Deep in the heart of Norway’s thriving tech ecosystem, ProVenture is quietly orchestrating a revolution in water technology. With NOK 1.3 billion under management across three funds, this Brentwood-based powerhouse has carved out a unique niche: identifying and nurturing early-stage Norwegian water tech startups with global potential. Their sweet spot? A NOK 20 million ticket size for pre-revenue companies, paired with hands-on guidance that transforms promising ideas into market-ready solutions. As water challenges intensify worldwide, ProVenture’s approach of blending local expertise with global ambition offers a compelling model for both entrepreneurs and impact investors seeking to make waves in the water sector.

ProVenture is part of my Ultimate Water Investor Database, check it out!

Investor Name: ProVenture

Investor Type: VC

Latest Fund Size: $152.9 Million

Dry Powder Available: No

Typical Ticket Size: <$250k

Investment Themes: Water Infrastructure, Water Technology, Water Treatment and Utilities

Investment History: $875000 spent over 2 deals

Often Invests Along: Lyse

Already Invested In: InfoTiles

Leads or Follows: Lead

Board Seat Appetite: Unknown

Key People:

The ProVenture Playbook: Decoding the Investment Strategy

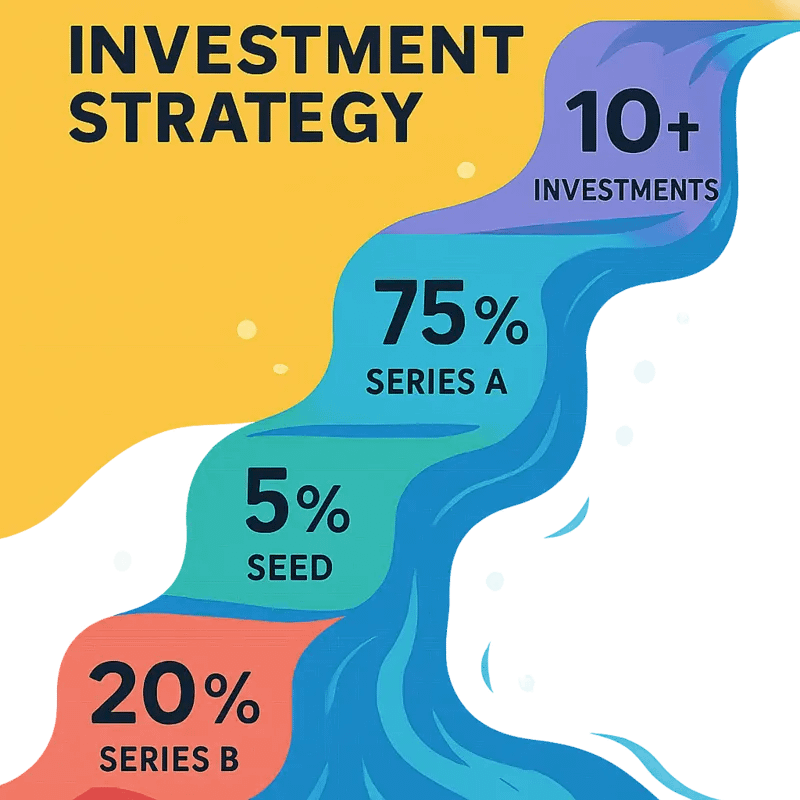

At the heart of ProVenture’s investment approach lies a carefully calibrated strategy that balances risk management with hands-on value creation. The fund’s sweet spot of NOK 20 million per investment reflects a deep understanding of early-stage water technology ventures’ capital needs. This targeted investment size enables meaningful ownership stakes while ensuring companies retain sufficient equity for future rounds.

ProVenture’s ownership target of 15-20% is strategically chosen to provide sufficient influence without overwhelming founders’ control. This balanced approach allows the fund to actively support portfolio companies while preserving entrepreneurial independence and motivation. The stake size also positions ProVenture as a valuable partner for follow-on investors, creating natural alignment for future funding rounds.

The fund’s hands-on methodology distinguishes it from traditional financial investors. Rather than simply providing capital, ProVenture embeds experienced water industry professionals within each portfolio company. This operational expertise helps startups navigate complex regulatory environments, accelerate product development cycles, and forge crucial industry partnerships. As highlighted in an article examining venture capital dynamics in water tech, this sector-specific expertise is crucial for success.

