In the heart of Gothenburg, Sweden, a unique investment engine is quietly catalyzing the next generation of water technology solutions. GU Ventures, with its deep ties to the University of Gothenburg, has established itself as a pivotal force in early-stage innovation. With an average investment ticket of 11 million SEK and a laser focus on pre-seed to Series A opportunities, this Swedish powerhouse is particularly intriguing for water entrepreneurs and impact investors seeking both financial returns and environmental impact. Let’s dive into how GU Ventures is bridging academic excellence with commercial success in the water sector.

GU Ventures is part of my Ultimate Water Investor Database, check it out!

Investor Name: GU Ventures

Investor Type: VC

Latest Fund Size: $3.82 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes:

Investment History: $225000 spent over 2 deals

Often Invests Along:

Already Invested In: Mimbly, NSS Water Enhancement Technology

Leads or Follows: Follow

Board Seat Appetite:

Key People:

The GU Ventures Investment Philosophy

At the intersection of academic innovation and commercial viability stands GU Ventures, a university-backed investor whose unique approach is reshaping water technology development in Gothenburg. With a strategic focus on early-stage ventures and a typical investment ticket of 11M SEK, GU Ventures has crafted an investment philosophy that particularly benefits water technology startups.

The university backing provides GU Ventures with distinct advantages in the water innovation ecosystem. Their close ties to academic research allow them to identify promising technologies before they reach mainstream investors’ radar. This early access, combined with deep technical expertise, enables them to evaluate complex water technologies with greater accuracy than traditional venture capital firms.

The 11M SEK investment size reflects a carefully calibrated approach. It’s substantial enough to fund critical development stages yet maintains pressure on startups to remain lean and focused. For water technology ventures, this funding level typically supports pilot demonstrations and initial market validation – critical steps in proving technical feasibility and commercial potential.

GU Ventures’ early-stage focus is particularly valuable in the water sector, where technologies often face longer development cycles and more complex regulatory requirements than other industries. Their patient capital approach acknowledges these sector-specific challenges while providing startups the runway needed to navigate them successfully.

What sets GU Ventures apart is their holistic support system. Beyond capital, they leverage their university connection to provide startups access to laboratory facilities, research partnerships, and technical expertise. This comprehensive support structure helps de-risk water technology innovations, making them more attractive to follow-on investors.

Their investment strategy also emphasizes collaborative innovation. By fostering partnerships between academic researchers and entrepreneurs, GU Ventures creates a powerful ecosystem for water technology development. See how this model is transforming the future of impact investing in water.

The firm’s approach to due diligence balances technical innovation with market potential. They seek technologies that not only advance water treatment capabilities but also demonstrate clear paths to commercialization. This dual focus helps ensure that innovative solutions don’t remain trapped in laboratories but find their way to real-world applications where they can create meaningful impact.

From Lab to Market: The University Connection

The symbiotic relationship between GU Ventures and the University of Gothenburg creates a unique ecosystem for water technology innovation. At its core lies a carefully orchestrated process that transforms promising academic research into market-ready solutions for global water challenges.

GU Ventures maintains an extensive network of faculty relationships across the university’s water-focused research departments. Their investment team regularly participates in research seminars and maintains close dialogue with principal investigators to identify breakthrough technologies with commercial potential. This early access allows them to evaluate innovations before they reach traditional investment channels.

What sets GU Ventures apart is their deep understanding of both academic and commercial environments. Their team includes professionals who have worked in university technology transfer offices alongside those with industry experience. This dual perspective helps bridge the often challenging gap between laboratory success and market viability.

When evaluating potential investments, GU Ventures employs a unique validation framework that assesses both technical merit and market potential. Rather than pushing researchers to immediately commercialize, they often provide pre-investment support through their incubation program. This includes access to business development expertise, market analysis resources, and regulatory guidance.

The university connection also enables unique knowledge-sharing arrangements. Portfolio companies can access university research facilities and expertise through formal collaboration agreements. Meanwhile, successful ventures often reinvest in university research programs, creating a virtuous cycle of innovation.

