In the heart of Paris, E3 Capital (formerly Energy Access Ventures) is redefining impact investment by recognizing a critical nexus: energy access enables water solutions. With €75-80 million under management and ticket sizes ranging from €0.5-3 million, this boutique fund has carved out a unique niche supporting early-stage companies that tackle Sub-Saharan Africa’s intertwined water and energy challenges. Their portfolio showcases how strategic energy investments can unlock innovative water solutions – from solar-powered irrigation systems transforming smallholder farming to decentralized water treatment facilities powered by renewable microgrids.

AC Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: AC Ventures

Investor Type: PE

Latest Fund Size: $437 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: Municipal/Centralized Water, Water & Sanitation (WASH), Sustainable Water Management

Investment History: $1783333.33 spent over 2 deals

Often Invests Along: PureTerra Ventures

Already Invested In: SWAN Systems, Swan Systems

Leads or Follows:

Board Seat Appetite: Moderate

Key People:

The Evolution: From Energy Access to Water Innovation

E3 Capital’s transformation from a pure energy investment fund to a pioneer in water innovation financing represents a strategic evolution shaped by the realities of Africa’s development needs. The fund’s leadership recognized early that sustainable energy access and water security are inextricably linked challenges that require an integrated approach.

The fund’s pivot began when portfolio companies repeatedly encountered water access limitations as a critical barrier to scaling their energy solutions. Rural communities needed reliable power for water pumping and treatment, while urban areas required energy-efficient water infrastructure. This practical insight led E3 Capital to develop a unique thesis: by strategically investing in technologies and business models that address both energy and water challenges simultaneously, they could unlock greater impact and returns.

A watershed moment came through an early investment in a solar-powered desalination company operating in coastal West Africa. The venture demonstrated how renewable energy could make water treatment economically viable in regions previously deemed too costly to serve. This success catalyzed E3’s deeper exploration of the water-energy nexus.

The fund has since built a portfolio that spans the full spectrum of water innovation. Their investments now include smart water metering startups using IoT technology, decentralized treatment systems powered by solar and wind, and water-efficient agricultural technologies. Each investment is evaluated not just on financial merits, but on its potential to create synergies between energy access and water security.

What sets E3 Capital’s approach apart is their emphasis on local entrepreneurship. Rather than simply importing solutions, they actively seek out and support African founders who understand regional water challenges firsthand. This strategy has led to breakthrough innovations in areas like mobile payment systems for water services and low-cost water quality monitoring tools.

The fund’s evolution has also influenced how they structure deals and measure impact. Traditional metrics like kilowatt-hours generated are now complemented by indicators such as liters of clean water provided and number of households with improved water access. This holistic approach has attracted a diverse mix of investors, from development finance institutions to impact-focused family offices.

Looking ahead, E3 Capital is positioning itself to play an even larger role in shaping the future of African water entrepreneurship. Their journey demonstrates how strategic investment can bridge critical infrastructure gaps while creating sustainable business opportunities in emerging markets.

Investment Strategy: Following the Water-Energy Nexus

E3 Capital’s investment thesis centers on the intrinsic connection between water access and energy infrastructure in Africa. The fund recognizes that reliable energy supply forms the backbone of sustainable water solutions, from powering treatment facilities to enabling smart distribution networks. By strategically investing in this nexus, E3 Capital aims to create lasting impact while generating attractive financial returns.

The fund typically deploys investments ranging from €2-10 million, targeting early-growth stage companies that demonstrate strong unit economics and clear paths to profitability. This ticket size allows E3 Capital to take meaningful ownership stakes while providing entrepreneurs sufficient capital to achieve significant operational milestones.

When evaluating potential investments, E3 Capital employs a rigorous three-pillar framework. First, they assess the technical innovation, examining how effectively solutions bridge energy and water challenges. The fund prioritizes technologies that can demonstrate measurable improvements in energy efficiency, water conservation, or both. Second, they analyze market dynamics and scalability potential, with a particular focus on solutions that can be replicated across multiple African markets. Third, they evaluate the management team’s ability to execute while navigating complex regulatory environments and stakeholder relationships.

A key differentiator in E3 Capital’s approach is their emphasis on solutions that create virtuous cycles between energy and water systems. For instance, they actively seek investments in projects that utilize renewable energy to power water treatment facilities, which in turn can provide reliable water supply for clean energy generation. This integrated perspective allows them to identify opportunities that might be overlooked by investors focused solely on either water or energy sectors.

