From the pristine lakes of Switzerland emerges a venture capital force that’s redefining early-stage investment in water technology. Wingman Ventures, recently rebranded as Founderful, has positioned itself as a pioneering investor in breakthrough water treatment solutions, particularly targeting complex challenges like PFAS contamination and micropollutant elimination. With an $85 million first close of Fund II and sights set on $120 million, this Zürich-based VC combines the precision of Swiss engineering with bold entrepreneurial vision. Their approach goes beyond mere capital injection – they’re architecting a new model of early-stage investment that prioritizes founder success while tackling some of water’s most pressing challenges.

Wingman Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Wingman Ventures

Investor Type: VC

Latest Fund Size: $85 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: PFAS, micropollutant elimination, industrial wastewater treatment

Investment History: $2300000 spent over 2 deals

Often Invests Along:

Already Invested In: CyanoGuard AG, Oxyle AG

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People: Alex Stöckl

The Evolution of a Water Tech Powerhouse

From its inception, Wingman Ventures has charted an ambitious course in the Swiss venture capital landscape, with a particular focus that would prove prescient: water technology innovation. The firm’s evolution mirrors the growing recognition of water tech as a critical investment sector, especially as global water challenges become increasingly urgent.

Wingman’s transformation began with a clear vision to support early-stage startups, but it was their strategic pivot toward water technology that truly set them apart. As climate change and water scarcity emerged as defining challenges of our era, Wingman positioned itself at the intersection of technological innovation and environmental sustainability.

The firm’s rebranding to Founderful marked more than just a name change – it signaled a maturation in their investment approach and a deepening commitment to their chosen sectors. This evolution coincided with remarkable fund growth, expanding from an initial $85 million to a targeted $120 million. This growth reflects both investor confidence and the expanding opportunities in water technology.

Wingman’s success in scaling its fund size can be attributed to several factors. Their early recognition of water technology’s potential has been validated by market developments and increasing institutional interest in sustainable investments. The firm has demonstrated particular skill in identifying promising water tech innovations at their earliest stages, where their capital and expertise can have the most significant impact.

Crucially, the firm has maintained its focus on supporting founders through more than just capital injection. Their hands-on approach to portfolio company development has created a virtuous cycle, where successful exits have enhanced their ability to attract both promising startups and additional investment capital. This commitment to founder support aligns perfectly with the water sector’s unique challenges, where technological innovation must be paired with practical implementation expertise to succeed.

As described in ‘What do you need to know to invest wisely in water technologies?’, the water sector demands investors who understand its specific dynamics and challenges. Wingman has positioned itself as exactly this type of specialized investor, combining deep sector knowledge with venture capital expertise.

The firm’s evolution from a traditional venture capital outfit to a water tech powerhouse reflects broader changes in the investment landscape. As environmental, social, and governance (ESG) factors become increasingly central to investment decisions, Wingman’s early focus on water technology has proved remarkably forward-thinking. Their growth trajectory suggests that their thesis about the critical importance of water technology innovation was not just correct but perhaps even conservative in its outlook.

