Deep in the heart of Cambridge, Massachusetts, a venture firm called The Engine is rewriting the playbook for water technology investment. With $398 million in fresh capital and a laser focus on ‘Tough Tech,’ this MIT spinout has positioned itself as a powerhouse for nurturing breakthrough water innovations. Their unique approach combines substantial financial backing with hands-on support, including access to specialized labs and workshops spanning 155,000 square feet. As water challenges intensify globally, The Engine’s model of patient capital and technical expertise offers a blueprint for accelerating water solutions from laboratory concepts to market-ready technologies.

The Engine is part of my Ultimate Water Investor Database, check it out!

Investor Name: The Engine

Investor Type: VC

Latest Fund Size: $398 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Advanced Water Treatment, Digital Water/Digital Twins, Decentralized Water Treatment

Investment History: $20671961.29 spent over 4 deals

Often Invests Along: Breakthrough Energy Ventures, Lowercarbon Capital

Already Invested In: Biobot Analytics, Hyfé, Lilac Solutions

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People:

The Investment Arsenal

With $398 million in dry powder from Fund III, The Engine stands uniquely positioned to transform early-stage water technology ventures into scalable solutions. The venture firm’s investment strategy centers on capital-intensive innovations that require substantial funding to move from laboratory breakthroughs to commercial deployment.

The Engine’s typical deal sizes range from $10 to $50 million, providing the robust financial backing necessary for water technology companies to overcome the ‘valley of death’ between proof-of-concept and commercial scale. This investment capacity allows portfolio companies to build pilot facilities, conduct extensive field trials, and optimize their technologies without the constant pressure of short-term fundraising.

What sets The Engine’s investment approach apart is their deep understanding of water technology’s unique challenges. Unlike software startups that can scale rapidly with minimal capital, water innovations often require significant infrastructure, regulatory approvals, and extended validation periods. By providing larger initial investments, The Engine gives companies runway to navigate these complexities while maintaining focus on technical development and market validation.

The firm’s $398M Fund III represents a significant expansion of their investment capacity, enabling them to support more capital-intensive projects than ever before. This funding pool allows The Engine to take concentrated positions in promising water technologies while maintaining reserves for follow-on investments as companies grow. Their ability to write larger checks also attracts co-investors, multiplying the total capital available to portfolio companies.

Beyond the size of individual investments, The Engine’s approach includes strategic deployment of capital across the water technology value chain. From advanced membrane materials to AI-powered treatment systems, their portfolio reflects a comprehensive view of water innovation needs. This diversification helps create synergies between portfolio companies while managing investment risk.

As explored in an unpopular yet true perspective on water venture capital, the water sector has historically struggled to attract sufficient investment due to long development cycles and complex market dynamics. The Engine’s substantial funding capacity and patient capital approach directly addresses these challenges, providing a model for how institutional investors can successfully support water innovation.

Beyond Capital: The Technical Ecosystem

The Engine’s comprehensive support infrastructure stands as a testament to MIT’s commitment to accelerating deep tech innovation beyond mere financial backing. At the heart of this ecosystem lies their expansive 155,000-square-foot facility, strategically designed to bridge the gap between breakthrough ideas and market-ready solutions in water technology.

Inside the facility’s specialized bio and chemistry laboratories, water technology innovators gain access to cutting-edge analytical equipment and testing capabilities. These labs enable crucial experiments in advanced water treatment processes, from novel membrane development to breakthrough chemical separation techniques. The controlled environment allows founders to rapidly iterate on their technologies while maintaining the rigorous standards necessary for scientific validation.

Beyond the wet labs, The Engine’s workshops serve as vital spaces for prototype development and small-scale manufacturing. Here, entrepreneurs can transform theoretical concepts into tangible solutions, testing and refining their innovations in real-world conditions. The facility’s flexible configuration accommodates diverse needs, from bench-scale water treatment systems to pilot-ready equipment assembly.

What sets The Engine’s technical ecosystem apart is its collaborative architecture. The shared spaces foster natural interactions between portfolio companies, creating an environment where water technology innovators can learn from peers working on complementary challenges. This cross-pollination of ideas accelerates problem-solving and opens doors to unexpected synergies.

The facility also houses specialized equipment that would typically be cost-prohibitive for early-stage companies to access independently. Advanced analytical instruments, high-throughput testing platforms, and precision fabrication tools become shared resources, dramatically reducing development costs and timelines for portfolio companies.

