At the intersection of cutting-edge water technology and circular economy principles stands Closed Loop Partners, a New York-based investment firm reshaping how we think about water innovation. With between $500 million to $999 million under management, they’re strategically deploying capital into breakthrough solutions – from advanced filtration systems to AI-powered leak detection. Their approach combines rigorous due diligence with an unwavering focus on environmental impact, making them a beacon for water entrepreneurs seeking not just funding, but a partner who understands the delicate balance between profit and planet.

Closed Loop Partners is part of my Ultimate Water Investor Database, check it out!

Investor Name: Closed Loop Partners

Investor Type: Impact

Latest Fund Size: $500 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: Industrial water filtration, Leak detection and building water efficiency, On-site water generation and filtration

Investment History: $946428.57 spent over 2 deals

Often Invests Along: Anthropocene Ventures, Michigan Capital Network, Oxcart Equity Partners

Already Invested In: Accelerated Filtration, Inc.

Leads or Follows: Lead

Board Seat Appetite: High

Key People: Amy Wagner, Damir Hamzic, Danielle Joseph, George Freyermuth

The Investment Philosophy: Where Water Meets Circularity

At the intersection of water technology and circular economy principles lies Closed Loop Partners’ distinctive investment approach. The firm’s philosophy centers on identifying and scaling solutions that not only address critical water challenges but fundamentally reimagine how water resources flow through our economic systems.

The investment team evaluates potential portfolio companies through a sophisticated dual lens. On the financial side, they assess traditional metrics like market opportunity, scalability, and projected returns. However, what sets their approach apart is the equal weight given to environmental impact metrics – particularly a technology’s potential to enable circular water use.

This philosophy manifests in their investment criteria, where technologies must demonstrate clear pathways to closing resource loops. Whether through advanced filtration systems that enable water reuse or smart monitoring solutions that prevent losses, each investment must show how it contributes to a more circular water economy. The firm has developed a proprietary framework that quantifies both immediate and long-term environmental benefits, from reduced water consumption to avoided wastewater discharge.

Circularity in their investment approach extends beyond individual technologies. The firm actively seeks solutions that create synergies across their portfolio, enabling what they call “circular value chains.” This might mean investing in complementary technologies that, when combined, create closed-loop systems with enhanced efficiency and reduced environmental impact.

Closely tied to their circular focus is an emphasis on market transformation. The firm recognizes that individual technologies, while important, must catalyze broader systemic changes. As explored in how to mitigate 4 shades of water risk through impact investing, their investments aim to demonstrate the commercial viability of circular water solutions while creating ripple effects across industries.

The firm’s due diligence process reflects this holistic perspective. Beyond traditional technical and market assessments, they evaluate how technologies fit into existing infrastructure, their potential to drive behavioral change, and their ability to create new value from what was previously considered waste. This comprehensive evaluation ensures selected investments have the highest potential for both financial returns and environmental impact.

Ultimately, Closed Loop Partners’ investment philosophy represents a fundamental shift in how water technology investments are evaluated and structured. By placing equal emphasis on circularity and commercial success, they’re helping create a new paradigm where environmental impact drives rather than constrains financial returns.

Portfolio Deep Dive: From Filtration to Smart Detection

Closed Loop Partners’ portfolio reflects a strategic focus on transformative water technologies that drive both environmental impact and commercial success. The firm’s investments showcase a deep understanding of how breakthrough solutions can reshape water management practices.

In the filtration space, Closed Loop has backed companies pioneering advanced separation technologies that dramatically reduce energy consumption while improving treatment efficacy. These solutions leverage novel materials and process innovations to remove contaminants more efficiently than conventional approaches. The portfolio companies’ filtration systems typically achieve 30-50% energy savings while maintaining or exceeding standard treatment performance metrics.

Smart detection and monitoring represents another key investment theme. Portfolio companies in this segment are developing sophisticated sensor networks and analytics platforms that enable predictive maintenance and real-time water quality monitoring. By integrating IoT devices with machine learning capabilities, these solutions help utilities and industrial clients optimize operations while ensuring regulatory compliance.

