With $250 million in assets under management and a fresh $187 million Growth Fund II, PeakBridge stands at the intersection of food technology and water innovation. From its strategic headquarters in Malta, this venture capital firm has carved out a unique position in the market by investing in technologies that not only revolutionize our food systems but also address critical water challenges. Through investments like BE WTR and a keen focus on sustainable solutions, PeakBridge demonstrates how water innovation can thrive within the broader context of food technology advancement.

PeakBridge is part of my Ultimate Water Investor Database, check it out!

Investor Name: PeakBridge

Investor Type: VC

Latest Fund Size: $187 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Sustainable drinking water, technology-driven hydration solutions, minimizing environmental impact of water consumption

Investment History: $14375000 spent over 2 deals

Often Invests Along:

Already Invested In: BE WTR

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People: Nadav Berger, Yoni Glickman

The Strategic Vision: Water Innovation through FoodTech

PeakBridge’s innovative approach to water technology investment represents a strategic convergence of FoodTech and sustainable water solutions. The firm’s thesis centers on the inextricable link between food systems and water resources, recognizing that addressing global water challenges requires a holistic view of the food-water nexus.

At the core of PeakBridge’s investment strategy lies a deep understanding that water innovation cannot exist in isolation from food production and agricultural advancement. Their portfolio reflects this integrated approach, with investments specifically targeting technologies that address water efficiency, treatment, and reuse within the food value chain.

The firm’s investment in BE WTR exemplifies this strategic vision. This investment showcases PeakBridge’s commitment to solutions that transform how we think about water consumption and distribution in the food service sector. By backing technologies that enable point-of-use water treatment and dispensing, they’re addressing both environmental sustainability and consumer convenience while disrupting traditional bottled water markets.

PeakBridge’s approach to water innovation extends beyond simple resource management. They actively seek technologies that create multiplicative effects across the food-water nexus. This includes solutions for precision irrigation, water quality monitoring, and waste reduction in food processing. Their investment criteria prioritize scalable solutions that can demonstrate measurable impact on water conservation while maintaining or improving food production efficiency.

The firm’s commitment to sustainable water solutions is further evidenced by their focus on circular economy principles. They actively seek investments in technologies that enable water reuse, resource recovery, and closed-loop systems within the food industry. This approach aligns with global sustainability goals while creating tangible business value.

Beyond individual investments, PeakBridge plays a crucial role in ecosystem development. They actively foster connections between water technology innovators and food industry players, creating opportunities for pilot projects and commercial partnerships. This network-centric approach accelerates the adoption of water innovations across the food sector.

Their investment strategy particularly resonates with the principles outlined in how to mitigate 4 shades of water risk through impact investing, demonstrating how strategic capital allocation can drive sustainable water solutions while generating attractive returns. This dual focus on environmental impact and financial performance has positioned PeakBridge as a key player in shaping the future of water technology investment.

Investment Horizons: From Seed to Series B

PeakBridge’s investment strategy demonstrates a comprehensive approach across multiple funding stages, with their recently launched $187M Growth Fund II serving as a cornerstone of their expanding portfolio. The firm maintains a deliberately broad investment horizon, extending from seed rounds through Series B, enabling them to support water innovation companies throughout critical growth phases.

The firm’s ticket sizes reflect this stage-agnostic approach, typically ranging from $500,000 for seed investments up to $15 million for later-stage rounds. This flexibility allows PeakBridge to calibrate their support based on both company maturity and market opportunity. Their investment thesis particularly shines in early-growth stages, where capital deployment can significantly accelerate technology adoption and market penetration.

Geographically, PeakBridge maintains a global perspective while focusing primarily on innovation hubs in Europe, Israel, and North America. This strategic focus aligns with regions demonstrating strong water technology ecosystems and established innovation frameworks. The Malta-based firm leverages its position at the crossroads of European and Middle Eastern markets to identify and nurture promising water technology solutions.

The Growth Fund II represents a significant evolution in PeakBridge’s investment capabilities. This fund not only increases their deployment capacity but also strengthens their position in the water technology investment landscape. The fund’s structure enables longer holding periods, critical for water technology companies that often require extended development cycles to achieve market validation and scale.

