From the shores of Lake Zurich emerges Lakestar, a venture capital powerhouse that’s quietly reshaping how we monitor and manage Earth’s most precious resource. With €2 billion under management and a sharp focus on technology-driven solutions, this Swiss firm has positioned itself at the intersection of space technology and water conservation. Their groundbreaking investment in constellr, a pioneer in satellite-based crop water monitoring, signals a bold vision: leveraging cutting-edge technology to solve age-old water challenges. For water entrepreneurs and impact investors seeking to understand where smart money is flowing in the water tech space, Lakestar’s strategic moves offer compelling insights into the future of water resource management.

Lakestar is part of my Ultimate Water Investor Database, check it out!

Investor Name: Lakestar

Investor Type: VC

Latest Fund Size: $600 Million

Dry Powder Available: Yes

Typical Ticket Size: $30M – $75M

Investment Themes: Digital monitoring / twins, Agricultural water efficiency, N/A

Investment History: $1988888.89 spent over 2 deals

Often Invests Along: Amathaon Capital, EIT Food, FTTF, Natural Ventures, Vsquared

Already Invested In: constellr

Leads or Follows: Lead

Board Seat Appetite: Moderate

Key People: Manu Gupta

The Digital Water Visionaries

At the intersection of technological innovation and water resource management, Lakestar has emerged as a pioneering force in European venture capital. The Swiss firm’s recent €600 million fund raise signals a decisive shift toward digitally-enabled solutions in the water sector, marking a new chapter in resource stewardship.

Lakestar’s investment thesis centers on the transformative power of digital technologies to revolutionize water management. The firm recognizes that traditional infrastructure-heavy approaches are insufficient to address mounting water challenges. Instead, they target companies leveraging artificial intelligence, satellite technology, and advanced analytics to optimize water usage and distribution.

This digital-first philosophy stems from a deep understanding that water challenges require precision, predictability, and real-time adaptation. By investing in companies that harness space-based monitoring systems and smart sensors, Lakestar is building a portfolio that can detect leaks, forecast water demand, and optimize treatment processes with unprecedented accuracy.

What sets Lakestar’s approach apart is their emphasis on scalable digital solutions that can be deployed across diverse geographical contexts. Rather than focusing solely on hardware innovations, they prioritize investments in software platforms that can integrate with existing infrastructure, effectively creating a digital nervous system for water management.

The firm’s strategic focus extends beyond immediate technological capabilities to encompass long-term sustainability goals. Their investment strategy aligns with growing evidence that digital transformation can drive both environmental benefits and financial returns, creating a virtuous cycle of sustainable water management.

Lakestar’s portfolio reflects a careful balance between ambitious innovation and practical implementation. They seek out companies that don’t just offer incremental improvements but rather fundamental reimaginings of how water resources can be monitored, managed, and preserved. This approach has positioned them to capitalize on the increasing convergence of space technology and water management.

As climate change continues to stress water systems worldwide, Lakestar’s emphasis on digital solutions becomes increasingly relevant. Their investments are helping to create a new paradigm where data-driven decision-making and real-time monitoring become standard practice in water resource management.

