Deep in the heart of Auckland, a venture capital powerhouse quietly cultivates New Zealand’s water innovation ecosystem. K1W1, founded by Sir Stephen Tindall, has deployed over $350 million across 175 companies, becoming an instrumental force in scaling water technology solutions. While maintaining a characteristically understated Kiwi approach, K1W1’s strategic focus on later-stage rounds and significant ticket sizes of $10-50 million has created a unique model that bridges the gap between early innovation and market-ready solutions. For water entrepreneurs and impact investors alike, understanding K1W1’s investment philosophy and operational approach offers valuable insights into successfully navigating the oceanic opportunities in water technology.

K1W1 is part of my Ultimate Water Investor Database, check it out!

Investor Name: K1W1

Investor Type: VC

Latest Fund Size: $350 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: water utilities & infrastructure, water quality and treatment tech, ESG integration

Investment History: $4226666.67 spent over 3 deals

Often Invests Along: DCVC

Already Invested In: Aquafortus Technologies, Croptide

Leads or Follows: Follow

Board Seat Appetite: Rare

Key People: Stephen Tindall, Robbie Tindall

The Strategic Evolution of K1W1

K1W1’s transformation from a local New Zealand investment firm to a pivotal force in water technology innovation exemplifies strategic foresight and calculated progression. Founded in the early 1990s amidst New Zealand’s emerging tech scene, K1W1 initially focused on backing homegrown ventures across various sectors. However, the firm’s leadership recognized water technology’s critical role in addressing global environmental challenges.

The firm’s water technology journey began through strategic co-investments with established players, allowing K1W1 to build expertise while managing risk. Their approach prioritized technologies addressing water scarcity, treatment efficiency, and infrastructure modernization. This careful positioning helped K1W1 develop a sophisticated understanding of water technology market dynamics and potential growth trajectories.

By the mid-2000s, K1W1 had refined its investment thesis in the water sector, focusing on scalable solutions with demonstrable environmental impact. The firm’s portfolio expanded to include innovations in membrane technology, smart monitoring systems, and water conservation solutions. Rather than pursuing quick exits, K1W1 adopted a patient capital approach, providing portfolio companies the runway needed to perfect their technologies and establish market presence.

A defining characteristic of K1W1’s evolution has been its emphasis on cross-border collaboration. The firm actively sought partnerships with international water technology clusters, particularly in Israel and Singapore, creating valuable knowledge exchange pathways and market access opportunities for portfolio companies. This global perspective, combined with deep local market understanding, positioned K1W1 as a bridge between New Zealand’s innovation ecosystem and international water technology markets.

Today, K1W1’s influence in water technology extends beyond capital deployment. The firm has become a trusted advisor to water technology startups, leveraging its extensive network to facilitate commercial partnerships and market entry strategies. Their portfolio companies benefit from K1W1’s accumulated expertise in navigating regulatory frameworks and securing strategic partnerships with utilities and industrial users.

The firm’s success in water technology investment has attracted co-investment from major international players, validating its approach and amplifying its impact. K1W1’s evolution reflects a broader shift in investment attitudes toward water technology, demonstrating how patient capital, coupled with sector expertise, can drive meaningful innovation in critical environmental sectors.

Particularly noteworthy is K1W1’s role in fostering water technology clusters within New Zealand, creating a virtuous cycle of innovation and investment. This ecosystem-building approach has helped establish New Zealand as an emerging hub for water technology development, attracting international attention and investment.

Investment Philosophy: The Smart Money Approach

K1W1’s investment strategy stands apart through its deliberate focus on follower positions and strategic co-investment partnerships. Rather than pursuing lead investor roles, K1W1 has crafted a sophisticated approach that leverages the strengths of collaboration while minimizing exposure to early-stage risks.

At the core of K1W1’s philosophy lies the concept of smart money deployment. The firm prioritizes investments alongside established venture capital firms and corporate partners, allowing them to benefit from the due diligence and industry expertise of leading players while maintaining significant influence over investment decisions. This approach has proven particularly effective in the water technology sector, where technical complexity and long commercialization cycles demand deep domain knowledge.

The follower position strategy serves multiple purposes. First, it enables K1W1 to validate investment opportunities through the lens of experienced lead investors who have conducted thorough market analysis and technical evaluations. Second, it creates a natural ecosystem of co-investors who can provide additional capital and strategic support during future funding rounds.