In keeping with their thesis of water innovation through FoodTech, PeakBridge has structured their investment approach to address the water-food nexus specifically. The firm recognizes that water technology solutions often require patient capital and deep sector expertise to achieve commercial success. This understanding influences their investment horizons, typically planning for 5-7 year holding periods to allow portfolio companies sufficient time to develop and commercialize their solutions.

PeakBridge’s involvement extends beyond mere capital provision, as evidenced by their hands-on approach to portfolio management. This comprehensive support system becomes particularly valuable for early-stage companies navigating the complex regulatory and market access challenges inherent in the water sector. Their structured investment approach, as detailed in “How to Take Mid-Market Green Tech Companies to the Next Level“, demonstrates their commitment to fostering sustainable growth in their portfolio companies.

The firm’s investment strategy reflects an understanding that water technology commercialization often requires longer development cycles compared to traditional technology investments. This patient capital approach, combined with their stage-agnostic investment mandate, positions PeakBridge as a significant player in advancing water innovation through strategic capital deployment.

Partnership Dynamics: Leading vs Following

PeakBridge’s investment approach reflects a sophisticated balance between leading and following investment rounds, carefully calibrated to maximize impact while managing risk. The firm’s 1.67 follow-on ratio demonstrates a strong commitment to supporting portfolio companies through multiple funding stages, providing crucial stability during growth phases.

As a strategic co-investor, PeakBridge has cultivated deep relationships with key players in the water technology ecosystem. Their collaborative investment model emphasizes partnerships with established industry leaders, creating synergistic opportunities that benefit both startups and strategic partners. This approach has proven particularly effective in water innovation, where market validation and industry connections are critical success factors.

The firm takes an active role in board participation, typically securing board seats in their lead investments while maintaining observer rights in co-investment scenarios. This dual approach allows PeakBridge to exercise meaningful influence over strategic decisions while maintaining efficient resource allocation across their portfolio. Their board strategy focuses on three key areas: strategic guidance, industry networking, and operational support.

PeakBridge’s co-investment framework is particularly noteworthy for its flexibility. When leading rounds, they often take a consortium-building approach, bringing together complementary investors with diverse expertise. In follow-on scenarios, they leverage their deep industry knowledge to validate and support deals led by trusted co-investors.

The firm’s partnership strategy extends beyond traditional venture capital relationships. They have established formal collaborations with research institutions, accelerators, and industry associations, creating a robust deal flow pipeline and ensuring early access to promising water technologies. This multilayered partnership approach helps mitigate risks while accelerating the commercialization of innovative water solutions.

In analyzing PeakBridge’s investment patterns, a clear preference emerges for deals where they can leverage their water technology expertise while sharing risk with strategic co-investors. This approach has proven particularly effective in scaling water innovations, as evidenced by their growing portfolio of successful water technology investments.

PeakBridge’s partnership model demonstrates that successful water technology investment requires more than capital – it demands a carefully orchestrated ecosystem of support, expertise, and strategic relationships. Their approach to leading versus following reflects a sophisticated understanding of how to optimize these elements for maximum impact in the water technology sector.

As explored in How to actively invest philanthropy and save the water world, this type of strategic investment approach is crucial for addressing global water challenges while generating sustainable returns.

Future Trajectory: Water Innovation Opportunities

PeakBridge’s strategic focus on FoodTech investment positions the firm uniquely to catalyze breakthrough innovations in sustainable water solutions. By recognizing the intrinsic connection between food systems and water resources, PeakBridge creates opportunities for transformative technologies that address both sectors’ challenges simultaneously.

