From pioneering water treatment technologies to revolutionizing ocean conservation, S2G Ventures stands at the forefront of water innovation financing. With $2.5 billion in committed capital and a laser focus on sustainability, this Chicago-based investment firm has emerged as a formidable force in shaping the future of water technology. Their unique approach combines deep sector expertise with flexible capital deployment across multiple stages, making them a crucial partner for water entrepreneurs seeking not just funding, but strategic guidance and extensive industry connections. Whether you’re a startup founder with groundbreaking water tech or an impact investor looking to dive into the blue economy, understanding S2G’s investment thesis and operational model could be your key to riding the next wave of water innovation.

S2G Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: S2G Ventures

Investor Type: VC

Latest Fund Size: $100 Million

Dry Powder Available: Yes

Typical Ticket Size: $10M – $30M

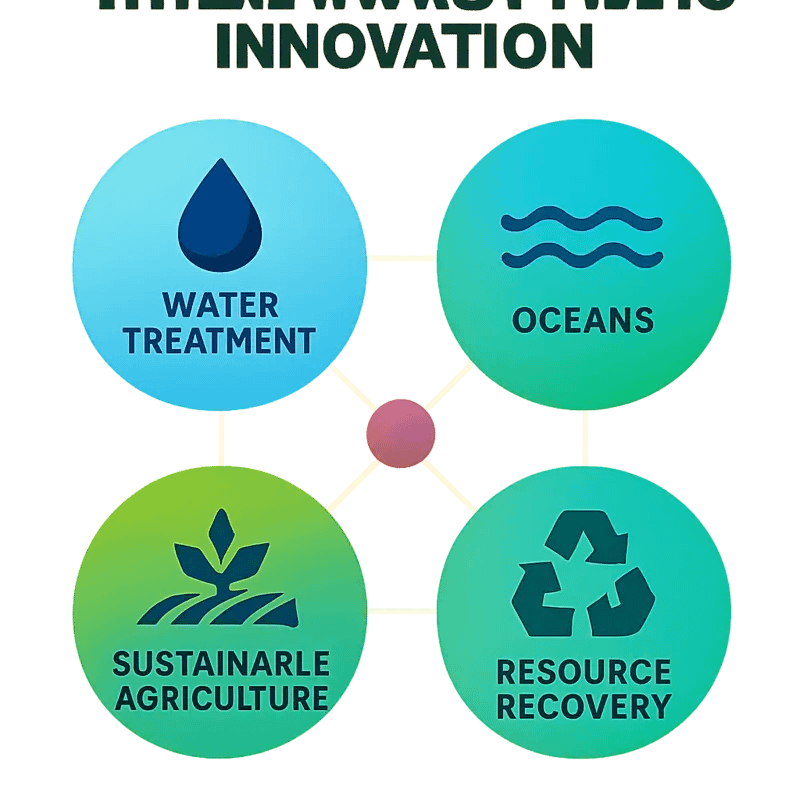

Investment Themes: Water Treatment, Blue Economy/Oceans & Aquaculture, Sustainable Food Production

Investment History: $21654338.67 spent over 5 deals

Often Invests Along: Mazarine Ventures

Already Invested In: Arable Labs, Inc., Growers Edge, Matter, Moleaer

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People: Aaron Rudberg, Chuck Templeton, Sanjeev Krishnan

The Investment Philosophy: Where Impact Meets Innovation

At the core of S2G Ventures’ water technology investment strategy lies a sophisticated dual mandate: generating market-rate financial returns while driving measurable environmental impact. This approach reflects a fundamental belief that the most sustainable solutions are those that create both economic and ecological value.

S2G’s investment thesis centers on identifying technologies that address critical challenges in water quality, infrastructure efficiency, and resource recovery. The firm evaluates potential investments through a rigorous framework that examines both commercial viability and environmental benefit metrics. This includes analyzing factors like water savings potential, energy efficiency improvements, and pollution reduction capabilities alongside traditional financial metrics.

What sets S2G apart is their deep understanding of water technology’s unique commercialization challenges. Read more about how they overcome these challenges. The firm recognizes that water solutions often require longer development cycles and more extensive pilot testing than other cleantech sectors. This insight shapes their patient capital approach, providing portfolio companies the runway needed to validate technologies in real-world conditions.

The firm’s investment decisions are guided by three core impact pillars: water security, infrastructure resilience, and ecosystem health. Rather than viewing these as constraints, S2G sees them as value creation opportunities. They actively seek technologies that can scale to address multiple challenges simultaneously – for instance, solutions that both reduce energy consumption in water treatment while improving water quality.

