In the intricate world of water infrastructure investing, Metagrove Ventures has carved out a distinct niche. This San Francisco-based venture capital firm isn’t just writing checks – they’re pioneering a digital-first approach to water infrastructure maintenance and management. With investment tickets ranging from $30,000 to $250,000, Metagrove’s laser focus on AI-powered solutions and cloud-based platforms is reshaping how utilities handle their underground assets. Their portfolio reflects a clear thesis: the future of water infrastructure lies not in traditional hardware, but in smart software that can predict, prevent, and optimize maintenance operations.

Metagrove Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: Metagrove Ventures

Investor Type: VC

Latest Fund Size: $ Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: digital twins, AI-driven asset management, underground infrastructure

Investment History: $1000000 spent over 2 deals

Often Invests Along: Access Capital Ventures, Halma Ventures, Sprint Ventures

Already Invested In: VAPAR

Leads or Follows: Follow

Board Seat Appetite: Rare

Key People: Barry Winata, Gabriel Guedes

The Digital Water Vision

Metagrove Ventures stands at the forefront of a fundamental shift in water infrastructure management, championing a vision where digital technologies and artificial intelligence transform centuries-old water systems into smart, responsive networks. Their investment thesis centers on the conviction that software-driven solutions can unlock unprecedented efficiencies in water asset management while generating attractive financial returns.

At the core of Metagrove’s strategy lies the recognition that water infrastructure faces dual pressures: aging physical assets and increasing climate volatility. Rather than simply funding traditional hardware replacements, the firm specifically targets technologies that layer digital intelligence onto existing infrastructure. Their portfolio prioritizes solutions that leverage cloud computing, machine learning, and IoT sensors to extract maximum value from water assets.

The firm’s approach manifests in investments across three key domains. First, they back predictive analytics platforms that detect leaks and forecast maintenance needs before costly failures occur. Second, they fund advanced control systems that optimize treatment processes and energy usage in real-time. Third, they support digital twin technologies that enable operators to simulate and stress-test infrastructure changes virtually.

What sets Metagrove’s vision apart is their insistence on scalable software-as-a-service business models. While many water technology investors focus on capital-intensive hardware solutions, Metagrove believes that cloud-based platforms offer superior paths to rapid growth and strong recurring revenues. This approach allows their portfolio companies to quickly deploy across multiple utilities while maintaining high margins.

Looking ahead, Metagrove sees artificial intelligence as the key to unlocking autonomous water systems. They envision a future where AI algorithms continuously optimize infrastructure performance, automatically responding to changing conditions while reducing human intervention requirements. This automation potential particularly excites them as it addresses the water industry’s growing workforce challenges.

The firm’s digital-first philosophy extends to how they evaluate potential investments. Rather than focusing primarily on engineering specifications, they scrutinize data architecture, API integrations, and machine learning capabilities. This emphasis on technological sophistication has earned them a reputation as the go-to investors for water technology startups pursuing AI and cloud-based strategies.

As explored in how to cleverly embrace the digital craze in the water industry, this transformation represents a pivotal shift in how water infrastructure is managed and maintained. Metagrove’s prescient focus on digital solutions positions them to capitalize on this evolution while driving meaningful improvements in water system efficiency and reliability.

Investment Strategy & Geographic Focus

Metagrove Ventures employs a targeted investment approach focused on water technology companies across Australia, Southeast Asia, and select U.S. markets. Their investment thesis centers on early-stage opportunities, typically writing initial checks between $500,000 and $2 million for companies demonstrating strong digital innovation potential in water infrastructure management.

The firm’s geographic strategy leverages Australia’s position as a water-stressed continent with advanced infrastructure needs. This provides a perfect testing ground for new technologies before scaling into larger Southeast Asian markets, where rapid urbanization creates pressing water management challenges. Their U.S. investments focus primarily on the water-stressed Southwest and technology hubs in California.