In line with how to mitigate 4 shades of water risk through impact investing, the fund maintains strict environmental and social impact criteria alongside financial metrics. Each investment must demonstrate potential for measurable impact in areas such as improved water access, reduced energy consumption, or enhanced resource efficiency. This dual-return approach has helped E3 Capital attract a diverse investor base, including development finance institutions, family offices, and institutional investors aligned with their mission.

The fund’s portfolio composition reflects their strategic focus on technological solutions that can operate effectively in infrastructure-constrained environments. They particularly value innovations that can function with limited grid connectivity or variable power supply – a common challenge in many African markets. This approach has led to investments in decentralized water treatment systems, smart metering solutions, and energy-efficient pumping technologies.

Partnership Approach: Co-Creating Success

E3 Capital’s partnership model exemplifies a hands-on investment approach that goes far beyond simply providing capital. The fund actively engages with portfolio companies through board positions and strategic support, fostering an environment where water entrepreneurs can thrive despite challenging market conditions in Africa.

Central to E3 Capital’s methodology is their collaborative co-investment strategy. By partnering with other impact investors, development finance institutions, and strategic corporate partners, they create robust funding syndicates that provide portfolio companies with diverse expertise and expanded networks. This approach helps de-risk investments while ensuring companies have access to follow-on capital for scaling.

Board participation forms a crucial pillar of E3’s engagement model. The fund’s partners take active board seats, leveraging their deep industry experience to guide strategic decision-making and governance. This direct involvement allows them to closely monitor progress while providing timely support in areas like business development, operational optimization, and talent acquisition.

Beyond governance, E3 Capital delivers hands-on operational support tailored to each company’s growth stage and specific challenges. Their team works closely with management to refine business models, strengthen financial planning, and develop go-to-market strategies. This operational guidance proves particularly valuable for early-stage companies navigating the complexities of scaling water solutions in emerging markets.

The fund has also built a powerful ecosystem of technical and commercial partners that portfolio companies can tap into. These partnerships facilitate technology validation, market entry, and customer acquisition – critical success factors for water enterprises. As highlighted in a recent analysis on how to actively invest philanthropy and save the water world, such ecosystem approaches are essential for sustainable impact.

E3’s partnership philosophy extends to how they structure deals, with a focus on alignment of interests between investors, founders, and other stakeholders. They typically take minority positions while ensuring appropriate investor protections, allowing entrepreneurs to maintain significant ownership and control over their ventures. This approach helps attract top talent while keeping founders highly motivated to achieve both commercial and impact objectives.

By combining active board engagement, operational support, and ecosystem access with patient capital, E3 Capital has created a comprehensive partnership model that addresses the unique challenges of scaling water enterprises in Africa. Their collaborative approach not only enhances the probability of success for individual investments but also contributes to building a more resilient water innovation ecosystem across the continent.

Future Vision: Scaling Water Impact

E3 Capital’s ambitious roadmap for expanding water-related investments across Africa centers on a bold vision: catalyzing sustainable access to clean water through strategic energy investments. The fund aims to deploy over €100 million in the next five years specifically toward water entrepreneurs who leverage innovative energy solutions.

The cornerstone of E3 Capital’s expansion strategy lies in identifying and nurturing ventures that demonstrate scalable business models connecting energy access to water availability. By focusing on technologies that reduce energy costs in water treatment and distribution, the fund enables entrepreneurs to offer water services at more affordable prices to underserved communities.

A key element of the fund’s future vision involves fostering partnerships between energy providers and water entrepreneurs. These collaborations create virtuous cycles where reliable power enables water operations, while water services generate steady demand for energy infrastructure. As highlighted in how to mitigate 4 shades of water risk through impact investing, this integrated approach helps mitigate both operational and financial risks.

E3 Capital plans to expand its geographic footprint beyond current operations in West Africa into East and Southern African markets. The fund has identified opportunities in Kenya, Tanzania, and Mozambique, where rapid urbanization and industrial growth create increasing demand for reliable water services. Rather than pursuing a one-size-fits-all approach, the fund will adapt its investment strategy to local contexts while maintaining focus on energy-water nexus solutions.

Beyond direct investments, E3 Capital aims to catalyze additional capital flows into the sector. The fund will leverage its early success stories to demonstrate the commercial viability of water enterprises in Africa to institutional investors. This includes developing innovative blended finance structures that can help de-risk investments and attract more conservative capital providers.

The fund recognizes that achieving meaningful scale requires more than just financial investment. E3 Capital will expand its technical assistance program to help portfolio companies optimize their operations, implement environmental and social best practices, and prepare for larger capital raises. This comprehensive support system aims to transform promising water enterprises into market leaders capable of serving millions of customers.

