Deep in the heart of New York’s Flatiron District, Plum Alley Ventures is quietly revolutionizing early-stage water technology investment. Led by General Partner Pratibha Vuppuluri, this $22 million fund combines rigorous due diligence with an unwavering commitment to diversity and impact. While not exclusively focused on water, their approach to funding frontier technologies has created unique opportunities for water entrepreneurs seeking that crucial first institutional check. Their sweet spot? Early-stage companies at the intersection of breakthrough innovation and sustainable impact, typically writing checks between $1-3 million for founders ready to scale their solutions.

Plum Alley Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Plum Alley Ventures

Investor Type: VC

Latest Fund Size: $22 Million

Dry Powder Available: Yes

Typical Ticket Size: $1M – $3M

Investment Themes:

Investment History: $4050000 spent over 2 deals

Often Invests Along: Better Ventures, Broadway Angels, Rethink Impact

Already Invested In: Ketos

Leads or Follows: Follow

Board Seat Appetite: Rare

Key People: Pratibha Vuppuluri

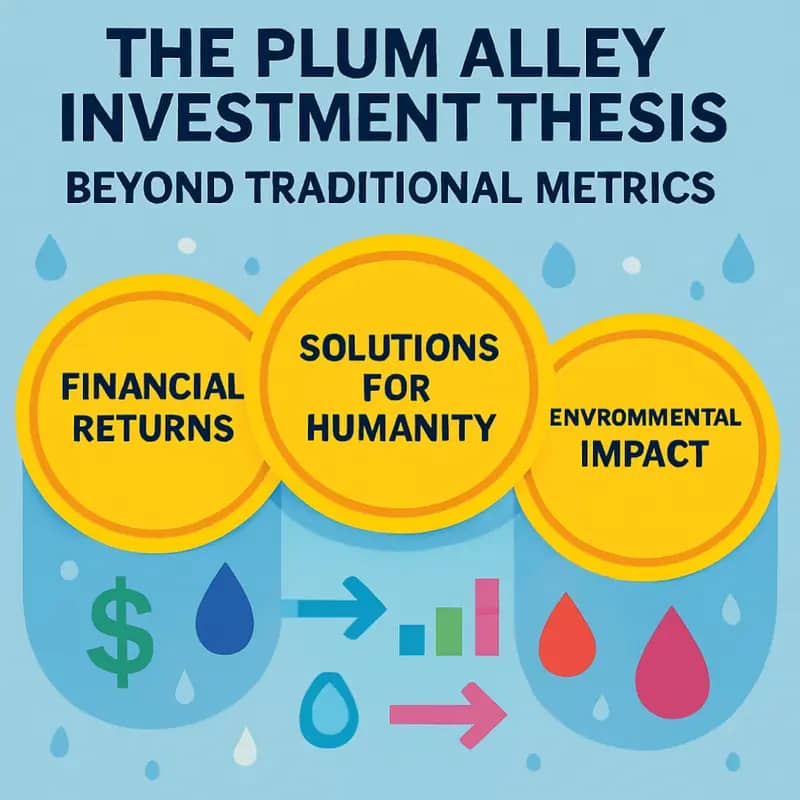

The Plum Alley Investment Thesis: Beyond Traditional Metrics

At the heart of Plum Alley’s $22M water technology fund lies a sophisticated investment framework that evaluates opportunities through three interconnected lenses: core impact potential, diversity credentials, and broader societal benefits. This multifaceted approach enables the fund to identify water innovations that not only promise strong financial returns but also drive meaningful environmental and social change.

The core impact assessment examines how effectively a water technology addresses critical challenges like water scarcity, quality, or infrastructure resilience. Plum Alley’s team meticulously evaluates quantifiable metrics such as water savings potential, treatment efficiency, and implementation scalability. However, they go beyond pure technical analysis to understand how solutions fit into existing water systems and regulatory frameworks.

Diversity stands as a cornerstone of Plum Alley’s investment philosophy, reflecting their conviction that diverse teams drive superior innovation and returns. Their evaluation extends beyond traditional diversity metrics to examine how companies foster inclusive cultures and leverage diverse perspectives in product development and market strategy. This approach has helped them identify promising technologies that might be overlooked by conventional venture capital firms.

The third lens – broader societal benefits – considers how water innovations can create positive ripple effects across communities and industries. This includes evaluating potential job creation, public health improvements, and environmental justice implications. Plum Alley recognizes that the most impactful water technologies often deliver benefits that transcend their immediate application.

For water entrepreneurs seeking investment, understanding this framework is crucial. Successful pitches must demonstrate clear alignment across all three dimensions while presenting compelling evidence of market viability. This might include pilot results that showcase both technical performance and community benefits, or go-to-market strategies that explicitly consider accessibility across different demographic groups.