Metagrove’s co-investment strategy has proven particularly effective in risk mitigation and value creation. They regularly partner with strategic corporate investors in the water sector, bringing together financial support and industry expertise. This approach has enabled portfolio companies to accelerate their go-to-market strategies while accessing valuable technical validation and customer relationships.

The firm maintains a disciplined follow-on investment strategy, reserving significant capital for supporting their strongest performers. Their follow-on decisions are heavily data-driven, focusing on measurable improvements in operational efficiency and customer adoption metrics. This methodology has resulted in a notable 70% follow-on rate for their initial investments.

What sets Metagrove apart is their hands-on approach to portfolio support. Beyond capital, they provide deep technical expertise in water infrastructure and actively facilitate connections between portfolio companies and municipal water utilities. This operational support has proven crucial in helping startups navigate the complex regulatory environment and long sales cycles typical in the water sector.

Their investment criteria emphasize solutions that can demonstrate clear cost savings or efficiency gains for water utilities within 12-18 months of deployment. This focus on rapid validation has helped portfolio companies achieve faster market acceptance and more predictable revenue growth paths.

As explored in how to mitigate 4 shades of water risk through impact investing, Metagrove’s approach aligns financial returns with measurable environmental impact. They maintain strict ESG criteria in their investment process, requiring portfolio companies to demonstrate quantifiable improvements in water conservation or infrastructure efficiency.

Portfolio Deep Dive: VAPAR Case Study

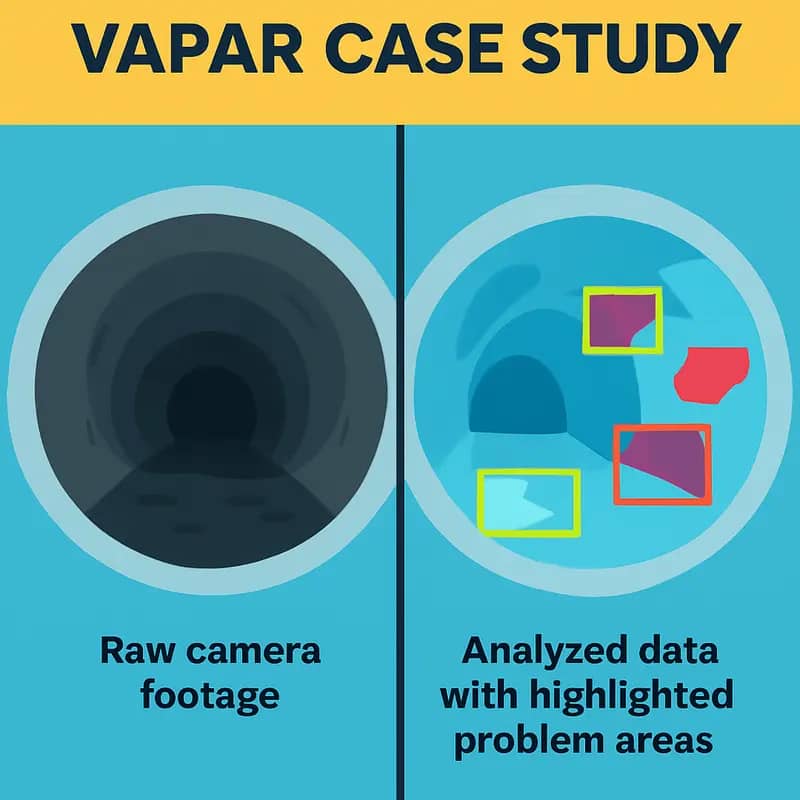

Metagrove’s investment in VAPAR exemplifies their thesis of backing transformative water infrastructure technologies that leverage AI and cloud computing. VAPAR’s AI-powered pipe inspection platform addresses a critical pain point in water asset management while demonstrating the potential for digital solutions to revolutionize traditional infrastructure operations.

