In the heart of Oslo, a venture fund is quietly reshaping the future of water technology. OBOS Oppstart, with its €500M war chest, has emerged as a pivotal force in the Nordic water tech ecosystem. While known primarily as the investment arm of Norway’s largest housing developer, this fund has demonstrated an uncanny ability to spot and nurture water technology innovations that address urgent urban challenges. Their strategic focus on flood mitigation, smart water infrastructure, and sustainable urban water management has positioned them as an essential partner for water entrepreneurs seeking not just capital, but deep industry expertise and Nordic market access.

OBOS Oppstart is part of my Ultimate Water Investor Database, check it out!

Investor Name: OBOS Oppstart

Investor Type: CVC

Latest Fund Size: $47 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: Flood risk prediction and mitigation, digitalization and modeling tools for urban water, nature-based solutions for water management

Investment History: $1908333.33 spent over 2 deals

Often Invests Along: Construct Venture, Momentum Partners

Already Invested In: 7Analytics

Leads or Follows: Follow

Board Seat Appetite: Moderate

Key People: Stian Holm

Smart Capital: OBOS Oppstart’s Investment Strategy

At the heart of OBOS Oppstart’s approach lies a deeply strategic investment philosophy focused on early-stage water technology ventures. With ticket sizes ranging from €200,000 to €1 million, the fund operates in a sweet spot where capital can make a meaningful difference while maintaining a portfolio diverse enough to manage risk effectively.

OBOS Oppstart doesn’t just write checks – they architect growth. Their investment strategy centers on three core pillars: technical validation, market access, and strategic partnerships. For every potential investment, the team conducts extensive technical due diligence, leveraging their deep water sector expertise to evaluate not just the technology’s current capabilities, but its scalability and market fit.

What truly sets OBOS Oppstart apart is their hands-on value creation model. Rather than taking a passive investment stance, they actively work with portfolio companies to accelerate their path to market. This includes providing access to their extensive network of water utilities, industrial players, and fellow investors across the Nordic region. Their strategic support often proves crucial in helping startups navigate the complex regulatory landscape of the water sector and secure pilot projects – traditionally one of the biggest hurdles for early-stage water tech companies.

The fund’s investment thesis specifically targets solutions addressing critical water challenges: infrastructure resilience, resource recovery, and smart water management. This focused approach allows them to build valuable synergies across their portfolio, creating opportunities for collaboration and shared learning among their companies.

OBOS Oppstart’s success stems from their patient capital approach, recognizing that water technology ventures often require longer development cycles than typical tech startups. Rather than pushing for quick exits, they focus on sustainable growth and long-term value creation. Their investment horizons typically span 5-7 years, providing portfolio companies the runway needed to develop, validate, and scale their solutions.

The fund’s track record speaks to the effectiveness of this strategy. Their portfolio companies have consistently shown strong growth trajectories, with several securing follow-on funding from international investors and establishing themselves as category leaders in their respective market segments. Their approach to smart capital deployment has become a blueprint for successful early-stage investment in the water sector.

This strategic investment methodology aligns perfectly with what the water industry desperately needs – patient, knowledgeable capital combined with deep sector expertise and active value creation. As detailed in “Private Capital’s Role in Water’s Future”, this approach is essential for driving meaningful innovation in the water sector.

Water Innovation Focus: From Floods to Smart Cities

OBOS Oppstart has positioned itself as a key investor in transformative water technologies, with a particular emphasis on urban resilience and smart water management solutions. Their portfolio showcases a strategic focus on innovations that address pressing challenges in flood prediction, water infrastructure optimization, and smart city integration.

A standout example of their investment thesis is their work with 7Analytics, a company revolutionizing flood risk assessment through advanced AI and machine learning capabilities. This investment demonstrates OBOS Oppstart’s commitment to technologies that combine cutting-edge data analytics with practical urban applications. The fund recognized early that traditional flood mapping methods were insufficient for modern climate challenges, making their bet on predictive analytics particularly prescient.

Beyond flood management, OBOS Oppstart has developed a comprehensive framework for evaluating urban water technologies. Their investment criteria prioritize solutions that can scale across Nordic cities while addressing multiple challenges simultaneously. This includes technologies for stormwater management, water quality monitoring, and infrastructure optimization – all critical components of resilient urban water systems.