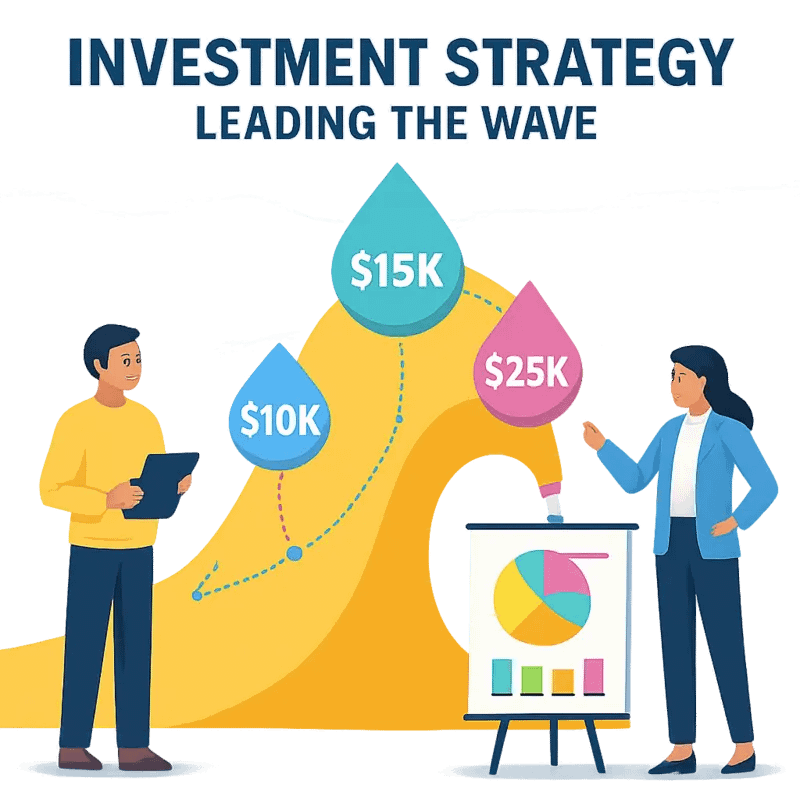

Investment Strategy: Leading the Wave

Wingman Ventures has carved out a distinctive position in the water technology investment landscape through a focused and methodical approach to early-stage funding. The firm’s investment thesis centers on being the first institutional investor in breakthrough water technologies, with typical ticket sizes ranging from $1-2 million in pre-seed and seed rounds.

This strategic positioning as a lead investor allows Wingman to play a pivotal role in shaping portfolio companies from their earliest stages. Rather than following other investors, the firm takes an active stance in deal structuring and company building. Their approach involves comprehensive due diligence that evaluates not just the technology’s potential, but also its practical applicability in solving critical water challenges.

The firm’s careful calibration of investment size reflects a deep understanding of early-stage water technology companies’ capital needs. A $1-2 million investment provides sufficient runway for startups to achieve crucial development milestones without over-diluting founders or creating unsustainable burn rates. This funding quantum has proven particularly effective for water technology ventures, where development cycles often require careful balance between technical validation and market testing.

Wingman’s focus on the pre-seed and seed stages reflects a deliberate strategy to capture maximum value creation potential. By establishing early relationships with promising water technology pioneers, the firm can help shape development pathways and commercial strategies when companies are most receptive to strategic guidance. This early-stage focus also allows them to support founders through critical early decisions about technology development, market entry strategies, and team building.

The firm’s investment approach emphasizes hands-on involvement beyond capital deployment. Their team works closely with portfolio companies to accelerate development timelines, forge industry partnerships, and navigate the unique challenges of commercializing water technologies. This active engagement model has proven particularly valuable in the water sector, where market adoption often requires carefully orchestrated collaboration between multiple stakeholders.

Beyond individual investments, Wingman’s strategy creates network effects across their portfolio. Early-stage companies benefit from shared learnings, potential collaboration opportunities, and access to a growing ecosystem of water technology innovators. This network-centric approach helps de-risk individual investments while accelerating the overall pace of innovation in the water sector.

Portfolio Deep Dive: Water Innovation Focus

Wingman Ventures’ commitment to revolutionizing water technology shines brightest through their strategic investment in pollution treatment solutions, particularly targeting emerging contaminants that pose unprecedented challenges to water quality and human health.

Their portfolio centerpiece, Oxyle, exemplifies Wingman’s thesis of backing transformative technologies in the water space. The startup has developed a groundbreaking approach to eliminating persistent organic pollutants and PFAS compounds through advanced electrochemical oxidation. What sets their technology apart is its ability to achieve complete degradation of these “forever chemicals” while consuming significantly less energy than conventional treatment methods.

This investment highlights Wingman’s keen understanding of market dynamics in the water sector. With PFAS regulations tightening globally and conventional treatment methods proving inadequate, the demand for innovative destruction technologies has skyrocketed. Rather than pursuing incremental improvements, Wingman backed a solution that fundamentally reimagines the treatment process.