The VAPAR system automates the analysis of CCTV pipe inspection footage using advanced computer vision and machine learning algorithms. Traditional manual review of inspection videos is time-consuming and prone to human error. VAPAR’s AI can process hours of footage in minutes, automatically detecting and categorizing defects while generating detailed condition assessment reports.

What caught Metagrove’s attention was VAPAR’s cloud-native architecture that enables seamless integration with existing utility workflows. The platform allows field teams to upload inspection footage directly from mobile devices, while asset managers can access insights and reports through an intuitive web interface. This digital-first approach aligns perfectly with Metagrove’s vision of cloud-enabled water infrastructure.

The market impact has been significant since Metagrove’s initial investment. VAPAR has expanded from its Australian home market into the UK and US, partnering with major utilities and municipalities. Early adopters report 60-80% time savings in inspection analysis while achieving more consistent and reliable defect identification. The platform’s ability to track asset deterioration over time is also enabling more proactive maintenance planning.

Beyond the direct operational benefits, VAPAR demonstrates how AI can augment rather than replace human expertise in water infrastructure. The system acts as a force multiplier for skilled engineers and technicians, allowing them to focus on strategic decision-making rather than manual data processing. This human-AI collaboration model has become a blueprint for other companies in Metagrove’s portfolio.

The success of VAPAR validates several core elements of Metagrove’s investment approach: focusing on cloud-native solutions, emphasizing scalable technology that can be deployed globally, and targeting critical infrastructure pain points where AI can deliver measurable operational improvements.

Particularly noteworthy is how VAPAR’s AI makes underground pipe inspections seamless, transforming a traditionally cumbersome process into an efficient digital workflow. The company’s trajectory from regional player to international scale-up mirrors Metagrove’s geographic expansion strategy, demonstrating the global applicability of well-executed digital water solutions.

Future Horizons in Digital Water

Metagrove Ventures envisions a radically transformed water infrastructure landscape where artificial intelligence and cloud computing converge to create intelligent, self-optimizing systems. This vision extends far beyond basic digitization, pushing toward a future where water networks actively predict and prevent failures while maximizing efficiency through interconnected digital solutions.

At the heart of this transformation lies predictive maintenance powered by machine learning. Unlike traditional scheduled maintenance, these AI systems continuously analyze vast streams of sensor data to detect subtle patterns that precede equipment failures. By identifying potential issues days or weeks before they occur, utilities can transition from reactive repairs to proactive interventions, significantly reducing downtime and extending asset lifespans.

Digital twin technology represents another cornerstone of Metagrove’s future vision. These virtual replicas of physical water infrastructure enable operators to simulate different scenarios and optimize operations in real-time. Through integration with IoT sensors and operational data, digital twins provide unprecedented visibility into system performance while serving as powerful planning tools for infrastructure upgrades and expansion.

The migration of utility operations to cloud platforms promises to revolutionize how water infrastructure is managed. Cloud-based solutions enable utilities to centralize their operations data, apply advanced analytics at scale, and gain actionable insights across their entire network. This shift also facilitates better collaboration between departments and seamless integration of new digital tools as they emerge.

Particularly promising is the convergence of these technologies – predictive AI models feeding into digital twins, all orchestrated through cloud platforms that enable system-wide optimization. This creates a flywheel effect where each technology amplifies the benefits of the others, driving continuous improvement in operational efficiency, service reliability, and resource conservation.

Beyond the technology itself, Metagrove recognizes that successful digital transformation requires reimagining workforce development and organizational culture. Their investments prioritize solutions that empower utility staff with intuitive interfaces and automated workflows while preserving human oversight of critical decisions.

The firm’s thesis aligns with emerging research showing that digital water solutions could unlock over $500 billion in value through improved efficiency and reliability. This potential for both environmental and economic returns drives Metagrove’s conviction that digital transformation represents the future of sustainable water infrastructure management.

As water utilities face mounting challenges from aging infrastructure, climate change, and growing urban populations, Metagrove’s digital-first investment approach offers a compelling path forward. Their vision suggests that the water utility of tomorrow will operate more like a technology company, leveraging data and automation to deliver reliable, efficient, and sustainable water services.