Portfolio company support extends beyond capital deployment. S2G leverages its extensive network of water industry veterans, utility operators, and regulatory experts to help startups navigate the complex landscape of water technology commercialization. This hands-on approach helps de-risk investments while accelerating market adoption.

The firm’s commitment to measurable impact is evidenced by their sophisticated impact measurement framework. Each investment must demonstrate clear potential for quantifiable environmental benefits, which are tracked and reported throughout the investment lifecycle. This data-driven approach ensures accountability while providing valuable insights for future investment decisions.

Critically, S2G’s investment philosophy recognizes water technology’s vital role in addressing climate change and environmental degradation. They prioritize solutions that can help communities and industries adapt to increasing water stress while reducing their environmental footprint. This forward-looking perspective positions them to capitalize on the growing demand for sustainable water solutions while delivering meaningful environmental impact.

Capital Deployment: From Seed to Scale

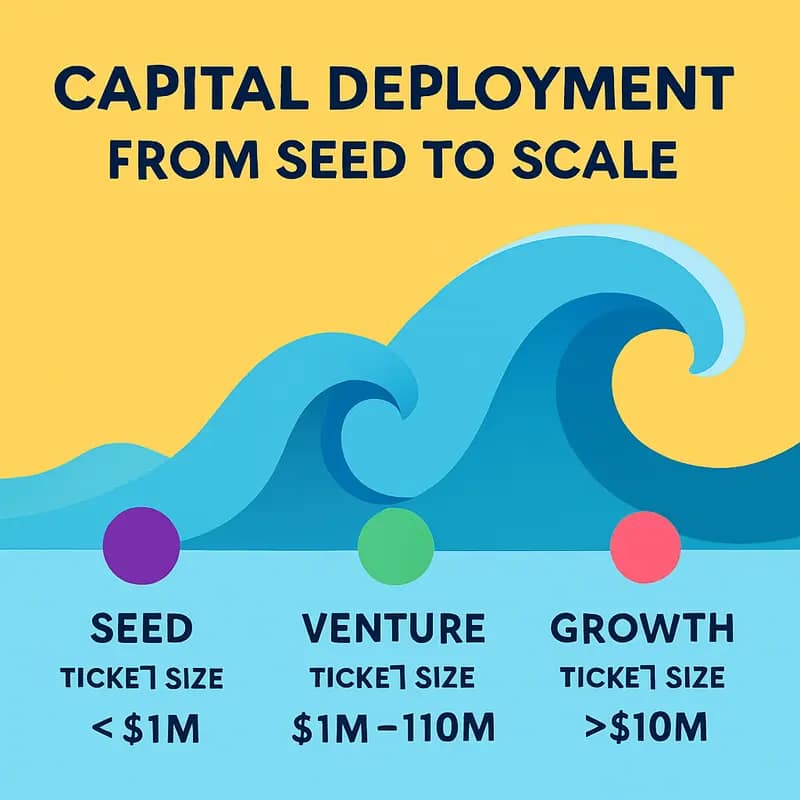

S2G Ventures has engineered a sophisticated capital deployment strategy that mirrors the diverse funding needs across the water technology lifecycle. Moving beyond traditional venture capital’s rigid investment parameters, S2G employs a flexible approach that enables them to write checks ranging from $500,000 for early-stage companies to $50 million for scaling enterprises.

This versatility stems from S2G’s unique fund structure, which allows them to maintain long-term relationships with portfolio companies through multiple funding rounds. Rather than forcing companies to seek new investors at each growth stage, S2G can continue supporting promising ventures from initial seed funding through late-stage growth capital.

The firm’s deal structuring reflects this long-term mindset. Early-stage investments typically involve convertible notes or priced equity rounds with pro-rata rights, ensuring S2G can participate in future fundraising. For growth-stage companies, S2G often employs structured equity instruments that provide downside protection while maintaining significant upside exposure.

S2G’s investment terms are deliberately crafted to align incentives between investors and entrepreneurs. Performance milestones are tied to both financial metrics and impact outcomes, such as water savings or pollution reduction. This dual-purpose approach ensures that commercial success drives environmental benefits.

The firm has also pioneered innovative financing mechanisms specifically for water technology companies. These include revenue-based financing for companies with predictable cash flows and project finance structures for capital-intensive infrastructure deployments. Such tailored approaches help overcome the unique challenges of commercializing and scaling water solutions.

What sets S2G apart is their ability to layer multiple capital vehicles within a single investment. A typical growth-stage deal might combine equity investment with project financing and working capital facilities. This comprehensive approach provides portfolio companies with the full spectrum of capital needed to scale operations.

