Deep in the heart of Ludwigsburg, Germany, MANN+HUMMEL Corporate Ventures is quietly revolutionizing the water technology landscape. As the venture arm of the €4.7 billion filtration giant, this strategic investor combines deep industrial expertise with venture capital acumen to back the next generation of water technology innovators. With typical investments ranging from $5-10 million in early to growth-stage companies, they’re not just writing checks – they’re building bridges between corporate knowledge and startup agility. Their laser focus on advanced filtration, digital water solutions, and sustainability is reshaping how we think about water technology commercialization.

MANN+HUMMEL Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: MANN+HUMMEL Corporate Ventures

Investor Type: CVC

Latest Fund Size: $ Million

Dry Powder Available: No

Typical Ticket Size: $3M – $10M

Investment Themes: Filtration, digital water management, industrial water treatment

Investment History: $8006769.9 spent over 3 deals

Often Invests Along: Burnt Island Ventures, R-Cubed Capital Partners

Already Invested In: ZwitterCo, Inc.

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People:

The Strategic Playbook: Investment Themes and Focus Areas

MANN+HUMMEL Ventures charts a focused investment strategy targeting transformative water technologies across three core pillars: advanced filtration, digital solutions, and sustainability innovations. This strategic focus amplifies the parent company’s century-long filtration expertise while pushing into emerging opportunities across the water sector.

In the filtration domain, the venture arm prioritizes breakthrough membrane technologies and novel separation methods that promise step-change improvements in efficiency and effectiveness. They’ve demonstrated particular interest in solutions addressing challenging contaminants like PFAS and microplastics, recognizing these as critical emerging threats to water quality.

The digital transformation of water systems represents another key investment theme. MANN+HUMMEL Ventures actively seeks startups developing AI-powered analytics, smart sensors, and digital twin technologies that enable predictive maintenance and optimization of water infrastructure. This digital focus reflects their conviction that software and data-driven solutions will reshape how water assets are managed.

Sustainability serves as the third strategic pillar, with particular emphasis on technologies that reduce energy consumption, enable water reuse, and support circular economy principles. The fund shows strong interest in innovations that help industrial clients achieve their environmental targets while delivering compelling economic returns.

What distinguishes MANN+HUMMEL’s investment approach is their deep integration with the parent company’s technical expertise and global market access. Portfolio companies gain more than capital – they can leverage MANN+HUMMEL’s extensive R&D capabilities, manufacturing infrastructure, and worldwide distribution channels to accelerate commercialization.

Their investment thesis emphasizes solutions that can scale globally while maintaining sustainable unit economics. Rather than pursuing moonshot technologies, they focus on pragmatic innovations that solve clear market needs and have demonstrable paths to profitability.

The venture team maintains active collaboration with portfolio companies, often taking board seats and providing hands-on operational support. This high-touch approach helps startups navigate technical validation, regulatory compliance, and market entry challenges unique to the water sector.

As explored in Can private capital change the world of water for the better?, this strategic combination of corporate backing and venture capital dynamics creates a powerful platform for accelerating water innovation. MANN+HUMMEL Ventures’ focused investment themes, coupled with their parent company’s industrial might, positions them to drive meaningful advancement in water technology while generating attractive financial returns.