What ties these investments together is their potential to drive systemic change in the water sector. Rather than pursuing incremental improvements, Closed Loop targets technologies that can fundamentally alter how we manage, treat, and monitor water resources. The firm’s thesis emphasizes solutions that can scale rapidly while delivering measurable environmental benefits.

A particularly compelling example lies in the firm’s work with companies developing smart infrastructure monitoring solutions. These technologies use advanced sensors and data analytics to detect issues like leaks and contamination events before they become major problems. The potential impact is significant – studies suggest that smart monitoring could help utilities reduce water losses by up to 25% while cutting operating costs.

Beyond individual technology solutions, Closed Loop’s portfolio companies often create powerful synergies. Filtration innovations can be enhanced by smart monitoring capabilities, while data analytics platforms can help optimize treatment processes. This systems-level thinking reflects the firm’s commitment to fostering a more circular and sustainable water economy.

The portfolio’s financial performance validates this approach. Several companies have achieved strong growth and successful exits, demonstrating that environmental impact and commercial success can go hand in hand. As discussed in How to Mitigate 4 Shades of Water Risk Through Impact Investing, strategic deployment of capital in water technology can generate both attractive returns and meaningful environmental benefits.

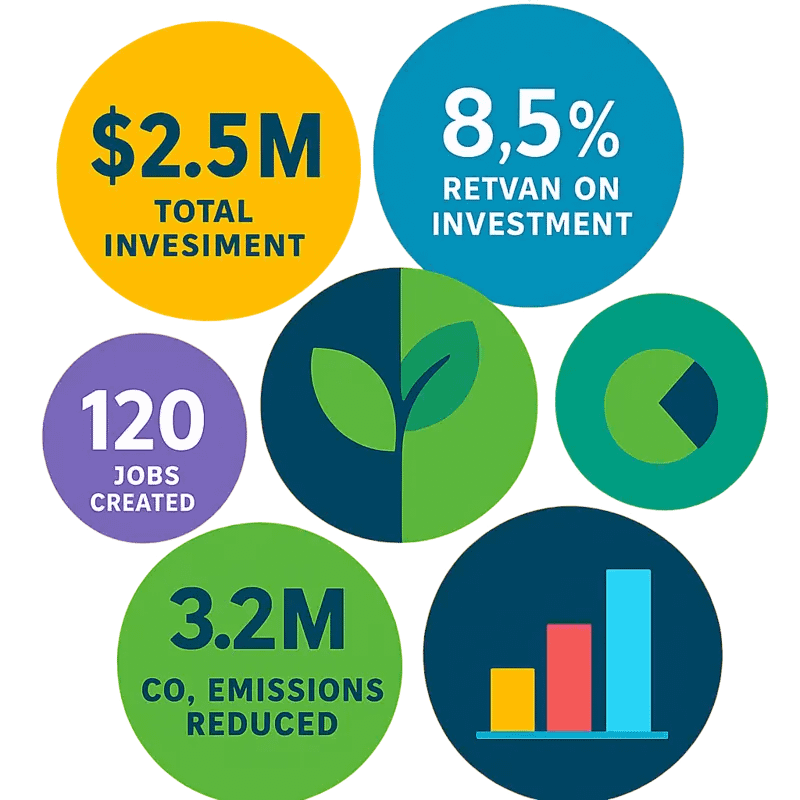

Investment Strategy: The Numbers Behind the Impact

Closed Loop Partners takes a uniquely calibrated approach to water technology investments, strategically balancing financial returns with measurable environmental impact. The firm typically deploys initial checks ranging from $2-5 million in Series A and B rounds, with the capacity to participate in follow-on funding up to $15 million per portfolio company.

What sets Closed Loop’s investment framework apart is their dual-metric evaluation system. Beyond traditional financial metrics like IRR and MOIC targets, each investment must demonstrate quantifiable environmental benefits – whether through water savings, improved quality, or reduced energy usage. This approach has proven particularly effective in water technology, where environmental gains often translate directly to cost savings and revenue growth.