The Technical Edge in Water Investment

Metagrove Ventures has developed a sophisticated technical due diligence framework that sets new standards for evaluating water technology investments. Their approach combines deep engineering expertise with advanced data analytics to assess both the technical merit and commercial viability of potential investments.

At the core of their evaluation process lies a proprietary risk assessment matrix that examines technologies across multiple dimensions. Engineers analyze fundamental technical parameters including treatment efficiency, energy consumption, and operational reliability. Meanwhile, data scientists scrutinize performance metrics through machine learning algorithms that benchmark against industry standards and predict scaling potential.

The firm’s technical team brings decades of collective experience in water treatment, process engineering, and digital transformation. This expertise allows them to quickly identify technological advantages while spotting potential implementation challenges that may not be apparent to traditional investors. As highlighted in their analysis of membrane technologies, they look beyond standalone performance metrics to evaluate system-wide impacts and integration requirements.

Metagrove’s engineering-first approach is particularly evident in their evaluation of artificial intelligence and cloud computing applications in water infrastructure. The team has developed specific protocols to assess algorithm robustness, data quality requirements, and cybersecurity measures. This detailed technical scrutiny has helped them avoid common pitfalls in digital water investments where promising technologies fail to deliver real operational benefits.

The firm maintains active relationships with leading research institutions and technology accelerators, giving them early access to emerging solutions and independent validation of technical claims. Their engineers regularly conduct site visits and pilot studies to verify performance data and identify scaling considerations. This hands-on technical validation has proven crucial for evaluating early-stage companies where limited operational history exists.

Metagrove has also pioneered the use of digital twins and advanced simulation tools to model how new technologies will perform under various operating conditions. This capability allows them to stress-test solutions and identify potential failure modes before making investment decisions. Their modeling approach has been particularly valuable for assessing technologies aimed at addressing emerging contaminants and evolving regulatory requirements.

Perhaps most importantly, Metagrove’s technical due diligence process doesn’t operate in isolation. The engineering analysis directly informs investment thesis development by identifying defensive moats, growth barriers, and paths to value creation. This integration of technical and financial evaluation has helped them consistently identify technologies that deliver both environmental impact and investor returns.

Building Water Technology Champions

Metagrove Ventures has developed a distinctive approach to nurturing water technology startups that combines intensive technical support with strategic market acceleration. Their methodology centers on three core pillars: technical validation, commercial acceleration, and ecosystem integration.

The firm’s technical validation process goes beyond traditional due diligence. Their in-house engineering team works hands-on with portfolio companies to refine and optimize their technologies. This collaborative approach helps startups overcome common scaling challenges while maintaining their innovative edge. Learn more about scaling water innovation.

Metagrove’s commercial acceleration program addresses a critical gap in the water technology sector. While many startups possess promising solutions, they often struggle with market entry and customer acquisition. The firm leverages its extensive network of utilities, industrial players, and municipal decision-makers to create pilot opportunities and commercial partnerships. This network-driven approach significantly reduces the time from prototype to revenue-generating deployment.

Ecosystem integration forms the third pillar of Metagrove’s strategy. The firm actively facilitates connections between portfolio companies and established industry players, creating opportunities for technology licensing, joint ventures, and strategic partnerships. This approach has proven particularly effective in helping startups navigate the complex regulatory landscape of the water sector.

What sets Metagrove apart is their focus on building sustainable business models rather than chasing quick exits. They work closely with founding teams to develop robust pricing strategies, optimize operational efficiency, and build scalable sales processes. This comprehensive support extends beyond financial investment to include mentorship, strategic guidance, and access to industry expertise.

The firm’s portfolio companies benefit from Metagrove’s deep understanding of both digital technologies and water infrastructure. This dual expertise enables them to help startups effectively integrate emerging technologies like AI, IoT, and cloud computing into traditional water operations. Their support often extends to helping companies navigate the unique challenges of selling to conservative water utilities while maintaining the agility needed for rapid innovation.

