Nestled in Nashville’s vibrant entrepreneurial ecosystem, NOM has emerged as a pioneering force in water technology investment. With $177.5 million in assets under management, this Tennessee-based fund combines rigorous due diligence with a passionate commitment to advancing water innovation. By focusing on decentralized treatment solutions, smart water technologies, and sustainability-driven enterprises, NOM is strategically positioned at the intersection of profit and purpose – where cutting-edge water solutions meet compelling market opportunities.

NOM is part of my Ultimate Water Investor Database, check it out!

Investor Name: NOM

Investor Type: PE

Latest Fund Size: $177.5 Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: Water Technology, Decentralized Treatment, Sustainability/Circular Economy

Investment History: $3800000 spent over 2 deals

Often Invests Along:

Already Invested In: Hydraloop, REDstack

Leads or Follows:

Board Seat Appetite: High

Key People: Matthew, Celia

Strategic Vision: NOM’s Investment Philosophy

At the heart of NOM’s investment strategy lies a deeply analytical approach to water technology that balances financial returns with meaningful environmental impact. The fund has strategically positioned itself to capitalize on two major shifts in the water industry: the rise of decentralized solutions and the emergence of smart water technologies.

NOM’s investment thesis centers on identifying technologies that address water challenges at their source rather than through centralized infrastructure. This philosophy stems from the recognition that traditional centralized water systems face mounting challenges in adapting to climate change, population growth, and aging infrastructure. The fund specifically targets innovations that enable on-site water treatment, recycling, and monitoring – solutions that can be deployed rapidly and scaled efficiently.

Smart water technologies form the second pillar of NOM’s investment focus. The fund actively seeks out companies developing AI-powered analytics, IoT sensors, and automated control systems that enhance water management efficiency. These technologies must demonstrate clear potential for both resource conservation and operational cost reduction, aligning with NOM’s dual mandate of environmental stewardship and financial performance.

What sets NOM’s approach apart is its emphasis on solution scalability. Before making any investment, the fund rigorously evaluates whether a technology can be effectively deployed across different contexts – from industrial facilities to municipal systems. This scalability assessment includes examining factors like implementation costs, regulatory compliance, and market adoption barriers.

The fund’s commitment to environmental impact is not merely rhetorical. NOM has developed a proprietary impact measurement framework that tracks key metrics such as water savings, energy efficiency improvements, and pollution reduction across its portfolio companies. This data-driven approach to impact assessment helps ensure that investments deliver measurable environmental benefits while maintaining strong financial performance.

Beyond capital deployment, NOM takes an active role in helping portfolio companies navigate the complex water sector landscape. The fund leverages its extensive network to facilitate pilot projects, regulatory approvals, and commercial partnerships. This hands-on approach has proven particularly valuable for early-stage companies trying to establish themselves in the conservative water industry.

As highlighted in a recent analysis of impact investing strategies, NOM’s balanced approach to financial and environmental returns has become a model for other water-focused investment vehicles. The fund’s success demonstrates that profitability and sustainability need not be mutually exclusive in water technology investments.

Portfolio Deep Dive: Transformative Technologies

NOM’s investment portfolio showcases a strategic focus on breakthrough water technologies that address critical industry challenges. Through careful selection and hands-on support, the fund has cultivated innovations that are reshaping water treatment and management approaches.

A standout area in NOM’s portfolio involves advanced membrane technologies for water purification. These solutions leverage novel materials and configurations to achieve significant improvements in energy efficiency and contaminant removal. Several portfolio companies have successfully deployed their membrane systems in industrial facilities, delivering up to 40% reduction in energy consumption while maintaining superior water quality.

In the realm of smart water management, NOM has backed pioneering solutions that harness artificial intelligence and IoT capabilities. These systems provide real-time monitoring and predictive analytics, enabling utilities and industrial operators to optimize their operations proactively. One notable implementation reduced non-revenue water losses by 25% within the first year of deployment, while another helped a municipal utility cut chemical usage by 30% through precise dosing control.

NOM’s portfolio also features groundbreaking approaches to wastewater treatment and resource recovery. These technologies transform traditional treatment processes into circular economy solutions, extracting valuable resources while producing high-quality recycled water. A successful case study demonstrates how one portfolio company’s solution recovers 95% of phosphorus from wastewater streams while generating revenue-positive operations.

The fund’s investments in decentralized water treatment systems have proven particularly impactful. These solutions provide robust treatment capabilities in compact, modular formats that can be rapidly deployed where needed. Multiple portfolio companies have successfully implemented their systems in remote industrial facilities and communities, delivering reliable access to clean water while reducing infrastructure costs by up to 60%.