For entrepreneurs, this strategy delivers multiple benefits beyond mere funding. Portfolio companies gain access to ProVenture’s extensive network of water utilities, industrial end-users, and technology partners. The fund’s deep industry knowledge helps startups avoid common pitfalls, compress development timelines, and optimize go-to-market strategies. This support system significantly improves survival rates and accelerates growth trajectories.

From an investor perspective, the strategy creates a compelling risk-reward profile. The combination of ownership influence and active value creation allows ProVenture to meaningfully impact outcomes. The fund’s focus on water technology provides natural diversification across applications while maintaining sector expertise advantages. The NOK 20 million ticket size enables a diversified portfolio within the NOK 1.3 billion fund while ensuring each investment receives adequate attention.

Critically, ProVenture’s approach acknowledges the unique characteristics of water technology ventures. The longer development cycles and complex stakeholder environments typical in this sector require patient capital coupled with deep domain expertise. By providing both, the fund creates a supportive ecosystem for innovation while maintaining disciplined return expectations for investors.

Water Tech Themes: Where ProVenture Places Its Bets

ProVenture’s investment thesis centers on transformative water technologies that address critical infrastructure and sustainability challenges. The fund has identified several high-potential sectors where innovation can deliver both environmental impact and attractive financial returns.

Water infrastructure modernization represents a primary focus area, with aging systems requiring urgent upgrades across Norway and Europe. ProVenture targets solutions for leak detection, pipe rehabilitation, and smart water metering that can extend asset lifespans while reducing water losses. The market opportunity in infrastructure renewal alone exceeds €3.3 trillion through 2030.

Digital transformation emerges as another key investment theme, as utilities embrace data-driven operations. The fund actively seeks startups developing AI-powered analytics, IoT sensors, and automation platforms that enhance operational efficiency. These technologies enable predictive maintenance, optimize treatment processes, and provide real-time monitoring capabilities – innovations that could generate 20-30% cost savings for utilities.

Resource recovery and circular economy solutions form a third strategic pillar. ProVenture backs technologies that extract value from wastewater streams, including nutrient recovery, biogas generation, and water reuse systems. With water scarcity intensifying globally, solutions enabling industrial water recycling and sustainable resource management present compelling growth trajectories.

The fund maintains particular interest in decentralized treatment technologies that can serve remote communities while reducing infrastructure demands. This includes packaged treatment systems, point-of-use purification, and nature-based solutions that provide resilient, cost-effective alternatives to centralized infrastructure.

Climate adaptation technologies round out ProVenture’s investment priorities. The fund recognizes mounting climate pressures on water systems and seeks innovations in flood management, drought resilience, and coastal protection. This encompasses both hardware solutions like smart stormwater systems and software for climate risk modeling and adaptation planning.

Across these themes, ProVenture emphasizes scalable technologies that can be validated in Norway’s advanced water market before expanding internationally. The fund’s deep sector expertise enables thorough evaluation of technical feasibility, market timing, and growth potential – crucial factors in early-stage water tech investing where patient capital and industry knowledge drive success.

