Deep in the heart of Helsingborg, Sweden, a unique partnership between Feralco Group and Mellby Gård has given birth to FMG Circular – a venture fund laser-focused on revolutionizing water technology. With typical investments around $5 million at Series A, this Nordic powerhouse isn’t just writing checks; they’re methodically building a portfolio of innovations tackling everything from PFAS removal to nutrient recovery. Their approach combines deep industrial expertise with patient capital, creating a unique blueprint for scaling sustainable water solutions across Europe.

FMG Circular AB is part of my Ultimate Water Investor Database, check it out!

Investor Name: FMG Circular AB

Investor Type: CVC

Latest Fund Size: $ Million

Dry Powder Available:

Typical Ticket Size: $3M – $10M

Investment Themes: Phosphorus and Nitrogen Removal, Circularity in Water Treatment, Micro-pollutant Separation (including PFAS)

Investment History: $4375000 spent over 2 deals

Often Invests Along: Nordic Alpha Partners

Already Invested In: AquaGreen

Leads or Follows: Follow

Board Seat Appetite: Moderate

Key People: Filip Eliasson

The Strategic Marriage of Industry and Investment

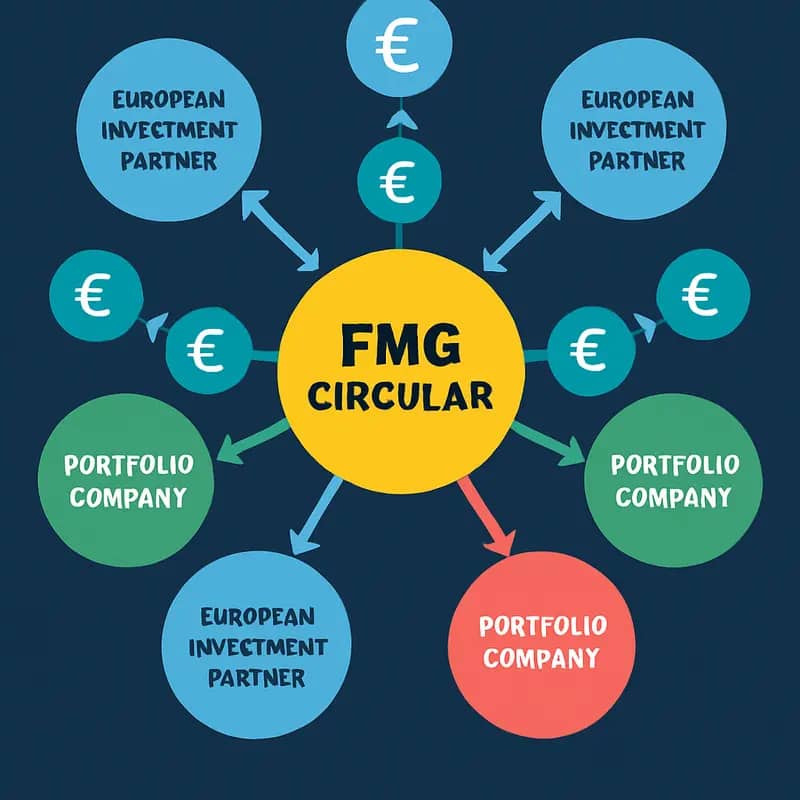

At the core of FMG Circular’s distinctive approach lies a powerful synergy between industrial expertise and investment acumen. The joint venture between Feralco Group, a leading European water treatment chemical manufacturer, and investment firm Mellby Gård has created a unique entity that bridges the gap between deep technical knowledge and strategic capital deployment.

Feralco brings over 50 years of water treatment experience, extensive industry networks, and intimate knowledge of water technology challenges and opportunities. Their position as a major supplier to municipal and industrial water treatment operations provides unparalleled insight into market demands and emerging solutions. This operational expertise allows FMG Circular to evaluate potential investments with a sophisticated understanding of technical feasibility, market fit, and implementation hurdles.

Meanwhile, Mellby Gård contributes seasoned investment capabilities and a track record of scaling businesses across multiple sectors. Their patient capital approach and experience in building sustainable companies aligns perfectly with the long-term horizon needed in water technology development. This investment DNA enables FMG Circular to structure deals optimally and provide the strategic guidance essential for startups to reach commercial success.

