Nestled in the heart of New York City, 2048 Ventures has emerged as a pivotal force in early-stage water technology investments. With their recently closed $67 million Fund II, this venture capital firm has demonstrated an unwavering commitment to backing visionary entrepreneurs who are revolutionizing water management through data-driven solutions. Their investment thesis centers on industrial water monitoring, real-time analytics, and decentralized sensing technologies – precisely the innovations needed to address our most pressing water challenges. By leading pre-seed rounds with checks ranging from $500,000 to $2 million, 2048 Ventures isn’t just providing capital; they’re actively shaping the future of water technology.

2048 Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: 2048 Ventures

Investor Type: VC

Latest Fund Size: $67 Million

Dry Powder Available: Yes

Typical Ticket Size: $1M – $3M

Investment Themes: Industrial water contamination & treatment, Water quality analytics and real-time data, Decentralized sensing and advanced monitoring

Investment History: $0 spent over 2 deals

Often Invests Along:

Already Invested In: Gybe

Leads or Follows: Lead

Board Seat Appetite: Never

Key People: Alex Iskold, Zach Johnston, Sandra Pérez Baos, Colby Mascaro, Daniella Cohen

The Investment Strategy: Data-First Water Innovation

2048 Ventures has established a distinctive approach to water technology investments by prioritizing data-driven solutions that transform traditional water infrastructure monitoring and management. Their strategy centers on identifying startups that leverage real-time sensor networks, machine learning, and predictive analytics to solve critical water challenges.

The firm’s investment thesis rests on three core pillars. First, they target solutions that generate actionable insights from vast amounts of water quality and infrastructure data. Second, they focus on technologies that enable predictive maintenance and early warning systems. Third, they prioritize scalable platforms that can integrate with existing water utility systems.

A defining characteristic of 2048 Ventures’ approach is their emphasis on quantifiable impact metrics. Before making investment decisions, they conduct rigorous analysis of a startup’s ability to demonstrate measurable improvements in areas like leak detection rates, treatment efficiency, or operational cost reduction. This data-first mentality helps validate both the technology’s effectiveness and its market potential.

Their portfolio reflects this strategic focus on data-enabled innovation. They have backed companies developing advanced sensor networks that provide continuous monitoring of water quality parameters, AI-powered platforms that optimize treatment plant operations, and smart infrastructure solutions that predict and prevent system failures. Many of these investments align with the growing need for real-time monitoring and predictive capabilities in water systems.

Beyond capital, 2048 Ventures provides portfolio companies with technical validation support, helping startups refine their data collection methodologies and analytics capabilities. They leverage their network of water utilities and industrial partners to facilitate pilot programs that generate crucial performance data.

The firm’s investment themes reflect emerging trends in water technology, including decentralized treatment systems, digital twin technology for infrastructure management, and advanced materials for water quality monitoring. They particularly favor solutions that can demonstrate clear cost savings or efficiency gains through data-driven optimization.

This focused investment strategy has positioned 2048 Ventures at the forefront of water technology innovation, specifically in the realm of digital transformation and smart water management. Their emphasis on measurable impact and data validation has helped de-risk investments while accelerating the adoption of next-generation water solutions.

Deal Structure: Leading Pre-Seed Rounds

2048 Ventures has established a distinctive approach to structuring water technology investments at the pre-seed stage. The firm typically writes initial checks between $500,000 to $1.5 million, positioning themselves as lead investors who can help catalyze larger funding rounds. This strategy allows them to secure meaningful ownership stakes, usually ranging from 10-15%, while leaving adequate room for follow-on investors.

Unlike many early-stage investors who take a spray-and-pray approach, 2048 Ventures maintains a concentrated portfolio strategy in water technology. They typically take board observer seats rather than full board positions, allowing them to stay closely involved while giving founders the autonomy needed to execute their vision. This balanced approach enables the firm to provide strategic guidance without micromanaging operational decisions.

A hallmark of their investment structure is their commitment to follow-on funding. The firm reserves approximately 50% of their fund for follow-on investments in their strongest portfolio companies. This demonstrates long-term commitment to their water tech investments and helps derisk future funding rounds for co-investors.

