Picture a world where Canadian water technology innovators have access to substantial capital, expert guidance, and a clear path to market. That’s exactly what Sustainable Development Technology Canada (SDTC) delivers through its recently recapitalized $750 million fund. As water entrepreneurs seek solutions to pressing challenges from industrial wastewater to emerging contaminants, SDTC stands as a beacon of support, typically investing $2-4 million per project to bridge the critical gap between innovation and commercialization. With its unique position as a lead investor focused on clean technology, SDTC is reshaping Canada’s water technology landscape one breakthrough at a time.

Sustainable Development Technology Canada (let’s call them SDTC, that’s too long! 😅) is part of my Ultimate Water Investor Database, check it out!

Investor Name: Sustainable Development Technology Canada

Investor Type: Gov. Fund

Latest Fund Size: $750 Million

Dry Powder Available: Yes

Typical Ticket Size: $1M – $3M

Investment Themes: Industrial Wastewater Treatment, Zero Liquid Discharge, Decentralized Treatments

Investment History: $10613333.33 spent over 5 deals

Often Invests Along:

Already Invested In: Hortau Inc., Pani Energy, Swirltex, Symbient Environmental

Leads or Follows: Lead

Board Seat Appetite: Rare

Key People: Leah Lawrence

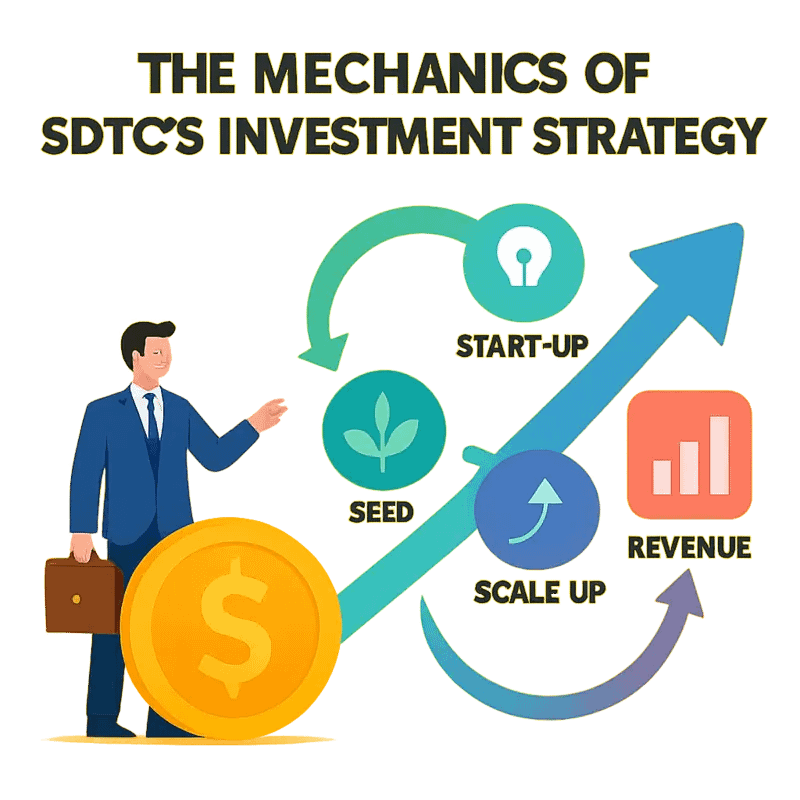

The Mechanics of SDTC’s Investment Strategy

Sustainable Development Technology Canada (SDTC) operates with a strategic precision that sets it apart in the cleantech funding landscape. At the core of their approach lies a substantial $750 million fund, carefully structured to maximize impact across Canada’s water technology sector while maintaining fiscal responsibility.

The fund’s deployment follows a well-calibrated investment thesis centered on early-stage to Series A companies. SDTC typically provides investments ranging from $2 million to $4 million – a sweet spot that offers meaningful capital without over-diluting founding teams. This positioning allows SDTC to act as a lead investor, setting terms and providing crucial validation for follow-on funders.

A distinguishing feature of SDTC’s strategy is its laser focus on Canadian-owned small and medium enterprises (SMEs). This emphasis stems from a deep understanding that domestic SMEs often face the most significant hurdles in scaling innovative water technologies, despite having tremendous potential for both environmental impact and economic returns.

