From its Palo Alto headquarters, J-Ventures is redefining what it means to be a venture capital fund in the water technology space. With a $22 million Impact Investment Fund and an innovative community-driven approach, this Silicon Valley powerhouse combines the strategic acumen of seasoned investors with the collaborative spirit of a kibbutz. Their unique model of uniting top investors, executives, and founders has created an ecosystem where water entrepreneurs can thrive beyond just securing capital. By focusing on early-stage investments between $250,000 and $1 million, J-Ventures is nurturing the next wave of water innovation – not through traditional top-down VC dynamics, but through the power of collective wisdom and shared success.

J-Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: J-Ventures

Investor Type: VC

Latest Fund Size: $22 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes:

Investment History: $4880000 spent over 2 deals

Often Invests Along: Dr. Kathy Fields + Dr. Garry Rayant

Already Invested In: Epic Cleantec

Leads or Follows: Follow

Board Seat Appetite: Rare

Key People: Oded Hermoni

The Community-Driven Investment Model

J-Ventures stands apart from traditional venture capital firms through its distinctive community-driven approach, drawing inspiration from the collaborative principles of the Israeli kibbutz system. This unique investment model fundamentally reshapes how decisions are made and expertise is leveraged in water technology investments.

At the heart of J-Ventures’ philosophy lies collective decision-making. Rather than concentrating power in the hands of a few partners, the firm operates through an engaged community of experts, entrepreneurs, and industry veterans who actively participate in investment decisions. This distributed approach ensures that multiple perspectives inform each investment, reducing blind spots and enriching the evaluation process with diverse domain knowledge.

The firm’s collaborative framework particularly shines in water technology investments, where technical complexity meets market uncertainty. Community members with backgrounds in hydrogeology, membrane technology, and water infrastructure can thoroughly assess technical risks, while those with utility management experience evaluate practical implementation challenges. This multifaceted evaluation helps identify truly promising water innovations with real-world application potential.

J-Ventures has formalized this collective expertise through structured working groups focused on specific water technology domains. These groups regularly convene to share insights, review potential investments, and monitor portfolio company progress. This ongoing dialogue creates a dynamic knowledge ecosystem that benefits both investors and entrepreneurs.

The community aspect extends beyond investment decisions into active portfolio support. When a water technology company joins the J-Ventures portfolio, they gain access to an extensive network of industry connections, potential customers, and technical advisors. This approach mirrors successful models in other sectors, as explored in the analysis of how collaborative innovation fuels growth.

Most importantly, this kibbutz-style model creates strong alignment between all stakeholders. Community members often become early adopters or beta testers for portfolio companies’ technologies, providing real-world validation and feedback. This practical support accelerates the path to market and reduces technical risks.

The shared expertise model also helps J-Ventures maintain a long-term perspective essential for water technology investments, which typically require more time to mature than software or consumer products. The community’s collective wisdom helps balance short-term pressures with strategic patience, supporting innovations through the extended development cycles common in the water sector.

This collaborative approach represents more than an organizational structure – it embodies a fundamental rethinking of how venture capital can better serve the unique needs of water technology innovation. By distributing both decision-making power and technical expertise across a broad community, J-Ventures has created a more resilient and insightful investment platform specifically attuned to water sector challenges.

Strategic Investment Focus: Early-Stage Water Innovation

J-Ventures has strategically positioned itself as a catalyst for early-stage water technology innovation, focusing on seed and Series A investments with ticket sizes ranging from $500,000 to $3 million. This precise targeting allows the firm to provide crucial support when water entrepreneurs face their greatest challenges: bridging the gap between proven technology and market adoption.

The firm’s investment thesis centers on water technologies that demonstrate both technical validation and clear paths to commercialization. Rather than chasing moonshot innovations, J-Ventures prioritizes pragmatic solutions that can scale within existing water infrastructure and market dynamics. This approach has proven particularly effective in areas like smart water monitoring, advanced treatment processes, and resource recovery technologies.

What truly sets J-Ventures apart is its hands-on approach to nurturing water entrepreneurs. Beyond capital injection, the firm provides technical validation support, regulatory navigation guidance, and access to pilot opportunities through its extensive network of water utilities and industrial partners. This comprehensive support system significantly reduces the time-to-market for portfolio companies while minimizing execution risks.