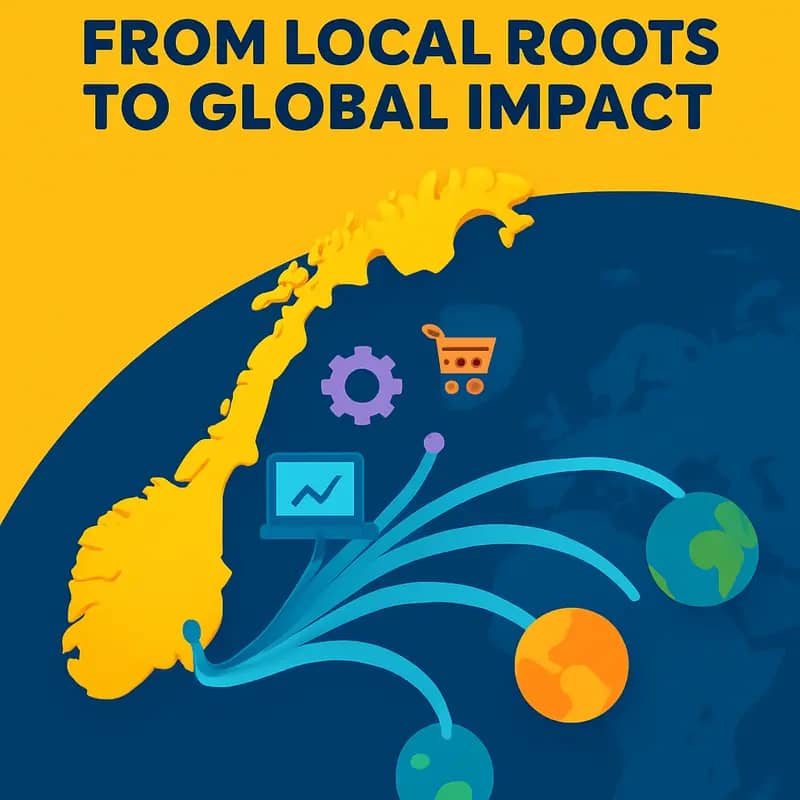

From Local Roots to Global Impact

Norway’s unique position as a leader in water technology innovation provides ProVenture with distinctive advantages in identifying and scaling breakthrough solutions. The fund’s robust validation process leverages Norway’s advanced water infrastructure as a real-world testing ground while maintaining a clear focus on global scalability.

The Norwegian water sector’s progressive regulatory framework and high environmental standards create an ideal environment for early validation. Municipal utilities actively participate in pilot programs, offering startups crucial operational feedback. This symbiotic relationship allows ProVenture to de-risk investments by thoroughly evaluating technologies in demanding real-world conditions before international expansion.

Beyond Norway’s borders, ProVenture employs a systematic approach to market validation across diverse geographies. The fund maintains strategic partnerships with utilities and industrial users in key markets across Europe, North America, and Asia. These relationships provide valuable market intelligence and potential customer pipelines for portfolio companies.

ProVenture’s expansion playbook emphasizes careful market selection based on three critical factors: regulatory alignment, market readiness, and local partnership opportunities. Rather than pursuing rapid global deployment, the fund helps portfolio companies establish strong regional footholds before expanding further. This measured approach has proven particularly effective in complex markets like municipal water infrastructure, where local relationships and track records significantly influence adoption.

The fund’s international network extends beyond potential customers to include research institutions, industry associations, and other venture capital firms. This ecosystem approach helps portfolio companies navigate different market dynamics while accessing complementary expertise and resources. ProVenture actively facilitates these connections, often taking board positions to guide international growth strategies.

A key element of ProVenture’s global scaling strategy is its focus on solutions that address universal water challenges. While technologies may originate from Norway’s specific context, the fund prioritizes innovations with broad applicability across different regulatory environments and infrastructure systems. This emphasis on versatile solutions has helped portfolio companies successfully adapt their offerings for diverse markets.

Recognizing that water technology adoption often requires significant stakeholder education, ProVenture supports portfolio companies in developing market-specific value propositions and implementation frameworks. The fund leverages its experience in translating Nordic water innovation success stories to help companies effectively communicate their solutions’ benefits to different audiences.

As explored in how to use a costly material to bring membrane treatment costs down, this approach of careful validation and strategic expansion has enabled numerous breakthrough technologies to achieve international success while maintaining strong connections to their Norwegian roots.

The Founder’s Journey: ProVenture’s Value-Add Approach

ProVenture’s support for water technology founders extends far beyond traditional venture capital funding. The fund has developed a comprehensive value-add model that addresses the unique challenges faced by early-stage water innovation companies.

At the core of ProVenture’s approach is their deep operational expertise in water technology commercialization. Each portfolio company gets paired with dedicated partners who have founded, scaled, and exited successful water enterprises. These partners provide hands-on guidance through critical growth phases, from product-market fit validation to international expansion strategy.

The fund’s strategic partnership network amplifies their impact. ProVenture has cultivated relationships with leading water utilities, industrial water users, and technology integrators across Europe. This network serves as both a customer discovery platform and potential commercial pathway for portfolio companies. Founders gain privileged access to decision-makers, allowing them to gather real-world feedback and secure pilot opportunities with marquee customers.

