At the intersection of impact investing and water innovation sits Bridges Israel, a pioneering fund that’s quietly revolutionizing how we approach water challenges. From their headquarters in Kibbutz Glil Yam, this $60 million impact fund has emerged as a key player in Israel’s water technology ecosystem. With investments spanning from smart wastewater management to groundbreaking irrigation solutions, Bridges Israel exemplifies how strategic capital deployment can simultaneously drive environmental impact and competitive returns. Their approach offers crucial insights for both entrepreneurs seeking funding and investors looking to make a splash in the water sector.

Bridges Israel is part of my Ultimate Water Investor Database, check it out!

Investor Name: Bridges Israel

Investor Type: Impact

Latest Fund Size: $60 Million

Dry Powder Available:

Typical Ticket Size: $10M – $30M

Investment Themes: wastewater pollution control, real-time monitoring, advanced irrigation efficiency

Investment History: $12952380.95 spent over 4 deals

Often Invests Along: Aliaxis, DC Thomson, Ram-On Investments and Holdings

Already Invested In: Kando, N-Drip Gravity Micro Irrigation

Leads or Follows:

Board Seat Appetite: Moderate

Key People:

Strategic Focus: Where Impact Meets Innovation

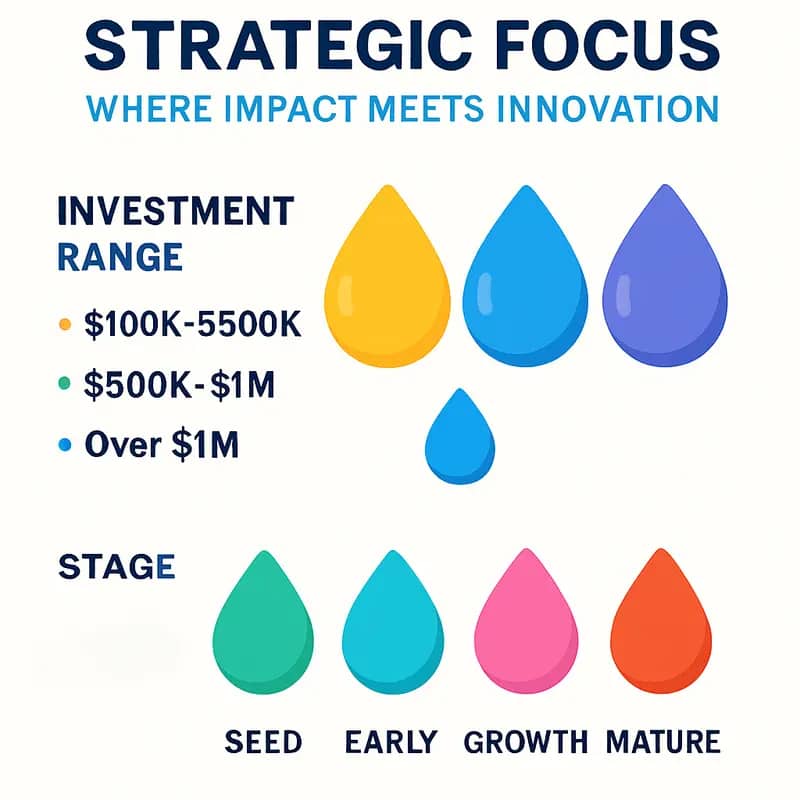

At the intersection of financial returns and environmental impact lies Bridges Israel’s carefully calibrated investment approach. The fund’s sweet spot – deals ranging from $10M to $50M in early to late-stage ventures – reflects a strategic balance between market opportunity and mission-driven objectives in water technology.

Bridges Israel’s investment thesis centers on identifying ventures that demonstrate both commercial viability and measurable environmental benefits. The fund evaluates potential investments through a dual lens: the ability to generate competitive financial returns while delivering quantifiable improvements in water efficiency, quality, or access. This approach has proven particularly effective in Israel’s water technology ecosystem, where innovation often emerges from necessity.

