From its headquarters in Norway, Momentum Partners has emerged as a pivotal force in water technology investment, wielding a fresh NOK 400 million fund launched in January 2025. The firm’s laser focus on sustainable water solutions, coupled with ticket sizes between $1-5M, positions it perfectly to catalyze innovation at the critical seed and Series A stages. With a particular emphasis on alternative water treatment, industrial efficiency, and climate impact, Momentum Partners isn’t just funding water tech – they’re actively shaping the future of how we manage, treat, and reuse our most precious resource.

Momentum Partners is part of my Ultimate Water Investor Database, check it out!

Investor Name: Momentum Partners

Investor Type: VC

Latest Fund Size: $44 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Alternative water treatment chemicals, Water reuse technologies, Industrial water efficiency

Investment History: $1908333.33 spent over 2 deals

Often Invests Along: Construct Venture, OBOS Oppstart

Already Invested In: 7Analytics

Leads or Follows: Lead

Board Seat Appetite:

Key People:

Strategic Investment Focus: Where Water Meets Innovation

Momentum Partners has established a distinctive approach to water technology investments, deploying capital strategically across the Nordic region’s most promising water innovations. With their NOK 400M fund, they target companies at the critical scale-up phase, typically investing between NOK 15-40M per portfolio company to accelerate growth and market penetration.

The fund’s investment thesis centers on three primary themes that address urgent water challenges. First, they focus on advanced water treatment technologies that reduce energy consumption and chemical usage while improving efficiency. Second, they prioritize digital solutions that enhance water infrastructure monitoring and management. Third, they seek innovations in resource recovery and circular water economy applications.

What sets Momentum Partners apart is their hands-on approach to portfolio support. Beyond capital injection, they provide operational expertise and access to their extensive network of water industry veterans. This strategy has proven particularly effective in helping portfolio companies navigate the complex regulatory landscape and accelerate commercial adoption.

Their stage focus deliberately targets companies that have already validated their technology through pilot projects and early commercial installations. This approach, while reducing technical risk, allows Momentum to concentrate on scaling proven solutions rather than early-stage technology development. As highlighted in how to take mid-market green tech companies to the next level, this strategic positioning in the growth phase has shown to be particularly effective in the water sector.

The fund maintains a disciplined investment approach, requiring portfolio companies to demonstrate clear paths to profitability and strategic advantages in their target markets. They particularly value innovations that can be deployed across multiple industrial sectors, creating broader market opportunities and reducing dependency on single customer segments.

In evaluating potential investments, Momentum Partners applies rigorous criteria focusing on three key aspects: technology differentiation, market potential, and team capability. They seek solutions that demonstrate substantial improvements over existing technologies, address markets with clear growth potential, and are led by teams with both technical expertise and commercial acumen.

This focused investment strategy reflects Momentum Partners’ deep understanding of the water sector’s specific challenges and opportunities. Their approach acknowledges that water technology commercialization requires patient capital combined with sector-specific expertise and strong industry networks.

Portfolio Deep Dive: Transforming Water Treatment

Momentum Partners’ water treatment portfolio reflects a strategic focus on technologies that challenge conventional chemical-intensive approaches. The fund actively seeks solutions that can reduce environmental impact while maintaining or improving treatment efficacy across industrial applications.

A key investment theme centers on alternative treatment methods that minimize chemical usage through advanced oxidation processes, electrochemical systems, and novel biological approaches. These technologies leverage natural processes and innovative catalysts to break down contaminants, representing a significant shift from traditional chemical treatment paradigms.

In the industrial sector, Momentum Partners has identified opportunities in solutions that address complex wastewater streams from manufacturing, mining, and energy production. Their portfolio companies develop technologies that can handle high-strength industrial effluents while recovering valuable resources and reducing disposal costs. This dual focus on treatment effectiveness and resource recovery aligns with the growing imperative for circular economy solutions in water management.

Sustainability drives investment decisions across the portfolio. The fund prioritizes technologies that demonstrate meaningful reductions in energy consumption, chemical usage, and waste generation compared to conventional alternatives. This approach addresses both environmental concerns and operational cost challenges faced by industrial water users.