Ultimately, E3 Capital envisions creating a new paradigm for sustainable water access in Africa – one where innovative energy solutions and entrepreneurial approaches combine to solve one of the continent’s most pressing challenges. Through strategic investments and ecosystem building, the fund aims to demonstrate that improving water access can be both impactful and commercially viable.

Strategic Focus: Indonesia’s Water Innovation Gateway

AC Ventures has positioned itself as a catalyst for water technology innovation in Indonesia by recognizing the unique challenges and opportunities within the archipelago’s water infrastructure landscape. The firm’s strategic presence in Jakarta places it at the heart of Southeast Asia’s largest economy, where water access and quality remain critical development priorities.

The fund’s investment thesis centers on three key pillars that make Indonesia an ideal gateway for water innovation. First, the country’s geographic diversity – spanning over 17,000 islands – creates natural testing grounds for various water technologies, from desalination solutions for coastal regions to efficient distribution systems for urban centers. Second, Indonesia’s rapidly growing middle class and increasing environmental awareness drive market demand for innovative water solutions. Third, the government’s commitment to achieving universal water access by 2030 provides a supportive regulatory framework for water entrepreneurs.

What sets AC Ventures apart is their deep understanding of local market dynamics and their ability to bridge the gap between international technology and Indonesian implementation challenges. The firm has cultivated strong relationships with local utilities, industrial players, and government agencies – essential partnerships that help portfolio companies navigate the complex regulatory landscape and accelerate market entry.

Their local presence matters significantly for water entrepreneurs because Indonesia’s water sector requires nuanced understanding of cultural, geographic, and economic factors. Through their extensive network, AC Ventures helps startups adapt their solutions to local contexts while maintaining technological integrity. This approach aligns with broader industry trends, as discussed in their exploration of how active investment philanthropy can save the water world.

The fund’s commitment to Indonesia extends beyond capital deployment. They actively work with portfolio companies to develop sustainable business models that can scale across Southeast Asia. This includes helping startups navigate public-private partnerships, essential for large-scale water infrastructure projects, and identifying opportunities for technology transfer that can benefit multiple markets within the region.

By focusing on Indonesia’s water technology landscape, AC Ventures has created a unique position that combines local market expertise with global technology trends. Their strategic approach not only supports individual entrepreneurs but also contributes to building a robust water innovation ecosystem in Southeast Asia’s largest market.

Investment Approach: The 20:1 Growth Formula

E3 Capital’s innovative 20:1 reserve ratio strategy represents a groundbreaking approach to supporting water technology startups across Africa. This methodology ensures sustained capital deployment while maintaining strict investment discipline in a sector notorious for long development cycles.

The firm’s reserve strategy allocates twenty dollars for future rounds for every initial dollar invested. This intentionally conservative approach stems from their deep understanding of water technology’s unique scaling challenges in emerging markets. Unlike traditional venture capital models that typically reserve 1:1 or 2:1, E3 Capital’s enhanced ratio acknowledges the capital-intensive nature of water infrastructure projects and the extended timelines required for market penetration in Africa.

How to frustrate 90% of start-up founders in 15 minutes in their best interest validates this patient capital approach, especially in water technology ventures where rapid scaling often leads to implementation failures.

The 20:1 formula serves multiple strategic purposes. First, it provides portfolio companies with confidence in future funding availability, enabling them to focus on technology development and market validation rather than continuous fundraising. Second, it allows E3 Capital to maintain significant ownership stakes through multiple rounds, protecting their initial investment thesis while supporting sustained growth.

This reserve ratio particularly benefits water entrepreneurs developing solutions for rural and peri-urban African communities. These startups often face extended pilot phases and complex stakeholder environments, requiring patient capital that understands the intersection of energy access and water service delivery. The formula enables E3 Capital to support companies through critical growth phases, from initial pilot projects to full-scale implementations.

E3 Capital’s approach also includes built-in flexibility within the 20:1 framework. While the ratio sets an upper limit for follow-on investment, the firm evaluates each subsequent funding round based on specific metrics including technology validation, market traction, and impact measurements. This disciplined yet adaptable strategy ensures that portfolio companies receiving follow-on investment have demonstrated both commercial viability and meaningful progress toward water access goals.

The success of this model lies in its alignment with the realities of water technology deployment in Africa. By acknowledging the need for extended runways and substantial capital reserves, E3 Capital has created an investment framework that supports sustainable growth while maintaining the discipline necessary for successful venture investing in challenging markets.

Portfolio Support: Beyond Capital

E3 Capital’s commitment to water innovation in Africa extends far beyond mere financial investment. The firm has developed a comprehensive support ecosystem that empowers entrepreneurs to overcome the unique challenges of scaling water solutions across diverse African markets.