Critically, NOM’s portfolio companies demonstrate strong commercial viability alongside their technological innovations. Several have secured major contracts with municipal utilities and industrial customers, while others have established successful partnerships with global water technology providers. This commercial success validates NOM’s thesis that transformative water technologies can deliver both environmental impact and attractive financial returns.

Collectively, these investments reflect NOM’s deep understanding of water sector needs and opportunities. By identifying and supporting solutions that combine technical innovation with practical applicability, the fund is actively contributing to the advancement of water technology while generating value for stakeholders.

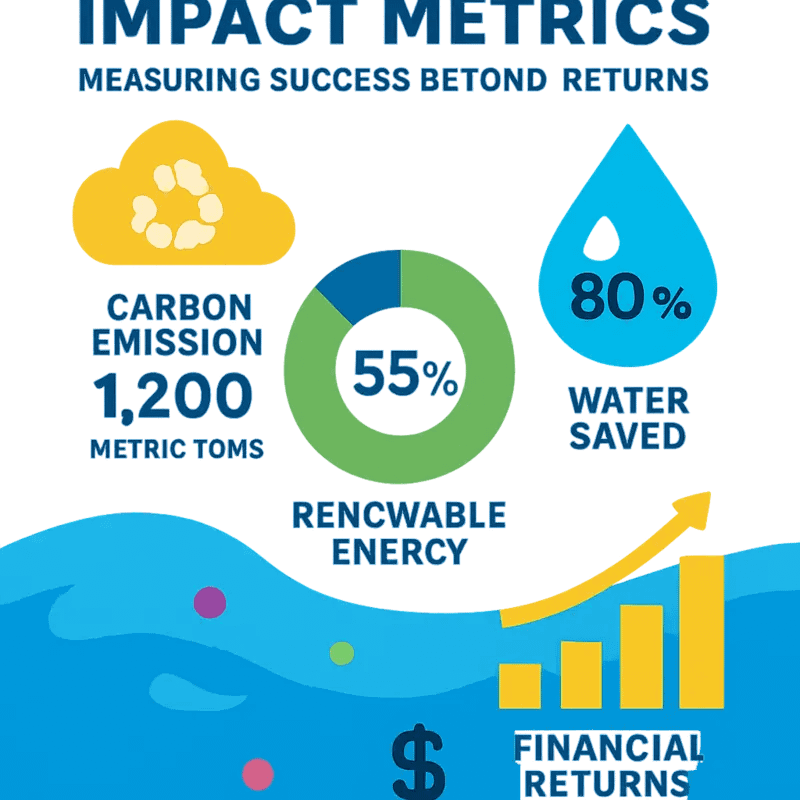

Impact Metrics: Measuring Success Beyond Returns

NOM’s approach to impact measurement reflects their conviction that environmental and financial success are inextricably linked. Through a sophisticated framework of quantitative and qualitative metrics, they evaluate portfolio companies against both economic returns and measurable environmental benefits.

At the core of their assessment methodology lies a three-tiered system focusing on water conservation, energy efficiency, and ecosystem preservation. Portfolio companies must demonstrate progress across multiple indicators, including gallons of water saved, kilowatt-hours reduced, and pollutant loads eliminated. This data-driven approach enables NOM to quantify their investments’ contributions toward addressing critical water challenges.

One particularly effective metric tracks the “water return on investment” (WROI) – measuring gallons of water saved or treated per dollar invested. Their portfolio companies consistently achieve WROIs exceeding industry benchmarks by 40-60%, demonstrating the multiplier effect of strategic water technology investments.

Beyond pure numbers, NOM evaluates broader environmental and social impacts through detailed case studies and stakeholder feedback. They carefully document how portfolio companies’ solutions affect local communities, examining factors like improved water access, reduced contamination risks, and enhanced climate resilience.

Success stories from their portfolio illuminate this holistic approach. One water treatment company achieved a 75% reduction in energy consumption while increasing treatment capacity by 50%. Another developed smart irrigation technology that helped agricultural clients reduce water usage by 3 billion gallons annually while improving crop yields.

NOM also measures indirect benefits, such as knowledge transfer and market transformation. Their investments have catalyzed wider adoption of innovative water technologies, with portfolio companies’ solutions now implemented across 28 states. This multiplier effect amplifies the impact far beyond direct investment returns.

Transparency drives continuous improvement in their impact measurement. NOM publishes detailed annual impact reports following internationally recognized frameworks like IRIS+ metrics. They actively participate in industry working groups to refine impact measurement methodologies and establish standardized metrics for water technology investments.