K1W1’s co-investment partnerships are carefully structured to maximize value creation. The firm maintains a network of strategic partners across the water industry, including utilities, engineering firms, and technology providers. These relationships not only provide valuable market insights but also create potential pathways for portfolio companies to access customers and scale their solutions.

The firm’s investment criteria reflect this measured approach. K1W1 typically enters deals at the Series A stage or later, when companies have demonstrated market traction and reduced technical risk. This timing allows them to leverage the validation provided by early investors while still capturing significant upside potential.

Unlike traditional venture capital firms that may push for rapid scaling and quick exits, K1W1 maintains a patient capital perspective aligned with the water sector’s longer development cycles. They understand that water technology innovations often require extended periods for testing, regulatory approval, and market adoption.

This disciplined investment philosophy has proven particularly valuable in navigating the water technology landscape, where many promising innovations struggle to bridge the commercialization gap. By focusing on companies that have already attracted institutional investment and strategic interest, K1W1 can better assess market readiness and reduce investment risk while still participating in transformative water technology solutions.

The firm’s co-investment approach also creates natural alignment with their portfolio companies’ growth trajectories. Rather than imposing aggressive timelines or exit pressures, K1W1 can support sustainable scaling that matches the market’s absorption capacity for new water technologies. This patient yet strategic deployment of capital has become a hallmark of their investment philosophy, setting them apart in the water technology investment landscape.

Water Technology Focus Areas

K1W1’s strategic investments in water technology encompass several key focus areas that align with pressing global water challenges. At the forefront is their emphasis on water infrastructure optimization and smart water management systems. The firm recognizes that aging infrastructure and inefficient water distribution networks contribute significantly to water losses worldwide, making this a critical investment priority.

Water quality monitoring and treatment technologies form another cornerstone of K1W1’s investment portfolio. With growing concerns about emerging contaminants and stricter regulatory requirements, the firm targets innovations in advanced treatment processes, real-time monitoring systems, and predictive analytics for water quality management. These investments directly address the rising demand for safe drinking water and effective wastewater treatment solutions.

Resource recovery and circular economy initiatives represent a forward-thinking focus area. K1W1 actively seeks technologies that can extract valuable resources from wastewater streams, including nutrients, energy, and rare minerals. This approach aligns with global sustainability goals while creating new revenue streams for water utilities.

Climate resilience technologies have emerged as a crucial investment theme. K1W1 recognizes that climate change impacts water availability and quality worldwide. Their investments in this space include drought-resistant water solutions, flood management systems, and technologies that reduce the water sector’s carbon footprint.

Digital transformation stands as a cross-cutting theme across K1W1’s water technology investments. The firm targets solutions that leverage artificial intelligence, Internet of Things (IoT), and advanced data analytics to optimize water operations. These digital solutions enable predictive maintenance, reduce operational costs, and improve asset management efficiency.

Notably, K1W1’s investment approach in these focus areas demonstrates a keen understanding of market dynamics and regulatory trends. The firm particularly values technologies that offer multiple benefits – such as solutions that simultaneously address water quality, energy efficiency, and resource recovery. This strategic alignment with market needs and global challenges has positioned K1W1 as a significant force in shaping the future of water technology.

K1W1’s water technology investments reflect a deep appreciation for scalable solutions that can be deployed across different geographical and regulatory contexts. By focusing on these core areas, the firm not only addresses immediate water challenges but also helps build resilient water infrastructure for future generations.

Future Trajectories and Opportunities

K1W1’s strategic positioning in New Zealand’s water technology landscape opens compelling pathways for future investment and collaboration. The fund’s proven track record in water innovation creates a unique platform for entrepreneurs and co-investors to participate in addressing global water challenges.

A key opportunity lies in scalable water treatment solutions that combine resource efficiency with cost-effectiveness. As highlighted in research on smart investment strategies, early-stage water technology companies offering modular, adaptable solutions are particularly attractive for investment consideration.

K1W1’s future investment focus encompasses several promising areas:

Digital Water Solutions

The integration of artificial intelligence and machine learning into water management presents significant growth potential. Smart monitoring systems, predictive maintenance, and automated treatment processes offer compelling investment opportunities while addressing operational efficiency challenges.

