Nestled in the historic heart of Edinburgh, Old College Capital (OCC) stands as a beacon for water entrepreneurs seeking both funding and deep academic expertise. As the University of Edinburgh’s venture arm, this unique investment vehicle combines the rigor of academic research with the dynamism of venture capital – creating an ideal springboard for water technology innovations. With investment tickets ranging from £20,000 to £250,000 and a collaborative approach to funding, OCC offers water startups more than just capital; it provides access to world-class research facilities, industry connections, and the gravitas of one of the UK’s most prestigious institutions.

Old College Capital is part of my Ultimate Water Investor Database, check it out!

Investor Name: Old College Capital

Investor Type: VC

Latest Fund Size: $2 Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes:

Investment History: $2595555.56 spent over 2 deals

Often Invests Along: Equity Gap, Scottish Enterprise

Already Invested In: MiAlgae

Leads or Follows: Follow

Board Seat Appetite: Moderate

Key People: Andrew Murphy

The Investment Philosophy: Where Academia Meets Innovation

Old College Capital (OCC) represents a unique fusion of academic rigor and commercial acumen in the water technology investment landscape. Operating at the intersection of the University of Edinburgh’s research excellence and the dynamic world of venture capital, OCC has cultivated a distinctive approach to identifying and nurturing water innovation.

The fund’s investment philosophy stems from a deep understanding that water challenges require both scientific breakthrough and commercial viability. By leveraging the University’s vast research capabilities across engineering, chemistry, and environmental sciences, OCC evaluates potential investments through multiple lenses. This approach allows them to assess not just the technical feasibility but also the broader impact potential of water technologies.

OCC’s strategy focuses on early-stage water technology companies that demonstrate strong intellectual property foundations and clear paths to scalability. The fund particularly values innovations that address critical challenges in water treatment, resource recovery, and infrastructure efficiency. This strategic focus aligns with their commitment to supporting sustainable solutions that can transform the water sector.

What sets OCC apart is their patient capital approach, recognizing that water technology development often requires longer gestation periods than typical venture investments. Rather than pursuing quick exits, they emphasize building robust foundations for long-term success. This philosophy has proven particularly valuable in supporting complex water treatment technologies that need extensive validation before market adoption.

The fund’s connection to academia provides portfolio companies with unique advantages. Start-ups gain access to state-of-the-art research facilities, scientific expertise, and a talent pipeline of graduate researchers. This academic partnership also enables more thorough technical due diligence, reducing investment risks while accelerating technology development.

Beyond financial returns, OCC measures success through environmental and social impact metrics. They prioritize technologies that demonstrate potential for significant water savings, energy efficiency improvements, or pollution reduction. This dual-bottom-line approach resonates with both impact-focused investors and environmentally conscious customers.

As highlighted in how to foster innovation and agility when you’re the world’s largest water company, the water sector demands a delicate balance between innovation and practical implementation. OCC’s investment philosophy embodies this balance, creating a bridge between academic discovery and commercial success in the water technology landscape.

Strategic Partnerships: The Power of Co-Investment

Old College Capital’s co-investment model represents a carefully orchestrated approach to scaling water technology innovations. By leveraging a network of over 150 investment partners, OCC has created a powerful ecosystem that multiplies the impact and reach of their funding initiatives.

At the heart of this model lies a philosophy of shared risk and amplified reward. When OCC identifies a promising water technology startup, they rarely invest alone. Instead, they orchestrate funding rounds where multiple partners contribute capital alongside them. This approach not only increases the total funding available but also brings diverse expertise and market access to portfolio companies.

The network of investment partners spans venture capital firms, corporate investors, family offices, and impact-focused funds. Each brings unique strengths – venture capitalists offer scaling expertise, corporate partners provide industry access and validation, while impact investors align with the long-term sustainability goals. This diversity creates a robust support system for startups navigating the complex water sector.

OCC’s co-investment strategy particularly shines in how it addresses the unique challenges of water technology commercialization. Learn more about navigating these complexities. Water solutions often require significant capital for pilot projects and infrastructure deployment. By pooling resources through co-investment, OCC helps startups overcome these capital-intensive hurdles while maintaining momentum toward market adoption.