The firm’s entrepreneur-in-residence program exemplifies this commitment to nurturing innovation. Through this initiative, promising water technology founders receive dedicated mentorship from seasoned water industry veterans, helping them refine their business models and avoid common pitfalls in the water sector. This program has become a cornerstone of J-Ventures’ value proposition, with several portfolio companies crediting it for their accelerated growth trajectories.

In terms of stage preferences, J-Ventures maintains a disciplined focus on companies that have moved beyond proof-of-concept but haven’t yet achieved significant commercial traction. This sweet spot allows the firm to leverage its technical expertise and industry connections most effectively, while still capturing significant upside potential. The firm shows particular interest in companies that have secured initial pilot installations or early customer commitments, viewing these as critical indicators of market validation.

Particularly noteworthy is J-Ventures’ approach to technical due diligence, which leverages a network of water industry experts to evaluate potential investments. This rigorous evaluation process, combined with the firm’s collective expertise, has resulted in a portfolio of companies that are not just technically sound but also commercially viable.

As outlined in “How to take mid-market green tech companies to the next level,” this focused approach to early-stage investment has become increasingly critical in advancing water innovation. J-Ventures’ model demonstrates how targeted capital deployment, combined with sector expertise and hands-on support, can accelerate the development of promising water technologies when they need it most.

The Power of Co-Investment Partnerships

J-Ventures’ distinctive approach to water technology investment centers on building powerful co-investment partnerships with established venture capital firms. This collaborative strategy has proven instrumental in amplifying the impact and reach of water innovation funding.

At the core of J-Ventures’ co-investment model lies a deep understanding that transformative water technologies require substantial capital and diverse expertise. By partnering with major VC firms, J-Ventures creates force-multiplier effects that benefit portfolio companies through expanded funding pools and complementary domain knowledge.

The firm’s partnership approach operates on multiple levels. Strategic co-investments help de-risk deals for traditional VCs who may be hesitant to enter the water sector independently. Meanwhile, J-Ventures leverages its partners’ due diligence capabilities and established networks to validate investment opportunities and accelerate market entry for portfolio companies.

This symbiotic relationship has yielded notable successes in advancing water treatment innovations. When J-Ventures identifies promising early-stage water technology startups, it often brings in co-investment partners whose expertise in scaling companies complements J-Ventures’ deep water industry knowledge. This has proven particularly effective in areas like smart water infrastructure, where software and hardware solutions intersect.

The multiplier effect of these partnerships extends beyond capital. Portfolio companies gain access to broader networks of potential customers, technical advisors, and follow-on investors through J-Ventures’ co-investment relationships. This comprehensive support system has helped accelerate the commercialization timeline for several breakthrough water technologies.

Perhaps most significantly, J-Ventures’ co-investment strategy has helped establish water technology as an attractive investment category for mainstream venture capital. By demonstrating successful collaboration models and investment returns, the firm has encouraged more VCs to explore opportunities in water innovation, creating a positive feedback loop for the sector.

Looking ahead, J-Ventures continues to expand its co-investment network while maintaining its community-driven ethos. The firm recognizes that solving global water challenges requires coordinated effort and shared risk-taking across the investment landscape. Through strategic partnerships, J-Ventures is helping build the collaborative funding infrastructure needed to accelerate water technology development and adoption.

As highlighted in a recent analysis of venture capital dynamics in the water sector, these co-investment partnerships represent a crucial evolution in how innovative water solutions secure funding and support. The model demonstrates how specialized water expertise can effectively combine with traditional venture capital to drive technological advancement in this critical sector.

Beyond Capital: Long-Term Support and Growth

J-Ventures’ commitment to its portfolio companies extends far beyond the initial capital injection, embodying a holistic approach to nurturing water technology innovations. The firm’s support strategy integrates both structured follow-on funding mechanisms and invaluable informal advisory relationships that help startups navigate the complex water sector landscape.

A cornerstone of J-Ventures’ post-investment support is its systematic follow-on funding approach. Rather than viewing initial investments as one-off transactions, the firm maintains dedicated capital reserves for supporting promising portfolio companies through subsequent growth phases. This strategic capital allocation ensures that successful ventures don’t face funding gaps during critical scaling periods.

What truly sets J-Ventures apart is its extensive informal advisory network. Portfolio company founders gain access to a carefully curated ecosystem of water industry veterans, technical experts, and successful entrepreneurs who have navigated similar challenges. These relationships often evolve organically, with advisors taking genuine interest in the companies’ success and providing guidance on everything from technical validation to market entry strategies.

