Nestled in the heart of the Pacific Northwest, Bellingham Angel Investors (BAI) has quietly emerged as a compelling force in early-stage water technology investment. Since 2005, this network of accredited investors has deployed over $30 million across approximately 50 companies, with a particular eye toward innovations that impact their home region’s rich water resources. While segment-agnostic in their approach, BAI’s strategic positioning in a water-rich geography has naturally drawn them toward breakthrough solutions in ocean monitoring, environmental intelligence, and water infrastructure – creating unique opportunities for both entrepreneurs and co-investors seeking to make a splash in the blue economy.

Belligham Angel’s are part of my Ultimate Water Investor Database, check it out!

Investor Name: Bellingham Angel Investors

Investor Type: Family Office

Latest Fund Size: $ Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: Ocean Data/Monitoring

Investment History: $2371249.5 spent over 2 deals

Often Invests Along:

Already Invested In: Membrion, Inc.

Leads or Follows: Follow

Board Seat Appetite: Moderate

Key People:

The Ripple Effect: BAI’s Investment Strategy

Bellingham Angel Investors (BAI) has crafted a distinctive investment approach that combines regional focus with strategic syndication to maximize impact in the water technology sector. Their investment thesis centers on early-stage companies developing innovative solutions for pressing water challenges, with check sizes ranging from $25,000 to $500,000.

BAI’s investment model emphasizes collaborative syndication, allowing them to participate in larger funding rounds while maintaining their focus on initial capital deployment. By partnering with other angel networks and early-stage venture funds, they can provide portfolio companies with robust follow-on funding pathways. This approach has proven particularly effective in the capital-intensive water technology sector, where companies often require significant resources to scale their solutions.

The network’s regional emphasis on the Pacific Northwest creates natural advantages in deal sourcing and portfolio support. Their proximity to major research institutions and technology hubs enables deep due diligence and hands-on mentorship. BAI leverages strong relationships with local universities, accelerators, and industry partners to identify promising water technology innovations at their earliest stages.

A hallmark of BAI’s strategy is their sector-specific expertise in water technology evaluation. The network includes active and former water industry executives who bring decades of operational experience to the due diligence process. This domain knowledge helps them assess not only the technical merits of potential investments but also their commercial viability and market fit.

BAI takes a patient capital approach, recognizing that water technology companies often face longer development cycles than traditional software startups. Their investment terms typically include provisions for milestone-based funding, allowing them to support companies through critical development phases while maintaining investment discipline.

The network has developed a reputation for being a value-add investor, actively connecting portfolio companies with pilot opportunities, strategic partners, and follow-on investors. This hands-on approach helps de-risk investments and accelerates the path to commercialization for early-stage water technologies.

Deep Dive: Water Technology Themes

Bellingham Angel Investors has strategically positioned itself at the intersection of two critical water technology domains: ocean data monitoring and environmental intelligence. Their investment thesis recognizes the growing importance of gathering high-resolution marine data to understand climate impacts and protect coastal ecosystems.

The network’s portfolio companies are developing sophisticated sensor networks and AI-powered analytics platforms that provide unprecedented visibility into ocean health indicators. These solutions enable real-time monitoring of parameters like temperature, salinity, and dissolved oxygen levels – critical data points for both environmental protection and commercial maritime operations.

One particularly promising focus area lies in PFAS remediation technologies. These ‘forever chemicals’ pose an urgent environmental and public health challenge that the EPA estimates will require over $30 billion in treatment infrastructure. BAI sees significant opportunities in novel destruction methods that could dramatically reduce remediation costs while achieving higher removal rates than conventional approaches.

The fund is actively evaluating electrochemical oxidation and supercritical water oxidation technologies that show promise in completely breaking down PFAS molecules rather than just filtering and concentrating them. This aligns with their thesis of backing transformative solutions to major water challenges.

Beyond hardware innovations, BAI recognizes the critical role of digital infrastructure in advancing water technology adoption. Their investments target solutions that help utilities and industrial customers better manage their water and wastewater operations through improved data collection, analysis, and process optimization.

