Deep in the heart of Sydney’s innovation district, Main Sequence is quietly revolutionizing how we approach water technology investment. Born from Australia’s premier scientific institution CSIRO, this venture capital firm has grown from managing a modest fund to stewarding over A$1 billion in assets. Their unique approach combines scientific rigor with commercial acumen, particularly in the water sector where they’re backing solutions to some of humanity’s most pressing challenges. With their third fund reaching A$450 million, Main Sequence exemplifies how patient capital, technical expertise, and a commitment to impact can unlock breakthrough water technologies.

Main Sequence is part of my Ultimate Water Investor Database, check it out!

Investor Name: Main Sequence

Investor Type: VC

Latest Fund Size: $305 Million

Dry Powder Available: Yes

Typical Ticket Size: <$250k

Investment Themes: PFAS, digital twins, decentralized treatments

Investment History: $2970909.09 spent over 2 deals

Often Invests Along: Breakthrough Victoria

Already Invested In: ElectraLith, Xefco

Leads or Follows: Follow

Board Seat Appetite: Moderate

Key People:

The Science-Backed Investment Powerhouse

Born from Australia’s national science agency CSIRO in 2017, Main Sequence has rapidly emerged as a transformative force in the venture capital landscape. The firm’s meteoric rise from institutional spinoff to managing over A$1 billion in assets showcases a unique approach to deep tech investment that seamlessly bridges scientific innovation and commercial viability.

At its core, Main Sequence operates with a distinctive investment philosophy that sets it apart from traditional venture capital firms. Rather than simply deploying capital, the firm leverages CSIRO’s vast research network and technical expertise to validate technologies, accelerate development, and create meaningful partnerships. This science-backed approach enables them to take calculated risks on emerging technologies that other investors might shy away from.

Their partnership model exemplifies the power of institutional collaboration. Through their formal relationship with CSIRO, Main Sequence gains privileged access to cutting-edge research, world-class facilities, and a deep pool of scientific talent. This connection allows portfolio companies to tap into decades of accumulated knowledge and infrastructure that would otherwise be out of reach for early-stage ventures.

The firm’s evolution has been marked by a series of strategic decisions that have amplified its impact. Rather than spreading investments thinly across multiple sectors, Main Sequence focuses on specific global challenges where science can drive transformative solutions. Water technology has emerged as a key focus area, with the firm recognizing the critical role of innovation in addressing global water scarcity and quality challenges.

Main Sequence’s approach to company building goes beyond traditional investment support. They actively participate in commercialization strategies, often helping to form new companies around promising technologies. This hands-on methodology has proven particularly valuable in the water sector, where bridging the gap between laboratory success and market adoption can be especially challenging.

The firm’s track record speaks to the effectiveness of their model. Their portfolio companies have consistently demonstrated the ability to scale technologies from concept to commercial reality, supported by Main Sequence’s unique combination of scientific rigor and commercial acumen. As detailed in the economic incentives of the water reuse revolution, this approach has been particularly impactful in advancing water technology solutions.

Looking ahead, Main Sequence’s influence continues to grow as they expand their investment thesis and deepen their impact across the Australian innovation ecosystem. Their success has not only validated their unique investment model but has also created a blueprint for how institutional scientific knowledge can be effectively leveraged to drive commercial outcomes in deep tech ventures.

