From its headquarters in Silicon Valley’s tech corridor, Heuristic Capital is quietly reshaping the landscape of water technology investment. With a $34 million fund and a laser focus on early-stage innovation, this venture firm has positioned itself at the intersection of pioneering water solutions and sustainable returns. Their approach combines rigorous technical analysis with a profound understanding of water industry dynamics, enabling them to identify and nurture breakthrough technologies that address our most pressing water challenges. As both entrepreneurs and investors increasingly recognize water tech as a critical frontier for innovation and impact, Heuristic Capital’s strategic vision offers valuable insights into how smart capital can accelerate the development of tomorrow’s water solutions.

Heuristic Capital is part of my Ultimate Water Investor Database, check it out!

Investor Name: Heuristic Capital

Investor Type: VC

Latest Fund Size: $34 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: PFAS, digital twins, decentralized treatment

Investment History: $5228571.43 spent over 2 deals

Often Invests Along:

Already Invested In: Larq, WaterBit

Leads or Follows: Lead

Board Seat Appetite: Unknown

Key People: Michael Liao

Strategic Investment Philosophy

Heuristic Capital’s investment approach reflects a deep understanding that the water sector requires patient capital combined with rapid innovation. The firm’s strategy centers on making targeted pre-seed and seed investments of $100,000 to $400,000 in water technology companies that demonstrate both compelling financial potential and meaningful environmental impact.

At the core of their philosophy lies the recognition that water challenges present a unique opportunity where financial returns and positive impact are inherently aligned. Rather than viewing these as competing objectives, Heuristic Capital seeks companies whose business models create value precisely by solving critical water issues.

Their investment criteria follow a systematic framework that evaluates potential portfolio companies across three key dimensions. First, they assess the technology’s potential for scalable impact – specifically looking for solutions that can meaningfully address water scarcity, quality, or infrastructure challenges. Second, they analyze the business model’s capacity to generate sustainable revenues while maintaining competitive advantages. Third, they evaluate the team’s technical expertise and entrepreneurial capabilities.

The relatively modest ticket sizes enable Heuristic to maintain a diversified portfolio while still providing meaningful support to early-stage companies. This approach acknowledges the capital-efficient nature of many water technology startups, where initial funding needs often focus on product development and market validation rather than capital-intensive infrastructure.

Critically, Heuristic Capital has developed specialized due diligence processes that account for the water sector’s unique characteristics. Their evaluation methods incorporate detailed technical assessments, regulatory compliance reviews, and market adoption timelines that are specific to water technologies. This specialized approach helps mitigate risks while identifying truly promising opportunities.

The firm takes an active investment stance, working closely with portfolio companies to accelerate their path to market. This hands-on approach includes connecting startups with potential customers, helping navigate regulatory requirements, and providing strategic guidance on business development. This level of involvement reflects their understanding that success in the water sector requires more than just capital – it demands deep industry expertise and strong networks.

As explored in their approach to impact investing in water technologies, Heuristic Capital’s investment philosophy represents a new model for driving innovation in the water sector – one that harmonizes financial returns with lasting environmental impact through strategic early-stage investments.

