From digital twins to PFAS remediation, water technology is experiencing unprecedented innovation – and unprecedented need for strategic capital. Enter MAIF Impact, the €120M French impact fund carving out a unique niche at the intersection of water entrepreneurship and sustainable returns. With ticket sizes ranging from €300K to €1.5M and a laser focus on Series A/B rounds, MAIF Impact isn’t just writing checks – they’re carefully selecting and nurturing the next generation of water technology leaders. But what makes their investment approach distinctive? How do they evaluate water opportunities? And most importantly, what can entrepreneurs and co-investors expect when partnering with this rising force in water innovation finance?

MAIF Impact is part of my Ultimate Water Investor Database, check it out!

Investor Name: MAIF Impact

Investor Type: Impact

Latest Fund Size: $130 Million

Dry Powder Available: Yes

Typical Ticket Size: $1M – $3M

Investment Themes: Water Treatment and Quality Improvement, Increasing Water Supply and Access, Decentralized Water Solutions

Investment History: $2262500 spent over 2 deals

Often Invests Along:

Already Invested In: Toopi Organics, vorteX-io

Leads or Follows: Follow

Board Seat Appetite: Unspecified

Key People: Simona Chiavassa

The MAIF Impact Investment Thesis

MAIF Impact’s €120M fund represents a strategic pivot toward water technology investments, underpinned by a rigorous evaluation framework that prioritizes scalable solutions addressing critical water challenges. At the core of their investment thesis lies a dual mandate: generating meaningful financial returns while creating measurable environmental impact.

The fund’s strategic focus centers on three key water technology verticals: water infrastructure optimization, water quality monitoring and treatment, and water resource recovery. Within these verticals, MAIF Impact seeks companies demonstrating proven technological capabilities and clear regulatory alignment, particularly with EU water directives and sustainability frameworks.

The evaluation process weighs multiple criteria, with scalability being paramount. Portfolio companies must demonstrate the ability to expand their solutions across different markets and applications while maintaining operational efficiency. The fund specifically looks for technologies that can achieve at least a 10x scale-up in deployment within five years of investment.

Regulatory alignment forms another crucial pillar of MAIF Impact’s assessment framework. Target companies must not only comply with current regulations but also demonstrate preparedness for anticipated regulatory changes. This forward-looking approach helps insulate investments from regulatory risks while positioning portfolio companies to capitalize on emerging compliance requirements.

MAIF Impact places particular emphasis on solutions that address pressing environmental challenges, especially those related to water scarcity, quality, and resilience. The fund evaluates potential investments through a comprehensive risk assessment lens that considers technical feasibility, market adoption barriers, and impact scalability.

Beyond individual technology assessment, MAIF Impact analyzes market dynamics and competitive positioning. Portfolio companies must demonstrate clear competitive advantages and defensible market positions. The fund favors solutions that create high barriers to entry through patent protection, proprietary data assets, or network effects.

Financial metrics receive equal scrutiny, with a focus on capital efficiency and path to profitability. MAIF Impact seeks companies with clear unit economics and the potential to achieve sustainable margins at scale. The fund typically targets investments in companies with validated commercial traction and proven customer adoption.

This balanced approach to water technology investment reflects MAIF Impact’s conviction that environmental impact and financial returns are increasingly aligned. Their thesis suggests that solutions addressing critical water challenges while meeting stringent investment criteria will deliver both the environmental outcomes and financial performance their stakeholders expect.

From Term Sheet to Partnership

MAIF Impact’s investment process reflects their position as a strategic follow-on investor, prioritizing companies with proven traction and clear paths to scale. The fund typically enters Series B or later rounds, deploying €5-15M per investment while reserving significant capital for follow-on participation.

The due diligence process centers on three key pillars: technology validation, market opportunity, and team capabilities. Before issuing a term sheet, MAIF Impact conducts extensive technical assessments, often engaging third-party experts to validate claims around water treatment efficiency, energy consumption, and operational reliability. This thorough approach, while time-intensive, helps minimize technology risk and builds confidence for follow-on rounds.

When structuring deals, MAIF Impact generally seeks minority stakes between 10-25%, with board observer rights rather than full board seats. This approach allows them to maintain strategic oversight while empowering management teams to drive execution. Their term sheets typically include standard minority protections and information rights, but notably avoid overly restrictive provisions that could hamper future fundraising flexibility.

