From the sun-baked fields of Morocco to Silicon Valley’s innovation hubs, Bidra Innovation Ventures operates at the confluence of water technology and sustainable development. With $250 million in committed capital and strategic backing from global phosphate leader OCP Group and Mohammed VI Polytechnic University, this San Francisco-based venture fund is methodically building a portfolio of game-changing water solutions. Their thesis? That the next generation of water innovation will emerge from the overlap of agricultural efficiency, industrial optimization, and breakthrough treatment technologies. For water entrepreneurs and impact investors alike, understanding Bidra’s investment approach offers valuable insights into where the sector is heading.

Bidra Innovation Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Bidra Innovation Ventures

Investor Type: VC

Latest Fund Size: $250 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Industrial water & reuse, Agricultural water conservation, Digital water solutions

Investment History: $5483333.33 spent over 2 deals

Often Invests Along:

Already Invested In: Aclarity, Tidal Metals

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People: Yassine Cherkaoui, Kevin Zussman

Strategic Vision and Investment Thesis

Bidra Innovation Ventures emerges as a pivotal force in water technology investment, wielding a $250M fund strategically positioned at the nexus of agricultural innovation, industrial advancement, and water sustainability. Backed by OCP Group’s deep expertise in phosphates and agricultural nutrients, alongside UM6P’s cutting-edge research capabilities, Bidra brings a unique perspective to water technology investment that few funds can match.

The fund’s investment thesis centers on identifying and accelerating technologies that address the critical challenges where agriculture, industry, and water intersect. Rather than viewing these sectors in isolation, Bidra recognizes their fundamental interconnectedness in driving sustainable development. This systems-thinking approach enables the fund to identify solutions that create cascading positive impacts across multiple domains.

Bidra’s strategic positioning reflects a deep understanding that the future of water technology lies not in siloed solutions, but in integrated approaches that consider the entire water cycle. The fund specifically targets innovations that can demonstrate measurable impacts in water efficiency, quality improvement, or circular economy applications while delivering clear economic benefits to end users.

Drawing from how to mitigate 4 shades of water risk through impact investing, Bidra’s investment philosophy emphasizes technologies that can scale rapidly while maintaining robust environmental and social governance standards. The fund’s substantial $250M capacity allows it to provide not just capital, but also the strategic support and industry connections that early-stage companies need to accelerate their path to market.

Crucially, Bidra’s vision extends beyond traditional venture returns. The fund seeks to catalyze a transformation in how water resources are managed across sectors, with a particular focus on solutions that can be deployed in water-stressed regions. This approach aligns with both the urgent need for water security and the growing market opportunity in water technology innovation.

By leveraging OCP Group’s global presence and UM6P’s research capabilities, Bidra can provide portfolio companies with unique advantages including access to testing facilities, pilot opportunities, and potential customer relationships. This operational support model distinguishes Bidra from traditional venture capital funds and positions it as a strategic partner in accelerating water technology adoption.

