From Rotterdam’s historic harbor emerges FTTF, a venture capital firm crafting a unique approach to water technology investment. With ticket sizes ranging from €250,000 to €1 million, this Dutch investor is strategically positioning itself at the intersection of water innovation and early-stage funding. Their laser focus on pre-seed to early-stage water technology ventures, combined with deep sector expertise, is creating ripples across the industry. As global water challenges intensify, FTTF’s investment thesis targeting water treatment, smart infrastructure, and resource efficiency demonstrates how focused capital deployment can drive both environmental impact and financial returns.

FTTF is part of my Ultimate Water Investor Database, check it out!

Investor Name: FTTF

Investor Type: VC

Latest Fund Size: $281.18 Million

Dry Powder Available: No

Typical Ticket Size: $250k – $1M

Investment Themes: PFAS, digital twins, decentralized treatments

Investment History: $1988888.89 spent over 2 deals

Often Invests Along: Amathaon Capital, EIT Food, Lakestar, Natural Ventures, Vsquared

Already Invested In: constellr

Leads or Follows:

Board Seat Appetite:

Key People:

The FTTF Investment Blueprint

FTTF has strategically positioned itself in the water technology investment landscape by focusing on pre-seed to early-stage companies, typically deploying tickets between €250,000 to €2 million. This deliberate focus on early-stage ventures allows FTTF to capture significant value potential while helping shape promising water innovations from their inception.

The fund’s investment blueprint centers on identifying and nurturing water technology companies at their most crucial development stage. By entering early, FTTF can provide not just capital but also essential guidance and industry connections when companies need them most. This approach allows them to secure favorable terms and maintain significant influence over the strategic direction of their portfolio companies.

A key element of FTTF’s strategy is their hands-on involvement with portfolio companies. Rather than simply providing capital, they work closely with founding teams to refine business models, establish market connections, and accelerate technology validation. This active management approach helps mitigate the inherent risks of early-stage investing while maximizing the potential for successful outcomes.

The fund’s ticket size range is particularly well-suited to the water technology sector’s dynamics. The €250,000 minimum allows FTTF to participate meaningfully in seed rounds while maintaining a diversified portfolio. The €2 million upper limit enables them to lead or co-lead investment rounds while ensuring sufficient capital remains for follow-on investments in their most promising portfolio companies.

FTTF’s positioning also reflects a deep understanding of the water sector’s evolution. As water challenges become more acute globally, early-stage water technology companies are increasingly well-positioned to develop and scale innovative solutions. By focusing on this segment, FTTF can identify and support companies addressing critical water challenges before they become mainstream investment opportunities.

The fund acknowledges that water technology development often requires patient capital and longer commercialization timelines compared to other sectors. Their investment approach is calibrated to these realities, with holding periods and support structures designed to give portfolio companies sufficient runway to achieve meaningful technical and commercial milestones.

This strategic positioning has proven particularly valuable as the water sector undergoes rapid transformation. With increasing pressure on water resources and infrastructure worldwide, FTTF’s early-stage focus allows them to identify and support innovations that address emerging challenges in water treatment, resource efficiency, and infrastructure modernization.

Water Innovation Themes

FTTF’s investment thesis centers on transformative water technologies across several high-impact themes that address critical industry challenges. The fund’s portfolio reflects a deep understanding of where innovation can create the most value in the water sector.

Advanced water treatment technologies form a cornerstone of FTTF’s investment focus. This includes novel approaches to removing emerging contaminants like PFAS, microplastics, and pharmaceutical compounds that traditional treatment methods struggle to address. The market for these solutions is expanding rapidly as regulations tighten and public awareness grows about water quality issues.

Resource recovery represents another key theme, with technologies that extract valuable materials from wastewater streams while reducing treatment costs and environmental impact. This includes innovations in nutrient recovery, rare earth element extraction, and energy generation from wastewater – a market projected to reach $50+ billion by 2030.

Smart water infrastructure and digital solutions comprise a third major focus area. FTTF targets technologies that leverage AI, IoT sensors, and advanced analytics to optimize water network operations, detect leaks, predict maintenance needs, and improve asset management. These solutions align with the growing push toward digital transformation in utilities.