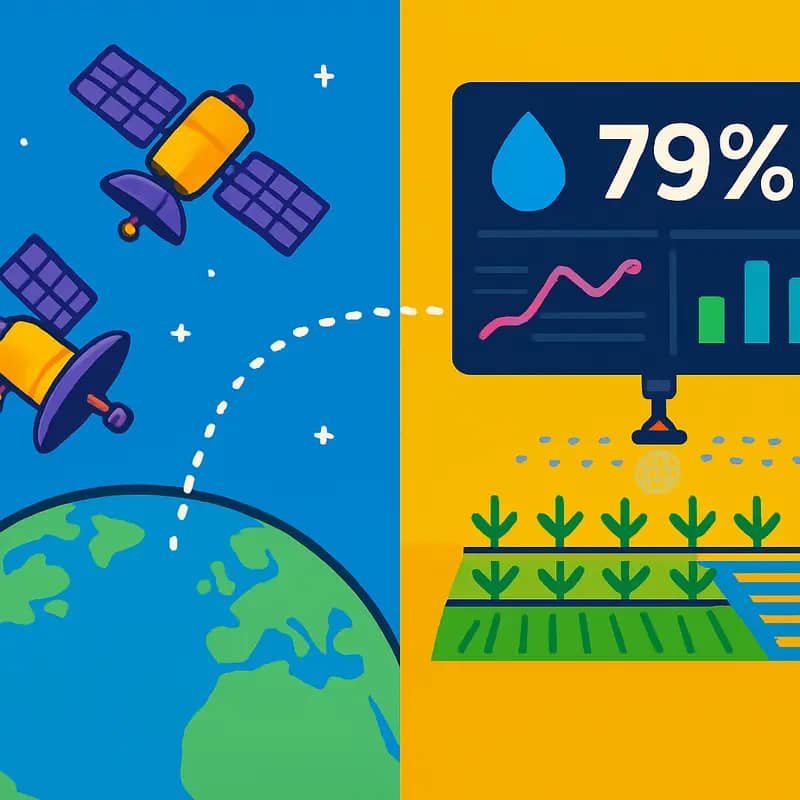

Space-Age Water Monitoring

Lakestar’s investment in constellr marks a pivotal advancement in agricultural water management through space-based monitoring technology. By leveraging thermal infrared imaging satellites, constellr provides unprecedented visibility into crop water stress and irrigation needs across vast agricultural regions.

The technology works by measuring land surface temperature and thermal signatures from space, enabling precision monitoring of water stress in crops with remarkable accuracy. This space-based approach allows farmers to optimize irrigation timing and volume with previously impossible precision. Early detection of water stress enables proactive rather than reactive irrigation management.

The potential impact of this technology on global water conservation is profound. Agriculture accounts for roughly 70% of global freshwater withdrawals, with significant inefficiencies in traditional irrigation practices. constellr’s satellite monitoring system can reduce agricultural water consumption by up to 30% while maintaining or improving crop yields.

Beyond individual farm operations, the technology provides valuable data for regional water resource planning. Water managers can track moisture patterns across entire watersheds, predict drought conditions, and allocate resources more effectively. This systems-level view enables better coordination between agricultural, urban, and environmental water needs.

The scalability of satellite monitoring represents a crucial advantage. Unlike ground-based sensors that require extensive infrastructure, satellite coverage can expand rapidly to new regions. A single satellite can monitor millions of hectares, making the technology particularly valuable for developing regions where traditional monitoring infrastructure is limited.

The environmental benefits extend beyond water conservation. More efficient irrigation reduces energy consumption for water pumping and helps prevent soil degradation from over-irrigation. The technology also supports climate resilience by helping farmers adapt irrigation practices to changing weather patterns.

Lakestar’s investment reflects a growing recognition that space technology will play a vital role in addressing global water challenges. As climate change intensifies pressure on water resources, the ability to monitor and optimize water use at scale becomes increasingly critical. Through strategic investments in companies like constellr, Lakestar is helping to build the infrastructure for more sustainable water management in the 21st century.

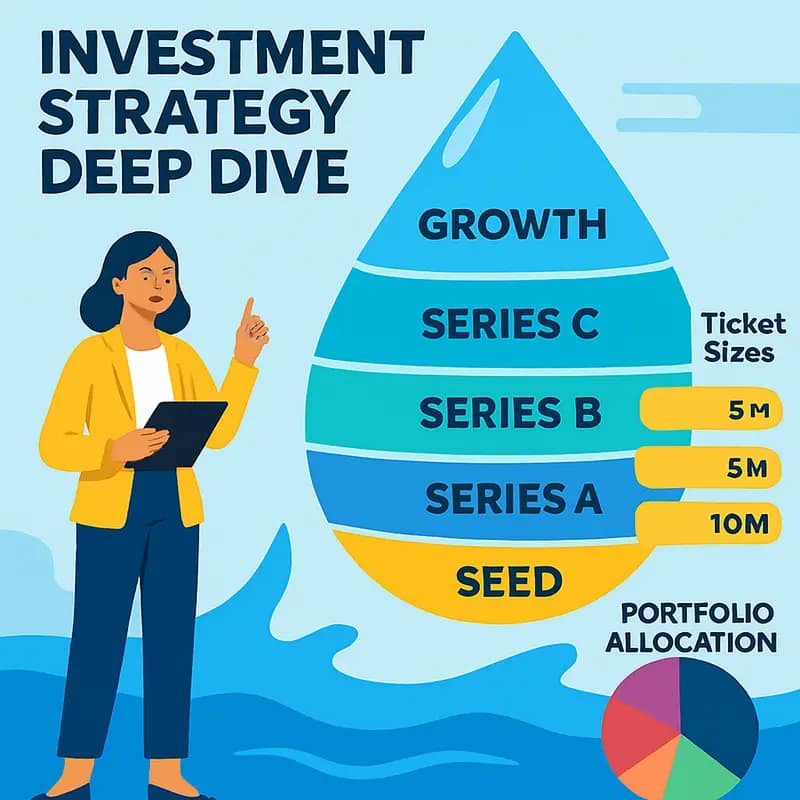

Investment Strategy Deep Dive

Lakestar’s investment approach in water technology reveals a sophisticated strategy balancing bold vision with measured execution. The firm’s average ticket size of $49 million positions them squarely in the growth capital space, enabling portfolio companies to achieve meaningful scale while maintaining operational flexibility.