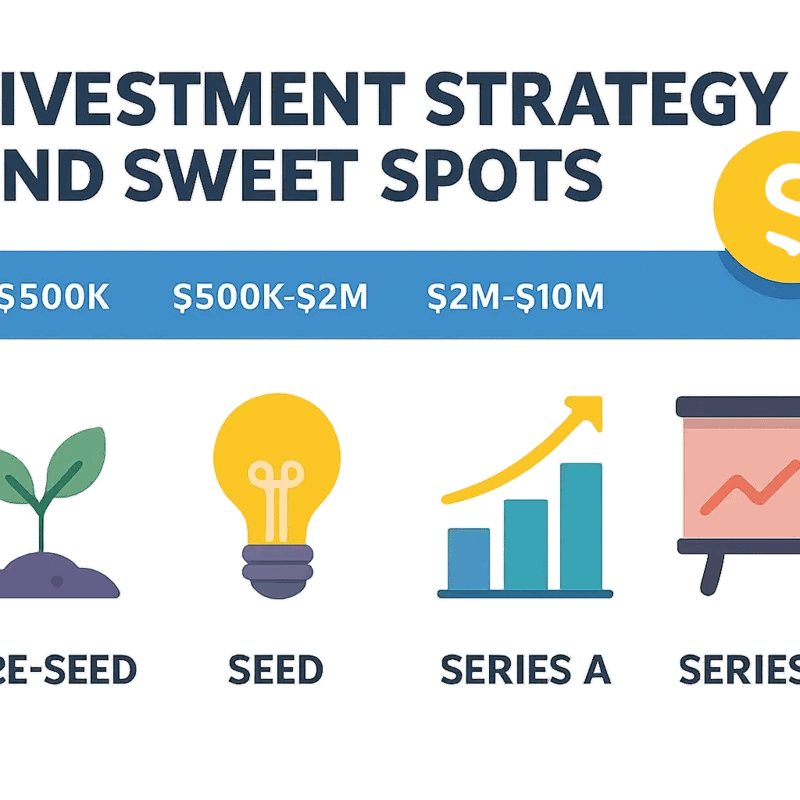

Investment Strategy and Sweet Spots

Main Sequence’s investment approach in water technology reflects a methodical strategy focused on early-stage companies poised to address critical challenges in water management and sustainability. The firm’s flexible check sizes, ranging from $100,000 to $10 million, allow them to support ventures at various stages of development while maintaining a clear focus on breakthrough innovations.

The firm’s investment criteria center on three core pillars: technological differentiation, market potential, and team capability. For water technology companies seeking funding, Main Sequence looks for solutions that demonstrate clear scientific validation, scalable business models, and the potential for significant environmental impact. This alignment with their broader deep tech mandate ensures portfolio companies can leverage CSIRO’s extensive research capabilities and industry partnerships.

Their sweet spot lies particularly in early-stage companies developing hardware and software solutions for water infrastructure, quality monitoring, and resource optimization. The investment team prioritizes technologies that show promise in reducing energy consumption, improving water quality assessment, or enabling more efficient water management systems.

A distinctive aspect of Main Sequence’s investment strategy is their collaborative approach with portfolio companies. Rather than simply providing capital, they actively engage in helping startups navigate the complex water industry landscape. This includes facilitating connections with potential customers, supporting regulatory compliance efforts, and providing access to testing facilities through their CSIRO partnership.

In evaluating potential investments, Main Sequence employs a rigorous due diligence process that examines both technical feasibility and commercial viability. Their investment committee, comprising seasoned water industry experts and technologists, assesses factors such as intellectual property protection, market entry barriers, and potential competition. This thorough evaluation ensures that portfolio companies have robust foundations for growth and scalability.

Main Sequence’s flexible funding approach allows them to participate in both initial and follow-on rounds, supporting companies throughout their growth journey. The firm typically seeks significant minority stakes, enabling them to maintain active involvement in strategic decisions while allowing founders to retain meaningful ownership and control.

Recognizing the long development cycles often required in water technology, Main Sequence structures their investments with realistic timelines for commercialization and market adoption. This approach aligns with insights shared in their guide on water technology investment strategies, emphasizing the importance of patient capital in achieving meaningful technological breakthroughs and market impact.

Water Technology Focus Areas

Main Sequence’s water technology investment portfolio reflects Australia’s unique water challenges and opportunities. The firm targets three core areas where innovation can drive meaningful impact: infrastructure modernization, advanced monitoring systems, and industrial water management.