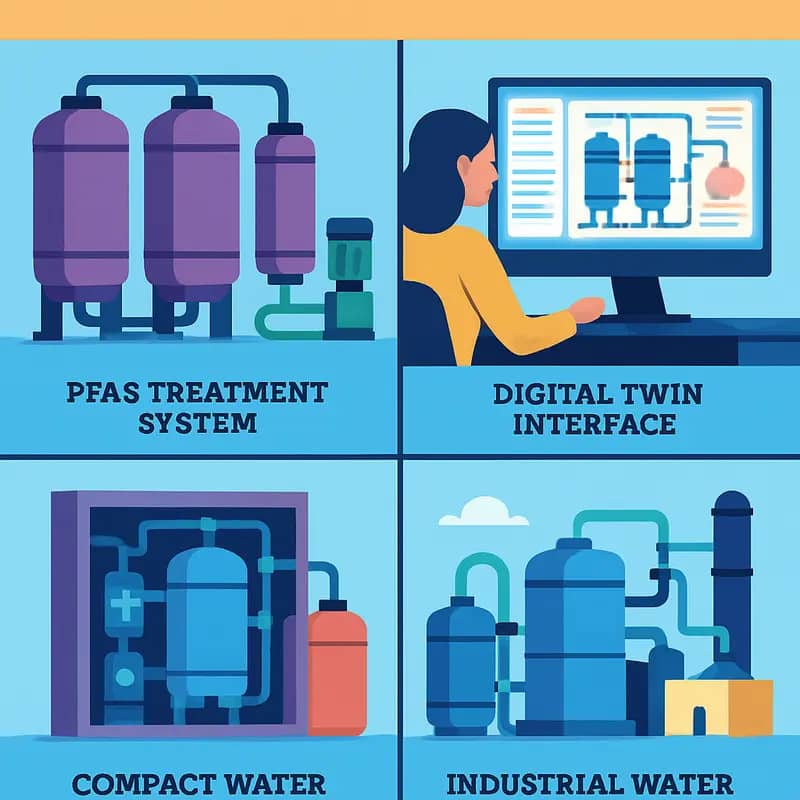

Water Technology Focus Areas

Heuristic Capital’s investment thesis centers on four transformative water technology domains that address critical environmental and infrastructure challenges. At the forefront is PFAS remediation technology, targeting the persistent “forever chemicals” contaminating water supplies worldwide. The market for PFAS treatment solutions is projected to reach $17.5 billion by 2025, driven by stricter regulations and growing public awareness. Heuristic seeks technologies that can destroy these compounds completely rather than just concentrating or transferring them.

Digital twin technology represents another key focus area, enabling utilities and industrial operators to create virtual replicas of their water infrastructure. These sophisticated simulation tools optimize operations, predict maintenance needs, and enhance resilience against climate impacts. The water digital twin market is expected to exceed $2 billion by 2026 as more facilities embrace data-driven decision making.

In the decentralized treatment space, Heuristic targets solutions that bring water and wastewater processing closer to the point of use or generation. This approach reduces infrastructure strain while enabling water reuse in water-stressed regions. Small-scale, modular systems allow rapid deployment and scaling to match demand growth. The decentralized water treatment market is growing at 10.5% annually as municipalities and industries seek flexible, sustainable solutions.

Industrial water reuse technologies form the fourth pillar of Heuristic’s investment focus. With manufacturing consuming 22% of global freshwater withdrawals, technologies enabling closed-loop water systems offer enormous environmental and economic benefits. Advanced membrane systems, electrochemical treatment methods, and resource recovery solutions help industries reduce freshwater demand while meeting discharge requirements. The industrial water reuse market is projected to reach $30 billion by 2027.

Across these focus areas, Heuristic prioritizes solutions that demonstrate commercial readiness, cost advantages over incumbent approaches, and measurable environmental impact metrics. The firm’s deep technical expertise in water treatment processes allows them to evaluate complex technologies and support founders in accelerating market adoption. By concentrating investments in these high-potential domains, Heuristic aims to generate both strong financial returns and meaningful contributions to water sustainability.

Portfolio Support Strategy

Heuristic Capital’s commitment to portfolio company success extends far beyond the initial investment, implementing a comprehensive support framework that maximizes each venture’s potential for growth and impact in the water technology sector.

At the core of this strategy lies active board participation, where Heuristic’s partners leverage their deep industry expertise and extensive networks to provide strategic guidance. This hands-on approach ensures portfolio companies benefit from decades of collective water sector experience while maintaining their entrepreneurial independence. The firm’s partners engage regularly in board meetings, offering critical insights on everything from product development to market entry strategies.

To support sustained growth, Heuristic maintains a substantial follow-on funding reserve ratio of 40-60%. This deliberate capital allocation strategy ensures the firm can continue supporting promising portfolio companies through subsequent funding rounds. This approach proves particularly valuable in the water sector, where commercialization timelines often extend beyond initial projections due to regulatory requirements and extended pilot phases.

Beyond financial support, Heuristic provides strategic guidance through several key channels. The firm facilitates connections between portfolio companies and potential customers, particularly among municipal utilities and industrial water users. This network effect creates valuable synergies, as solutions from different portfolio companies can often complement each other to address complex water challenges.