Climate Resilience Technologies

As climate change impacts intensify, technologies focusing on drought resilience, flood management, and water reuse will become increasingly critical. Investment opportunities in this space include advanced filtration systems, water storage solutions, and innovative distribution technologies.

Resource Recovery Innovations

The circular economy approach to water management continues to gain traction. Technologies that extract valuable resources from wastewater streams, including nutrients, energy, and rare materials, represent a growing market segment with substantial return potential.

For Entrepreneurs and Co-investors

K1W1’s investment framework provides several advantages:

- Access to established networks within the water technology ecosystem

- Technical validation support through partnerships with research institutions

- Strategic guidance in navigating regulatory frameworks

- Opportunities for international market expansion

The fund’s collaborative approach to investment creates opportunities for co-investors to participate in deals with thoroughly vetted technical and commercial potential. This model helps mitigate risks while maximizing the potential for successful commercialization.

Market Evolution Considerations

The water technology market’s maturation presents both opportunities and challenges. While competition for quality deals intensifies, the expanding market size and growing urgency of water challenges create numerous entry points for strategic investment. K1W1’s position as a specialized water technology investor provides unique advantages in deal sourcing and evaluation.

Successful water technology investments will increasingly require:

- Strong intellectual property protection

- Clear paths to market adoption

- Scalable business models

- Demonstrated environmental and social impact

- Robust risk management strategies

K1W1’s future trajectory aligns with these requirements, positioning the fund and its partners to capitalize on emerging opportunities while contributing to solutions for global water challenges.

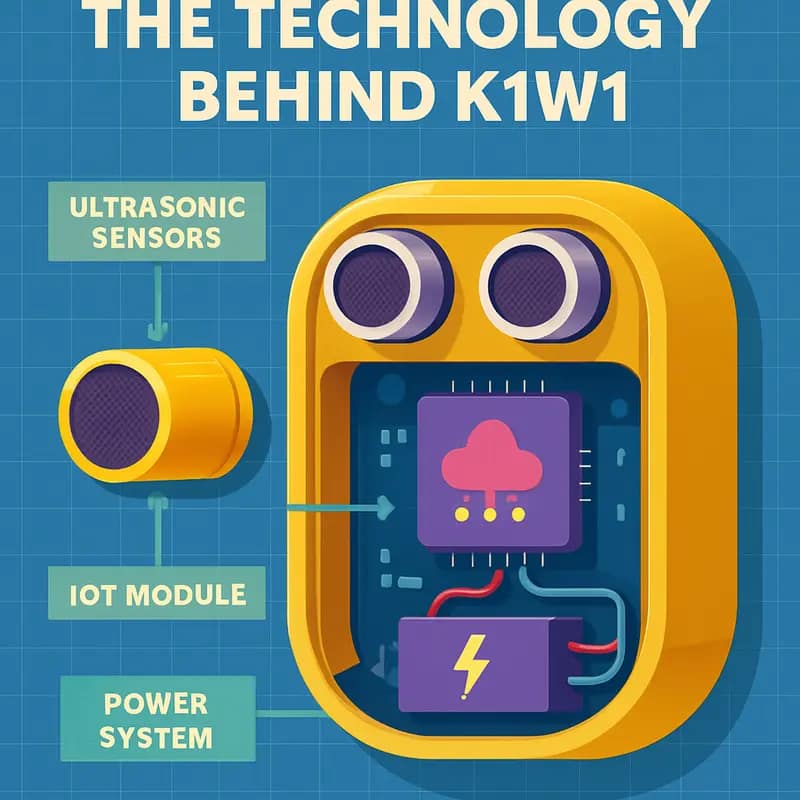

The Technology Behind K1W1

At the heart of K1W1’s groundbreaking water innovation lies an intricate ecosystem of advanced technologies working in seamless harmony. The system’s foundation rests on a network of ultra-precise ultrasonic sensors, each capable of detecting flow variations as minute as 0.1 liters per hour. These sensors employ piezoelectric crystals that generate high-frequency sound waves, measuring both transit time and doppler shift to deliver unprecedented accuracy in flow measurement.

