From the historic streets of Edinburgh, Par Equity is quietly reshaping the landscape of water technology investment in the UK. With a fresh £100 million fund and a keen eye for game-changing innovations, this Scottish venture capital firm has positioned itself at the intersection of water sustainability and critical mineral recovery. Their investment in Watercycle Technologies signals a deeper understanding of tomorrow’s water challenges – where resource recovery and water purification converge. As climate change intensifies water scarcity globally, Par Equity’s strategic focus on dual-impact technologies demonstrates how modern venture capital can drive both environmental and financial returns.

Par Equity is part of my Ultimate Water Investor Database, check it out!

Investor Name: Par Equity

Investor Type: PE

Latest Fund Size: $2350 Million

Dry Powder Available: Yes

Typical Ticket Size: $30M – $75M

Investment Themes: No specific water sub-themes identified

Investment History: $2400000 spent over 2 deals

Often Invests Along:

Already Invested In: Kibosh, WaterCycle Technologies

Leads or Follows: Lead

Board Seat Appetite: High

Key People: Antonio Gracias, Jon, Juan Sabater, David Heskett, Bradley Sheftel

The Scottish Touch in Water Tech Investment

Edinburgh’s Par Equity stands as a testament to Scotland’s growing influence in water technology investment, bringing together the nation’s engineering heritage with modern environmental imperatives. The firm’s recent £100M fund launch marks a watershed moment for water tech investment in Scotland, demonstrating how regional expertise can drive global innovation.

The Scottish capital’s rich history of engineering excellence provides Par Equity with unique advantages in evaluating water technology investments. Drawing from centuries of hydroelectric power development and water management expertise, the firm applies distinctly Scottish pragmatism to identifying promising water innovations. This approach combines technical rigor with commercial sensibility, a hallmark of Scottish engineering tradition.

Par Equity’s investment strategy reflects Scotland’s distinctive relationship with water resources. In a country where rainfall shapes both landscape and industry, the firm demonstrates deep understanding of water management challenges. Their portfolio selection emphasizes solutions that address water scarcity, purification, and resource recovery – critical issues that Scotland has grappled with throughout its industrial evolution.

The firm’s £100M fund represents more than just capital deployment; it embodies a vision for Scotland’s role in solving global water challenges. Par Equity leverages Edinburgh’s position as a financial hub while maintaining strong connections to Scotland’s industrial heartland. This unique positioning enables them to bridge the gap between innovative water technologies and practical implementation.

What sets Par Equity apart is their emphasis on collaborative growth. Rather than simply providing capital, they foster connections between portfolio companies and Scotland’s robust network of water engineering expertise. This ecosystem approach, linking academic research, industrial experience, and entrepreneurial drive, creates a powerful platform for water technology development.

The firm’s approach to water technology assessment bears the hallmark of Scottish engineering precision. Their due diligence process combines technical evaluation with pragmatic market analysis, ensuring that promising technologies can scale effectively. This methodology, refined through decades of engineering excellence, helps identify solutions with genuine market potential.

Par Equity’s commitment to water technology reflects a broader Scottish tradition of environmental stewardship. Their investment criteria emphasize solutions that deliver both environmental and economic benefits, recognizing that sustainable water management requires balanced consideration of both factors. This dual focus positions them well to address emerging challenges in water technology, from resource recovery to climate resilience.

Strategic Focus: Water Meets Mineral Recovery

Par Equity’s strategic investment in Watercycle Technologies exemplifies a sophisticated understanding of how water technology innovation intersects with critical mineral recovery. This dual-purpose approach addresses both water purification challenges and the growing demand for strategic materials, particularly in the clean energy transition.

The firm’s investment thesis centers on technologies that can extract valuable minerals from industrial wastewater streams and mining effluents while simultaneously treating contaminated water. This approach resonates strongly with the broader environmental imperative to maximize resource efficiency while minimizing waste – a concept known as the circular economy.

Watercycle Technologies’ breakthrough selective extraction process represents a pivotal advancement in recovering lithium and other critical minerals from brines and process waters. The technology’s ability to selectively capture specific ions while treating wastewater streams showcases how water purification technology can create multiple value streams. This aligns perfectly with Par Equity’s vision of backing transformative technologies that deliver both environmental and economic benefits.

The investment strategy reflects a deep understanding of market dynamics. As global demand for battery materials surges, traditional extraction methods face increasing scrutiny for their environmental impact. Water-efficient mineral recovery technologies offer a compelling solution to this challenge, creating a natural synergy between water treatment and resource recovery.

Par Equity’s approach goes beyond simple financial backing. The firm actively supports the development and commercialization of these technologies through strategic partnerships and industry connections. This hands-on involvement helps portfolio companies navigate the complex regulatory landscape while accelerating their path to market adoption.

The focus on water technology innovation in mineral recovery also positions Par Equity at the forefront of the clean technology revolution. Their investment strategy acknowledges that future water treatment solutions must do more than just clean water – they must create value from waste streams while minimizing environmental impact.

This strategic direction aligns with global sustainability goals and positions Par Equity’s portfolio companies to capture value from the growing intersection of water technology and critical mineral recovery markets. Their approach demonstrates how targeted investment in water technology can unlock new value chains while addressing pressing environmental challenges.

Investment Philosophy and Partnership Approach

Par Equity’s investment methodology centers on a collaborative approach that maximizes impact while managing risk in the water technology sector. The firm typically targets deal sizes between £1-5 million, positioning itself in a sweet spot where companies have proven their technology but need strategic capital to scale operations and accelerate market penetration.