The firm’s community-driven model creates unique synergies between portfolio companies. Regular portfolio meetings and knowledge-sharing sessions enable founders to learn from each other’s experiences, avoid common pitfalls, and identify collaborative opportunities. This peer support network has proven particularly valuable for companies working on complementary water technologies or targeting similar market segments.

Particularly noteworthy is J-Ventures’ approach to talent development and team building within portfolio companies. The firm leverages its deep industry connections to help startups attract key personnel and build advisory boards. This focus on human capital development has proven crucial for young companies transitioning from technical innovation to commercial success.

The effectiveness of this comprehensive support model is evident in the successful scaling of several portfolio companies that have become water sector leaders. As highlighted in a recent analysis of water technology venture capital, this patient, multi-faceted approach to company building has proven especially valuable in the water sector, where commercialization cycles tend to be longer than in other technology domains.

Beyond operational support, J-Ventures actively facilitates connections with potential customers and partners. The firm’s extensive relationships with utilities, industrial water users, and engineering firms often lead to pilot projects and commercial deployments that accelerate portfolio company growth. This practical, market-focused approach helps bridge the critical gap between promising technology and commercial adoption.

The Water Technology Investment Thesis

J-Ventures has developed a distinctive approach to water technology investments that combines rigorous technical evaluation with community-driven insights. Their investment thesis centers on three key pillars: technological innovation, market readiness, and sustainability impact.

The firm prioritizes technologies that address critical water challenges while demonstrating clear paths to scalability and commercialization. Their technical due diligence process, which mirrors successful approaches in evaluating water innovations, examines not just the core innovation, but its practical implementation potential.

When evaluating potential investments, J-Ventures focuses on solutions targeting major industry pain points: water scarcity, quality monitoring, infrastructure efficiency, and resource recovery. The firm shows particular interest in technologies that create multiple value streams – for instance, water treatment solutions that also generate valuable byproducts or energy savings.

Their evaluation framework weighs several critical factors:

Technical Merit and IP Protection

The firm conducts deep technical assessments of the core technology, examining aspects like energy efficiency, operational reliability, and maintenance requirements. Strong intellectual property protection is essential, particularly in competitive market segments.

Market Validation and Adoption Potential

J-Ventures prioritizes solutions with demonstrated market pull rather than just technological push. They seek evidence of customer willingness to adopt new technologies, often through pilot programs or early commercial deployments.

Team Capabilities and Vision

The investment team places significant emphasis on founding teams that combine technical expertise with commercial acumen. They look for leaders who understand both the complexities of water technology and the challenges of market adoption.

Sustainability Metrics

Environmental impact measurements are fundamental to their evaluation process. J-Ventures requires portfolio companies to demonstrate quantifiable benefits in areas like water conservation, energy reduction, or pollution prevention.

What sets J-Ventures apart is their collaborative approach to due diligence. They leverage their community of water industry experts, utilities, and end-users to validate technology claims and market assumptions. This network-driven evaluation helps derisk investments while providing portfolio companies with valuable market insights and potential customer connections.

Their investment sizing typically ranges from early-stage seed rounds to Series B investments, with a preference for companies that have moved beyond pure research and development into early commercialization phases. The firm maintains a long-term perspective, recognizing that water technology adoption cycles often require patient capital and sustained support.

Portfolio Success Stories

J-Ventures’ portfolio companies are delivering remarkable environmental and financial returns through innovative water technologies. Their strategic investments have catalyzed solutions addressing critical challenges across the water sector.

A standout success emerged from their early investment in advanced membrane filtration technology. This portfolio company developed a breakthrough approach that reduces energy consumption by 60% while increasing water recovery rates to 98% in industrial applications. The technology has been deployed at over 50 facilities globally, treating more than 100 million gallons daily and generating $45 million in annual recurring revenue.

Another portfolio company pioneered AI-powered leak detection systems that integrate with existing utility infrastructure. Their smart sensors and predictive analytics have helped water utilities reduce non-revenue water losses by an average of 30%. The solution has been adopted by major utilities across three continents, leading to the company’s successful Series C funding round of $75 million.