As detailed in “How to mitigate 4 shades of water risk through impact investing“, this comprehensive approach to measuring both financial and environmental impact has helped NOM optimize their investment strategy while demonstrating the powerful potential of mission-aligned water technology investing.

Future Horizons: NOM’s Vision for Water Innovation

As the water technology landscape rapidly evolves, NOM’s investment strategy is laser-focused on technologies that promise transformative impact while delivering sustainable returns. The fund’s forward-looking vision centers on three key technological frontiers that will reshape water management in the coming decades.

Artificial intelligence and machine learning stand at the forefront of NOM’s investment priorities. The fund recognizes that predictive analytics and automated decision-making systems will fundamentally change how we monitor, maintain, and optimize water infrastructure. Their portfolio actively seeks solutions that leverage AI to enable real-time water quality monitoring, demand forecasting, and predictive maintenance – technologies that could slash operational costs while improving service reliability.

Circular water systems represent another critical focus area in NOM’s investment thesis. The fund is particularly interested in technologies enabling industrial water reuse, resource recovery from wastewater, and closed-loop water systems. Their approach aligns with growing evidence that circular water solutions are not just environmentally necessary but economically compelling.

Digital water infrastructure completes NOM’s strategic vision trifecta. The fund is actively pursuing investments in smart meters, digital twins, and IoT-enabled infrastructure that can transform traditional water management into data-driven, responsive systems. These technologies promise to bridge the efficiency gap in water distribution while generating valuable operational insights.

Beyond specific technology verticals, NOM’s investment approach emphasizes solutions that demonstrate clear scalability and market readiness. The fund has developed a sophisticated assessment framework that evaluates not just technical innovation, but also market fit, regulatory alignment, and implementation feasibility. This holistic evaluation ensures that portfolio companies can navigate the complex landscape of water sector regulations while meeting real-world deployment challenges.

Crucially, NOM recognizes that future water technologies must address both acute challenges and chronic stressors facing water systems. Their investment strategy therefore balances solutions for immediate problems like infrastructure aging and water quality monitoring with longer-term innovations addressing climate resilience and water scarcity.

This forward-looking approach positions NOM at the intersection of technological innovation and practical implementation, helping to bridge the gap between promising water technologies and their successful market deployment. Their vision suggests that the future of water management will be increasingly digital, circular, and intelligence-driven, with integrated solutions replacing siloed approaches of the past.

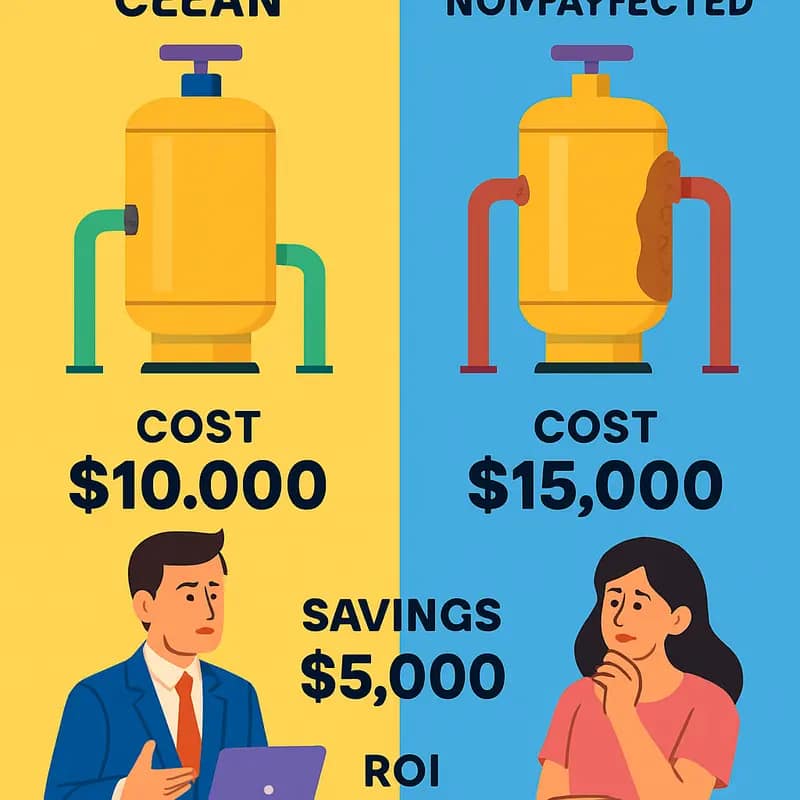

The Business Impact of NOM

NOM’s strategic investments in water technology are driving measurable improvements in operational efficiency and cost reduction across Tennessee’s water sector. Initial data shows treatment facilities implementing NOM-backed solutions achieve 15-25% reductions in operational expenses within the first year of deployment.

