Duke Energy stands at the confluence of power and water, wielding an $83 billion investment war chest with strategic precision. As the second-largest hydroelectric operator among investor-owned utilities in the US, Duke’s water footprint extends far beyond mere power generation. From innovative hydropanels to watershed management across multiple river basins, the utility giant is carving out a unique position in the water sector that deserves attention from both impact investors and water entrepreneurs. Let’s dive into how this energy behemoth is navigating the waters of innovation, infrastructure, and environmental stewardship.

Duke Energy is part of my Ultimate Water Investor Database, check it out!

Investor Name: Duke Energy

Investor Type: PE

Latest Fund Size: $83000 Million

Dry Powder Available: Yes

Typical Ticket Size: >$75M

Investment Themes: Hydroelectric power & smart water management, Decentralized water generation, Recreational/public water access

Investment History: $23333333.33 spent over 2 deals

Often Invests Along: Breakthrough Energy Ventures

Already Invested In: SOURCE Water,

Leads or Follows: Lead

Board Seat Appetite: Rare

Key People:

The Hydroelectric Empire

Duke Energy’s hydroelectric operations span a vast network of dams, reservoirs, and power stations across multiple river basins in the Carolinas and Midwest. This intricate water management infrastructure serves dual purposes: generating clean electricity and ensuring reliable water supplies for millions.

At the heart of Duke’s hydroelectric empire lies the Catawba-Wateree system, comprising 13 hydroelectric stations and 11 reservoirs along 225 miles of river. This system alone generates over 800 megawatts of renewable energy while providing drinking water to nearly 2 million people. The utility’s masterful orchestration of water releases and reservoir levels has created a model of integrated watershed management.

Beyond power generation, Duke Energy’s water infrastructure plays a crucial role in flood control, drought mitigation, and recreational activities. The company’s reservoirs act as massive storage batteries, retaining water during wet periods and releasing it strategically during dry spells. This capability has proven invaluable during extreme weather events, which are becoming more frequent with climate change.

The utility’s water management extends far beyond dam operations. Through sophisticated monitoring systems and predictive analytics, Duke Energy optimizes water flows to balance multiple competing needs. Industrial users, municipal water utilities, and environmental requirements all factor into complex release schedules that change with seasons and conditions.

Particularly noteworthy is Duke’s pioneering approach to environmental stewardship. The company maintains minimum flow requirements to support aquatic ecosystems, manages shoreline development to prevent erosion, and implements innovative fish passage systems. These efforts have earned recognition from environmental groups and regulators alike.

The scale of Duke Energy’s hydroelectric operations provides unique advantages in water resource management. The interconnected nature of their systems allows for coordinated responses to regional water challenges. When drought threatens one area, water can be strategically shifted from other parts of the network to maintain critical services.

This water infrastructure also positions Duke Energy as a key player in regional water planning. The utility’s extensive data collection and modeling capabilities inform policy decisions and help communities prepare for future water needs. As climate pressures mount, this planning role becomes increasingly vital.

Innovation Beyond the Dam

Duke Energy’s venture into cutting-edge water technologies marks a strategic evolution beyond its traditional hydroelectric operations. The utility giant has positioned itself at the forefront of atmospheric water generation, recognizing that tomorrow’s water challenges require solutions that transcend conventional infrastructure.

The company’s significant investment in hydropanel technology exemplifies its forward-thinking approach. These solar-powered systems extract moisture from the air, producing clean drinking water without traditional water sources or infrastructure. The technology proves particularly valuable in water-stressed regions within Duke’s service territory, where conventional water delivery systems face mounting challenges.

Beyond atmospheric water generation, Duke Energy has cultivated a diverse portfolio of water innovation investments. The utility has backed technologies that enhance water efficiency in cooling systems, crucial for power plant operations. These innovations reduce water consumption while maintaining optimal power generation performance – a dual benefit that aligns with both environmental stewardship and operational efficiency.

Duke’s innovation strategy extends to water quality monitoring and management systems. The company has deployed advanced sensors and artificial intelligence platforms across its facilities to optimize water usage patterns and predict maintenance needs before they become critical issues. This proactive approach has resulted in significant water savings and reduced operational costs.