This digital layer acts as a force multiplier – enabling legacy treatment systems to operate more efficiently while providing the connectivity and intelligence needed to implement new technologies at scale. The fund sees particular value in platforms that can integrate disparate data streams and translate them into actionable insights for operators.

Looking ahead, BAI is monitoring emerging opportunities in decentralized water treatment, resource recovery from wastewater, and nature-based solutions for water quality improvement. Their investment approach favors technologies that can demonstrate clear paths to commercial deployment while delivering measurable environmental benefits.

Through careful portfolio construction across these themes, BAI aims to accelerate the adoption of innovations that address critical water challenges while generating attractive returns for their limited partners. Their deep domain expertise in water technology helps them identify promising early-stage companies and support their growth through strategic guidance and industry connections.

Partnering for Success: BAI’s Collaborative Model

Bellingham Angel Investors (BAI) has cultivated a distinct approach to venture partnership, positioning itself as a strategic follower investor while building robust syndication networks. This model leverages the group’s deep water technology expertise while spreading risk and expanding deal flow opportunities.

BAI typically joins funding rounds as a co-investor, contributing $250,000 to $750,000 alongside established lead investors. Rather than competing for lead positions, BAI focuses on adding specialized water sector knowledge and regional connections to deals. This approach has enabled successful co-investments with prominent water-focused funds and angel networks across North America.

The organization’s board participation strategy emphasizes active engagement without overextension. BAI typically seeks observer rights rather than formal board seats, allowing them to provide strategic guidance while maintaining bandwidth across their growing portfolio. Portfolio companies particularly value BAI’s deep understanding of Pacific Northwest water challenges and connections to regional utilities, regulators, and research institutions.

BAI has developed a comprehensive post-investment support framework that aligns with their collaborative ethos. Portfolio companies gain access to BAI’s network of water industry veterans who provide technical validation, regulatory navigation assistance, and introductions to potential customers and partners. This support system has proven especially valuable for companies expanding into the Pacific Northwest market.

The group’s syndication partnerships extend beyond traditional venture capital relationships. BAI actively collaborates with regional accelerators, technology validation centers, and utility innovation programs to create seamless pathways for water technology commercialization. This integrated approach helps portfolio companies overcome the unique scaling challenges in the water sector.

As explored in a recent analysis of water technology venture capital dynamics, BAI’s model demonstrates how regional angel networks can play a vital role in the water innovation ecosystem by focusing on their comparative advantages rather than trying to replicate traditional VC structures.

BAI’s collaborative approach has yielded several notable successes, particularly in deals where their water expertise complemented the lead investor’s broader market perspective. Their portfolio companies consistently cite the value of having an investor who deeply understands both regional water challenges and the broader innovation landscape.

Making Waves: Impact and Future Trajectory

Bellingham Angel Investors’ strategic focus on water technology has catalyzed meaningful progress in regional water innovation while laying groundwork for expanded impact. The network’s early investments have helped validate promising water technologies and attract follow-on capital, creating a flywheel effect that strengthens the Pacific Northwest’s water technology ecosystem.

BAI’s evolving investment thesis reflects deepening expertise in water technology evaluation and changing market dynamics. While maintaining core criteria around strong intellectual property and clear paths to commercialization, the group has expanded its aperture to include solutions addressing emerging challenges like climate resilience, water reuse, and digital transformation. This evolution enables BAI to stay ahead of industry trends while leveraging accumulated domain knowledge.

For water technology entrepreneurs, BAI represents more than just capital. The network’s deep industry connections and hands-on portfolio support help startups navigate complex stakeholder dynamics and accelerate market entry. Portfolio companies particularly value BAI’s assistance with pilot project development, regulatory guidance, and introductions to potential customers and partners.

Co-investment opportunities continue expanding as BAI builds its track record and strengthens relationships with aligned investors. The network’s specialized water technology expertise makes it an attractive syndicate partner, while its regional focus helps attract investors seeking exposure to the Pacific Northwest innovation ecosystem.