Critical to S2G’s success is their deep sector expertise, which enables sophisticated risk assessment and creative deal structuring. The firm maintains an extensive network of technical advisors who assist in due diligence and provide ongoing portfolio support. This knowledge advantage allows S2G to take informed risks on emerging technologies while structuring appropriate protections.

Strategic Partnership: Beyond the Check

S2G Ventures’ success in water technology stems from their comprehensive partnership approach that extends far beyond simple capital deployment. The firm takes a hands-on stance with portfolio companies, providing strategic guidance through active board participation and deep operational expertise.

Board seats are not merely ceremonial positions for S2G’s investment team. Their directors actively shape strategy, leverage industry connections, and help navigate complex regulatory environments. This level of engagement allows S2G to identify challenges early and marshal resources to address them before they become critical issues.

The firm’s follow-on investment strategy reflects their long-term commitment to portfolio success. Rather than taking a “set it and forget it” approach, S2G maintains dry powder specifically for supporting existing investments through multiple funding rounds. This creates alignment between investor and founder interests while providing companies the runway needed to achieve meaningful milestones.

Perhaps S2G’s most valuable contribution lies in their extensive network of industry partners, customers, and fellow investors. Portfolio companies gain access to potential clients through S2G’s relationships with major utilities and industrial water users. Technical partnerships emerge through connections to leading research institutions and engineering firms. When companies need additional capital, S2G leverages their co-investor network to build powerful funding syndicates.

Beyond individual connections, S2G facilitates collaboration between portfolio companies to unlock powerful synergies. A treatment technology provider might partner with a digital solutions company to create more comprehensive offerings. Or multiple companies might bundle complementary products to better serve specific market segments.

The firm’s deep market intelligence function provides another strategic advantage. S2G maintains comprehensive datasets on water technology trends, regulatory developments, and customer pain points. This research helps portfolio companies identify opportunities, refine product-market fit, and make data-driven decisions about resource allocation.

As explored in how to take mid-market green tech companies to the next level, this type of active investment approach is critical for scaling water technology businesses. S2G has refined this model through years of experience, creating a blueprint for turning promising water innovations into market-leading companies.

Their partnership philosophy recognizes that breakthrough technologies alone rarely create successful businesses. It takes a combination of strategic guidance, operational support, and ecosystem development to overcome the unique challenges of the water sector. By providing this comprehensive platform, S2G helps portfolio companies navigate the long path from innovation to impact.

The Blue Economy Opportunity

S2G Ventures’ launch of a dedicated $100M Oceans and Seafood fund marks a pivotal moment in sustainable water innovation financing. This strategic move reflects the firm’s vision of the blue economy as the next frontier for transformative impact and returns.

The fund takes aim at critical challenges facing our oceans and waterways, from overfishing and habitat destruction to water pollution and coastal resilience. Rather than viewing these as isolated environmental issues, S2G recognizes them as interconnected opportunities for technological innovation and sustainable business models.

A key focus area is aquaculture technology, where breakthrough solutions in feed alternatives, disease prevention, and production systems can simultaneously boost yields while reducing environmental impacts. S2G’s investment thesis extends beyond farm operations to encompass the entire value chain – from novel ingredients and monitoring systems to consumer products and market access platforms.

The fund’s scope also includes technologies addressing ocean plastic pollution, marine ecosystem restoration, and coastal infrastructure adaptation. By taking an integrated approach, S2G aims to catalyze solutions that deliver both environmental and economic returns.

What sets this fund apart is S2G’s emphasis on co-investment opportunities. The firm actively seeks to partner with strategic corporate investors, family offices, and institutional players who share their vision for sustainable ocean and water innovation. This collaborative approach helps de-risk investments while accelerating commercialization through industry partnerships.

Market trends strongly support the timing of this initiative. Global seafood demand continues to grow while wild catch plateaus, creating opportunities in sustainable aquaculture. Rising awareness of ocean plastic pollution is driving innovation in materials and recycling. Coastal communities increasingly seek resilience solutions as climate impacts intensify.

Through this dedicated vehicle, S2G is positioning itself at the intersection of these converging trends. Their hands-on investment approach, proven in agriculture and food tech, translates well to scaling breakthrough water technologies. As the firm notes in their investment thesis, water innovation requires patient capital combined with deep operational expertise – precisely the mix they bring to the table.

The $100M fund represents more than just capital deployment; it’s a signal to entrepreneurs and co-investors that sustainable water innovation has reached an inflection point. S2G’s move helps validate the sector while providing a blueprint for others to follow in backing promising water technologies.