A cornerstone of Par Equity’s strategy is their co-investment model, which leverages a network of experienced business angels and institutional partners. This approach not only provides portfolio companies with deeper capital pools but also access to diverse expertise and industry connections. The syndication model helps de-risk investments while creating a powerful support ecosystem for growth-stage companies.

The firm’s approach to managing water technology investments mirrors successful patterns in impact investing, combining financial returns with environmental impact. Their hands-on partnership model extends beyond capital provision, encompassing strategic guidance, operational support, and market access facilitation.

Par Equity takes an active role in their portfolio companies’ development, typically securing board representation to help guide strategic decisions. Their value-addition framework focuses on three key areas: commercial scaling, operational excellence, and strategic partnerships. This includes helping companies refine their go-to-market strategies, optimize their operational processes, and forge crucial industry relationships.

The firm’s due diligence process is particularly noteworthy, combining technical assessment with commercial validation. They leverage their network of industry experts to evaluate both the technological innovation and market potential of prospective investments. This comprehensive evaluation ensures that portfolio companies possess not just breakthrough technology but also viable paths to market adoption and scale.

In terms of portfolio support, Par Equity maintains a balanced approach between guidance and autonomy. While providing strategic direction and resources, they empower management teams to execute their vision. This philosophy has proven especially valuable in the water technology sector, where innovation often requires iterative development and market adaptation.

The firm’s exit strategy typically aims for a 4-7 year investment horizon, though this remains flexible based on company progress and market opportunities. They maintain strong relationships with potential strategic buyers and larger private equity firms, creating multiple pathways for successful exits that benefit both investors and portfolio companies.

Future Vision: Scaling Water Innovation

Par Equity’s strategic vision for water technology centers on scaling breakthrough innovations that address our most pressing global water challenges. The Edinburgh-based firm recognizes that traditional approaches alone cannot meet the escalating demands of water scarcity, quality concerns, and infrastructure resilience.

At the heart of Par Equity’s forward-looking strategy lies a commitment to technologies that can achieve meaningful scale. The firm actively seeks solutions that demonstrate potential for exponential growth – innovations that can expand from serving local markets to making global impact. This scaling mindset shapes everything from initial investment criteria to ongoing portfolio support.

Drawing from their deep expertise in the Scottish innovation ecosystem, Par Equity has identified several key technology domains primed for scaling. These include advanced materials for water treatment, AI-powered infrastructure monitoring, and resource recovery solutions. The firm’s technical advisors work closely with portfolio companies to optimize their technologies for widespread deployment across diverse geographic and regulatory environments.

Beyond pure technology advancement, Par Equity recognizes that successful scaling requires building robust business models and strategic partnerships. The firm leverages its extensive network to help portfolio companies forge connections with major utilities, industrial players, and fellow investors who can accelerate market adoption. This collaborative approach helps promising innovations bridge the critical gap between pilot projects and full commercial deployment.

Looking ahead, Par Equity sees tremendous opportunity in solutions that integrate water technology with climate resilience. As highlighted in their investment thesis, technologies that can simultaneously address water challenges while reducing carbon footprints hold particular promise. The firm actively seeks innovations at this intersection, recognizing that scalable solutions must deliver both environmental and economic benefits.

Critically, Par Equity’s vision extends beyond simply growing individual companies. The firm aims to catalyze broader systemic change in how water resources are managed and protected. Through strategic co-investments and industry partnerships, they work to create the enabling conditions for widespread adoption of breakthrough water technologies.

As explored in “How to take mid-market green tech companies to the next level“, success in scaling water innovation requires patient capital combined with deep sector expertise. Par Equity embodies this approach, maintaining a long-term perspective while providing the hands-on support needed to help portfolio companies navigate complex market dynamics.

This balanced strategy – combining ambitious vision with practical execution support – positions Par Equity to play a pivotal role in shaping the future of water technology. As global water challenges intensify, their focus on scalable solutions becomes increasingly vital for ensuring sustainable water security.

Investment Philosophy and Focus Areas

Par Equity’s investment approach in water technology reflects a carefully calibrated strategy that prioritizes established businesses with demonstrated market traction. Rather than chasing early-stage startups still searching for product-market fit, the firm focuses on companies that have already validated their solutions and are poised for significant growth.

At the core of Par Equity’s investment philosophy lies a deep commitment to sustainability and innovation in water solutions. The firm actively seeks out companies developing technologies that address critical challenges in water conservation, treatment, and management. This strategic focus aligns with both environmental imperatives and market opportunities, as water scarcity and quality issues continue to intensify globally.

The firm’s investment criteria emphasize three key elements: proven commercial viability, scalable technology, and strong management teams. Companies in Par Equity’s portfolio typically demonstrate recurring revenue streams, established customer relationships, and clear paths to profitability. This approach helps mitigate investment risks while maximizing the potential for substantial returns.

In evaluating water technology opportunities, Par Equity pays particular attention to innovations that drive operational efficiency and environmental sustainability. The firm recognizes that successful water solutions must deliver both economic and ecological benefits to achieve widespread adoption. This dual focus has proven particularly effective in identifying investments that can generate attractive returns while contributing to water sustainability goals.

One distinctive aspect of Par Equity’s approach is its hands-on engagement with portfolio companies. Beyond providing capital, the firm leverages its extensive network and sector expertise to help companies optimize their growth strategies and navigate market challenges. This collaborative approach has helped numerous water technology companies accelerate their development and expand their market presence.

Par Equity’s investment strategy also reflects a keen understanding of the water sector’s evolving regulatory landscape and technological trends. The firm maintains a particular interest in solutions that help utilities and industrial users comply with increasingly stringent environmental standards while improving operational efficiency.