Deal Structure and Investment Approach

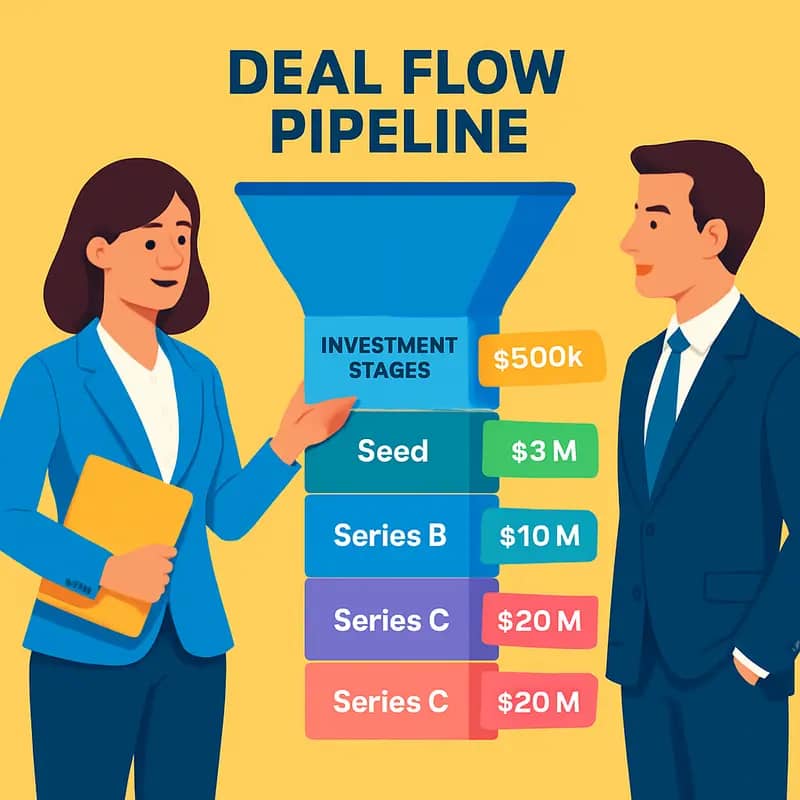

MANN+HUMMEL Ventures operates with a flexible yet strategic approach to water technology investments, deploying capital across multiple stages while maintaining a disciplined focus on value creation. The firm typically writes initial checks ranging from €2-5 million, though it maintains the capacity to participate in larger rounds when opportunities align with their core thesis.

The venture arm demonstrates particular interest in Series A and B rounds, where companies have validated their technology and begun generating initial commercial traction. This stage preference allows MANN+HUMMEL to leverage its industrial expertise and global network while managing technology risk. However, they maintain flexibility to participate in select seed rounds for breakthrough innovations in filtration and water treatment.

Geographically, while MANN+HUMMEL Ventures maintains a global outlook, they concentrate primarily on Europe and North America, with growing attention to innovation hubs in Israel and Singapore. This focus allows them to maintain close operational oversight while accessing diverse technology ecosystems.

Their investment approach typically involves taking minority stakes, usually between 10-25%, though they remain open to larger positions in strategic situations. MANN+HUMMEL Ventures regularly secures board observer rights and occasionally full board seats, particularly in cases where their industrial expertise can significantly accelerate portfolio company development.

A defining characteristic of their investment strategy is their strong commitment to follow-on funding. Rather than spreading capital thinly across many investments, they maintain significant reserves to support portfolio companies through multiple rounds. According to their track record, approximately 60% of their initial investments receive follow-on funding, demonstrating their long-term partnership approach.

Most notably, MANN+HUMMEL Ventures structures deals with clear paths to strategic collaboration, often incorporating commercial agreements or joint development opportunities alongside their financial investment. This hybrid approach, blending financial returns with strategic value creation, has proven particularly attractive to entrepreneurs seeking more than just capital.

Regarding exit horizons, while they maintain patience appropriate for hardware-intensive water technology development cycles, they typically target liquidity events within 5-7 years. Their exit strategy focuses primarily on strategic sales to industrial players, though they remain open to IPO paths for companies achieving significant scale.

Beyond Capital: Strategic Value Addition

MANN+HUMMEL’s venture arm doesn’t just write checks – it deploys a comprehensive support system that transforms promising water technology startups into market leaders. This strategic approach leverages the company’s century-long filtration expertise, global manufacturing capabilities, and extensive industry relationships to accelerate portfolio companies’ growth trajectories.

At the core of this value-addition strategy lies deep technical collaboration. MANN+HUMMEL’s R&D teams work closely with portfolio companies to refine and validate their technologies. This hands-on support helps startups overcome engineering challenges, optimize designs for manufacturability, and meet rigorous quality standards. The company’s state-of-the-art testing facilities and specialized equipment become accessible resources, saving startups significant capital expenditure while accelerating their product development cycles.

The manufacturing muscle that MANN+HUMMEL provides is equally crucial. Portfolio companies gain access to world-class production facilities, established supply chains, and decades of manufacturing expertise. This industrial scaling capability helps startups transition smoothly from prototype to commercial production while maintaining consistent quality. The company’s global manufacturing footprint also enables portfolio companies to rapidly expand their geographic reach.