Beyond PFAS, Wingman’s portfolio demonstrates a systematic approach to addressing various water contamination challenges. Their investments span technologies targeting industrial wastewater treatment, micropollutant elimination, and advanced oxidation processes. This diversified yet focused strategy reflects their deep understanding that water quality challenges require multiple complementary solutions rather than a single silver bullet.

Wingman’s hands-on investment approach has proven particularly valuable in the water technology space, where the path from laboratory breakthrough to commercial deployment often proves challenging. Their team works closely with portfolio companies to accelerate market validation, forge industry partnerships, and navigate the complex regulatory landscape surrounding water treatment technologies.

The venture firm’s success in water technology investments stems from their ability to identify solutions that balance technical innovation with practical applicability. For deeper insights into effective water technology investment strategies, explore our analysis of what investors need to know about water technologies.

Wingman’s portfolio companies consistently demonstrate strong intellectual property positions, clear paths to scalability, and the potential for significant environmental impact. This approach has positioned them as a crucial player in advancing next-generation water treatment solutions, particularly in addressing emerging contaminants that traditional methods struggle to handle effectively.

Future Flow: What’s Next for Wingman

Wingman Ventures stands at an inflection point in Switzerland’s water technology landscape. Building on their successful investments in breakthrough water treatment solutions, the firm is charting an ambitious course to amplify their impact across Europe’s water innovation ecosystem.

Their vision centers on three key pillars that will shape their investment strategy in the coming years. First, Wingman aims to double down on technologies addressing emerging contaminants and micropollutants. Their experience with advanced treatment solutions has revealed vast untapped potential in this space, particularly as regulations tighten globally.

Second, the firm is expanding its focus on water infrastructure digitalization. Recognizing that aging water systems need more than physical upgrades, Wingman is actively seeking startups developing AI-powered solutions for predictive maintenance, real-time monitoring, and automated optimization. As explored in how to cleverly embrace the digital craze in the water industry, this digital transformation represents a crucial evolution for the sector.

Third, Wingman is strengthening its role as an ecosystem builder. Beyond capital deployment, they’re creating platforms for collaboration between startups, utilities, and industrial partners. This includes launching a dedicated water technology accelerator program and fostering partnerships with research institutions across Switzerland.

The firm’s expanding geographical reach reflects their growing ambition. While maintaining their Swiss roots, Wingman is extending their investment scope to promising water technology startups across German-speaking Europe. This strategic expansion leverages Switzerland’s position as a water innovation hub while tapping into broader European expertise and markets.

Critically, Wingman recognizes that successful water innovation requires patient capital and deep sector expertise. They’re structuring longer investment horizons that accommodate the unique development cycles of water technologies. Their team is also growing, bringing in technical experts who can provide hands-on support to portfolio companies navigating complex regulatory and market dynamics.

Looking ahead, Wingman envisions catalyzing a new wave of water technology commercialization. Their approach combines financial support with strategic guidance, helping startups bridge the notorious valley of death between innovation and market adoption. By fostering these connections and providing targeted support, Wingman aims to accelerate the deployment of critical water solutions across Europe and beyond.

The Wingman Philosophy: Beyond Traditional VC

At the heart of Wingman Ventures’ distinctive approach lies a philosophy that transcends conventional venture capital paradigms, particularly when it comes to water technology innovation. While many VCs focus solely on financial returns, Wingman has cultivated a holistic investment methodology that recognizes the intricate relationship between technological advancement, environmental impact, and sustainable business growth.

A cornerstone of this innovative approach to water sector investments is Wingman’s emphasis on founder-centric partnerships. Rather than viewing investments as mere financial transactions, the firm positions itself as a genuine collaborator in the entrepreneurial journey. This manifests through hands-on involvement that extends far beyond capital injection – from strategic guidance to operational support.

Wingman’s investment thesis is built on three fundamental pillars: scientific credibility, market viability, and scalable impact. The firm demonstrates remarkable patience in nurturing early-stage water technology ventures, understanding that breakthrough innovations in water treatment, conservation, and resource recovery often require longer development cycles than traditional software startups.