What truly sets K1W1’s technology apart is its sophisticated signal processing algorithm. Raw sensor data passes through multiple layers of noise filtering and pattern recognition before being transformed into actionable insights. The system’s machine learning capabilities allow it to distinguish between normal usage patterns and potential anomalies, becoming more precise over time as it learns from each facility’s unique characteristics.

The cloud-based analytics platform serves as the system’s neural center, processing millions of data points hourly through a distributed computing architecture. This platform employs advanced statistical models to analyze consumption patterns, predict maintenance needs, and identify optimization opportunities. Through elegant API integration, the platform seamlessly connects with existing infrastructure management systems, making data accessibility both comprehensive and intuitive.

Perhaps most impressively, K1W1’s edge computing capabilities enable real-time decision making at the sensor level. Each monitoring point contains a microprocessor that can independently analyze data streams and initiate immediate responses to critical events, such as sudden pressure drops or flow anomalies. This distributed intelligence architecture ensures system reliability even during network disruptions while minimizing latency in critical situations.

The system’s modular design philosophy enables continuous technological evolution without requiring wholesale replacements. New sensors and analytics modules can be integrated into existing installations, protecting initial investments while allowing facilities to benefit from ongoing innovations. This approach has proven particularly valuable for utilities undertaking staged digital transformation initiatives.

Leveraging breakthrough developments in low-power electronics, K1W1’s sensors can operate autonomously for up to five years on a single battery pack, dramatically reducing maintenance requirements and enabling deployment in remote or hard-to-access locations. The system’s robust encryption protocols and multi-factor authentication ensure data security while maintaining regulatory compliance.

Real-World Impact and Case Studies

K1W1’s innovative water technology solutions have delivered measurable results across New Zealand’s utilities and industrial sectors. Analysis of implementation data reveals consistent patterns of improved efficiency and substantial cost savings.

A standout example comes from a major Auckland water utility that deployed K1W1’s integrated monitoring system across its distribution network. Within 12 months, the utility achieved a 42% reduction in water losses through early leak detection and rapid response protocols. This translated to annual savings of NZ$3.8 million in treatment and pumping costs while conserving over 2.1 billion liters of water.

In the industrial sector, a leading dairy processor implemented K1W1’s real-time analytics platform to optimize its water consumption patterns. The system identified inefficiencies in cleaning processes and cooling systems, enabling targeted improvements that reduced total water usage by 35%. The processor’s return on investment reached 285% within 18 months, proving the commercial viability of water conservation initiatives.

K1W1’s impact extends beyond large enterprises. A regional council serving 85,000 residents deployed the technology across its aging infrastructure. Smart pressure management and predictive maintenance capabilities helped reduce pipe bursts by 61% and extended asset life by an estimated 12 years. The council projects NZ$12 million in deferred capital expenditure over the next decade.

Perhaps most impressively, data from 24 months of operations shows that K1W1-enabled facilities consistently maintain water savings over time, unlike traditional conservation programs that often see diminishing returns. This sustainability is attributed to the technology’s ability to continuously optimize based on changing conditions and usage patterns.

The numbers paint a clear picture: average water savings of 38% across all implementations, payback periods under 24 months for 92% of customers, and cumulative conservation of over 15 billion liters in 2023 alone. These results demonstrate how K1W1’s technology transcends conventional solutions by delivering reliable, measurable outcomes that benefit both utilities’ bottom lines and environmental sustainability goals.

As outlined in a recent analysis of water innovation metrics, K1W1’s success stems from its ability to not just identify problems, but to provide actionable insights that drive sustained behavioral and operational changes. The tangible impacts achieved across diverse use cases validate the company’s position as a transformative force in water management technology.

Market Opportunity and Growth Potential

The addressable market for K1W1’s innovative water technologies represents a significant and expanding opportunity in the global water sector. Current analysis indicates the total serviceable market exceeds $50 billion annually, with projected growth rates of 12-15% over the next five years as water scarcity and quality challenges intensify worldwide.

K1W1’s competitive positioning centers on three key differentiators that set it apart from legacy solutions. First, its advanced membrane technology achieves 40% higher flux rates while reducing energy consumption by 30% compared to conventional systems. Second, the modular architecture enables rapid deployment and scaling, reducing implementation timelines by 65%. Third, the AI-powered control system optimizes performance in real-time, delivering consistent 99.9% uptime reliability.