Perhaps most valuable is MANN+HUMMEL’s extensive network of industry relationships. Portfolio companies can tap into the firm’s established connections with major water utilities, industrial end-users, and regulatory bodies worldwide. This network access helps startups secure pilot projects, obtain necessary certifications, and accelerate commercial adoption of their technologies. The credibility of MANN+HUMMEL’s brand also lends additional legitimacy to portfolio companies when engaging with large customers and partners.

Beyond technical and operational support, MANN+HUMMEL provides strategic guidance through dedicated board representation and regular engagement with portfolio companies. This helps startups navigate complex market dynamics, refine their business models, and make informed decisions about growth opportunities. The company’s deep understanding of water industry trends and customer needs proves invaluable for portfolio companies charting their strategic direction.

As outlined in The Secret Formula for Profit in Water Tech Venture Capital, this comprehensive support system creates a powerful platform for water technology innovation. By combining financial investment with extensive strategic value addition, MANN+HUMMEL helps portfolio companies overcome the typical challenges that plague water startups and achieve faster, more sustainable growth trajectories.

Future Trajectory and Investment Outlook

MANN+HUMMEL Ventures stands at a pivotal intersection of emerging water technology trends, strategically positioning itself to capitalize on transformative opportunities in the sector. The venture arm’s forward-looking approach aligns with several key developments reshaping the water industry landscape.

Artificial intelligence and machine learning applications are revolutionizing water infrastructure management, predictive maintenance, and treatment optimization. MANN+HUMMEL recognizes this shift by actively seeking startups developing AI-powered solutions for real-time monitoring, automated control systems, and data analytics platforms that enhance operational efficiency.

The rising imperative of water reuse and circular economy principles is driving innovation in treatment technologies. The venture team specifically targets investments in advanced filtration, membrane systems, and resource recovery solutions that enable water recycling while extracting valuable materials from waste streams. This dual focus on environmental impact and economic value creation reflects a maturing understanding of water tech opportunities.

As digital water solutions continue gaining traction, MANN+HUMMEL’s venture strategy emphasizes technologies enabling smart, connected water systems. The firm sees particular promise in solutions integrating Internet of Things (IoT) sensors, cloud computing, and advanced analytics to provide unprecedented visibility into water networks and treatment processes.

Climate resilience represents another key investment theme, with the venture arm evaluating technologies that help water infrastructure adapt to extreme weather events and changing environmental conditions. This includes innovations in stormwater management, flood prediction, and drought-resistant water supply solutions.

Most significantly, MANN+HUMMEL Ventures is expanding its definition of strategic value beyond pure financial returns. The firm increasingly evaluates potential investments through the lens of global water security challenges, seeking technologies that can scale rapidly to address pressing environmental and social needs while maintaining commercial viability.

To support this evolved investment thesis, MANN+HUMMEL is strengthening its partnerships with research institutions, accelerators, and fellow corporate investors. This collaborative approach helps identify promising technologies earlier in their development cycle while providing portfolio companies access to broader expertise and resources.

As explored in How long will it take to grow the 4 stages of water innovation, the water sector’s innovation trajectory requires patient capital combined with deep industry knowledge – qualities that MANN+HUMMEL brings to its venture activities. The firm’s long-term perspective and technical capabilities position it to play an increasingly vital role in accelerating water technology adoption and scaling solutions to global water challenges.

The Strategic Vision Behind the Ventures

MANN+HUMMEL’s venture strategy represents a calculated push into water technology innovation, driven by the recognition that global water challenges present both humanitarian imperatives and commercial opportunities. The company’s investment thesis centers on identifying and accelerating breakthrough solutions that address three core pillars: water scarcity, water quality, and water infrastructure resilience.

At the heart of MANN+HUMMEL’s approach lies a deep understanding of the water technology landscape gained through decades of filtration expertise. Rather than pursuing incremental improvements, the venture arm targets transformative technologies that can fundamentally reshape how we treat, monitor, and distribute water resources. This focus aligns with growing market demands for more sustainable and efficient water management solutions.