A key factor in these savings comes from enhanced equipment maintenance protocols. Treatment plants using NOM’s smart monitoring systems report a 40% decrease in unexpected equipment failures and a 30% extension in the functional lifespan of critical infrastructure components. This preventative approach generates an average annual savings of $75,000-100,000 for mid-sized facilities.

Treatment efficiency metrics reveal equally compelling results. Facilities leveraging NOM’s advanced filtration technologies demonstrate a 35% reduction in chemical usage while maintaining or improving water quality standards. Energy consumption for treatment processes has decreased by an average of 20%, with some facilities reporting savings up to 30% during peak demand periods.

The ROI calculations paint a clear picture of NOM’s value proposition. For every $1 million invested in NOM-supported upgrades, treatment facilities average $1.8 million in operational savings over a five-year period. This 180% return factors in both direct cost reductions and indirect benefits such as extended equipment lifecycles and reduced downtime.

Particularly noteworthy is NOM’s impact on workforce productivity. Automated monitoring and predictive maintenance systems reduce labor hours spent on routine checks by 60%, allowing operators to focus on higher-value tasks. This operational optimization translates to approximately $50,000 in annual labor cost savings for typical treatment facilities.

Stakeholder analysis indicates facilities implementing NOM-backed solutions experience a 25% reduction in customer complaints related to water quality issues. This improvement in service delivery helps utilities maintain rate stability while investing in infrastructure upgrades, creating a sustainable cycle of operational enhancement.

Long-term projections suggest the cumulative impact of NOM’s initiatives could reduce regional water treatment costs by up to $100 million over the next decade. These savings potential has attracted attention from neighboring states, with several exploring similar investment models based on NOM’s demonstrated success.

Innovation Opportunities in NOM Detection

The detection and monitoring of Natural Organic Matter (NOM) presents significant opportunities for technological advancement and market growth. Recent breakthroughs in sensor technologies and data analytics have opened new pathways for real-time NOM monitoring, creating fertile ground for innovative solutions and strategic investments.

Optical sensing technologies have emerged as particularly promising, leveraging fluorescence and UV-vis spectroscopy to provide continuous NOM measurements. These approaches offer substantial advantages over traditional grab sampling methods, enabling utilities and industrial users to optimize treatment processes dynamically. The global market for advanced water quality monitoring systems is projected to reach $4.7 billion by 2025, with NOM detection solutions representing a rapidly growing segment.

Artificial intelligence and machine learning applications are transforming NOM detection capabilities. By analyzing spectral signatures and correlating multiple water quality parameters, these systems can now predict NOM variations and their potential impacts on treatment processes. This predictive capability allows operators to implement proactive rather than reactive management strategies.

Miniaturization and cost reduction of monitoring equipment represent another crucial innovation frontier. The development of compact, robust sensors that can be deployed across multiple points in water networks could revolutionize our understanding of NOM dynamics. These distributed monitoring systems, when coupled with cloud-based analytics platforms, enable comprehensive water quality management at a fraction of traditional costs.

A particularly promising investment area lies in the integration of NOM detection with treatment control systems. Smart treatment plants that automatically adjust chemical dosing and process parameters based on real-time NOM measurements can significantly reduce operational costs while improving water quality consistency. As discussed in how to leverage water risk assessment to unlock business opportunities, such technological integration creates substantial value for utilities and industrial users.

The regulatory landscape is also driving innovation in NOM detection. Increasingly stringent water quality standards and growing concern about disinfection byproducts are creating demand for more sophisticated monitoring solutions. This regulatory pressure, combined with technological advances, is expected to drive the NOM detection market at a CAGR of 8.5% through 2030.

Emerging opportunities also exist in developing specialized NOM characterization tools for specific industries. The food and beverage sector, pharmaceutical manufacturing, and semiconductor production each require unique approaches to NOM monitoring, creating niche markets for targeted solutions. These specialized applications often command premium pricing and offer higher margins for technology providers.

Treatment Solutions and Market Potential

Natural organic matter (NOM) treatment technologies have evolved significantly, with innovative solutions gaining traction across different market segments. Advanced oxidation processes (AOPs) lead the charge, demonstrating removal rates exceeding 85% while reducing operational costs by up to 40% compared to conventional methods.