The model also creates a multiplier effect on deal flow quality. Investment partners regularly bring opportunities to OCC, knowing their deep water sector expertise and university connections can add significant value. This two-way relationship strengthens the overall ecosystem while ensuring OCC sees the most promising innovations early.

Perhaps most importantly, the co-investment approach helps de-risk investments for all parties involved. OCC’s technical due diligence, backed by university expertise, gives co-investors confidence in the underlying technology. Meanwhile, the market validation and commercial networks that partners bring help ensure viable paths to scale.

The result is a virtuous cycle where successful investments attract more partners, creating larger pools of capital and expertise for future water technology ventures. This collaborative approach has proven essential in bridging the gap between promising academic research and commercial success in the water sector.

From Lab to Market: The OCC Support Journey

Old College Capital’s comprehensive support system transforms promising water technologies into market-ready solutions through a carefully orchestrated journey. This unique approach combines financial backing with deep academic expertise and commercial guidance.

At the core of OCC’s support lies their meticulous due diligence process. Portfolio companies receive thorough technical validation leveraging the University of Edinburgh’s world-class research facilities and expertise. This scientific rigor helps de-risk innovations while providing crucial proof points for future investors and customers.

Beyond initial funding, OCC takes an active role in governance through strategic board positions. Their directors bring decades of commercial experience, helping shape business strategy and opening doors to valuable industry connections. This hands-on involvement extends to monthly review meetings where portfolio companies receive structured feedback on their progress and strategic direction.

A distinguishing feature of OCC’s model is the seamless access to university resources. Portfolio companies can tap into specialized research equipment, laboratory space, and testing facilities that would otherwise be cost-prohibitive for early-stage ventures. The proximity to leading academics also facilitates ongoing technical collaboration and keeps innovations at the cutting edge.

Equally valuable is OCC’s talent pipeline support. Through strong ties with the university’s engineering and business schools, portfolio companies can recruit top graduates and interns. Many ventures have built their core technical and commercial teams through these channels, benefiting from fresh perspectives while keeping recruitment costs manageable.

The fund’s expertise in intellectual property management proves particularly valuable for university spin-outs. Their in-house team helps navigate complex IP arrangements and licensing agreements, ensuring founders maintain appropriate rights while protecting valuable innovations. This support extends to patent strategy and portfolio development.

Perhaps most critically, OCC acts as a bridge between academic innovation and commercial reality. Their team helps translate complex technical solutions into clear value propositions that resonate with customers and investors alike. This commercial lens shapes everything from product development to market entry strategies, dramatically improving chances of success.

As portfolio companies mature, OCC leverages its extensive network to facilitate follow-on funding rounds. Their stamp of approval and continuing support give confidence to new investors, while their experience helps ventures optimize their capital raising approach.

This holistic support system creates a fertile environment where water technology innovations can flourish and scale. By addressing both technical and commercial challenges, OCC maximizes the chances of successfully bridging the critical gap between laboratory breakthrough and market impact.

Future Horizons: OCC’s Vision for Water Innovation

As Old College Capital charts its course ahead, the fund’s strategic vision centers on transformative water technologies that address pressing global challenges. Building on its established foundation of nurturing early-stage innovations, OCC is positioning itself at the intersection of digital transformation and environmental sustainability.

A key focus area lies in advanced data analytics and artificial intelligence applications for water management. By leveraging machine learning, smart sensors, and predictive modeling, OCC aims to support solutions that enable more precise water quality monitoring, infrastructure maintenance, and resource optimization. The fund recognizes that digital tools can dramatically improve operational efficiency while reducing costs for utilities and industrial users.

Sustainability drives another crucial dimension of OCC’s forward-looking strategy. The fund is actively seeking technologies that advance water reuse, energy-efficient treatment processes, and circular economy approaches. This includes innovations in resource recovery from wastewater, solutions for emerging contaminants like PFAS, and technologies that help reduce the water sector’s carbon footprint.

OCC’s commitment to addressing global water challenges manifests in its emphasis on scalable solutions for water scarcity and climate resilience. The fund is particularly interested in technologies that can be deployed in water-stressed regions and developing economies. This includes decentralized treatment systems, nature-based solutions, and innovations that enable communities to better manage their water resources in the face of climate change.