The strategic vision extends beyond pure financial returns. MANN+HUMMEL views its venture activities as a crucial avenue for accessing emerging technologies that complement its core business while positioning the company at the forefront of water innovation. This dual-purpose approach enables the firm to both strengthen its market position and contribute meaningfully to addressing global water challenges.

Particularly noteworthy is the company’s emphasis on water quality solutions that can scale globally. With deteriorating water quality threatening both developed and developing regions, MANN+HUMMEL seeks technologies that can effectively remove both traditional and emerging contaminants while remaining cost-effective and energy-efficient. The venture team specifically evaluates potential investments based on their ability to address critical challenges like micropollutants, industrial wastewater treatment, and water reuse.

The investment strategy also reflects a keen awareness of market timing. As the water sector undergoes rapid digitalization and technological advancement, MANN+HUMMEL has positioned itself to capitalize on the convergence of multiple trends – from advanced materials and AI-driven solutions to decentralized treatment systems. This forward-looking approach ensures the venture portfolio remains relevant as water challenges evolve.

Most significantly, MANN+HUMMEL’s venture strategy exemplifies a broader shift in how corporate venture capital can drive water innovation. By combining deep industry expertise with strategic capital deployment, the company creates a powerful platform for accelerating the commercialization of promising water technologies. This approach not only benefits portfolio companies but also helps bridge the critical gap between innovation and real-world implementation in the water sector.

Investment Portfolio and Success Stories

Building on decades of filtration expertise, MANN+HUMMEL Ventures has carefully assembled a portfolio of water technology pioneers that are reshaping the industry’s future. The firm’s investment strategy focuses on breakthrough solutions addressing critical challenges in water quality, efficiency, and sustainability.

A standout success story emerged through their investment in membrane technology innovation. By providing not just capital but also extensive technical support and market access, MANN+HUMMEL helped one portfolio company scale its novel membrane chemistry from laboratory testing to full commercial deployment in under two years. The technology now enables 40% more energy-efficient water treatment across multiple industries.

In the digital water space, MANN+HUMMEL’s backing proved transformational for an analytics startup developing AI-powered solutions for water quality monitoring. Beyond the initial funding round, the corporate venture team facilitated pilot projects with major utilities and industrial customers, accelerating real-world validation. The startup’s technology is now deployed across three continents, with demonstrated reductions in treatment chemical usage of up to 30%.

What sets MANN+HUMMEL Ventures apart is their hands-on approach to value creation. Portfolio companies gain access to the parent company’s global network of water technology experts, testing facilities, and manufacturing capabilities. This operational support helps startups overcome common scale-up challenges around product development, quality control, and supply chain optimization.

The venture arm also serves as a bridge between startups and MANN+HUMMEL’s extensive customer base across municipal, industrial, and residential markets. This commercial access has helped portfolio companies dramatically accelerate their go-to-market timelines and expand into new geographic regions and applications.

Perhaps most significantly, MANN+HUMMEL Ventures maintains a long-term partnership mindset that extends beyond traditional investment horizons. Rather than pushing for quick exits, they focus on sustainable growth and technology advancement that can meaningfully impact global water challenges. This approach has fostered deep collaboration between portfolio companies and MANN+HUMMEL’s core business units, leading to multiple joint development projects and strategic technology integrations.

Linking to an insightful case study on water technology investment dynamics, what do you need to know to invest wisely in water technologies, their balanced strategy exemplifies how corporate venture capital can accelerate water innovation when paired with deep domain expertise and patient capital.

Technical Excellence Meets Venture Agility

MANN+HUMMEL’s decades of filtration expertise provides a unique foundation for evaluating and accelerating water technology ventures. The company’s deep technical knowledge spans membrane science, materials engineering, and fluid dynamics – critical capabilities that enable thorough due diligence and meaningful strategic guidance for portfolio companies.

When assessing potential investments, MANN+HUMMEL’s technical teams can quickly validate core technologies and identify both challenges and opportunities that may not be apparent to traditional venture investors. This technical validation extends beyond surface-level reviews, diving into the fundamental science and engineering principles that will determine a solution’s real-world viability.