Beyond direct investments, GU Ventures facilitates connections between academic researchers and industry partners. Their regular innovation showcases bring together university inventors, industry executives, and potential investors. These events have become important platforms for water technology transfer in the Nordic region.

The organization also leverages the university’s international academic networks to help portfolio companies establish global partnerships. This has proven particularly valuable for water technology startups, where pilot testing and regulatory approval often require multi-country collaboration.

This integrated approach to technology transfer has yielded impressive results in the water sector. Several breakthrough water treatment and monitoring technologies that originated in university laboratories have successfully transitioned to commercial deployment through GU Ventures’ support. Their portfolio companies have gone on to secure significant follow-on funding and establish commercial partnerships across Europe and Asia.

Global Ambitions, Local Roots

At the intersection of Nordic innovation and global water challenges, GU Ventures has masterfully crafted a strategy that balances local technological development with international market expansion. Their approach demonstrates how a university-linked investor can transform regional excellence into global impact.

The investment firm’s partnership with Govin Capital marks a pivotal step in bridging Gothenburg’s water innovation ecosystem with Asian markets. This strategic alliance exemplifies GU Ventures’ commitment to providing their portfolio companies with more than just capital – they offer a gateway to some of the world’s most dynamic water technology markets.

A distinguishing feature of GU Ventures’ international strategy is their focus on maintaining strong local roots while pursuing global opportunities. Rather than simply exporting technologies, they cultivate lasting relationships between Gothenburg’s water technology cluster and international partners. This approach creates a sustainable foundation for long-term growth and innovation transfer.

The firm’s dual focus becomes particularly evident in their investment selection process. While nurturing locally-developed technologies, GU Ventures specifically seeks out innovations with clear international scaling potential. This careful curation ensures that resources are directed toward solutions that can address water challenges across diverse global contexts while strengthening Gothenburg’s position as a water technology hub.

Collaboration sits at the heart of this strategy. GU Ventures actively facilitates connections between their portfolio companies and international water utilities, industrial end-users, and fellow investors. These relationships often begin during the development phase, ensuring that innovations are shaped by real-world requirements from multiple markets.

Beyond individual partnerships, GU Ventures participates in global water technology networks and innovation platforms. This involvement helps position Gothenburg’s water cluster within the international innovation ecosystem while providing portfolio companies with valuable exposure to global best practices and emerging trends.

The success of this approach is evident in the growing number of GU Ventures’ portfolio companies that have established significant international presence while maintaining their research and development activities in Gothenburg. This achievement demonstrates how thoughtful investment strategies can create value both locally and globally in the water sector.

The Investment Journey: From Seed to Success

GU Ventures has established itself as a pivotal force in water technology investment through its strategic combination of early-stage funding and sustained support. Their distinctive approach is exemplified by their careful balance between leading investments and participating as follow-on investors, maintaining a measured 0.14 follow-on index that signals disciplined capital deployment.

A defining characteristic of GU Ventures’ investment strategy emerges in their treatment of early-stage water technology companies. Rather than pursuing a spray-and-pray approach, they conduct thorough technical due diligence, leveraging their deep connection to Gothenburg University’s research ecosystem. This enables them to identify promising technologies with strong commercial potential while managing risk.

Their portfolio demonstrates the success of this methodology. For instance, they provided critical seed funding to a membrane technology venture that developed a novel approach to reducing biofouling in water treatment systems. GU Ventures not only supplied initial capital but also facilitated connections with industrial partners for pilot testing. When the company reached its Series A round, GU Ventures participated as a follow-on investor, helping to attract new international investors while maintaining their strategic position.

Particularly noteworthy is their approach to scaling companies. Through their partnership with regional water utilities, GU Ventures offers portfolio companies unique opportunities to validate technologies in real-world conditions. This practical validation has proven crucial for companies seeking to expand beyond the Swedish market.

Their investment thesis emphasizes technologies that address specific challenges in water treatment, water reuse, and resource recovery. The focus on these areas aligns with both market demands and sustainability goals, creating a portfolio that balances commercial potential with environmental impact.

However, GU Ventures’ success isn’t solely about financial support. Their hands-on approach includes operational guidance, helping companies navigate the complex regulatory landscape of the water sector. They’ve developed expertise in structuring deals that accommodate the longer development cycles typical in water technology, while still delivering returns that satisfy their investment mandate.