The S2G Investment Philosophy

At the heart of S2G Ventures’ transformative approach to water technology investment lies a sophisticated three-pillar framework centered on sustainability, scalability, and societal impact. This methodology has enabled them to deploy over $2.5 billion in capital while maintaining strict adherence to both financial returns and environmental stewardship.

Through meticulous due diligence, S2G evaluates potential investments against stringent environmental, social, and governance (ESG) criteria. Their investment thesis prioritizes technologies that demonstrate measurable impacts on water conservation, quality improvement, or infrastructure efficiency. Each potential portfolio company must prove not just technological innovation, but also a clear path to commercial viability and market adoption.

S2G’s sector focus spans across the entire water value chain, with particular emphasis on digital solutions, advanced treatment technologies, and resource recovery innovations. The firm shows strategic preference for companies addressing major industry pain points like aging infrastructure, regulatory compliance, and emerging contaminants. This comprehensive view allows them to identify synergies between portfolio companies and create value through strategic partnerships.

What truly sets S2G apart is their hands-on investment approach. Beyond capital injection, they provide portfolio companies with extensive operational support, industry connections, and strategic guidance. Their team of water industry veterans works closely with management teams to accelerate commercialization, optimize business models, and navigate complex regulatory landscapes.

The firm’s investment criteria extend beyond traditional metrics like revenue growth and market size. They place significant weight on a company’s potential to drive systemic change in the water sector. This includes evaluating factors such as technology scalability, regulatory alignment, and ability to address multiple sustainability challenges simultaneously.

In terms of deal structure, S2G demonstrates flexibility while maintaining rigorous standards. Investment sizes typically range from early-stage ventures to growth equity, with the firm often leading or co-leading funding rounds. Their long-term investment horizon allows portfolio companies to develop and scale solutions properly, rather than pursuing quick exits at the expense of sustainable growth.

Notably, S2G’s investment philosophy reflects a deep understanding of water technology’s unique commercialization challenges. As explored in How to Take Mid-Market Green Tech Companies to the Next Level, they recognize that water innovation requires patient capital and strategic support to overcome market adoption barriers. This insight drives their commitment to providing both financial resources and operational expertise to portfolio companies.

Portfolio Success Stories

S2G Ventures’ investment portfolio showcases remarkable transformations in water technology. Among their standout successes is a water quality monitoring startup that revolutionized real-time contamination detection, securing contracts with major utilities across North America and Europe within just three years of S2G’s initial investment.

Another portfolio company pioneered an energy-efficient wastewater treatment solution that reduces operational costs by up to 60% while improving effluent quality. Their technology has been adopted by industrial facilities in food processing, pharmaceuticals, and municipal treatment plants, delivering both environmental and economic benefits. The company’s valuation has increased fivefold since S2G’s investment.

Particularly noteworthy is S2G’s role in scaling a breakthrough water reuse technology that enables decentralized treatment and recycling. This innovation has proven transformative for water-stressed regions, with successful implementations in agriculture, manufacturing, and commercial buildings. The company’s exponential growth attracted follow-on investment from global water industry leaders.

In the infrastructure space, an S2G-backed enterprise developed advanced leak detection and pipeline assessment capabilities using artificial intelligence. Their solution has helped utilities prevent over 50 billion gallons of water loss while extending infrastructure lifespans. The technology’s rapid market adoption led to a successful exit that generated substantial returns for S2G’s investors.

A common thread across these success stories is S2G’s hands-on approach to value creation. Beyond capital, the firm provides strategic guidance, industry connections, and operational expertise that accelerates commercialization. Their portfolio companies benefit from S2G’s deep understanding of market dynamics, regulatory landscape, and customer needs in the water sector.

These examples demonstrate how S2G’s investment thesis – focusing on scalable solutions that drive both sustainability and profitability – plays out in practice. The firm’s ability to identify promising technologies and support their path to market has established them as a catalyst for innovation in the water industry.

As detailed in How to Take Mid-Market Green Tech Companies to the Next Level, this approach to scaling environmental technologies has proven particularly effective in the water sector, where navigating the complex stakeholder landscape requires both patience and expertise.

The Entrepreneur’s Journey with S2G

When founders first engage with S2G Ventures, they quickly discover this isn’t a typical venture capital relationship. The firm takes a deeply hands-on approach that starts well before any investment discussion and continues long after the deal closes.

The journey typically begins with a thorough evaluation process that goes far beyond standard due diligence. S2G’s team of water technology experts conducts extensive technical validation, market analysis, and strategic fit assessment. But what truly sets them apart is their focus on the entrepreneur’s vision and ability to execute. As one entrepreneur noted, the firm’s extensive questioning and challenging of assumptions, while initially daunting, ultimately strengthens the business plan.

