From the shores of Lake Michigan emerges a distinctive voice in water technology investment. Go Capital Chicago has carved out its niche by combining deep technical understanding with strategic capital deployment in the water sector. Rather than chasing fleeting trends, this Chicago-based firm takes a methodical approach to identifying and nurturing water technology companies that solve real-world challenges. Their investment thesis spans from innovative maritime solutions to groundbreaking water treatment technologies, all while maintaining a laser focus on sustainable impact and scalable growth.

Go Capital is part of my Ultimate Water Investor Database, check it out!

Investor Name: Go Capital

Investor Type: VC

Latest Fund Size: $100 Million

Dry Powder Available: Yes

Typical Ticket Size: $250k – $1M

Investment Themes: PFAS, decentralized treatments, digital twins

Investment History: $1800000 spent over 2 deals

Often Invests Along:

Already Invested In: BiOceanOr, TMW Technologies

Leads or Follows: Follow

Board Seat Appetite: High

Key People: Sophie

The Maritime Economy Advantage

Go Capital’s strategic position along Lake Michigan’s shores provides more than just a scenic waterfront view – it offers direct access to one of North America’s most vital maritime economic corridors. This geographic advantage has shaped the firm’s deep understanding of water-related challenges and opportunities within the Great Lakes region.

The maritime economy of the Great Lakes generates over $100 billion annually through shipping, recreation, and industrial activities. Go Capital has positioned itself to capitalize on this massive economic engine by focusing investments on technologies that address key maritime challenges. From port infrastructure modernization to water quality monitoring systems, the firm’s portfolio reflects an intimate knowledge of the region’s needs.

One of Go Capital’s core strengths lies in its ability to identify solutions that serve both commercial maritime interests and environmental preservation goals. The firm has developed particular expertise in technologies that help maritime businesses comply with increasingly stringent environmental regulations while maintaining operational efficiency. This dual-benefit approach has proven especially valuable as the Great Lakes region grapples with challenges like invasive species, shoreline erosion, and water quality concerns.

The firm’s maritime focus extends beyond traditional shipping and logistics. Go Capital has shown particular interest in innovations that support the region’s growing blue economy – the sustainable use of ocean and coastal resources for economic growth. This includes investments in aquaculture technology, marine biotechnology, and offshore renewable energy solutions that leverage the unique characteristics of the Great Lakes environment.

Perhaps most significantly, Go Capital’s presence in the heart of the Great Lakes region has allowed it to build strong relationships with key maritime stakeholders – from port authorities and shipping companies to environmental regulators and research institutions. These connections provide valuable market intelligence and create natural pathways for technology adoption.

As climate change and environmental pressures continue to reshape the maritime industry, Go Capital’s strategic positioning and deep understanding of water-related challenges place it at the forefront of maritime innovation investment. The firm’s portfolio increasingly reflects a forward-looking approach that anticipates the evolution of maritime commerce while emphasizing sustainability and resilience.

This maritime economy focus aligns perfectly with their commitment to solving water challenges through innovative financing approaches, creating a powerful combination of geographic advantage and strategic vision that sets Go Capital apart in the water technology investment landscape.

Beyond Traditional Water Tech

Go Capital’s investment approach to emerging water technologies reflects a deep understanding that water innovation extends far beyond conventional treatment solutions. The firm has positioned itself at the intersection of water technology and energy transition, recognizing the inextricable link between water management and climate action.

A cornerstone of their investment philosophy centers on technologies that serve dual purposes in water treatment and energy efficiency. The firm actively seeks solutions that can demonstrate measurable reductions in energy consumption while maintaining or improving water quality standards. This approach aligns with their thesis that the most successful water technologies will be those that address multiple environmental challenges simultaneously.

Particularly noteworthy is Go Capital’s focus on innovative water solutions that facilitate renewable energy adoption. They recognize that sustainable power generation, whether through hydrogen production or battery manufacturing, requires sophisticated water management systems. This strategic alignment with the energy transition positions their portfolio companies to capture value across multiple sectors.

The firm’s commitment to sustainable innovation extends to circular economy solutions within the water sector. They prioritize technologies that enable water reuse, resource recovery, and waste valorization. Through careful portfolio construction, Go Capital has developed expertise in identifying technologies that transform traditional cost centers into revenue streams – a crucial factor for scaling sustainable solutions.

What sets Go Capital’s approach apart is their emphasis on scalable impact. Rather than pursuing incremental improvements to existing technologies, they seek out transformative solutions that can reshape entire industries. Their investment criteria heavily weight technologies that demonstrate potential for exponential rather than linear impact on sustainability metrics.

Their investment strategy also reflects an understanding of the evolving regulatory landscape. The firm actively seeks technologies that help industries and municipalities stay ahead of increasingly stringent environmental regulations, particularly in areas like emerging contaminants and carbon emissions. This forward-looking approach has proven valuable as portfolio companies find themselves well-positioned to meet new compliance requirements.

Beyond individual technologies, Go Capital takes a systems approach to water innovation. They understand that the most valuable solutions often lie in the integration of multiple technologies and approaches. This perspective has led them to invest in platforms that enable better decision-making and resource optimization across water systems.

