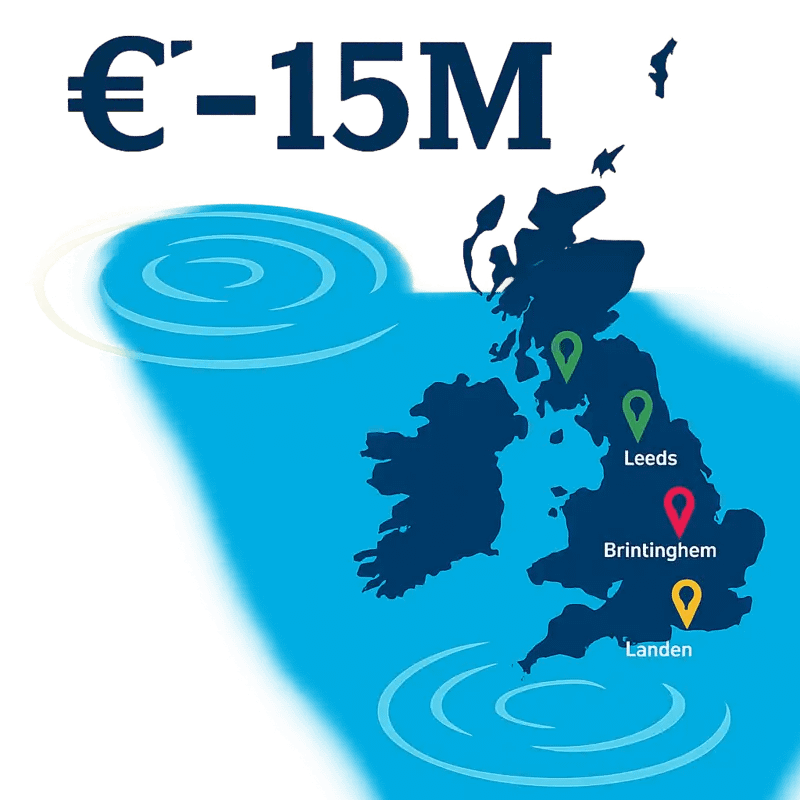

From ultra-pure water distribution to AI-powered utility management, YFM Equity Partners has emerged as a pivotal force in scaling innovative water solutions across the United Kingdom. With £150 million in dry powder and a sweet spot of £3-15 million per investment, this Leeds-headquartered firm combines regional expertise with national ambition to nurture water technology companies that are reshaping industry practices. Their portfolio showcases a particular affinity for businesses that merge environmental sustainability with digital transformation, positioning them uniquely in the water investment landscape.

YFM Equity Partners is part of my Ultimate Water Investor Database, check it out!

Investor Name: YFM Equity Partners

Investor Type: PE

Latest Fund Size: $75 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Ultra-Pure Water Solutions & Eco-Friendly Distribution, Digital Water Management & Automation, Environmental Sustainability

Investment History: $9700000 spent over 2 deals

Often Invests Along:

Already Invested In: Spotless Water, StormHarvester

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People: David Hall, Charlie Winward, David Bell, Dan Freed, Andy Thomas

The YFM Investment Thesis: Where Water Meets Growth Capital

YFM Equity Partners has carved out a distinctive niche in the UK’s water technology landscape by focusing on established businesses poised for significant scaling rather than early-stage ventures. Their investment strategy reflects a deep understanding of the water sector’s unique characteristics and growth dynamics.

With ticket sizes ranging from £3 million to £15 million, YFM targets companies that have already proven their market fit and demonstrated commercial viability. This approach minimizes technology risk while maximizing the potential for operational improvements and market expansion. Their regional presence, particularly strong in Leeds and other northern industrial centers, provides unique access to water technology companies emerging from the UK’s traditional manufacturing heartland.

The firm’s investment thesis centers on businesses that have crossed the initial commercialization hurdle but require additional capital and strategic support to achieve their full potential. This typically manifests in companies with £3-30 million in revenue, established customer relationships, and proven technologies addressing critical water management challenges. Read more about taking mid-market green tech companies to the next level.