ProVenture also takes an active role in talent acquisition and team building. Drawing from their extensive industry connections, they help founders recruit key technical and commercial hires. The fund regularly organizes peer learning sessions where portfolio company leaders can exchange insights on common challenges around scaling water innovations.

Noteworthy is ProVenture’s approach to strategic partnerships, which focuses on creating sustainable competitive advantages. Rather than pursuing transactional relationships, they help founders forge deep technical and commercial collaborations. This includes joint development agreements, licensing partnerships, and go-to-market alliances that accelerate time-to-market while preserving startup independence.

The fund’s commitment to founder support is evident in their resource allocation. Beyond the initial investment, ProVenture maintains dedicated operational support teams specializing in areas like regulatory compliance, supply chain optimization, and international market entry. This allows founders to access specialized expertise without building extensive in-house capabilities prematurely.

By taking an entrepreneur-first approach while leveraging deep water industry knowledge, ProVenture has created a support ecosystem that meaningfully improves the odds of success for water technology startups. Their model demonstrates how hands-on guidance, strategic partnerships, and operational support can help bridge the challenging journey from innovation to market impact.

The Innovation Pipeline

ProVenture’s approach to identifying breakthrough water technologies combines rigorous technical assessment with deep market understanding. The fund’s evaluation process leverages a multi-layered screening methodology that examines both the scientific merit and commercial viability of emerging solutions.

At the heart of their technical due diligence is a network of specialized advisors – leading researchers, engineers, and industry veterans who scrutinize the fundamental science and engineering behind each innovation. This expert panel assesses factors like technical differentiation, scalability potential, and implementation complexity. They specifically look for solutions that can demonstrate clear performance advantages over existing technologies while maintaining practical feasibility for real-world deployment.

Beyond pure technical evaluation, ProVenture places significant emphasis on market validation and customer discovery. The fund’s team engages extensively with utilities, industrial users, and other key stakeholders to verify genuine market pull for new technologies. This hands-on approach helps identify solutions that not only work technically but also address pressing customer pain points and deliver compelling economic value.

The fund has developed a proprietary scoring framework that weighs multiple criteria including technical readiness, market size, competitive positioning, team capabilities, and environmental impact. Technologies must meet minimum thresholds across all dimensions to advance through the pipeline. This systematic approach helps filter out solutions that may be scientifically interesting but lack clear paths to commercial success.

What truly sets ProVenture’s process apart is their focus on identifying technologies with network effects – solutions that become more valuable as adoption grows. The fund actively seeks innovations that can create new technology platforms or enable broader system-level improvements rather than just point solutions.

Their deep understanding of water industry dynamics also informs the evaluation process. By closely tracking regulatory trends, emerging contaminants, and shifting customer preferences, ProVenture can better assess which technologies are positioned to solve tomorrow’s challenges, not just today’s problems. This forward-looking perspective helps identify true gamechangers that can reshape the industry landscape.

While maintaining high technical standards, the fund recognizes that even promising technologies often need refinement to succeed commercially. ProVenture takes an active role in helping shape product development roadmaps and go-to-market strategies. This hands-on approach helps derisk investments while accelerating the path to market for breakthrough innovations.

The fund’s process draws inspiration from successful technology commercialization models in other sectors while adapting them to water’s unique characteristics. As explored in how to make the best use of each dollar to cut water losses as a small community, careful resource allocation is critical when evaluating water innovations.

Investment Strategy Reimagined

ProVenture’s investment approach represents a fundamental shift in how water technology ventures are funded and supported. At its core lies a sophisticated dual-criteria framework that evaluates both financial performance potential and measurable environmental impact, creating what the fund calls ‘amplified returns.’

The fund’s matching process begins with a comprehensive assessment of each technology’s capacity to address critical water challenges. Rather than pursuing quick wins, ProVenture specifically seeks out solutions that can demonstrate scalable impact across multiple markets and geographies. This approach allows them to build investment portfolios that balance risk while maximizing both financial and environmental outcomes.

A distinguishing feature of ProVenture’s strategy is their ‘impact-first due diligence’ methodology. Before diving into traditional financial metrics, the team evaluates each potential investment’s water conservation potential, energy efficiency improvements, and pollution reduction capabilities. This environmental impact assessment uses standardized metrics that align with global sustainability frameworks, enabling accurate comparison across different technologies and applications.