The firm structures deals to incentivize both rapid scaling and sustained impact. A typical term sheet includes environmental impact covenants alongside financial ones, with specific milestones tied to both metrics. For example, portfolio companies must report quarterly on key performance indicators like gallons of water conserved or contamination levels reduced. This data feeds into Closed Loop’s proprietary impact measurement framework, which helps optimize capital deployment across the portfolio.

In terms of ownership, Closed Loop typically takes minority stakes between 15-30%, allowing founders to maintain control while providing enough influence to help drive strategic decisions. The firm often leads rounds but also regularly co-invests with strategic partners, creating powerful syndicates that can support portfolio companies through multiple growth phases.

Perhaps most innovative is Closed Loop’s approach to exit strategies. While traditional exits through acquisition or IPO remain important, the firm also explores alternative liquidity paths that preserve long-term environmental mission alignment. This might include structured secondary sales to impact-focused buyers or revenue-based financing arrangements that maintain operational independence.

Closer examination reveals how this investment strategy has evolved to address key market gaps. As discussed in How to Mitigate 4 Shades of Water Risk Through Impact Investing, the firm increasingly focuses on technologies that can scale rapidly while delivering measurable improvements across multiple risk categories – from physical water scarcity to regulatory compliance.

This carefully calibrated approach has enabled Closed Loop to build a portfolio of water technology companies that are not only growing commercially but also moving the needle on critical environmental challenges. The firm’s ability to maintain this balance while generating attractive returns has helped establish water technology as a legitimate institutional investment category rather than merely an impact play.

Future Vision: Scaling Water Innovation

As Closed Loop Partners charts its path forward, the firm is laser-focused on accelerating breakthrough water technologies that can drive systemic change at scale. Building on their proven investment approach, they are targeting several high-impact themes that could reshape water management over the next decade.

A key priority is advancing water reuse and circular systems that can help communities build resilience against climate impacts while reducing strain on freshwater resources. The firm sees immense potential in decentralized treatment solutions that enable water recycling at the building or district level, effectively closing local water loops. This aligns with their broader thesis around distributed infrastructure as a cornerstone of climate adaptation.

Closed Loop is also deeply interested in digital transformation and the power of data analytics to optimize water networks. They’re evaluating technologies that leverage AI and IoT sensors to predict maintenance needs, detect leaks in real-time, and dynamically manage water quality – ultimately helping utilities do more with less. The goal is to make water infrastructure smarter, more efficient, and more responsive to evolving challenges.

Perhaps most critically, the firm recognizes that scaling impact requires more than just deploying capital. They’re actively working to create enabling conditions for water innovation to thrive, from policy advocacy to ecosystem development. This includes collaborating with utilities, municipalities, and corporates to establish strategic pilot programs that can validate new technologies and accelerate market adoption.

To amplify their impact, Closed Loop is exploring innovative financing structures that can help de-risk water technology deployment. This could include blended capital approaches that combine private investment with catalytic funding from foundations and development agencies. The firm believes such models are essential for bridging the commercialization gap that often stalls promising water solutions.

Looking ahead, success will be measured not just in financial returns, but in gallons saved, communities served, and climate resilience built. As highlighted in how water technologies matter in lithium mining and why you should buy now, strategic investment in water innovation can unlock value across multiple sectors while advancing sustainability goals. The firm remains committed to proving that doing well and doing good are not mutually exclusive in the water sector.

The Circular Vision

At the heart of Closed Loop Partners’ transformative approach lies a profound understanding that our water systems need more than incremental fixes – they require a complete paradigm shift. The firm’s circular vision reimagines water infrastructure not as a linear system of extraction, use, and disposal, but as an interconnected cycle where waste becomes a valuable resource.

This philosophy manifests in their unique investment thesis that focuses on technologies enabling water reuse, resource recovery, and closed-loop systems. Rather than viewing wastewater treatment as a burden, they see it as an opportunity to extract valuable materials like nutrients, energy, and even rare minerals. This perspective has proven particularly powerful as emerging technologies make resource recovery increasingly cost-effective and environmentally beneficial.