The firm’s stage-agnostic philosophy, spanning from seed to post-Series B rounds, demonstrates their commitment to nurturing innovation throughout the entire company lifecycle. This versatility allows Lakestar to identify promising water technologies early while also supporting established companies ready to expand their impact. Their high lead ratio of 60-70% indicates a preference for taking significant ownership positions and driving investment terms.

What sets Lakestar’s water investment strategy apart is their focus on companies leveraging digital innovation and advanced technology to solve complex water challenges. Rather than pursuing traditional infrastructure plays, they target ventures applying cutting-edge approaches like AI, IoT, and advanced analytics to water resource management. This aligns with their broader thesis that technology convergence will fundamentally reshape how we monitor, distribute, and optimize water usage.

Their portfolio construction reflects a deliberate balance between risk and potential impact. Early-stage investments typically receive smaller check sizes but benefit from Lakestar’s extensive operational support and industry connections. Later-stage deals command larger capital commitments and often involve co-investment partnerships with strategic players in the water sector.

Lakestar has developed a reputation for patient capital deployment, recognizing that water technology companies often require longer development cycles than traditional software startups. This longer-term perspective is evidenced in their typical investment horizon of 5-7 years, allowing portfolio companies sufficient runway to achieve technological validation and market penetration.

The firm’s due diligence process places particular emphasis on evaluating both the technological innovation and practical implementation potential of water solutions. They assess not only the core technology but also its scalability, regulatory compliance pathway, and potential for integration with existing water infrastructure. This thorough evaluation approach helps explain their strong track record in identifying promising water technology investments.

Their investment strategy dovetails naturally with the growing emphasis on environmental sustainability and water security. As explored in how to mitigate 4 shades of water risk through impact investing, this approach positions them to capitalize on increasing institutional interest in water technology solutions while delivering meaningful environmental impact.

Partnership Philosophy

Lakestar’s partnership approach stands out through its deeply collaborative engagement model with portfolio companies. Rather than taking a rigid stance on board representation, the firm adopts a flexible approach tailored to each investment’s unique needs and growth stage.

The VC firm’s engagement philosophy centers on being an active yet nimble partner. While maintaining strong oversight through regular strategic reviews and performance monitoring, Lakestar avoids micromanaging day-to-day operations. This balanced approach allows portfolio companies to preserve their operational autonomy while benefiting from the firm’s extensive network and expertise in scaling water technology businesses.

In their co-investment strategy, Lakestar has forged strong relationships with institutional investors like Aviva Investors, particularly in later-stage deals. These partnerships enable larger funding rounds while bringing complementary sector expertise and network access. The firm’s collaborative mindset extends to working constructively with co-investors, often taking the lead in structuring deals and coordinating syndicate dynamics.

A distinctive aspect of Lakestar’s partnership model is their emphasis on cross-portfolio synergies. The firm actively facilitates connections between portfolio companies, creating opportunities for technical collaboration, market access sharing, and joint ventures. This network effect has proven especially valuable in the water sector, where integrated solutions often deliver the most impact.

Lakestar’s hands-on support focuses particularly on helping portfolio companies navigate complex regulatory environments and secure strategic partnerships with utilities and industrial players. Their team includes seasoned water industry veterans who provide practical guidance on compliance, procurement processes, and stakeholder management.

The firm has pioneered several innovative partnership structures that align incentives between investors and founders for long-term value creation. Rather than pushing for quick exits, Lakestar often takes a patient capital approach, supporting companies through multiple growth phases while maintaining significant ownership stakes.

This partnership philosophy has proven particularly effective in the water sector, where technology adoption cycles tend to be longer and stakeholder alignment is crucial for success. By taking a flexible yet deeply engaged approach, Lakestar has established itself as a trusted partner for water technology innovators seeking both capital and strategic support.

The Genesis of a Water Tech Pioneer

When Klaus Hommels founded Lakestar in Zurich in 2012, few could have predicted the firm’s dramatic evolution from a traditional technology investor into one of Europe’s most innovative forces in water technology investment. The transformation began in 2018 when Lakestar’s analysts identified an overlooked opportunity at the intersection of space technology and water resource management.

