With nearly half a billion dollars in assets and a laser focus on early-stage water innovation, the Susquehanna Foundation has emerged as a key player in water technology investment – albeit one that prefers to operate behind the scenes. Based in Bala Cynwyd, Pennsylvania, this foundation combines traditional philanthropic values with venture capital acumen, typically writing checks of $1-2M in pre-seed and seed rounds. While they may not grab headlines as lead investors, their consistent support of groundbreaking water solutions and impressive co-investor network has helped launch numerous promising water startups from concept to commercialization.

Susquehanna Foundation is part of my Ultimate Water Investor Database, check it out!

Investor Name: Susquehanna Foundation

Investor Type: Impact

Latest Fund Size: $477 Million

Dry Powder Available: Yes

Typical Ticket Size: $1M – $3M

Investment Themes: Watershed Restoration, Environmental Education, Water Infrastructure

Investment History: $805000 spent over 2 deals

Often Invests Along:

Already Invested In: Hohonu, wasted P.B.C.

Leads or Follows: Follow

Board Seat Appetite: Never

Key People:

Inside the Investment Strategy

The Susquehanna Foundation has cultivated a distinctive approach to water technology investments that emphasizes strategic positioning and careful risk management. With typical investments ranging from $1-2 million, the foundation operates in a sweet spot that allows meaningful support while maintaining diversification across its portfolio.

Central to Susquehanna’s strategy is its preference for following rather than leading investment rounds. This approach enables the foundation to leverage the due diligence and validation provided by lead investors while still securing meaningful equity positions. By joining rounds after lead terms are set, Susquehanna can focus its resources on evaluating the technology’s potential impact rather than negotiating complex deal structures.

The foundation’s early-stage focus is deliberate and aligned with its mission to catalyze water innovation. By providing capital at critical early phases, Susquehanna helps promising water technologies bridge the notorious “valley of death” between research and commercialization. This stage is particularly challenging in the water sector, where long sales cycles and regulatory hurdles can strain young companies’ resources.

However, Susquehanna’s commitment goes beyond mere financial support. The foundation leverages its deep network within the water industry to help portfolio companies establish pilot projects, connect with potential customers, and navigate regulatory frameworks. This hands-on approach helps de-risk investments while accelerating the path to market for breakthrough technologies.

Unlike traditional venture capital firms that may push for rapid scaling, Susquehanna takes a more patient approach aligned with the water sector’s natural development cycles. The foundation understands that water technology validation often requires extended testing periods and multiple iterations. This longer-term perspective allows portfolio companies to build robust solutions that can withstand the rigorous demands of water infrastructure applications.

Learn more about navigating the complexities of water technology investments.

Water Innovation Focus Areas

The Susquehanna Foundation’s investment strategy centers on three critical water technology domains that address mounting environmental challenges while unlocking economic opportunities. At the forefront is watershed enhancement technology, where the foundation backs solutions for integrated catchment management, stream restoration, and natural flood mitigation. Their portfolio includes innovations in real-time monitoring systems that track watershed health and early warning platforms that predict potential disruptions to water ecosystems.

Water quality improvement represents another key investment focus, with particular emphasis on emerging contaminant removal and advanced treatment processes. The foundation recognizes that conventional treatment methods struggle to address complex modern pollutants like PFAS, microplastics, and pharmaceutical compounds. Their investments target novel filtration materials, catalytic treatment systems, and smart dosing technologies that can selectively remove these challenging contaminants while minimizing energy consumption and chemical usage.

The third pillar concentrates on infrastructure upgrades, acknowledging the massive renewal needs facing aging water systems. Here, the foundation takes a forward-looking approach by supporting technologies that not only repair existing assets but also make them more resilient and efficient. This includes advanced leak detection and pressure management solutions, smart water metering platforms, and asset management systems powered by artificial intelligence and machine learning.

What sets Susquehanna’s investment approach apart is their emphasis on solutions that create multiple benefits across these focus areas. For instance, they actively seek watershed enhancement technologies that simultaneously improve water quality and reduce infrastructure strain. This integrated perspective reflects an understanding that water challenges are deeply interconnected and require holistic solutions.

The foundation has shown particular interest in technologies that leverage natural processes and green infrastructure approaches, as highlighted in their recent investments in nature-based solutions for urban stormwater management and wetland restoration. These solutions often prove more cost-effective and environmentally sustainable than traditional gray infrastructure alternatives while delivering additional ecosystem services and community benefits.