The firm’s approach to circularity extends beyond simple recycling. They actively seek out technologies that can create regenerative cycles, where the outputs of one process become valuable inputs for another. For instance, they champion solutions that transform sewage sludge into biogas and fertilizers, effectively turning waste management costs into revenue streams while reducing environmental impact.

A key aspect of their circular vision involves breaking down traditional silos between different parts of the water sector. By viewing water infrastructure as an integrated system, they identify opportunities for symbiotic relationships between municipal utilities, industrial users, and agricultural operations. This systems-thinking approach enables more efficient resource use and creates multiple value streams from what was once considered waste.

Their investment strategy particularly emphasizes scalable technologies that can close resource loops while delivering strong financial returns. This dual focus on environmental impact and economic viability has proven crucial in demonstrating that circular solutions can outperform traditional linear approaches in both environmental and financial terms.

Perhaps most importantly, Closed Loop Partners recognizes that achieving true circularity requires more than just technological innovation. Their vision encompasses changes in business models, regulatory frameworks, and consumer behavior. By supporting technologies that enable these systemic changes, they’re helping to build the foundation for a more sustainable water future.

As explored in how to mitigate 4 shades of water risk through impact investing, this approach to circular water innovation represents a powerful framework for addressing multiple environmental challenges while generating sustainable returns.

Investment Strategy Deep Dive

Closed Loop Partners employs a multi-layered investment strategy that carefully balances risk and impact across the water technology spectrum. Their approach centers on three key investment stages, each with distinct risk profiles and return expectations.

At the early stage, the firm takes calculated risks on breakthrough technologies that could fundamentally transform water infrastructure. These investments typically range from $1-5 million and focus on innovations in advanced materials, AI-enabled solutions, and circular treatment processes. The risk assessment framework for these ventures weighs technical feasibility and market timing against potential environmental returns measured in water savings, energy reduction, and waste elimination.

For growth-stage investments, Closed Loop Partners targets companies with proven technologies ready for commercial scale-up. The firm provides $5-20 million in growth capital while applying rigorous due diligence that examines market validation, operational excellence, and measurable sustainability metrics. A critical evaluation criterion is the potential for circular value creation – how effectively the technology transforms traditional linear processes into closed-loop systems.

Infrastructure-scale investments represent the third pillar, where the firm deploys $20+ million in project finance for large-scale water treatment, reuse, and resource recovery facilities. These investments undergo extensive technical and financial modeling to validate long-term viability. The risk assessment emphasizes operational track records, contractual guarantees, and clear paths to stable returns through water savings or resource monetization.

Across all investment stages, Closed Loop Partners implements a proprietary impact measurement framework that tracks both environmental and financial metrics. This dual-return approach allows the firm to demonstrate that circular water solutions can deliver competitive returns while driving meaningful sustainability outcomes. The framework evaluates water savings, energy efficiency, waste reduction, and greenhouse gas mitigation alongside traditional financial metrics.

The firm’s risk mitigation strategy includes active portfolio management, strategic partnerships with industry leaders, and a focus on technologies with multiple commercial applications. This approach has enabled Closed Loop Partners to maintain strong returns while pushing the boundaries of water technology innovation. As explored in their approach to mitigating water risk through impact investing, the firm’s strategy demonstrates that environmental impact and financial returns are not mutually exclusive in the water sector.

By maintaining this carefully structured investment approach across different stages and risk profiles, Closed Loop Partners has positioned itself as a leading force in accelerating the transition to circular water systems while generating attractive returns for investors.

Success Stories in Water Tech

Closed Loop Partners’ portfolio showcases several breakthrough water technology companies that exemplify the firm’s dual focus on financial returns and environmental impact. These success stories demonstrate how strategic capital deployment can accelerate water innovation while generating meaningful results.

One standout portfolio company developed an energy-efficient wastewater treatment system that reduces energy consumption by 80% compared to conventional technologies. The system’s modular design allows for easy scaling, enabling treatment of industrial effluents ranging from 50,000 to over 1 million gallons per day. Beyond impressive technical metrics, this investment has yielded a 3x return while preventing over 100,000 metric tons of CO2 emissions annually.