Beyond capital, MAIF Impact delivers value through their extensive network in the water sector. They actively facilitate introductions to potential customers, especially among European utilities and industrial water users. Their team includes former water industry executives who provide operational guidance, particularly around regulatory compliance and market entry strategies.

The fund has developed a systematic approach to portfolio support, focused on three areas: commercial acceleration, operational excellence, and strategic positioning. Portfolio companies receive quarterly reviews with dedicated investment professionals who help identify and unlock growth opportunities. This hands-on engagement model has proven particularly valuable for companies expanding into new geographic markets or adjacent customer segments.

MAIF Impact also organizes regular portfolio company summits, fostering knowledge sharing and potential collaboration opportunities across their water technology investments. These events have led to several successful commercial partnerships between portfolio companies, creating additional value beyond traditional financial returns.

As highlighted in how to take mid-market green tech companies to the next level, their partnership approach emphasizes patient capital deployment aligned with the longer development cycles typical in water technology. This strategy allows portfolio companies to focus on sustainable growth rather than rushed exits, ultimately leading to better outcomes for both investors and water sector innovation.

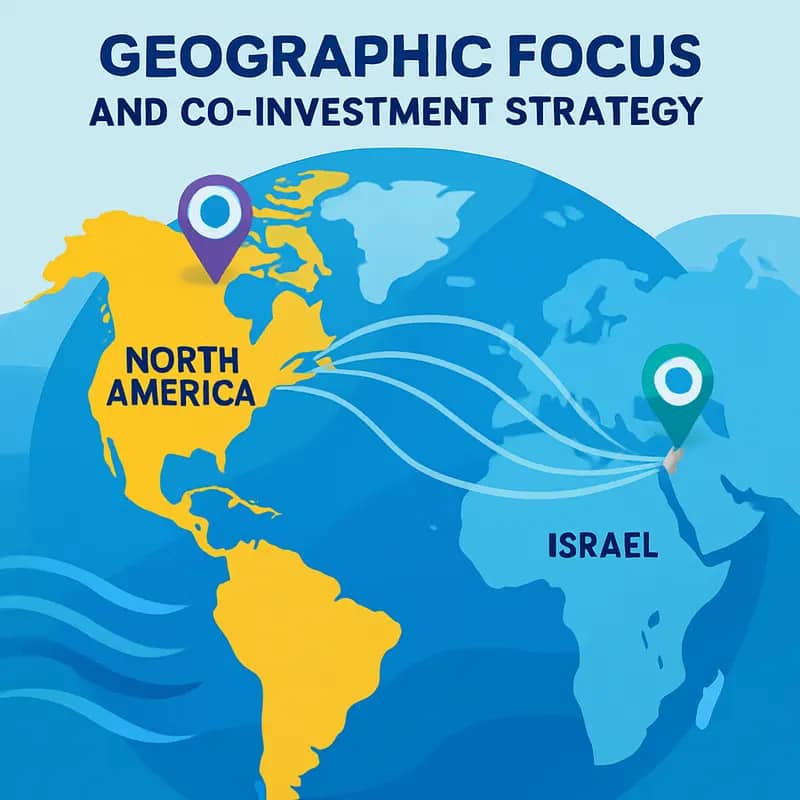

Geographic Focus and Co-Investment Strategy

MAIF Impact’s strategic geographic concentration in North America and Israel stems from these regions’ proven track records in water technology innovation and commercialization. The fund’s presence in these key markets enables privileged access to deal flow while leveraging strong local networks of entrepreneurs, researchers, and industry experts.

In North America, MAIF Impact targets companies addressing critical water infrastructure challenges, particularly those focused on resource recovery, digital solutions, and advanced treatment technologies. The fund’s operations closely align with major water technology hubs like Massachusetts, California, and Ontario, where robust innovation ecosystems exist.

Israel’s position as a global water technology leader makes it a natural focus area. The country’s necessity-driven innovation culture has produced numerous breakthrough technologies in desalination, water reuse, and smart water management. MAIF Impact maintains close relationships with Israeli accelerators and research institutions to identify promising early-stage opportunities.