Recognizing Scotland’s unique position as a hub for water innovation, OCC leverages its connections to the University of Edinburgh’s research capabilities and Scotland’s wider water technology cluster. The fund aims to create synergies between academic research, industry expertise, and entrepreneurial talent to accelerate the development and deployment of breakthrough water technologies.

Cross-sector collaboration remains central to OCC’s vision. The fund actively fosters partnerships between startups, established industry players, and research institutions. These collaborations are essential for testing and validating new technologies, sharing knowledge, and creating pathways to market adoption. As highlighted in how to build the world leading water innovation accelerator, such ecosystem approaches are vital for successful water innovation.

Looking ahead, OCC’s investment strategy reflects a deep understanding that tomorrow’s water challenges require multifaceted solutions. The fund’s vision encompasses not just technological innovation, but also business model innovation and new approaches to market deployment. This holistic perspective positions OCC to play a pivotal role in shaping the future of water technology while generating sustainable returns for its investors.

The Academic Edge in Water Investment

Old College Capital (OCC) stands apart in the water investment landscape through its unique symbiosis with Edinburgh University’s deep research expertise. This academic foundation provides OCC with unparalleled advantages in evaluating and nurturing water technology ventures.

At the core of OCC’s approach is direct access to Edinburgh University’s world-class water research facilities and interdisciplinary knowledge base. The fund’s investment team works closely with faculty experts across engineering, chemistry, environmental science, and business departments to conduct thorough technical due diligence on potential investments. This academic scrutiny helps identify truly innovative solutions while filtering out technologies that may face fundamental scientific challenges.

The university connection also enables OCC to tap into an extensive network of water industry partnerships built through decades of research collaborations. These relationships provide valuable market insights and potential customer connections for portfolio companies. Additionally, portfolio companies gain opportunities to validate their technologies through pilot projects at university facilities, accelerating their path to commercialization.

OCC’s academic roots shape its long-term investment perspective, prioritizing sustainable innovation over quick exits. The fund recognizes that breakthrough water technologies often require extended development cycles to achieve market readiness. By leveraging university resources and expertise, OCC can provide patient capital while actively supporting ventures through technical challenges.

This academic edge extends to talent acquisition for portfolio companies. As highlighted in how venture capital could reshape the water technology landscape, access to skilled engineers and researchers is critical for water tech startups. OCC’s portfolio companies can recruit from a pipeline of top graduates and benefit from ongoing research partnerships with university labs.

The fund’s position within the university ecosystem also creates unique opportunities for knowledge transfer and innovation. Portfolio companies can explore new applications of their technologies through collaborative research projects, while academic teams gain real-world implementation insights. This virtuous cycle of innovation helps maintain Edinburgh’s position as a leading hub for water technology development.

Beyond individual investments, OCC’s academic foundation enables it to take a systems-level view of water challenges. The fund can identify synergies between different technologies and foster collaboration among portfolio companies to develop integrated solutions. This comprehensive approach, informed by cutting-edge research, positions OCC to drive meaningful advancement in addressing global water challenges.

Investment Strategy and Portfolio Success

Old College Capital’s investment strategy centers on identifying and nurturing breakthrough water technologies that demonstrate both environmental impact and commercial viability. The fund employs a rigorous due diligence process that leverages the University of Edinburgh’s deep research expertise while maintaining strict commercial discipline.

The investment criteria focus on three key pillars: technology validation, market opportunity, and team capability. Technologies must demonstrate proof-of-concept through university research or third-party validation. Market opportunities need to address critical water challenges with clear paths to scalability. Most importantly, OCC seeks founding teams that combine technical expertise with commercial acumen.

OCC typically invests between £250,000 to £2 million in early-stage companies, taking minority stakes while maintaining board representation to provide strategic guidance. The fund structures investments to enable follow-on funding rounds, often co-investing alongside other institutional investors to build strong syndicates.

This approach has yielded notable successes in OCC’s water technology portfolio. Several portfolio companies have achieved significant commercial traction by addressing pressing water industry challenges. One standout example developed advanced membrane technology that reduces energy consumption in water treatment by 40% while extending membrane life by 3x. Another pioneered smart sensors that enable predictive maintenance of water infrastructure, reducing leakage rates by over 25%.