At the core of E3’s value-add approach is their deep technical expertise in both energy and water sectors. A dedicated team of engineers and industry veterans provides hands-on support in product development, helping startups optimize their technologies for local conditions while maintaining quality standards. This technical guidance proves especially crucial when adapting solutions to operate reliably with intermittent power supply – a common challenge in many African regions.

The firm has also built strategic partnerships with utilities, industrial players, and government agencies across multiple African countries. These relationships provide portfolio companies with vital pilot opportunities and pathways to commercial scale. Through how to actively invest philanthropy and save the water world, E3 demonstrates how blended finance approaches can accelerate adoption of innovative water technologies.

Recognizing that talent acquisition is a major growth barrier, E3 maintains an extensive network of technical and managerial professionals. This talent pool helps portfolio companies build local teams with the right mix of skills. The firm also facilitates peer learning among portfolio companies, creating opportunities for founders to share insights and collaborate on common challenges.

Beyond operational support, E3 takes an active role in helping startups navigate regulatory frameworks and secure necessary permits – often a complex process given the regulated nature of water services. Their government relations team maintains strong working relationships with water authorities and helps expedite approvals while ensuring compliance.

The firm’s commitment to long-term value creation is reflected in their patient approach to growth. Rather than pushing for rapid scaling, E3 works with founders to establish sustainable business models and build robust operational foundations. This includes developing appropriate pricing strategies, optimizing supply chains, and implementing quality management systems.

Importantly, E3 leverages its pan-African presence to help portfolio companies expand strategically across the continent. Their market intelligence team provides detailed insights on water needs, competitive dynamics, and partnership opportunities in different regions. This data-driven approach enables startups to prioritize markets and adapt their go-to-market strategies accordingly.

This comprehensive support system has proven essential in helping water entrepreneurs bridge the challenging gap between innovation and impact. By addressing both technical and commercial aspects of scaling, E3 Capital enables promising water technologies to reach the communities that need them most.

Impact Metrics: Measuring Water Innovation Success

E3 Capital has developed a sophisticated framework for evaluating the environmental and social impact of its water investments across Africa. Their metrics system balances quantitative data with qualitative assessments to capture both immediate outputs and long-term outcomes.

At the portfolio level, E3 Capital tracks three core impact dimensions: water access, resource efficiency, and community empowerment. For water access, they measure the number of new connections established, volume of clean water delivered, and percentage of previously underserved populations reached. Resource efficiency metrics include water losses prevented, energy savings achieved, and carbon emissions avoided through improved infrastructure and operations.

The community empowerment dimension examines job creation, skills development, and increased economic activity enabled by reliable water access. E3 Capital places particular emphasis on tracking benefits to women and youth, who often bear the greatest burden of water scarcity.

Beyond these standardized metrics, E3 Capital works with each portfolio company to develop customized key performance indicators (KPIs) aligned with their specific impact goals. For infrastructure projects, this may include measures of system reliability and water quality. For technology companies, KPIs often focus on adoption rates and verified performance improvements.

Importantly, E3 Capital has moved beyond simply counting outputs to measuring lasting behavioral and systemic changes. Their impact assessment framework examines whether interventions lead to sustained improvements in water management practices, policy reforms, and market dynamics. This helps ensure their investments catalyze transformative rather than just incremental progress.

The fund employs a mix of data collection methods, from smart meters and remote sensors to household surveys and stakeholder interviews. Regular impact audits verify reported metrics and surface opportunities for improvement. This comprehensive approach has helped E3 Capital demonstrate concrete results to investors while maintaining accountability to beneficiary communities.

Perhaps most significantly, E3 Capital openly shares their impact measurement methodology and learnings with the broader water sector. As noted in their 2022 impact report, “standardized, credible impact metrics are essential for scaling up investment in water innovation.” By establishing clear frameworks for measuring success, they aim to lower barriers for new investors entering the space.

This commitment to rigorous impact measurement has proven valuable not just for accountability, but as a management tool helping portfolio companies optimize their operations and maximize positive outcomes. The metrics framework provides early warning of potential issues and helps identify opportunities for greater impact through collaboration across the portfolio.

Investment Philosophy and Ticket Sizes

E3 Capital’s investment strategy reflects a nuanced understanding of the water technology landscape, particularly in the African context where energy and water access are intrinsically linked. The fund employs a flexible investment approach that spans both early-stage ventures and growth-phase companies, recognizing that water innovation requires support across multiple development stages.

The fund’s typical investment tickets range from €500,000 to €5 million, allowing them to provide meaningful capital while maintaining the ability to participate in follow-on rounds. This measured approach enables E3 Capital to support companies through critical growth phases while managing risk exposure. For early-stage investments, the fund typically takes minority stakes between 15-25%, providing enough influence to guide strategic decisions while leaving founders with significant ownership.