The fund’s strategy emphasizes scalable solutions that address critical water challenges. By focusing on companies in their growth phase, Bridges Israel can provide not just capital, but also strategic guidance to help portfolio companies expand their market presence and enhance their environmental impact. Their deal structure typically involves significant minority stakes, allowing them to influence company direction while empowering entrepreneurs to maintain operational control.

A distinctive aspect of their investment philosophy is the emphasis on measurable impact metrics. Portfolio companies must demonstrate clear environmental benefits, whether through water savings, improved treatment efficiency, or enhanced resource recovery. The fund has developed sophisticated frameworks to quantify these impacts, aligning with global sustainability standards while maintaining focus on financial performance.

Bridges Israel’s approach to value creation extends beyond initial investment. The fund actively works with portfolio companies to optimize their business models, enhance operational efficiency, and expand market reach. This hands-on strategy has proven particularly valuable in the water sector, where commercialization paths can be complex and regulatory landscapes challenging.

The fund’s focus on water technology is not merely opportunistic but reflects a deep understanding of global water challenges. As detailed in how to mitigate 4 shades of water risk through impact investing, their investment strategy addresses multiple dimensions of water-related risks while capturing emerging market opportunities.

Bridges Israel’s portfolio composition reveals a preference for technologies that can scale internationally while solving local water challenges. This dual-market approach helps mitigate investment risks while maximizing potential returns and impact. The fund’s success in balancing these objectives has established a compelling model for impact investing in water technology, demonstrating that environmental stewardship and financial performance need not be mutually exclusive.

Portfolio Deep Dive: Water Innovation Champions

Bridges Israel’s portfolio showcases transformative water technologies that address critical global challenges. Two standout investments exemplify their strategic approach to water innovation and impact.

Kando’s wastewater intelligence platform has revolutionized how utilities monitor and manage their networks. The company’s AI-powered solution deploys IoT sensors throughout sewer systems to detect pollution events and predict maintenance needs in real-time. Since Bridges Israel’s investment, Kando has expanded to serve over 20 major utilities across three continents, demonstrating impressive 300% year-over-year revenue growth. Their technology enables utilities to reduce pollution events by up to 70% while cutting operational costs by 40%.

N-Drip represents another breakthrough in water conservation through their gravity-powered micro-irrigation system. By eliminating the need for external energy sources and complex infrastructure, N-Drip makes precision irrigation accessible to farmers worldwide. The technology achieves water savings of 50% compared to flood irrigation while increasing crop yields by 25%. What began as an implementation in Israel’s Negev desert has grown to over 50,000 acres across 17 countries.

Both companies align perfectly with Bridges Israel’s thesis of scaling proven technologies that deliver measurable environmental impact alongside strong financial returns. Their success validates the fund’s approach of identifying solutions that are not just innovative, but also commercially viable and ready for rapid market adoption.

The portfolio companies’ growth trajectories showcase effective deployment of capital – Kando raised a $22M Series B round to accelerate global expansion, while N-Drip secured partnerships with major agricultural players to scale implementation. Most importantly, their solutions directly address UN Sustainable Development Goal 6 while generating attractive returns for investors.

The success metrics speak volumes: combined annual water savings exceeding 100 billion liters, pollution reduction equivalent to taking 50,000 cars off the road, and consistent double-digit revenue growth. These achievements demonstrate how strategic investment in water technology can drive both environmental stewardship and commercial success.

Linking into broader industry development, these companies exemplify how Israeli innovation is reshaping global water technology, powered by strategic investment and market-driven solutions.

Investment Philosophy: The Follow-On Strategy

Bridges Israel’s distinctive follow-on investment approach reveals a carefully calibrated strategy that maximizes impact while maintaining financial discipline. With a follow-on index of 0.41 and an investment ratio of 1.80, the fund demonstrates a measured approach to supporting portfolio company growth through subsequent funding rounds.

The 0.41 follow-on index indicates that Bridges Israel reserves significant capital for follow-on investments while avoiding over-concentration in any single company. This balanced approach allows the fund to provide crucial growth capital to successful portfolio companies while maintaining diversification. The 1.80 investment ratio shows that follow-on investments tend to be larger than initial investments, reflecting increased conviction and reduced risk as companies prove their business models.