Beyond direct investments, OCC has established a robust support ecosystem for portfolio companies. This includes access to the university’s world-class testing facilities, connections to industry partners, and mentorship from seasoned water industry executives. The fund also facilitates commercial pilots through its network of utility and industrial partners, accelerating the path to market adoption.

The fund’s success in water technology investments stems from its patient capital approach, typically maintaining investment positions for 5-7 years to allow technologies to mature and gain market acceptance. This longer-term perspective, combined with deep sector expertise and strong university linkages, has enabled OCC to consistently deliver both environmental impact and financial returns.

By focusing on water technologies that deliver measurable improvements in efficiency, quality, or sustainability, OCC has demonstrated how university-linked investment funds can play a crucial role in commercializing research innovations while generating attractive returns. Their portfolio success stories underscore the value of combining academic expertise with commercial rigor in water technology investments.

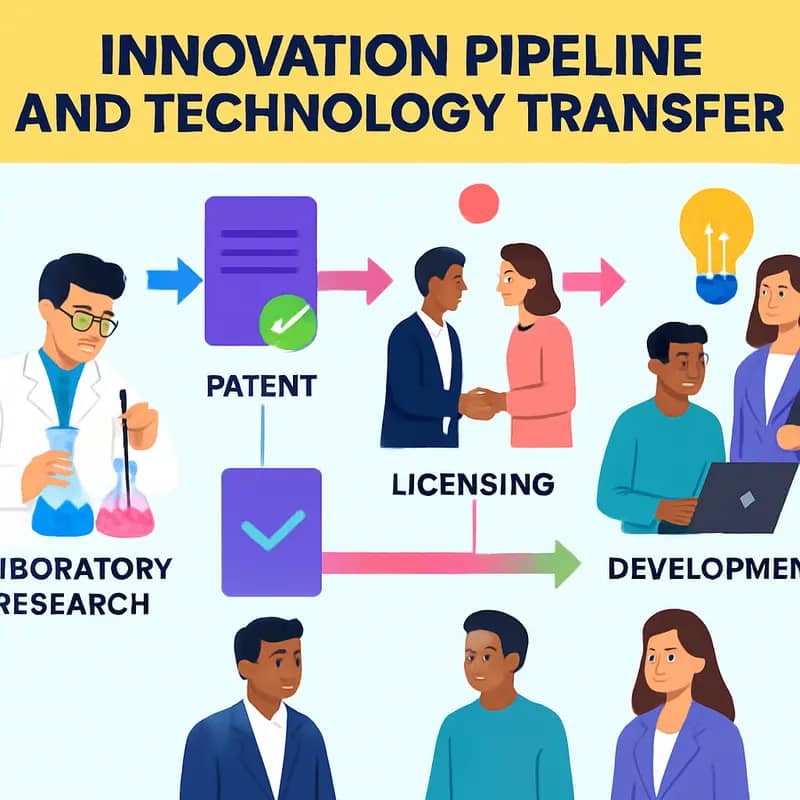

Innovation Pipeline and Technology Transfer

Old College Capital (OCC) has developed a robust framework for transforming promising water research into market-ready solutions. The fund’s technology transfer process combines academic expertise with commercial acumen to bridge the notorious ‘valley of death’ between laboratory success and market adoption.

At the core of OCC’s commercialization strategy lies its deep integration with the University of Edinburgh’s research ecosystem. Rather than waiting for innovations to emerge organically, OCC takes a proactive approach by regularly engaging with research groups to identify promising water technologies early in their development. This early identification allows OCC to provide guidance on commercial viability and market needs while the technology is still malleable.

Once a potential innovation is identified, OCC deploys a comprehensive support system that extends far beyond mere funding. Their technology transfer specialists work closely with researchers to develop proof-of-concept studies, protect intellectual property, and craft compelling business cases. This hands-on approach has proven particularly valuable for academic innovators who may lack commercial experience.