In infrastructure modernization, Main Sequence focuses on technologies that extend asset life and improve operational efficiency. This includes smart sensors and predictive analytics for leak detection, novel pipe rehabilitation methods, and decentralized treatment solutions. The emphasis is on solutions that help utilities maximize existing infrastructure rather than capital-intensive new builds.

Water quality monitoring represents another key investment theme, driven by increasing regulatory requirements and public health concerns. Main Sequence backs companies developing real-time monitoring platforms, advanced detection methods for contaminants like PFAS, and integrated data analytics systems that enable proactive water quality management. These technologies help utilities and industrial users maintain compliance while optimizing treatment processes.

Perhaps the most transformative focus area is industrial water management, where Main Sequence sees tremendous potential for innovation. The firm targets technologies that enable water recycling and reuse, zero liquid discharge systems, and resource recovery from wastewater streams. This includes membrane technologies, electrochemical treatment methods, and digital solutions for water use optimization.

Notably, Main Sequence looks for solutions that address multiple challenges simultaneously. For example, they favor technologies that both reduce energy consumption and improve treatment effectiveness, or monitoring systems that enhance both operational efficiency and regulatory compliance. This integrated approach reflects their thesis that the most impactful water innovations deliver benefits across environmental, operational, and financial dimensions.

Their investment focus aligns with the growing need for sustainable water solutions outlined in “How to mitigate 4 shades of water risk through impact investing.” The firm’s portfolio companies must demonstrate clear pathways to commercial adoption while delivering measurable environmental benefits. This dual focus on commercial viability and sustainability impact drives their evaluation of potential investments across all three focus areas.

Partnership Philosophy and Co-Investment Strategy

Main Sequence’s approach to water technology investment reflects a carefully orchestrated balance between leading investments and strategic co-investment partnerships. The venture capital firm has developed a distinctive model that leverages CSIRO’s deep technical expertise while actively engaging with both domestic and international co-investors to maximize impact and returns.

At the core of Main Sequence’s partnership philosophy lies a commitment to being a catalyst rather than just a capital provider. When leading investments, the firm typically takes an active role in shaping the company’s technical and commercial strategy, drawing on CSIRO’s extensive research capabilities and industry connections. This hands-on approach allows them to de-risk technologies effectively while accelerating their path to market.

The firm’s co-investment strategy operates on multiple levels. At the institutional level, Main Sequence has forged alliances with major Australian superannuation funds, creating a robust domestic capital base for water technology investments. These partnerships provide not just financial resources but also long-term stability and credibility to portfolio companies.

Internationally, Main Sequence has demonstrated expertise in organizing strategic co-investment syndicates that bring together complementary capabilities. They actively seek partners who can contribute specific market access, technical validation, or commercial relationships that complement their own strengths in research and development.

A notable aspect of their approach is the emphasis on strategic alignment in co-investment relationships. Rather than pursuing purely financial partnerships, Main Sequence prioritizes co-investors who share their long-term vision for transforming water technology and can add meaningful value beyond capital. This selective approach has proven particularly effective in water infrastructure projects, where long development cycles and complex stakeholder relationships require patient, aligned capital.

The firm has also pioneered innovative co-investment structures that help bridge the gap between research and commercialization. These include staged investment mechanisms that tie funding to technical milestones and creative risk-sharing arrangements that align incentives across the partnership network. Such structures have proven particularly valuable in early-stage water technology ventures where traditional venture capital models might not be optimal.

By maintaining flexibility in their investment role – whether leading or following – Main Sequence has created a dynamic model that can adapt to different opportunities while maintaining their core focus on deep tech innovation in water technology. This adaptability, combined with their strong partnership network, positions them uniquely in Australia’s water technology ecosystem.

The Science-Driven Investment Thesis

At the core of Main Sequence’s investment philosophy lies a unique convergence of scientific rigor and commercial opportunity in water technology. Their methodology puts equal weight on technical validation and market potential, recognizing that breakthrough water innovations must satisfy both dimensions to create lasting impact.