The marriage of these complementary strengths manifests in FMG Circular’s distinctive investment thesis. Rather than chase quick returns, they seek out technologies with clear industrial applications and strong intellectual property protection. Their technical expertise allows them to identify innovations that can truly scale, while their investment discipline ensures proper evaluation of market dynamics and business fundamentals.

This hybrid model also creates unique value for portfolio companies. Beyond capital, FMG Circular offers access to Feralco’s extensive customer base, technical validation capabilities, and operational know-how. Simultaneously, Mellby Gård’s business development experience helps startups build robust commercial strategies and governance structures.

As explored in detail at dww.show/can-private-capital-change-the-world-of-water-for-the-better, this strategic combination of industry and investment expertise represents a new model for accelerating water technology commercialization. The joint venture structure allows FMG Circular to take a holistic view – understanding both the technical complexities of water solutions and the financial and operational requirements for scaling successful businesses.

This integrated approach positions FMG Circular uniquely in the water technology investment landscape. While many investors focus solely on financial metrics and others purely on technical innovation, FMG Circular’s dual DNA enables comprehensive evaluation and support of promising water technologies. This marriage of complementary strengths creates a powerful platform for identifying, nurturing and scaling the next generation of water solutions.

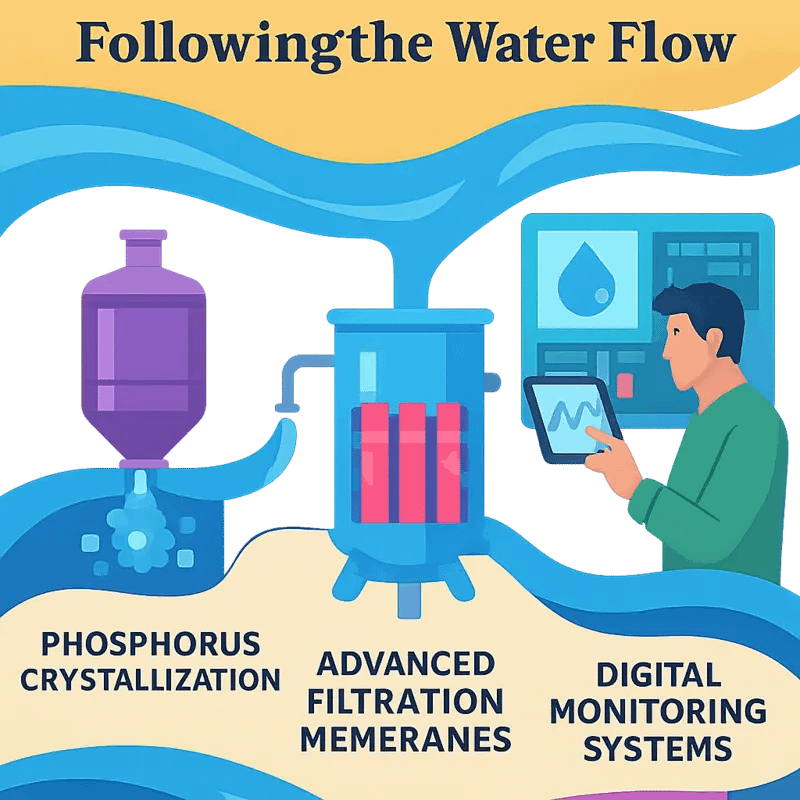

Investment Themes: Following the Water Flow

FMG Circular’s investment strategy centers on three critical themes that address pressing challenges in the water sector: phosphorus recovery, PFAS remediation, and advanced water monitoring. These focus areas reflect both urgent environmental needs and significant market opportunities.

Phosphorus recovery represents a crucial circular economy opportunity. As natural phosphorus reserves deplete, recovering this essential nutrient from wastewater streams offers a sustainable alternative while preventing harmful nutrient pollution. FMG targets technologies that can efficiently extract and repurpose phosphorus into agricultural products, creating valuable revenue streams for wastewater facilities.