Momentum’s technical due diligence process carefully evaluates scalability and real-world performance. Portfolio companies must demonstrate their solutions work reliably in industrial settings, not just laboratory conditions. This emphasis on practical application helps bridge the critical gap between promising technology and commercial success.

The fund’s approach to water treatment technology reflects a deep understanding of industry pain points and regulatory trends. Their portfolio companies develop solutions that help industrial customers meet increasingly stringent discharge requirements while improving operational efficiency. This alignment of environmental and economic benefits has proven crucial for driving adoption of new treatment technologies.

Beyond individual technologies, Momentum Partners seeks opportunities to create synergies across their portfolio. Their investments often complement each other, enabling comprehensive treatment solutions that combine multiple innovative approaches. This strategic portfolio construction helps accelerate the transformation of industrial water treatment practices.

As explored in how-to-treat-wastewater-in-a-net-grid-positive-way-while-mimicking-your-body, many of these emerging treatment technologies draw inspiration from natural processes, offering more sustainable approaches to water purification. This biomimetic angle represents an important innovation pathway within Momentum’s investment thesis.

Beyond Capital: Momentum’s Value-Add Strategy

Momentum Partners has cultivated a distinctive approach to portfolio support that extends far beyond traditional capital investment. The firm’s hands-on methodology centers on active board participation and deep operational engagement with their water technology companies.

At the board level, Momentum’s partners leverage decades of sector expertise to help shape strategic direction and accelerate growth. Rather than taking a passive monitoring role, they actively participate in key decisions around market entry, technology development, and partnership opportunities. This engagement allows portfolio companies to tap into Momentum’s extensive network across the Nordic water sector and beyond.

The firm’s operational support focuses on addressing critical growth challenges through practical assistance. Their team works directly with company leadership to optimize organizational structures, enhance commercial strategies, and streamline operational processes. This can include everything from refining go-to-market approaches to implementing more efficient financial controls.

A cornerstone of Momentum’s value-add strategy is their emphasis on sustainable scaling. Drawing from their experience in growing water technology ventures, the team helps companies build robust foundations for expansion while maintaining focus on environmental impact. This includes guidance on sustainable manufacturing practices, supply chain optimization, and responsible resource management.

The firm has also developed specialized expertise in helping portfolio companies navigate the complex regulatory landscape of water technology. Their deep understanding of regional and international water quality standards, environmental regulations, and certification requirements proves invaluable as companies scale across markets.

Momentum’s collaborative approach extends to facilitating connections between portfolio companies, fostering knowledge sharing and potential synergies. This internal ecosystem creates opportunities for joint development projects, shared learning, and market cooperation that individual companies might not achieve independently.

By taking this comprehensive support stance, Momentum Partners helps accelerate the commercialization of innovative water technologies while ensuring their portfolio companies develop sustainable business models. Their value-add strategy reflects a recognition that in the specialized water technology sector, financial capital alone is insufficient for success – deep sector expertise and hands-on operational support are equally critical.

Future Horizons: Climate Impact and Water Innovation

Momentum Partners’ forward-looking vision centers on transforming water technology into a powerful force for climate action. The fund recognizes that water and energy systems are inextricably linked, with water treatment and distribution accounting for roughly 4% of global electricity consumption. This presents both a challenge and an opportunity for meaningful impact.

The fund’s investment thesis prioritizes technologies that can dramatically reduce the energy intensity of water operations while improving treatment effectiveness. Advanced membrane technologies, energy-neutral treatment processes, and smart control systems represent key areas of focus. These innovations could potentially slash the sector’s energy consumption by 25-40% while maintaining or enhancing water quality standards.

Beyond energy considerations, Momentum Partners sees tremendous potential in water technologies that directly address climate resilience. As extreme weather events become more frequent, solutions for flood management, drought mitigation, and water reuse grow increasingly critical. The fund is particularly interested in artificial intelligence and predictive analytics that can help utilities adapt their operations to changing climate patterns.