The firm’s commitment to sustainable water solutions aligns well with the growing emphasis on environmental, social, and governance (ESG) criteria in investment decisions. As highlighted in a recent analysis of water technology investment opportunities, this focus positions Par Equity to capitalize on the increasing flow of capital toward sustainable water solutions while contributing to meaningful environmental impact.

Portfolio Success Stories

Par Equity’s strategic investments in water technology companies have yielded remarkable results, particularly with standout performers like Spotless Water and StormHarvester. These success stories demonstrate the firm’s ability to identify and scale innovative solutions addressing critical water challenges.

Spotless Water exemplifies Par Equity’s investment thesis in action. The company’s network of automated pure-water vending stations has revolutionized access to purified water for window cleaning professionals and other commercial users. Since Par Equity’s initial investment, Spotless Water has expanded from 12 to over 250 vending locations across the UK. This rapid scaling resulted in revenue growth exceeding 400% in just three years, while maintaining strong unit economics and profitability metrics.

Equally impressive is StormHarvester’s trajectory in intelligent stormwater management. The company’s AI-powered technology predicts rainfall events and automatically optimizes drainage infrastructure capacity. With Par Equity’s backing, StormHarvester secured multiple utility contracts and expanded into international markets. Their installations have demonstrated up to 50% reduction in urban flooding incidents and 30% decrease in combined sewer overflows.

Beyond pure financial returns, these investments showcase Par Equity’s commitment to environmental impact. The combined water savings from their portfolio companies exceed 500 million liters annually. StormHarvester’s solutions alone have prevented an estimated 2,000 tons of pollutants from entering waterways.

Par Equity’s hands-on approach has been crucial to these outcomes. The firm helped recruit key management talent, opened doors to strategic partners, and provided ongoing operational guidance. This level of engagement helped portfolio companies navigate critical growth phases while maintaining focus on innovation and sustainability goals.

The success of these investments validates Par Equity’s thesis that established water technology companies with proven solutions can deliver both attractive financial returns and meaningful environmental impact. By focusing on businesses solving real-world water challenges at scale, Par Equity has built a portfolio that’s reshaping the water technology landscape.

As detailed in How to Take Mid-Market Green Tech Companies to the Next Level, this approach of supporting proven technologies through their commercialization and scaling phases has become increasingly vital for the water sector’s development.

Partnership Approach and Value Addition

Par Equity’s success in water technology investment stems from their deeply collaborative partnership model that goes far beyond simply providing capital. The firm takes an actively engaged approach with each portfolio company, leveraging their extensive network and expertise to accelerate growth and innovation.

At the core of their strategy is meaningful board participation. Par Equity partners typically take board observer or director positions, allowing them to provide ongoing strategic guidance while respecting management autonomy. This hands-on involvement enables them to spot both challenges and opportunities early, helping portfolio companies navigate critical growth phases.

The firm’s value addition extends across multiple dimensions. Their technical advisory network brings specialized water industry expertise, helping validate technologies and identify market opportunities. The commercial team assists with business development, making introductions to potential customers and partners across their Scottish and broader UK network. Additionally, Par Equity provides operational support in areas like financial planning, recruitment, and establishing robust governance structures.

What truly sets Par Equity apart is their thoughtful approach to follow-on investment. Rather than taking a rigid stance, they maintain flexibility to support promising companies through multiple funding rounds. This philosophy stems from their deep understanding of the water technology sector’s longer commercialization timelines and capital requirements. As explored in “How to Take Mid-Market Green Tech Companies to the Next Level“, staged capital deployment allows them to manage risk while supporting sustained growth.

The firm also facilitates peer learning among portfolio companies, creating valuable knowledge-sharing opportunities. Regular portfolio events and introductions enable founders to learn from each other’s experiences in areas like technology development, market entry strategies, and scaling operations. This collaborative ecosystem multiplies the value of Par Equity’s individual company partnerships.

Importantly, Par Equity maintains active dialogue with portfolio companies between board meetings through regular check-ins and updates. This ongoing engagement helps identify support needs early and ensures alignment on strategic direction. The firm’s partners remain accessible to management teams, serving as trusted advisors through both challenges and opportunities.

This comprehensive partnership approach has proven essential for navigating the unique challenges of scaling water technology companies. Par Equity’s ability to provide both strategic guidance and practical support, while maintaining the right balance of involvement, has been key to their portfolio’s success.

Future Investment Outlook

Par Equity stands poised to make significant moves in Scotland’s water technology landscape, with substantial dry powder reserves earmarked specifically for water and climate tech innovations. The firm’s investment thesis centers on three key themes that will shape their deployment strategy over the coming years.

First, Par Equity sees immense potential in digital water solutions that enhance infrastructure resilience. Their investment targets include technologies for predictive maintenance, real-time monitoring, and smart water management systems. The firm believes Scotland’s engineering heritage positions it uniquely to develop breakthrough solutions in this space.

Second, they’re pursuing innovations in water-energy nexus technologies. This includes solutions for energy-efficient treatment processes, heat recovery from wastewater, and water conservation in energy production. As Scotland pushes toward its ambitious net-zero targets, Par Equity views this intersection as crucial for future returns.

Third, the firm is actively seeking opportunities in climate adaptation technologies, particularly those addressing water scarcity and quality challenges. Their investment strategy aligns with Scotland’s reputation for water abundance while acknowledging global water stress challenges.

Par Equity’s deployment approach reflects a measured optimism about the sector’s growth potential. Rather than rushing to deploy capital, they’re maintaining rigorous due diligence standards while actively building a pipeline of promising opportunities. The firm’s investment committee has notably increased its allocation for follow-on funding, recognizing that water technology companies often require patient capital to achieve commercial scale.