This data-driven strategy enables Bridges Israel to act as a committed long-term partner to water technology innovators. When portfolio companies achieve key milestones and demonstrate market traction, the fund can deploy additional capital to accelerate their growth trajectory. This sustained support is particularly vital in the water sector, where technology commercialization often requires patient capital and longer development cycles.

The fund’s follow-on philosophy aligns with the unique characteristics of water technology ventures, which frequently need multiple rounds of funding to scale their solutions. By maintaining dry powder for follow-on investments, Bridges Israel can protect its ownership stakes in high-performing companies while providing founders with a reliable source of growth capital. This approach helps portfolio companies avoid dilutive emergency fundraising and maintains positive momentum.

Bridges Israel’s follow-on strategy also creates powerful signaling effects in the broader water technology ecosystem. The fund’s continued support of portfolio companies helps attract co-investors and validates the commercial viability of innovative water solutions. This multiplier effect amplifies the fund’s impact beyond direct capital deployment.

The disciplined follow-on approach reflects a deep understanding of both venture capital dynamics and water sector specificities. As explored in “how to leverage water risk assessment to unlock business opportunities“, proper risk assessment and capital deployment strategies are crucial for success in the water technology space. By maintaining strategic reserves for follow-on funding while establishing clear investment parameters, Bridges Israel maximizes its ability to support promising water innovations through multiple stages of growth.

Future Horizons: Water Tech Trends and Opportunities

The water technology landscape stands at an inflection point, with emerging trends creating unprecedented opportunities for impact investors like Bridges Israel. Digital transformation represents one of the most promising frontiers, as advanced analytics, artificial intelligence, and IoT sensors revolutionize how water infrastructure is monitored and managed.

Predictive maintenance powered by machine learning enables utilities to detect and prevent failures before they occur, dramatically reducing costly downtime and water losses. Smart metering and digital twin technologies provide granular, real-time insights into water distribution networks, supporting data-driven decision making and operational optimization. These digital solutions align perfectly with Bridges Israel’s focus on scalable technologies that drive both environmental and financial returns.

Climate resilience represents another critical trend shaping water innovation. As extreme weather events increase in frequency and intensity, water utilities and industrial users seek technologies that enhance system adaptability and redundancy. Advanced water reuse systems, decentralized treatment solutions, and technologies for managing stormwater surges are gaining traction. Nature-based approaches that leverage natural infrastructure for water management while sequestering carbon offer compelling dual climate benefits.

Modernizing aging water infrastructure through smart, sustainable solutions presents massive market potential. Traditional gray infrastructure is being augmented or replaced with smart systems that integrate sensors, automation, and advanced materials. These upgrades improve operational efficiency while reducing energy consumption and maintenance costs. New financing models like Water-as-a-Service are emerging to help utilities fund these capital-intensive improvements.

These converging trends create opportunities for technologies that deliver multiple benefits – cost savings, improved resilience, reduced environmental impact. Bridges Israel’s deep water sector expertise and follow-on investment strategy position the fund to identify and scale the most promising solutions. Their emphasis on proven technologies with strong commercial traction helps de-risk adoption of innovations addressing pressing water challenges.

By focusing on digital transformation, climate adaptation, and infrastructure modernization, Bridges Israel can accelerate deployment of water technologies that generate both compelling returns and measurable impact. The fund’s ability to provide strategic guidance and growth capital enables portfolio companies to capitalize on these market drivers while advancing sustainable water management practices.

The Investment Philosophy

At the core of Bridges Israel’s investment approach lies a fundamental belief that financial returns and environmental impact are not mutually exclusive goals. Their investment philosophy centers on identifying early-stage water technology companies that demonstrate both innovative solutions and clear pathways to sustainability.

The fund employs a rigorous due diligence process that evaluates potential investments through dual lenses. On the commercial side, they analyze market opportunity, competitive advantage, and scalability potential. On the impact side, they assess measurable environmental benefits, particularly in water conservation, quality improvement, and infrastructure efficiency.