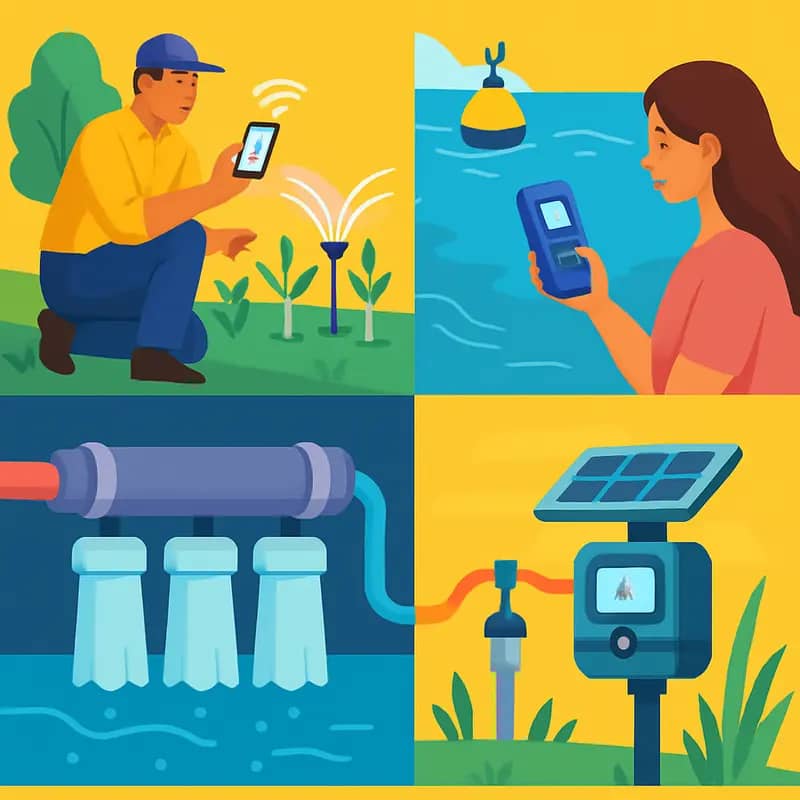

The firm’s investment thesis aligns with emerging trends in precision irrigation, water reuse in food processing, and smart monitoring systems for agricultural water management. These convergence points between food and water technologies represent some of the most promising areas for innovation and value creation. Particularly notable is the potential for digital solutions that optimize water usage across the food value chain, from farm to factory.

Looking ahead, PeakBridge’s portfolio is likely to expand into several key water innovation domains. Smart sensors and AI-driven analytics platforms could revolutionize water quality monitoring and treatment process optimization. Advanced materials science breakthroughs may yield more efficient filtration and purification technologies. Meanwhile, blockchain and IoT integration could enhance water trading and allocation systems.

The firm’s emphasis on scalable solutions positions it well to address growing water scarcity challenges across global food production systems. As climate change intensifies pressure on water resources, technologies that enable precise water management and recycling will become increasingly vital. PeakBridge’s investment approach suggests a focus on solutions that can be rapidly deployed and scaled across different geographies and contexts.

Particularly promising are opportunities in decentralized water treatment systems, which align with the trend toward localized food production. These solutions could help food processors reduce their water footprint while ensuring compliance with tightening environmental regulations. Advanced membrane technologies and resource recovery systems represent other high-potential areas where PeakBridge’s expertise in FoodTech could drive significant innovation.

The convergence of digital transformation and sustainability imperatives creates fertile ground for next-generation water solutions. Remote monitoring systems, predictive maintenance platforms, and automated treatment processes could dramatically improve water infrastructure efficiency. PeakBridge’s experience in scaling innovative technologies positions it well to identify and nurture these opportunities.

As water stress increases globally, the firm’s investment strategy may increasingly emphasize solutions that enhance water security for food production while minimizing environmental impact. This could include technologies for atmospheric water generation, precision leak detection, and advanced water recycling systems tailored to food industry applications.

The PeakBridge Investment Philosophy

PeakBridge’s investment philosophy centers on a sophisticated understanding that water technology investments require a unique approach, balancing environmental impact with commercial viability. The firm has developed a comprehensive framework that evaluates potential investments through multiple critical lenses while maintaining unwavering focus on scalable solutions for pressing water challenges.

At the core of PeakBridge’s investment strategy lies a meticulous due diligence process that examines both technical innovation and market dynamics. The firm’s evaluation methodology scrutinizes three key dimensions: technology validation, market readiness, and financial sustainability. Each potential investment undergoes rigorous technical assessment to validate performance claims and scalability potential. Market analysis focuses on identifying clear paths to commercialization and verifying substantial addressable markets.