The fund’s approach to water innovation reflects a deep understanding of the unique challenges faced by Nordic municipalities. Rather than pursuing standalone solutions, they favor integrated technologies that can work within existing urban infrastructure while providing multiple benefits. This strategic alignment has helped their portfolio companies achieve faster market adoption and more sustainable growth trajectories.

Significantly, OBOS Oppstart has pioneered a collaborative model between startups and city authorities. Their portfolio companies benefit from direct access to municipal decision-makers, creating valuable feedback loops that accelerate product development and market fit. This hands-on approach to value creation sets them apart from traditional venture capital firms.

Their investment strategy also emphasizes solutions that can demonstrate clear environmental and economic benefits. Portfolio companies must show potential for both water conservation and cost reduction, making their technologies more attractive to budget-conscious municipalities. This dual-benefit approach has proven particularly effective in driving adoption across the Nordic region.

Connecting their water technology investments to broader urban development goals has been another key success factor. By linking water innovation to smart city initiatives, OBOS Oppstart helps their portfolio companies tap into larger municipal budgets and implementation programs. This strategic positioning has enabled faster scaling and more sustainable growth paths for their investments.

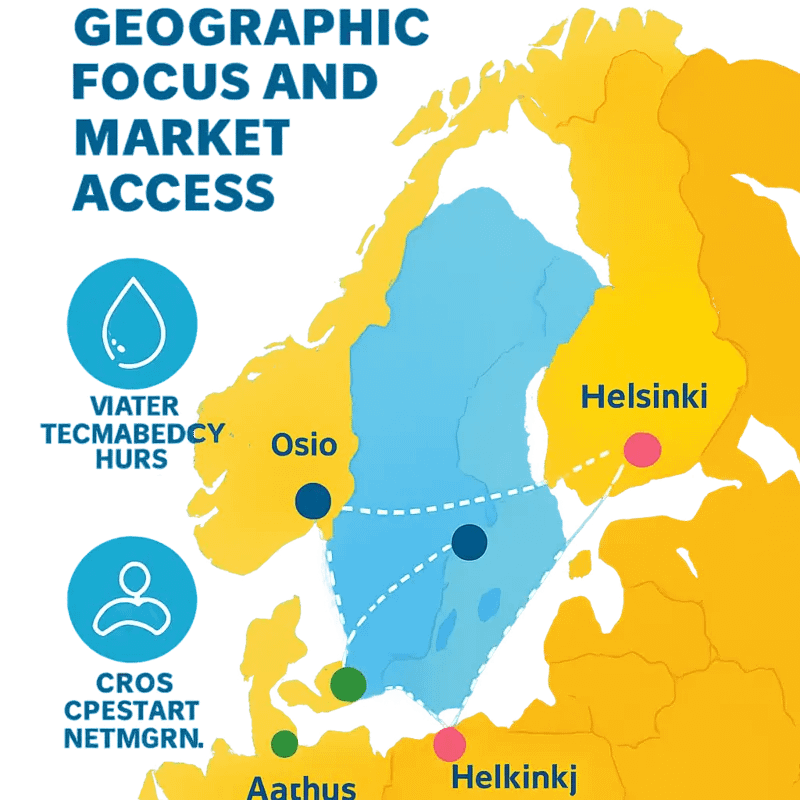

The Nordic Advantage: Geographic Focus and Market Access

OBOS Oppstart’s strategic positioning within the Nordic region provides water technology startups with unique advantages that extend far beyond simple geographic proximity. At the heart of this advantage lies the region’s established reputation as a water technology pioneer, particularly in areas of flood management, smart city solutions, and sustainable water infrastructure.

The Nordic markets serve as an ideal testing ground for emerging water technologies. With their combination of advanced infrastructure, progressive environmental policies, and challenging climate conditions, these countries offer startups the perfect environment to validate and refine their solutions. This regional expertise enables OBOS Oppstart to provide portfolio companies with deep market intelligence and regulatory insight that proves invaluable during crucial growth phases.

An often overlooked aspect of OBOS Oppstart’s Nordic advantage is its extensive network of municipal and industrial partners across Sweden, Norway, Denmark, and Finland. These relationships open doors for water tech ventures to secure pilot projects and initial commercial deployments – critical milestones that can make or break a startup’s journey to market. The fund leverages these connections to create what they call ‘reference installations,’ which serve as powerful proof points for global expansion.