The fund’s investment criteria also emphasize partnership potential and adaptability. Water technology startups must demonstrate their ability to collaborate with utilities, municipalities, and other stakeholders while remaining flexible enough to evolve with changing regulatory and market conditions.

This comprehensive evaluation approach has enabled Plum Alley to build a portfolio of water innovations that challenge conventional investment wisdom. By looking beyond traditional metrics, they’ve identified opportunities that promise both substantial returns and lasting impact on the global water crisis.

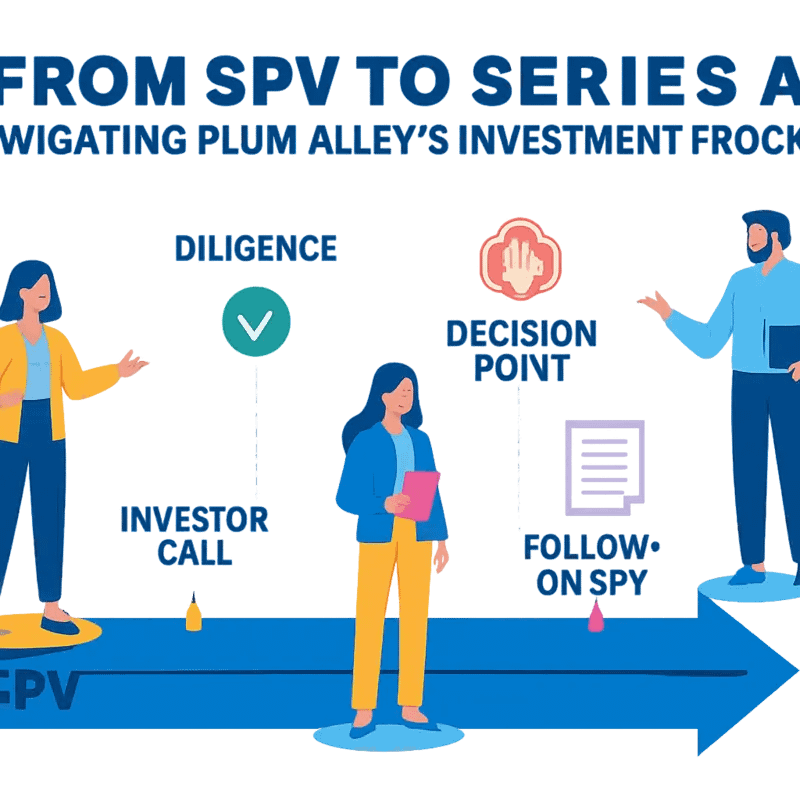

From SPV to Series A: Navigating Plum Alley’s Investment Process

Plum Alley Ventures has developed a streamlined yet thorough investment process that reflects their commitment to supporting innovative water technology solutions. Learn how to take better investment decisions in water technologies

The journey typically begins with a Special Purpose Vehicle (SPV) investment ranging from $250,000 to $750,000. This initial engagement allows Plum Alley to closely evaluate both the technology and the team while providing crucial early-stage capital. Companies that demonstrate strong performance and alignment with Plum Alley’s investment thesis may receive follow-on funding up to $2 million in Series A rounds.

Due diligence at Plum Alley extends beyond traditional financial metrics. Their process incorporates a comprehensive technical assessment focusing on water-specific parameters such as treatment efficiency, energy consumption, and operational reliability. Environmental impact measurements, including carbon footprint and resource recovery potential, receive particular attention.

Water tech startups seeking investment should prepare detailed documentation addressing three core areas. First, technical validation through pilot results, third-party testing data, and clear scalability pathways. Second, market positioning with identified customer segments, regulatory compliance strategies, and competitive advantages. Third, impact metrics demonstrating quantifiable environmental and social benefits.

Plum Alley structures their deals to align incentives for long-term success. Standard terms include board observer rights, pro-rata rights for follow-on rounds, and information rights. The firm often takes a collaborative approach, working with founders to establish meaningful milestones that trigger additional capital deployment.

Successful applicants typically demonstrate:

- Clear technology differentiation in addressing critical water challenges

- Scalable business models with identified paths to profitability

- Strong intellectual property protection

- Diverse and experienced leadership teams

- Robust pilot results or commercial validation

- Strategic partnerships with industry stakeholders

The firm maintains regular engagement with portfolio companies through monthly updates, quarterly board meetings, and ongoing strategic support. This hands-on approach helps identify potential challenges early and enables rapid deployment of resources when opportunities arise.