Notably, the utility has established partnerships with universities and research institutions across its service territory, creating a robust innovation ecosystem. These collaborations focus on developing and testing new water technologies, from advanced filtration systems to smart distribution networks. The approach allows Duke to evaluate emerging solutions in real-world conditions while supporting regional economic development.

The company’s water technology investments also reflect a broader understanding of climate resilience. As extreme weather events become more frequent, Duke’s support for innovative water solutions helps communities adapt to changing conditions. These investments serve both as a hedge against climate-related risks and as a platform for future growth.

Perhaps most significantly, Duke Energy’s water innovation initiatives demonstrate a shift in how utilities view their role in water resource management. No longer content to be merely large-scale water users, they are emerging as active participants in shaping water technology’s future. This transformation mirrors the evolving relationship between energy providers and the communities they serve.

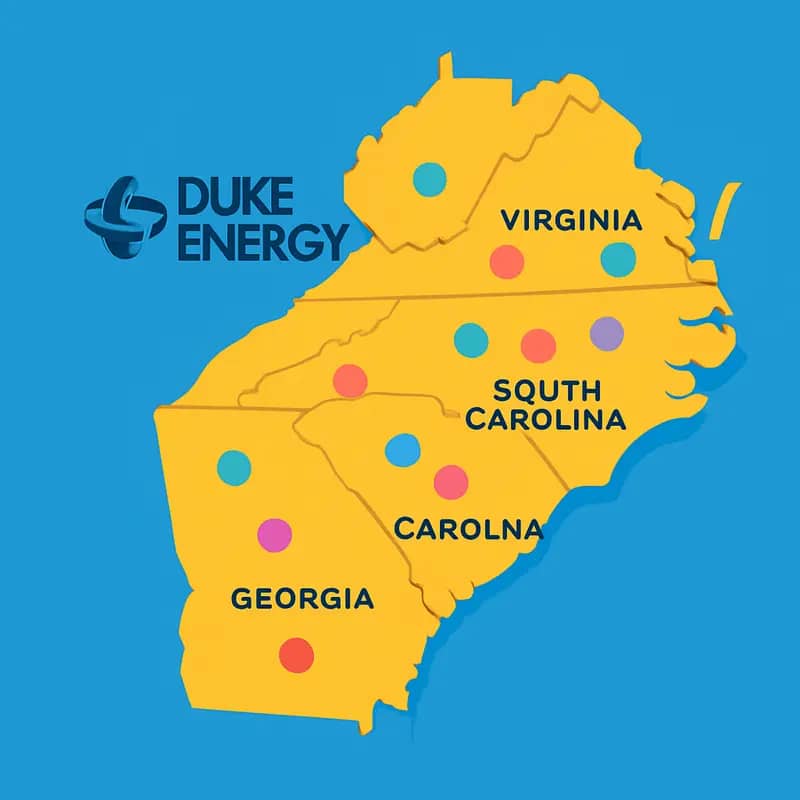

Regional Investment Strategy

Duke Energy’s strategic footprint spans six key states across the Southeastern United States, where the utility giant implements a carefully orchestrated capital deployment approach that interweaves water infrastructure with economic development goals. The company’s investment strategy reflects both geographic priorities and emerging water needs across North Carolina, South Carolina, Florida, Indiana, Ohio, and Kentucky.

In North Carolina, Duke’s home state, the company focuses heavily on modernizing aging water infrastructure, particularly around its nuclear and coal facilities. Their $200 million investment in the Marshall Steam Station demonstrates their commitment to responsible water management while maintaining reliable power generation. The company has implemented advanced cooling systems that reduce water withdrawal from Lake Norman by 67%.

South Carolina sees a different investment profile, with Duke Energy prioritizing flood control and stormwater management. The utility has partnered with local governments to develop innovative water retention systems, particularly in coastal regions where rising sea levels pose increasing challenges. These investments align with the company’s broader strategy of building climate resilience into its infrastructure.

In Florida, where water scarcity and saltwater intrusion threaten coastal aquifers, Duke Energy has pioneered investments in advanced water treatment and recycling systems. Their approach here demonstrates how power utilities can play a crucial role in regional water conservation efforts. Through targeted investments in water-efficient cooling technologies, they’ve reduced freshwater consumption at their Crystal River facility by 40%.