This pivotal insight emerged from studying satellite data’s potential to revolutionize water infrastructure monitoring. Rather than viewing water challenges through a conventional lens, Lakestar recognized that space-based observations could provide unprecedented visibility into water systems, from detecting leaks to monitoring watershed health.

The firm’s watershed moment came through their first water tech investment in 2019, backing a startup that used satellite imagery and AI to detect water infrastructure anomalies. This initial success catalyzed a strategic shift, with Lakestar methodically building expertise in water technology evaluation and actively seeking out innovators addressing global water challenges.

What distinguished Lakestar’s approach was their unique blend of technological sophistication and environmental impact assessment. Rather than treating water investments as purely environmental plays, they approached each opportunity through the dual lenses of technological innovation and sustainability. This framework enabled them to identify solutions that could deliver both strong financial returns and meaningful environmental impact.

By 2021, Lakestar had established a dedicated water technology investment vertical, with a particular focus on digital solutions for water resource optimization. Their investment thesis centered on technologies that could enable predictive maintenance, real-time monitoring, and data-driven decision making in water infrastructure management.

The firm’s evolution reflects a broader shift in venture capital, where environmental imperatives increasingly align with technological opportunities. As climate change intensifies water scarcity and infrastructure challenges, Lakestar’s early recognition of water technology’s strategic importance has positioned them as thought leaders in the space.

Perhaps most significantly, Lakestar has helped reshape how the investment community views water technology opportunities. Rather than viewing water investments as slow-moving utility plays, they’ve demonstrated how technological innovation can unlock rapid scaling and attractive returns while addressing critical environmental challenges.

Their portfolio now spans the spectrum of water innovation, from advanced filtration technologies to AI-powered infrastructure management platforms. This diversified yet focused approach has established Lakestar as a crucial bridge between Europe’s technical expertise and the growing global demand for water technology solutions.

Portfolio Deep Dive: Where Tech Meets Water

Lakestar’s water technology portfolio represents a carefully curated ecosystem of solutions targeting the water sector’s most pressing challenges. The firm’s investments span across three key domains: advanced monitoring systems, resource optimization platforms, and breakthrough treatment technologies.

At the core of Lakestar’s selection criteria lies a unique blend of technological innovation and market readiness. The firm specifically seeks solutions that leverage cutting-edge capabilities like satellite-based monitoring, artificial intelligence, and advanced materials science while maintaining clear paths to commercial deployment. This dual focus has enabled portfolio companies to achieve both technological breakthroughs and meaningful market traction.

Space technology forms a particular strength in Lakestar’s portfolio approach. By backing ventures that utilize satellite data and remote sensing, the firm has helped pioneer new methods for water resource mapping, leak detection, and quality monitoring at unprecedented scales. These innovations have proven especially valuable for water utilities and agricultural operations managing vast infrastructure networks.

Data analytics represents another crucial investment theme. Lakestar has strategically backed companies developing artificial intelligence and machine learning solutions that transform raw water data into actionable insights. These platforms help utilities optimize their operations, predict maintenance needs, and improve resource allocation – delivering both environmental and economic benefits.

Beyond individual investments, Lakestar has played an instrumental role in fostering collaboration across its portfolio. The firm regularly facilitates technology partnerships and knowledge sharing between portfolio companies, creating powerful synergies that accelerate innovation. This collaborative approach has helped establish new industry standards and best practices for water technology deployment.

Lakestar’s influence extends beyond direct investments through active industry engagement and advocacy. The firm has helped shape water technology policy discussions and standards development, particularly around emerging areas like digital water management and satellite-based monitoring. As explored in how to leverage water risk assessment to unlock business opportunities, this broader market-building activity has been crucial for the sector’s development.

The success of Lakestar’s portfolio approach is evident in the growing adoption of its companies’ technologies by major utilities, industrial users, and agricultural operations worldwide. Several portfolio companies have achieved significant scale, with technologies now managing billions of gallons of water daily across multiple continents. These implementations have demonstrated both the technical validity and commercial viability of next-generation water solutions.

The Lakestar Investment Philosophy

At the core of Lakestar’s water technology investment approach lies a sophisticated framework that merges traditional venture capital principles with specialized water sector expertise. The firm’s investment philosophy centers on identifying technologies that not only promise substantial returns but also deliver measurable environmental impact through improved water resource management.

Lakestar’s due diligence process stands out for its three-pillar evaluation system. First, they assess technical innovation through detailed engineering reviews and pilot study analysis. Their team of water experts examines each solution’s scalability, energy efficiency, and operational reliability under various conditions. Second, they evaluate market potential by analyzing regulatory landscapes, competitive dynamics, and adoption barriers across different regions. Third, they scrutinize the founding team’s capability to execute their vision while adapting to the water sector’s unique challenges.