Beyond the immediate regional market, OBOS Oppstart’s Nordic presence acts as a gateway to broader European opportunities. The fund’s deep understanding of EU water regulations and standards helps portfolio companies navigate complex compliance requirements while accessing EU funding mechanisms and support programs. This proves particularly valuable when scaling solutions across European markets.

The fund’s geographic focus also aligns perfectly with the region’s strong emphasis on environmental, social, and governance (ESG) principles. Nordic institutional investors and corporations are often early adopters of sustainable technologies, creating a receptive market for water innovation. This alignment allows portfolio companies to benefit from the region’s growing appetite for sustainable solutions while building credibility for international expansion.

Perhaps most significantly, OBOS Oppstart’s Nordic roots enable a unique approach to value creation. The fund combines traditional venture capital support with deep technical expertise and an intimate understanding of how water solutions must perform in challenging Nordic conditions. This creates a powerful platform for developing robust technologies that can succeed globally.

For deeper insights into Nordic water innovation approaches, see how nature-based solutions are protecting cities from environmental risks.

Partnership Dynamics: The Co-Investment Playbook

OBOS Oppstart’s success in water technology investments stems from its sophisticated approach to partnerships and co-investment strategies. The fund’s philosophy centers on creating robust syndication networks that combine financial strength with deep sector expertise.

At the core of their co-investment model lies a deliberate focus on complementary capabilities. OBOS typically leads funding rounds while actively seeking partners who bring specialized knowledge in water technology, market access in specific regions, or operational expertise in scaling water ventures. This approach has proven particularly effective in complex water infrastructure projects where multiple stakeholders need to align.

The fund maintains three distinct partnership tiers. Their primary syndicate partners include established water technology venture capital firms, particularly those with strong Nordic roots. These relationships enable deal flow sharing and risk distribution while maintaining regional market influence. The second tier comprises corporate venture arms of major water industry players, providing valuable technical validation and potential customer relationships. The third tier consists of family offices and impact investors who share OBOS’s long-term vision for sustainable water solutions.

A distinctive element of OBOS’s partnership strategy is their flexible capital deployment model. Rather than adhering to rigid investment thresholds, they adjust their position size based on the strategic value their co-investment partners bring to the table. This adaptability has proven crucial in securing deals where technical expertise or market access outweighs pure financial considerations.

The fund has also pioneered an innovative approach to managing co-investment relationships through what they call ‘partnership councils.’ These quarterly gatherings bring together key co-investors to share market intelligence, discuss portfolio company challenges, and identify collaborative opportunities. This systematic knowledge exchange has become a powerful tool for de-risking investments and accelerating portfolio company growth.

In terms of deal structure, OBOS typically aims for a 20-40% ownership stake, with co-investors collectively holding a similar proportion. This balanced approach ensures aligned interests while maintaining sufficient influence over strategic decisions. The remaining equity is usually reserved for founders and management teams, creating a three-way partnership that balances innovation, execution capability, and financial resources.

Their success in co-investment partnerships is perhaps best illustrated by their track record in follow-on rounds. Over 80% of their initial investments have attracted additional capital from new strategic partners, demonstrating the value of their collaborative approach to venture building in the water technology sector.

The Cooperative Advantage in Water Tech

OBOS’s cooperative foundation provides a distinctive edge in water technology investment that stems from its deep-rooted commitment to community benefit and long-term value creation. Unlike traditional venture capital firms focused primarily on rapid returns, OBOS’s cooperative structure enables a more patient and holistic approach to water innovation.

At its core, the cooperative model aligns perfectly with the fundamental nature of water as a shared resource. OBOS’s member-owned structure creates natural incentives to pursue technologies that deliver sustainable community impact alongside financial returns. This dual-purpose mandate allows OBOS to evaluate water tech investments through a wider lens that considers environmental stewardship, public health, and social equity.

The cooperative advantage manifests in several concrete ways. First, OBOS can take longer investment horizons that match the typically extended development and adoption cycles of water technologies. While conventional VCs often push for exits within 5-7 years, OBOS’s cooperative structure enables holding periods of 10+ years when needed for technologies to reach their full potential.

Secondly, OBOS leverages its vast network of housing cooperatives as both testing grounds and early adopters for promising water innovations. This built-in market access significantly de-risks the commercialization journey for portfolio companies while providing real-world validation. The feedback loop between end-users and innovators helps refine solutions to address genuine community needs.