Water efficiency and reuse technologies represent a fourth critical theme. This includes innovations in water recycling, closed-loop systems, and advanced filtration that enable industrial and municipal customers to reduce freshwater consumption and wastewater discharge. The industrial water reuse market alone is expected to exceed $30 billion by 2025.

Nature-based solutions and green infrastructure round out FTTF’s investment themes. These approaches leverage natural processes and ecological systems to manage water resources more sustainably. Examples include constructed wetlands, bioretention systems, and other solutions that combine environmental benefits with lower operational costs.

By focusing on these complementary themes, FTTF’s portfolio addresses both immediate market needs and longer-term sustainability challenges. The fund’s early-stage investment approach allows it to support innovative technologies through critical development phases while positioning for significant growth as these markets mature.

From Seed to Growth

Strategic early-stage investment in water technology requires more than just capital deployment. FTTF has developed a comprehensive approach that combines careful investment staging with hands-on support to help promising innovations reach their full potential.

The fund’s investment philosophy centers on a milestone-based funding strategy. Initial seed investments typically range from €250,000 to €1 million, providing critical early capital while maintaining options for follow-on rounds. This measured approach allows FTTF to evaluate progress and de-risk investments before committing larger amounts.

What truly sets FTTF apart is their active involvement in portfolio company development. Their support system includes three key pillars: technical validation, commercial acceleration, and operational guidance. Technical validation involves connecting startups with research institutions and pilot facilities to rigorously test and optimize their solutions. The commercial acceleration program leverages FTTF’s extensive network to facilitate introductions to potential customers, partners, and industry experts.

On the operational front, FTTF assigns experienced venture partners to each portfolio company. These partners provide hands-on mentorship in areas like business strategy, team building, and fundraising preparation. This intensive support helps companies avoid common pitfalls and accelerate their path to market.

The fund’s follow-on investment strategy is equally methodical. As portfolio companies achieve predetermined milestones, FTTF can participate in subsequent funding rounds, often taking lead investor positions. This creates alignment between the fund and founders while ensuring continued support through critical growth phases.

A distinctive aspect of FTTF’s approach is their focus on building sustainable business models. Rather than pushing for rapid scaling at all costs, they encourage portfolio companies to establish solid foundations – robust technology validation, clear market fit, and sustainable unit economics. As detailed in an article about nurturing water innovation, this patient capital approach is essential for water technology success.

FTTF also facilitates collaboration between portfolio companies, creating valuable synergies and knowledge sharing opportunities. This community approach helps accelerate learning and creates a supportive ecosystem for water innovation. Through careful investment staging, comprehensive support, and ecosystem building, FTTF is establishing a new model for nurturing early-stage water technology companies from seed to growth stage success.

Impact Metrics and Returns

FTTF’s investment philosophy centers on the principle that environmental impact and financial returns are not mutually exclusive, but rather mutually reinforcing. The fund has developed a sophisticated framework to evaluate both dimensions across their portfolio companies.

At the core of their impact assessment lies a set of quantifiable metrics tied to the UN Sustainable Development Goals, particularly SDG 6 (Clean Water and Sanitation) and SDG 13 (Climate Action). Portfolio companies must demonstrate measurable improvements in water efficiency, quality, or accessibility. These metrics include cubic meters of water saved, reduction in contamination levels, and number of people gaining improved water access.

The fund’s approach to measuring success extends beyond traditional financial indicators. While they target market-rate returns of 15-20% IRR, they evaluate investments through a comprehensive scorecard that weighs environmental benefits alongside economic performance. This dual-return framework has proven particularly effective in attracting institutional investors who increasingly seek sustainable investment opportunities.

FTTF’s vision for sustainable water technology investment is rooted in scaling solutions that address critical water challenges while building resilient businesses. They actively seek technologies that can demonstrate tangible impact through water savings, energy efficiency, or pollution reduction. How to mitigate 4 shades of water risk through impact investing provides deeper insights into their risk assessment approach.