The fund’s co-investment approach emphasizes partnerships with three distinct profiles. First, strategic corporate investors bring industry expertise and potential customer relationships. These partners typically include established water utilities, engineering firms, and industrial water users who can provide pilot opportunities and market validation.

Second, MAIF Impact regularly collaborates with specialized water technology venture capital firms. These co-investors contribute deep technical due diligence capabilities and often have complementary geographic focuses. The fund particularly values partners with proven track records in scaling water technology companies through various growth stages.

Third, impact-focused investors whose mandates align with MAIF Impact’s sustainability goals round out the co-investment strategy. These partners, including family offices and institutional investors, share MAIF Impact’s long-term perspective on value creation through environmental and social benefits.

Typical partnership structures involve clear alignment on investment horizons, board representation, and follow-on investment rights. MAIF Impact often takes lead investor positions but remains flexible to accommodate strategic co-investors’ requirements. The fund emphasizes transparent communication channels and regular portfolio reviews with co-investors to ensure coordinated support for portfolio companies.

This geographic and co-investment strategy creates a powerful multiplier effect, enabling MAIF Impact to participate in larger deals while maintaining its focus on water technology innovation. The approach has proven particularly effective in bridging the commercialization gap that many water technology companies face when scaling from pilot to full commercial deployment.

The Future of Water Tech Investment

MAIF Impact’s strategic vision for water technology evolution centers on three key transformative trends that will reshape the sector over the next decade. The fund recognizes that water scarcity and climate change are accelerating the need for breakthrough solutions in water efficiency, reuse, and smart infrastructure.

A primary focus area is the convergence of digital technologies with traditional water infrastructure. Machine learning and AI are enabling predictive maintenance, real-time monitoring, and automated optimization of water systems at an unprecedented scale. MAIF Impact is actively seeking startups developing smart sensors, analytics platforms, and digital twins that can dramatically improve operational efficiency while reducing costs.

The fund sees particular promise in technologies enabling circular water economy models. This includes advanced water recycling systems that can transform wastewater into high-purity process water for industrial applications. Beyond just treating water, these solutions often recover valuable resources like nutrients and energy, creating additional revenue streams. MAIF Impact’s portfolio strategy prioritizes companies pioneering closed-loop systems that maximize water reuse while minimizing environmental impact.

The third major trend driving MAIF Impact’s investment thesis is the growing role of nature-based solutions and green infrastructure. Traditional “grey” infrastructure like dams and treatment plants are increasingly being complemented or replaced by constructed wetlands, bioswales, and other natural systems that can filter water, buffer against floods, and enhance ecosystem resilience. The fund is evaluating opportunities to scale these approaches through innovative financing models and technology enablement.

To position their portfolio for these emerging opportunities, MAIF Impact employs a multi-stage investment strategy. Early-stage investments focus on validating novel technologies and business models, while growth-stage funding helps proven solutions achieve rapid commercial scale. The fund maintains deep relationships with utilities, municipalities, and industrial water users to understand evolving market needs and create paths to deployment for portfolio companies.

This forward-looking approach is already yielding results, as highlighted in their recent investments in companies pioneering decentralized water treatment solutions that are reshaping how we think about infrastructure. By maintaining a long-term perspective while remaining responsive to near-term market dynamics, MAIF Impact aims to generate both strong financial returns and meaningful environmental impact.

The MAIF Impact Philosophy

MAIF Impact has pioneered a distinctive approach to water technology investment that seamlessly integrates financial returns with measurable environmental impact. At the core of their €120M fund lies a sophisticated framework that evaluates potential investments through multiple lenses, prioritizing solutions that address critical water challenges while delivering sustainable financial performance.

The fund’s investment thesis centers on three key pillars: water security, infrastructure resilience, and circular economy solutions. MAIF Impact specifically targets technologies that reduce water losses, improve treatment efficiency, enable water reuse, or enhance infrastructure monitoring and management. Their rigorous due diligence process examines not just financial metrics, but also quantifiable environmental benefits such as water savings, energy reduction, and pollution prevention.

What sets MAIF Impact apart is their patient capital approach, which acknowledges the longer development cycles typical in water technology. Rather than pursuing quick exits, they provide strategic support and expertise to help portfolio companies achieve sustainable growth and meaningful impact. This includes active board participation, operational guidance, and facilitating connections with key industry stakeholders.