Looking ahead, Par Equity envisions Scotland emerging as a global hub for water innovation. They’re particularly excited about opportunities to combine Scotland’s renewable energy advantages with water technology development. The firm sees potential for breakthrough technologies in areas like sustainable desalination, advanced filtration systems, and water reuse solutions.

Their investment thesis notably aligns with the broader trend toward impact investing in water technologies. Par Equity believes that financial returns and positive environmental impact aren’t mutually exclusive – rather, they’re increasingly interlinked in the water sector.

The firm’s future success will likely hinge on their ability to identify technologies that not only solve critical water challenges but also demonstrate clear paths to commercial viability. Their focus remains on solutions that can scale beyond Scotland’s borders while leveraging local expertise and resources.

Investment Strategy and Focus

Par Equity has carved out a distinctive niche in Scotland’s water technology landscape through a carefully calibrated investment approach focused on early-stage opportunities. The firm typically deploys initial investments ranging from £500,000 to £2 million, positioning itself as a lead investor for water technology companies at critical growth inflection points.

In the industrial water sector, Par Equity pursues a thesis-driven strategy centered on technologies that address mounting challenges around water scarcity, quality, and operational efficiency. Their investment criteria emphasize scalable solutions that can demonstrate clear commercial validation while maintaining reasonable capital efficiency in early deployment phases.

Par’s strategic positioning reflects a deep understanding of the industrial water market’s evolving dynamics. The firm specifically targets companies developing technologies for water-intensive industries, including manufacturing, mining, and food & beverage processing. This focus allows Par to leverage Scotland’s rich industrial heritage while tapping into global market opportunities.

A hallmark of Par’s approach is their hands-on engagement model with portfolio companies. Rather than pursuing a pure financial engineering strategy, the firm actively works with management teams to accelerate commercial traction and optimize operational execution. This includes leveraging Par’s extensive network of industry contacts and technical experts to provide strategic guidance and market access.

In evaluating potential investments, Par employs a rigorous due diligence process that examines not just technical merit, but also market positioning, competitive dynamics, and team capabilities. The firm looks for companies that have progressed beyond pure R&D to demonstrate initial market validation, typically through pilot projects or early customer engagements.

Par’s investment thesis in water technology aligns with broader sustainability imperatives while maintaining a clear focus on commercial viability. As explored in How to Fight a Pandemic with the Help of Your Feces, the firm recognizes that successful water technology investments must balance environmental impact with robust business fundamentals.

This measured approach to early-stage water technology investing has enabled Par to build a portfolio of companies addressing critical industrial water challenges while maintaining the discipline required for sustainable returns in this capital-intensive sector.

Water Technology Innovation Portfolio

Par Equity’s water technology portfolio reflects a strategic focus on industrial water treatment and filtration solutions that address pressing environmental challenges. The firm has built a diverse collection of innovative companies developing next-generation technologies for water purification, reuse, and resource recovery.

In the industrial filtration space, Par Equity’s investments target companies pioneering advanced membrane technologies and smart filtration systems. These solutions enable manufacturers to effectively remove contaminants while minimizing energy consumption and waste generation. The portfolio includes technologies that combine traditional filtration methods with novel approaches like biomimetic membranes and electrochemical treatment.

Par Equity has placed significant emphasis on water treatment technologies that enable industrial water reuse and recovery of valuable materials. Several portfolio companies are developing solutions for treating complex industrial wastewaters containing metals, oils, and emerging contaminants. Their technologies not only clean water for reuse but also extract and recycle valuable components, creating additional revenue streams for industrial customers.

The firm demonstrates particular interest in technologies that reduce the energy and chemical intensity of water treatment. Portfolio companies are leveraging advanced materials, process optimization, and automation to achieve superior treatment performance with lower operational costs and environmental impact. This aligns with growing industrial demand for sustainable water management solutions.

Digital water technologies form another key focus area, with investments in companies developing smart monitoring systems, predictive analytics, and automation platforms. These solutions enable real-time optimization of treatment processes, predictive maintenance, and data-driven decision making for industrial water management.

Par Equity’s portfolio also includes several companies working on specialized treatment technologies for emerging contaminants like PFAS and microplastics. As regulatory pressures increase around these substances, the firm has positioned itself to capture growing market demand for effective removal solutions.

The portfolio reflects Par Equity’s thesis that water technology innovation will be critical for industrial sustainability and regulatory compliance. By investing in companies developing more efficient, cost-effective treatment solutions, they aim to accelerate the adoption of advanced water technologies across industrial sectors.

Significantly, Par Equity takes an active role in supporting portfolio companies’ commercialization efforts. Beyond capital, they provide strategic guidance on product development, market entry strategies, and industry partnerships. This hands-on approach helps bridge the gap between innovative technologies and practical industrial applications.

Geographic Investment Strategy

Par Equity’s geographic focus on Scotland’s water technology sector represents a strategic advantage that combines regional expertise with global ambitions. The firm has cultivated deep roots in Edinburgh’s innovation ecosystem, allowing it to identify and nurture promising water tech ventures at their earliest stages.

This regional concentration delivers several key benefits. First, Par Equity maintains close relationships with Scottish universities and research institutions, providing early access to breakthrough technologies in water treatment, monitoring, and infrastructure. The firm’s proximity to centers like the University of Edinburgh and Heriot-Watt University creates natural pipelines for water tech innovation.

Second, Scotland’s unique geographic and climate conditions make it an ideal testing ground for water technologies. The country’s mix of urban and rural water challenges, coupled with its ambitious sustainability targets, creates a proving ground for solutions that can scale globally. Par Equity leverages this environment to validate technologies before expanding internationally.

