With €1.5 billion in fresh capital and an unwavering focus on water technology, Invest-NL has emerged as a pivotal force in scaling breakthrough water solutions. This Amsterdam-based impact investor combines government backing with commercial savvy to address critical challenges in water quality, reuse, and climate adaptation. Their minimum €5 million ticket size and focus on growth-stage companies signals their commitment to transforming promising water technologies into market-ready solutions. For water entrepreneurs and impact investors alike, understanding Invest-NL’s investment approach and thematic focus areas is crucial for navigating the evolving landscape of water innovation financing.

Invest-NL is part of my Ultimate Water Investor Database, check it out! (they also are an investor in PureTerra Ventures)

Investor Name: Invest-NL

Investor Type: Impact

Latest Fund Size: $1000 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: Water reuse and recycling, water quality improvement, circular water use

Investment History: $11300000 spent over 2 deals

Often Invests Along:

Already Invested In: Hydraloop, Paques Biomaterials

Leads or Follows: Lead

Board Seat Appetite: Rare

Key People: Rinke Zonneveld, Stefanie Landman, Andrea van Dijk, Jan Pieter Postma

Investment Strategy & Capital Structure

With €1.5 billion in available capital, Invest-NL has positioned itself as a cornerstone investor in the Netherlands’ water technology innovation landscape. The organization’s investment strategy artfully balances its government-backed mandate with commercial viability requirements, creating a unique model for catalyzing water sector transformation.

At the heart of Invest-NL’s approach is a focus on Series A and later-stage companies, with a minimum ticket size of €5 million per investment. This strategic choice allows the fund to support companies that have proven their technology and business model but need significant capital to scale. By targeting this growth stage, Invest-NL helps bridge the critical funding gap that often hampers water technology commercialization.

The fund’s dual mandate sets it apart from traditional venture capital firms. While maintaining rigorous commercial return expectations, Invest-NL also prioritizes investments that drive meaningful environmental and social impact. This hybrid approach enables the organization to take longer-term positions and support technologies that might be considered too early or risky for conventional investors.

Invest-NL’s government backing provides a stable capital base and allows for patient investment horizons. However, the organization operates with full commercial independence, making investment decisions based on thorough due diligence and market analysis. This autonomy ensures that funded projects have genuine commercial potential while advancing water sustainability goals.

The fund deploys capital through various financial instruments, including equity investments, convertible loans, and subordinated debt. This flexibility allows Invest-NL to structure deals that best suit each company’s growth stage and capital needs while maintaining appropriate risk-return profiles.

Particularly noteworthy is Invest-NL’s approach to risk mitigation through active portfolio management. The fund takes board seats in portfolio companies and provides hands-on support in areas like corporate governance, strategic planning, and business development. This involvement helps protect investments while accelerating company growth.

In line with its mandate to catalyze private investment, Invest-NL often acts as an anchor investor, helping companies attract additional capital from private sources. This multiplier effect significantly expands the total funding available for water technology innovation, creating a more robust ecosystem for sector growth.

Water Technology Focus Areas

Invest-NL’s water technology portfolio reflects a strategic focus on three critical domains that align with both global challenges and Dutch expertise. At the forefront is water quality improvement, where the fund targets innovations addressing emerging contaminants like PFAS, microplastics, and pharmaceutical residues. These investments aim to protect public health while preserving aquatic ecosystems that form the backbone of the Netherlands’ water infrastructure.

Circular water usage represents another key investment theme, with particular emphasis on industrial water reuse and resource recovery. The fund actively seeks technologies that can transform wastewater treatment plants into resource factories – extracting valuable materials like phosphorus and nitrogen while producing clean water for reuse. This approach not only reduces freshwater demand but also creates new revenue streams for utilities and industries.

Climate adaptation technologies form the third pillar of Invest-NL’s water focus. With rising sea levels threatening coastal communities and extreme weather events becoming more frequent, the fund prioritizes innovations in flood protection, stormwater management, and urban water resilience. These investments range from smart drainage systems to nature-based solutions that can absorb excess rainfall while creating recreational spaces.