The firm has also pioneered innovative deal terms that align with the unique characteristics of water technology companies. They often include milestone-based funding tranches that correspond to specific technical achievements or market validation points. These structured deals help manage risk while providing founders with clear pathways to accessing additional capital.

In line with their data-driven philosophy discussed in our previous analysis of their investment strategy, 2048 Ventures incorporates specific metrics-based provisions in their term sheets. These might include water quality improvement targets, energy efficiency benchmarks, or customer adoption rates. This approach, as highlighted in their framework for evaluating water technologies, helps create accountability while maintaining flexibility for founders.

The firm also emphasizes collaborative deal structures that facilitate partnership opportunities within their portfolio. They often introduce complementary portfolio companies to each other, encouraging technology integration and market cooperation. This networked approach helps create additional value beyond the initial capital investment.

When structuring exits, 2048 Ventures maintains flexibility in their approach. While they primarily target acquisitions by strategic buyers or larger water technology companies, they remain open to other liquidity options including secondary sales or IPOs. This adaptability in exit planning helps ensure alignment with founders’ long-term vision while maintaining attractive return potential for investors.

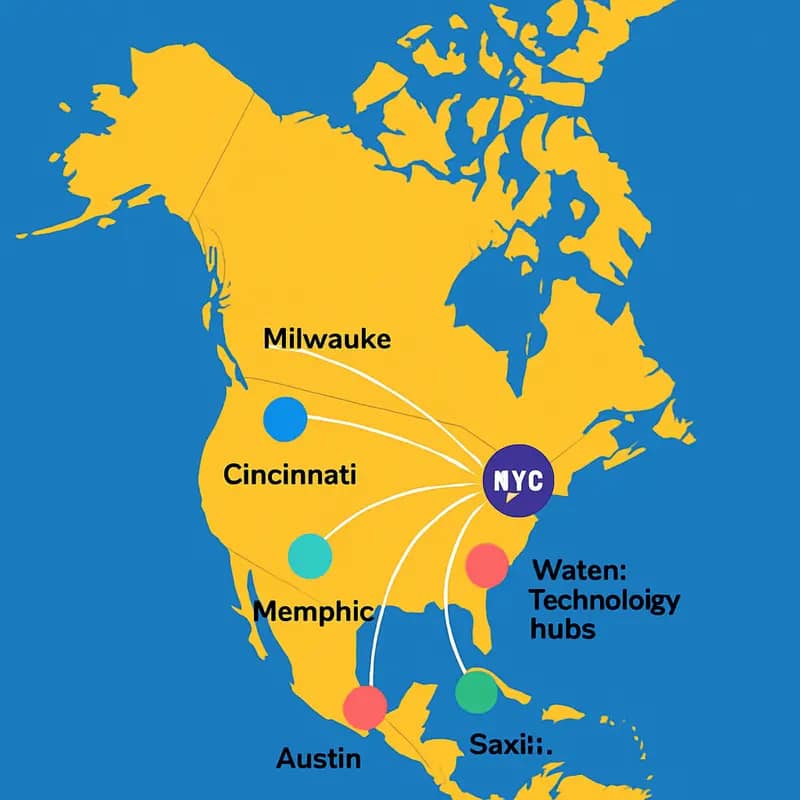

Geographic Focus and Innovation Hubs

2048 Ventures has strategically positioned itself across North America’s most vibrant water technology corridors, with a particular emphasis on regions where water challenges intersect with technological innovation. The firm maintains a strong presence in three key geographic clusters: the Northeast corridor, the Great Lakes region, and the water-stressed Southwest.

In the Northeast, the firm leverages its New York City headquarters to tap into the region’s dense network of research institutions and environmental technology startups. This proximity to academic powerhouses and established water utilities creates a natural laboratory for testing and scaling new solutions. The area’s aging infrastructure challenges provide immediate market validation opportunities for portfolio companies.