The firm has built strong co-investment partnerships with Scottish Enterprise, the country’s economic development agency, and other regional investors who share their focus on water innovation. These relationships enhance deal flow and provide portfolio companies with additional support beyond capital. The collaborative approach has helped establish Par Equity as a trusted partner in Scotland’s water tech community.

While maintaining its Scottish base, Par Equity actively seeks opportunities to scale portfolio companies internationally. The firm’s geographic strategy involves first proving technologies locally, then expanding through strategic partnerships in key markets like North America and Asia. This “think local, grow global” approach helps mitigate risks while maximizing growth potential.

Par Equity’s commitment to Scotland has also yielded unexpected benefits in talent acquisition and retention. The firm has built a specialized team that deeply understands both the technical and commercial aspects of water technology. This expertise, combined with strong local networks, gives portfolio companies advantages in recruiting, business development, and industry partnerships.

By focusing intensively on Scotland’s water tech sector, Par Equity has created a virtuous cycle where success breeds further opportunity. The firm’s track record of identifying and scaling promising water technologies has made it a magnet for both entrepreneurs and co-investors seeking exposure to the sector.

Partnership and Co-Investment Approach

Par Equity has established itself as a distinctive force in Scotland’s water technology investment landscape through its collaborative approach to deal-making and syndicate building. The firm’s partnership model emphasizes the power of collective expertise and shared risk, creating a robust foundation for scaling promising water innovations.

At the core of Par Equity’s co-investment strategy lies a carefully cultivated network of investment partners, ranging from institutional investors to industry-specific funds. This diverse coalition allows the firm to leverage complementary strengths while distributing risk across multiple stakeholders. When evaluating potential water technology investments, Par Equity frequently assumes the role of lead investor, bringing its deep sector knowledge and extensive due diligence capabilities to the table.

The firm’s syndicate-building prowess particularly shines in how it structures investment rounds. Rather than simply aggregating capital, Par Equity orchestrates partnerships that add strategic value beyond funding. For instance, when backing water treatment innovations, the firm often brings together co-investors with operational expertise in utilities, industrial processes, or regulatory compliance. This approach creates a support ecosystem that significantly enhances portfolio companies’ chances of success.

Par Equity’s collaborative style extends to how it manages ongoing investments. The firm maintains active engagement with co-investors through structured communication channels and regular strategy sessions. This level of coordination ensures aligned interests and enables quick decision-making when portfolio companies need additional support or face challenges.

A notable aspect of Par Equity’s partnership approach is its commitment to maintaining strong relationships with Scottish Enterprise and other public sector bodies. These connections help bridge the gap between innovation and commercialization, particularly crucial in the water sector where public-private partnerships often drive adoption.

The firm has developed a reputation for its ability to coordinate complex investment rounds while maintaining nimble decision-making processes. This efficiency stems from established protocols for due diligence sharing, standardized investment documentation, and clear governance frameworks that protect all stakeholders’ interests. Learn more about crafting effective investment strategies in water technology.

Par Equity’s co-investment model has proven particularly valuable in supporting water technology companies through various growth stages. By bringing together investors with complementary expertise and resources, the firm creates resilient funding structures that can sustain companies through extended development cycles typical in the water sector.

The Par Equity Advantage: More Than Just Capital

Par Equity stands out in Scotland’s investment landscape through its distinctive approach that goes far beyond traditional venture capital funding. The firm’s philosophy centers on active partnership, combining deep operational expertise with strategic capital deployment to accelerate water technology companies’ growth trajectories.

At the core of Par Equity’s methodology lies its hands-on operational engagement model. The firm’s investment team brings decades of combined experience in scaling technology businesses, particularly in the water and climate sectors. This expertise translates into practical guidance for portfolio companies, helping them navigate complex regulatory environments, optimize their go-to-market strategies, and build robust operational frameworks.

Par Equity has cultivated an extensive network of industry experts and seasoned entrepreneurs who serve as advisors and mentors to portfolio companies. This ecosystem approach creates a multiplier effect, where young water technology firms can tap into a vast pool of knowledge and connections. Portfolio companies gain invaluable insights from those who have successfully scaled similar businesses, helping them avoid common pitfalls and accelerate their growth.

The firm’s track record in scaling water technology companies speaks volumes about their effectiveness. Their portfolio companies consistently demonstrate stronger operational metrics and faster market penetration compared to industry averages. This success stems from Par Equity’s balanced focus on both technological innovation and commercial execution.

Par Equity’s partnership model extends beyond traditional board representation. The firm takes an active role in key strategic decisions, from talent acquisition to international expansion strategies. This hands-on approach has proven particularly valuable for water technology companies navigating the complex intersection of innovation, regulation, and market adoption.

What truly sets Par Equity apart is their commitment to long-term value creation. Rather than pursuing quick exits, they focus on building sustainable businesses that can drive meaningful change in the water sector. This alignment of interests creates a foundation for genuine partnership, where both investor and company work toward the same goal: building robust, scalable water technology solutions that address critical environmental challenges.

This comprehensive support system has become increasingly crucial as water technology companies face growing pressure to scale rapidly while maintaining technological excellence and regulatory compliance. Through their unique combination of capital, expertise, and strategic support, Par Equity has established itself as a catalyst for innovation in Scotland’s water technology sector.

Strategic Focus: Where Water Meets Innovation

Par Equity has carved out a distinctive niche in Scotland’s water technology landscape by targeting three interconnected investment themes that address critical global water challenges.