What sets E3 Capital’s investment philosophy apart is their emphasis on the energy-water nexus. By targeting companies that address both water access and energy efficiency, they create a multiplier effect that enhances the impact and commercial viability of their portfolio companies. This strategic focus aligns with their broader mission of fostering sustainable water entrepreneurship in Africa.

The fund prioritizes companies with proven technologies and clear paths to scalability, particularly those that can demonstrate successful pilot implementations. Rather than chasing purely experimental approaches, E3 Capital seeks innovations that combine established engineering principles with novel applications or business models. This pragmatic stance helps mitigate technology risk while still supporting meaningful innovation.

Critically, E3 Capital’s investment thesis centers on backing entrepreneurs who understand local market dynamics and can navigate the unique challenges of operating in African markets. They look for teams that can demonstrate not just technical expertise, but also the ability to build relationships with local stakeholders and adapt their solutions to regional contexts.

The fund maintains active involvement in portfolio companies, often taking board seats and providing strategic guidance beyond capital. This hands-on approach helps portfolio companies navigate regulatory environments, build local partnerships, and access additional funding sources when needed.

As explored in “Can Private Capital Change the World of Water for the Better?”, this investment philosophy represents a growing recognition that private capital, when strategically deployed, can accelerate water technology adoption while generating both financial returns and social impact.

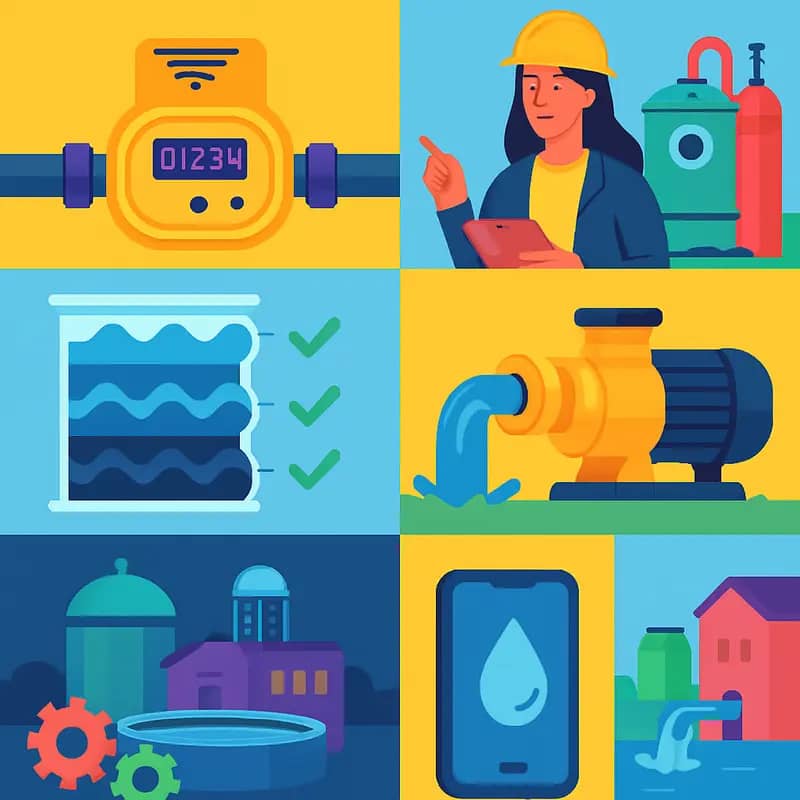

Water Technology Focus Areas

E3 Capital adopts a balanced approach in water technology investments, strategically focusing on proven solutions while maintaining calculated exposure to emerging innovations. The fund’s primary emphasis lies in sustainable water infrastructure technologies that can deliver immediate impact across African communities.

In the infrastructure domain, E3 prioritizes decentralized water treatment systems that enable local communities to process and distribute clean water efficiently. These systems must demonstrate robust performance in challenging environments while maintaining cost-effectiveness for widespread deployment. The fund particularly values technologies that integrate renewable energy sources, recognizing the critical nexus between water access and energy availability in underserved regions.

Water quality monitoring and analytics represent another key investment focus. E3 seeks technologies that enable real-time water quality assessment and predictive maintenance capabilities. This includes advanced sensors, data analytics platforms, and quality control systems that can operate reliably in remote locations with minimal technical supervision.

In wastewater treatment, the fund concentrates on resource recovery solutions that transform waste streams into valuable products. Technologies that enable water reuse, nutrient recovery, and energy generation from wastewater particularly attract E3’s attention. These solutions must demonstrate clear commercial viability while addressing pressing environmental challenges.