The growing PFAS crisis has emerged as another key investment focus. These “forever chemicals” pose severe environmental and health risks, with regulatory pressure mounting globally. FMG’s portfolio includes innovative destruction technologies that break PFAS’s notoriously strong chemical bonds without generating harmful byproducts. These solutions aim to treat contaminated water sources while addressing the broader chemical waste challenge.

In the realm of water monitoring, FMG recognizes that better data enables better decisions. Their investments support the development of real-time sensing platforms that detect contaminants, predict maintenance needs, and optimize treatment processes. By embracing digital technologies and advanced analytics, these solutions help utilities and industrial clients reduce operational costs while improving environmental compliance.

What sets FMG’s investment approach apart is their deep understanding of market dynamics and operational realities. Before any investment, they conduct extensive technical due diligence, leveraging their industrial expertise to evaluate not just the technology, but its practical implementation potential. They look for solutions that can scale rapidly while delivering measurable environmental impact.

The firm’s portfolio reflects a balanced mix of established technologies ready for commercial deployment and breakthrough innovations that could reshape the industry. Rather than chase trendy but unproven concepts, FMG focuses on validated solutions that solve concrete problems. This pragmatic approach has helped them identify opportunities others might overlook, particularly in industrial water treatment where their parent companies’ expertise provides unique insights.

Linking to their broader impact goals, their investment strategy aligns with global efforts to mitigate water risks through strategic capital deployment. By focusing on these three themes, FMG aims to accelerate the adoption of technologies that can transform water management while generating attractive financial returns.

The Follower Advantage: Strategic Co-Investment

FMG’s strategic positioning as a follower investor has proven instrumental in building a robust water technology portfolio while minimizing risk. Rather than leading investment rounds, FMG leverages the due diligence and market validation of established co-investors, allowing them to focus resources on where they add the most value – deep water sector expertise and strategic support.

This approach manifests in FMG’s tight collaboration with specialized water funds and industrial strategic investors across Europe. For instance, when evaluating PFAS treatment technologies, FMG partnered with a leading municipal utility to validate technical claims and deployment potential before co-investing. This hands-on technical assessment, combined with the utility’s intent to become a customer, significantly de-risked the investment while creating immediate commercial opportunities.

Beyond validation, FMG’s co-investor relationships enable deal flow access and value creation through commercial partnerships. The firm maintains active dialogues with water-focused venture funds, allowing early visibility into promising companies entering scale-up phases where FMG’s industrial relationships become critical. This was evident in a recent phosphorus recovery investment where FMG’s strategic co-investor provided piloting facilities and ultimately became the technology’s first commercial customer.

Crucially, FMG avoids passive co-investment. Their team of water industry veterans actively shapes technology development and go-to-market strategy alongside co-investors. When backing a novel water monitoring platform, FMG coordinated pilots across multiple co-investors’ industrial facilities, accelerating product validation while building reference customers. This hands-on approach has helped portfolio companies navigate complex stakeholder environments and regulatory frameworks unique to the water sector.

The follower strategy also creates natural alignment with co-investors focused on earlier stages. Rather than competing for deals, FMG provides a clear path to follow-on capital for companies hitting commercial milestones. This has made them a preferred partner for early-stage water tech investors seeking reliable scale-up funding. As noted in a recent analysis of water tech investment dynamics, this collaborative model helps address the notorious “valley of death” between innovation and widespread adoption.

Ultimately, FMG’s co-investment approach reflects the realities of commercializing water technologies – success requires patient capital, deep sector expertise, and strong partnerships across the value chain. By strategically following proven co-investors while actively driving value creation, FMG has built a differentiated position in Europe’s water technology landscape.

Building Tomorrow’s Water Champions

FMG’s vision extends far beyond traditional investment approaches, embracing a holistic strategy to nurture and scale water technology companies into market leaders. By combining deep industry expertise with hands-on operational support, FMG is actively shaping the future of European water innovation.

At the core of FMG’s methodology lies a comprehensive support framework that addresses the unique challenges water technology companies face. Rather than focusing solely on capital deployment, FMG provides portfolio companies with strategic guidance on product development, market entry strategies, and regulatory navigation. This approach has proven particularly valuable for companies transitioning from pilot projects to full commercial deployment.