In the agricultural sector, a J-Ventures-backed startup developed precision irrigation technology that combines soil moisture sensing, weather data, and crop modeling. Early trials demonstrated 40% water savings while maintaining or increasing crop yields. The company has expanded from initial pilots to full commercial deployment across 200,000 acres, with a compound annual growth rate exceeding 100%.

A fourth success story centers on wastewater treatment optimization. This portfolio company’s biological treatment enhancement technology has reduced treatment plants’ energy consumption by 25% while improving effluent quality. The solution has been implemented at over 30 facilities, generating both strong financial returns and measurable environmental impact through reduced greenhouse gas emissions.

J-Ventures’ hands-on approach has been crucial to these successes. Beyond capital, they provide technical expertise, market access, and strategic guidance. Their deep industry network has accelerated commercial partnerships and enabled rapid scaling of proven solutions.

Collectively, these portfolio companies validate J-Ventures’ thesis that water technology innovation can deliver both excellent financial returns and meaningful environmental impact. As noted in a deeper analysis of water tech venture capital dynamics, their portfolio demonstrates how strategic investment combined with sector expertise can overcome traditional barriers to scaling water solutions.

The success metrics extend beyond financial returns – their portfolio companies have collectively helped conserve over 50 billion gallons of water annually while reducing energy consumption and improving water quality. This track record has attracted additional investment to the sector and established new benchmarks for water technology commercialization.

The Entrepreneur’s Journey

At J-Ventures, water technology entrepreneurs find more than just capital – they discover a comprehensive support ecosystem designed to nurture innovation from concept to market success. This unique approach has fundamentally transformed how water startups scale and thrive.

The journey begins with J-Ventures’ distinctive pitch process, where entrepreneurs present not just to financial analysts, but to a diverse panel of water industry veterans, technical experts, and successful founders. This multifaceted evaluation ensures that promising technologies receive both strategic funding and invaluable expert feedback from day one.

Once selected, entrepreneurs gain access to J-Ventures’ mentor network – a carefully curated group of seasoned water industry professionals who provide hands-on guidance. These mentors help refine business models, navigate regulatory requirements, and forge crucial industry connections. The relationship goes beyond occasional check-ins, with mentors often becoming deeply invested in their mentees’ success.

J-Ventures has developed a pioneering commercialization framework that addresses the unique challenges of water technology deployment. Through strategic partnerships with utilities and industrial facilities, entrepreneurs can access real-world testing environments to validate their solutions. This practical approach dramatically reduces the typical time and cost barriers to market entry.

The accelerator phase provides intensive support in key areas like regulatory compliance, pilot project design, and scalable manufacturing processes. Entrepreneurs receive specialized training in water industry dynamics, helping them avoid common pitfalls and accelerate their path to market.

Perhaps most valuable is the peer community J-Ventures fosters among its portfolio companies. Regular founder forums and technology workshops create opportunities for collaboration, shared learning, and mutual support. This collaborative environment has sparked numerous partnerships between portfolio companies, leading to innovative integrated solutions.

As companies progress toward scale-up, J-Ventures leverages its extensive industry network to facilitate customer introductions and strategic partnerships. The firm’s deep relationships with major water utilities, industrial water users, and engineering firms provide entrepreneurs with qualified leads and accelerated sales cycles.

Beyond the conventional venture capital metrics, J-Ventures measures success through sustained impact on water challenges. This long-term perspective allows entrepreneurs to build robust, sustainable businesses rather than chase quick exits. The result is a growing portfolio of water technology companies delivering real solutions while building lasting value.