The firm particularly values solutions that demonstrate potential for exponential impact. This means technologies that can address multiple challenges simultaneously or offer cascading benefits across the water value chain. For instance, innovations that reduce energy consumption while improving water treatment efficiency receive heightened attention, as they align with both environmental sustainability goals and operational cost reduction imperatives.

PeakBridge’s approach to risk management is equally sophisticated, incorporating both traditional venture capital principles and water industry-specific considerations. The firm maintains a balanced portfolio strategy that spans different technology readiness levels, from early-stage breakthrough innovations to growth-stage companies with proven market traction. This diversification helps mitigate risk while maintaining exposure to potentially transformative technologies.

True to its vision of fostering sustainable water solutions, PeakBridge actively participates in value creation beyond capital deployment. The firm leverages its extensive network of industry connections and technical expertise to accelerate portfolio companies’ growth trajectories. This hands-on approach includes facilitating strategic partnerships, providing operational guidance, and supporting market expansion strategies.

Critically, PeakBridge recognizes that successful water technology investments require patience and long-term commitment. The firm’s investment horizon reflects this understanding, allowing portfolio companies sufficient time to navigate the complex regulatory landscape and achieve meaningful market penetration. This patient capital approach, combined with active support, has proven instrumental in helping promising water technologies bridge the notorious “valley of death” between innovation and widespread adoption.

As explored in how to mitigate 4 shades of water risk through impact investing, the firm’s investment philosophy demonstrates how strategic capital allocation can drive both environmental impact and financial returns in the water sector.

Portfolio Success Stories

PeakBridge’s portfolio showcases remarkable success in identifying and nurturing water technology innovators that deliver both environmental impact and financial returns. Among their most notable investments are companies pioneering breakthrough approaches to water treatment, monitoring, and conservation.

One standout portfolio company developed an advanced membrane technology that reduces energy consumption in desalination by 40% while increasing water recovery rates. This innovation attracted significant follow-on investment and established commercial partnerships with major utilities across Europe and the Middle East. The technology now helps provide drinking water to over 2 million people.

Another portfolio success story focuses on smart water infrastructure monitoring. Using AI and IoT sensors, this company’s solution detects leaks and predicts maintenance needs with 95% accuracy. Their technology has been deployed by water utilities serving more than 50 cities, preventing billions of gallons in water losses while generating strong recurring revenue streams.

PeakBridge’s hands-on approach to portfolio support has been critical to these outcomes. Beyond capital, they provide strategic guidance, industry connections, and operational expertise. Their deep understanding of water sector dynamics helps portfolio companies navigate complex regulatory environments and lengthy sales cycles characteristic of the water industry.

The firm’s emphasis on scalable solutions addressing critical water challenges is evident in their investment in a water quality monitoring platform. This company’s technology revolutionized contaminant detection through real-time analytics, leading to its acquisition by a global water technology leader – delivering both strong financial returns and expanded market impact.

PeakBridge has demonstrated particular success in helping portfolio companies expand internationally. Their global network of water industry experts and decision-makers opens doors for promising technologies to enter new markets. Several portfolio companies have leveraged these relationships to establish presence across multiple continents within 18-24 months of investment.

Notably, these successes build on careful alignment between commercial potential and environmental impact. As explored in this analysis of successful water tech investments, portfolio companies typically achieve market validation through pilot projects demonstrating both operational excellence and measurable sustainability benefits before scaling more broadly.

Impact Metrics and ESG Integration

PeakBridge has developed a comprehensive dual-impact framework that meticulously measures both financial returns and environmental benefits across its water technology investments. This sophisticated approach aligns with the growing recognition that how to mitigate 4 shades of water risk through impact investing requires robust metrics and clear accountability.

The firm’s impact assessment framework operates across three key dimensions. First, it evaluates water efficiency metrics, measuring cubic meters saved, treated, or reused through portfolio companies’ technologies. Second, it tracks environmental impact through carbon emission reductions, energy savings, and pollution prevention. Third, it quantifies societal benefits by assessing improvements in water access, quality, and affordability.