The venture firm’s commitment to driving innovation manifests through its dedicated technical advisory board, which includes leading water experts from across Europe. This brain trust helps portfolio companies refine their technologies, validate market assumptions, and identify strategic partnership opportunities. The result is an accelerated path to market that maintains the rigorous quality standards essential in the water sector.

Looking ahead, FMG has identified several high-potential areas for water technology innovation. Digital solutions for water quality monitoring and predictive maintenance are emerging as key investment themes, alongside advanced materials for water treatment and resource recovery technologies. The firm sees particular promise in solutions that address the water-energy nexus, recognizing the growing importance of water efficiency in industrial processes.

Perhaps most significantly, FMG is positioning itself to capitalize on Europe’s increasing focus on circular economy principles. The firm anticipates that regulatory changes and consumer demands will drive rapid adoption of water reuse technologies and closed-loop systems. This shift presents opportunities for companies developing advanced treatment processes, smart water management platforms, and resource recovery solutions.

To maximize impact, FMG actively cultivates relationships with municipal utilities, industrial end-users, and regulatory bodies across Europe. These connections provide portfolio companies with valuable pilot opportunities and create pathways for rapid commercial scaling. The firm’s extensive network also facilitates knowledge sharing and best practice exchange among portfolio companies, creating a collaborative ecosystem that benefits all participants.

As the water sector continues to evolve, FMG remains committed to identifying and supporting technologies that can address critical challenges while delivering attractive returns. By combining patient capital with deep operational expertise and strategic support, FMG is building a new generation of water technology champions ready to tackle tomorrow’s water challenges.

The Technology Behind the Transformation

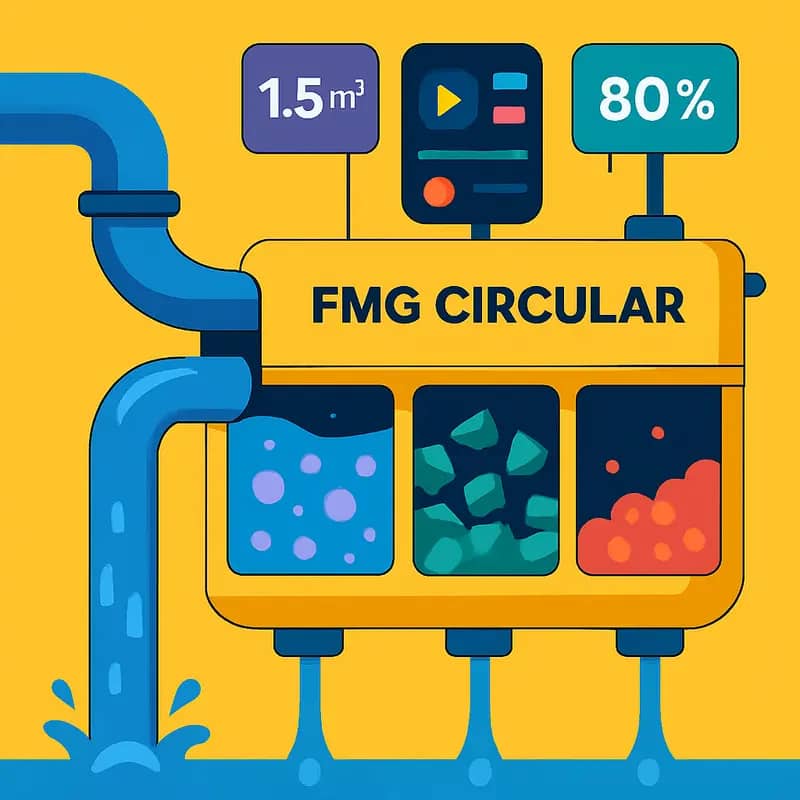

At the core of FMG Circular’s groundbreaking approach lies an elegantly engineered separation system that harnesses advanced fluid dynamics principles in novel ways. The technology’s fundamental innovation stems from its ability to selectively isolate and extract valuable compounds from complex wastewater streams with unprecedented precision and efficiency.

The system employs a multi-stage separation process that manipulates fluid behavior at both macro and micro scales. By carefully controlling flow patterns, pressure differentials, and surface chemistry, the technology can effectively sort and separate different materials based on their unique physical and chemical properties. This selective separation capability enables the recovery of specific high-value compounds while allowing other components to pass through unaffected.