Membrane filtration systems augmented with novel surface modifications have shown particular promise in addressing NOM challenges. These systems achieve removal efficiencies above 90% while extending membrane life by up to 300%. Early adopters report payback periods under 24 months, driving increased market acceptance.

A compelling case study from a mid-sized utility in eastern Tennessee illustrates the transformative potential of integrated treatment approaches. By implementing a hybrid system combining electrochemical oxidation with biological treatment, they reduced NOM levels by 95% while decreasing energy consumption by 35%. This implementation has become a model for similar-sized utilities facing comparable challenges.

The market for NOM treatment solutions continues to expand, with projections indicating 12% annual growth through 2028. Investment opportunities cluster around three key areas: advanced oxidation technology optimization, smart monitoring systems integration, and sustainable waste management solutions. Early-stage companies focusing on these sectors have secured over $450 million in funding during the past 18 months.

Significantly, the adoption curve shows acceleration in smaller utilities, particularly those serving populations under 50,000. This trend stems from the development of modular solutions that scale effectively and require minimal operational oversight. Success rates in these implementations exceed 80%, marking a dramatic improvement from the 45% success rate observed five years ago.

The investment landscape increasingly favors technologies demonstrating clear operational benefits beyond NOM removal. Solutions that simultaneously address multiple water quality parameters while reducing energy consumption attract premium valuations, often commanding multiples 2-3 times higher than single-purpose alternatives.

Recent pilot programs indicate that integrated treatment approaches, combining multiple technologies in series, deliver the most compelling results. These systems show particular promise in addressing emerging contaminants alongside NOM, presenting an attractive value proposition for utilities facing complex treatment challenges.

Private equity firms have taken notice, investing strategically in water technology innovations. Their involvement has accelerated commercialization timelines and improved market penetration rates for promising technologies. This trend suggests a maturing market ready for substantial growth and technological advancement.

Future-Proofing Water Investments

Strategic investment in water infrastructure demands a thorough understanding of Natural Organic Matter (NOM) challenges and their long-term implications. Successful future-proofing requires investors to look beyond conventional metrics and incorporate NOM-specific considerations into their decision-making frameworks.

A comprehensive NOM risk assessment starts with characterizing source water variability and projecting future changes in NOM concentrations and composition. Climate change impacts, land use modifications, and watershed management practices significantly influence these parameters. Investors must evaluate how potential shifts in NOM levels could affect treatment efficiency and operational costs over facility lifespans spanning several decades.

To build resilience against increasing NOM challenges, facility designs should incorporate modular and adaptable treatment trains. This flexibility allows for technology upgrades and capacity expansions without major infrastructure overhauls. Membrane-based systems, advanced oxidation processes, and biological treatment options offer varying degrees of NOM removal capability that can be optimized as conditions evolve.

Financial modeling for NOM-resilient facilities must account for both capital expenditure and lifecycle operational costs. Energy consumption, chemical usage, and maintenance requirements typically increase with rising NOM levels. Smart investments in monitoring systems and process automation can help optimize treatment parameters and reduce long-term operating expenses. As explored in how to leverage water risk assessment to unlock business opportunities, proper risk evaluation creates opportunities for strategic advantage.

Stakeholder engagement represents another crucial aspect of future-proofing investments. Treatment facilities must maintain compliance with evolving regulations while meeting customer expectations for water quality and cost. Building strong relationships with regulators, watershed managers, and community groups helps anticipate and address emerging NOM-related challenges.

Successful future-proofing also requires ongoing research and development investments. Pilot testing of innovative technologies, participation in industry research initiatives, and partnerships with academic institutions can provide early insights into promising NOM treatment solutions. This proactive approach helps facilities stay ahead of treatment challenges while managing adoption risks.

By taking a comprehensive view of NOM considerations in investment planning, water treatment facilities can build resilience against future challenges while maintaining operational efficiency and regulatory compliance. The key lies in combining technical expertise, financial prudence, and stakeholder collaboration to create adaptable infrastructure that delivers long-term value.

Final words

NOM’s strategic positioning in the water technology investment landscape represents more than just financial opportunity – it embodies a vision for sustainable water management that bridges current challenges with future innovations. Their $177.5 million fund serves as a catalyst for transformative solutions, while their methodical approach to both leading and following investments ensures balanced portfolio growth. As water challenges continue to evolve globally, NOM’s focus on decentralized solutions and smart technologies positions them uniquely to drive meaningful change while delivering compelling returns. For entrepreneurs and co-investors alike, NOM offers not just capital, but a partner in shaping the future of water technology. Their commitment to measuring both financial and environmental impact sets a new standard for investment success in the water sector.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!