A notable success story in Invest-NL’s portfolio demonstrates the fund’s ability to scale breakthrough technologies. One of their early-stage investments focused on advanced membrane technology has grown from a university spin-off to a commercial enterprise, now treating industrial wastewater across Europe while using 40% less energy than conventional systems. This exemplifies how the fund’s patient capital approach enables promising water innovations to reach market maturity.

The geographical advantage of the Netherlands as a living lab for water innovation adds another dimension to Invest-NL’s focus areas. The country’s dense population, industrial activity, and water management challenges create ideal testing conditions for new technologies. This enables portfolio companies to validate their solutions in real-world conditions before expanding internationally.

By maintaining this focused yet comprehensive approach to water technology investments, Invest-NL is actively shaping the future of water management while generating sustainable returns. Their strategy demonstrates how government-backed investment can catalyze innovation in critical environmental sectors.

Investment Process & Requirements

Invest-NL employs a rigorous yet streamlined process when evaluating water technology companies for potential investment. The organization’s due diligence framework balances financial viability with environmental and social impact potential.

The assessment begins with an initial screening focusing on three core criteria. First, companies must demonstrate clear water-related innovation addressing pressing challenges in water quality, circularity, or climate adaptation. Second, the technology should have proven technical validation through pilots or early commercial deployments. Third, the business model needs to show potential for scalability and market adoption.

For companies passing initial screening, Invest-NL conducts comprehensive due diligence across multiple dimensions. The technical review examines the underlying science, IP position, and development roadmap. Market analysis validates the addressable opportunity, competitive landscape, and go-to-market strategy. The team assessment evaluates leadership capabilities, industry expertise, and execution track record.

Financial due diligence scrutinizes historical performance, projections, unit economics, and capital requirements. Environmental impact metrics are carefully quantified, including water savings, pollution reduction, or climate benefits. The investment committee weighs these factors holistically when making funding decisions.

Entrepreneurs approaching Invest-NL should prepare detailed documentation addressing these key areas. Strong applications typically include:

- Clear articulation of the water challenge being solved

- Technical validation data and third-party verification

- Detailed financial model with key assumptions

- Quantified environmental impact metrics

- IP strategy and competitive positioning

- Team background and execution capabilities

- Capital deployment plan and milestones

Invest-NL typically invests €2-15 million per company, taking minority stakes while maintaining board representation. The organization looks for companies with clear paths to profitability within 3-5 years while delivering measurable water impact.

As highlighted in an analysis of water tech investment fundamentals, successful water tech companies often require patient capital given longer development and adoption cycles. Invest-NL’s approach reflects this reality while maintaining commercial discipline in its investment process.

Portfolio Support & Value Creation

Beyond providing capital, Invest-NL takes an active role in nurturing its portfolio companies through comprehensive value-creation initiatives that accelerate growth and maximize impact potential. This hands-on approach stems from their deep understanding that water technology ventures require more than just funding to achieve meaningful scale.

At the board level, Invest-NL typically seeks observer rights rather than direct board seats, allowing them to provide strategic guidance while empowering entrepreneurs to maintain operational control. This balanced approach helps portfolio companies benefit from Invest-NL’s expertise without compromising their autonomy or agility.

The firm’s value-creation strategy centers on three core pillars: operational excellence, market access, and follow-on funding support. For operational excellence, Invest-NL leverages its extensive network to connect portfolio companies with seasoned industry experts who can advise on everything from manufacturing optimization to regulatory compliance. This proves especially valuable for early-stage water tech companies navigating complex certification processes or scaling production.

Regarding market access, Invest-NL actively facilitates connections between portfolio companies and potential customers, partners, and distributors across Europe and beyond. Their strong relationships with utilities, industrial water users, and government agencies help accelerate commercial traction. They also organize regular portfolio showcases and networking events that create valuable business development opportunities.