On the financial side, ProVenture has developed an innovative blended capital structure that combines traditional venture funding with environmental impact bonds. This approach allows them to attract a broader range of investors, from institutional players seeking market-rate returns to impact-focused funders prioritizing environmental outcomes. The fund typically targets investments ranging from NOK 10-50 million, with the flexibility to participate in larger rounds through co-investment partnerships.

Particularly noteworthy is ProVenture’s commitment to aligning investor and entrepreneur interests through thoughtfully structured deal terms. Their investment agreements often include impact-linked incentives, where achieving specific environmental metrics can unlock additional funding or more favorable terms. This creates a powerful motivation for portfolio companies to deliver on both their business and sustainability promises.

The fund’s active management style further distinguishes their approach. Beyond capital deployment, ProVenture takes a hands-on role in helping portfolio companies navigate the complex water technology landscape. Their team leverages deep industry networks to facilitate pilot projects, regulatory approvals, and commercial partnerships – critical elements for scaling water innovations.

As explored in how to mitigate 4 shades of water risk through impact investing, this integrated approach to water technology investment is increasingly seen as a model for the sector. By treating environmental impact not as a constraint but as a value driver, ProVenture is demonstrating how financial returns and sustainability goals can effectively reinforce each other.

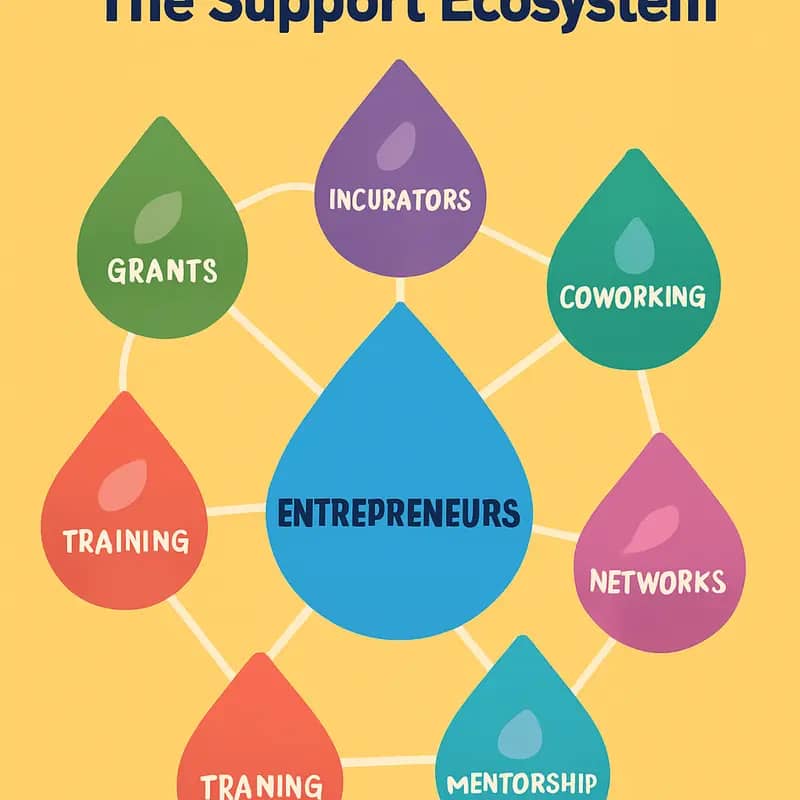

Beyond Capital: The Support Ecosystem

ProVenture’s approach extends far beyond traditional venture funding, creating a comprehensive support ecosystem that nurtures water technology entrepreneurs through every stage of their journey. By combining technical validation capabilities with strategic market access, the fund has established itself as a true partner in innovation.

At the core of ProVenture’s support system lies their Technical Validation Center, a state-of-the-art facility where promising water technologies undergo rigorous testing under real-world conditions. This controlled environment allows entrepreneurs to refine their solutions, gather crucial performance data, and validate their technology’s effectiveness before full-scale deployment. The center’s expert team provides hands-on guidance, helping startups optimize their systems and overcome technical hurdles.