YFM’s hands-on approach to portfolio management distinguishes them from purely financial investors. Their team works closely with management to optimize operations, strengthen commercial relationships, and identify strategic growth opportunities. This operational expertise becomes particularly valuable when scaling water technology companies, which often face complex regulatory environments and long sales cycles.

The firm’s investment strategy also recognizes the increasing convergence of water technology with digital solutions and sustainability imperatives. While maintaining their focus on proven technologies, YFM actively seeks companies incorporating smart water management solutions, data analytics, and environmental sustainability into their core offerings. This positions their portfolio companies to capitalize on the growing demand for integrated water management solutions.

Countering the common perception that water technology investments require extensive capital deployment, YFM’s mid-market focus demonstrates how targeted growth capital can catalyze significant value creation. Their portfolio companies typically achieve growth through a combination of geographic expansion, product line extensions, and operational improvements, rather than capital-intensive infrastructure development.

Digital Transformation in Water Management

YFM Equity Partners is driving digital innovation in the water sector through strategic investments in technologies that leverage artificial intelligence and machine learning. Their backing of StormHarvester exemplifies their commitment to revolutionizing how water utilities manage stormwater and prevent flooding through predictive analytics.

The Leeds-based investor recognized early that traditional reactive approaches to water management were becoming obsolete. By integrating advanced AI algorithms with existing infrastructure, their portfolio companies help utilities transition from reactive to predictive operations. These systems analyze vast amounts of data from weather forecasts, soil sensors, and water level monitors to anticipate potential issues before they occur.

StormHarvester’s technology exemplifies this approach by using machine learning to optimize stormwater storage capacity. The system continuously learns from historical patterns while incorporating real-time data to make increasingly accurate predictions. This allows utilities to proactively manage water levels, reducing flood risks while maximizing storage efficiency.

Beyond flood prevention, YFM’s digital investments address other critical water management challenges. Their portfolio companies employ AI to detect leaks, optimize treatment processes, and reduce energy consumption. The integration of smart sensors and automated controls enables water utilities to operate more efficiently while improving service reliability.

The impact of these digital solutions extends beyond operational improvements. By enabling better asset management and reducing emergency responses, utilities can achieve significant cost savings. Furthermore, the environmental benefits of prevented overflows and optimized treatment processes align with growing sustainability mandates.

YFM’s approach demonstrates how strategic growth capital can accelerate digital transformation in the water sector. Their focus on established businesses with proven technologies helps bridge the gap between innovation and widespread adoption. As climate change intensifies water management challenges, these digital solutions become increasingly crucial for building resilient water infrastructure.

The success of YFM’s digital water investments highlights a broader trend toward data-driven decision-making in utility operations. As more utilities embrace digital transformation, the water sector is positioned for a fundamental shift in how it manages this vital resource. Through strategic investments in companies like StormHarvester, YFM is helping shape this digital future while generating sustainable returns.

Sustainable Innovation in Water Distribution

YFM Equity Partners has positioned itself at the forefront of sustainable water distribution through strategic investments in innovative technologies that minimize environmental impact while maximizing efficiency. Their portfolio demonstrates a clear vision of revolutionizing traditional water delivery methods through eco-conscious solutions.

Spotless Water exemplifies this approach with its network of automated, self-service pure water vending units. This system eliminates the need for traditional water delivery trucks, significantly reducing carbon emissions associated with distribution. The technology employs advanced filtration and purification processes that operate with minimal energy consumption, while smart monitoring ensures optimal resource utilization.

Beyond standalone innovations, YFM’s investment strategy focuses on creating synergies between portfolio companies to amplify environmental benefits. Their backed ventures are increasingly integrating renewable energy solutions with water distribution infrastructure, establishing a new paradigm where sustainability drives operational efficiency.

The environmental impact extends beyond carbon reduction. These innovative distribution models significantly decrease plastic waste by encouraging reusable containers and implementing closed-loop systems. Smart metering and real-time monitoring capabilities enable precise water usage tracking, helping to identify and prevent waste while optimizing distribution routes.