Looking ahead, BAI is well-positioned to play an expanded role in water technology commercialization. The combination of climate pressures, aging infrastructure, and increasing water stress creates growing demand for innovative solutions. BAI’s thesis-driven approach and collaborative model provide a framework for identifying and scaling promising technologies.

BAI’s impact extends beyond individual investments to strengthen the broader regional water innovation ecosystem. The network’s activities help attract talent and capital while fostering connections between startups, utilities, and established industry players. This ecosystem-building work creates lasting benefits that persist beyond specific investment outcomes.

For the future of water innovation in the Pacific Northwest, BAI’s sustained commitment provides crucial early-stage support when many investors hesitate. The network’s evolving model demonstrates how regional angel groups can help bridge the commercialization gap for water technologies while generating attractive returns.

The Blueprint: Bellingham’s Investment Philosophy

At the heart of Bellingham Angels’ water technology investment strategy lies a sophisticated three-pillar framework that has proven instrumental in identifying and nurturing breakthrough innovations. This methodical approach reflects the network’s deep understanding that successful water technology ventures must balance innovation, commercial viability, and environmental impact.

The first pillar, technological innovation, demands more than mere novelty. Bellingham’s investment committee scrutinizes the fundamental science and engineering behind each solution, evaluating patents, technical validation data, and scalability potential. The network particularly values technologies that demonstrate significant improvements over existing solutions, whether through enhanced efficiency, reduced energy consumption, or novel treatment approaches.

Market viability forms the second critical pillar of assessment. Startup teams must demonstrate a clear path to commercialization, including realistic cost structures, defensible pricing models, and well-defined target markets. Read more about evaluating water technology investment potential. The angels pay particular attention to regulatory compliance and certification requirements, understanding that these factors can significantly impact time-to-market and operational costs.

The third pillar, environmental impact, reflects Bellingham Angels’ commitment to fostering sustainable water solutions. Proposals must demonstrate measurable environmental benefits, whether through water conservation, pollution reduction, or ecosystem preservation. The network employs sophisticated metrics to quantify potential environmental returns, considering factors like carbon footprint, waste reduction, and resource efficiency throughout the technology’s lifecycle.

What sets Bellingham’s approach apart is the dynamic interplay between these pillars. Rather than treating them as separate checkboxes, the network evaluates how they reinforce each other. For instance, a technology’s environmental benefits often translate into market advantages, while commercial viability can enable broader adoption and thus greater environmental impact.

This holistic evaluation process typically unfolds over several months, involving multiple rounds of due diligence. Early-stage companies undergo rigorous technical reviews, market analysis, and environmental impact assessments. The network frequently engages external experts and industry veterans to validate claims and provide specialized insights, ensuring investment decisions are grounded in deep domain expertise.

Bellingham Angels’ investment philosophy also emphasizes the importance of founder alignment. Beyond technical and business capabilities, the network seeks entrepreneurs who share their vision for sustainable water management and demonstrate the resilience needed to overcome the unique challenges of the water sector.

Portfolio Deep Dive: Success Stories in Water Tech

Bellingham Angels’ water technology portfolio showcases a strategic focus on innovations that address critical challenges in water management while delivering strong returns. Their investments have catalyzed breakthroughs across treatment, conservation, and distribution systems.

One of their earliest success stories revolutionized membrane filtration technology for industrial wastewater treatment. The venture developed a novel biomimetic membrane that reduced energy consumption by 40% while increasing contaminant removal efficiency. After five years of steady growth and technology refinement, the company was acquired by a global water treatment corporation for $85 million, generating a 12x return for early investors.

In the smart distribution space, Bellingham’s portfolio includes a groundbreaking AI-powered leak detection system. This technology uses advanced acoustic sensors and machine learning to identify potential pipeline failures before they occur. The system has helped utilities reduce water losses by up to 30% and maintenance costs by 45%. The company recently closed a Series C funding round at a $200 million valuation, validating Bellingham’s early vision.