The Midwest region, encompassing Indiana, Ohio, and Kentucky, presents unique challenges related to agricultural water use and industrial development. Duke’s investment strategy here focuses on developing water infrastructure that supports both power generation and regional economic growth. The company has invested significantly in water quality monitoring systems and treatment facilities that serve multiple industrial users.

Across all regions, Duke Energy employs a three-tiered capital allocation framework that prioritizes: essential infrastructure maintenance, capacity expansion, and innovation initiatives. This approach ensures balanced investment across their territory while maintaining operational reliability. Their economic development initiatives have created over 12,000 jobs through water-related infrastructure projects.

The utility’s regional strategy showcases how water infrastructure investments can serve multiple objectives, from ensuring reliable power generation to supporting broader community development goals. As explored in How to Win at Negotiating with the Most Powerful Stakeholders, Duke’s approach to stakeholder engagement has been crucial in securing public support for these investments.

Looking ahead, Duke Energy’s regional investment strategy positions the company to address emerging water challenges while maintaining its core power generation capabilities. Their geographic diversification provides resilience against localized water stress events, while their integrated approach to water and energy infrastructure creates operational efficiencies that benefit both sectors.

Future Waters

Duke Energy’s ambitious $83 billion capital expenditure strategy represents a transformative vision for water infrastructure development over the next decade. This unprecedented investment signals a fundamental shift in how utilities approach water resource management in an era of increasing climate uncertainty.

At the heart of Duke’s strategy lies a comprehensive modernization of aging water infrastructure assets. The utility plans to allocate approximately 40% of its capital expenditure toward upgrading water treatment facilities, smart metering systems, and distribution networks. These investments aim to reduce water losses, improve operational efficiency, and enhance system resilience.

A significant portion of the investment will support innovative water reuse and recycling initiatives. Duke Energy recognizes that traditional water sourcing methods may not sustainably meet future demands. By implementing advanced water recycling technologies across their facilities, they aim to reduce freshwater withdrawals by 50% by 2030.

The strategy also emphasizes the integration of digital solutions and artificial intelligence for predictive maintenance and real-time monitoring. Smart sensors and analytics platforms will enable proactive identification of potential system failures, reducing downtime and operational costs while improving service reliability.

Environmental sustainability forms a crucial pillar of Duke’s future water strategy. The utility plans to invest heavily in nature-based solutions for watershed protection and groundwater recharge. These initiatives include constructed wetlands, bioswales, and green infrastructure projects that naturally filter and manage stormwater while supporting local ecosystems.

Critically, Duke Energy’s investment strategy extends beyond physical infrastructure. The utility has earmarked funds for research and development partnerships with academic institutions and technology providers to accelerate water innovation. These collaborations focus on emerging technologies like advanced membrane systems, energy-efficient treatment processes, and water quality monitoring solutions.

The implementation of this ambitious strategy faces several challenges, including regulatory compliance, technological readiness, and stakeholder engagement. However, Duke Energy’s comprehensive approach demonstrates a clear understanding that future water security requires more than traditional infrastructure investments – it demands a fundamental reimagining of how utilities manage and value water resources.

The Water-Energy Nexus

At the heart of Duke Energy’s operations lies a profound symbiosis between water and power generation that positions the utility giant uniquely in America’s infrastructure landscape. The company’s vast network of reservoirs, cooling systems, and hydroelectric facilities doesn’t just enable electricity production—it represents one of the largest water management systems in the United States.

Duke Energy’s hydroelectric operations span over 3,000 miles of shoreline, managing nearly 2.5 million acre-feet of water. This massive water infrastructure serves multiple critical functions beyond power generation. The company’s reservoirs provide drinking water to millions, support recreation economies, and act as crucial flood control systems. This integrated approach to water management exemplifies the water-energy nexus in action.

What sets Duke Energy apart is how its water infrastructure creates a natural laboratory for innovation. The company’s reservoirs function as living test beds for new technologies in water quality monitoring, predictive analytics, and ecosystem management. By leveraging its existing water assets, Duke Energy can pilot and scale water technologies with immediate real-world applications.

The company’s water footprint also positions it at the forefront of climate resilience planning. As weather patterns become more extreme, Duke Energy’s reservoir system provides critical flexibility in managing both drought and flood conditions. The ability to store and release water strategically helps balance competing needs while maintaining reliable power generation.