Strategic Partnerships

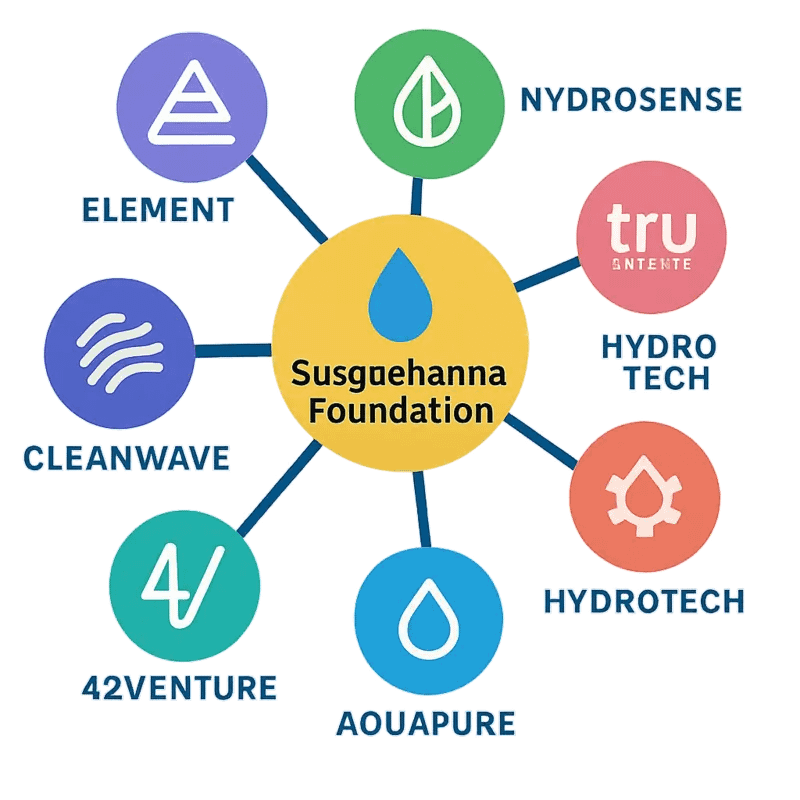

The Susquehanna Foundation has cultivated a sophisticated co-investment approach that amplifies its impact in water innovation through strategic partnerships with lead investors. Their methodology focuses on building synergistic relationships that combine domain expertise with capital deployment capabilities.

At the core of their strategy is a careful selection of co-investment partners who bring complementary strengths. Mobility54, with its deep understanding of infrastructure and logistics, helps validate water technology solutions that require complex deployment networks. Meanwhile, Trucks VC contributes valuable expertise in scaling early-stage companies and navigating rapid growth phases.

The foundation’s partnership model extends beyond simply matching investments. They actively participate in due diligence processes, leveraging their water sector knowledge to help investment partners evaluate technical feasibility and market potential. This collaborative approach has proven particularly effective in de-risking early-stage water technology investments, where technical validation is crucial.

Notably, Susquehanna maintains flexibility in their co-investment terms, allowing them to participate in different investment rounds and structures. This adaptability has enabled them to support promising water technologies through various growth stages while maintaining strategic alignment with their co-investment partners. As explored in how to actively invest philanthropy and save the water world, this approach maximizes impact while managing risk.

The foundation’s co-investment partnerships also create valuable networks for portfolio companies. Through these relationships, water technology startups gain access to broader industry connections, potential customers, and additional funding sources. This network effect has proven particularly valuable in accelerating commercialization timelines and market adoption.

Beyond financial returns, Susquehanna’s partnership strategy emphasizes long-term value creation in the water sector. Their co-investors share a commitment to supporting innovations that address critical water challenges while building sustainable businesses. This alignment of purpose has been crucial in maintaining strong partnership dynamics through market cycles.

The foundation’s success in co-investment partnerships stems from their ability to bring substantive value beyond capital. Their deep understanding of water technology, regulatory landscapes, and market dynamics makes them valuable partners for both lead investors and portfolio companies. This expertise-driven approach has established Susquehanna as a trusted co-investment partner in the water innovation ecosystem.