OCC’s entrepreneur-in-residence program pairs seasoned water industry veterans with emerging innovations. These mentors provide crucial insights into market dynamics, regulatory requirements, and scaling challenges specific to the water sector. They also help researchers navigate the complex stakeholder landscape of utilities, industrial users, and regulatory bodies.

To accelerate commercialization, OCC has established strategic partnerships with leading water utilities and industrial water users who serve as beta testing sites. These real-world validation opportunities prove invaluable for refining technologies and building credibility with potential customers. The fund’s strong industry networks also facilitate introductions to potential customers, partners, and follow-on investors.

Significantly, OCC takes a patient capital approach that acknowledges the longer development cycles typical in water technology. This approach aligns with findings explored in “The 4 Stages of Water Innovation” which detail the unique timeline considerations for water sector innovations. Rather than pushing for quick exits, the fund provides sustained support through multiple development stages, helping portfolio companies build sustainable businesses.

The success of this model is evident in OCC’s growing portfolio of commercialized water technologies. From advanced membrane systems to smart monitoring solutions, OCC-supported innovations are increasingly finding their way into real-world applications, delivering both environmental impact and financial returns. This track record has helped establish Edinburgh as a recognized hub for water technology innovation, attracting talent and investment from across the global water sector.

Future Vision and Global Impact

Old College Capital’s strategic vision extends far beyond Edinburgh’s boundaries, positioning itself as a catalyst for solving pressing global water challenges. Building on its successful track record of commercializing innovative water technologies, OCC is expanding its investment portfolio with a particular focus on solutions addressing water scarcity, quality, and resilience.

The fund’s expansion strategy centers on three key pillars: scaling breakthrough technologies, fostering international partnerships, and leveraging Scotland’s unique water expertise. With climate change intensifying water-related challenges worldwide, OCC recognizes the critical need for solutions that can be deployed rapidly and effectively across diverse geographical contexts.

A cornerstone of OCC’s future vision involves creating dedicated investment streams for technologies targeting emerging water challenges. This includes advanced water recovery systems, smart infrastructure solutions, and innovative approaches to water quality monitoring. The fund is particularly interested in solutions that combine environmental benefits with strong commercial potential, ensuring sustainable impact through market-driven adoption.

Recognizing the power of collaborative innovation, OCC is establishing partnerships with global water technology hubs, research institutions, and industry leaders. These relationships facilitate knowledge exchange, accelerate technology validation, and create pathways for international market entry. The fund’s unique position within the University of Edinburgh ecosystem provides access to world-class research capabilities and a global network of water experts.

OCC’s approach to global impact emphasizes solutions that can be adapted and scaled across different contexts. The fund actively seeks technologies that address multiple challenges simultaneously – for instance, water treatment solutions that also reduce energy consumption or waste recovery systems that generate valuable byproducts. This integrated approach reflects the interconnected nature of water challenges and the need for holistic solutions.

Looking ahead, OCC is developing new investment models that better align with the needs of water technology companies at different stages of growth. This includes flexible funding mechanisms, technical support packages, and structured pathways to follow-on investment. The fund recognizes that successfully scaling water innovations often requires longer development cycles and more patient capital than traditional venture investments.

Through these strategic initiatives, OCC aims to significantly expand its impact on global water challenges while maintaining its commitment to rigorous investment principles and sustainable returns. The fund’s vision represents a bold step forward in transforming promising water technologies into practical solutions that can help secure our water future.

Final words

Old College Capital represents a unique bridge between academic excellence and commercial success in the water technology sector. Their approach, combining rigorous scientific understanding with strategic investment acumen, creates a powerful platform for water entrepreneurs looking to scale their innovations. The fund’s commitment to co-investment, coupled with its access to world-class research facilities and expertise, positions it perfectly to support the next generation of water technology solutions. For entrepreneurs in the water sector, OCC offers more than just financial backing – it provides a comprehensive ecosystem that can transform promising research into market-ready solutions. As global water challenges continue to mount, the importance of institutions like OCC, which can effectively translate academic innovation into real-world impact, becomes increasingly crucial. The fund’s focus on sustainable, scalable solutions, combined with its strong network of investment partners, makes it an invaluable resource for water entrepreneurs seeking to make a lasting impact on global water security.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!