The fund’s balanced scorecard approach has yielded noteworthy results. Portfolio companies have collectively saved over 50 billion liters of water annually while maintaining strong financial performance. This success has validated FTTF’s thesis that water technology solutions offering clear environmental benefits often translate into stronger market adoption and sustainable business models.

Looking ahead, FTTF is expanding its impact metrics to include broader environmental and social indicators. They’re developing new frameworks to measure ecosystem services, community benefits, and climate resilience. This evolution reflects their understanding that water challenges are deeply interconnected with other environmental and social issues.

The fund maintains transparency through detailed impact reports that track both quantitative metrics and qualitative outcomes. This commitment to rigorous measurement has helped establish FTTF as a trusted partner for investors seeking genuine impact alongside financial returns in the water technology sector.

The FTTF Revolution: Understanding the Basics

The integration of smart technologies in water infrastructure marks a revolutionary shift in how we manage our most precious resource. FTTF (Flow-Through Treatment and Filtration) technology represents a quantum leap forward by combining advanced sensor networks, real-time monitoring capabilities, and automated distribution systems into a cohesive intelligent water management platform.

At the core of FTTF systems lies a sophisticated network of smart sensors strategically positioned throughout the water infrastructure. These sensors continuously measure critical parameters like flow rates, pressure, temperature, turbidity, and chemical composition. Each sensor acts as a vigilant sentry, generating thousands of data points per day to create a comprehensive picture of water quality and system performance.

The real-time monitoring framework processes this torrent of data through advanced analytics engines that can detect subtle patterns and anomalies. Machine learning algorithms adapt and improve their analytical capabilities over time, enabling increasingly accurate predictions of potential issues before they become critical problems. This predictive capability allows utilities to shift from reactive maintenance to proactive system optimization.

The automated distribution network represents the action arm of FTTF technology. Smart valves and pumps respond automatically to changing conditions, optimizing flow rates and pressure levels across the entire system. During peak demand periods, the network can dynamically adjust distribution patterns to ensure consistent service. If water quality issues arise, affected sections can be isolated and alternative routing implemented within minutes.

What makes FTTF truly revolutionary is how these components work in concert. When sensors detect a potential quality issue, the monitoring system analyzes the data in real-time and triggers precise responses through the automated distribution network. This might involve adjusting chemical dosing, redirecting flow patterns, or initiating specialized treatment protocols – all without human intervention.

The economic implications of this integration are substantial. By optimizing treatment processes and reducing waste, FTTF systems can decrease operational costs by 15-30% while improving service reliability. The technology’s ability to prevent problems before they occur significantly reduces emergency repair costs and extends infrastructure lifespan.

As explored in detail at how to save over 1 million tons of CO2 every year with thermal hydrolysis, these smart systems also contribute meaningfully to sustainability goals through improved energy efficiency and reduced chemical usage. The environmental benefits compound as more utilities adopt these intelligent water management solutions.

The modularity of FTTF technology allows for staged implementation, enabling utilities to gradually upgrade their systems while maintaining continuous service. This flexibility, combined with demonstrable cost savings, makes FTTF an increasingly attractive option for water utilities of all sizes seeking to modernize their operations.

Market Opportunity and Growth Potential

The water technology investment landscape is experiencing unprecedented growth, with the global water and wastewater treatment market projected to reach $675 billion by 2025. This surge creates a compelling opportunity for FTTF (Flow-Through Treatment Facilities) technology adoption across municipal and industrial sectors.

Significant market drivers include aging infrastructure replacement needs, increasingly stringent environmental regulations, and growing water scarcity concerns. Population growth and urbanization further amplify demand, particularly in developing regions where water infrastructure development lags. Climate change impacts are accelerating adoption as utilities seek resilient solutions.

A landmark implementation in Rotterdam demonstrates FTTF’s transformative potential. The facility achieved 40% reduction in operating costs while increasing treatment capacity by 35% compared to conventional systems. Real-time monitoring enabled predictive maintenance, reducing downtime by 60% and extending equipment life cycles. The project’s success catalyzed similar adoptions across the Netherlands, with 12 utilities now implementing FTTF systems.