Momentum’s investment strategy also acknowledges the growing intersection between water technology and renewable energy. Innovations in areas like floating solar installations on treatment facilities and biogas generation from wastewater sludge demonstrate how water infrastructure can become a net producer of clean energy rather than just a consumer.

Particularly promising is the emerging field of resource recovery, where wastewater treatment plants are reimagined as bio-refineries that extract valuable materials while cleaning water. This approach transforms traditional cost centers into revenue-generating facilities while reducing environmental impact. The fund is actively exploring technologies that can recover nutrients, rare earth elements, and even hydrogen from water streams.

Looking ahead, Momentum Partners anticipates that water technology innovation will increasingly focus on distributed systems that bring treatment closer to the point of use or discharge. This shift could dramatically reduce the energy required for water transport while improving system resilience. The fund sees particular promise in modular, containerized treatment solutions that can be rapidly deployed where needed.

By maintaining this forward-looking perspective while remaining grounded in practical solutions, Momentum Partners aims to accelerate the adoption of technologies that deliver both environmental and economic returns. Their approach recognizes that the most successful climate solutions will be those that create compelling business cases while driving positive environmental impact.

The Technical DNA Behind Investment Decisions

At the core of Momentum Partners’ investment strategy lies a deeply technical approach that sets it apart in the Nordic water technology landscape. The fund’s investment team combines decades of hands-on engineering experience with a granular understanding of water treatment processes, enabling them to evaluate potential investments through a uniquely technical lens.

Unlike traditional venture capital firms that prioritize market size and financial metrics, Momentum Partners begins its due diligence by diving deep into the fundamental science and engineering principles behind each technology. The team meticulously analyzes aspects like mass transfer efficiency, energy consumption profiles, and process control architectures to validate technical claims and identify potential scaling challenges early in the evaluation process.

This technical-first approach allows Momentum to spot promising innovations that other investors might overlook. For instance, when evaluating membrane technologies, the team examines not just performance data but also conducts detailed analyses of membrane chemistry, module design, and fouling mechanisms. This level of technical scrutiny has helped them identify breakthrough technologies that solve critical industry pain points while avoiding solutions that may face fundamental physical limitations when scaled.

The fund has developed a proprietary technical assessment framework that examines over 50 parameters across categories like process robustness, operational complexity, and resource efficiency. This systematic approach helps quantify both technical risks and opportunities while ensuring investment decisions are grounded in engineering reality rather than market hype.

Momentum Partners’ technical DNA also shapes how they structure deals and support portfolio companies. Understanding the technical challenges of scaling water technologies allows them to set realistic milestones and provide hands-on engineering support during critical development phases. This approach has proven particularly valuable for early-stage companies transitioning from laboratory success to full-scale implementation.

The team’s technical expertise extends beyond traditional water treatment into emerging areas like digital water, resource recovery, and climate resilience solutions. This broad technical foundation enables them to evaluate convergence opportunities where water technology intersects with other sectors like renewable energy, agriculture, and circular economy solutions.

As evidenced in their approach to water tech venture capital investing, Momentum Partners demonstrates that deep technical knowledge isn’t just an advantage – it’s essential for identifying truly transformative water technologies and supporting their path to market success. This technical-first investment philosophy has become a key differentiator in their ability to build a portfolio of innovations that can meaningfully impact the water sector’s most pressing challenges.

Beyond Capital: The Entrepreneurial Support System

Momentum Partners has architected a comprehensive support ecosystem that transforms promising water technology ventures into market-ready solutions. Building on their technical due diligence capabilities, the firm deploys a multi-faceted approach that addresses the unique challenges water entrepreneurs face.

At the core of their support system is a dedicated team of industry veterans who serve as active advisors. These experts work closely with portfolio companies to refine business models, optimize go-to-market strategies, and navigate complex regulatory frameworks. Rather than taking a passive investment approach, Momentum Partners embeds these seasoned professionals directly within their portfolio companies at critical growth stages.

The firm has also cultivated an extensive network of pilot and demonstration sites across the Nordic region. This network allows entrepreneurs to validate their technologies in real-world conditions while building crucial reference cases. Through strategic partnerships with utilities, industrial facilities, and research institutions, portfolio companies can access diverse testing environments that accelerate their path to commercial deployment.