Perhaps most impactful is their investment in water conservation technology. One portfolio company developed an innovative atmospheric water harvesting system that produces potable water from air using renewable energy. The technology has proven particularly valuable in water-stressed regions and during disaster relief operations. The venture maintains strong year-over-year growth while delivering measurable environmental impact.

Bellingham’s current portfolio includes promising innovations in water quality monitoring, decentralized treatment systems, and resource recovery. A standout example is their investment in advanced nutrient recovery technology that transforms wastewater treatment byproducts into high-value fertilizers. This circular economy approach has attracted significant attention from agricultural and industrial partners.

Their success in water technology investments stems from a commitment to solutions that combine technical innovation with clear market demand and quantifiable environmental benefits. By maintaining a focused investment thesis while remaining adaptable to emerging opportunities, Bellingham Angels continues to shape the future of water technology while generating attractive returns for investors.

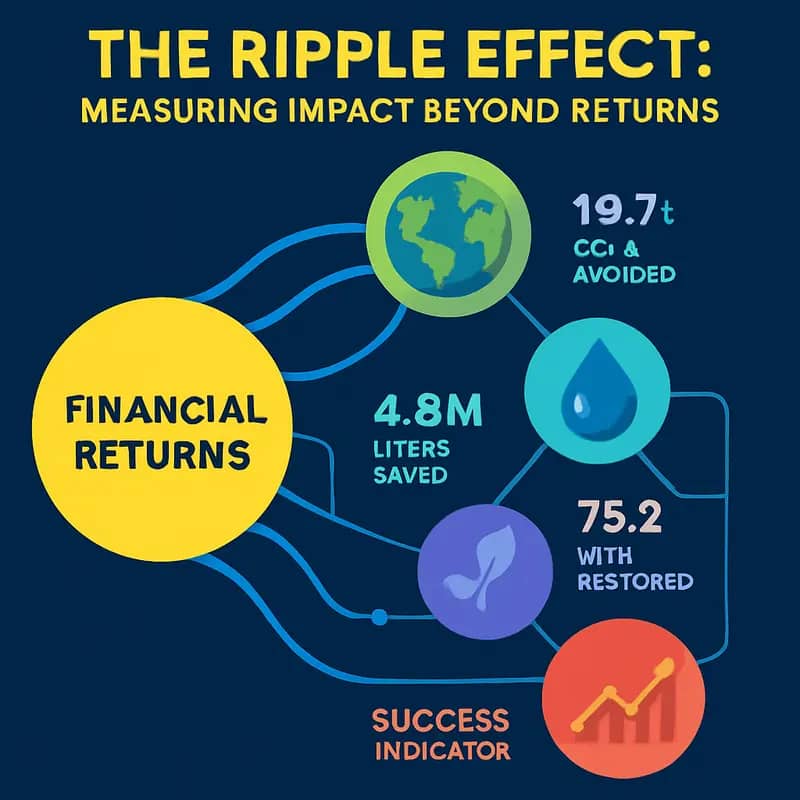

The Ripple Effect: Measuring Impact Beyond Returns

At Bellingham Angels, success isn’t measured solely in dollars and cents. Their innovative dual-metric framework tracks both financial performance and environmental impact, creating accountability for the transformative potential of water technology investments.

The network has developed a comprehensive Impact Measurement System (IMS) that quantifies water conservation, quality improvements, and ecosystem benefits. Portfolio companies must report quarterly on key metrics like gallons of water saved, contaminants removed, and energy efficiency gains. This data feeds into an annual impact report that helps investors understand their contributions to water sustainability.

A standout example is their investment in an advanced water treatment technology that has helped municipal utilities reduce chemical usage by 40% while improving discharge quality. The system has been deployed across three facilities in Washington state, preventing over 50,000 pounds of treatment chemicals from entering waterways annually. The financial returns exceeded 3x, while the environmental impact metrics demonstrated measurable improvements in stream health and aquatic biodiversity.

Another portfolio company developed smart irrigation controls that have saved over 100 million gallons of water across commercial and agricultural installations. Using AI and real-time soil moisture data, the system optimizes water delivery while reducing runoff and nutrient leaching. Beyond the impressive 65% reduction in water usage, downstream monitoring showed decreased nitrogen loads in nearby watersheds.