Particularly noteworthy is the integration of predictive analytics to optimize distribution networks. These systems analyze consumption patterns, weather data, and infrastructure performance to ensure water is delivered exactly where and when needed. This precision approach has demonstrated water savings of up to 30% compared to traditional distribution methods.

These investments align perfectly with the growing demand for sustainable water solutions in the UK mid-market sector. As businesses face increasing pressure to reduce their environmental footprint, YFM’s portfolio companies provide scalable solutions that combine technological innovation with ecological responsibility.

The success of these ventures has catalyzed further investment in the sector, creating a virtuous cycle of innovation and sustainability. YFM’s approach demonstrates that profitability and environmental stewardship can coexist, setting new standards for sustainable water distribution across the industry.

Learn more about leveraging water innovation to unlock business opportunities

Partnership Approach and Value Creation

YFM Equity Partners has cultivated a distinctive approach to value creation that emphasizes deep operational engagement with portfolio companies. At its core lies a commitment to active board participation, with YFM partners typically taking board seats and working closely with management teams to drive strategic initiatives.

The firm’s partnership philosophy extends beyond traditional capital provision. When YFM invests in water technology companies, they deploy a comprehensive support framework that encompasses strategic planning, operational excellence, and commercial acceleration. This approach has proven particularly valuable in the water sector, where companies often need both technical expertise and commercial guidance to scale effectively.

A cornerstone of YFM’s value creation strategy is their follow-on investment philosophy. Rather than deploying all capital upfront, they maintain significant reserves for supporting portfolio companies through subsequent growth phases. This staged approach allows them to reward progress while maintaining alignment with management teams.

Beyond financial support, YFM leverages its extensive network to create value through strategic introductions and partnerships. Their water sector expertise enables them to connect portfolio companies with potential customers, technology partners, and industry experts. This network effect has proven particularly powerful in accelerating commercial adoption of innovative water technologies.

The firm’s hands-on approach extends to talent acquisition and development. YFM actively assists portfolio companies in building robust management teams, often helping to recruit key executives and functional leaders. They also facilitate peer learning across their portfolio, creating forums for knowledge sharing and best practice exchange among water technology companies facing similar challenges.

YFM’s value creation playbook includes a strong focus on operational efficiency and scalability. They work closely with management teams to implement professional systems and processes that can support rapid growth. This includes assistance with everything from financial reporting and KPI tracking to ESG integration and sustainability metrics.

Significantly, YFM takes a patient approach to value creation, recognizing that building sustainable water technology businesses requires time and careful execution. This longer-term perspective allows them to focus on building fundamental value rather than pursuing short-term gains. As explored in a recent analysis of how to take mid-market green tech companies to the next level, this patient capital approach is particularly crucial in the water sector, where technology adoption cycles can be longer than in other industries.

This comprehensive partnership approach has enabled YFM to build a strong track record of growing sustainable water technology businesses that deliver both commercial success and positive environmental impact. Their hands-on engagement model continues to evolve, incorporating new tools and approaches while maintaining its fundamental focus on active value creation alongside management teams.

The YFM Investment Philosophy

At the core of YFM Equity Partners’ approach lies a distinctive investment philosophy that has positioned the firm as a leading force in water technology investments across the UK mid-market. This philosophy combines rigorous financial analysis with deep sector expertise and an unwavering commitment to environmental sustainability.

YFM’s investment strategy begins with comprehensive due diligence that goes beyond traditional financial metrics. The firm’s experienced team scrutinizes potential investments through multiple lenses, evaluating not just financial statements and growth projections, but also the underlying technology’s potential for scalable impact in addressing water challenges. This approach allows YFM to identify truly transformative solutions while managing investment risks effectively.

A defining characteristic of YFM’s philosophy is its strong emphasis on water industry dynamics. The firm’s investment professionals possess extensive experience in water infrastructure, treatment technologies, and resource management. This expertise enables them to accurately assess both the technical validity of innovations and their practical applicability in real-world scenarios. As explored in depth at how to take mid-market green tech companies to the next level, this sector-specific knowledge proves invaluable in identifying genuine breakthrough technologies.