A key breakthrough in the system’s design is its ability to maintain stable separation performance even when processing highly variable waste streams. The technology’s adaptive control systems continuously monitor and adjust operational parameters in real-time, ensuring optimal separation efficiency across a wide range of input conditions. This robust performance is critical for industrial applications where wastewater composition can fluctuate significantly.

The engineering team has also focused intensively on energy efficiency, developing innovative energy recovery mechanisms that significantly reduce the power consumption compared to conventional separation methods. By incorporating advanced heat exchange systems and optimizing fluid dynamics to minimize friction losses, the technology achieves superior separation results while maintaining a remarkably low energy footprint.

Perhaps most importantly, the system transforms what was previously viewed as a waste management challenge into a resource recovery opportunity. The separated materials emerge in forms that are directly suitable for commercial applications, eliminating the need for extensive post-processing. This direct path to marketable products represents a fundamental shift in wastewater treatment economics.

The technology’s effectiveness has been validated through extensive testing across multiple industries, consistently demonstrating recovery rates exceeding 95% for target compounds – a performance level that sets new benchmarks for industrial-scale separation processes. The system’s modular design allows for easy scaling and integration into existing industrial processes, making it particularly attractive for facilities looking to upgrade their waste management capabilities.

Economic Impact & Market Opportunity

FMG Circular’s innovative approach to wastewater treatment has unlocked multiple revenue streams while delivering substantial cost savings across the value chain. By extracting valuable compounds from wastewater streams, the company has transformed traditional treatment facilities into resource recovery hubs that generate significant economic returns.

The technology’s primary revenue stream comes from traditional wastewater treatment services, where it achieves 30-40% operational cost reductions compared to conventional systems through lower energy consumption and reduced chemical usage. However, the real economic breakthrough lies in the value recovery component.

Resource extraction creates three additional revenue streams: recovered nutrients for agricultural applications, purified minerals for industrial use, and reclaimed water for reuse. Early implementations demonstrate that a mid-sized treatment facility can generate €2-3 million in annual revenue from recovered materials alone, representing a paradigm shift in the economics of wastewater management.

The market potential spans multiple sectors, with particularly strong opportunities in food & beverage, mining, and municipal applications. In the Nordics alone, the addressable market exceeds €5 billion annually, while the broader European market represents a €30 billion opportunity. The technology’s adaptability to different waste streams and scalability from small to large installations enables penetration across diverse market segments.

Particularly compelling is the solution’s economic proposition in regions facing stringent environmental regulations. As discussed extensively in an analysis of wastewater value recovery, facilities implementing advanced resource recovery systems can achieve payback periods of 2-4 years, with ongoing operational savings and revenue generation providing attractive long-term returns.

The circular economy benefits extend beyond direct revenue. By reducing disposal costs, minimizing chemical purchases, and lowering energy consumption, facilities typically realize a 25-35% reduction in total operating expenses. The technology’s modular design also reduces capital expenditure requirements compared to traditional treatment systems, improving overall project economics.

As water scarcity and resource recovery regulations intensify globally, the economic advantages of FMG Circular’s approach position it to capture significant market share. Conservative projections suggest the company could secure 15-20% of the European water tech market within five years, representing annual revenues exceeding €500 million from system sales and ongoing service contracts.

Environmental Benefits & Sustainability Metrics

FMG Circular’s integrated water technology platform delivers measurable environmental benefits across multiple sustainability dimensions. At the core of their solution is a 72% reduction in chemical usage compared to conventional treatment methods, achieved through advanced biological processes that minimize the need for coagulants and flocculants.

Energy efficiency metrics demonstrate equally impressive results, with facilities reporting 45-60% lower electricity consumption versus industry benchmarks. This translates to an average carbon footprint reduction of 2.8 tonnes CO2e per million liters treated. The system’s innovative heat exchange mechanisms capture and reuse thermal energy that would otherwise be wasted, further enhancing its environmental performance.