Parallel to technical validation, ProVenture’s Market Access Program connects entrepreneurs with an extensive network of industry partners, utilities, and potential customers across Scandinavia and beyond. How to take mid-market green tech companies to the next level. This strategic matchmaking accelerates the path to market by facilitating pilot projects and commercial partnerships, while providing invaluable feedback from end-users.

The fund’s entrepreneur-in-residence program pairs founding teams with seasoned water industry veterans who serve as mentors and advisors. These mentors provide strategic guidance on everything from product development to business model refinement, drawing from their deep industry experience to help ventures avoid common pitfalls and identify opportunities for growth.

Recognizing that water technology commercialization requires specialized expertise, ProVenture has built an in-house team of regulatory specialists who help portfolio companies navigate the complex landscape of water quality standards, environmental permits, and compliance requirements across different markets. This regulatory support significantly reduces time-to-market and ensures solutions meet all necessary standards.

The ecosystem approach extends to intellectual property protection, with ProVenture providing access to patent attorneys specialized in water technology. This support helps entrepreneurs build robust IP portfolios and develop strong competitive moats around their innovations. The fund also assists with grant applications and helps companies access additional funding sources, maximizing their capital efficiency.

Perhaps most uniquely, ProVenture facilitates collaboration between portfolio companies, creating opportunities for technology integration and joint market entry strategies. This collaborative environment has led to several successful partnerships where complementary solutions have been combined to create more comprehensive offerings for customers.

Success Stories and Future Vision

ProVenture’s strategic investments have already yielded remarkable successes in Norway’s water technology landscape. A standout partnership emerged with a pioneering wastewater analytics firm that developed breakthrough sensor technology for real-time monitoring. Within 18 months of ProVenture’s investment, the company secured contracts with three major Nordic utilities and expanded into Germany and the UK, demonstrating the fund’s ability to accelerate market entry.

Another notable achievement came through ProVenture’s collaboration with a startup focused on energy-efficient desalination. By combining the fund’s technical expertise with its extensive industry network, the company optimized its technology to achieve 40% lower energy consumption compared to conventional systems. This innovation now serves as a model for sustainable desalination globally.

Looking ahead, ProVenture has outlined an ambitious vision to scale water innovation beyond Norwegian borders. The fund aims to establish Norway as Europe’s water technology hub by 2030, leveraging the country’s abundant water resources and engineering expertise. A core component of this strategy involves creating international partnerships with water utilities, industrial users, and fellow investment funds to accelerate the adoption of promising technologies.

ProVenture recognizes that water challenges are inherently local, yet solutions can be global. The fund is developing a systematic approach to validate technologies in Norway’s advanced water infrastructure before adapting them for different market conditions worldwide. This includes establishing testing facilities that simulate various water quality scenarios and regulatory frameworks.

Central to ProVenture’s future vision is the concept of “water technology democratization.” The fund is exploring innovative financing models that could make advanced water solutions accessible to smaller utilities and developing markets. This includes performance-based contracts and technology-as-a-service offerings that reduce upfront capital requirements.

By 2025, ProVenture aims to have at least five of its portfolio companies operating in multiple continents, with a particular focus on regions facing severe water stress. The fund is also working to create standardized frameworks for measuring and verifying water technology impact, which could help attract additional capital to the sector.

Partnering with research institutions remains a priority, as ProVenture seeks to bridge the gap between academic innovation and commercial application. The fund is establishing a dedicated research commercialization program that will help promising laboratory discoveries navigate the complex journey to market-ready solutions.

Final words

ProVenture’s approach to water technology investment represents a masterclass in combining local expertise with global ambition. Their focused strategy of deploying NOK 20 million tickets into pre-revenue Norwegian startups, while maintaining a hands-on approach to growth and development, has created a unique model in the water technology investment landscape. The firm’s emphasis on sustainable water solutions, coupled with their deep understanding of both technological innovation and market dynamics, positions them perfectly to capitalize on the growing global demand for water technology solutions. For water entrepreneurs, ProVenture offers more than just capital – they provide a partnership that can transform local innovations into global solutions. For impact investors, the firm’s track record and strategic approach offer a compelling pathway to participate in the future of water technology while generating meaningful returns. As water challenges continue to mount globally, ProVenture’s model of nurturing early-stage innovation while maintaining a clear path to international scale sets a standard for how venture capital can drive positive change in the water sector.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!