What truly sets Wingman apart is its commitment to building resilient companies rather than chasing quick exits. The firm actively encourages its portfolio companies to establish robust foundations through strategic partnerships, rigorous pilot programs, and comprehensive validation processes. This methodical approach helps startups navigate the complex regulatory landscape and lengthy adoption cycles characteristic of the water sector.

The firm has also pioneered an innovative risk-sharing model that aligns interests between investors and entrepreneurs. By structuring investments with flexible milestones and providing follow-on funding tied to specific technical and commercial achievements, Wingman creates a supportive environment that enables founders to focus on long-term value creation rather than short-term metrics.

Moreover, Wingman leverages its deep roots in the Swiss innovation ecosystem to facilitate connections between startups and established industry players. This network effect amplifies the impact of individual investments and accelerates the path to market for promising water technologies. The firm’s strong ties to research institutions, industry partners, and public sector stakeholders create a powerful platform for collaboration and knowledge exchange.

This philosophical foundation positions Wingman not just as a capital provider, but as a catalyst for transformative change in the water technology landscape. By combining patient capital with deep sector expertise and a collaborative mindset, the firm is helping to build the next generation of water technology leaders while addressing some of our most pressing environmental challenges.

Technical Excellence Meets Market Vision

At the intersection of cutting-edge water technology and commercial viability lies Wingman Ventures’ distinct advantage. Through a carefully calibrated approach combining deep technical due diligence with sophisticated market analysis, Wingman has developed a unique methodology for identifying and nurturing water innovation that can truly scale.

The firm’s technical assessment framework goes far beyond traditional metrics. Their team of specialists evaluates not just the core technology, but its entire operational ecosystem – from energy requirements and maintenance needs to regulatory compliance and environmental impact. This comprehensive technical lens allows them to spot innovations that are both groundbreaking and practically implementable.

However, technical excellence alone doesn’t guarantee success. Drawing from their extensive network of industry veterans, Wingman overlays rigorous market intelligence to evaluate commercial potential. They analyze market size, competitive dynamics, and adoption barriers while pressure-testing business models against real-world constraints. This dual focus helps identify technologies that can deliver both environmental impact and financial returns.

What truly sets Wingman’s approach apart is their emphasis on collaboration between technical and commercial expertise. Rather than treating these as separate evaluation tracks, they facilitate ongoing dialogue between technical experts and market analysts throughout the due diligence process. This integrated approach helps surface critical insights about technology-market fit early in the evaluation process.

The firm has developed specialized frameworks for assessing technologies across different water industry segments – from water quality monitoring and treatment to resource recovery and digital solutions. These frameworks consider segment-specific factors like regulatory requirements, customer pain points, and adoption dynamics. This targeted approach allows them to evaluate opportunities within their proper context rather than applying one-size-fits-all criteria.

Significantly, Wingman’s technical and market assessment capabilities extend beyond initial investment decisions into active portfolio support. Their team works closely with founders to optimize technology development roadmaps based on market feedback and customer needs. This ongoing alignment between technical advancement and commercial opportunity has proven crucial for helping portfolio companies achieve sustainable growth.

The result is a proven ability to identify water technologies that are not just scientifically sound, but commercially viable and ready for scale. By combining technical rigor with market intelligence in this systematic way, Wingman has built a strong track record of backing innovations that deliver both environmental impact and financial returns.

The Founder Journey: From Concept to Scale

At the heart of Wingman Ventures’ success lies a methodical yet flexible approach to founder support, recognizing that each startup’s journey through the water technology landscape demands unique guidance. Rather than applying a one-size-fits-all formula, Wingman has developed an adaptive framework that evolves with founders’ changing needs.

Wingman’s engagement begins at the critical proof-of-concept stage, where technical validation intersects with market potential. Here, the firm’s deep water expertise proves invaluable in helping founders refine their technology while simultaneously identifying the most promising commercial applications. This approach mirrors successful models highlighted in ‘how to build the world leading water innovation accelerator’.

As startups progress to early commercialization, Wingman shifts focus to strategic customer acquisition and operational scaling. The firm’s extensive network becomes a powerful asset, connecting founders with potential pilot partners, key industry players, and fellow entrepreneurs who have navigated similar challenges. This collaborative ecosystem approach has proven particularly effective in accelerating market entry and validation.