Experience shows that startups maximizing their chances of securing investment maintain open communication throughout the process, demonstrate adaptability in response to feedback, and clearly articulate their technology’s unique value proposition within the broader water industry landscape.

Building Strategic Partnerships: Plum Alley’s Co-Investment Approach

Plum Alley’s co-investment strategy centers on building powerful syndicates that amplify impact while mitigating risk in the water technology sector. The firm strategically aligns with both institutional investors and strategic corporate partners who bring complementary expertise and resources to portfolio companies.

A hallmark of Plum Alley’s approach is their emphasis on cultivating relationships with corporate strategic partners who can provide industry validation, pilot opportunities, and potential paths to market. These partners often include major water utilities, engineering firms, and industrial water users who can serve as both investors and customers. This strategic approach to co-investment mirrors successful models in accelerating water innovation.

When structuring deals, Plum Alley typically takes board observer seats rather than formal board positions, allowing them to maintain close oversight while empowering founders to retain control. This approach reflects their philosophy of being an active but not controlling investor. The firm leverages these board relationships to facilitate introductions and strategic discussions between portfolio companies and co-investors.

For water technology startups seeking investment, tapping into Plum Alley’s network requires demonstrating both technical innovation and clear paths to scale. The firm looks for companies that can benefit from their extensive relationships across the water sector while also contributing unique capabilities to the broader ecosystem. Successful partnerships often emerge when startups can articulate how their solution addresses specific pain points for Plum Alley’s strategic partners.

The firm’s co-investment framework extends beyond capital to include structured mentorship and expertise sharing between portfolio companies. Regular portfolio company summits and targeted introduction sessions help facilitate knowledge transfer and potential collaboration opportunities. This creates a multiplier effect where each new strategic partnership strengthens the overall network.

Plum Alley maintains strict criteria for co-investor alignment, seeking partners who share their long-term vision for transforming water technology. This selective approach has helped build a trusted network of co-investors who consistently participate across multiple deals. The result is an ecosystem where water tech startups can access not just capital, but the comprehensive support system needed to scale innovative solutions.

Beyond Capital: Maximizing Value from Plum Alley’s Platform

Plum Alley Ventures has developed a comprehensive support ecosystem that extends far beyond traditional capital investment for their water technology portfolio companies. This multifaceted platform approach helps startups navigate critical growth challenges while accelerating their path to market impact.

At the core of Plum Alley’s value-add strategy is their deep technical expertise in water innovation. Portfolio companies gain access to a dedicated advisory team of water industry veterans who provide hands-on guidance on everything from pilot project design to regulatory compliance. This specialized knowledge helps startups avoid common pitfalls while optimizing their technology development roadmaps.

The fund has also built out robust commercial networks that portfolio companies can leverage for business development. Through strategic partnerships with utilities, industrial water users, and engineering firms, Plum Alley creates direct pathways for startups to engage with potential customers and secure pilot opportunities. These relationships often evolve into long-term commercial deployments, helping portfolio companies establish crucial market validation.

Mentorship plays a central role in Plum Alley’s platform, with founders receiving regular coaching from successful water entrepreneurs and industry executives. These mentors provide strategic guidance on topics like talent acquisition, supply chain optimization, and scaling operations. The fund also facilitates peer learning through founder roundtables where portfolio companies can share challenges and best practices.

Plum Alley has developed specialized resources to help water tech startups navigate complex regulatory landscapes and certification processes. Their regulatory affairs team provides hands-on support for EPA and NSF certifications while helping companies develop compliance strategies for different jurisdictions. This expertise is particularly valuable for startups working on drinking water technologies.

The fund’s commitment to impact investing also creates unique opportunities for portfolio companies to connect with sustainability-focused corporations and organizations. Through these relationships, startups can explore pilot projects and partnerships that advance both commercial and environmental objectives.

Beyond structured support, Plum Alley’s platform creates an active community where founders can collaborate and support each other’s growth. Regular events and workshops foster relationships between portfolio companies, often leading to knowledge sharing and even commercial partnerships that amplify their collective impact in the water sector.

This comprehensive platform approach helps explain why Plum Alley’s water tech portfolio companies have been able to accelerate their development trajectories and achieve meaningful market traction. By providing founders with resources and relationships beyond capital, the fund maximizes the odds of success for promising water innovations.

The Genesis of Gender-Lens Water Investing

When Andrea Turner Moffitt and Deborah Jackson founded Plum Alley Ventures in 2015, they recognized a critical gap in the venture capital landscape. While water technology innovation was accelerating to address mounting global challenges, female founders consistently faced barriers accessing capital despite their innovative solutions.