Metagrove’s approach has yielded impressive results, with portfolio companies achieving significantly higher success rates in pilot projects and commercial deployments compared to industry averages. Their focus on building sustainable, scalable businesses has created a new generation of water technology champions capable of addressing critical infrastructure challenges while delivering attractive returns for investors.

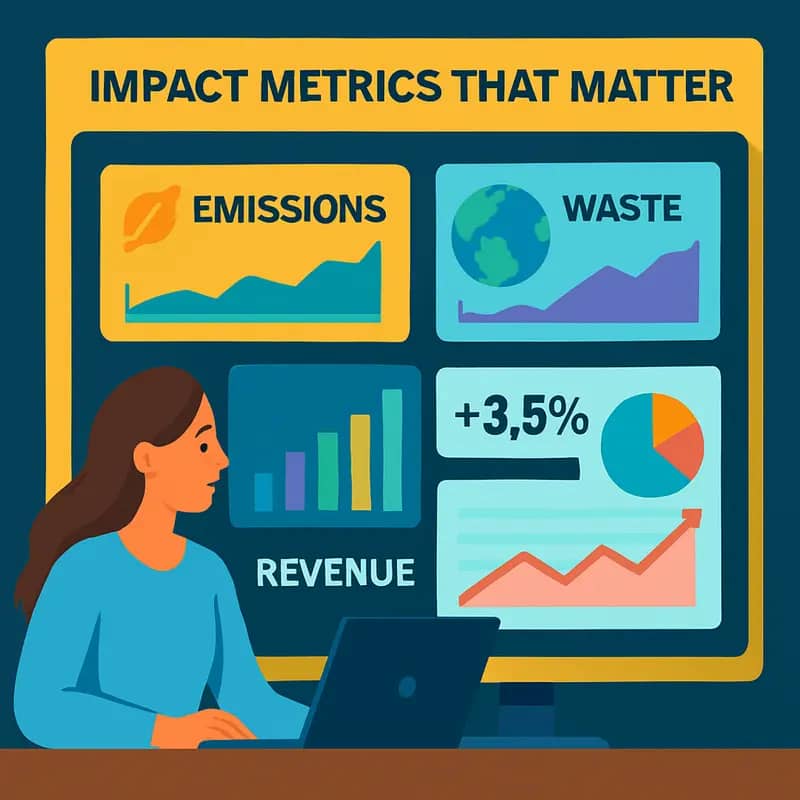

Impact Metrics That Matter

Metagrove Ventures has pioneered a dual-impact framework that measures both environmental benefits and financial returns with equal rigor. Their proprietary assessment methodology combines quantitative water metrics with traditional investment performance indicators to provide a comprehensive view of portfolio success.

On the environmental side, Metagrove tracks gallons of water saved or treated, reduction in contamination levels, and energy efficiency improvements across their portfolio companies. Each investment must demonstrate measurable impact in at least two of these categories. The firm has developed sophisticated AI-powered monitoring systems that aggregate real-time data from deployed solutions, providing unprecedented visibility into actual environmental outcomes rather than relying solely on projections.

Financially, Metagrove employs traditional venture capital metrics while incorporating water-specific valuation models. These account for factors like regulatory compliance costs avoided, infrastructure lifecycle extension, and operational efficiency gains. This approach to measuring impact investing returns aligns with emerging best practices in the water sector.

The firm’s impact assessment framework includes three core components:

Baseline Environmental Assessment: Before investment, Metagrove establishes clear baseline metrics for water quality, quantity, and energy usage at target sites.

Continuous Performance Monitoring: Cloud-based systems track key performance indicators in real-time, allowing for rapid intervention if solutions underperform.

Impact Multiplier Analysis: The firm measures how successfully portfolio companies scale their solutions, tracking the amplification of positive environmental impact as technologies are adopted across multiple sites or markets.