Beyond financial backing, Wingman provides hands-on operational support in critical areas such as talent acquisition, regulatory compliance, and business model optimization. The firm’s partners regularly engage with founding teams, offering both strategic guidance and practical problem-solving support. This high-touch approach has helped portfolio companies avoid common pitfalls while accelerating their path to market.

One distinctive aspect of Wingman’s methodology is its emphasis on sustainable growth over rapid scaling. The firm encourages founders to build robust foundations – both technically and commercially – before pursuing aggressive expansion. This patient capital approach, while sometimes running counter to traditional venture capital timelines, has proven especially valuable in the water sector, where technology adoption cycles tend to be longer.

Wingman also places significant emphasis on helping founders build resilient organizations. This includes establishing strong governance structures, developing scalable processes, and creating cultures that can attract and retain top talent. The firm’s experience shows that these organizational elements often prove as critical to long-term success as the underlying technology.

As portfolio companies mature, Wingman assists in preparing for larger funding rounds, strategic partnerships, and eventual exits. The firm’s deep understanding of both water industry dynamics and venture capital requirements helps founders position their companies for optimal outcomes, whether through acquisition, public offering, or continued independent growth.

Building the Water Innovation Ecosystem

Wingman Ventures has established itself as a critical force in cultivating Switzerland’s water technology ecosystem, orchestrating a complex network of partnerships that amplifies innovation impact far beyond direct investments.

At the heart of this ecosystem-building approach lies strategic collaboration with research institutions. Wingman maintains close ties with ETH Zürich and EPFL, Switzerland’s premier technical universities, providing a vital bridge between academic breakthroughs and commercial applications. These relationships enable early access to promising technologies while offering researchers practical pathways to market.

The firm’s ecosystem extends beyond academia through carefully curated corporate partnerships. By facilitating connections between startups and established industry players, Wingman creates opportunities for pilot projects, customer validation, and potential exits. These relationships benefit both sides – startups gain market access while corporates tap into external innovation.

What sets Wingman’s ecosystem approach apart is its focus on cross-pollination between portfolio companies. Regular founder gatherings and targeted introductions foster knowledge sharing and potential collaborations. A startup developing advanced sensors might partner with another building data analytics platforms, creating integrated solutions neither could achieve alone.

The venture firm has also pioneered innovative funding mechanisms that strengthen the ecosystem. Beyond traditional equity investments, Wingman experiments with flexible financing structures that help startups bridge the commercialization gap. This includes working with public institutions and impact investors to create blended capital solutions.

Mentorship forms another crucial ecosystem layer. Wingman has assembled a network of experienced water industry executives who advise portfolio companies. These mentors provide strategic guidance while expanding startups’ professional networks. The firm maintains an active alumni network of successful founders who pay it forward by supporting the next generation.

Perhaps most importantly, Wingman takes a long-term view of ecosystem development. Rather than pursuing quick wins, the firm invests in foundational elements like talent development programs and industry events that strengthen the entire water innovation community. This patient approach has earned Wingman trust as an ecosystem orchestrator.

As explored in this analysis of water innovation acceleration, the most successful supporters of water technology startups focus on building robust ecosystems. Wingman exemplifies this philosophy, creating an environment where innovative solutions to water challenges can flourish through the power of strategic connection and collaboration.

Final words

Wingman Ventures stands at the confluence of financial acumen and environmental innovation, demonstrating how strategic early-stage investment can accelerate water technology solutions. Their evolution into Founderful marks not just a rebranding, but a reinforcement of their commitment to fostering groundbreaking water technologies. With their precision-focused investment approach, strong preference for leading rounds, and deep expertise in complex water challenges, they’re uniquely positioned to drive the next wave of water innovation. As water challenges intensify globally, their model of combining substantial capital with hands-on expertise offers a blueprint for impactful water technology investment. For entrepreneurs and co-investors alike, Wingman represents more than just a funding source – they’re a strategic partner in building a more sustainable water future.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!