The cooperative model also brings unique governance benefits. OBOS’s democratic decision-making process, involving diverse stakeholder perspectives, helps ensure investments align with community priorities and values. This participatory approach leads to more thorough due diligence and stronger buy-in for selected technologies.

Perhaps most importantly, as explored in how to make water more attractive than the Apple and Samsungs of this world, the cooperative structure enables OBOS to take calculated risks on transformative technologies that might be too early or unconventional for traditional investors. Without pressure for quick exits, OBOS can nurture innovations through the “valley of death” between prototype and commercial scale.

This patient, community-centric approach positions OBOS as an ideal partner for water tech ventures seeking to create lasting positive impact. The cooperative advantage provides the perfect foundation for building sustainable water solutions that serve both commercial and social imperatives.

Investment Strategy and Water Focus

OBOS Oppstart’s investment approach in water technology combines rigorous due diligence with an understanding of water’s fundamental role in sustainable development. The fund’s water technology thesis centers on three key pillars: resource efficiency, infrastructure resilience, and circular solutions.

When evaluating potential water technology investments, OBOS Oppstart employs a comprehensive framework that examines both technical and market fundamentals. The technical assessment scrutinizes the core innovation’s scientific validity, scalability potential, and environmental impact. Their team of water experts analyzes factors like energy efficiency, chemical usage reduction, and operational reliability compared to existing solutions.

On the market side, OBOS Oppstart seeks technologies that address clear pain points while offering compelling unit economics. The fund prioritizes solutions that can demonstrate quantifiable benefits in terms of cost savings, operational improvements, or environmental impact. This commercial lens helps ensure portfolio companies have viable paths to profitability and scale.

The fund’s sweet spot lies in early-stage companies, typically investing in Series A and B rounds with check sizes ranging from €1-5 million. However, OBOS Oppstart maintains flexibility to participate in seed rounds for exceptionally promising technologies. The team looks for founding teams that combine deep water industry expertise with entrepreneurial drive, recognizing that successful water tech commercialization requires both technical knowledge and business acumen.

A distinctive aspect of OBOS Oppstart’s strategy is their focus on technologies that can leverage Norway’s unique water resources and expertise. The fund actively seeks innovations in areas like hydropower optimization, aquaculture sustainability, and advanced water treatment – sectors where Norway holds competitive advantages. This regional specialization, combined with their global perspective, helps them identify opportunities others might miss.

Portfolio companies must demonstrate clear environmental and social benefits aligned with UN Sustainable Development Goals, particularly SDG 6 (Clean Water and Sanitation) and SDG 14 (Life Below Water). The fund has developed proprietary impact metrics to track portfolio companies’ contributions to water conservation, pollution reduction, and ecosystem protection.

Particularly noteworthy is OBOS Oppstart’s patient capital approach, which acknowledges the longer development cycles typical in water technology. While maintaining rigorous return expectations, the fund structures investments to support sustained R&D and market development, recognizing that transformative water solutions often require time to achieve widespread adoption.

Nordic Innovation Ecosystem

The Nordic region stands as a powerhouse of water technology innovation, with OBOS Oppstart playing a pivotal role in its thriving ecosystem. This €500M fund operates as both a catalyst and connector, weaving together various stakeholders across Norway, Sweden, Denmark, and Finland into a cohesive network driving water innovation forward.

At the heart of OBOS Oppstart’s approach lies a deep understanding that breakthrough water technologies require more than just capital. The fund has systematically built collaborative bridges between research institutions, established utilities, and emerging startups. Through strategic partnerships with technical universities across the Nordic region, OBOS helps commercialize promising academic research while providing startups access to world-class testing facilities.

A key differentiator in OBOS Oppstart’s ecosystem role is their “Nordic Water Hub” initiative, which connects portfolio companies with municipal utilities across the region. This provides startups with real-world validation opportunities while helping utilities access cutting-edge solutions. The program has facilitated over 50 pilot projects, with a remarkable 70% conversion rate to commercial contracts.

The fund’s collaborative approach extends beyond traditional boundaries through their pioneering “Water Tech Exchange” platform. This digital marketplace enables portfolio companies to share resources, expertise, and market intelligence while facilitating partnerships among complementary technologies. The result is an innovation multiplier effect, where individual breakthroughs combine to create comprehensive water management solutions.