Perhaps most crucially, Invest-NL takes a proactive approach to follow-on funding. They maintain close relationships with other water technology investors and often lead subsequent funding rounds for high-performing portfolio companies. This funding continuity provides startups with greater financial security and allows them to focus on execution rather than constant fundraising.

Invest-NL has also established a dedicated Portfolio Success team that works closely with companies to identify and address key business challenges. This team conducts regular strategic reviews, helps set and track KPIs, and brings in specialized expertise when needed. They’ve developed standardized frameworks and tools to assist with common growth hurdles while maintaining the flexibility to provide customized support based on each company’s unique needs.

This comprehensive support system reflects Invest-NL’s commitment to being a true partner in their portfolio companies’ success, going far beyond the traditional capital provider role to actively drive value creation and sustainable impact in the water technology sector.

The Investment Philosophy: Beyond Traditional Venture Capital

Invest-NL stands apart from conventional venture capital firms through its distinctive approach to water technology investments. At its core lies a philosophy that recognizes water innovation requires more than just capital—it demands patience, technical expertise, and a commitment to measurable impact.

The organization’s investment strategy rests on three fundamental pillars. First, patient capital allows water technology companies to develop and validate their solutions properly. Unlike traditional VCs seeking quick returns, Invest-NL maintains longer investment horizons of 7-10 years, acknowledging that water technologies often require extensive testing and regulatory approvals.

Second, Invest-NL combines financial support with deep technical expertise. Their team includes water engineers, environmental scientists, and industry veterans who can evaluate technologies beyond financial metrics. This technical understanding enables them to assess risks more accurately and provide valuable operational guidance to portfolio companies.

Third, and perhaps most distinctively, Invest-NL employs a rigorous impact measurement framework. Each investment must demonstrate clear potential for environmental and social benefits, quantified through metrics like water savings, energy reduction, or improved access to clean water. This approach aligns with their mission to address water challenges while generating sustainable returns.

The firm’s €1.5 billion capital base allows for substantial initial investments and crucial follow-on funding. However, money alone doesn’t define their relationships with portfolio companies. Invest-NL takes an active role in governance, often securing board seats and working closely with management teams to optimize growth strategies and impact outcomes.

This comprehensive approach has proven particularly valuable in the water sector, where traditional venture capital often struggles. While some VCs shy away from water technologies due to longer development cycles and complex regulatory landscapes, Invest-NL’s model embraces these characteristics. They leverage their understanding of market dynamics, regulatory frameworks, and technological developments to make informed investment decisions that balance risk and reward.

As highlighted in discussions about impact investing’s role in water technology, this patient, expertise-driven approach creates a virtuous cycle. Portfolio companies benefit from stable, long-term support, while investors gain exposure to thoroughly vetted opportunities in the growing water technology market. The result is a model that serves both financial returns and environmental impact, setting a new standard for water technology investment.