The fund maintains strict investment criteria that blend commercial viability with impact potential. Portfolio companies must demonstrate proven technology, clear market demand, and scalable business models. Equally important is their ability to deliver measurable environmental benefits aligned with the UN Sustainable Development Goals, particularly SDG 6 (Clean Water and Sanitation) and SDG 13 (Climate Action).

MAIF Impact’s commitment to sustainable development extends beyond individual investments to broader ecosystem support. They actively collaborate with research institutions, industry partners, and policy makers to advance water innovation and create enabling conditions for technology adoption. This systems-level engagement helps derisk investments while accelerating the deployment of impactful solutions.

The fund’s investment strategy reflects a deep understanding of water sector dynamics and emerging opportunities. While maintaining a technology-agnostic approach, they focus on solutions that can be deployed at scale to address pressing challenges like aging infrastructure, climate resilience, and resource recovery. This strategic positioning has enabled them to build a diverse portfolio of complementary technologies that collectively advance water sustainability.

As explored in how to mitigate 4 shades of water risk through impact investing, MAIF Impact’s approach demonstrates how strategic capital allocation can drive both financial returns and positive environmental change in the water sector. Their success provides a blueprint for impact investors seeking to support water innovation while generating sustainable returns.

Portfolio Success Stories

MAIF Impact’s portfolio showcases remarkable innovations in water technology that demonstrate both financial returns and meaningful environmental impact. Several standout companies exemplify the fund’s strategic investment approach and commitment to solving global water challenges.

A pioneering membrane technology company in the portfolio has revolutionized wastewater treatment by reducing energy consumption by 40% while improving water quality. After receiving €8M in Series B funding from MAIF Impact, the company expanded operations across Europe and Asia, now treating over 100 million liters of industrial wastewater daily. This investment generated a 4x return while preventing the release of thousands of tons of pollutants into waterways.

Another portfolio success centers on smart water infrastructure monitoring. This company developed AI-powered sensors that detect leaks and predict maintenance needs across municipal water networks. Their technology helped utilities reduce water losses by an average of 25% and extend infrastructure lifespan by 40%. The company’s rapid growth led to a successful €90M acquisition by a global water technology leader, delivering substantial returns to MAIF Impact while scaling the solution’s environmental benefits.

MAIF Impact also backed an innovative water purification startup using electrochemical treatment to remove emerging contaminants like PFAS from drinking water supplies. The technology proved transformative, achieving 99.9% removal rates while using 60% less energy than conventional methods. The company secured contracts with major utilities and industrial clients, growing revenue by 300% annually for three consecutive years.

Beyond individual successes, MAIF Impact’s portfolio companies collectively contribute to water conservation, quality improvement, and infrastructure resilience. Their technologies help preserve over 500 billion liters of water annually while reducing treatment-related carbon emissions by millions of tons. This powerful combination of commercial success and environmental impact validates MAIF Impact’s thesis that solving water challenges can generate both strong financial returns and measurable positive change.

Interestingly, several portfolio companies have formed strategic partnerships, creating valuable synergies in areas like smart city water management and industrial water reuse. This collaborative approach, actively encouraged by MAIF Impact, accelerates both technology adoption and environmental benefits.

Investment Strategy and Due Diligence

MAIF Impact’s disciplined investment approach combines rigorous financial analysis with deep water sector expertise to identify and nurture promising water technology ventures. The fund employs a multi-layered screening process that evaluates both commercial potential and environmental impact.

The initial assessment begins with technology validation, where MAIF Impact’s technical experts scrutinize the core innovation’s scientific foundations, scalability potential, and competitive advantages. This phase includes extensive pilot data review and independent technical due diligence to verify performance claims. Teams must demonstrate clear technological differentiation and robust intellectual property protection.

Market opportunity analysis forms the second evaluation layer, examining total addressable market size, competitive landscape, and go-to-market strategy. MAIF Impact prioritizes solutions addressing critical water challenges like infrastructure efficiency, water quality, and resource recovery. The fund’s analysts model various market penetration scenarios and validate key assumptions through customer interviews and industry expert consultations.