OBOS Oppstart has also been instrumental in attracting international attention to Nordic water innovation. Their annual “Nordic Water Summit” has become the region’s premier water technology event, drawing global utilities, industrial players, and fellow investors. This has helped position the Nordic region as a leading hub for water technology development, particularly in areas like digital water solutions and energy-efficient treatment processes.

Leveraging the Nordic tradition of public-private partnership, OBOS Oppstart works closely with government agencies to align innovation efforts with policy objectives. This coordinated approach has proven especially valuable in addressing challenges like climate resilience and micropollutant removal, where regulatory frameworks significantly influence technology adoption.

Beyond individual investments, OBOS Oppstart’s ecosystem-building efforts have created a self-reinforcing cycle of innovation. Successful exits drive reinvestment in new ventures, while established companies increasingly look to the Nordic region for water technology solutions. This virtuous cycle has established the region as a global leader in water innovation, with OBOS Oppstart as a central driving force.

The fund’s impact extends beyond immediate portfolio returns, fostering a culture of collaboration that strengthens the entire Nordic water sector. Their systematic approach to ecosystem development serves as a model for other regions seeking to build robust innovation networks in the water technology space.

Future Horizons in Water Investment

OBOS Oppstart stands at the forefront of reshaping water technology investment for the coming decades. Their strategic vision centers on three key pillars: accelerating breakthrough technologies, fostering cross-border collaboration, and maximizing environmental impact alongside financial returns.

The fund’s forward-looking investment thesis prioritizes technologies addressing water scarcity and quality challenges through innovative approaches. Their analysts have identified advanced membrane technologies, AI-powered infrastructure management, and resource recovery solutions as critical focus areas for future capital deployment. This aligns with projections showing the water technology market reaching $1 trillion by 2030.

In terms of concrete initiatives, OBOS Oppstart plans to launch a dedicated early-stage funding program specifically for water tech startups developing climate adaptation solutions. This program will provide not just capital, but also technical expertise and market access through OBOS’s extensive Nordic industrial network. The fund aims to support 20 new ventures through this program over the next three years.

Beyond individual investments, OBOS Oppstart is pioneering new financing models that could transform how water projects are funded. They’re developing innovative blended finance structures that combine institutional capital with philanthropic resources to de-risk early-stage water technology deployment. This approach could unlock significantly more capital for the sector.

Perhaps most ambitiously, OBOS Oppstart is working to establish what they call the “Nordic Water Innovation Platform” – a collaborative ecosystem bringing together utilities, industrial players, research institutions, and startups. This platform aims to accelerate the adoption of new technologies by creating standardized frameworks for piloting and validation.

The fund’s commitment to measuring and maximizing impact is evident in their development of sophisticated metrics that go beyond traditional financial returns. Their framework tracks specific water-related outcomes like gallons saved, contaminants removed, and infrastructure efficiency gains. This data-driven approach to impact measurement could set new standards for the industry.

Looking ahead, OBOS Oppstart sees tremendous opportunity in technologies that address the water-energy nexus, particularly solutions that can help decarbonize water treatment and transport while improving efficiency. As outlined in their recent analysis of impact investing opportunities, this intersection of water and climate tech represents a key growth area.

The fund’s future trajectory suggests a shift toward larger, more transformative investments as successful portfolio companies scale. This evolution could help bridge the critical gap between innovative solutions and widespread deployment – a persistent challenge in the water sector.

Final words

OBOS Oppstart stands as a compelling partner for water technology entrepreneurs and co-investors alike. Their strategic positioning in the Nordic market, combined with their deep understanding of urban water challenges, creates a unique value proposition in the water technology investment landscape. The fund’s careful balance of financial support and strategic value-add, exemplified by their follow-on reserve ratio of 60-70% and flexible approach to board participation, demonstrates their commitment to long-term partnership with portfolio companies. For water technology entrepreneurs, particularly those focused on flood mitigation, smart infrastructure, and urban water management, OBOS Oppstart offers more than just capital – they provide a gateway to one of Europe’s most sophisticated markets for water innovation. As climate change and urbanization continue to drive demand for advanced water solutions, OBOS Oppstart’s strategic focus and regional expertise position them as an increasingly important player in the global water technology ecosystem.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!