Once selected, portfolio companies gain access to S2G’s comprehensive support ecosystem. This includes strategic introductions to potential customers, partners, and industry experts within their extensive network. The firm’s operating partners work closely with management teams to refine go-to-market strategies, optimize operations, and accelerate growth. Their deep industry expertise helps companies navigate complex regulatory landscapes and technical challenges unique to the water sector.

Beyond operational support, S2G provides ongoing strategic guidance through regular board participation and quarterly reviews. Their collaborative approach means entrepreneurs can tap into the collective wisdom of the entire S2G platform, including fellow portfolio companies facing similar challenges. This peer network has proven invaluable for sharing best practices and avoiding common pitfalls.

The firm’s long-term perspective is evident in how they structure deals and support follow-on funding rounds. Rather than pushing for quick exits, S2G focuses on building sustainable businesses that can drive lasting impact in the water sector. They often take a patient capital approach, working with founders to achieve meaningful technological and commercial milestones before seeking larger funding rounds or strategic exits.

Most notably, S2G’s value-add extends to helping companies build credibility within the notoriously conservative water industry. Their stamp of approval and extensive relationships with utilities, industrial users, and regulators help accelerate adoption of innovative solutions. This combination of capital, expertise, and industry access has proven transformative for many water technology entrepreneurs navigating the challenging path from innovation to widespread implementation.

Future Vision and Market Impact

S2G Ventures is charting an ambitious course for water technology investment that extends far beyond traditional infrastructure plays. The firm’s vision centers on technologies that can transform how we manage, treat, and value water resources in an increasingly water-stressed world.

A key focus area is the intersection of water and climate resilience. S2G recognizes that water infrastructure must adapt to extreme weather events while reducing its carbon footprint. The firm actively seeks breakthrough solutions in energy-efficient treatment, smart infrastructure monitoring, and climate adaptation technologies that can scale rapidly.

Digital transformation represents another critical investment theme. S2G believes that AI, IoT sensors, and advanced analytics will revolutionize how utilities and industrial users optimize their water operations. The firm is particularly interested in solutions that can predict maintenance needs, detect leaks in real-time, and enable data-driven decision making across water networks.

Resource recovery and circular economy approaches are also high on S2G’s radar. The firm sees immense potential in technologies that can extract valuable materials from wastewater streams, generate renewable energy, and enable water reuse at scale. This aligns with their thesis that water utilities and industrial facilities can transform from cost centers into profit generators.

What sets S2G’s vision apart is their emphasis on market-ready solutions that can achieve rapid commercial adoption. Rather than betting on early-stage moonshots, they prioritize proven technologies that solve immediate customer pain points while building toward longer-term sustainability goals.

The firm’s market impact extends beyond individual investments. By focusing on scalable solutions and actively supporting portfolio companies’ growth, S2G is helping establish new industry standards and business models. Their investments send strong signals about which technologies are commercially viable, influencing broader market adoption patterns.

Looking ahead, S2G anticipates growing opportunities in specialized treatment technologies for emerging contaminants, distributed treatment systems, and integrated water management platforms that can optimize resources across entire watersheds. The firm’s deep understanding of market drivers positions them to identify and scale solutions that will shape the future of water management.

As explored in a recent analysis of impact investing in water, S2G’s approach demonstrates how strategic capital deployment can accelerate the adoption of critical water innovations while generating attractive returns. Their vision suggests that the water technology sector is entering a new era of rapid innovation and commercial scale-up.

Final words

S2G Ventures represents more than just another investment firm in the water technology landscape – it embodies a comprehensive approach to accelerating water innovation through strategic capital deployment and hands-on partnership. Their $2.5 billion platform demonstrates not only the scale of their commitment but also their understanding that water challenges require multilayered solutions spanning treatment, conservation, and resource recovery. For water entrepreneurs, S2G offers more than capital – they provide a pathway to scale through their extensive network, strategic guidance, and deep sector expertise. Their flexible investment approach, ranging from $500K to $50M, ensures they can support companies throughout their growth journey, while their strong follow-on ratio of 2.33 signals long-term commitment to portfolio success. Impact investors will find in S2G a partner that thoroughly understands how to balance financial returns with environmental impact, particularly through their newest vehicles like the $100M Oceans and Seafood fund. As water challenges intensify globally, S2G’s model of active, strategic investment in water innovation positions them as a crucial catalyst in shaping sustainable solutions for our water future.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!