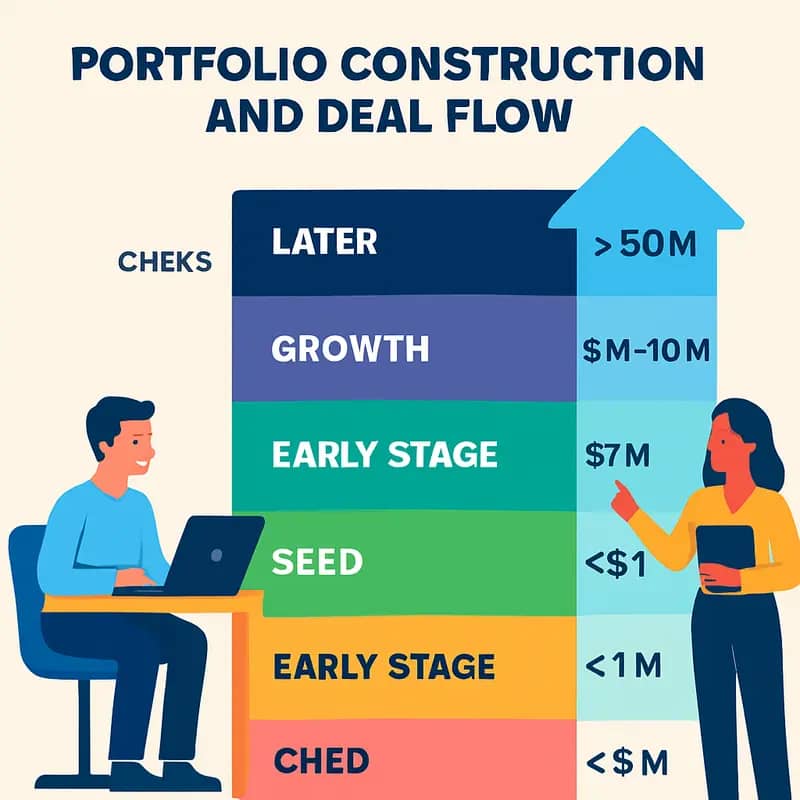

Portfolio Construction and Deal Flow

Bidra Innovation Ventures employs a disciplined yet flexible investment strategy across early and growth stages, focusing primarily on Series A and B rounds while maintaining selective seed-stage participation. The fund’s typical check sizes range from $5 million to $10+ million, allowing meaningful ownership stakes and the ability to lead or co-lead investment rounds.

In constructing its portfolio, Bidra takes a thesis-driven approach, actively seeking companies that align with its water technology focus while demonstrating strong commercial traction and scalable business models. For leading positions, the fund targets 15-25% ownership stakes, enabling significant influence on strategic direction while leaving room for follow-on investments in subsequent rounds.

The fund’s deal sourcing leverages deep industry networks across the water sector, including strategic partnerships with research institutions, accelerators, and corporate innovation teams. This multi-channel approach generates proprietary deal flow beyond traditional venture channels, particularly in identifying breakthrough technologies addressing critical water challenges.

A key differentiator in Bidra’s investment process is its technical due diligence capabilities, drawing on the expertise of OCP Group and UM6P’s research facilities to validate technology claims and market potential. This technical validation complements traditional venture metrics in deal evaluation.

Recent investments showcase Bidra’s strategic focus on transformative water technologies. For example, the fund led a $12 million Series A round in an advanced membrane technology company, demonstrating its commitment to innovations that can dramatically improve water treatment efficiency. In another case, Bidra participated in an $8 million seed extension round for a digital water management platform, highlighting its selective early-stage investing when breakthrough solutions emerge.

Bidra’s portfolio construction emphasizes building a balanced mix of technology risk and market maturity across investments. Approximately 60% of capital is allocated to growth-stage companies with proven commercial traction, while 40% targets earlier-stage opportunities with disruptive potential. This balanced approach helps manage risk while maintaining exposure to potentially transformative innovations.

The fund maintains dry powder for follow-on investments, typically reserving 40-50% of its capital for supporting portfolio companies through their growth journey. This reserve strategy ensures Bidra can continue supporting its most promising investments through multiple rounds, maintaining meaningful ownership positions as companies scale.

Water Technology Focus Areas

Bidra Innovation Ventures has strategically positioned its $250M fund across four key water technology domains that address critical industry challenges while capitalizing on emerging opportunities for transformation and growth.

In industrial water management, Bidra targets technologies that optimize water usage in manufacturing, mining, and processing operations. The focus is on closed-loop systems that maximize water recycling and resource recovery while minimizing discharge. Advanced separation technologies, real-time monitoring solutions, and smart control systems that reduce operational costs while improving environmental compliance are priorities.

Within the agricultural sector, Bidra invests in precision irrigation technologies and data-driven farming solutions that boost water use efficiency. This includes soil moisture sensors, weather analytics platforms, and automated irrigation controls that help farmers optimize water application. The fund also supports innovations in water treatment and reuse specific to agricultural applications, recognizing that agriculture accounts for 70% of global freshwater withdrawals.

Digital water solutions represent another key investment theme, with Bidra backing companies developing AI-enabled analytics, IoT sensor networks, and cloud-based platforms that enable smarter water infrastructure management. These technologies help utilities and industrial operators detect leaks, predict equipment failures, optimize treatment processes, and make data-driven decisions about system maintenance and upgrades.