The firm’s scientific due diligence process starts with a deep technical assessment led by subject matter experts drawn from CSIRO’s extensive research network. These specialists evaluate the fundamental science behind proposed water technologies, examining aspects like thermodynamic efficiency, scalability potential, and environmental impact. This rigorous scientific screening helps identify truly transformative solutions while filtering out innovations that may be scientifically sound but impractical at scale.

Beyond pure technical evaluation, Main Sequence employs a systematic framework to validate market fit. The firm’s investment thesis hinges on identifying water technologies that address critical pain points in Australia’s water-stressed industries – from mining to agriculture. Their methodology examines factors like regulatory tailwinds, competitive dynamics, and adoption barriers through extensive stakeholder engagement.

What sets their approach apart is the emphasis on finding the intersection between scientific excellence and commercial viability. The firm actively seeks technologies with strong intellectual property protection that can demonstrate clear cost advantages or performance improvements over existing solutions. This dual focus helps ensure portfolio companies have sustainable competitive moats.

Perhaps most distinctively, Main Sequence takes a hands-on approach to validating technologies through real-world pilot testing. The firm leverages CSIRO’s extensive facilities and industry partnerships to rapidly prototype and iterate solutions in operational environments. This accelerates the path from lab to market while generating valuable performance data to support commercialization.

The investment methodology also places significant weight on the quality and capabilities of technical founding teams. Main Sequence actively seeks scientist-entrepreneurs who combine deep domain expertise with commercial acumen. The firm provides extensive support in augmenting technical teams with business talent when needed.

This science-driven investment approach reflects Main Sequence’s conviction that the next generation of water technology breakthroughs will come from the convergence of multiple scientific disciplines – from materials science to biotechnology. Their systematic methodology for identifying and validating such innovations provides a blueprint for bridging the gap between research excellence and commercial success in water technology.

From Lab to Market: The Commercialization Pipeline

Main Sequence’s commercialization process represents a carefully orchestrated journey that transforms promising scientific discoveries into market-ready water technologies. At its core lies a systematic approach that balances scientific validation with commercial viability.

The firm’s commercialization pipeline begins with thorough technical due diligence, building upon their science-driven investment thesis. A dedicated team of scientists and engineers works alongside inventors to validate core technology claims and identify scaling challenges early. This crucial step helps avoid common pitfalls in translating laboratory success to industrial applications.

Once the technical foundation is established, Main Sequence deploys a unique incubation model that combines hands-on support with structured stage gates. Portfolio companies receive dedicated workspace within CSIRO facilities, enabling continued access to world-class research infrastructure and expertise. This proximity to scientific resources proves invaluable during the critical proof-of-concept and pilot testing phases.

The firm’s commercial validation approach focuses on establishing clear product-market fit before significant capital deployment. Through their extensive network of industry partners, Main Sequence facilitates early customer engagement and real-world testing opportunities. This market-driven feedback loop helps refine both technology and business models, significantly improving commercialization success rates.

A distinctive aspect of their strategy is the emphasis on parallel development tracks. While engineering teams work on technology optimization, commercial teams simultaneously validate market assumptions and develop go-to-market strategies. This concurrent approach accelerates the path to market while reducing development risks.

Main Sequence has also pioneered an innovative milestone-based funding model that aligns capital deployment with commercial progress. Rather than following traditional venture capital timelines, funding tranches are released as companies achieve specific technical and commercial objectives. This approach maintains momentum while ensuring efficient capital utilization.

Beyond direct support, Main Sequence leverages Australia’s water technology ecosystem to accelerate commercialization. They actively facilitate connections between portfolio companies and established industry players, creating opportunities for pilot projects and commercial partnerships. This ecosystem approach, highlighted in “How to build the world leading water innovation accelerator“, has proven particularly effective in the water sector, where market entry barriers traditionally remain high.