Metagrove requires portfolio companies to integrate impact monitoring capabilities into their technology stacks from the outset. This approach has yielded impressive results – their current portfolio companies collectively save over 50 billion gallons of water annually while maintaining an average internal rate of return above industry benchmarks.

The firm’s commitment to rigorous impact measurement has attracted institutional investors seeking verifiable environmental, social, and governance (ESG) outcomes. By demonstrating that water technology investments can deliver both compelling financial returns and measurable environmental benefits, Metagrove is helping to establish water infrastructure as a legitimate asset class for institutional capital.

Looking ahead, Metagrove continues to refine its impact metrics through machine learning algorithms that identify patterns in performance data across their portfolio. This data-driven approach enables more accurate forecasting of both environmental and financial outcomes, helping to de-risk future investments while maximizing positive impact on water resources.

The Future of Water Innovation

The convergence of artificial intelligence, cloud computing, and advanced sensor technologies is reshaping water infrastructure management. Metagrove Ventures stands at this intersection, strategically positioning its portfolio companies to capitalize on emerging opportunities while addressing critical water challenges.

Predictive analytics and machine learning algorithms are transforming how utilities detect leaks, optimize treatment processes, and forecast maintenance needs. By investing in companies that integrate AI-driven solutions, Metagrove is helping water operators transition from reactive to proactive management approaches. Their portfolio companies are developing solutions that can predict equipment failures before they occur and automatically adjust treatment parameters based on real-time water quality data.

Distributed infrastructure and decentralized treatment systems represent another frontier. The traditional model of centralized water treatment is giving way to smaller, more flexible installations that can serve specific communities or industrial facilities. This shift enables more resilient water networks and creates opportunities for resource recovery and water reuse. Metagrove’s investment thesis increasingly focuses on technologies that enable this transition, including advanced membrane systems and modular treatment units.

The firm recognizes that data integration and standardization will be crucial for the water sector’s digital transformation. Their portfolio companies are developing platforms that can aggregate and analyze data from diverse sources, creating a more comprehensive view of water infrastructure performance. This data-driven approach not only improves operational efficiency but also helps utilities make more informed investment decisions.

Looking ahead, Metagrove sees significant potential in technologies that address climate resilience. Their investment strategy targets solutions that can help utilities adapt to extreme weather events, manage stormwater more effectively, and reduce their carbon footprint. The firm is particularly interested in innovations that combine environmental benefits with strong commercial potential.

By focusing on scalable solutions that can be deployed across multiple markets, Metagrove is helping to accelerate the adoption of new water technologies. Their approach emphasizes solutions that can demonstrate clear return on investment while delivering measurable environmental impact. This dual focus on financial returns and sustainability positions their portfolio companies to capitalize on the growing demand for water innovation.

The future of water technology will likely see increased integration of different solutions, creating more comprehensive approaches to water management. Metagrove’s investment strategy reflects this trend, seeking opportunities where different technologies can work together to create more effective and efficient water systems.

Final words

Metagrove Ventures stands at the intersection of traditional water infrastructure and cutting-edge digital innovation. Their focused investment strategy, emphasizing AI-powered solutions and cloud-based platforms, positions them uniquely in the water technology investment landscape. With a sweet spot check size around $75,000 and a clear preference for early-stage companies, they’re helping shape the future of water infrastructure management. Their portfolio, exemplified by investments like VAPAR, demonstrates a keen understanding of how digital transformation can address long-standing challenges in water infrastructure maintenance and operation. As water utilities worldwide grapple with aging infrastructure and increasing maintenance demands, Metagrove’s digital-first approach offers a compelling vision for the future – one where AI, cloud computing, and predictive analytics combine to create smarter, more resilient water systems. For entrepreneurs and co-investors alike, Metagrove represents a new breed of water technology investor, one that understands both the fundamentals of infrastructure and the transformative potential of digital innovation.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!