Perhaps most significantly, Duke Energy’s water infrastructure enables the company to play a pivotal role in the transition to renewable energy. The utility’s pumped storage hydroelectric facilities act as massive batteries, storing energy when demand is low and releasing it during peak periods. This capability becomes increasingly valuable as more intermittent renewable sources enter the grid.

The company has begun exploring innovative approaches to enhance the efficiency of its water use in power generation, particularly in addressing the challenges of water sustainability. From implementing closed-loop cooling systems to developing smart water management technologies, these initiatives demonstrate how the water-energy nexus can drive technological advancement.

Duke Energy’s position at this crucial intersection creates unique opportunities to shape the future of both sectors. As water becomes an increasingly precious resource, the company’s expertise in managing the water-energy relationship positions it to lead in developing solutions that benefit both utility operations and broader society. The challenge now lies in leveraging this position to accelerate innovation in water technology while ensuring sustainable management of these critical resources.

Innovation Pipeline

Duke Energy’s strategic investment in water technology represents a watershed moment for entrepreneurs and startups in the water sector. Building on its extensive water infrastructure footprint, the utility giant has established a multi-pronged approach to foster innovation and create commercial opportunities.

At the heart of Duke’s water technology initiatives lies their Water Innovation Hub, which serves as an incubator and testing ground for emerging solutions. The hub provides startups with access to real-world testing environments across Duke’s vast network of cooling systems, treatment facilities, and water management infrastructure. This practical validation capability has proven invaluable for early-stage companies seeking to demonstrate technology effectiveness at scale.

The utility’s venture arm has earmarked significant capital specifically for water technology investments, focusing on three key areas: smart water management systems, water quality monitoring and treatment technologies, and water conservation solutions. Rather than taking a passive investment approach, Duke actively partners with portfolio companies to accelerate commercialization through pilot programs and potential deployment across their operations.

For entrepreneurs, Duke’s most compelling offering may be their Technology Validation Program. This structured pathway allows startups to work directly with Duke’s technical experts and operations teams to refine their solutions. The program provides detailed performance data and operational feedback that startups can leverage for product optimization and market validation. Several companies have already used this program as a springboard to secure additional funding and expand into broader utility markets.

Duke has also pioneered an innovative partnership model that helps de-risk technology adoption for both startups and the utility. Through flexible commercial arrangements that may include revenue sharing, minimum volume commitments, or staged deployment schedules, early-stage companies can secure the crucial first reference customer while Duke maintains technological optionality.

Looking ahead, Duke’s water innovation strategy appears poised to expand further. The utility has signaled interest in technologies addressing emerging challenges like PFAS treatment, digital twins for water infrastructure, and advanced materials for water efficiency. This creates opportunities for startups working on cutting-edge solutions in these domains.

As explored in https://dww.show/what-do-you-need-to-know-to-invest-wisely-in-water-technologies/, successful water technology investments require both technical validation and clear paths to market adoption – precisely what Duke’s comprehensive innovation program aims to provide. For entrepreneurs navigating the complex water sector, Duke Energy’s expanding technology initiatives represent a valuable platform to accelerate commercialization and achieve meaningful scale.

Impact Investment Landscape

Duke Energy’s foray into water management has created compelling opportunities for impact investors seeking both environmental and financial returns. The utility’s strategic water initiatives are attracting diverse capital through innovative partnership models and demonstrating promising investment performance metrics.

At the core of Duke’s investment appeal is its integrated water-energy approach. By treating water management as a critical component of power generation rather than a separate vertical, the company has developed projects that deliver dual benefits. Their water recycling systems at thermal plants, for instance, generate 15-20% cost savings while reducing environmental impact – a combination that appeals strongly to ESG-focused investors.

Partnership structures have evolved beyond traditional utility models. Duke Energy has pioneered a “shared infrastructure” framework where multiple stakeholders collectively invest in water treatment facilities, spreading both risks and returns. These arrangements typically involve 10-15 year agreements with guaranteed minimum returns, providing the long-term predictability that institutional investors seek.

The numbers paint an encouraging picture. Water-focused projects in Duke’s portfolio have demonstrated returns ranging from 8-12% annually, outperforming many traditional infrastructure investments. More importantly, these returns have shown resilience during economic downturns, as water demand remains relatively inelastic.