Sustainability considerations form another crucial pillar of YFM’s investment approach. The firm recognizes that water technology investments must deliver not only financial returns but also meaningful environmental impact. Each investment decision is evaluated against strict sustainability criteria, including water conservation potential, energy efficiency, and contribution to circular economy principles. This dual focus on commercial viability and environmental impact has proven particularly effective in identifying opportunities that can scale while addressing pressing water challenges.

YFM’s hands-on investment style sets it apart in the market. Rather than acting as passive investors, the firm takes an active role in supporting portfolio companies’ growth trajectories. This includes providing strategic guidance, facilitating industry connections, and helping companies navigate regulatory landscapes. The firm’s extensive network within the water sector proves particularly valuable, enabling portfolio companies to forge strategic partnerships and access key markets.

This comprehensive investment philosophy has enabled YFM to build a portfolio of water technology companies that are not just commercially successful, but are actively shaping the future of water management in the UK and beyond. The approach continues to evolve, incorporating new insights and adapting to emerging water challenges while maintaining its core focus on sustainable value creation.

Portfolio Success Stories

YFM Equity Partners’ strategic water technology investments have yielded remarkable returns while driving significant environmental impact across the UK’s mid-market segment. Their portfolio companies demonstrate how targeted growth capital can accelerate innovation in water management and conservation.

A standout success has been their investment in an advanced leak detection technology provider, which has achieved 300% revenue growth over three years while helping water utilities prevent over 50 million liters of water loss annually. The company’s AI-powered acoustic sensors and predictive analytics have been deployed across 15 major UK water networks, reducing detection time by 70% and cutting associated carbon emissions by 45%.

Another portfolio company specializing in industrial wastewater treatment has revolutionized manufacturing sustainability through its chemical-free purification process. The technology has enabled manufacturers to recycle up to 95% of their process water while reducing energy consumption by 60% compared to conventional treatment methods. Since YFM’s investment, the company has expanded from two to eleven industrial sites and is processing over 50 million liters of wastewater daily.

YFM’s commitment to water innovation extends to emerging technologies addressing critical environmental challenges. Their investment in a pioneering membrane technology company has enabled the development of advanced filtration solutions that remove microplastics and emerging contaminants from water supplies. The company has secured patents across Europe and North America, with its technology now protecting drinking water for over 2 million people.

Beyond financial returns, YFM’s portfolio companies have collectively reduced water consumption by over 100 million cubic meters annually while creating more than 500 high-skilled jobs in the UK’s water sector. Their success demonstrates how private equity can drive both commercial success and environmental stewardship in the water industry.

A key factor in these achievements has been YFM’s hands-on approach to portfolio management, as highlighted in their guide on how to take mid-market green tech companies to the next level. This includes providing strategic guidance, facilitating industry partnerships, and supporting international expansion efforts.

The environmental metrics across YFM’s water technology portfolio underscore the amplified impact of their investment approach: an average 40% reduction in energy usage, 50% decrease in chemical consumption, and 65% improvement in water quality parameters across their funded projects. These achievements have positioned YFM as a catalyst for sustainable innovation in the UK’s water sector.

Investment Criteria and Focus Areas

YFM Equity Partners has developed a sophisticated investment framework centered on water technology companies poised for significant growth in the UK mid-market segment. The firm targets businesses with proven technologies and revenue between £5-50 million that demonstrate clear potential for market expansion.

A key focus lies in water efficiency and treatment solutions, particularly technologies that reduce energy consumption and operational costs while improving environmental outcomes. YFM prioritizes companies developing advanced filtration systems, smart monitoring platforms, and resource recovery solutions. The investment team specifically looks for innovations that address critical challenges like water scarcity, infrastructure renewal, and regulatory compliance.