ESG integration at PeakBridge goes beyond superficial screening. The firm employs a rigorous due diligence process that evaluates potential investments against science-based environmental criteria, governance standards, and social impact indicators. This comprehensive assessment helps identify companies that not only promise strong financial returns but also demonstrate genuine potential for driving sustainable water solutions.

What sets PeakBridge’s approach apart is its commitment to ongoing measurement and verification. Portfolio companies must regularly report against established key performance indicators (KPIs), including water-specific metrics like gallons saved, contaminants removed, and system efficiency improvements. These KPIs are tracked through a proprietary digital platform that enables real-time monitoring and analysis.

The firm has also pioneered an innovative impact multiplier methodology. This approach quantifies how each dollar invested generates cascading environmental benefits through technology adoption and market scaling. For instance, when portfolio companies achieve successful commercial deployments, the environmental impact often multiplies exponentially as solutions are replicated across different sites and sectors.

To ensure credibility and transparency, PeakBridge subjects its impact metrics to third-party verification. The firm collaborates with environmental auditors and water industry experts to validate reported outcomes and refine measurement methodologies. This commitment to independent verification strengthens stakeholder trust and helps maintain high standards of impact reporting.

Most importantly, PeakBridge’s dual-return framework has demonstrated that environmental impact and financial performance can be mutually reinforcing. Portfolio companies that achieve the strongest environmental metrics often show corresponding improvements in customer acquisition, market expansion, and operational efficiency – ultimately driving superior financial returns.

Future of Water Investment

PeakBridge envisions a future where water technology investment becomes increasingly intertwined with global sustainability imperatives. The firm’s forward-looking strategy centers on three key pillars: technological convergence, circular economy integration, and climate resilience.

As digital transformation accelerates, PeakBridge anticipates breakthrough opportunities at the intersection of artificial intelligence, Internet of Things (IoT), and advanced materials science. These convergent technologies will enable more precise water quality monitoring, predictive maintenance of infrastructure, and optimization of treatment processes. The firm actively seeks startups developing solutions that leverage multiple emerging technologies to address complex water challenges.

Circular economy principles are reshaping how PeakBridge evaluates potential investments. Rather than viewing wastewater as a liability, the firm sees tremendous value in technologies that can extract resources, generate energy, and create new revenue streams from what was previously considered waste. This includes innovations in resource recovery, water reuse systems, and closed-loop industrial processes.

Climate resilience has emerged as a critical investment criterion as extreme weather events intensify. PeakBridge is particularly interested in technologies that help utilities and industries adapt to climate volatility while reducing their environmental impact. This encompasses solutions for flood management, drought mitigation, and energy-efficient treatment processes.

Looking ahead, PeakBridge plans to expand its investment thesis beyond traditional water infrastructure. The firm recognizes that addressing future water challenges requires a systems-level approach that considers the water-energy-food nexus. This broader perspective opens new opportunities in agriculture technology, alternative protein production, and decentralized treatment systems.

The firm’s investment strategy increasingly emphasizes scalable business models that can rapidly deploy water innovations across multiple geographies and sectors. As highlighted in their approach to leveraging private capital for water solutions, PeakBridge seeks to catalyze transformative change by backing entrepreneurs who combine technological innovation with sustainable business practices.

To accelerate adoption of promising solutions, PeakBridge is strengthening its network of strategic partners across utilities, industries, and research institutions. This ecosystem approach helps portfolio companies validate their technologies, access new markets, and scale their impact more effectively. The firm believes this collaborative model will be essential for addressing increasingly complex water challenges in the decades ahead.

Final words

PeakBridge’s approach to water technology investment represents a sophisticated understanding of how water innovation intersects with the future of food systems. Their $187 million Growth Fund II, combined with their strategic focus on Series A and B investments, positions them uniquely to drive advancement in sustainable water solutions through the lens of food technology. With a follow-on ratio of 1.67 and strong co-investment partnerships, they provide both the capital and strategic support necessary for scaling impactful water innovations. As water challenges become increasingly critical to food security and sustainability, PeakBridge’s integrated investment approach offers a compelling model for how venture capital can address these interconnected challenges. Their success with investments like BE WTR demonstrates the potential for generating both financial returns and positive environmental impact through strategic water technology investments.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!