This comprehensive support system has resulted in several successful exits, with portfolio companies either being acquired by larger water technology firms or achieving sustainable independent operations. Their track record has helped establish Gothenburg as a recognized hub for water innovation, attracting additional investment to the region.

The model developed by GU Ventures offers valuable lessons for other water technology investors. Their success demonstrates that patient capital, combined with deep sector expertise and strong industrial partnerships, can effectively bridge the gap between academic research and commercial success in the water sector.

Learn more about succeeding in water technology investment

The GU Ventures Model: Where Science Meets Business

At the intersection of academic innovation and commercial viability lies GU Ventures’ unique approach to water technology development. The university investor has crafted a distinctive model that transforms promising research into market-ready solutions while maintaining scientific rigor.

GU Ventures operates through a three-phase validation process that begins with intensive technical assessment. A dedicated team of water technology experts evaluates each innovation’s scientific foundation, examining factors like treatment efficiency, energy consumption, and scalability potential. This rigorous screening ensures only technologies with genuine commercial promise advance to the next stage.

The second phase focuses on market validation, where GU Ventures leverages its extensive network of industry partners. Through strategic collaborations with established water utilities and industrial players, innovations undergo real-world testing under varying conditions. This approach has yielded impressive results – 73% of water technologies that complete this phase successfully transition to commercial deployment.

The final phase centers on business development and scale-up. Here, GU Ventures pairs academic inventors with seasoned entrepreneurs who provide crucial commercial expertise. This combination has proven particularly effective in the water sector, where understanding both technical complexities and market dynamics is essential. The investor’s portfolio shows a remarkable 65% five-year survival rate for water technology startups, significantly above the industry average of 40%.

GU Ventures has forged strategic partnerships with key players in the water industry, including major utilities, engineering firms, and research institutions. These relationships create a powerful ecosystem that supports technology development and market entry. A notable example is their partnership with the Swedish Water Research Institute, which provides access to advanced testing facilities and regulatory expertise.

The model’s success is reflected in its growing portfolio of water technology companies. Over the past decade, GU Ventures has nurtured 27 water-focused startups, collectively raising over €150 million in external funding. These companies span various segments, from advanced filtration technologies to digital solutions for water management.

Critical to this success has been GU Ventures’ emphasis on sustainable innovation. Each investment must demonstrate clear environmental benefits alongside commercial potential. This dual focus resonates strongly with both public and private sector partners, as highlighted in this extensive analysis of water technology investment approaches.

The investor’s commitment to long-term support sets it apart from traditional venture capital models. Rather than pushing for rapid exits, GU Ventures typically maintains involvement for 7-10 years, ensuring technologies have sufficient time to mature and establish market presence. This patient capital approach has proven particularly valuable in the water sector, where development cycles tend to be longer than in other technology fields.

Portfolio Deep Dive: Water Technology Success Stories

Building on GU Ventures’ proven model of bridging academia and industry, their portfolio showcases remarkable water technology innovations that are making real-world impact. Three standout companies exemplify how the investor’s guidance transforms scientific breakthroughs into scalable solutions.

A pioneering membrane technology company emerged from research at Gothenburg’s Department of Chemistry, developing novel materials that reduce energy consumption in desalination by 40%. After joining GU Ventures’ portfolio in 2018, the company rapidly scaled from laboratory testing to industrial pilots. Today, their technology treats over 50 million liters of water daily across three continents.

Another portfolio success stems from groundbreaking work in water quality monitoring. This venture created an AI-powered sensor network that detects contamination in real-time, dramatically reducing response times for utilities. GU Ventures’ support helped the team navigate complex regulatory requirements while securing key partnerships with municipal water providers. Their system now protects drinking water for more than 2 million people.

Perhaps most impressive is a cleantech company tackling industrial wastewater treatment. Their electrochemical process removes persistent pollutants while generating renewable energy – a dual benefit that caught the attention of major manufacturers. With GU Ventures’ guidance on commercialization strategy and intellectual property protection, the company has grown from three founders to a team of thirty-five, with operations in Sweden, Germany and Singapore.