Digital solutions stand at the forefront of their investment strategy, with a particular focus on technologies that enhance water infrastructure monitoring and management. The firm recognizes that aging water networks, coupled with increasing climate pressures, demand sophisticated digital oversight. Their portfolio prioritizes solutions that leverage artificial intelligence and IoT sensors to detect leaks, predict maintenance needs, and optimize distribution networks.

In treatment technologies, Par Equity focuses on breakthrough approaches that challenge conventional water and wastewater processing methods. Their interest spans advanced filtration systems, novel chemical-free treatment solutions, and energy-efficient purification technologies. The firm shows particular enthusiasm for innovations that address emerging contaminants like microplastics and PFAS, recognizing these as critical challenges for water quality worldwide.

Infrastructure innovation forms the third pillar of Par’s investment focus, where they seek technologies that revolutionize how water infrastructure is built, maintained, and upgraded. This includes modular treatment systems, smart materials for pipe networks, and decentralized water management solutions that can transform urban water resilience.

What sets Par Equity’s approach apart is their emphasis on scalable solutions that can demonstrate clear market demand and robust commercial potential. They actively seek technologies that can address multiple challenges simultaneously – for instance, treatment solutions that also reduce energy consumption or digital platforms that both optimize operations and improve regulatory compliance.

The firm’s investment thesis aligns closely with global water market trends. As water scarcity intensifies and regulatory pressures mount, Par Equity targets solutions that can scale rapidly to meet growing market demands. Their focus on technologies that offer measurable efficiency gains or cost reductions helps portfolio companies achieve faster market adoption.

Par Equity’s strategic focus reflects a deep understanding of how to mitigate water risk through impact investing. They recognize that successful water technology investments must balance environmental impact with commercial viability. This approach has positioned them to capitalize on the growing intersection between climate resilience and water security, while maintaining their commitment to delivering strong returns for investors.

Their investment themes collectively address a market opportunity that extends beyond Scotland’s borders, targeting global water challenges while leveraging local expertise and innovation capabilities. This strategic positioning enables Par Equity to support technologies that can scale from their Scottish base to address worldwide water management challenges.

From Investment to Impact: Par Equity’s Playbook

Par Equity’s approach to portfolio company support exemplifies the firm’s commitment to hands-on value creation in Scotland’s water technology sector. Their post-investment strategy combines active board participation, strategic guidance, and operational support to accelerate growth and innovation.

At the core of Par Equity’s methodology lies their board participation model. The firm typically places both an investment director and an experienced industry professional on each portfolio company’s board. This dual representation ensures both financial oversight and deep sector expertise guide strategic decisions. The investment director maintains alignment with Par Equity’s investment thesis, while the industry professional provides technical and market insights.

Beyond formal board roles, Par Equity employs a distinctive three-pillar support framework. First, they connect portfolio companies with their extensive network of water industry veterans, potential customers, and technical experts. These connections often lead to commercial partnerships, technical collaborations, and accelerated market entry.

Second, Par Equity provides hands-on operational support through their in-house team of analysts and operational specialists. This team helps portfolio companies optimize their financial planning, strengthen their operational processes, and develop robust growth strategies. They particularly focus on helping companies scale efficiently while maintaining technological excellence.

Third, the firm facilitates peer-to-peer learning among portfolio companies. Regular portfolio days bring together founders and management teams to share experiences, challenges, and best practices. This community approach has proven particularly valuable in the water technology sector, where companies often face similar technical and regulatory hurdles.

Par Equity’s strategic guidance extends to key growth initiatives. They assist portfolio companies in identifying and pursuing international expansion opportunities, particularly in markets where Scottish water technology expertise is highly valued. The firm also supports companies in securing additional funding rounds, leveraging their relationships with co-investors and later-stage investors.

Another distinctive element of Par Equity’s approach is their focus on environmental impact measurement. They work closely with portfolio companies to develop meaningful metrics for tracking both commercial success and environmental benefits. This dual-focus helps companies articulate their value proposition to customers and stakeholders while ensuring alignment with global sustainability goals.

The firm’s commitment to long-term value creation is evidenced by their typical holding period of 5-7 years. This timeframe allows for meaningful technology development, market expansion, and the establishment of sustainable competitive advantages. Throughout this period, Par Equity maintains active engagement, adjusting their support based on each company’s evolving needs and market dynamics.

The Future of Water Investment: Par Equity’s Vision

Par Equity’s vision for water technology investment centers on addressing escalating global water challenges through targeted funding of transformative solutions. Their strategy aligns with emerging trends that signal a fundamental shift in how we manage and protect water resources.

The firm recognizes three key vectors shaping future water tech investments. First, climate resilience has become non-negotiable, driving demand for technologies that help utilities and industries adapt their water infrastructure. Second, data-driven solutions are revolutionizing water management, from predictive maintenance to real-time quality monitoring. Third, circular economy principles are gaining traction, spurring innovations in water reuse and resource recovery.

Looking ahead, Par Equity sees particular promise in technologies bridging traditional infrastructure with digital capabilities. Smart sensors, artificial intelligence, and advanced analytics will enable more precise, efficient water management. The firm actively seeks startups developing solutions that can scale rapidly while delivering measurable environmental impact.

Par Equity’s investment thesis emphasizes solutions that tackle multiple challenges simultaneously. For instance, they prioritize technologies that both reduce energy consumption and improve water quality, or those that combine waste reduction with resource recovery. This integrated approach reflects their understanding that tomorrow’s water challenges require holistic solutions.

The firm’s commitment extends beyond mere financial returns. They deliberately structure investments to accelerate the adoption of promising technologies across Scotland’s water sector while creating pathways for global expansion. This dual focus on local impact and international scalability distinguishes their approach.