Perhaps most valuable is Momentum’s structured approach to facilitating connections and collaborations. The firm regularly organizes targeted matchmaking events that bring together entrepreneurs, potential customers, and strategic partners. These carefully curated interactions have proven instrumental in helping portfolio companies secure initial contracts and expand into new markets.

Knowledge sharing is another cornerstone of their support system. Momentum Partners maintains a proprietary knowledge base of best practices, market intelligence, and regulatory insights that all portfolio companies can access. Regular workshops and peer learning sessions enable entrepreneurs to learn from each other’s experiences while avoiding common pitfalls in technology commercialization.

Critically, the firm provides hands-on support in areas where water startups typically struggle, such as intellectual property protection, certification processes, and scaling manufacturing operations. Their in-house expertise in these domains helps portfolio companies navigate complex technical and operational challenges while maintaining focus on core innovation activities.

As detailed in How to Frustrate 90% of Start-up Founders in 15 Minutes in Their Best Interest, this comprehensive support system creates the foundation needed for sustainable growth while maintaining rigorous standards. The result is an ecosystem that not only provides capital but actively shapes the success trajectory of water technology ventures.

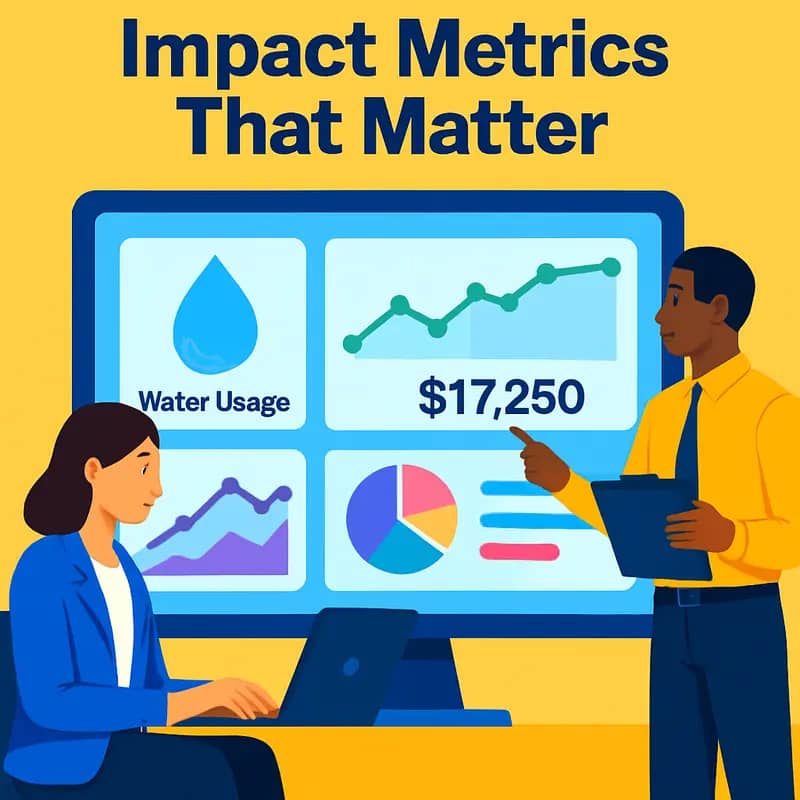

Impact Metrics That Matter

At Momentum Partners, measuring success goes far beyond traditional financial returns. The fund has developed a sophisticated dual-tracking system that quantifies both economic performance and tangible water impact across its portfolio.

The fund’s impact measurement framework centers on four key water metrics: cubic meters of water saved, cubic meters of wastewater treated, tons of water-related CO2 emissions avoided, and number of people gaining improved water access. Portfolio companies must report these metrics quarterly, with independent verification of claims.

A particularly innovative aspect of Momentum’s approach is their weighted scoring system that accounts for both the magnitude and persistence of water impacts. For example, a one-time water savings receives a lower multiplier compared to recurring annual savings. This nuanced methodology helps identify investments that deliver lasting positive change.