The firm’s strategic guidance extends to helping portfolio companies navigate the unique challenges of the water sector. This includes assistance with regulatory compliance, pilot project design, and developing go-to-market strategies that resonate with conservative water industry buyers. Drawing from their extensive experience in water technology commercialization, Heuristic’s team helps companies avoid common pitfalls while accelerating their path to market acceptance.

One distinctive aspect of Heuristic’s support strategy is its emphasis on collaboration between portfolio companies. Regular portfolio company summits and targeted introductions foster a collaborative ecosystem where companies can share learnings, explore potential partnerships, and leverage each other’s strengths. This approach has proven particularly effective in helping companies address the water sector’s complex, interconnected challenges.

As highlighted in a deep dive into venture capital dynamics in the water sector, this comprehensive support strategy reflects the unique requirements of building successful water technology companies. By combining active board participation, strategic capital reserves, and deep industry expertise, Heuristic creates an environment where innovative water solutions can thrive and scale.

Future Growth Trajectory

Heuristic Capital stands poised to accelerate its expansion across the water technology landscape through a methodically designed growth strategy. Building on their established portfolio support infrastructure, the firm is implementing an innovative co-investment framework that amplifies both capital deployment and impact potential.

The cornerstone of their growth trajectory lies in strategic geographic expansion. While maintaining their Silicon Valley headquarters as a hub for technology evaluation and deal sourcing, Heuristic Capital is establishing satellite offices in water-stressed regions across the American Southwest and Southeast. These regional anchors will enable deeper market understanding and stronger relationships with local water utilities, industrial users, and entrepreneurs developing location-specific solutions.

Heuristic’s co-investment approach represents a particularly promising avenue for scaling their influence. The firm has formalized partnerships with several established water industry strategics, family offices focused on sustainability, and infrastructure-focused private equity firms. These relationships allow Heuristic to participate in larger deals while leveraging the domain expertise and distribution channels of co-investors. The firm typically maintains a 25-40% ownership stake in co-invested deals, ensuring meaningful influence while spreading risk.

Looking ahead five years, Heuristic Capital aims to triple their assets under management while maintaining their focused investment thesis around water technology innovation. Rather than pursuing growth through strategy drift, they are deepening their expertise in core themes like smart water infrastructure, alternative water sources, and resource recovery. Their expansion plan anticipates launching dedicated investment vehicles for specific water technology verticals as deal flow and market opportunities mature.

Measuring and scaling impact remains central to Heuristic’s growth vision. The firm is developing a proprietary impact measurement framework that tracks key water conservation, quality, and access metrics across their portfolio. This data-driven approach to impact assessment will help optimize capital allocation toward the highest-potential solutions while providing transparency to limited partners.

Heuristic’s meticulous focus on how to take mid-market green tech companies to the next level has positioned them to capitalize on the expanding opportunity set in water technology. By maintaining investment discipline while thoughtfully scaling their platform, they aim to generate both compelling returns and measurable progress toward water sustainability. The firm’s growth trajectory suggests they will emerge as an increasingly influential force in shaping the future of water innovation.

The Technical Edge in Water Investment

At the core of Heuristic Capital’s investment philosophy lies an unparalleled technical understanding that sets them apart in the water technology venture space. Their team combines deep engineering expertise with practical industry experience, enabling them to evaluate water technologies with exceptional precision and foresight.

The firm’s technical evaluation framework dissects potential investments across multiple dimensions. They examine not just the theoretical validity of new technologies, but their practical scalability, energy efficiency, and integration potential within existing water infrastructure. This comprehensive technical assessment helps identify truly transformative solutions while filtering out incremental improvements masquerading as breakthroughs.

Heuristic’s technical edge manifests in their ability to spot technological convergence opportunities. By understanding the intersections between water treatment, digital solutions, and emerging fields like artificial intelligence and advanced materials, they can identify innovations that leverage multiple technology trends. This cross-disciplinary perspective often reveals investment opportunities others miss.

Beyond pure technical analysis, the firm excels at evaluating the broader implementation context. They assess factors like regulatory compliance pathways, supply chain resilience, and operational maintenance requirements that can make or break a water technology’s real-world success. This practical lens helps ensure their portfolio companies don’t just offer elegant technical solutions, but viable business propositions.