Perhaps most critically, The Engine’s technical ecosystem includes access to MIT’s broader research infrastructure and expertise. This connection provides founders with opportunities to collaborate with leading academics, tap into specialized knowledge, and leverage advanced research facilities when needed. The result is a powerful combination of academic rigor and practical application that accelerates the path from laboratory breakthrough to commercial success.

This comprehensive technical support system works in concert with The Engine’s investment capital, creating a uniquely powerful platform for water technology development. By removing both financial and technical barriers simultaneously, The Engine enables founders to focus entirely on solving the complex challenges of water innovation, rather than being constrained by infrastructure limitations.

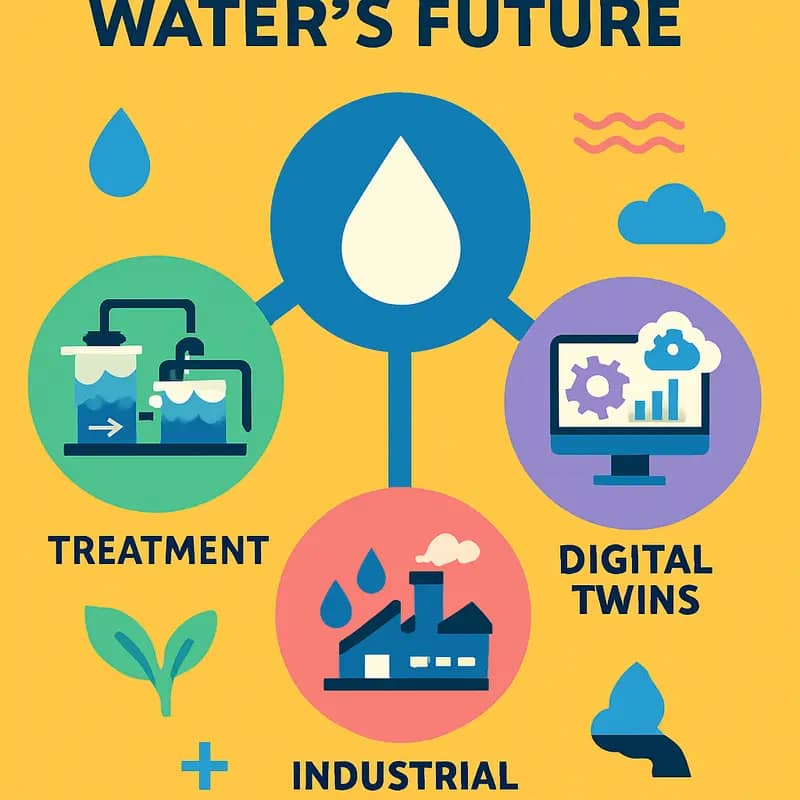

Investment Themes Shaping Water’s Future

The Engine’s water technology investment thesis centers on four key areas poised to transform the industry landscape. Advanced treatment technologies lead their portfolio focus, particularly innovations addressing emerging contaminants like PFAS and microplastics. These solutions leverage novel materials, advanced oxidation, and selective separation processes to achieve unprecedented removal efficiencies while reducing energy and chemical requirements.

Digital solutions represent another critical investment theme, with The Engine backing technologies that harness AI, IoT sensors, and predictive analytics to optimize water system operations. These innovations enable real-time monitoring, automated control, and data-driven decision making – fundamentally changing how utilities and industrial facilities manage their water resources. The potential market impact is substantial, with digital water solutions projected to exceed $50 billion globally by 2030.

Decentralized water and wastewater treatment systems form the third key investment focus. The Engine recognizes that traditional centralized infrastructure cannot sustainably meet growing water demands, particularly in rapidly developing regions. Their portfolio includes modular treatment units, water recycling systems, and resource recovery technologies that enable localized water management. This approach not only improves resilience but also unlocks new business models around Water-as-a-Service.

The fourth pillar centers on industrial water management, where The Engine targets technologies that help water-intensive industries achieve sustainability goals while improving operational efficiency. This includes zero liquid discharge systems, smart cooling solutions, and process water optimization tools. The industrial sector represents a particularly attractive market given increasing regulatory pressure and corporate environmental commitments.

Across these themes, The Engine prioritizes solutions that deliver multiple benefits – such as technologies that simultaneously reduce energy use, recover valuable resources, and improve water quality. Their investment approach recognizes that the most successful water innovations will be those that create value across the water-energy-waste nexus while remaining commercially viable.