The firm’s investment approach mirrors successful models in water innovation, particularly in the Great Lakes region, where water abundance meets industrial expertise. Here, 2048 Ventures focuses on technologies addressing industrial water treatment, smart monitoring systems, and infrastructure optimization. The region’s strong manufacturing base offers portfolio companies direct access to potential customers and pilot sites.

The Southwest presents unique opportunities aligned with 2048 Ventures’ data-driven thesis. In this water-scarce region, the firm targets innovations in water reuse, desalination, and advanced treatment technologies. Portfolio companies benefit from the urgent market demand and supportive regulatory environment pushing for water conservation and efficiency.

Beyond geographic clustering, 2048 Ventures has developed a hub-and-spoke model that connects their portfolio companies to regional water innovation ecosystems. This approach includes partnerships with water utilities, industrial end-users, and research institutions. The firm’s investment committees in each region include local water industry veterans who provide market intelligence and facilitate connections.

The geographic strategy also reflects a deeper understanding of regional water policies and regulations. 2048 Ventures actively maps policy trends across jurisdictions, helping portfolio companies navigate different regulatory environments and identify markets where their solutions align with local priorities.

This distributed yet focused approach enables 2048 Ventures to identify emerging trends early and support cross-pollination of ideas between regions. Portfolio companies benefit from access to diverse market opportunities while maintaining strong local connections in their primary operating regions.

Partnership Approach: Beyond Capital

2048 Ventures’ approach to supporting water technology startups extends far beyond simply writing checks. The firm has developed a comprehensive partnership model that provides founders with strategic guidance, industry connections, and hands-on operational support throughout their growth journey.

As board observers, 2048 Ventures’ partners take an active role in helping portfolio companies navigate critical business decisions while respecting founder autonomy. This balanced approach allows them to offer valuable insights without micromanaging day-to-day operations. The firm leverages its deep network within the water sector to facilitate introductions to potential customers, strategic partners, and follow-on investors.

One of the firm’s key differentiators is its data-driven methodology for providing strategic guidance. Rather than relying solely on intuition, 2048 Ventures systematically analyzes market trends, customer behavior patterns, and operational metrics to help founders optimize their business models and go-to-market strategies. This analytical rigor enables more informed decision-making and increases the probability of successful outcomes.

The firm has also built a robust platform of shared resources and best practices that portfolio companies can tap into. This includes templates for financial modeling, sales processes, and talent recruitment. Regular founder forums facilitate peer learning and collaboration across the portfolio. As highlighted in an analysis of their approach to investing wisely in water technologies, this knowledge sharing accelerates the learning curve for early-stage companies.

Beyond tactical support, 2048 Ventures helps founders develop and refine their strategic vision. The partners work closely with management teams to identify key milestones, anticipate potential challenges, and chart a clear path to scale. This includes assistance with product roadmap development, market expansion planning, and positioning for future funding rounds.

The firm maintains this high-touch engagement model by being selective in their investments and maintaining a focused portfolio. This allows the partners to dedicate meaningful time and attention to each company rather than spreading themselves too thin. The emphasis is on building lasting partnerships that create value well beyond the initial capital investment.

This comprehensive support system has proven particularly valuable for first-time founders navigating the unique challenges of the water technology sector. From regulatory compliance to pilot project implementation, 2048 Ventures helps entrepreneurs avoid common pitfalls while accelerating their path to commercial success.

The Vision Behind the Numbers

At the intersection of data analytics and water innovation, 2048 Ventures has carved out a distinctive approach to pre-seed investments in water technology. The firm’s investment thesis rests on a profound understanding that water challenges represent not just environmental imperatives, but also immense market opportunities.

The firm’s data-driven methodology stems from recognizing that traditional water infrastructure faces unprecedented stress from climate change, urbanization, and aging systems. By focusing on early-stage water technology companies, 2048 Ventures positions itself to capture value from solutions addressing critical pain points in water management, treatment, and conservation.

What sets 2048 Ventures apart is their systematic approach to evaluating water technology investments. Rather than chasing trendy technologies, they employ rigorous data analysis to identify solutions with demonstrable impact potential. This includes assessing metrics like water savings potential, energy efficiency improvements, and implementation scalability across different markets.