What truly distinguishes Lakestar is their value-addition strategy that extends far beyond capital injection. The firm has developed an extensive network of water utilities, industrial users, and regulatory bodies across Europe. This network serves as a powerful platform for their portfolio companies to validate technologies, secure pilot projects, and accelerate commercial deployment. As detailed in How to Win at Negotiating with the Most Powerful Stakeholders, such relationships prove crucial in navigating the complex stakeholder landscape of water infrastructure.

Their support system includes dedicated technical advisors who help portfolio companies optimize their solutions for specific market applications. These advisors also facilitate knowledge transfer between portfolio companies, creating valuable synergies and accelerating the learning curve for early-stage ventures.

Lakestar’s investment thesis particularly favors technologies that leverage data analytics and artificial intelligence to enhance water infrastructure efficiency. They seek solutions that can demonstrate clear cost advantages while delivering environmental benefits, such as reduced energy consumption or improved water quality monitoring. This dual focus on economic and environmental returns reflects their belief that sustainable water management must be commercially viable to achieve widespread adoption.

The firm maintains a patient capital approach, acknowledging the longer development cycles typical in water technology. However, they actively work with portfolio companies to identify and capture early revenue opportunities, often through strategic partnerships with established industry players. This balanced approach helps startups maintain momentum while developing more comprehensive solutions.

Lakestar’s risk mitigation strategy includes structured milestone-based funding, ensuring that capital deployment aligns with technical and commercial progress. They actively participate in subsequent funding rounds, often leading follow-on investments for their most promising portfolio companies. This continued support provides stability and confidence to other potential investors, helping portfolio companies attract additional capital for scaling operations.

Future Horizons: Lakestar’s Vision for Water Tech

Lakestar’s strategic vision for water technology investment centers on three transformative pillars that will reshape resource management over the next decade. The Swiss venture capital firm sees unprecedented opportunities at the intersection of space technology, artificial intelligence, and distributed infrastructure.

Satellite-enabled water monitoring stands as a cornerstone of Lakestar’s future investment thesis. Advanced Earth observation capabilities, coupled with machine learning, will enable unprecedented visibility into water resources, from tracking agricultural water use to detecting contamination in real-time. This space-to-ground integration promises to revolutionize how utilities and industries manage water assets.

The firm’s second focus area involves autonomous systems and AI-driven operations. Lakestar anticipates that predictive analytics will transform infrastructure maintenance, while automated treatment processes will optimize resource efficiency. Smart sensors and edge computing will enable decentralized decision-making, reducing response times and operating costs across water networks.

Most significantly, Lakestar is betting big on distributed water infrastructure. The firm envisions a future where centralized treatment plants are complemented by networks of smaller, localized systems. This shift enables more resilient water supplies while opening new markets for innovative treatment technologies. Modular, plug-and-play solutions will allow rapid deployment in both urban and rural settings.

Beyond individual technologies, Lakestar seeks to catalyze system-level transformation. The firm actively evaluates startups developing interoperable platforms that can integrate diverse water technologies into cohesive solutions. This systems approach reflects their belief that the future of water management requires orchestrating multiple innovations rather than isolated breakthroughs.

Looking ahead, Lakestar sees climate resilience as a key driver of water technology adoption. Rising temperatures and extreme weather events will stress existing infrastructure, creating urgent demand for adaptive solutions. The firm prioritizes technologies that enhance system flexibility while reducing energy intensity and environmental impact.

Critically, Lakestar’s investment strategy emphasizes scalability and commercial viability alongside technical innovation. The firm seeks solutions that can rapidly achieve market penetration through compelling economic benefits, recognizing that widespread adoption is essential for meaningful impact on global water challenges.

Final words

As the water technology landscape evolves, Lakestar stands out as a forward-thinking investor that recognizes the transformative potential of digital and space-based solutions. Their strategic focus on technology-driven water management, exemplified by investments like constellr, demonstrates a sophisticated understanding of how innovation can address global water challenges. With substantial dry powder available and a proven track record of leading investments, Lakestar is well-positioned to continue shaping the future of water resource management. For water entrepreneurs developing cutting-edge solutions and impact investors seeking aligned partners, Lakestar represents a compelling combination of technological vision and practical execution. Their approach suggests that the future of water management lies not just in traditional infrastructure, but in the intelligent application of digital technology and space-based monitoring systems. As water scarcity becomes an increasingly pressing global challenge, Lakestar’s investment thesis might just provide the blueprint for sustainable water management in the 21st century.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!