The collective market opportunity across these four investment themes is immense. Water industry analysts project the total addressable market to exceed $1 trillion by 2025, driven by aging infrastructure, climate pressures, and stricter regulations. The Engine’s focused investment strategy positions them to capitalize on this growth while accelerating the deployment of critical water solutions.

Leading the Charge: Investment Strategy

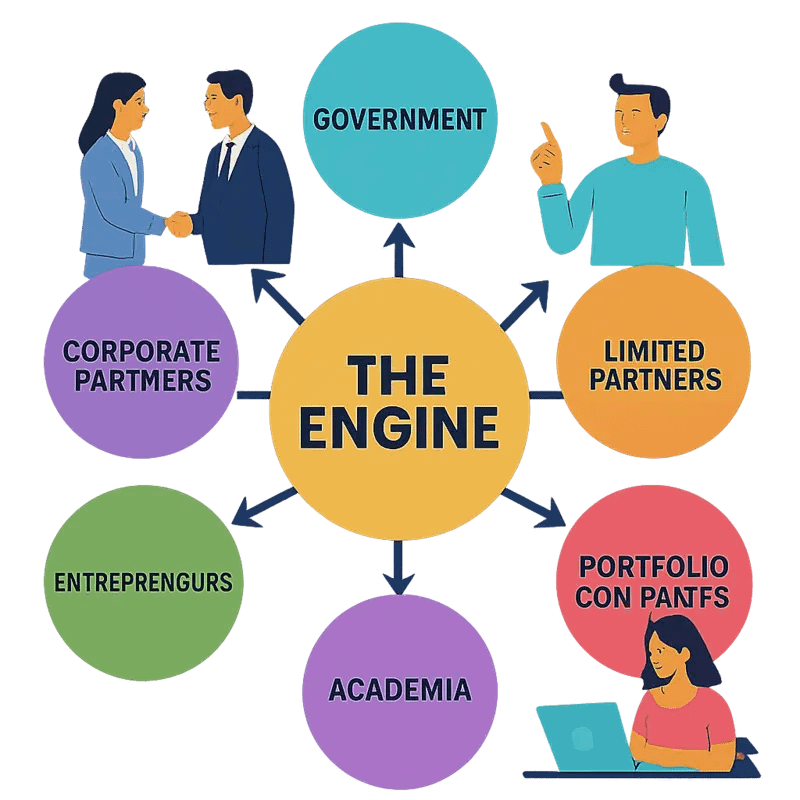

The Engine’s distinctive investment approach centers on being a lead investor that provides sustained, long-term support to revolutionary water technology companies. With $398M in dry powder, the firm takes a hands-on role in building and scaling portfolio companies through strategic co-investment partnerships and systematic follow-on funding.

As a lead investor, The Engine typically commits $2-10M in initial funding while actively structuring investment rounds and setting terms. This leadership position allows them to shape company strategy and governance from the outset. Their deep technical expertise in water technology enables thorough due diligence and validation of complex innovations before deployment of capital.

The firm has cultivated strong co-investment relationships with strategic corporate partners, family offices, and institutional investors who share their long-term vision. These partnerships create powerful syndicates that provide portfolio companies with not just capital, but also industry connections, technical validation, and potential commercial pathways. By bringing in aligned co-investors, The Engine helps companies build robust support networks essential for navigating the challenges of commercializing breakthrough water technologies.

Critically, The Engine takes a staged approach to follow-on investment, reserving significant capital to support portfolio companies through multiple rounds of financing. This patient capital strategy recognizes that water technology companies often require 5-7 years or more to reach meaningful scale. Rather than pushing for quick exits, The Engine focuses on helping companies achieve technical milestones, expand market presence, and build sustainable business models.

Beyond capital, The Engine provides hands-on operational support through its extensive network of industry experts, technical advisors, and experienced operators. Portfolio companies gain access to specialized facilities, testing resources, and partnerships that accelerate development and deployment. The firm’s deep understanding of water industry dynamics and regulations helps companies navigate complex stakeholder relationships and regulatory requirements.

This comprehensive investment strategy reflects The Engine’s thesis that transformative water technologies require not just funding, but also deep domain expertise, extensive networks, and unwavering long-term support to achieve widespread adoption and impact. By leading investments, fostering strategic partnerships, and providing sustained capital and operational assistance, The Engine is building a new model for advancing innovation in the water sector.