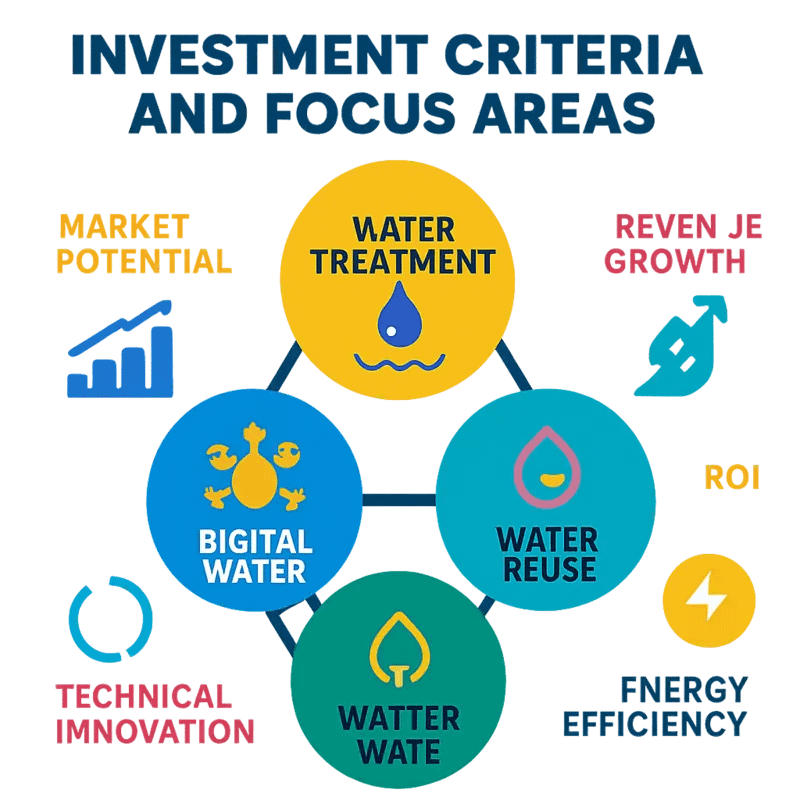

Investment Criteria and Focus Areas

Invest-NL applies a rigorous investment framework centered on both financial returns and measurable water impact. The fund targets technologies addressing critical water challenges while meeting strict investment thresholds.

The core investment criteria emphasize three key pillars: proven technology readiness, market validation, and scalability potential. Companies must demonstrate at minimum a Technology Readiness Level (TRL) of 7, indicating successful prototype demonstration in an operational environment. Additionally, target companies need to show early market traction through pilot projects or initial commercial deployments.

Within the water technology space, Invest-NL focuses on solutions across four strategic domains: water infrastructure optimization, water quality improvement, resource recovery, and climate resilience. The fund prioritizes technologies that enable significant water savings, enhance treatment efficiency, or facilitate water reuse and resource extraction.

Financial requirements include minimum investment tickets of €2 million, though larger amounts are available for later-stage companies. Invest-NL typically seeks minority stakes between 10-49% and expects companies to demonstrate a clear path to profitability within 3-5 years. The fund looks for ventures with the potential to scale beyond the Netherlands, particularly targeting expansion into European markets.

Beyond financial metrics, investee companies must demonstrate quantifiable environmental and social impact aligned with UN Sustainable Development Goals, particularly SDG 6 (Clean Water and Sanitation) and SDG 13 (Climate Action). Impact measurement frameworks track metrics like cubic meters of water saved, pollution reduction levels, and energy efficiency gains.

Portfolio companies receive more than just capital – they gain access to Invest-NL’s technical expertise, industry networks, and support in areas like regulatory compliance and market entry strategies. This hands-on approach helps de-risk investments while accelerating commercialization timelines.

The investment committee evaluates opportunities through a comprehensive due diligence process examining technology validation, intellectual property position, management team capabilities, and market dynamics. Special attention is given to assessing competitive advantages and barriers to entry in target markets.

As referenced in How to Mitigate 4 Shades of Water Risk Through Impact Investing, the fund’s approach balances risk mitigation with catalytic impact potential. This dual focus helps ensure portfolio companies can deliver both attractive financial returns and meaningful contributions to solving global water challenges.

Success Stories and Portfolio Analysis

Invest-NL’s water technology portfolio demonstrates remarkable success in catalyzing innovation while generating both environmental and financial returns. The fund’s strategic approach has yielded several transformative investments that showcase the potential of water technology solutions.

A particularly noteworthy success emerged through their investment in decentralized water treatment systems. By backing technologies that enable water reuse at industrial sites, Invest-NL helped multiple companies reduce their water footprint while achieving significant cost savings. These projects typically deliver ROIs between 15-20% while saving millions of cubic meters of water annually.

Analysis of the portfolio reveals clear patterns in successful investments. Companies that combine innovative technology with strong business models consistently outperform. The most successful ventures share three key characteristics: scalable solutions, clear market validation, and measurable impact metrics.

Invest-NL’s data shows that water technology companies in their portfolio achieving the strongest growth typically address multiple challenges simultaneously. For instance, projects combining water efficiency with energy recovery or resource extraction demonstrate superior financial performance compared to single-focus solutions.