The firm’s commercialization pipeline culminates in a structured exit preparation process, ensuring portfolio companies are well-positioned for either acquisition or public markets. This comprehensive approach to commercialization has established Main Sequence as a crucial bridge between scientific innovation and market impact in Australia’s water technology landscape.

Portfolio Synergies and Ecosystem Building

Main Sequence’s approach to water innovation extends far beyond individual investments, focusing on creating powerful synergies across its portfolio companies and fostering a robust ecosystem that amplifies impact. The firm’s strategic portfolio connections help accelerate commercialization while building lasting infrastructure for water technology development in Australia.

At the portfolio level, Main Sequence actively facilitates collaboration between complementary technologies and business models. Companies working on water quality monitoring can integrate with treatment solutions providers, while data analytics platforms support optimization across multiple portfolio companies’ operations. These intentional connections create value multipliers that benefit both individual startups and the broader water innovation landscape.

The ecosystem building strategy operates on multiple fronts. Main Sequence has established strong partnerships with universities, research institutions, and industry players to provide its portfolio companies with access to testing facilities, technical expertise, and potential customers. This network approach helps de-risk new technologies while accelerating market validation.

Notably, the firm leverages its CSIRO connection to build bridges between scientific discovery and commercial application. Regular innovation showcases and networking events bring together researchers, entrepreneurs, and industry experts to spark new collaborations. These gatherings have become crucial forums for identifying emerging opportunities and sharing lessons learned across the water technology sector.

Beyond facilitating connections, Main Sequence takes an active role in developing the support infrastructure needed for water innovation to thrive. This includes working with policymakers to create regulatory frameworks that enable new technologies, engaging with industry associations to build market awareness, and partnering with other investors to ensure promising companies have access to growth capital.

The firm has also pioneered novel partnership models that help startups navigate the unique challenges of the water sector. For instance, by connecting portfolio companies with established utilities and industrial water users, Main Sequence creates pathways for real-world validation while generating early revenue opportunities. These partnerships often evolve into long-term commercial relationships that benefit both parties.

Perhaps most importantly, Main Sequence’s ecosystem-building efforts help create a virtuous cycle for water innovation. Success stories inspire new entrepreneurs to enter the space, while lessons learned help subsequent startups avoid common pitfalls. The growing network of alumni companies, mentors, and industry partners provides an invaluable knowledge base for the next generation of water technology innovators.

This holistic approach to portfolio and ecosystem development has established Main Sequence as a cornerstone of Australia’s water innovation landscape. By focusing on strategic connections and infrastructure building alongside direct investment, the firm helps ensure that promising water technologies don’t just survive but thrive and scale their impact.