The fund’s structure incorporates several sophisticated mechanisms to protect taxpayer interests while catalyzing innovation. SDTC maintains rigorous due diligence processes, evaluating not just technical merit but also market potential, management capability, and environmental benefits. This comprehensive assessment approach helps ensure that public funds are directed toward ventures with the highest probability of success and impact.

As a lead investor, SDTC takes an active role in governance and strategic guidance. The organization leverages its extensive network to connect portfolio companies with potential customers, partners, and follow-on investors. This hands-on approach significantly enhances the success rate of funded companies and helps accelerate their path to commercialization.

The fund’s investment criteria reflect a balance between commercial viability and environmental impact. Projects must demonstrate clear potential for greenhouse gas reduction or other environmental benefits while presenting a compelling business case. This dual mandate has proven effective in identifying technologies that can achieve both financial returns and meaningful environmental outcomes.

Particularly relevant to water technology innovations, SDTC’s investment approach recognizes the longer development cycles often required in this sector. The fund’s patient capital model, with investment horizons extending beyond typical venture capital timeframes, provides crucial runway for water tech companies to validate their solutions and establish market traction.

Water Technology Priorities and Innovation Focus

SDTC’s investment focus reflects Canada’s most pressing water challenges, with clear priorities emerging around industrial wastewater treatment, water reuse, and digital transformation technologies. The fund strategically targets innovations that promise both environmental impact and commercial viability.

Industrial wastewater treatment commands significant attention, particularly solutions addressing complex contamination from mining, oil and gas, and manufacturing sectors. Key investment areas include advanced oxidation processes, membrane technologies, and electrochemical treatment systems that can handle high-strength industrial effluents while recovering valuable resources. The fund particularly values solutions that demonstrate energy efficiency and operational cost advantages over conventional treatment methods.

Zero liquid discharge (ZLD) technologies represent another crucial investment theme, reflecting growing water scarcity concerns and stricter discharge regulations. SDTC seeks innovations that make ZLD economically viable for a broader range of industries through reduced energy consumption, improved recovery rates, and creative approaches to managing concentrated waste streams. This includes novel evaporation technologies, crystallization systems, and hybrid treatment trains that maximize water recovery while minimizing waste generation.

Digital water technologies form the third major investment pillar, with emphasis on solutions that enhance operational efficiency and decision-making capabilities. This encompasses advanced sensors and monitoring systems, artificial intelligence for process optimization, and predictive analytics platforms that enable proactive maintenance and resource management. SDTC particularly values digital solutions that can be integrated across existing infrastructure to improve performance without requiring complete system overhauls.

Emerging areas of interest include decentralized treatment systems, nature-based solutions, and technologies addressing emerging contaminants like PFAS. The fund shows increasing attention to solutions that combine multiple benefits – such as treatment systems that simultaneously reduce energy consumption, recover resources, and improve water quality. This reflects a broader shift toward viewing wastewater as a resource rather than a waste stream.

SDTC’s investment approach emphasizes scalability and market readiness, seeking technologies that can demonstrate clear paths to commercial implementation. The fund structures investments to support critical development milestones, from pilot demonstrations to early commercial deployments. This strategic focus helps bridge the gap between promising innovations and market-ready solutions.

Aligning with broader sustainability goals, SDTC prioritizes technologies that contribute to climate change mitigation and adaptation while solving water challenges. Technologies improving energy efficiency in water treatment, reducing chemical usage, or enabling water reuse receive particular attention.

The Co-Investment Ecosystem

SDTC’s strategic position as a lead investor creates powerful ripple effects across Canada’s water technology landscape. By providing initial capital and validation through rigorous due diligence, SDTC effectively de-risks promising water innovations and catalyzes additional investment from diverse funding sources.

At the core of SDTC’s co-investment approach lies a sophisticated partner network spanning private equity firms, venture capital groups, and other government agencies. Through carefully structured funding arrangements, SDTC typically provides 33-40% of project costs while requiring matching investments from private sector partners. This model has proven remarkably effective at leveraging public funds to unlock private capital.

The co-investment ecosystem particularly shines in addressing the notorious “valley of death” that plagues many cleantech startups. When promising water technologies struggle to secure funding between proof-of-concept and commercial scale, SDTC’s involvement sends a powerful signal to other investors. Their thorough technical and commercial validation process gives co-investors confidence to participate in subsequent funding rounds.