Decentralized and distributed treatment technologies round out Bidra’s investment focus areas. The fund recognizes that centralized infrastructure alone cannot meet growing water demands sustainably. Small-scale, modular treatment systems that can be deployed at the point of need show tremendous promise for improving water access and quality in underserved communities while reducing infrastructure costs.

Across these themes, Bidra prioritizes solutions that demonstrate clear paths to commercialization, strong intellectual property protection, and the potential for significant environmental and social impact alongside financial returns. The fund’s deep domain expertise in water technology allows it to evaluate technical risks and market opportunities while helping portfolio companies accelerate their path to scale.

Value-Add and Strategic Advantages

Bidra Innovation Ventures leverages a powerful combination of industrial expertise and research capabilities to accelerate portfolio companies’ growth and market access. Through its strategic partnership with OCP Group, one of the world’s largest phosphate mining and fertilizer producers, Bidra provides water technology startups with unparalleled opportunities to validate and scale their solutions across diverse industrial applications.

OCP’s extensive industrial footprint spans multiple continents, offering portfolio companies real-world testing environments and commercial deployment opportunities. This industrial validation serves as a powerful proof point for water technology companies seeking to demonstrate their solutions’ effectiveness at scale. The group’s deep expertise in water-intensive processes also helps startups refine their technologies to meet the exacting requirements of industrial customers.

Meanwhile, Mohammed VI Polytechnic University (UM6P) provides cutting-edge research facilities and scientific expertise to support technology development and optimization. The university’s water research centers offer specialized equipment and analytical capabilities that would be cost-prohibitive for early-stage companies to access independently. This research partnership enables startups to accelerate their R&D timelines and strengthen their technical foundations.

Bidra’s global network extends well beyond North Africa, with strong connections across North America and Asia. Portfolio companies can tap into these relationships to establish commercial partnerships, distribution channels, and market entry strategies tailored to regional needs. The fund’s presence in multiple geographies also provides valuable market intelligence and regulatory insights to guide expansion plans.

Perhaps most importantly, Bidra takes an active role in helping portfolio companies navigate the complex stakeholder landscape in different markets. Drawing from extensive experience in water innovation commercialization, the fund’s team provides hands-on support in developing go-to-market strategies, building customer relationships, and structuring commercial agreements.

This comprehensive support ecosystem sets Bidra apart from traditional financial investors. Beyond capital, portfolio companies gain access to industrial pilot sites, research facilities, domain expertise, and global networks – resources that can dramatically accelerate their path to commercial success and market leadership. The fund’s ability to bridge the gap between innovation and real-world implementation addresses a critical need in the water technology sector.

The Bidra Difference: More Than Just Capital

Bidra Innovation Ventures stands apart in the water technology investment landscape through its distinctive approach that transcends traditional venture capital. While the $250M fund provides crucial financial backing, it’s the firm’s comprehensive support ecosystem that truly differentiates its model.

At the core of Bidra’s methodology lies deep water industry expertise integrated across every investment decision and portfolio interaction. The investment team combines decades of operational experience in water utilities, agricultural water management, and industrial water treatment – bringing practical insights that help portfolio companies navigate complex regulatory frameworks and industry-specific challenges.

This expertise manifests in Bidra’s hands-on strategic support, which encompasses everything from technical validation to market entry strategy. Portfolio companies gain access to Bidra’s extensive network of water industry veterans, potential customers, and strategic partners. This network proves invaluable for startups seeking to validate their technologies and establish crucial pilot projects – often the make-or-break point for water tech innovations.

Bidra’s technical due diligence process exemplifies their differentiated approach. Beyond standard financial metrics, the team conducts comprehensive technical assessments leveraging their deep domain knowledge. This allows them to identify truly transformative technologies while helping innovators refine their solutions for real-world applications.

Perhaps most critically, Bidra takes a long-term view that aligns with the natural development cycles of water technology. Unlike traditional VCs seeking quick exits, Bidra understands that water innovations often require extended periods for testing, regulatory approval, and market acceptance. This patient capital approach, combined with active support throughout the commercialization journey, creates an environment where breakthrough water technologies can flourish.