When evaluating experimental approaches, E3 Capital applies stringent criteria focusing on scalability and market readiness. The fund typically allocates 70-80% of investments to proven technologies with established track records, while reserving 20-30% for promising innovations that could potentially disrupt the sector. This calculated approach to risk management ensures portfolio stability while maintaining exposure to breakthrough solutions.

Notably, E3 shows particular interest in technologies that bridge traditional infrastructure gaps through innovative business models. For instance, they actively seek water-as-a-service solutions that can make advanced treatment technologies accessible to communities without requiring large upfront capital investments.

The fund’s technology assessment framework heavily weights solutions that demonstrate clear paths to commercial viability within 18-24 months. This pragmatic approach, as explored in how to solve the wastewater riddle in 6 steps, ensures that portfolio companies can achieve meaningful market penetration while maintaining sustainable growth trajectories.

Investment Process and Value Addition

E3 Capital’s investment process reflects its deep commitment to fostering water innovation while maintaining rigorous due diligence standards. The fund employs a systematic approach to identify and evaluate potential investments in water technology companies across Africa.

Deal sourcing leverages E3’s extensive network of water industry experts, technology accelerators, and regional partners. The team actively participates in water technology conferences and maintains close relationships with research institutions focused on water solutions. Their approach emphasizes finding companies that demonstrate both technical excellence and clear market validation.

The due diligence process encompasses three core dimensions: technical validation, market opportunity assessment, and team evaluation. Technical reviews involve independent expert verification of the technology’s capabilities, scalability potential, and competitive advantages. Market assessments analyze the addressable opportunity, competitive landscape, and regulatory environment. Team evaluation focuses on the founders’ domain expertise, execution capabilities, and alignment with E3’s mission.

Post-investment, E3 Capital provides comprehensive support beyond mere capital injection. The fund takes an active board participation approach, typically securing board observer rights and maintaining regular strategic involvement. Their value-addition framework centers on three pillars: strategic guidance, operational support, and ecosystem access.

Strategic guidance includes assistance with business model refinement, go-to-market strategy development, and expansion planning. The fund’s partners leverage their extensive experience in water infrastructure projects to help portfolio companies navigate complex stakeholder relationships and regulatory requirements.

Operational support focuses on strengthening internal processes, talent acquisition, and financial management. E3’s team works closely with portfolio companies to implement robust reporting systems and optimize operational efficiency. This hands-on approach helps companies achieve sustainable growth while maintaining focus on their core innovation objectives.

Regarding follow-on investments, E3 maintains a structured philosophy aligned with milestone-based growth. The fund typically reserves 50-60% of its capital for follow-on rounds, demonstrating long-term commitment to portfolio companies’ success. However, follow-on decisions strictly adhere to performance metrics and market validation benchmarks.

This comprehensive investment approach, as discussed in “How to actively invest philanthropy and save the water world,” enables E3 Capital to effectively bridge the gap between innovative water technologies and successful market implementation while maintaining strong returns for investors.

Impact Metrics and Success Stories

E3 Capital has developed a comprehensive framework to measure and track the impact of its water investments across environmental and social dimensions. The fund’s approach combines quantitative metrics with qualitative assessments to evaluate how portfolio companies contribute to water security and accessibility in Africa.

On the environmental front, E3 Capital tracks key performance indicators including cubic meters of water saved, treated, or provided; reduction in groundwater extraction; and carbon emissions avoided through energy-efficient water solutions. Portfolio companies must report these metrics quarterly, enabling the fund to aggregate impact across its investments and demonstrate progress toward environmental goals.

Social impact metrics focus on measuring improved water access for underserved communities, job creation, and economic empowerment. The fund places particular emphasis on gender equity, tracking the percentage of women in leadership positions and female beneficiaries reached. This aligns with research showing women and girls are disproportionately affected by water scarcity.

One notable success story is a portfolio company that developed solar-powered water purification systems for rural communities. Within 18 months of E3 Capital’s investment, the company expanded from 3 to 15 districts, providing clean drinking water to over 50,000 people while creating 200 local jobs. The project achieved a 40% reduction in waterborne diseases in served areas.

Another portfolio company exemplifies the fund’s focus on sustainable agriculture through efficient irrigation technology. Their smart drip systems have helped small-scale farmers reduce water consumption by 60% while increasing crop yields by 35%. The technology now serves over 10,000 farmers, with women representing 45% of users.