SDTC has developed several innovative mechanisms to maximize co-investment impact. Their flagship instrument involves milestone-based funding releases tied to specific technical and commercial achievements. This approach allows co-investors to manage risk while ensuring accountability. Additionally, SDTC frequently takes board observer positions to provide strategic guidance and facilitate connections with potential customers and partners.

Recent analysis shows SDTC’s model generates an average leverage ratio of 2.7x, meaning each dollar invested mobilizes $2.70 in private funding. Beyond direct co-investment, SDTC’s support often leads to follow-on funding rounds, strategic partnerships, and successful exits – creating a virtuous cycle that strengthens Canada’s entire water innovation ecosystem.

The organization has also pioneered novel partnership structures with provincial agencies and utilities. These arrangements help de-risk first deployments of new water technologies through pilot projects and demonstration sites. Such real-world validation is often crucial for securing additional private investment.

Critically, SDTC takes a long-term view focused on building sustainable businesses rather than quick exits. Their patient capital approach, typically spanning 3-5 years, gives water technology companies time to validate their solutions and establish market traction. This timeline alignment helps attract strategic investors focused on long-term value creation rather than short-term returns.

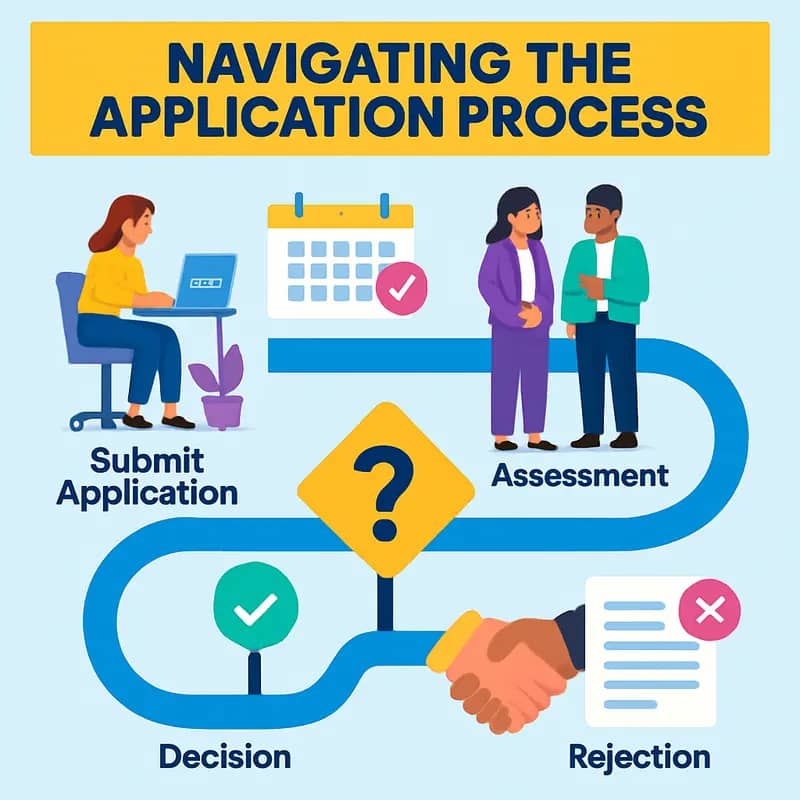

Navigating the Application Process

Securing funding from Sustainable Development Technology Canada (SDTC) requires careful navigation of a structured yet competitive application process. Companies seeking support must first demonstrate clear alignment with SDTC’s mandate of advancing clean technology solutions while creating measurable environmental and economic benefits for Canada.

The foundation of a successful application rests on three core eligibility pillars. First, applicants must be Canadian companies developing novel technological solutions with significant environmental benefits. Second, the proposed technology must be at Technology Readiness Level (TRL) 3 or higher, demonstrating proof-of-concept in a laboratory environment. Third, projects should have a clear path to commercialization within Canada.

The application journey typically unfolds across four key stages. The initial Statement of Interest (SOI) requires a concise overview of the technology, market opportunity, and expected environmental benefits. Successful SOIs progress to the detailed proposal phase, where companies must provide comprehensive technical specifications, market analysis, financial projections, and environmental impact assessments. The third stage involves due diligence reviews and project refinement, while the final stage culminates in funding decisions and agreement negotiations.