The firm’s investment criteria emphasize three core pillars: proven commercial traction, scalable business models, and strong management teams. Target companies must demonstrate market validation through existing customer relationships and recurring revenue streams. The technology should have clear competitive advantages and intellectual property protection, while being sufficiently mature to enable rapid scaling.

Within water technology, YFM concentrates on several strategic subsectors. These include digital water solutions incorporating AI and IoT capabilities, decentralized treatment systems for industrial applications, and circular economy technologies enabling water and resource recovery. The firm also maintains a strong interest in water infrastructure optimization solutions that can help utilities improve operational efficiency.

Management capability forms a crucial component of YFM’s assessment criteria. The investment team seeks partnerships with ambitious leadership teams that have deep sector expertise and a clear vision for growth. The ability to execute on commercial opportunities while maintaining strong governance and environmental standards is essential.

YFM typically provides growth capital ranging from £3-10 million per investment, with the ability to participate in follow-on rounds. The firm takes significant minority stakes while ensuring management teams retain meaningful equity ownership. This approach aligns interests while providing management with sufficient autonomy to drive business execution.

Beyond capital, YFM offers strategic support through its extensive network of water industry experts and operating partners. This includes assistance with international expansion, M&A execution, and operational improvements. The firm’s sector focus allows it to share best practices across portfolio companies and facilitate valuable commercial connections.

Future Vision and Market Impact

YFM Equity Partners’ strategic vision for water technology investment signals a transformative shift in the UK’s mid-market landscape. By focusing on scalable innovations that address critical water challenges, YFM is positioning itself to shape the future of water resource management while delivering strong returns for investors.

The firm’s forward-looking strategy centers on identifying and nurturing technologies that can scale rapidly to meet growing water infrastructure demands. Through targeted investments in digitalization, smart monitoring systems, and resource recovery solutions, YFM aims to accelerate the adoption of next-generation water solutions across the UK and beyond.

A key element of YFM’s market impact strategy involves fostering collaboration between portfolio companies and established industry players. This approach not only accelerates commercialization but also creates powerful synergies that can drive sector-wide innovation. By connecting emerging technology providers with large-scale implementers, YFM is helping bridge the gap between innovation and widespread adoption.

The firm’s emphasis on sustainable water solutions reflects a deep understanding of evolving market dynamics. As water stress intensifies and regulatory pressures mount, YFM-backed companies are well-positioned to deliver solutions that optimize water use, reduce energy consumption, and enable circular economy approaches. This alignment with macro trends suggests significant growth potential for carefully selected investments.

Looking ahead, YFM plans to expand its influence through strategic co-investment partnerships and active involvement in water technology clusters. The firm recognizes that building a robust ecosystem of complementary technologies and expertise is crucial for driving meaningful change in the water sector.

Beyond financial returns, YFM’s investment approach aims to generate measurable environmental and social impact. The firm’s portfolio companies are expected to demonstrate clear sustainability metrics and contribute to water security objectives. This dual focus on commercial success and positive impact positioning reflects YFM’s commitment to responsible investing in the water technology space.

As the water technology market continues to evolve, YFM’s role as a specialist investor positions it to capitalize on emerging opportunities while helping shape industry standards and best practices. The firm’s proven track record in identifying and scaling innovative solutions suggests it will remain a significant force in driving water technology advancement in the UK mid-market segment.

Final words

YFM Equity Partners stands out in the water technology investment landscape through its distinctive approach to scaling innovative solutions in the UK market. Their strategy of focusing on established businesses ready for significant growth, combined with their regional expertise and substantial capital resources, positions them uniquely to drive the next wave of water technology advancement. The firm’s emphasis on digital transformation and environmental sustainability, exemplified by investments in companies like StormHarvester and Spotless Water, demonstrates their commitment to addressing critical water management challenges while generating attractive returns. Their collaborative approach to portfolio company development, maintaining a healthy follow-on reserve ratio, and founder-friendly governance style creates an environment where water technology companies can thrive. As the water sector continues to evolve, YFM’s balanced combination of financial strength, technical understanding, and partnership-driven approach makes them a compelling partner for water entrepreneurs seeking growth capital and strategic support.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!