The firm has also pioneered a collaborative model that breaks down traditional silos between startups, utilities, and industrial players. Through carefully orchestrated partnerships, Bidra helps portfolio companies access real-world testing environments and initial customers while helping established players benefit from cutting-edge innovation. This virtuous cycle accelerates both technology development and market adoption.

As explored in a recent analysis of impact investing approaches, Bidra’s model demonstrates how specialized expertise combined with patient capital can drive meaningful innovation in complex sectors like water technology. The firm’s holistic approach ensures that promising water technologies don’t just receive funding, but also gain the strategic support needed to achieve widespread implementation and lasting impact.

Portfolio Power: Success Stories in Water Innovation

Bidra Innovation Ventures’ portfolio companies exemplify how strategic investment paired with deep industry expertise can accelerate water technology adoption and impact. Through careful selection and hands-on support, several portfolio companies have achieved remarkable breakthroughs in addressing critical water challenges.

One standout success emerged in agricultural water efficiency. A portfolio company developed smart irrigation technology that reduced water consumption by 40% while increasing crop yields by 25% across pilot deployments. Their system combines soil moisture sensors, weather data, and machine learning to deliver precise irrigation scheduling. After Bidra’s investment and strategic guidance, they expanded from initial trials on 500 acres to over 50,000 acres within 18 months.

In the industrial sector, another Bidra-backed company revolutionized wastewater treatment for manufacturing facilities. Their novel electrochemical process removes complex contaminants while consuming 60% less energy than conventional methods. The technology earned rapid adoption among semiconductor manufacturers, where it enables water reuse rates above 90%. This pioneering approach mirrors insights shared about innovation pathways in water treatment.

Municipal infrastructure has also seen transformation through Bidra’s portfolio. One company developed AI-powered leak detection technology that helps utilities reduce water losses and extend infrastructure life. Their smart sensors and predictive analytics platform identified over $50 million in preventable water losses across early customer deployments. The solution now monitors thousands of miles of pipeline infrastructure globally.

Beyond individual company successes, Bidra’s portfolio demonstrates powerful synergies. Companies frequently collaborate on integrated solutions, amplifying their collective impact. For instance, the smart irrigation technology now incorporates water quality monitoring from another portfolio company, while the industrial treatment system leverages AI capabilities from a third.

These successes stem from Bidra’s comprehensive support model. Beyond capital, portfolio companies receive extensive operational guidance, customer introductions, and technical validation support. This hands-on approach has helped companies overcome common scaling challenges in the water sector, from lengthy sales cycles to complex regulatory requirements.

The portfolio’s impact extends beyond commercial success. Collectively, Bidra-backed companies have enabled the conservation of over 50 billion gallons of water annually while improving water quality for millions of people. This demonstrates how strategic investment in water innovation can deliver both strong financial returns and meaningful environmental impact.

Investment Thesis: Where Impact Meets Returns

Bidra Innovation Ventures’ investment approach rests on a fundamental belief: solving water challenges can generate both meaningful environmental impact and attractive financial returns. The fund’s thesis emerges from a deep understanding of water technology’s unique position at the intersection of urgent global needs and market opportunities.

At the core of Bidra’s strategy lies a rigorous evaluation framework that weighs multiple dimensions of potential investments. The fund prioritizes technologies addressing critical water challenges across three key verticals: agricultural water efficiency, industrial water treatment, and sustainable water infrastructure. Within these spaces, Bidra seeks solutions that demonstrate clear pathways to both environmental benefits and commercial success.

The evaluation process begins with impact assessment. Bidra analyzes metrics like water savings potential, energy efficiency improvements, and pollution reduction capabilities. However, the fund recognizes that environmental benefits alone don’t ensure business viability. Their methodology, as discussed in how to mitigate 4 shades of water risk through impact investing, carefully examines market dynamics, regulatory drivers, and competitive advantages.

Bidra’s investment criteria emphasize scalable technologies with proven pilot results and clear paths to widespread adoption. The fund looks for solutions that can demonstrate tangible cost advantages or performance improvements over existing approaches. This focus on practical implementation helps ensure that environmental benefits can be achieved sustainably through market mechanisms rather than relying solely on subsidies or regulatory mandates.