Successful proposals share several distinguishing characteristics. They clearly articulate the innovative aspects of their technology while demonstrating market validation through customer discovery and engagement. Environmental benefits are quantified using robust methodologies and supported by credible third-party validation where possible. Strong applications also showcase capable management teams and present realistic commercialization timelines with well-defined milestones.

The entire process typically spans 6-8 months from initial submission to funding decision. Companies should prepare for intensive engagement during the due diligence phase, which often requires multiple iterations and clarifications. Early engagement with SDTC’s investment team through available channels can provide valuable guidance on proposal development and increase alignment with funding priorities.

One often overlooked success factor is the strength of the project consortium. While not mandatory, partnerships with academic institutions, industry players, or other cleantech innovators can significantly enhance a proposal’s credibility and execution capabilities. These collaborations demonstrate market validation and help de-risk technology development through shared expertise and resources.

For guidance on developing winning proposals and navigating complex funding decisions, review detailed insights in our analysis on how to take mid-market green tech companies to the next level.

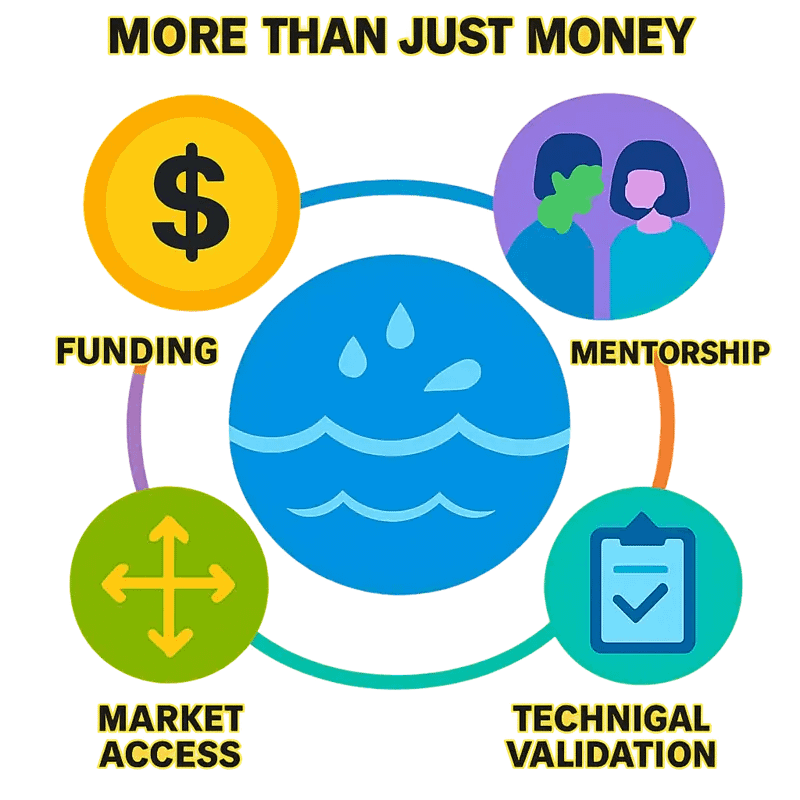

The SDTC Advantage: More Than Just Money

Sustainable Development Technology Canada has engineered a unique funding model that transcends traditional venture capital approaches. At its core lies a holistic support system that combines substantial financial backing with an extensive ecosystem of resources and expertise.

SDTC’s investment criteria reflect its mandate to accelerate clean technology development in Canada’s water sector. The fund prioritizes solutions that demonstrate clear environmental benefits, strong commercial potential, and technological innovation. Successful applicants must show how their technology can deliver measurable improvements in water treatment efficiency, quality, or conservation while maintaining economic viability.

The funding amounts are notably generous, ranging from $2 million to $20 million per project. Unlike conventional investors, SDTC doesn’t take equity positions, instead providing non-dilutive capital that allows companies to retain full ownership while scaling their innovations. This approach has proven particularly valuable for water technology ventures, which often require significant capital for pilot projects and commercial demonstrations.