Par Equity’s forward-looking strategy includes strengthening partnerships with research institutions, industry leaders, and policy makers. These collaborations help identify emerging opportunities while ensuring invested technologies align with evolving regulatory frameworks and market needs.

Their vision acknowledges that successful water technology investment requires deep sector expertise. Par Equity continues building specialized knowledge across their team, enabling better evaluation of technical innovations and market potential. This expertise-driven approach helps them identify truly transformative solutions amid an increasingly crowded water tech landscape.

Through this comprehensive strategy, Par Equity aims to catalyze the next generation of water technology breakthroughs while generating sustainable returns. Their vision represents a bold bet on innovation’s crucial role in securing our water future.

The Par Equity Investment Philosophy

Par Equity’s investment approach stands out through its deliberate fusion of financial returns with environmental impact in Scotland’s burgeoning water technology sector. At its core lies a sophisticated dual-mandate strategy that evaluates potential investments through both commercial and sustainability lenses.

The firm’s focus on early-stage water technology companies reflects a deep understanding of Scotland’s innovation ecosystem. Par Equity typically engages with companies at the critical phase when proven technology needs capital and expertise to scale. Their sweet spot encompasses businesses that have demonstrated technical feasibility and early market traction but require strategic support to accelerate growth.

Par Equity’s evaluation process employs a rigorous three-pillar framework. First, they assess the technology’s potential to address pressing water challenges while delivering measurable environmental benefits. The investment team scrutinizes factors like water conservation metrics, energy efficiency improvements, and pollution reduction capabilities. Second, they examine the commercial viability through market size analysis, competitive positioning, and scalability potential. The third pillar focuses on the management team’s capacity to execute, emphasizing previous entrepreneurial experience and domain expertise in water technology.

What truly distinguishes Par Equity’s philosophy is their hands-on value creation approach. Rather than being passive investors, they actively leverage their network of industry experts and technical advisors to support portfolio companies. This includes helping founders refine their go-to-market strategies, make key hiring decisions, and forge strategic partnerships within Scotland’s water technology ecosystem.

Their investment thesis particularly favors technologies that sit at the intersection of water management and climate resilience. This strategic focus aligns with Scotland’s ambition to become a global leader in water innovation, while acknowledging the growing market demand for solutions that address water scarcity and quality challenges.

The firm maintains a disciplined approach to valuation, recognizing that early-stage water technology companies often require patient capital. Their investment tickets typically range from initial seed rounds through Series A, with capacity for follow-on funding to support sustained growth. This staged investment approach allows Par Equity to manage risk while providing portfolio companies with clear pathways to subsequent funding rounds.

Portfolio Success Stories

Par Equity’s strategic investments in water technology companies have yielded remarkable success stories, demonstrating their ability to identify and nurture groundbreaking innovations in Scotland’s burgeoning water tech sector.

One standout portfolio company has revolutionized wastewater treatment through an innovative membrane technology that reduces energy consumption by 40% compared to conventional systems. Par Equity’s early-stage investment enabled the rapid scaling of their pilot program to full commercial deployment across multiple Scottish municipalities. The firm’s hands-on support in developing the business strategy and facilitating industry partnerships proved instrumental in accelerating market adoption.

Another notable success emerged from Par Equity’s investment in smart water monitoring solutions. This Edinburgh-based startup developed AI-powered sensors that provide real-time water quality analysis and predictive maintenance capabilities for utility networks. Par Equity’s involvement went beyond capital injection – their industry expertise helped refine the product-market fit and expand the company’s presence across the UK and European markets.

In the field of water purification, a Par Equity portfolio company has pioneered an energy-efficient desalination technology that’s particularly well-suited for Scotland’s remote coastal communities. The firm’s investment enabled the company to build a demonstration facility that validated their approach, leading to several commercial contracts. Par Equity’s extensive network proved invaluable in connecting the company with key decision-makers in the water utility sector.

One of the firm’s most impactful investments focuses on climate resilience through innovative stormwater management solutions. This company developed a nature-based approach that combines traditional engineering with green infrastructure. Par Equity’s support helped the company secure major infrastructure projects, demonstrating how environmental impact can align with commercial success.

These portfolio companies exemplify how Par Equity’s investment approach effectively bridges the gap between innovative water technologies and market implementation. Their success stories showcase not just financial returns but also meaningful contributions to water sustainability and climate resilience. The firm’s ability to identify promising technologies early and provide comprehensive support has established them as a pivotal force in Scotland’s water technology ecosystem.

The Investment Process Decoded

For water technology entrepreneurs seeking investment from Par Equity, understanding the firm’s methodical yet entrepreneur-friendly approach is crucial. The investment journey follows a structured path while remaining adaptive to each company’s unique circumstances.

The process begins with initial screening, where Par Equity’s investment team evaluates potential opportunities against key criteria. Water tech ventures must demonstrate clear technological differentiation, strong intellectual property protection, and compelling market validation. Most importantly, companies need to show how their solutions address critical water challenges while maintaining commercial viability.

Successful applicants progress to detailed due diligence, where Par Equity’s expertise in both water technology and Scottish innovation comes into play. The firm leverages its extensive network of industry experts and technical advisors to validate the technology, market opportunity, and team capabilities. This phase typically spans 8-12 weeks, during which founders can expect rigorous examination of their business model, competitive positioning, and growth strategy.

What sets Par Equity apart is their collaborative approach during deal structuring. Rather than imposing rigid terms, they work with founders to create investment structures that align incentives while supporting the company’s growth trajectory. Learn more about venture capital dynamics in water technology.

Post-investment, Par Equity takes an active yet balanced role. Portfolio companies gain access to the firm’s extensive network of water industry contacts, potential customers, and co-investment partners. The investment team provides strategic guidance while respecting management’s operational autonomy. Regular review meetings focus on key performance indicators and strategic initiatives rather than micromanagement.