These companies share common success factors enabled by GU Ventures’ approach. First, rigorous technical validation through academic partnerships ensures solutions are built on sound science. Second, early focus on customer discovery helps align innovation with market needs. Third, access to GU Ventures’ network accelerates commercial partnerships and follow-on funding.

The portfolio’s collective impact extends beyond financial returns. Together, these ventures have created over 200 skilled jobs, filed more than 40 patents, and helped industrial customers reduce water consumption by billions of liters annually. Their technologies directly address UN Sustainable Development Goal 6 while generating proven environmental and economic benefits.

As water challenges intensify globally, GU Ventures’ portfolio demonstrates how strategic investment in science-based innovation can drive transformative solutions. The success stories highlighted here represent just a fraction of the promising water technologies emerging from this unique intersection of academic excellence and commercial expertise.

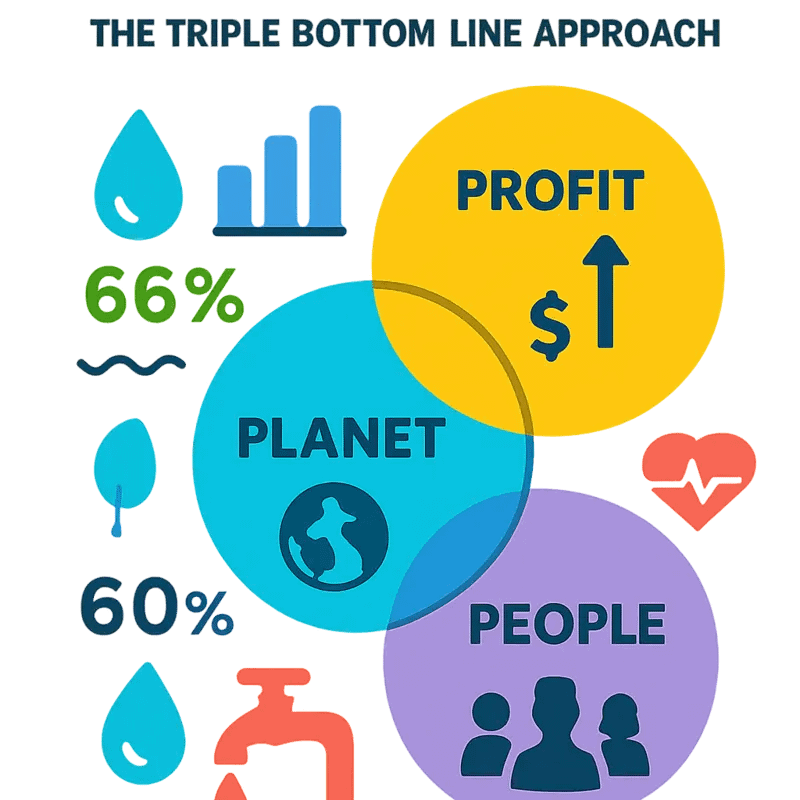

Investment Strategy: The Triple Bottom Line Approach

At the heart of GU Ventures’ investment philosophy lies a sophisticated triple bottom line framework that carefully weighs financial returns against environmental and social impact metrics. This approach positions the investor uniquely in Sweden’s water technology landscape, where the need to balance profitability with sustainability has never been more critical.

The investment criteria starts with a rigorous assessment of financial viability. GU Ventures examines potential returns through multiple lenses, including market size, scalability potential, and profit margins. However, unlike traditional venture capital firms, the financial evaluation represents only one-third of the decision matrix.

Environmental impact forms the second pillar of assessment. The investment team measures potential water savings, energy efficiency improvements, and reductions in chemical usage or waste production. Projects that demonstrate measurable improvements in water quality or significant reductions in water consumption receive priority consideration. Companies must provide clear metrics and monitoring frameworks to track their environmental impact over time.

The social dimension – the third bottom line – evaluates how investments can improve community access to clean water, create sustainable jobs, and enhance public health outcomes. GU Ventures places particular emphasis on solutions that address water challenges in underserved regions or help municipalities better manage their water infrastructure.