What truly sets SDTC apart is its comprehensive ecosystem support. Grant recipients gain access to a network of technical experts, industry partners, and potential customers. The fund facilitates connections with research institutions, regulatory bodies, and other funding sources, creating a powerful multiplier effect that amplifies the impact of its financial investment.

SDTC’s value-added services include specialized mentorship programs, market intelligence support, and regulatory navigation assistance. A dedicated team of investment professionals works closely with portfolio companies to overcome technical hurdles, refine business strategies, and accelerate market entry. This hands-on approach has proven particularly effective in helping water technology ventures navigate the complex regulatory landscape and lengthy adoption cycles typical in the water sector.

Through its pilot project support program, SDTC helps companies bridge the critical gap between laboratory success and commercial implementation. The fund works with utilities and industrial partners to create real-world testing opportunities, generating the performance data essential for market acceptance.

As explored in how to consistently deliver on the promise as a consultant engineer, this comprehensive approach to technology validation and market preparation has become increasingly crucial in the water sector. SDTC’s model addresses these challenges head-on, providing both the financial resources and expert guidance needed to navigate the path to commercial success.

The fund’s commitment extends beyond individual investments to building a robust clean technology ecosystem in Canada. By fostering collaboration between startups, established companies, research institutions, and government agencies, SDTC is creating a supportive environment that accelerates innovation and commercialization in the water technology sector.

Success Stories: From Lab to Market

The transformative impact of SDTC’s investments in water technology becomes most apparent through the concrete achievements of its portfolio companies. These success stories demonstrate how strategic funding paired with ecosystem support can accelerate the commercialization of groundbreaking water innovations.

A standout example emerged from a small Calgary-based company that developed an energy-efficient membrane filtration system. Within three years of receiving SDTC support, they scaled their technology from pilot demonstrations to full commercial installations across five provinces. Their innovation reduced energy consumption in industrial water treatment by 40% while processing 50% more water volume, resulting in annual carbon emissions reductions of 75,000 tons CO2 equivalent.

Another remarkable case involves an Ontario-based venture specializing in real-time water quality monitoring. Their SDTC-backed project deployed advanced sensor networks across municipal water systems, enabling predictive maintenance and reducing water losses by 30%. The technology now monitors over 500 kilometers of pipeline infrastructure, saving an estimated 15 billion liters of water annually while generating $12 million in recurring revenue.

Perhaps most impressive is the story of a Vancouver startup that revolutionized wastewater nutrient recovery. How to make carbon negative fuel boost utility’s revenue and save the world. After receiving initial SDTC funding, they developed a process that extracts valuable minerals from wastewater streams while reducing treatment costs. Their innovation now operates in 15 facilities across North America, converting what was once a waste stream into a revenue-generating resource worth $40 million annually.

These successes extend beyond individual companies. The ripple effects have created new supply chains, spawned complementary innovations, and established Canada as a global leader in water technology. Collectively, SDTC-supported water companies have created over 3,000 high-skilled jobs and attracted more than $2 billion in follow-on investment.

The environmental metrics are equally impressive. SDTC-backed water technologies have enabled the treatment of over 100 billion liters of contaminated water, reduced industrial water consumption by 40%, and prevented the release of millions of tons of pollutants into natural water bodies. These quantifiable impacts demonstrate how strategic investment in water innovation can deliver both environmental and economic returns.

Crucially, these companies have proven that water technology can scale rapidly when given the right support. Their success has attracted additional private investment to the sector, creating a virtuous cycle of innovation and implementation that continues to accelerate the adoption of sustainable water solutions.

The Investment Thesis: Why Water Tech Matters

Canada’s water technology sector represents a compelling investment opportunity driven by urgent environmental challenges and growing market demand. SDTC’s $750M clean tech fund strategically positions the country to capitalize on this potential while addressing critical water infrastructure needs.

The global water technology market is projected to reach $1 trillion by 2025, spurred by aging infrastructure, climate change impacts, and stricter environmental regulations. Within this landscape, Canada holds distinct advantages – abundant freshwater resources, world-class research institutions, and a robust innovation ecosystem. These elements create fertile ground for breakthrough water technologies.

SDTC’s investment approach addresses a crucial gap in the water technology commercialization pipeline. While early-stage research often receives academic funding and mature companies can access traditional financing, the critical valley between prototype and market-ready product remains treacherous. By providing strategic capital at this stage, SDTC de-risks private investment and accelerates time-to-market for promising innovations.