Industrial applications show equally promising results. A major semiconductor manufacturer integrated FTTF technology into their ultrapure water systems, realizing 25% energy savings and 30% reduction in chemical usage. The improved water quality and process reliability translated to an estimated €8 million in annual cost benefits.

Market analysis reveals several key growth vectors. Municipal utilities represent the largest addressable segment, driven by regulatory compliance needs and operational efficiency goals. Industrial users, particularly in water-intensive sectors like power generation and manufacturing, form a rapidly expanding market as water risks threaten business continuity.

The technology’s scalability enables penetration across market tiers. While large utilities lead early adoption, modular FTTF solutions are gaining traction among smaller operators. This market democratization expands the total addressable market while accelerating industry-wide digital transformation.

Regional growth patterns highlight Europe and North America as current adoption leaders, with Asia-Pacific markets showing the highest growth potential. Emerging economies present significant opportunities as they bypass legacy infrastructure to implement advanced solutions directly.

Beyond direct market size, FTTF creates value through ecosystem effects. Enhanced data analytics capabilities enable new service models, while improved resource efficiency supports circular economy initiatives. This multiplier effect suggests the technology’s total economic impact could exceed current market projections.

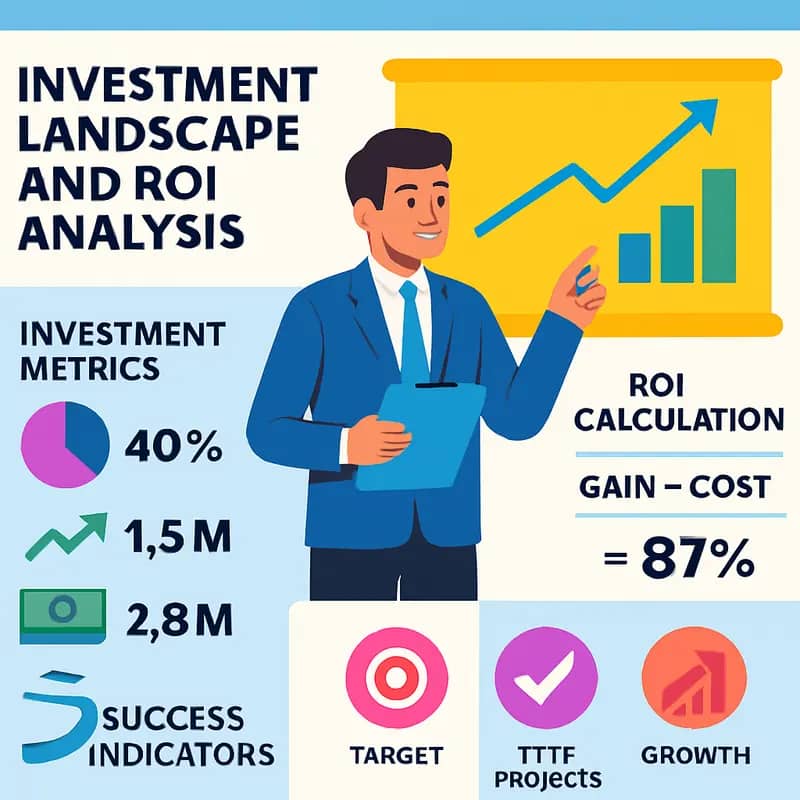

Investment Landscape and ROI Analysis

The water technology investment landscape represents a unique intersection of environmental impact and financial returns. FTTF’s strategic early-stage funding approach has demonstrated compelling ROI metrics across various investment entry points, with typical returns ranging from 3x to 8x over 5-7 year horizons.

Early-stage investments in water technology companies through FTTF generally fall into three tiers. Seed rounds averaging €500,000 to €2 million target proof-of-concept validation and initial market entry. Series A investments of €2-5 million support commercial scale-up and team expansion. Growth capital investments of €5-15 million accelerate market penetration and international expansion.

A key success story illustrating FTTF’s investment thesis involves a membrane technology company that achieved a 6.2x return in 5 years. The company’s innovative approach to water filtration reduced energy consumption by 40% while improving output quality. This combination of operational efficiency and environmental benefit exemplifies the dual-return potential in water technology investments.