E3 Capital also measures financial sustainability alongside impact metrics. The fund believes long-term social and environmental benefits can only be achieved through commercially viable business models. Portfolio companies must demonstrate a path to profitability while maintaining affordable pricing for base-of-pyramid customers.

To validate impact claims, the fund partners with independent third-party evaluators who conduct periodic assessments. This ensures transparency and credibility in impact reporting while identifying opportunities for improvement. The fund shares these learnings across its portfolio to accelerate the adoption of best practices.

Linking back to an analysis of how impact investing frameworks drive meaningful change in the water sector, the fund’s approach aligns with industry best practices outlined in how to mitigate 4 shades of water risk through impact investing. Their metrics capture both immediate outputs and long-term outcomes that contribute to sustainable development goals.

The Investment Philosophy

E3 Capital’s investment philosophy rests on a fundamental premise: water challenges in Africa require more than just capital—they demand an intricate understanding of the energy-water nexus. The fund’s approach synthesizes technical expertise with market insights to identify and nurture water innovations that can scale sustainably across the continent.

At the core of E3’s strategy lies a three-pillar framework that guides investment decisions. First, they evaluate technologies based on their potential to reduce energy consumption in water treatment and distribution processes. This focus on energy efficiency isn’t merely environmental—it’s economic, as energy costs often represent the largest operational expense for water utilities and treatment facilities.

Second, the fund prioritizes solutions that can operate reliably in resource-constrained environments. This means favoring robust technologies that require minimal maintenance and can function effectively even in areas with limited infrastructure. By focusing on operational resilience, E3 ensures their portfolio companies can deliver consistent performance in challenging conditions.

Third, and perhaps most critically, E3 seeks innovations that create demonstrable social impact while maintaining commercial viability. Their investment thesis aligns with growing evidence that sustainable water solutions can generate both financial returns and positive social outcomes.

The fund’s due diligence process reflects this comprehensive approach. Beyond traditional financial metrics, E3 evaluates potential investments through an impact lens that considers factors such as water savings potential, energy efficiency gains, and community benefits. This holistic assessment helps identify opportunities where market forces can drive sustainable water solutions.

E3 also recognizes that successful water entrepreneurship in Africa requires more than just innovative technology. Their hands-on investment style includes providing strategic guidance, operational support, and access to a network of industry partners. This support helps portfolio companies navigate complex regulatory environments, build strong local partnerships, and achieve scale more effectively.

By maintaining a laser focus on the intersection of energy and water, E3 has positioned itself to capitalize on opportunities that others might overlook. Their investment philosophy acknowledges that addressing Africa’s water challenges requires patient capital combined with deep sector expertise—a combination that positions them uniquely in the impact investment landscape.

Portfolio Success Stories

E3 Capital’s strategic investments have catalyzed remarkable growth among water technology innovators across Africa, demonstrating how targeted capital can unlock sustainable solutions while generating strong returns. Their portfolio showcases the transformative potential of bridging energy access with water entrepreneurship.

One standout success comes from a rural water treatment enterprise that leveraged E3’s investment to develop solar-powered purification systems. By eliminating reliance on inconsistent grid power, the company expanded from serving 5,000 people to reaching over 100,000 within two years. Their modular treatment units now operate in over 50 villages, providing reliable access to safe drinking water while generating stable revenue streams.

Another portfolio company revolutionized agricultural irrigation through smart solar pumping technology. The system’s AI-driven controls optimize water usage based on soil moisture data and weather patterns, reducing water waste by 40% while increasing crop yields. Farmers report 60% lower energy costs compared to diesel pumps, with the company’s pay-as-you-go model making the technology accessible to smallholder farmers.

E3’s investment in decentralized wastewater treatment has also yielded impressive results. Their portfolio company developed compact, energy-efficient treatment systems that recycle wastewater for non-potable uses. The technology now serves multiple industrial parks and residential developments, treating over 5 million liters daily while recovering valuable resources like biogas and fertilizers.

Beyond individual successes, E3’s portfolio companies demonstrate powerful network effects. Many collaborate on integrated water-energy solutions, sharing expertise and resources to tackle complex challenges. This collaborative approach has accelerated technology adoption and helped establish new industry standards for sustainable water management.

By prioritizing solutions that combine positive environmental impact with strong unit economics, E3 Capital has built a portfolio that delivers both financial returns and measurable progress toward water security goals. Their success stories validate the fund’s thesis that sustainable water innovation requires reliable, affordable energy access as a foundation.

Crucially, these companies have achieved growth while maintaining strong governance and environmental standards, setting benchmarks for responsible investment in the water sector. Their ability to scale while deepening impact exemplifies how private capital can change the world of water for the better.