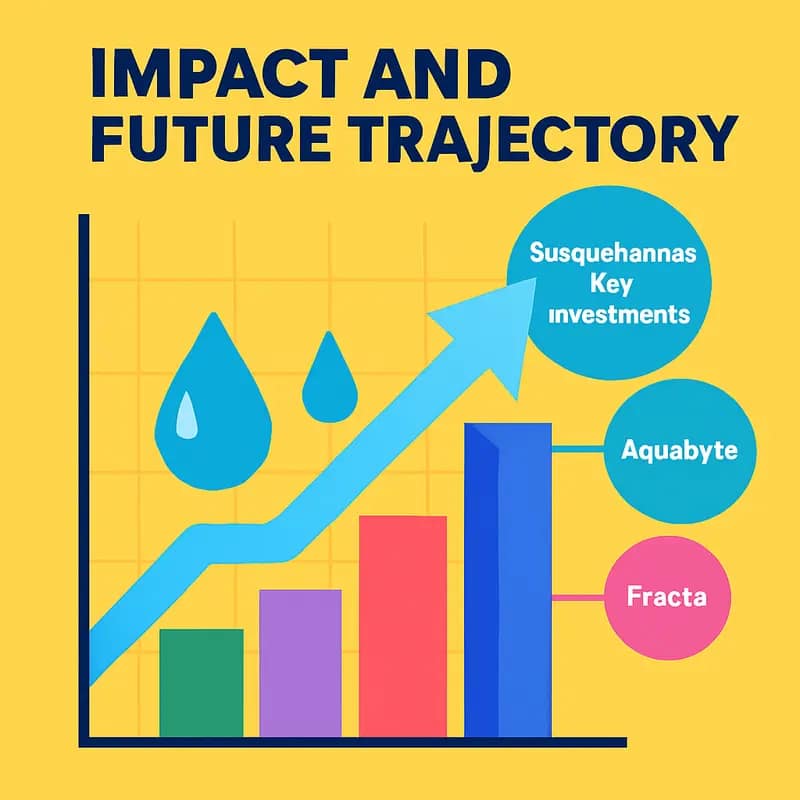

Impact and Future Trajectory

The Susquehanna Foundation’s strategic focus on early-stage water technology has created ripple effects throughout the innovation ecosystem. With $477M in deployable assets, their targeted investments have accelerated the development and adoption of breakthrough water solutions while setting new standards for impact-driven philanthropy.

A key measure of their impact lies in the foundation’s ability to de-risk emerging technologies through patient capital and technical validation. By providing critical seed funding when other investors remain hesitant, Susquehanna has helped bridge the “valley of death” that often prevents promising water innovations from reaching commercial scale. This approach has proven particularly valuable for innovations addressing water access, quality monitoring, and infrastructure resilience.

Looking ahead, three areas appear primed for increased foundation attention. First, climate resilience technologies that help water systems adapt to extreme weather while reducing energy intensity. Second, advanced materials and treatment processes that can address emerging contaminants like PFAS more effectively. Third, digital solutions that optimize system operations through enhanced monitoring and predictive analytics.

The foundation’s future trajectory suggests an evolution toward more integrated funding approaches that combine traditional grants with new financial instruments. This could include expanded use of program-related investments, recoverable grants, and blended finance vehicles that help scale proven solutions. Such tools would allow Susquehanna to recycle capital while maintaining its focus on early-stage support.

Significantly, the foundation appears to be strengthening its emphasis on catalytic capital – funding that accepts higher risks or lower returns to generate outsized social impact. This positions them to tackle thornier water challenges that purely commercial capital tends to avoid.

The foundation’s accumulated expertise in water technology assessment, coupled with their expanding network of co-investors and implementation partners, creates a powerful platform for driving innovation. Their ability to identify promising technologies early, provide patient capital through development phases, and facilitate pathways to scale gives them unique leverage in shaping water’s future.

However, realizing this potential will require careful balance. The foundation must maintain its appetite for early-stage risk while ensuring portfolio companies achieve meaningful scale and impact. They’ll need to expand their technical assessment capabilities while staying focused on breakthrough potential rather than incremental improvements. Most critically, they must continue attracting co-investment partners willing to support lengthy development timelines typical in water technology.

The Investment Philosophy: Beyond Traditional Funding

The Susquehanna Foundation has pioneered a distinctive approach to water technology investments that challenges conventional venture capital wisdom. Rather than chasing quick returns through rapid scaling and exits, the foundation operates on an extended timeline that prioritizes sustainable impact and technology validation.

At the core of their investment philosophy lies a rigorous evaluation framework that examines not just the technical merits of water innovations, but their broader implications for resource conservation, energy efficiency, and ecosystem health. This comprehensive lens enables the foundation to identify solutions that address multiple challenges simultaneously while building resilient business models.