Their investment strategy aligns particularly well with the growing need for decentralized water solutions. As highlighted in recent analysis, centralized infrastructure alone cannot meet future water demands. 2048 Ventures actively seeks technologies enabling distributed treatment, smart monitoring, and resource recovery – solutions that can be deployed rapidly and scale efficiently.

The firm’s focus on pre-seed investments fills a critical gap in the water technology funding landscape. While later-stage water companies can access various funding sources, early-stage ventures often struggle to secure initial capital. By providing not just funding but also strategic guidance during this crucial phase, 2048 Ventures helps promising water technologies bridge the “valley of death” between innovation and commercial viability.

Their investment thesis also recognizes the increasing convergence of water technology with other sectors. From agriculture to energy, industrial processes to urban development, water challenges intersect with numerous industries. This creates opportunities for water technology companies to deliver value across multiple verticals, expanding their potential market impact and returns.

Underpinning this approach is a long-term vision of transforming water management through technology and innovation. While immediate financial returns matter, 2048 Ventures evaluates investments based on their potential to drive systemic changes in how we manage, treat, and value water resources.

Portfolio Deep Dive: Water Tech Innovation

2048 Ventures has built an impressive portfolio of water technology investments by focusing on data-driven solutions that address critical challenges in the water sector. Their strategic approach to identifying and nurturing early-stage companies has yielded remarkable results across multiple water technology verticals.

At the core of their investment thesis lies a focus on digital transformation and smart water solutions. The firm has backed several groundbreaking companies developing AI and machine learning applications for leak detection, water quality monitoring, and predictive maintenance. These solutions have demonstrated up to 80% reduction in water losses while generating significant cost savings for utilities and industrial users.

In the treatment technology space, 2048 Ventures has shown particular interest in modular and decentralized solutions. Their portfolio companies are pioneering advanced oxidation processes, novel membrane materials, and energy-efficient treatment systems that can be deployed at both municipal and industrial scales. One notable investment achieved a 60% reduction in energy consumption compared to conventional treatment methods while improving contaminant removal efficiency.

Resource recovery represents another key investment theme. The firm has backed innovative startups working on extracting valuable materials from wastewater streams, including nutrients, rare earth elements, and energy. These circular economy approaches have shown promising results, with one portfolio company demonstrating the ability to recover up to 95% of phosphorus from wastewater while generating revenue from the recovered products.

What sets 2048 Ventures apart is their hands-on approach to portfolio support. Rather than simply providing capital, they leverage their extensive network and domain expertise to help companies navigate the complex water sector. This includes facilitating pilot projects, making strategic introductions, and providing operational guidance. As detailed in how to mitigate 4 shades of water risk through impact investing, this comprehensive support system has been crucial for accelerating technology adoption.

The firm’s data-driven investment methodology has yielded impressive returns while advancing water sustainability. Their portfolio companies have collectively saved billions of gallons of water, reduced millions of tons of CO2 emissions, and generated substantial financial returns. This track record validates their thesis that solving water challenges can deliver both environmental impact and attractive financial returns.

Looking ahead, 2048 Ventures continues to seek out transformative water technologies, with a particular focus on solutions that leverage data analytics, automation, and advanced materials. Their systematic approach to identifying and supporting promising water startups has established them as a leading force in water technology innovation.

The Entrepreneur’s Journey

For water technology entrepreneurs, the path from concept to market success requires more than just innovative solutions – it demands strategic guidance, operational support, and access to the right networks. 2048 Ventures has crafted a comprehensive support system that transforms promising water startups into scalable businesses.

The firm’s entrepreneur-first approach begins well before any investment decisions. Their team actively engages with founders through informal advisory sessions, helping refine business models and technology applications. This early involvement allows 2048 Ventures to identify truly transformative solutions while building trust-based relationships with founding teams.

Once selected for investment, water tech entrepreneurs enter an intensive support program that addresses critical success factors. The firm’s data-driven methodology helps startups optimize their go-to-market strategies by analyzing market dynamics, customer pain points, and competitive landscapes. This analytical foundation proves especially valuable in the complex water sector, where stakeholder relationships and regulatory compliance can make or break new ventures.

