6 on clean water and sanitation. Key performance indicators track water conservation volumes, reduction in pollutant loads, and improvements in water quality parameters. The fund has integrated advanced monitoring systems that provide real-time data on water savings, energy efficiency, and emissions reduction across its portfolio companies.

A particularly innovative aspect of Hostplus’s approach is its emphasis on measuring indirect or secondary environmental benefits. For instance, when evaluating wastewater treatment technologies, the fund considers not just direct water quality improvements but also downstream effects on ecosystem health, agricultural productivity, and community wellbeing. This holistic view helps capture the full value creation potential of water investments.

To ensure accountability and transparency, Hostplus requires portfolio companies to report quarterly on both financial and environmental metrics. These reports feed into an integrated scoring system that weighs environmental impact alongside financial returns when making investment decisions and evaluating portfolio performance. This balanced scorecard approach has proven effective in identifying investments that deliver both strong returns and meaningful environmental benefits.

Looking ahead, Hostplus is working to standardize its impact measurement methodology across the water technology sector. The fund actively participates in industry working groups focused on developing consistent ESG metrics for water investments. This collaborative effort aims to create more reliable benchmarks for comparing performance across different water technology solutions and investment strategies.

In keeping with its commitment to driving innovation in water technology investment, Hostplus regularly evaluates and refines its measurement framework. Recent enhancements include incorporating climate resilience metrics and expanding social impact indicators to better capture the full spectrum of benefits generated by water investments.

Future Horizons: Innovation Pipeline

Hostplus’s forward-looking water sector strategy reveals a sophisticated approach to emerging technologies and investment opportunities. The fund’s innovation pipeline focuses on three critical areas that promise to reshape water management: digital transformation, resource recovery, and climate resilience.

At the forefront of Hostplus’s digital transformation focus is the integration of artificial intelligence and machine learning for predictive maintenance and operational optimization. The fund recognizes that smart water infrastructure could help utilities save up to $136 trillion liters annually, making this a particularly attractive investment avenue.

In the resource recovery space, Hostplus is evaluating technologies that transform wastewater treatment plants into resource factories. Their analysts have identified promising opportunities in nutrient recovery systems that extract phosphorus and nitrogen for agricultural use. Additionally, they’re exploring innovative approaches to energy generation from wastewater, including advanced anaerobic digestion systems and microbial fuel cells.

The climate resilience segment of their pipeline emphasizes nature-based solutions and adaptive infrastructure. This includes investments in green infrastructure technologies that combine traditional engineering with ecological approaches. The fund is particularly interested in solutions that address urban flooding while providing additional ecosystem services.

Hostplus’s innovation pipeline also reveals a strategic shift toward water-tech convergence with other sectors. They’re investigating technologies that bridge water management with renewable energy, such as floating solar installations on water reservoirs and hydropower optimization systems. This cross-sector approach reflects their understanding that future water solutions will increasingly integrate with broader infrastructure and energy systems.

The fund’s innovation screening process has evolved to incorporate both technological readiness and market adoption potential. They’ve developed a sophisticated framework that evaluates not just the technical merits of new solutions but also their scalability and potential for market disruption. This approach helps identify technologies that can deliver both environmental impact and financial returns.

Looking ahead, Hostplus is positioning itself to capitalize on emerging trends in water technology commercialization. Their pipeline includes early-stage investments in water quality monitoring systems using advanced sensors, decentralized treatment solutions, and innovative membrane technologies. These investments reflect their belief that the future of water management will be increasingly decentralized, data-driven, and resource-efficient.

Final words

As water challenges continue to multiply globally, Hostplus’s investment strategy offers valuable lessons for both institutional investors and water entrepreneurs. Their balanced approach – combining infrastructure investments with venture capital allocations – demonstrates how large-scale capital can be deployed effectively in the water sector. While maintaining their fiduciary duty to members, Hostplus has shown that generating returns and driving water innovation aren’t mutually exclusive goals. Their example suggests that the future of water investment lies not in choosing between profit and impact, but in finding sophisticated ways to achieve both. For water entrepreneurs and impact investors, Hostplus’s evolving strategy provides a roadmap for engaging with institutional capital while advancing water sustainability goals.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!