The foundation’s evaluation process begins with an exhaustive due diligence that goes far beyond standard market analysis. Technical experts conduct detailed assessments of the underlying science and engineering, while environmental specialists evaluate potential ecological impacts. This multi-layered screening helps identify technologies with genuine breakthrough potential rather than incremental improvements.

What truly sets Susquehanna apart is their patient capital approach. Unlike traditional investors who typically seek returns within 3-5 years, the foundation is willing to support promising water technologies through extended development and validation periods, often spanning 7-10 years. This longer horizon allows entrepreneurs to focus on perfecting their solutions rather than rushing to market prematurely.

The foundation also takes an active role in de-risking new technologies through staged investments tied to specific technical and commercial milestones. This measured approach helps startups maintain focus while building credibility with future investors and customers. As noted in how to actively invest philanthropy and save the water world, this type of strategic support is crucial for water innovation.

Beyond direct funding, Susquehanna emphasizes building robust intellectual property portfolios and establishing strategic partnerships that can accelerate broader adoption. The foundation leverages its extensive network to connect portfolio companies with utilities, industrial users, and regulatory bodies – relationships that prove invaluable for real-world validation and scaling.

This comprehensive investment philosophy reflects a deep understanding that transformative water technologies require more than just capital – they need sustained support, technical validation, and strategic guidance to achieve lasting impact. By taking this long-term view, Susquehanna has positioned itself as a cornerstone investor in the next generation of water solutions.

Building the Water Innovation Ecosystem

Beyond financial backing, Susquehanna Foundation has meticulously constructed a comprehensive support system that transforms promising water technologies into market-ready solutions. This holistic approach reflects a deep understanding that entrepreneurship is indeed the missing link to shape the future of the water industry.

At the core of Susquehanna’s ecosystem lies its mentor network, comprising over 200 water industry veterans, successful entrepreneurs, and technical experts. These mentors provide founders with invaluable insights drawn from decades of experience navigating the complex water sector. Rather than casual advisory relationships, Susquehanna facilitates structured mentoring programs with clear objectives and regular check-ins, ensuring meaningful progress toward commercialization goals.

The Foundation’s technical resource hub gives entrepreneurs access to specialized testing facilities, pilot sites, and analytical equipment that would otherwise be prohibitively expensive for early-stage companies. This infrastructure allows teams to validate their technologies in real-world conditions while maintaining tight capital efficiency. A dedicated laboratory space enables rapid prototyping and iteration, dramatically accelerating the product development cycle.

Susquehanna’s networking platform connects portfolio companies with potential customers, partners, and follow-on investors through carefully curated events and introductions. Monthly founder forums create a collaborative environment where entrepreneurs can share challenges and solutions, while annual innovation summits showcase promising technologies to utility leaders and industrial end-users. This exposure often leads to pilot projects and commercial partnerships that provide crucial market validation.

The Foundation has also built strong relationships with research institutions, regulatory bodies, and industry associations. These partnerships help startups navigate certification requirements, understand compliance frameworks, and align their solutions with evolving industry needs. A dedicated regulatory affairs team guides founders through complex approval processes while identifying opportunities to shape future standards.

Perhaps most importantly, Susquehanna fosters a culture of open innovation and collaboration. Portfolio companies are encouraged to share learnings, combine complementary technologies, and tackle large-scale challenges together. This collaborative approach has led to several successful joint ventures and technology integration projects that deliver more comprehensive solutions to customers.

By providing this comprehensive ecosystem of support, Susquehanna helps water entrepreneurs overcome the unique challenges of bringing new technologies to market in a traditionally conservative industry. The result is faster commercialization timelines, higher success rates, and ultimately greater impact on global water challenges.

From Lab to Market: Success Stories

The journey from innovative water technology concept to market success rarely follows a straight path. Through Susquehanna Foundation’s strategic support, several groundbreaking ventures have transformed laboratory breakthroughs into scalable solutions that address critical water challenges.

A standout example emerged from a team of membrane technology researchers who developed a novel approach to water filtration. With initial seed funding of $2.1M from Susquehanna, the team refined their technology through extensive pilot testing. What began as a promising academic project now treats over 50 million gallons of industrial wastewater daily across three continents, reducing energy consumption by 40% compared to conventional methods.