Another portfolio success centers on smart water infrastructure monitoring. This company’s AI-powered sensors and analytics platform helps utilities detect leaks and optimize operations in real-time. The technology has been deployed across multiple major U.S. cities, helping save over 2 billion gallons of water and $15 million in costs. The investment has generated a 5x return while advancing water conservation at scale.

In the water reuse space, Closed Loop backed an innovative membrane technology company that makes water recycling more energy efficient and cost-effective. The technology reduces energy usage by 40% compared to conventional membranes while increasing water recovery rates. This investment exemplifies the firm’s thesis that environmental solutions can drive strong commercial outcomes.

A common thread across these successes is Closed Loop’s hands-on approach to value creation. Beyond capital, the firm provides strategic guidance, industry connections, and operational support to help portfolio companies overcome commercialization barriers and achieve rapid growth. This active investment style has been key to generating both strong returns and measurable impact.

These examples highlight how Closed Loop’s investment strategy targets opportunities where business success and environmental benefit are mutually reinforcing. By backing technologies that make water infrastructure more efficient, resilient and sustainable, the firm is demonstrating that solving water challenges can be both profitable and impactful.

The environmental metrics across the portfolio are substantial – billions of gallons of water saved, millions of metric tons of emissions avoided, and thousands of pounds of waste diverted. Meanwhile, the financial performance validates that water technology represents an attractive investment opportunity when approached with the right expertise and strategy.

Future of Water Finance

Closed Loop Partners is pioneering a transformative approach to water infrastructure financing that could reshape how we fund critical water projects globally. By leveraging innovative financial instruments and blended capital strategies, the firm is creating scalable models that address both financial returns and environmental impact.

At the core of their strategy lies the recognition that traditional financing mechanisms have failed to adequately address the estimated $1 trillion water infrastructure funding gap in the United States alone. How to actively invest philanthropy and save the water world demonstrates how their approach combines catalytic capital with commercial investment to de-risk promising water technologies.

The firm’s financing framework emphasizes three key pillars: technology validation, market acceleration, and infrastructure deployment. This integrated approach allows them to support water innovations across their entire development lifecycle – from early-stage R&D through full-scale implementation.

What sets Closed Loop Partners apart is their focus on circular economy principles in water financing. Rather than viewing water infrastructure as a one-time capital expense, they structure investments to capture value from resource recovery, water reuse, and operational efficiencies. This creates sustainable revenue streams that can support long-term infrastructure maintenance and upgrades.

Their innovative financing models are already influencing how other investors approach water technology. By demonstrating that water infrastructure can generate both environmental and financial returns, they’re helping attract new sources of capital to the sector. Their success has encouraged traditional infrastructure funds, pension funds, and even commercial banks to reconsider water investments.

Looking ahead, Closed Loop Partners is positioned to play an even more pivotal role in water finance. As climate change and aging infrastructure create greater urgency around water investment, their proven approach to blending different types of capital could become a blueprint for mobilizing the massive funding needed for water infrastructure modernization.

Their work is also helping establish new metrics and standards for measuring the impact of water investments. By quantifying both financial returns and environmental benefits, they’re creating frameworks that other investors can adopt to evaluate water technology opportunities.

As the water technology sector continues to evolve, Closed Loop Partners’ financing innovations may help unlock the capital needed to accelerate the adoption of breakthrough water solutions at scale. Their success could ultimately transform how we fund and implement critical water infrastructure improvements in the decades ahead.

Final words

Closed Loop Partners stands as a compelling example of how strategic capital deployment can accelerate water technology innovation while advancing circular economy principles. Their investment approach – combining rigorous financial analysis with clear impact metrics – offers a blueprint for scaling solutions to critical water challenges. From their sweet spot in early-stage investments to their hands-on board involvement, they’re positioned to shape the next generation of water technology companies. For entrepreneurs developing breakthrough water solutions, Closed Loop Partners represents more than just a source of capital – they’re a strategic partner with the expertise and network to help scale meaningful innovation. Their continued focus on circular solutions and commitment to follow-on funding suggests they’ll remain a crucial player in advancing water technology that matters.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my ‘(don’t) Waste Water’ platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!