What sets Bridges Israel’s philosophy apart is their active investment approach. Beyond providing capital, they take a hands-on role in portfolio company development. This includes strategic guidance, operational support, and leveraging their extensive network within Israel’s water technology ecosystem. Their team’s deep sector expertise allows them to identify promising technologies that others might overlook.

The fund’s investment thesis particularly focuses on technologies that address critical water challenges. This includes solutions for water scarcity, treatment efficiency, quality monitoring, and infrastructure optimization. By targeting these areas, they align their investments with both market demands and environmental imperatives.

Bridges Israel has developed a proprietary impact measurement framework that tracks both quantitative and qualitative metrics. This allows them to monitor progress across their portfolio while ensuring accountability to their dual mandate of returns and impact. Their framework considers factors such as water savings, energy efficiency improvements, and pollution reduction alongside traditional financial metrics.

Critically, the fund recognizes that successful water technology investments require patience and long-term vision. Unlike some sectors where rapid scaling is possible, water technology often involves longer development cycles and complex regulatory requirements. Their investment philosophy accounts for these sector-specific characteristics while maintaining focus on sustainable growth.

This measured approach has proven particularly effective in the Israeli context, where water innovation has been driven by necessity. The fund’s strategy aligns closely with the country’s position as a global leader in water technology, leveraging local expertise while targeting global market opportunities.

Portfolio Success Stories

Bridges Israel’s investment portfolio showcases how strategic funding combined with environmental impact goals can transform promising water technology startups into industry leaders. The fund’s hands-on approach has yielded several notable success stories that demonstrate the power of impact investing in the water sector.

A standout example is their investment in advanced wastewater treatment technology. One portfolio company developed an innovative biological treatment process that reduces energy consumption by 60% compared to conventional systems. The technology now treats over 50 million gallons of industrial wastewater daily across three continents, preventing the release of harmful contaminants while saving significant energy costs.

Another portfolio success revolutionized water quality monitoring through AI-powered sensors. This startup’s technology enables real-time detection of contaminants at a fraction of traditional testing costs. What began as a small pilot with Israeli utilities has expanded to over 200 installations globally, helping utilities optimize treatment processes and ensure water safety.

Bridges Israel’s investment in water infrastructure analytics has been particularly impactful. Their portfolio company developed machine learning algorithms that detect leaks and predict pipe failures with over 90% accuracy. The technology has helped municipalities reduce water losses by an average of 30%, conserving billions of gallons annually while generating substantial cost savings.

The fund’s focus on circular water solutions led to backing a company that transforms wastewater into high-value agricultural products. This technology not only treats wastewater but generates revenue through resource recovery, creating a financially sustainable model for water treatment facilities.

Crucially, Bridges Israel doesn’t just provide capital – they actively support portfolio companies with strategic guidance, industry connections, and expertise in scaling operations. This hands-on approach has helped portfolio companies secure major contracts, enter new markets, and attract follow-on investment.

As discussed in How to Mitigate 4 Shades of Water Risk Through Impact Investing, the fund’s success demonstrates how targeted investment in water technology can deliver both strong financial returns and measurable environmental impact. Their portfolio companies have collectively saved over 100 billion gallons of water and prevented millions of tons of CO2 emissions, while growing into profitable enterprises serving global markets.

Impact Measurement Framework

Bridges Israel implements a sophisticated dual-track impact measurement framework that rigorously evaluates both financial returns and environmental benefits across their water technology portfolio. This data-driven approach ensures accountability while providing clear metrics to demonstrate real-world impact.

At the core of their framework is a set of standardized key performance indicators (KPIs) that each portfolio company must track and report quarterly. These KPIs span three key dimensions: water conservation metrics (cubic meters saved), water quality improvements (contaminant reduction levels), and operational efficiency gains (energy/chemical usage reductions). Portfolio companies utilize automated monitoring systems to capture this data, ensuring accuracy and consistency.