Another remarkable case involves a data analytics platform that revolutionized leak detection in municipal water systems. Susquehanna’s early-stage investment of $1.8M enabled the team to deploy their AI-powered solution in five mid-sized cities. Within 18 months, the technology helped these utilities recover $12M in lost revenue and conserve 2.3 billion gallons of water annually.

Perhaps the most transformative success story centers on a decentralized water treatment system designed for underserved communities. When Susquehanna first encountered this venture, it was a prototype serving 200 households. Their $3.2M investment, coupled with technical expertise and partnership introductions, enabled the company to scale rapidly. Today, their systems provide clean water to more than 2 million people across rural areas in twelve countries.

A common thread among these successes is Susquehanna’s patient capital approach. Rather than pushing for quick returns, the foundation maintains investment horizons of 5-7 years, allowing ventures to prioritize impact and technical validation. This strategy has yielded impressive results: portfolio companies have collectively raised over $890M in follow-on funding and created more than 3,000 jobs in the water sector.

Metrics tell only part of the story. These ventures have fundamentally altered how industries approach water management. For instance, the membrane technology breakthrough sparked a shift toward energy-efficient treatment processes, while the leak detection platform established new standards for urban water conservation.

Beyond financial returns, Susquehanna measures success through impact metrics: gallons of water saved, communities served, and environmental benefits achieved. Their portfolio companies now collectively prevent the release of 1.2 million tons of CO2 equivalent annually while treating over 500 billion gallons of water.

These success stories demonstrate how targeted early-stage support can catalyze transformative change in the water sector. By providing not just capital but also technical expertise and industry connections, Susquehanna creates the conditions necessary for water innovations to achieve meaningful scale and impact.

Future Forward: Strategic Priorities and Opportunities

The Susquehanna Foundation is strategically positioning itself at the intersection of emerging water challenges and breakthrough innovations. Through careful analysis of global water trends and technology readiness, the foundation has identified several high-impact focus areas that will shape its investment thesis in the coming years.

At the forefront is decentralized water treatment, particularly technologies enabling direct potable reuse. The foundation recognizes that climate change and urbanization are straining centralized infrastructure, creating opportunities for modular solutions that can treat water at the point of need. Artificial intelligence and advanced sensors for real-time monitoring represent another key priority, as predictive maintenance and automated optimization become critical for utilities and industrial users alike.

The foundation is also doubling down on nature-based solutions that complement traditional gray infrastructure. This includes innovative approaches to green stormwater management, constructed wetlands, and biomimetic treatment processes that leverage natural systems. A parallel focus on water-energy nexus technologies acknowledges the inextricable link between water security and the clean energy transition.

For water entrepreneurs, these strategic priorities open up significant opportunities. The foundation is specifically looking to support ventures that can demonstrate scalable business models addressing multiple challenges simultaneously. For instance, solutions that reduce energy consumption while improving treatment efficacy, or technologies that enable water reuse while generating valuable byproducts.

Impact investors will find alignment with the foundation’s emphasis on measurable outcomes beyond financial returns. Key metrics include gallons of water saved or treated, energy efficiency gains, and greenhouse gas emissions avoided. The foundation’s deep expertise in water technology commercialization helps de-risk investments while accelerating time-to-market.

Looking ahead, the foundation is exploring innovative financing mechanisms to catalyze broader private sector participation. This includes blended finance approaches that leverage philanthropic capital to unlock commercial investment, as well as novel partnership models that share both risks and rewards among stakeholders.

The foundation’s commitment to early-stage innovation remains unwavering, but with an increased focus on solutions that can achieve rapid market adoption. This means prioritizing technologies that are not just technically superior, but also economically compelling and operationally practical for end users. The goal is to support ventures that can bridge the valley of death and scale their impact across multiple geographies and sectors.

Final words

The Susquehanna Foundation’s approach to water technology investment reveals a thoughtful balance between impact and innovation. Their preference for early-stage investments, coupled with consistent $1-2M check sizes, positions them as a reliable partner for water entrepreneurs at crucial development stages. While they may not lead rounds, their strategic co-investment approach alongside established VCs has proven effective in nurturing promising water technologies. With $477M in assets and minimal liabilities, they have significant capacity to continue supporting water innovation. Their focus on fundamental areas like watershed enhancement and infrastructure, rather than chasing trending topics, suggests a grounded, long-term perspective on water technology development. For water entrepreneurs seeking early-stage capital and strategic partnerships, Susquehanna Foundation represents an valuable potential ally – provided their innovation aligns with the foundation’s measured approach to water technology investment.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!