Beyond capital, Par Equity offers portfolio companies valuable support in subsequent fundraising rounds. Their strong relationships with later-stage investors and strategic acquirers help companies navigate future growth phases. The firm’s track record in water technology gives portfolio companies credibility when approaching potential partners or customers.

Entrepreneurs should note Par Equity’s emphasis on capital efficiency and realistic valuation expectations. While the firm backs ambitious growth plans, they prefer companies with clear paths to profitability over those requiring multiple large funding rounds. This approach aligns well with the water sector’s typically longer commercialization timelines compared to other technology segments.

Future Vision and Impact Metrics

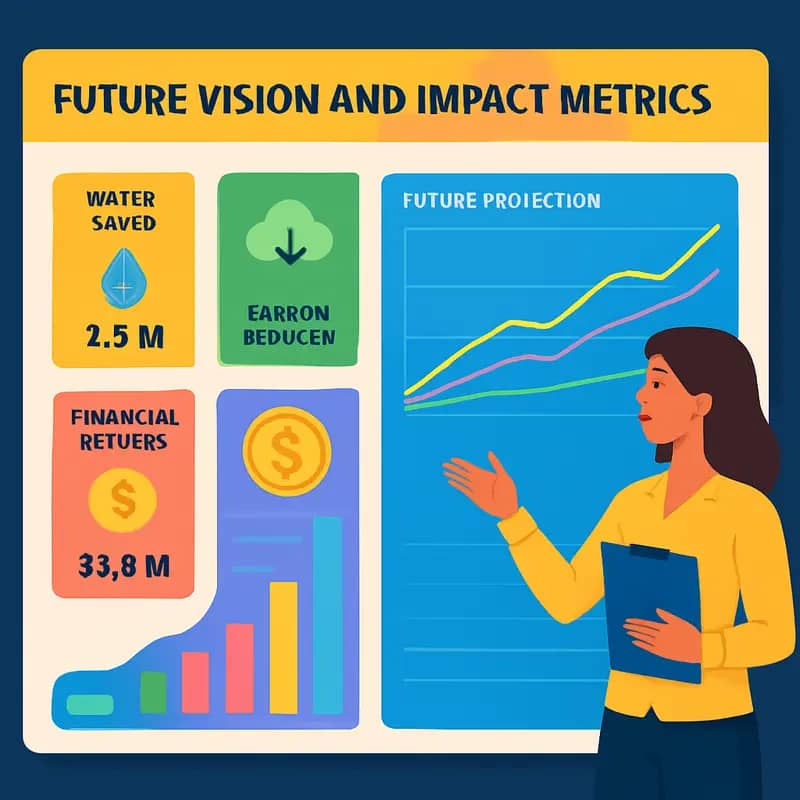

Par Equity stands at the forefront of Scotland’s water technology investment landscape with an ambitious vision that extends well beyond traditional financial returns. The firm has developed a sophisticated dual-metric system that simultaneously tracks both economic performance and environmental impact across its water technology portfolio.

The investment team employs a proprietary framework that quantifies water savings, energy reduction, and carbon mitigation achieved through their portfolio companies’ technologies. Each investment must demonstrate measurable environmental benefits alongside commercial viability. For example, treatment efficiency improvements are measured in cubic meters of water saved, while energy innovations are evaluated through kilowatt-hour reductions and corresponding emissions cuts.

Looking ahead, Par Equity aims to double its water technology portfolio over the next five years, with a particular focus on breakthrough innovations in water reuse, decentralized treatment, and digital water management. The firm has earmarked significant capital for early-stage companies developing solutions for climate resilience and water security.

In measuring success, Par Equity takes a holistic approach that considers both direct and indirect impacts. Beyond standard financial metrics like IRR and multiple on invested capital, the firm tracks broader indicators such as the number of communities served, volumes of wastewater recycled, and tons of CO2 equivalent avoided. This comprehensive evaluation helps ensure investments deliver genuine environmental and social value alongside financial returns.

Par Equity’s future strategy emphasizes scalable solutions that can be deployed globally while maintaining strong ties to Scotland’s innovation ecosystem. The firm actively seeks technologies that can address water challenges in both developed and emerging markets, recognizing that different contexts require different approaches to implementation and impact measurement.

Critically, Par Equity views impact measurement not as a constraint but as a driver of value creation. As explored in how to mitigate 4 shades of water risk through impact investing, this dual-focus approach helps identify opportunities where environmental benefits directly contribute to commercial success.

The firm’s forward-looking investment thesis centers on technologies that can deliver exponential rather than incremental improvements. This includes innovations in advanced materials, AI-driven optimization, and circular economy solutions that fundamentally reimagine how we manage and conserve water resources.

Final words

Par Equity’s emergence as a significant player in water technology investment represents more than just financial opportunity – it symbolizes a crucial bridge between innovation and sustainability. Their strategic focus on technologies that combine water purification with critical mineral recovery demonstrates a sophisticated understanding of future environmental challenges. With £100 million in fresh capital and a proven track record of nurturing northern UK’s technology companies, Par Equity is well-positioned to drive the next wave of water technology innovation. Their approach to investment, balancing hands-on support with strategic co-investment partnerships, creates a robust framework for scaling water technology solutions. As global water challenges intensify, Par Equity’s commitment to funding dual-impact technologies positions them not just as financial investors, but as architects of sustainable water solutions. Their journey from Edinburgh to the forefront of water technology investment serves as a blueprint for how regional venture capital can address global environmental challenges while generating compelling returns.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!