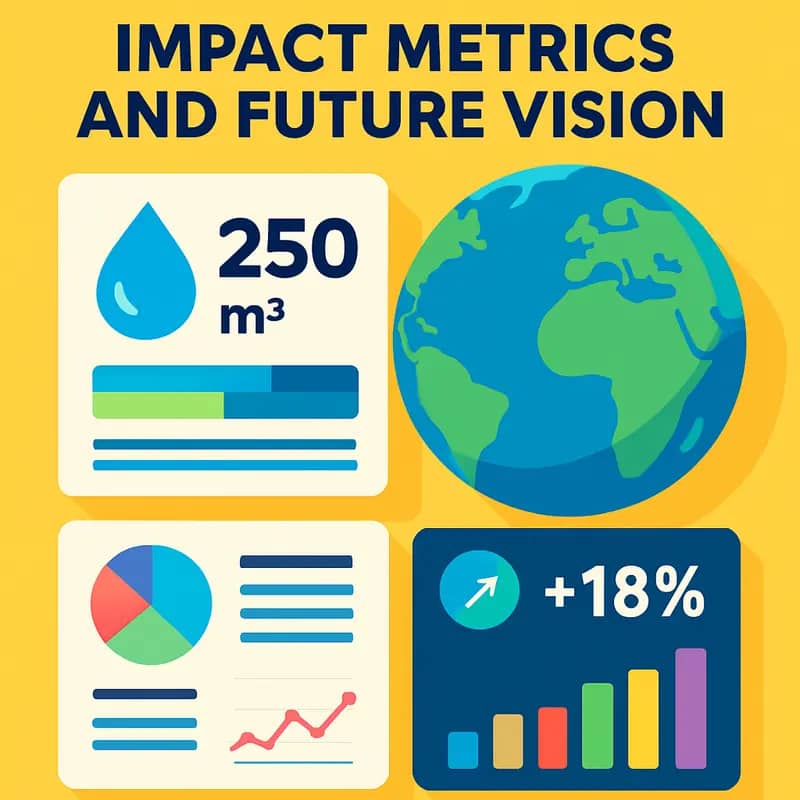

Impact Metrics and Future Vision

Main Sequence’s approach to measuring water impact stems from a fundamental belief that meaningful metrics must directly connect to real-world outcomes. The venture firm has developed a sophisticated framework that evaluates portfolio companies across three key dimensions: water savings, quality improvements, and accessibility enhancement.

At the core of their measurement methodology lies a focus on quantifiable results rather than theoretical projections. Portfolio companies are required to track and report specific metrics tied to their unique water solutions – whether that’s millions of liters conserved, contaminant reduction levels achieved, or number of people gaining improved water access. This data-driven approach allows Main Sequence to maintain accountability while demonstrating concrete progress to stakeholders.

Beyond individual company metrics, Main Sequence takes a systems-level view of impact assessment. Through detailed analysis of portfolio synergies, they evaluate how different water technologies can amplify each other’s effects when deployed in combination. This holistic perspective helps identify opportunities to scale impact exponentially rather than linearly.

Looking ahead, Main Sequence’s strategic vision centers on positioning Australia as a global water innovation hub while scaling solutions internationally. The firm is actively building bridges between the Australian water technology ecosystem and key international markets, particularly in water-stressed regions across Asia and the Middle East. Their goal is to demonstrate that Australian water innovations can effectively address global challenges.

A critical element of this vision involves cultivating the next generation of water technology entrepreneurs. Main Sequence has implemented specialized programs to identify and support emerging innovators, providing them with not just capital but also the deep technical expertise and industry connections needed to accelerate commercialization. This talent pipeline development is seen as essential for maintaining long-term innovation momentum.

The firm is also pioneering new financial models to scale proven solutions. Rather than relying solely on traditional venture capital approaches, they’re exploring innovative funding mechanisms like water-as-a-service models and blended finance structures that can help de-risk adoption of new technologies. This financial innovation is crucial for bridging the gap between promising solutions and widespread implementation.

Ultimately, Main Sequence’s impact philosophy recognizes that solving global water challenges requires both breakthrough technologies and thoughtful scaling strategies. Their dual focus on rigorous impact measurement and strategic international expansion positions them to drive meaningful progress toward water sustainability while building a thriving innovation ecosystem in Australia.

Final words

Main Sequence stands as a beacon for science-driven water technology investment, demonstrating how deep technical expertise can be successfully paired with venture capital acumen. Their methodical approach to investment, ranging from $100K pre-seed checks to multi-million dollar growth rounds, provides crucial support across the innovation lifecycle. What sets them apart is their unique position as CSIRO’s venture arm, giving them unparalleled access to scientific talent and research breakthroughs. Their co-investment strategy, typically joining forces with 2-3 other investors, helps create robust support networks for portfolio companies. As water challenges intensify globally, Main Sequence’s model of patient, science-backed capital could prove instrumental in scaling the next generation of water technology solutions. Their success suggests that the future of water innovation may well be found in the synthesis of scientific excellence and strategic investment.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!