Lessons learned from FTTF’s portfolio highlight several critical success factors. Technology validation through pilot projects with established industry partners significantly reduces commercialization risk. Strong intellectual property protection and clear regulatory compliance pathways protect long-term value. Most importantly, solutions must demonstrate clear cost advantages or operational benefits to drive market adoption.

The cost-benefit analysis of water technology investments reveals particularly attractive metrics in three areas. Water reuse solutions typically show payback periods of 2-4 years through reduced water procurement and discharge costs. Advanced treatment technologies targeting emerging contaminants command premium pricing due to regulatory drivers. Digital solutions enabling predictive maintenance and optimization deliver ROI through operational cost savings of 15-30%.

FTTF’s portfolio companies have shown that water technology investments can deliver both strong financial returns and measurable environmental impact. While development timelines may be longer than traditional software investments, the fundamental market drivers of water scarcity and quality requirements create durable competitive advantages.

A distinguishing feature of successful water technology investments is the ability to quantify and monetize multiple value streams. Beyond direct cost savings, benefits often include reduced environmental compliance risk, improved operational reliability, and enhanced sustainability metrics. This multi-dimensional value proposition supports premium pricing and sustained competitive advantages.

As discussed in How to Win in a Competitive Mature Niche Market, careful market positioning and clear differentiation are essential for achieving target returns. The most successful investments combine proven core technologies with innovative business models or unique applications that address specific market pain points.

Implementation Strategies and Best Practices

Successful implementation of FTTF water technology solutions requires a systematic approach that balances innovation with pragmatic execution. Drawing from extensive experience in water technology ventures, several key strategies have emerged as critical success factors.

The technology selection process must begin with a thorough assessment of market needs and technological readiness. Successful entrepreneurs focus on solutions that demonstrate clear commercial viability while addressing pressing water challenges. When evaluating potential technologies, consider scalability, operational costs, and integration requirements with existing infrastructure.

Partnership development serves as a cornerstone for successful implementation. Strategic alliances should span the entire value chain – from research institutions and technology providers to end-users and regulatory bodies. The most effective partnerships leverage complementary strengths while maintaining clear accountability frameworks. Municipalities and utilities make particularly valuable early adopters, providing real-world validation and references for broader market adoption.

Risk mitigation requires a multi-layered approach. Technical risks can be addressed through rigorous pilot testing and staged implementation. Regulatory compliance must be built into the development process from the start, not treated as an afterthought. Financial risks demand careful structuring of investment terms and clear milestone-based funding releases.

A robust implementation framework also depends on building the right team. Beyond technical expertise, successful teams need members with regulatory knowledge, project management capabilities, and commercial acumen. Cross-functional teams often prove more resilient in navigating implementation challenges.

Data collection and performance monitoring form another crucial element. Implementing comprehensive monitoring systems helps validate technology claims, optimize operations, and build credibility with stakeholders. This data-driven approach enables continuous improvement while providing valuable insights for future deployments.

Perhaps most importantly, successful implementation requires patience and persistence. The water sector’s inherent conservatism means that even proven technologies face lengthy adoption cycles. Entrepreneurs must balance the drive for rapid scaling with the sector’s methodical approach to innovation.

Maintaining focus on long-term sustainability rather than short-term gains has proven essential for successful FTTF implementations. This mindset helps organizations weather the inevitable challenges while building lasting value in the water technology ecosystem.

Final words

FTTF’s strategic positioning in the water technology investment landscape represents a compelling model for driving innovation in this critical sector. Their focused approach to early-stage investment, combined with deep sector expertise and a clear thesis around water innovation, creates a powerful platform for supporting the next generation of water technology companies. As global water challenges continue to mount, the importance of such specialized investors cannot be overstated. FTTF’s balanced focus on both environmental impact and financial returns demonstrates that profit and purpose can coexist in water technology investment. For entrepreneurs and co-investors alike, FTTF’s model offers valuable lessons in how targeted capital deployment can accelerate the development and adoption of critical water solutions. Their success in identifying and nurturing promising water technology ventures sets a benchmark for impact investing in the water sector.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!