Learn more about forging successful investment partnerships in water technology

The Tough Tech Philosophy

The Engine has pioneered a distinct investment approach that addresses a critical gap in water technology funding. Traditional venture capital’s focus on rapid returns and scalable software solutions has historically left complex water innovations struggling to secure adequate funding. The Engine’s ‘tough tech’ philosophy fundamentally rewrites this narrative.

At its core, The Engine’s model acknowledges that breakthrough water technologies require patient capital and longer development timelines. While conventional VCs typically expect returns within 5-7 years, water technology innovations often need 8-12 years to move from lab to market. The Engine’s commitment to extended holding periods, sometimes up to 18 years, provides the runway these complex solutions demand.

This patient capital approach is coupled with deep technical expertise. The Engine’s investment team combines venture experience with advanced technical backgrounds, enabling them to evaluate and support complex water innovations that might perplex traditional investors. This expertise proves particularly valuable when assessing technologies like advanced membrane materials, novel treatment processes, or complex sensing systems.

The Engine’s tough tech philosophy also emphasizes the importance of comprehensive support beyond capital. Portfolio companies gain access to specialized lab space, advanced equipment, and a network of technical experts. This ecosystem approach helps bridge the notorious ‘valley of death’ where many promising water technologies historically faltered.

Perhaps most distinctively, The Engine embraces complexity rather than avoiding it. Rather than seeking quick wins in software or simple hardware, they actively pursue technically challenging solutions that address fundamental water challenges. Their investment thesis recognizes that transformative water innovations often require breakthroughs in materials science, chemistry, or engineering – areas traditional VCs tend to avoid.

This approach seems particularly well-calibrated to water technology’s unique challenges. The sector’s capital intensity, regulatory complexity, and market fragmentation have historically deterred venture investment. The Engine’s model, combining patient capital, technical expertise, and comprehensive support, creates a framework where these challenges become manageable rather than insurmountable.

As explored in “What do you need to know to invest wisely in water technologies?”, this investment philosophy represents a crucial evolution in how we fund water innovation. The Engine’s $398M in dry powder, deployed through this lens, has the potential to catalyze breakthrough solutions to our most pressing water challenges.

Portfolio Deep Dive: Water Innovation

The Engine’s water technology portfolio represents a strategic focus on breakthrough solutions addressing critical challenges in water access, quality, and infrastructure. Building on their patient capital approach, the firm has assembled a diverse set of companies developing transformative technologies.

In the desalination space, The Engine has backed ventures pioneering energy-efficient membrane technologies that dramatically reduce the power requirements and environmental impact of water purification. These innovations leverage advanced materials science and novel system designs to achieve up to 65% energy savings compared to conventional reverse osmosis processes.

Water quality monitoring has emerged as another key investment theme, with portfolio companies developing next-generation sensing platforms. These solutions combine sophisticated detection methods with AI-powered analytics to provide real-time insights into contaminants, enabling proactive treatment decisions. The technology can identify trace amounts of emerging pollutants like PFAS at parts-per-trillion levels, addressing a critical need for utilities and industrial users.

Infrastructure optimization represents a third strategic focus, with investments in companies revolutionizing how water systems are managed and maintained. Their portfolio includes ventures developing predictive analytics platforms that help utilities prevent failures, reduce water loss, and optimize operations. These solutions have demonstrated the ability to cut non-revenue water losses by up to 30% while extending infrastructure life cycles.

One particularly promising portfolio company has developed a modular water treatment system that can be rapidly deployed in underserved communities. The technology combines advanced filtration with smart monitoring capabilities, enabling decentralized water access solutions that are both cost-effective and reliable. This approach aligns with The Engine’s vision of democratizing access to clean water technologies.

The firm’s investment thesis emphasizes solutions that can scale globally while delivering measurable environmental and social impact. Their portfolio companies must demonstrate clear technological advantages and robust intellectual property protection. Most importantly, they seek innovations that can achieve commercial viability within 5-7 years, balancing breakthrough potential with practical market considerations.

Beyond individual technologies, The Engine actively fosters collaboration between portfolio companies, creating opportunities for complementary solutions to be integrated into more comprehensive offerings. This ecosystem approach has accelerated the development and deployment of water innovations while helping portfolio companies overcome common commercialization challenges.

Beyond Capital: Technical Support

The Engine’s support system transcends traditional venture capital by providing water technology startups with comprehensive technical resources critical for overcoming development hurdles. At the heart of this ecosystem lies a network of specialized facilities and equipment that would typically be out of reach for early-stage companies.