But technical excellence alone isn’t enough in the fast-moving venture space. MANN+HUMMEL has developed what they call “structured agility” – combining rigorous technical assessment with the speed and flexibility required for venture operations. Technical reviews are streamlined through standardized evaluation frameworks, while maintaining the depth needed for confident investment decisions.

For portfolio companies, this marriage of technical depth and venture agility creates unique advantages. Rather than just providing capital, MANN+HUMMEL can actively accelerate technology development and commercial deployment. Their technical teams collaborate closely with startups to overcome engineering challenges, optimize designs, and validate performance claims.

The company’s global network of technical experts becomes an extension of portfolio companies’ R&D capabilities. This multiplier effect helps startups achieve technical milestones faster and with greater confidence. Whether it’s accessing specialized testing equipment, tapping into application expertise, or leveraging relationships with suppliers, MANN+HUMMEL’s technical resources create tangible acceleration.

Crucially, this technical partnership extends through the full venture lifecycle. Early-stage companies receive support in prototype development and proof-of-concept testing. Growth-stage ventures gain assistance with manufacturing scale-up and quality systems. Later-stage companies benefit from help optimizing operations and expanding into new applications.

MANN+HUMMEL’s venture approach demonstrates how corporate technical excellence can be effectively deployed in the startup ecosystem. By maintaining agility while leveraging deep domain expertise, they provide unique value to water technology ventures beyond what traditional financial investors can offer. This technical foundation, combined with venture flexibility, positions them to identify and accelerate the next generation of water innovation.

Future Horizons: Water Technology 2030

MANN+HUMMEL Ventures envisions a transformative decade ahead for water technology, driven by three key imperatives: digitalization, sustainability, and resource recovery. The company’s strategic vision goes beyond traditional filtration to embrace emerging technologies that will reshape the water industry landscape by 2030.

At the core of this vision lies a commitment to developing intelligent water systems that leverage artificial intelligence and advanced analytics. These systems will enable predictive maintenance, optimize treatment processes, and provide real-time monitoring of water quality parameters. By integrating smart sensors and IoT capabilities, MANN+HUMMEL aims to create a new paradigm of data-driven decision-making in water management.

Sustainability stands as another crucial pillar of the company’s forward-looking strategy. MANN+HUMMEL Ventures is actively investing in technologies that minimize energy consumption and reduce chemical usage in water treatment processes. The focus extends to developing circular economy solutions that transform waste streams into valuable resources. This aligns with their vision of turning finance into the water sector’s new best ally.

Resource recovery represents the third strategic frontier. The company recognizes that tomorrow’s water treatment facilities must evolve beyond simple purification to become resource recovery hubs. Their investment thesis targets technologies that can extract valuable materials from wastewater streams, including nutrients, rare earth elements, and energy precursors.

Beyond these core areas, MANN+HUMMEL Ventures is positioning itself to address emerging challenges in water security and quality. Their portfolio strategy includes investments in advanced membrane technologies, innovative filtration materials, and nature-based solutions that can cope with increasingly complex contamination profiles.

The company’s approach to shaping industry innovation involves more than just financial investment. They are cultivating an ecosystem of collaboration, connecting startups with industrial partners and research institutions. This network effect accelerates the commercialization of breakthrough technologies and ensures solutions are both technically viable and market-ready.

By 2030, MANN+HUMMEL Ventures aims to have catalyzed the deployment of technologies that significantly reduce the water industry’s environmental footprint while improving operational efficiency. Their investment strategy reflects a deep understanding that future water challenges require solutions that are not only technologically advanced but also economically sustainable and environmentally responsible.

Final words

MANN+HUMMEL Corporate Ventures stands as a compelling example of how corporate venture capital can drive innovation in the water technology sector. Their strategic approach, combining deep industrial expertise with venture capital discipline, creates a unique value proposition for water entrepreneurs. The firm’s focus on advanced filtration, digital solutions, and sustainability aligns perfectly with the evolving needs of the global water industry. For entrepreneurs, their ability to provide not just capital but also technical expertise, market access, and global networks makes them an attractive partner. For co-investors, their industrial knowledge and strategic approach to value creation make them a valuable syndicate partner. As water challenges continue to grow globally, MANN+HUMMEL’s venture arm is well-positioned to play a crucial role in scaling the next generation of water technology solutions.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!