The Investment Process

E3 Capital’s investment process reflects its dual commitment to driving water innovation while ensuring sustainable energy access in Africa. The fund employs a rigorous multi-stage evaluation framework that carefully balances financial returns with measurable impact metrics.

The initial screening phase focuses on three core criteria: technology validation, market potential, and team capabilities. Ventures must demonstrate proven water technologies that can scale effectively in African markets while maintaining reasonable energy requirements. The fund particularly values solutions that can operate reliably in remote or off-grid locations.

Once a startup passes preliminary screening, E3 Capital conducts comprehensive due diligence spanning technical, commercial, and impact dimensions. The technical assessment examines not just the core water technology, but also its energy efficiency and ability to integrate with local infrastructure constraints. Commercial validation involves detailed market sizing, competitive analysis, and unit economics modeling specific to target African regions.

A distinctive aspect of E3 Capital’s approach is its emphasis on partnership development during the evaluation process. The fund actively connects promising startups with its network of utility operators, government agencies, and implementation partners across Africa. This helps validate market fit while accelerating potential deployment pathways.

Post-investment support is equally structured, with dedicated resources for technical optimization, business development, and impact measurement. Portfolio companies receive hands-on assistance in areas like pilot project design, regulatory navigation, and local team building. The fund leverages its deep understanding of both water and energy sectors to help startups optimize their solutions for African operating conditions.

E3 Capital maintains active board involvement in its portfolio companies, typically taking board seats to provide strategic guidance while monitoring both financial and impact KPIs. The fund’s expertise in blended finance also helps portfolio companies access additional growth capital through strategic co-investment partnerships.

This systematic yet flexible investment approach has enabled E3 Capital to build a portfolio of water technology companies that are advancing access to sustainable water solutions across Africa while maintaining sound unit economics. Their process demonstrates how patient capital, when deployed strategically, can bridge critical gaps in the water-energy nexus.

Future Vision and Impact

E3 Capital’s strategic outlook for the water technology sector centers on catalyzing transformative innovation while ensuring sustainable impact. Through their targeted investments and ecosystem-building approach, the fund aims to create a self-reinforcing cycle of water entrepreneurship across Africa.

A cornerstone of their future vision involves developing clusters of complementary water technologies that can scale effectively. Rather than viewing individual investments in isolation, E3 Capital strategically connects portfolio companies to amplify their collective impact. This network effect enables startups to leverage shared resources, knowledge, and market access.

The fund’s ecosystem development strategy extends beyond direct investments. E3 Capital actively works to strengthen the broader infrastructure supporting water innovation. This includes partnerships with technical universities, collaborations with established utilities, and engagement with policy stakeholders. By taking this systems-level approach, they aim to address fundamental barriers that have historically limited water technology adoption.

Looking ahead, E3 Capital sees tremendous potential in solutions that bridge energy access and water security. Their investment thesis increasingly focuses on technologies that can operate reliably in energy-constrained environments while delivering essential water services. This aligns with their commitment to building climate resilience in vulnerable communities.

Measurable impact remains central to their strategy. The fund has developed sophisticated frameworks to evaluate both financial returns and social/environmental benefits. These metrics go beyond traditional indicators to capture systemic change, such as improved water governance and strengthened local innovation capacity.

E3 Capital recognizes that successful water innovation requires patient capital aligned with implementation timelines. Their long-term vision includes expanding blended finance mechanisms that can support different stages of technology development and market entry. This flexibility enables them to nurture promising solutions through the critical phases of pilot testing and early commercialization.

Significantly, the fund aims to demonstrate that investing in African water innovation can generate attractive returns while advancing sustainable development goals. As highlighted in their analysis of impact investment approaches, this dual objective is increasingly resonating with global investors seeking both financial and impact performance.

Ultimately, E3 Capital’s future vision centers on catalyzing a new paradigm where innovative water solutions emerge from and scale within African markets. By building robust innovation ecosystems and providing strategic capital, they aim to unlock the entrepreneurial potential that can transform the continent’s water sector.

Final words

E3 Capital’s strategic evolution from pure energy access to enabling water innovation exemplifies how thoughtful impact investment can address multiple sustainable development challenges simultaneously. Their approach of leveraging energy solutions to unlock water access demonstrates the power of integrated thinking in impact investing. The fund’s success in fostering partnerships, supporting early-stage companies, and maintaining strong governance through board participation has created a repeatable model for scaling water innovation across Africa. As water entrepreneurs and impact investors look to the future, E3 Capital’s example shows that the path to sustainable water access often runs through complementary sectors like energy. Their continued commitment to early-stage investment, coupled with significant follow-on reserves, positions them well to support the next generation of water innovation leaders emerging from Africa.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!