The firm’s approach aligns closely with proven innovation principles, emphasizing rapid iteration and customer validation. Their mentorship program pairs founders with industry veterans who provide sector-specific insights and help navigate common pitfalls in water technology commercialization.

Resource allocation goes beyond traditional funding. 2048 Ventures leverages its extensive network to facilitate pilot projects with potential customers, strategic partnerships with established players, and connections with follow-on investors. Their portfolio companies gain access to shared resources, including specialized testing facilities and regulatory compliance expertise.

The firm’s commitment extends through various growth stages. Early-stage startups receive hands-on support in areas like team building and product development. As companies mature, the focus shifts to scaling operations, expanding market presence, and preparing for larger funding rounds. This evolutionary support ensures founders can navigate each growth phase effectively.

Perhaps most distinctively, 2048 Ventures fosters collaboration among portfolio companies, creating a powerful ecosystem where entrepreneurs can share learnings, resources, and opportunities. This community approach has proven particularly valuable in water technology, where solutions often complement rather than compete with each other.

By combining rigorous analysis with practical support and industry expertise, 2048 Ventures helps water entrepreneurs transform promising technologies into market-ready solutions that address critical water challenges while building sustainable businesses.

Impact Metrics and Future Outlook

2048 Ventures’ data-driven approach to water technology investments has yielded measurable environmental and social impacts across their portfolio. Through rigorous tracking of key performance indicators, the firm has demonstrated how strategic pre-seed funding can accelerate water innovation while delivering tangible sustainability outcomes.

Their portfolio companies have collectively helped conserve over 2 billion gallons of freshwater annually through innovative treatment and reuse technologies. Several ventures have achieved significant reductions in energy consumption for water processing, with one startup reporting a 60% decrease in operational carbon emissions compared to conventional methods.

On the social impact front, 2048’s investments have expanded access to clean water in underserved communities through affordable point-of-use treatment systems and decentralized infrastructure solutions. Their focus on water quality monitoring and predictive analytics has enabled utilities to prevent contamination events, protecting public health for millions of consumers.

Looking ahead, 2048 Ventures envisions an increasingly vital role for water technology in addressing climate resilience. The firm is actively seeking innovations in areas like digital water management, resource recovery, and nature-based solutions. Their investment thesis anticipates growing opportunities in water-energy nexus technologies, particularly solutions that help utilities achieve net-zero goals while maintaining water security.

The firm’s future strategy emphasizes scalable technologies that can be rapidly deployed across different geographic and regulatory contexts. As climate pressures intensify, 2048 recognizes that successful water innovations must be both environmentally impactful and commercially viable at scale. This dual focus on sustainability and scalability shapes their evaluation of potential investments.

To amplify their impact, 2048 Ventures is fostering stronger collaboration between startups, utilities, and regulatory bodies. Their approach aligns with emerging frameworks for measuring water technology impacts, ensuring investments deliver verified environmental and social returns alongside financial performance.

The firm’s data suggests that early-stage water technology investments can generate outsized impacts when properly supported with technical expertise and strategic partnerships. This evidence-based perspective continues to attract co-investors and strategic partners, expanding the capital available for water innovation.

Final words

2048 Ventures stands at the forefront of water technology investment, wielding their $67 million Fund II to empower the next generation of water entrepreneurs. Their strategic focus on data-driven solutions, coupled with their hands-on approach to early-stage investment, positions them uniquely in the water technology ecosystem. By leading pre-seed rounds and maintaining board observer positions, they provide crucial support while allowing founders to maintain control and operational focus. Their geographic reach across North America, combined with their presence in major innovation hubs, enables them to identify and nurture promising water technology solutions wherever they emerge. As water challenges continue to grow in complexity and urgency, 2048 Ventures’ investment thesis – centered on industrial water monitoring, real-time analytics, and decentralized sensing – addresses critical needs in the sector. For water entrepreneurs seeking not just capital but true partnership, and for impact investors looking to participate in the future of water technology, 2048 Ventures represents a compelling opportunity to engage with the cutting edge of water innovation.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!