Drawing from their extensive experience in investment banking and technology, Turner Moffitt and Jackson crafted a unique thesis: combining gender-lens investing with deep domain expertise in water technology could unlock outsized returns while driving meaningful impact. Their hypothesis stemmed from compelling data showing women-led companies delivered higher ROI despite receiving less than 3% of venture funding.

Early Resistance and Validation

Initially, many traditional investors questioned whether focusing specifically on women-led water tech companies would limit deal flow and returns. However, Plum Alley’s thorough analysis revealed the opposite – female founders were developing some of the most promising solutions in water treatment, monitoring, and infrastructure but struggled to secure institutional capital.

The fund’s first investments validated this approach. By providing early-stage capital to overlooked founders developing breakthrough water technologies, Plum Alley demonstrated that gender-diverse teams could drive both financial returns and environmental impact. Their portfolio companies consistently outperformed industry benchmarks in key metrics like customer adoption and capital efficiency.

Building a New Model

Beyond capital, Plum Alley developed a comprehensive support system for portfolio companies, including:

- Technical expertise and industry connections to accelerate commercialization

- Leadership development specifically addressing challenges women founders face

- A collaborative community sharing best practices and resources

This model proved particularly valuable in the water sector, where long sales cycles and complex stakeholder relationships create unique hurdles for startups. By combining sector expertise with a deep understanding of gender-specific challenges, Plum Alley helped portfolio companies navigate these obstacles more effectively.

As highlighted in how to mitigate 4 shades of water risk through impact investing, their approach demonstrated that addressing gender disparity in venture funding wasn’t just about equality – it was about capturing overlooked opportunities to solve critical water challenges.

The $22M fund represents more than capital deployment; it’s a proof point that investing in diverse founders tackling water innovation can generate compelling returns while advancing environmental sustainability. This foundation set the stage for Plum Alley’s expanding portfolio of breakthrough water technologies and their growing influence in reshaping venture capital’s approach to both gender equity and water innovation.

Portfolio Deep Dive: Water Innovation Success Stories

Plum Alley’s portfolio exemplifies how female-led water technology companies are driving breakthrough solutions for critical environmental challenges. At the heart of their investment thesis lies a focus on scalable innovations that deliver both environmental and financial returns.

A standout portfolio company pioneered an energy-efficient water treatment technology that reduces energy consumption by 60% compared to conventional systems. By leveraging electrochemical processes rather than traditional membrane filtration, this solution achieves superior contaminant removal while dramatically lowering operational costs. Early pilot implementations demonstrate potential annual savings of $2.4 million for a typical municipal treatment plant.

Another portfolio success story centers on smart water infrastructure monitoring. Using advanced sensor networks and predictive analytics, this female-founded company helps utilities detect leaks and reduce water losses by up to 30%. Their technology has been deployed across 12 major U.S. cities, preventing an estimated 4 billion gallons of water loss annually. The solution’s rapid payback period of under 18 months has driven strong market adoption.

Plum Alley’s investment in decentralized water treatment is reshaping industrial wastewater management. One portfolio company developed a modular system that enables on-site treatment and water reuse, reducing freshwater demand by up to 90% for manufacturing facilities. The technology has been validated through partnerships with Fortune 500 companies and generated $8.5 million in revenue last year alone.

Beyond individual successes, Plum Alley’s portfolio companies demonstrate powerful network effects. Cross-pollination of ideas and collaborative pilot projects between portfolio companies have accelerated commercialization timelines. This ecosystem approach has helped portfolio companies secure over $150 million in follow-on funding and establish partnerships with major utilities and industrial players.

The fund’s emphasis on founder diversity has proven particularly valuable in water technology innovation. Female founders in the portfolio bring unique perspectives on user needs and implementation challenges, leading to more practical and adoptable solutions. This approach aligns with research showing diverse founding teams deliver superior financial returns while driving meaningful environmental impact.

Investment Strategy and Due Diligence Process

At the core of Plum Alley’s investment strategy lies a rigorous framework that evaluates both technological innovation and founder capabilities in the water sector. Their unique approach combines traditional venture metrics with specialized water technology assessment criteria to identify breakthrough solutions with the highest potential for scaled impact.

The firm employs a three-tiered evaluation process that begins with technology validation. Technical experts assess solutions based on their scientific merit, scalability potential, and ability to address critical water challenges. Key factors include energy efficiency, operational reliability, and environmental impact. The team pays particular attention to technologies that can demonstrate measurable improvements over existing solutions while maintaining economic viability.