The fund’s focus on water technology is particularly timely. Municipalities face mounting pressure to upgrade water infrastructure while reducing operational costs and environmental impact. Industrial water users increasingly seek solutions for water efficiency, reuse, and regulatory compliance. These market drivers create natural customers for emerging water technologies, reducing commercial risk for investors.

SDTC’s portfolio approach provides additional risk mitigation. By investing across multiple water technology segments – from advanced treatment and monitoring to resource recovery and digital solutions – the fund creates diversification while maintaining sector focus. This strategy allows investors to participate in water market growth while spreading risk across multiple technological approaches and business models.

The economic case for water technology investment extends beyond direct returns. Successful commercialization of Canadian water innovations strengthens domestic expertise, creates high-value jobs, and positions Canadian companies to capture share in growing global markets. SDTC’s support helps companies scale internationally while maintaining Canadian roots, creating lasting economic benefits.

Most importantly, SDTC’s investment thesis aligns environmental and financial returns. Water technology innovations that reduce energy consumption, improve treatment efficiency, or enable water reuse deliver measurable environmental benefits while generating cost savings for end users. This dual value proposition makes water technology particularly attractive for impact-oriented investors seeking both financial returns and environmental benefits.

As highlighted in a recent analysis of water technology investment opportunities, the sector’s fundamentals remain strong despite market volatility in other areas. SDTC’s strategic focus on water technology reflects this enduring opportunity while providing critical support to accelerate innovation in this essential sector.

Navigating the Application Process

Securing funding from Sustainable Development Technology Canada requires a strategic and well-prepared approach. Successful applications demonstrate not just technological innovation, but also clear market potential and environmental benefits.

The first critical step is verifying eligibility. SDTC seeks Canadian companies developing novel water technologies that offer quantifiable environmental benefits. The innovation must be beyond basic research, with a clear path to commercialization. Projects typically require 2-5 years for completion and budgets between $2-20 million.

The application itself follows a two-stage process. The initial Statement of Interest (SOI) requires a concise yet compelling overview of your technology, market opportunity, and expected environmental outcomes. About 25% of SOIs advance to the full proposal stage, where detailed technical, business, and financial plans are required.

To stand out among competitors, focus on three key areas that align with SDTC’s evaluation criteria. First, clearly articulate your technology’s innovative aspects and competitive advantages. Second, provide robust market analysis demonstrating commercial viability and scale-up potential. Third, quantify environmental benefits using credible metrics and methodologies.

Common pitfalls that derail otherwise promising applications include overestimating market readiness, underestimating development timelines, and failing to demonstrate strong project management capabilities. Many applicants also struggle to provide sufficient evidence of customer validation or industry partnerships.

A successful proposal requires significant preparation time – typically 3-4 months for the full application. Build a strong consortium of partners early, including academic institutions, customers, and other stakeholders who can validate your technology and market opportunities. Their letters of support add credibility to your application.

Remember that SDTC funding is highly competitive, with only about 10% of initial applicants ultimately receiving investment. The process demands thorough preparation, attention to detail, and realistic projections. For practical guidance on navigating the complexities of cleantech funding applications, review this illuminating case study on how to take mid-market green tech companies to the next level at https://dww.show/how-to-take-mid-market-green-tech-companies-to-the-next-level/.

While the application process is rigorous, successful companies gain more than just funding. SDTC’s support provides valuable market validation, technical guidance, and access to an extensive network of industry partners and potential customers. This ecosystem of support significantly improves the odds of commercial success for promising water technologies.

Final words

SDTC stands as a pivotal force in Canada’s water technology landscape, offering more than just capital – it provides a comprehensive support system for innovative solutions to reach market-ready status. With its $750 million fund and strategic focus on clean technology, SDTC demonstrates Canada’s commitment to fostering sustainable water solutions. For water entrepreneurs and impact investors, SDTC represents an invaluable partner in the journey from innovative concept to commercial success. Their approach of leading investments while fostering co-investment partnerships creates a robust ecosystem for water technology development. As water challenges continue to evolve, SDTC’s role in supporting breakthrough technologies becomes increasingly critical. Their investment strategy, focusing on both environmental impact and commercial viability, sets a model for how public funding can effectively catalyze private sector innovation in the water sector.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!