The firm’s technical credibility also strengthens their position as value-add investors. Portfolio companies benefit from Heuristic’s deep technical network and their ability to provide meaningful input on technology development and scaling strategies. This hands-on technical support often proves crucial in helping startups overcome the unique challenges of commercializing water technologies.

Perhaps most importantly, Heuristic’s technical foundation enables them to take calculated risks on early-stage technologies. Their ability to independently validate technical claims and assess development pathways allows them to back promising innovations when they’re still unproven in the market. This approach, discussed further in “What do you need to know to invest wisely in water technologies?”, has positioned them to capture outsized returns as these technologies mature.

Their technical excellence also informs their portfolio construction strategy. By deeply understanding technology development timelines and risks, they can build complementary portfolios that balance near-term commercialization opportunities with longer-term breakthrough potential. This technical-driven portfolio approach helps maintain consistent returns while pursuing transformative impact in the water sector.

Building the Water Innovation Pipeline

Heuristic Capital’s approach to discovering and nurturing water technology startups reflects a carefully orchestrated system designed to maximize both entrepreneurial success and investment returns. The firm’s methodology centers on creating an environment where innovative water technologies can thrive while maintaining rigorous due diligence standards.

At the heart of their discovery process lies a unique network of technical experts, industry veterans, and research institutions that serves as an early warning system for breakthrough technologies. This network allows Heuristic to identify promising innovations before they hit traditional venture capital radar screens. The firm has cultivated relationships with leading water research laboratories and universities, gaining privileged access to cutting-edge developments in water treatment, monitoring, and resource recovery.

Once potential investments are identified, Heuristic Capital employs a distinctive three-phase evaluation process. The initial screening focuses on technical validation, examining not just the core technology but its practical implementation potential. This approach, deeply rooted in their technical expertise discussed in the previous chapter, helps filter out solutions that may work in laboratories but face significant scaling challenges.

The second phase involves comprehensive market analysis and customer validation. Rather than relying solely on founders’ market projections, Heuristic actively engages potential end-users and industry stakeholders to verify market demand and implementation feasibility. This hands-on approach helps startups refine their value propositions and business models before significant capital deployment.

In the final phase, Heuristic Capital works closely with founding teams to develop robust commercialization strategies. This includes identifying pilot opportunities, establishing industry partnerships, and creating clear pathways to market adoption. The firm’s methodology mirrors successful approaches seen in other sectors, as explored in “The 10 Secrets to an Outstanding Innovation Culture That Boil Down to One”.

Critically, Heuristic Capital’s entrepreneur-friendly approach extends beyond initial investment. The firm maintains a dedicated team of operational experts who provide ongoing support in areas like regulatory compliance, supply chain optimization, and strategic partnerships. This hands-on involvement helps portfolio companies navigate the complex water industry landscape while maintaining focus on technical excellence and market execution.

The firm’s funding structure is equally innovative, offering flexible capital arrangements that align with the longer development cycles typical in water technology. Rather than forcing companies into traditional venture capital timelines, Heuristic works with founders to establish realistic milestones and funding schedules that support sustainable growth while protecting intellectual property and maintaining founder equity.

This systematic approach to building a water innovation pipeline has resulted in a portfolio of companies that not only advance technical solutions but also demonstrate clear paths to commercial success. As we’ll explore in the next chapter, this methodology directly contributes to meaningful impact metrics while generating attractive financial returns.

Impact Metrics that Matter

Heuristic Capital has pioneered a sophisticated dual-metric system that places equal weight on environmental impact and financial returns. This balanced scorecard approach represents a paradigm shift in water technology investment evaluation.

The firm’s environmental impact assessment framework examines three core dimensions. First, water conservation metrics track gallons saved through improved efficiency and reduced waste. Second, water quality improvements are measured through reductions in contaminant levels and compliance with regulatory standards. Third, energy efficiency gains are calculated as decreased power consumption and associated carbon emissions reductions.

On the financial side, Heuristic employs both traditional venture capital metrics and water industry-specific indicators. Beyond standard measures like IRR and cash-on-cash returns, they analyze water cost savings per installation, implementation timeframes, and total addressable market penetration rates. This multi-layered approach helps identify technologies that can scale profitably while delivering meaningful environmental benefits.