Particularly notable is Bidra’s emphasis on team capabilities and market timing. The fund seeks entrepreneurs who combine deep technical expertise with commercial acumen. They recognize that successful water technology commercialization requires navigating complex stakeholder relationships, from utilities and regulators to industrial end-users.

Risk management features prominently in Bidra’s approach. The fund maintains a balanced portfolio across development stages and technology types. Early-stage investments in breakthrough technologies are complemented by growth-stage funding for proven solutions ready for market expansion. This diversification helps manage technology risk while maintaining exposure to potentially transformative innovations.

Bidra’s investment thesis also recognizes the growing importance of data and digital solutions in the water sector. The fund actively seeks opportunities where smart technology can optimize water management, predict maintenance needs, or enable new business models. This digital overlay often provides additional paths to value creation beyond core water technology improvements.

Ultimately, Bidra’s approach demonstrates that environmental impact and financial returns need not be mutually exclusive. Their thesis shows how careful selection criteria, deep sector expertise, and strategic support can help water technology companies scale solutions that benefit both shareholders and the planet.

The Future of Water Tech Investment

Water technology investment stands at an unprecedented inflection point. Climate pressures, population growth, and aging infrastructure create urgent demand for innovative solutions. Yet the path forward requires careful navigation of emerging trends and strategic positioning.

Bidra Innovation Ventures recognizes that successful water tech deployment increasingly depends on scalable digital solutions. Machine learning and AI capabilities are becoming essential for optimizing treatment processes, predicting maintenance needs, and managing distributed water systems. The fund actively seeks startups leveraging these technologies while maintaining a focus on tangible impact metrics.

Another critical trend reshaping the sector is the convergence of water management with renewable energy and circular economy principles. Forward-thinking portfolio companies are developing solutions that not only treat water but also recover valuable resources and generate clean energy. This integrated approach strengthens both environmental and financial outcomes.

Regulatory evolution also heavily influences investment strategy. Stricter standards around contaminants like PFAS, along with expanded reporting requirements, create opportunities for innovative monitoring and treatment technologies. Bidra’s due diligence process specifically evaluates how potential investments align with and anticipate regulatory trajectories.

Perhaps most significantly, the economic incentives driving water reuse adoption are fundamentally shifting. Water scarcity and rising costs make recycling and reuse increasingly attractive across industrial, agricultural, and municipal applications. This creates fertile ground for technologies that enable cost-effective, reliable water reclamation.

To address these trends, Bidra employs a multi-pronged approach. The fund maintains deep technical expertise to evaluate emerging solutions while leveraging partnerships with utilities, corporations, and research institutions to accelerate adoption. Portfolio companies receive support in navigating regulatory requirements, accessing pilot opportunities, and building customer relationships.

Critically, Bidra recognizes that technology alone cannot solve water challenges. The fund emphasizes solutions that consider implementation constraints, operational realities, and stakeholder dynamics. This includes evaluating business models that can overcome traditional adoption barriers and scale effectively.

Looking ahead, Bidra anticipates growing opportunities in integrated water management platforms, advanced materials for treatment and recovery, and distributed smart infrastructure. The fund’s investment thesis continues evolving to capture emerging opportunities while maintaining focus on proven approaches that can deliver both environmental and financial returns.

Final words

As water challenges intensify globally, Bidra Innovation Ventures stands out as a uniquely positioned investor equipped to accelerate the next generation of water technology solutions. Their $250 million fund size, combined with the industrial might of OCP Group and the research capabilities of UM6P, creates a powerful platform for scaling water innovations. The fund’s focus on the nexus of agriculture, industry, and sustainability, coupled with their ability to deploy significant capital across stages, makes them a compelling partner for ambitious water technology entrepreneurs. For impact investors seeking co-investment opportunities in water, Bidra’s strategic approach to portfolio construction and value-add capabilities warrant serious attention. As they continue building their portfolio, their influence on shaping the future of water technology innovation, particularly in critical areas like industrial water management and agricultural efficiency, is likely to grow substantially.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!