Impact Metrics and Future Vision

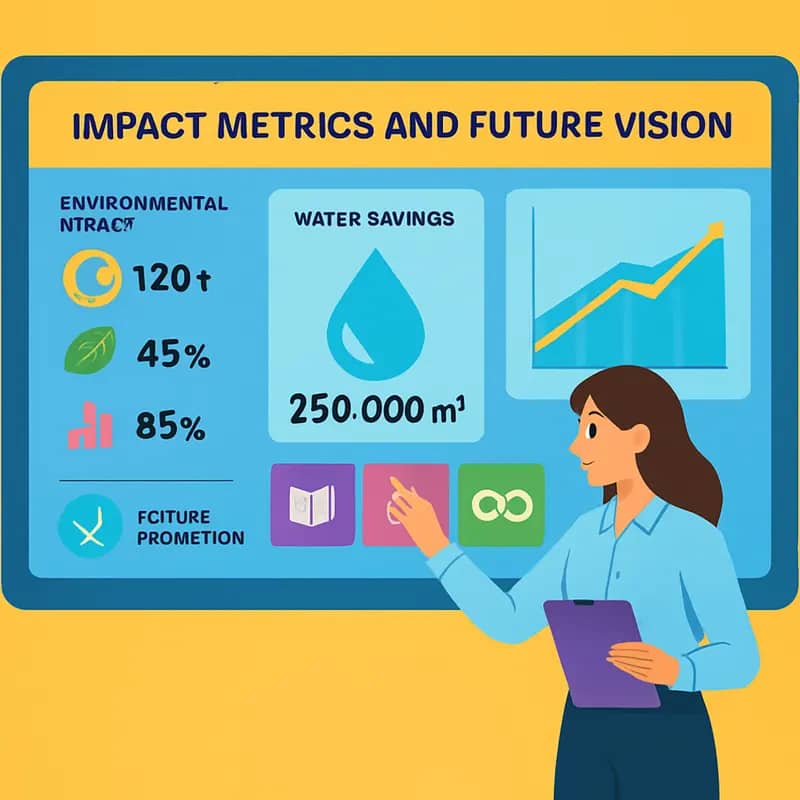

J-Ventures’ pioneering approach to water technology investment hinges on a sophisticated impact measurement framework that quantifies both financial returns and environmental outcomes. The firm has developed a comprehensive scoring system that evaluates portfolio companies across three core dimensions: water savings potential, energy efficiency gains, and greenhouse gas emissions reduction.

At the foundation of their assessment methodology lies a rigorous data collection protocol that requires portfolio companies to report standardized metrics quarterly. These metrics go beyond traditional financial KPIs to include specific water-related impacts such as gallons saved, contaminants removed, and infrastructure improvements achieved. This granular tracking enables J-Ventures to aggregate impact across their entire portfolio and demonstrate the collective contribution toward global water sustainability goals.

Looking ahead, J-Ventures envisions scaling their community-driven investment model to mobilize significantly more capital toward water innovation. Their five-year roadmap includes ambitious targets to double their current portfolio size while maintaining strict impact criteria. A key focus area is expanding their network of technical advisors and industry partners who provide critical validation and commercialization support to portfolio companies.

The firm is also exploring innovative financing mechanisms to better align investor returns with measurable water impact. This includes the potential development of water outcome-based bonds and blended finance vehicles that can attract institutional capital while preserving their commitment to generating tangible environmental benefits.

Critically, J-Ventures recognizes that technology alone cannot solve the world’s water challenges. Their future vision emphasizes the need for parallel innovation in business models, policy frameworks, and stakeholder engagement approaches. The firm is actively working to share best practices and learnings from their portfolio companies to help catalyze systemic change in how water solutions are developed and deployed.

As explored in https://dww.show/how-to-mitigate-4-shades-of-water-risk-through-impact-investing/, this dual focus on measurable impact and scalable solutions positions J-Ventures at the forefront of transforming water technology investment. Their framework provides a blueprint for how venture capital can drive both financial returns and environmental progress in the water sector.

Their ultimate goal is to demonstrate that community-driven investment approaches can outperform traditional venture models in identifying and scaling breakthrough water technologies. By continuing to refine their impact metrics and expand their collaborative ecosystem, J-Ventures aims to establish a new paradigm for how innovation capital can address global water challenges.

Final words

J-Ventures stands as a beacon of innovation in the water technology investment landscape, not just for its capital deployment but for its revolutionary approach to venture capital itself. Their $22 million Impact Investment Fund represents more than just financial firepower – it’s a testament to the power of community-driven investment in solving complex water challenges. By maintaining their sweet spot of $250,000 to $1 million initial investments while fostering deep partnerships with industry giants like Lightspeed and GGV, J-Ventures has created a unique ecosystem where water entrepreneurs can thrive. The fund’s deliberate choice to avoid formal board seats in favor of collaborative advisory roles, combined with their impressive 1.29 follow-on investment ratio, demonstrates a commitment to long-term growth over short-term control. As water technology continues to evolve and new challenges emerge, J-Ventures’ model of combining Silicon Valley expertise with collective wisdom positions them perfectly to nurture the next generation of water innovation leaders. Their success proves that in the complex world of water technology investment, community-driven approaches can create ripples that turn into waves of positive change.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!