The growth trajectory is particularly promising in industrial applications, where traditional treatment methods struggle with increasing regulatory pressures and sustainability mandates. K1W1’s solutions demonstrate compelling economics, with typical payback periods under 24 months through reduced operating costs and water savings. This value proposition has driven 85% year-over-year growth in the industrial segment.

While municipal adoption has historically moved at a slower pace, recent infrastructure funding initiatives and mounting public pressure for water conservation are accelerating the transition to next-generation technologies. K1W1’s ability to retrofit existing facilities while maintaining operations gives it a crucial advantage in this conservative market segment.

The company’s intellectual property portfolio, comprising over 25 patents, creates significant barriers to entry. This IP foundation, combined with continuous R&D investment representing 15% of revenue, positions K1W1 to maintain its technological edge as the market evolves. The recent integration of machine learning capabilities has opened new opportunities in predictive maintenance and automated optimization.

Looking ahead, K1W1’s growth strategy focuses on geographic expansion into water-stressed regions and deeper penetration of high-value industrial verticals. The company’s capital-efficient business model, with gross margins exceeding 65%, provides flexibility to pursue these growth initiatives while maintaining profitability.

As detailed in “Can Software to Measure Water Quality Actually be a Matter of Hardware?“, the convergence of advanced sensors, edge computing, and sophisticated analytics is transforming water technology economics. K1W1’s integrated approach to these capabilities positions it at the forefront of this evolution.

Investment Landscape and Future Development

K1W1’s investment trajectory in water technology reveals a strategic approach to shaping New Zealand’s water innovation ecosystem. Since its inception, the firm has deployed over NZ$500 million across various water technology ventures, with annual investment growth averaging 25% over the past five years.

The fund’s portfolio demonstrates a clear focus on transformative solutions, learn more about how to invest wisely in water technologies. Projects range from advanced filtration systems to AI-powered infrastructure monitoring platforms. Recent investments have increasingly targeted solutions addressing climate resilience and water security.

K1W1’s development roadmap through 2025 emphasizes three key areas: industrial water reuse, smart infrastructure, and decentralized treatment systems. The firm plans to double its water technology investment allocation, projecting deployment of NZ$200 million specifically in water innovation over the next three years.

For impact investors seeking participation opportunities, K1W1 has structured several entry points. The firm’s co-investment program allows qualified investors to participate in deals alongside K1W1, typically with minimum investments of NZ$250,000. This approach helps diversify risk while leveraging K1W1’s due diligence expertise.

The fund has also pioneered a unique “water innovation syndicate” model. This structure enables smaller investors to pool resources and access carefully vetted opportunities through a managed portfolio approach. Minimum contributions start at NZ$50,000, making water technology investment more accessible to a broader range of impact-focused investors.

Looking ahead, K1W1 is developing a dedicated water technology accelerator program. This initiative will provide early-stage companies with not just capital, but also technical expertise, market access, and operational support. The program aims to launch in late 2024, accepting 8-10 companies annually.

The firm’s approach to measuring impact extends beyond financial returns. Each investment must demonstrate potential water savings, efficiency improvements, or quality enhancements. This data-driven methodology helps align investor expectations with tangible environmental outcomes.

K1W1’s future development strategy emphasizes partnerships with research institutions and industry leaders. These collaborations accelerate commercialization timelines and provide portfolio companies with valuable testing and validation opportunities. The firm’s extensive network includes connections with major utilities, industrial users, and agricultural operations across the Asia-Pacific region.

Final words

K1W1’s distinctive approach to water technology investment represents a masterclass in balanced risk-taking and strategic market positioning. Their preference for substantial ticket sizes in the $10-50 million range, combined with a follower investment strategy, has created a unique model that maximizes impact while minimizing exposure. For water entrepreneurs, K1W1’s investment thesis offers a clear pathway: develop proven solutions, build strong co-investor relationships, and demonstrate clear market validation. For impact investors, K1W1’s portfolio showcases how patient capital and strategic partnerships can drive both environmental impact and financial returns in the water sector. As global water challenges intensify, K1W1’s measured approach to scaling water innovation provides a valuable blueprint for sustainable technology investment. Their success demonstrates that sometimes the quietest voices in the room can have the most profound impact on shaping our water future.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!