The fund overlays these environmental metrics with traditional financial performance tracking, creating a holistic view of each investment’s total impact. Return on investment calculations incorporate both direct financial returns and monetized environmental benefits, providing a more complete picture of value creation. This approach, outlined in detail at how to mitigate 4 shades of water risk through impact investing, has become a model for other impact investors.

Bridges Israel also employs third-party verification of impact claims through independent auditors and environmental consultants. This external validation adds credibility to their reporting while identifying opportunities for improvement. The fund maintains a proprietary impact database that aggregates portfolio-wide metrics, enabling trend analysis and impact forecasting.

Beyond quantitative measures, the framework incorporates qualitative assessments through detailed case studies and stakeholder interviews. These narratives provide crucial context about how water technologies create real-world benefits for communities and ecosystems. The fund regularly publishes impact reports that synthesize this data for investors and the broader water technology ecosystem.

This comprehensive approach to impact measurement has enabled Bridges Israel to clearly demonstrate the dual benefits of their investment strategy. Portfolio companies have collectively saved billions of cubic meters of water while delivering strong financial returns. The framework’s success has attracted additional capital to the water technology sector while establishing new standards for impact accountability.

Looking ahead, Bridges Israel continues refining their measurement methodology, incorporating emerging environmental accounting standards and expanding their impact metrics. This commitment to rigorous impact assessment provides a foundation for scaling their water technology investments while maintaining focus on measurable environmental benefits.

Future Vision

Bridges Israel’s strategic roadmap for water technology investments charts an ambitious course toward global impact scaling. Building on their established $60M portfolio, the fund aims to catalyze transformative growth in water innovation while maintaining their disciplined focus on measurable environmental and social returns.

At the core of their expansion strategy lies a commitment to identifying and nurturing breakthrough technologies that address the most pressing water challenges. The fund’s leadership envisions deploying capital across three primary vectors: water access enhancement, efficiency optimization, and quality improvement. This targeted approach aligns with their proven framework for evaluating water technology investments.

Geographic expansion features prominently in Bridges Israel’s future vision. While maintaining their strong foothold in Israel’s water technology ecosystem, they’re strategically positioning to extend their reach into emerging markets where water stress intersects with rapid urbanization and industrial growth. This calculated expansion enables portfolio companies to validate their solutions in diverse operating environments while accelerating their path to scale.

The fund’s approach to scaling impact leverages two distinct mechanisms. First, they’re developing strategic partnerships with established water utilities and industrial operators who can serve as early adopters and reference customers. Second, they’re building bridges between portfolio companies and global water technology leaders, creating pathways for commercial partnerships and potential acquisitions.

Bridges Israel recognizes that successful scaling requires more than capital alone. Their vision encompasses the creation of a comprehensive support ecosystem for portfolio companies, including technical expertise, market access partnerships, and regulatory navigation support. This holistic approach aims to reduce time-to-market for innovative solutions while maximizing their adoption potential.

Looking ahead, the fund is actively exploring innovative financing structures that can help de-risk early-stage water technology deployments. These include performance-based financing mechanisms and blended capital approaches that combine impact investment with traditional venture funding. This financial innovation aims to unlock larger pools of capital for water technology scaling while maintaining strong alignment with impact objectives.

Critically, Bridges Israel’s future vision maintains unwavering focus on additionality – ensuring their investments catalyze developments that wouldn’t otherwise occur. This principle guides their portfolio expansion strategy and shapes their approach to market development initiatives.

Final words

Bridges Israel stands as a testament to the power of purposeful investment in water technology. Their strategic approach – combining substantial ticket sizes, thoughtful follow-on investments, and a laser focus on impactful solutions – has created a blueprint for successful water tech investing. The fund’s portfolio companies are not just surviving but thriving, demonstrating that water challenges can be addressed while generating competitive returns. For entrepreneurs in the water space, Bridges Israel represents more than just a funding source; it’s a partner that understands the unique challenges and opportunities in water technology. For fellow investors, their success offers valuable lessons in how to approach impact investing in the water sector effectively. As water challenges continue to grow globally, Bridges Israel’s model of combining financial acumen with environmental impact becomes increasingly relevant.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!