Founder assessment forms the second critical component, where Plum Alley places significant emphasis on diverse leadership teams. The firm has developed specific metrics to evaluate founders’ technical expertise, industry knowledge, and ability to navigate the complex regulatory landscape of water technology. Their approach recognizes that successful water innovation requires both technical excellence and strong commercialization capabilities.

Risk assessment represents the third pillar of their strategy, with a sophisticated framework that considers multiple dimensions of risk. Beyond standard market and execution risks, Plum Alley evaluates regulatory compliance challenges, pilot-to-commercial scaling risks, and potential environmental impacts. The firm has developed a proprietary scoring system that weights these factors based on historical data and sector expertise.

Particularly noteworthy is Plum Alley’s focus on technologies that demonstrate clear paths to regulatory approval and market adoption. As highlighted in their approach to mitigating water risk through impact investing, the firm prioritizes solutions that can navigate complex regulatory frameworks while maintaining competitive advantages.

The due diligence process typically spans 8-12 weeks, during which potential investments undergo extensive technical validation, market analysis, and stakeholder interviews. This comprehensive approach has enabled Plum Alley to maintain a strong track record of identifying promising water technologies while managing investment risks effectively.

Their investment criteria also emphasize solutions that can demonstrate measurable impact metrics. These include quantifiable improvements in water quality, reduction in energy consumption, or increased treatment efficiency. This data-driven approach allows for more precise evaluation of potential returns, both financial and environmental.

Future Vision: Scaling Impact in Water Tech

Plum Alley Ventures stands at the forefront of a transformative period in water technology investment, positioning itself strategically to scale impact across the sector. The fund’s forward-looking approach centers on identifying and nurturing breakthrough technologies that address critical water challenges while delivering strong financial returns.

Market analysis reveals several high-potential areas where Plum Alley aims to expand its portfolio. Water scarcity solutions, particularly those focused on water reuse and efficient treatment technologies, present significant growth opportunities. The global water reuse market is projected to reach $50 billion by 2026, driven by increasing water stress and stricter environmental regulations.

Decentralized water treatment systems represent another key focus area, as municipalities and industries seek more resilient and flexible infrastructure solutions. This shift aligns with Plum Alley’s emphasis on scalable, modular technologies that can be deployed rapidly across diverse geographic locations.

The fund’s expansion strategy leverages three core pillars: technological innovation, market readiness, and impact measurement. By prioritizing solutions that demonstrate clear paths to commercialization and quantifiable environmental benefits, Plum Alley aims to accelerate the adoption of transformative water technologies.

Collaboration plays a central role in the fund’s scaling vision. Through strategic partnerships with research institutions, industry leaders, and policy advocates, Plum Alley works to create robust support ecosystems for portfolio companies. These relationships help bridge the gap between innovation and implementation, addressing one of the water sector’s persistent challenges.

Digital transformation presents another significant opportunity. Smart water management systems, powered by AI and IoT technologies, offer unprecedented potential for optimization and resource efficiency. Plum Alley recognizes these technologies as critical enablers for next-generation water infrastructure.

The fund’s commitment to diversity-driven investment remains integral to its expansion plans. Research consistently shows that diverse teams drive better outcomes in both innovation and financial performance. By maintaining this focus while scaling, Plum Alley aims to reshape industry demographics while delivering superior returns.

Looking ahead, Plum Alley’s strategic roadmap includes targeted investments in emerging water tech subsectors, with particular emphasis on solutions that address climate resilience and water security. The fund’s approach to scaling impact extends beyond capital deployment to include active support for policy initiatives and industry standards that accelerate water technology adoption.

As highlighted in this exploration of impact investing’s role in water technology, success in this sector requires a nuanced understanding of both technical and market dynamics. Plum Alley’s vision for the future encompasses not just growing its investment portfolio, but catalyzing systemic change in how water challenges are addressed globally.

Final words

Plum Alley Ventures represents a new breed of early-stage investor, one that recognizes the intrinsic link between diversity, innovation, and impact in water technology. Their $22 million fund, while not exclusively focused on water, offers a compelling opportunity for water entrepreneurs who align with their vision of technology-driven sustainability. The firm’s approach to investment – combining thorough due diligence with a commitment to diverse founding teams – has created a unique position in the market. For water technology startups seeking that crucial early-stage capital, Plum Alley offers more than just funding; they provide a platform for growth, a network for collaboration, and a partnership model that extends well beyond the initial investment. As the water technology sector continues to evolve, Plum Alley’s emphasis on both impact and returns positions them as a valuable partner for entrepreneurs working to solve our most pressing water challenges. Their strategic focus on $1-3 million investments, combined with their collaborative approach to deal-making, makes them an increasingly important player in the water technology ecosystem.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!