On the financial side, Momentum maintains rigorous tracking of conventional metrics like IRR, MOIC, and cash-on-cash returns. However, they’ve also pioneered novel indicators that bridge financial and impact performance. Their ‘Impact-Adjusted Return’ metric, for instance, quantifies how water-positive outcomes enhance company valuations and reduce operational risks.

Momentum’s reporting goes beyond static numbers to examine causality and attribution. Portfolio companies must demonstrate clear linkages between their solutions and measured impacts. This evidence-based approach has helped the fund identify which business models and technologies most effectively drive both financial returns and water sustainability.

Critically, Momentum makes its impact measurement methodology open-source, encouraging standardization across the water technology investment landscape. Their framework has been adopted by several other Nordic funds, creating valuable benchmarking opportunities.

As detailed in a recent case study exploring water impact investment strategies, Momentum’s dual-return approach has yielded compelling results. Their portfolio companies average 42% water use reduction in customer operations while delivering market-rate financial returns.

The fund’s commitment to rigorous impact measurement has attracted mission-aligned investors and helped portfolio companies secure follow-on funding. More importantly, it provides actionable intelligence to optimize both commercial success and water stewardship across the portfolio.

The Future of Water Investment

Momentum Partners envisions a radical transformation of water infrastructure through strategic deployment of breakthrough technologies and innovative financing models. The fund’s forward-looking strategy centers on three key pillars that will shape water investment over the next decade.

First, Momentum Partners recognizes that decentralized water systems will play an increasingly vital role. Rather than relying solely on massive centralized infrastructure, the fund is targeting solutions that enable local water treatment, reuse, and management. This distributed approach improves resilience while reducing energy consumption and transmission losses.

The second pillar focuses on data-driven optimization. By investing in advanced sensors, artificial intelligence, and predictive analytics, Momentum Partners aims to transform how water infrastructure is monitored and controlled. Real-time insights will enable proactive maintenance, reduced operating costs, and more efficient resource allocation across networks.

The third strategic element involves catalyzing public-private partnerships through innovative financial structures. Momentum Partners is pioneering blended finance approaches that de-risk water infrastructure projects and attract institutional capital. This includes performance-based funding models where returns are tied to measurable improvements in water efficiency, quality, and accessibility.

Critically, Momentum Partners sees these pillars as mutually reinforcing. Decentralized systems generate rich operational data that enables optimization. Better data drives more accurate project evaluation and unlocks new financing options. And increased private investment accelerates the adoption of decentralized solutions.

The fund’s vision extends beyond individual technology investments to reshaping how water infrastructure projects are conceived, funded and delivered. By proving the commercial viability of sustainable water solutions, Momentum Partners aims to establish new market mechanisms that properly value water resources and incentivize conservation.

Looking ahead, Momentum Partners anticipates that climate change impacts will make water infrastructure investment an increasingly urgent priority across the Nordics and globally. The fund is positioning itself to demonstrate how private capital can drive innovation while delivering both strong financial returns and measurable environmental benefits.

As explored in this analysis of water technology investment requirements, success will require a deep understanding of local water challenges combined with the ability to identify and scale breakthrough solutions. Momentum Partners’ approach offers a compelling model for mobilizing private capital to address one of society’s most fundamental challenges.

Final words

Momentum Partners stands at the forefront of water technology investment in the Nordic region, wielding both significant capital and deep sector expertise. Their NOK 400 million fund, launched in 2025, represents more than just financial firepower – it embodies a comprehensive vision for advancing sustainable water solutions. Through strategic investments ranging from $1-5M, the firm has positioned itself as a crucial enabler of innovation at the seed and Series A stages, precisely where many promising water technologies need support to scale. Their focus on alternative water treatment, industrial efficiency, and climate impact demonstrates a nuanced understanding of both market needs and environmental imperatives. As water challenges continue to grow globally, Momentum’s approach of combining capital with hands-on operational support creates a powerful model for accelerating the adoption of crucial water technologies. For entrepreneurs and co-investors alike, Momentum Partners represents not just a source of capital, but a partner in building a more sustainable water future.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!