What sets their methodology apart is the integration of these metrics into a unified scoring system that guides investment decisions. Rather than treating environmental and financial outcomes as competing priorities, Heuristic’s framework reveals how they reinforce each other. Technologies that deliver superior environmental performance often translate into stronger financial returns through reduced operating costs and increased regulatory compliance.

The firm has also developed innovative ways to validate impact claims. They partner with independent water quality testing laboratories and environmental consultants to verify performance data. Real-time monitoring systems track key metrics across their portfolio companies’ installations. This empirical approach builds credibility with both investors and customers.

Most notably, Heuristic makes their impact measurement methodology openly available to portfolio companies and the broader water technology ecosystem. As discussed in a recent analysis of impact investing tactics, this transparency helps establish industry standards while accelerating the adoption of effective sustainability metrics.

The results speak for themselves – portfolio companies using this framework have collectively saved over 50 billion gallons of water while delivering above-market financial returns. This track record demonstrates that when properly measured and managed, environmental and economic value creation can advance hand in hand.

Heuristic continues refining their impact metrics as new sustainability challenges emerge. They recently added indicators for circular economy principles and climate resilience. This evolution ensures their measurement system remains relevant while pushing the water technology sector toward greater accountability and impact.

The Future of Water Technology Investment

Heuristic Capital envisions water technology investment evolving beyond traditional infrastructure plays into an integrated ecosystem of digital, biological, and physical solutions. By examining emerging trends and opportunities, we can map the trajectory of this critical sector.

At the forefront stands the convergence of artificial intelligence and sensor technologies, enabling predictive maintenance, real-time monitoring, and automated optimization of water systems. This fusion creates opportunities for investors to back companies developing smart infrastructure that can dramatically reduce water losses while improving operational efficiency. The potential for data-driven solutions to transform utility operations represents a pivotal shift in how we manage water resources.

Another key trend is the rise of nature-based solutions and biomimicry approaches. Technologies that harness natural processes for water treatment, flood management, and ecosystem restoration are gaining traction. These solutions often require less energy and chemical inputs while delivering multiple environmental benefits. As climate impacts intensify, investment opportunities in this space will likely expand significantly.

The circular economy presents another frontier, with technologies enabling water reuse, resource recovery, and waste valorization becoming increasingly viable. Innovations in membrane technology, advanced oxidation, and biological treatment processes are making it possible to extract value from wastewater while reducing environmental impact. This alignment of environmental and economic benefits creates compelling investment cases.

Perhaps most significantly, we’re witnessing the emergence of integrated water management platforms that combine multiple technologies to address complex challenges. These solutions often incorporate elements of digitalization, advanced materials, and biological processes to deliver comprehensive water management capabilities. The ability to package multiple innovations into scalable solutions represents a particularly promising investment avenue.

Critically, successful investment in this evolving landscape requires a deep understanding of both technological capabilities and market dynamics. The most promising opportunities often lie at the intersection of proven technologies and emerging needs, where solutions can be rapidly scaled to address pressing water challenges while generating attractive returns.

As highlighted in recent analysis of venture capital dynamics in water technology, the sector demands patient capital combined with strategic support to help companies navigate complex regulatory environments and long sales cycles. This reality shapes investment strategies, favoring approaches that balance innovation with practical implementation pathways.

The future of water technology investment will increasingly focus on solutions that can demonstrate measurable impact while scaling efficiently. Success will require not just identifying promising technologies, but also understanding how they fit within broader water management systems and regulatory frameworks.

Final words

Heuristic Capital stands at the forefront of a critical evolution in water technology investment, where sophisticated technical understanding meets strategic capital deployment. Their focused approach to early-stage investment, coupled with a deep commitment to hands-on portfolio support, creates a powerful model for accelerating water innovation. The firm’s strategic balance of financial returns with meaningful impact positions them uniquely in the water technology ecosystem. As water challenges grow more complex and urgent, Heuristic Capital’s investment thesis – targeting breakthrough technologies with scalable solutions – becomes increasingly relevant. Their success in navigating this space offers valuable lessons for both entrepreneurs and fellow investors in the water sector. The future of water technology investment will likely follow many of the pathways Heuristic Capital is pioneering today, making them a key player to watch in the ongoing development of sustainable water solutions.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!