The cornerstone of The Engine’s technical support is its 40,000-square-foot shared workspace equipped with specialized labs, prototyping facilities, and testing equipment specifically configured for water technology development. This infrastructure enables startups to conduct crucial experiments and validate their technologies without the massive upfront capital investment typically required.

Beyond physical infrastructure, The Engine has assembled a brain trust of technical experts and industry veterans who serve as advisors and mentors. These specialists provide guidance on everything from membrane chemistry optimization to pilot plant design, helping startups avoid costly technical missteps. The firm’s close ties with MIT’s research community create additional pathways for startups to access cutting-edge scientific expertise and facilities.

Perhaps most valuable is The Engine’s role in facilitating connections between portfolio companies and potential development partners. Through its network, startups can access pilot testing sites at water utilities, form partnerships with established equipment manufacturers, and collaborate with other portfolio companies working on complementary technologies. This ecosystem approach helps accelerate the path from prototype to commercial deployment.

The firm also provides crucial support in navigating regulatory compliance and certification processes – a major hurdle for water technology companies. Their regulatory affairs specialists help startups develop testing protocols that align with EPA and NSF requirements while maintaining efficient paths to market.

This comprehensive support system reflects The Engine’s understanding that water technology commercialization requires more than just capital. Technical de-risking, specialized facilities access, and strategic partnerships are often the difference between breakthrough innovations that reach the market and those that remain stuck in development. By providing these resources alongside funding, The Engine has created an environment where water startups can focus on solving technical challenges rather than being constrained by infrastructure limitations or expertise gaps.

Impact Metrics and Future Vision

The Engine’s strategic investment approach is yielding measurable impacts across the water technology landscape, with key performance indicators demonstrating significant progress toward their mission of accelerating water innovation. Their portfolio companies have collectively raised over $1.2 billion in follow-on funding, validating The Engine’s expertise in identifying promising water technologies.

On the environmental front, supported startups are driving tangible improvements in water sustainability. Through advanced treatment technologies, these companies have enabled the treatment of over 50 million gallons of contaminated water and achieved energy efficiency gains of 30-40% compared to conventional approaches. The deployment of smart monitoring solutions has helped utilities reduce water losses by up to 25% in pilot implementations.

Looking ahead, The Engine envisions scaling these innovations globally through a three-pronged strategy. First, they are expanding their geographic footprint by establishing strategic partnerships with water utilities and industrial players across North America, Europe, and Asia. This network effect amplifies the reach and impact of portfolio companies’ solutions.

Second, The Engine is doubling down on technologies that address multiple challenges simultaneously. For instance, they prioritize solutions that not only improve water quality but also reduce energy consumption and capture valuable resources from waste streams. This integrated approach maximizes the return on investment while delivering broader environmental benefits.

Third, they are working to lower barriers to adoption through innovative financing models and risk-sharing mechanisms. By partnering with development banks and impact investors, The Engine helps de-risk the deployment of new water technologies in emerging markets where the need is often greatest.

Perhaps most importantly, The Engine measures success not just in financial returns but in real-world impact. They track metrics like gallons of water conserved, pounds of contaminants removed, and kilowatt-hours saved. This data-driven approach helps quantify the tangible benefits of water innovation and attract additional capital to the sector.

As climate change intensifies water challenges globally, The Engine’s robust support system and strategic vision position them to catalyze the next wave of water technology breakthroughs. Their work demonstrates how targeted investment, combined with comprehensive technical and operational support, can accelerate the development and deployment of solutions that address our most pressing water challenges.

As highlighted in how to mitigate 4 shades of water risk through impact investing, this type of focused investment approach is critical for addressing complex water challenges while generating sustainable returns.

Final words

The Engine represents a new paradigm in water technology investment, one that recognizes the unique challenges and opportunities in bringing breakthrough innovations to market. Their combination of substantial capital, technical infrastructure, and strategic support creates a powerful platform for water entrepreneurs. With $398 million in fresh capital and a proven track record of leading investments, The Engine is well-positioned to drive the next wave of water technology breakthroughs. Their emphasis on patient capital and deep technical expertise particularly resonates in the water sector, where innovations often require extended development timelines and specialized support. For water entrepreneurs and co-investors alike, The Engine offers not just funding, but a comprehensive pathway to scale impactful water solutions. As water challenges continue to mount globally, this model of investment and support may well prove crucial in accelerating the technologies we need for a water-secure future.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!