Bellingham Angels takes a long view on impact, recognizing that some environmental benefits may take years to fully materialize. They’ve partnered with regional universities to conduct longitudinal studies tracking watershed health indicators near deployment sites. This research helps validate their impact measurement methodology while providing valuable data to improve future investment decisions.

The network has found that companies delivering strong environmental impacts often generate superior financial returns. Their data shows portfolio companies with top quartile environmental metrics have averaged 25% higher valuations at exit. This correlation has helped attract additional impact-focused investors to the region, creating a virtuous cycle of sustainable water innovation.

As explored in how to mitigate 4 shades of water risk through impact investing, Bellingham’s approach demonstrates how strategic early-stage investment can drive both business growth and environmental progress. Their rigorous impact measurement framework has become a model for other regional investment networks looking to support water technology innovation while ensuring accountability for environmental outcomes.

Future Flows: Investment Trends and Opportunities

Bellingham Angels is strategically positioning itself at the convergence of several transformative trends in water technology innovation. The group’s investment thesis reflects a deep understanding of emerging opportunities in water resource management and treatment solutions.

A key focus area is decentralized water treatment technologies. The investment group recognizes that traditional centralized infrastructure faces mounting challenges from climate change, population growth, and aging systems. They’re actively exploring companies developing point-of-use and point-of-entry treatment systems that can provide resilient, localized solutions.

Data analytics and artificial intelligence represent another critical investment vector. Bellingham Angels sees tremendous potential in startups leveraging machine learning to optimize water distribution networks, predict maintenance needs, and enhance treatment processes. These technologies promise to dramatically improve operational efficiency while reducing costs.

The circular water economy presents compelling opportunities that align with both environmental and financial objectives. The group is evaluating technologies that enable water reuse, resource recovery, and waste-to-value conversion. Particularly promising are innovations in industrial water recycling and nutrient recovery from wastewater.

Climate resilience technologies have emerged as a priority investment area. With increasing water scarcity and extreme weather events, Bellingham Angels is targeting solutions for drought mitigation, flood management, and coastal protection. This includes advanced materials, smart infrastructure, and nature-based solutions.

Beyond individual technology sectors, the investment group is taking a systems approach to water innovation. They recognize that the most impactful solutions often integrate multiple technologies and address multiple challenges simultaneously. This holistic perspective influences their due diligence process and portfolio construction strategy.

Bellingham Angels is particularly interested in technologies with clear paths to commercialization and scalability. While they maintain a long-term vision, they seek innovations that can demonstrate near-term impact and market traction. This balanced approach helps manage risk while pursuing transformative opportunities.

The group’s investment strategy significantly aligns with broader sustainability goals and ESG criteria, as detailed in “How to Mitigate 4 Shades of Water Risk Through Impact Investing“. This alignment positions them to attract co-investment from institutional investors increasingly focused on water security and climate resilience.

By maintaining deep connections within the water technology ecosystem, Bellingham Angels stays ahead of emerging trends and identifies promising investment opportunities early. Their approach combines rigorous technical evaluation with strategic market analysis to build a portfolio positioned for both impact and returns.

Final words

Bellingham Angel Investors stands at a unique intersection of regional focus and water innovation potential. Their measured approach to early-stage investment, emphasizing collaboration over competition, has created a sustainable model for nurturing water technology breakthroughs. While not exclusively focused on water, their strategic position in the Pacific Northwest naturally aligns them with opportunities in ocean monitoring, environmental intelligence, and water infrastructure innovation. For water entrepreneurs, BAI represents more than just capital – they offer a gateway to a robust regional ecosystem and co-investment network. Their preference for follower positions in syndicated deals makes them an attractive partner for lead investors looking to build strong syndicates. As water challenges intensify globally, BAI’s regional expertise and collaborative model position them well to play an increasingly important role in scaling solutions that matter. Their journey illustrates how focused regional investors can create outsized impact in specific sectors, even without explicit thematic mandates.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!