The fund’s early-stage investments in smart water monitoring systems have proven particularly impactful. These technologies enable predictive maintenance and optimization of water infrastructure, resulting in reduced operational costs and improved resource management. Several portfolio companies in this space have secured follow-on funding at significantly higher valuations, validating Invest-NL’s initial investment thesis.

Learnings from less successful investments provide equally valuable insights. Projects that failed to gain traction often struggled with lengthy sales cycles or complex regulatory requirements. This experience has refined Invest-NL’s due diligence process, particularly regarding regulatory compliance and market readiness assessments.

Emerging trends in the portfolio indicate growing opportunities in water quality monitoring, resource recovery, and nature-based solutions. The fund’s recent investments increasingly focus on technologies that integrate artificial intelligence and advanced analytics, reflecting the water sector’s digital transformation.

Portfolio companies have collectively contributed to significant environmental impact metrics, including water savings exceeding 50 million cubic meters annually and substantial reductions in chemical usage and energy consumption. These achievements align with both financial returns and Invest-NL’s mission to accelerate the transition to a sustainable water economy.

Learn more about maximizing impact through water technology investments.

Application Process and Support Framework

Engaging with Invest-NL follows a structured yet flexible process designed to support water technology innovators throughout their growth journey. The application journey begins with an initial screening phase where companies submit a comprehensive business plan highlighting their technology’s water impact potential, market opportunity, and financial projections.

To qualify for consideration, ventures must demonstrate clear water-related environmental or social benefits while maintaining commercial viability. Key evaluation criteria include technology readiness level, scalability potential, team capabilities, and alignment with Invest-NL’s impact objectives in the water sector.

The due diligence process typically spans 8-12 weeks and involves deep technical assessment, market validation, and financial modeling. During this phase, Invest-NL’s sector specialists work closely with applicants to refine their business case and identify potential risks and mitigation strategies. This collaborative approach helps strengthen proposals while building a foundation for long-term partnership.

Beyond financial investment, Invest-NL provides crucial support mechanisms to accelerate growth and impact. Their “Smart Capital” approach combines funding with strategic guidance, industry connections, and specialized expertise. Portfolio companies gain access to Invest-NL’s extensive network of water utilities, industrial end-users, research institutions, and co-investors.

The support framework includes dedicated portfolio managers who serve as strategic advisors, helping companies navigate challenges and capitalize on opportunities. Regular portfolio reviews ensure alignment of objectives and identify areas where additional support may be needed. This hands-on engagement model has proven particularly valuable for early-stage companies scaling novel water technologies.

Post-investment, companies can leverage Invest-NL’s technical assistance facility for specific growth initiatives such as pilot projects, market expansion studies, or operational improvements. This facility provides matching grants up to €250,000 for approved development activities, significantly enhancing the impact of the initial investment.

As highlighted in How to make water more attractive than the Apple and Samsung’s of this world, successful applicants join a growing ecosystem of water innovation leaders who are reshaping the sector’s future while generating attractive financial returns. Through this comprehensive support system, Invest-NL helps bridge the gap between promising water technologies and successful market deployment.

Final words

Invest-NL stands as a cornerstone institution in the Dutch water technology ecosystem, wielding €1.5 billion in capital to accelerate the commercialization of breakthrough water solutions. Their strategic focus on growth-stage companies, substantial minimum ticket size of €5 million, and comprehensive portfolio support approach positions them uniquely in the impact investment landscape. For water entrepreneurs, Invest-NL represents more than just a capital provider – they offer a pathway to scale technologies that address critical water challenges while maintaining commercial viability. The institution’s careful balance of government backing with market-driven returns demonstrates how public-private partnerships can effectively drive innovation in the water sector. As water challenges intensify globally, Invest-NL’s model offers valuable lessons for other regions seeking to mobilize capital for water technology development. Their success in nurturing water technology companies while delivering both environmental and financial returns sets a compelling precedent for impact investors worldwide.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!