Duke has also introduced an innovative “Water Impact Bond” structure, allowing investors to participate in specific water conservation projects while linking returns to measurable environmental outcomes. This model has attracted over $500 million in new capital, particularly from impact-focused funds and family offices seeking quantifiable sustainability metrics alongside financial returns.

Historically, water investments have struggled with scale and liquidity challenges. Duke’s approach addresses these barriers through standardized project frameworks that can be replicated across facilities, creating investment opportunities of sufficient size to attract institutional capital. The company’s strong credit rating and regulated status provide additional comfort to investors concerned about long-term stability.

Looking at risk-adjusted returns, water projects have emerged as strong performers in Duke’s broader portfolio. Capital recovery periods average 5-7 years, with operational costs trending downward as technologies mature and economies of scale kick in. This performance has caught the attention of mainstream investors who previously viewed water primarily through an ESG lens.

As highlighted in “How to Mitigate 4 Shades of Water Risk Through Impact Investing“, the sector’s risk profile is evolving favorably. Duke’s track record demonstrates that well-structured water investments can deliver competitive returns while advancing crucial sustainability goals.

Future Flow

Duke Energy’s forward-looking water management strategy represents a paradigm shift in how utilities approach water resources. The company’s ambitious plans center on developing integrated water systems that combine traditional infrastructure with innovative technologies and nature-based solutions.

At the core of Duke’s future vision is the concept of circular water management. Rather than treating water as a one-time-use resource, the utility aims to maximize water recycling and reuse across its operations. This creates significant opportunities for entrepreneurs developing advanced water treatment technologies, particularly in areas like membrane filtration, digital monitoring, and resource recovery.

The company has earmarked substantial investments for upgrading aging infrastructure with smart technologies. This modernization drive opens doors for startups specializing in AI-powered leak detection, predictive maintenance, and real-time water quality monitoring. Investors can expect growing demand for solutions that enhance operational efficiency while reducing water losses.

Duke Energy’s increasing focus on watershed protection and restoration presents another promising avenue. The utility plans to expand its nature-based infrastructure projects, creating opportunities for companies developing green solutions for stormwater management, wetland restoration, and aquifer recharge.

Perhaps most intriguing is Duke’s push toward water-energy nexus innovations. The company seeks technologies that can simultaneously address water and energy challenges, such as systems for capturing thermal energy from wastewater or reducing cooling water consumption at power plants. This intersection of water and energy efficiency represents a particularly attractive space for impact investors.

Regulatory compliance and climate resilience are also driving Duke’s future water strategy. The utility anticipates stricter environmental regulations and more frequent extreme weather events, creating demand for advanced treatment technologies and climate adaptation solutions. Early-stage companies developing robust, scalable solutions in these areas stand to benefit.

However, entrepreneurs and investors should note that Duke Energy maintains stringent requirements for new technologies. Solutions must demonstrate clear cost benefits, reliability at scale, and compatibility with existing systems. The most successful ventures will likely be those that can validate their technologies through pilot projects while building strong relationships with key decision-makers within the utility.

As detailed in how to mitigate 4 shades of water risk through impact investing, strategic partnerships between utilities and innovative solution providers will be crucial for addressing future water challenges. Duke Energy’s evolving water management approach exemplifies this trend, creating a rich ecosystem of opportunities for forward-thinking entrepreneurs and impact-oriented investors.

Final words

Duke Energy’s approach to water investment reveals a utility company thinking far beyond traditional power generation. Their $83 billion capital expenditure plan, coupled with strategic investments in innovative water technologies like Source Global’s hydropanels, positions them as a significant force in shaping water infrastructure’s future. While maintaining their leadership in hydroelectric operations, Duke Energy’s geographic focus across six southeastern states demonstrates a regional strategy that combines economic development with water resource management. For water entrepreneurs, Duke Energy represents not just a potential partner but a blueprint for scaling water innovations within established utility frameworks. Impact investors should note how Duke’s massive infrastructure investments are increasingly intertwining water security with energy transition goals. As water scarcity concerns grow and climate challenges mount, Duke Energy’s integrated approach to water and power infrastructure may well become a model for utilities worldwide.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!