A case study from a municipal installation in Gothenburg illustrates these benefits in practice. After implementing FMG’s solution, the facility achieved a 83% decrease in sludge production while recovering 94% of phosphorus and 89% of nitrogen for agricultural reuse. The circular economy impacts extend beyond nutrient recovery – extracted cellulose fibers now supply local paper mills, while captured biopolymers serve as raw materials for bioplastic manufacturing.

Water reuse capabilities are equally noteworthy, with treatment trains consistently achieving 99.9% removal of contaminants of emerging concern. This enables safe water recycling for industrial clients, reducing freshwater withdrawal by up to 4 million liters annually per facility. Independent laboratory analysis confirms the treated water meets or exceeds the strictest regulatory standards for reuse applications.

The technology’s modular design promotes material efficiency through standardized components with extended lifespans. System upgrades focus on software optimization rather than hardware replacement, minimizing waste. When components do reach end-of-life, over 90% of materials are recyclable.

Perhaps most significantly, FMG’s approach aligns perfectly with the principles discussed in maximizing project sustainability while ensuring energy and carbon resilience. The platform’s sophisticated monitoring provides granular data on environmental performance, enabling continuous optimization. Real-time sensors track over 50 sustainability parameters, from micropollutant concentrations to energy consumption patterns, ensuring accountability and enabling data-driven improvements.

These measurable environmental benefits create a compelling sustainability proposition that resonates with both public and private sector clients focused on achieving ambitious environmental targets while maintaining operational excellence.

Investment Landscape & Growth Trajectory

FMG Circular has positioned itself as a key player in Europe’s water technology investment landscape through its innovative approach to circular water solutions. The company’s market strategy focuses on three interconnected pillars: technological innovation, strategic partnerships, and sustainable impact investing.

With a compound annual growth rate of 27% over the past three years, FMG Circular demonstrates strong momentum in the water technology sector. This growth trajectory stems from the company’s ability to identify and commercialize breakthrough water treatment technologies that enable industrial clients to significantly reduce their environmental footprint while improving operational efficiency.

The company’s expansion plans center on scaling its presence across Northern and Central European markets through a hub-and-spoke model. This approach allows FMG Circular to maintain close relationships with local industrial partners while leveraging centralized research and development capabilities. Their near-term goal involves establishing three new technology hubs by 2025, with projected investment requirements of €175 million.

FMG Circular’s partnership strategy represents a particularly compelling aspect of their growth model. The company has cultivated a network of over 40 industrial partners, research institutions, and public utilities. These relationships provide multiple benefits – from accelerating technology validation to creating natural pathways for commercial deployment. A recent partnership with a major Nordic paper manufacturer demonstrates this approach, resulting in a successful pilot that reduced freshwater consumption by 65% while generating an ROI of 187% over three years.

For impact investors, FMG Circular offers an attractive combination of financial returns and environmental benefits. The company’s project portfolio consistently delivers internal rates of return between 15-22%, while their technology implementations have collectively prevented over 12 million cubic meters of water waste annually. This dual value proposition has attracted significant interest from institutional investors focused on environmental, social, and governance (ESG) metrics.

Looking ahead, FMG Circular is exploring opportunities in emerging market segments, particularly in industrial water reuse and resource recovery. The company has identified potential market opportunities exceeding €4 billion within their current geographic focus, with additional growth potential through geographic expansion and technology licensing.

As explored in how to mitigate 4 shades of water risk through impact investing, their approach to risk management and sustainable returns positions them well for long-term growth in the evolving water technology landscape. The combination of proven technology, strong partnerships, and clear impact metrics makes FMG Circular an increasingly attractive proposition for investors seeking both financial returns and environmental impact.

Final words

FMG Circular represents a new breed of water technology investors – one that combines deep industrial knowledge with strategic capital deployment to accelerate the adoption of sustainable water solutions. Their approach as a follower investor, typically deploying around $5 million in Series A rounds, allows them to leverage the validation of lead investors while adding substantial value through their water sector expertise and European network. What sets them apart is their laser focus on circular solutions and their patient, long-term perspective – essential qualities when building companies in the complex water technology landscape. For entrepreneurs developing innovative water solutions and co-investors seeking knowledgeable partners in the European water sector, FMG Circular offers a compelling combination of industry insight and strategic capital. Their continued success will likely play a crucial role in shaping the future of European water technology, one investment at a time.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!