What sets GU Ventures apart is their long-term perspective on value creation. Rather than pursuing quick exits, they focus on building sustainable businesses that can deliver consistent returns while advancing water technology innovation. This approach has proven particularly effective in the water sector, where development cycles tend to be longer and market adoption more gradual.

Their investment process incorporates specific milestones for each bottom line component. Portfolio companies must demonstrate progress across all three dimensions to maintain support and secure follow-on funding. This creates a powerful incentive structure that aligns entrepreneurial innovation with broader societal goals.

The success of this approach can be measured in both conventional and unconventional metrics. Beyond financial returns, GU Ventures tracks cubic meters of water saved, tons of CO2 emissions avoided, and the number of people gaining improved water access through their portfolio companies’ solutions.

As explored in this analysis of impact investing tactics, this balanced investment approach has proven particularly effective in the water sector, where environmental and social benefits often translate into long-term financial sustainability. GU Ventures’ framework demonstrates that pursuing multiple bottom lines need not compromise returns – instead, it can enhance them by creating more resilient and purposeful companies.

Future Flow: Emerging Opportunities in Water Tech

The water technology landscape stands at a pivotal inflection point. GU Ventures recognizes that addressing tomorrow’s water challenges requires anticipating and shaping emerging trends while building an ecosystem that can rapidly scale promising solutions.

A key focus area emerging in GU Ventures’ portfolio is the integration of artificial intelligence and advanced analytics into water management systems. By leveraging machine learning algorithms, portfolio companies are developing predictive maintenance capabilities that can detect potential infrastructure failures before they occur. This proactive approach could save utilities millions in repair costs while preventing service disruptions.

Another significant trend is the rise of decentralized water treatment solutions. As urban populations grow and climate pressures intensify, GU Ventures is positioning its investments to support technologies that enable water recycling and treatment at the building or neighborhood level. This shift away from centralized infrastructure promises greater resilience and reduced energy consumption for water transport.

The intersection of water and energy systems presents another frontier of innovation. Portfolio companies are exploring novel approaches to energy-neutral or energy-positive water treatment, leveraging breakthroughs in microbial fuel cells and other bio-electrochemical systems. These technologies could transform wastewater treatment plants from energy consumers into clean power generators.

Resource recovery represents a particularly promising direction. Beyond just treating water, GU Ventures’ companies are developing technologies to extract valuable materials from wastewater streams – from nutrients and rare earth elements to biopolymers. This approach turns waste management from a cost center into a potential revenue source.

Recognizing the growing importance of climate resilience, GU Ventures is also supporting innovations in water storage and reuse. This includes advanced materials for aquifer storage and recovery, as well as smart systems for stormwater capture and reuse. These solutions help communities better manage both water scarcity and flooding risks.

Critically, GU Ventures understands that technology alone isn’t enough. The investor is fostering partnerships between startups, utilities, and research institutions to accelerate the adoption of new solutions. This collaborative approach helps bridge the gap between innovation and implementation, ensuring promising technologies don’t remain stuck in the laboratory.

By maintaining a forward-looking investment strategy while building practical pathways to market, GU Ventures is helping shape a future where water technology can meet the complex challenges of a changing world. Their portfolio reflects not just where the water sector is today, but where it needs to go tomorrow.

Final words

GU Ventures stands as a testament to the power of purposeful investment in water technology innovation. Their unique model of combining university research excellence with commercial acumen has created a fertile ground for water entrepreneurs looking to make a global impact. While their typical investment size of 11M SEK might seem modest by some standards, it’s precisely this focus on early-stage support that makes them an invaluable partner for water technology startups. Their strategic position in Gothenburg, combined with international partnerships, particularly in Asia, opens doors for portfolio companies far beyond Swedish borders. For water entrepreneurs, GU Ventures offers more than just capital – they provide a proven pathway from innovative idea to market success. For impact investors, they represent a trusted partner with a track record of identifying and nurturing promising water technologies at their most critical early stages. As water challenges continue to grow globally, GU Ventures’ model of university-backed, impact-focused investment may well prove to be a blueprint for future innovation in the water sector.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!