Leadership team assessment receives particular attention, as MAIF Impact views strong management as crucial for successful technology commercialization. Beyond evaluating technical and business expertise, the team examines founders’ ability to adapt strategies, build strategic partnerships, and maintain focus through challenges.

Risk evaluation encompasses multiple dimensions including technology risk, market risk, regulatory risk, and execution risk. MAIF Impact develops detailed risk mitigation strategies for each portfolio company, often leveraging its extensive network to provide strategic support. The fund maintains a balanced portfolio approach, combining established growth-stage companies with select early-stage opportunities.

Impact measurement forms an integral part of the investment process, not an afterthought. MAIF Impact has developed a proprietary framework aligned with UN Sustainable Development Goals to quantify environmental and social outcomes. Key metrics include water savings, energy reduction, pollution prevention, and climate resilience benefits. Portfolio companies must demonstrate clear impact pathways and commit to regular impact reporting.

The final investment decision synthesizes all evaluation components, considering both potential returns and strategic fit within the portfolio. Post-investment, MAIF Impact maintains active engagement with portfolio companies, providing operational support, facilitating strategic partnerships, and monitoring progress against established milestones.

Future Vision and Market Outlook

MAIF Impact’s strategic vision for the future of water technology investment reflects both ambitious goals and pragmatic market awareness. With climate change intensifying water scarcity globally, the fund recognizes unprecedented opportunities in water innovation while maintaining a clear-eyed view of implementation challenges.

For the next investment cycle, MAIF Impact plans to double down on technologies addressing three critical market needs: water reuse and recycling solutions, smart infrastructure for leak detection and prevention, and energy-efficient treatment processes. The fund anticipates that regulatory pressures and resource constraints will drive rapid adoption of these solutions, particularly in water-stressed regions.

A key element of MAIF Impact’s forward strategy centers on fostering collaboration between portfolio companies and established utilities. This ecosystem-building approach aims to accelerate the typically slow adoption cycles in the water sector. By connecting innovators directly with end-users early in the development process, the fund helps derisk new technologies while ensuring market fit.

However, MAIF Impact’s leadership acknowledges several persistent challenges facing water technology scale-up. Fragmented regulatory frameworks continue to complicate market entry, while conservative utility procurement practices often favor conventional solutions over innovations. To address these barriers, the fund is developing new investment structures that provide longer runway periods and technical support resources for portfolio companies navigating complex stakeholder environments.

Looking ahead, MAIF Impact sees particular promise in technologies that sit at the intersection of water and energy efficiency, reflecting growing market demand for solutions that address both water security and climate action. The fund’s analysis suggests that integrated water-energy technologies could represent a €50 billion market opportunity by 2030.

MAIF Impact’s role in shaping the water innovation ecosystem extends beyond direct investments. The fund actively works with policy makers and industry groups to advocate for regulatory frameworks that incentivize water technology adoption. This systems-level engagement aims to create more favorable conditions for scaling promising solutions.

Ultimately, MAIF Impact’s future vision centers on catalyzing a transformation in how water resources are managed and valued. By strategically deploying capital alongside ecosystem support, the fund seeks to accelerate the transition to more sustainable and resilient water systems. Their approach recognizes that while technology innovation is crucial, successful market integration requires carefully orchestrated collaboration across the entire water sector value chain.

Final words

As water challenges intensify globally, MAIF Impact’s strategic approach to water technology investment offers a compelling model for both entrepreneurs and co-investors. Their focused ticket sizes, geographic specialization, and emphasis on Series A/B rounds position them uniquely in the water innovation ecosystem. For entrepreneurs, MAIF Impact represents more than capital – they offer a partnership approach that balances strategic guidance with operational independence. For co-investors, their track record of thoughtful follow-on investing and sector expertise makes them a valuable syndicate partner. As water technology continues its rapid evolution, MAIF Impact’s €120M fund stands ready to support solutions that combine commercial viability with meaningful environmental impact. Their investment thesis, centered on scalable technologies and regulatory alignment, provides a framework for evaluating opportunities that’s both rigorous and forward-looking. Whether you’re a water entrepreneur seeking growth capital or an impact investor looking for co-investment opportunities, understanding MAIF Impact’s approach offers valuable insights into the future of water technology investment.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!