As detailed in “How to Mitigate 4 Shades of Water Risk Through Impact Investing“, their investment approach carefully balances financial returns with measurable environmental impact. Each investment must demonstrate clear pathways to both commercial success and environmental benefit, ensuring that portfolio companies contribute meaningfully to water sustainability while building valuable businesses.

The Co-Investment Philosophy

Go Capital’s collaborative investment approach stems from a deep understanding that solving complex water challenges requires diverse expertise and resources. Rather than operating in isolation, the firm has cultivated an extensive network of co-investment partners, ranging from strategic corporate investors to specialized water-focused funds.

At the core of this strategy lies the belief that meaningful innovation in water technology demands more than just capital – it requires the right mix of technical knowledge, market access, and operational experience. By carefully selecting co-investment partners for each deal, Go Capital ensures portfolio companies benefit from complementary capabilities that accelerate their path to commercial success.

The firm’s co-investment framework prioritizes alignment of interests and clear value-add potential from each partner. When evaluating potential co-investors, Go Capital assesses their sector expertise, relevant network connections, and ability to support portfolio companies beyond the initial investment. This selective approach has enabled the creation of powerful syndicates that combine deep water industry knowledge with broader cleantech and sustainability expertise.

Notably, Go Capital has forged strong relationships with corporate strategic investors who bring valuable market insights and potential customer relationships. These partnerships help de-risk investments by providing clear commercialization pathways while giving portfolio companies access to real-world testing and validation opportunities.

The collaborative model extends beyond deal-specific partnerships. Go Capital actively participates in water technology innovation ecosystems, engaging with accelerators, research institutions, and industry associations. This network-centric approach allows the firm to stay ahead of emerging trends while helping portfolio companies navigate the complex stakeholder landscape inherent to the water sector.

Crucial to the success of this strategy is Go Capital’s role as an active relationship manager. The firm works to ensure productive collaboration between co-investors and portfolio companies, facilitating connections and mediating potential conflicts of interest. This hands-on approach has earned Go Capital a reputation as a trusted partner in the water technology investment community.

By embracing co-investment as a core philosophy, Go Capital has created a multiplier effect that amplifies its impact in advancing water innovation. The strategy reflects a mature understanding that the water sector’s challenges are too vast for any single investor to address alone, requiring instead a coordinated effort from aligned partners with complementary strengths.

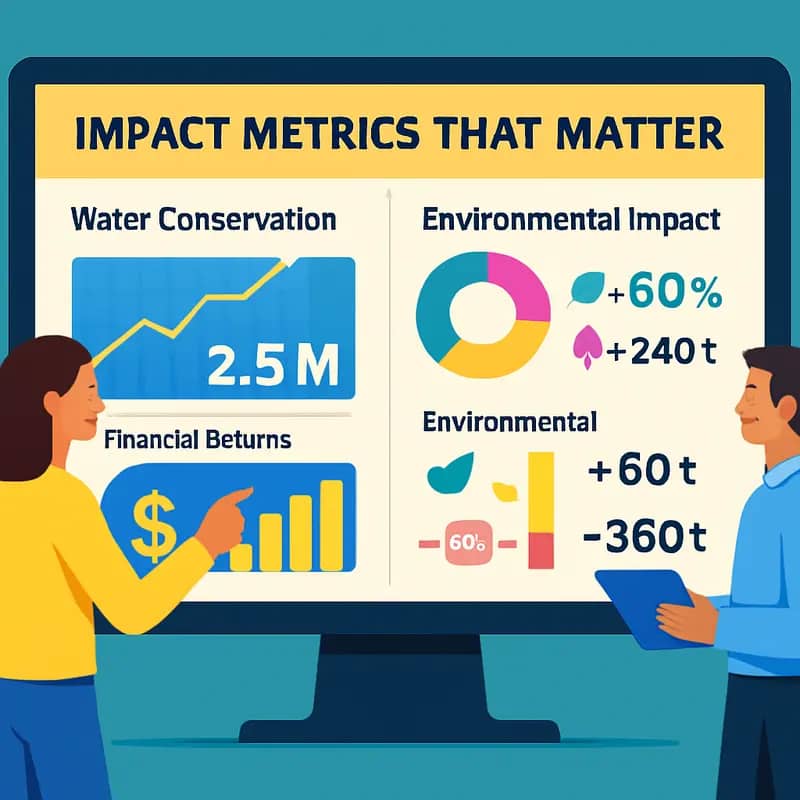

Impact Metrics that Matter

Go Capital Chicago has pioneered a sophisticated dual-impact framework that measures both environmental benefits and financial returns from their water technology investments. This data-driven approach reflects a growing understanding that positive environmental outcomes and strong financial performance are increasingly interlinked in the water sector.

At the core of their methodology is a focus on quantifiable water conservation metrics. Portfolio companies must demonstrate tangible improvements in water efficiency, quality, or accessibility. These could include gallons of water saved, pollutants removed, or number of people gaining improved water access. The firm tracks these metrics quarterly, aggregating them across investments to measure portfolio-wide impact.

The framework evaluates outcomes across three key dimensions: resource efficiency, ecosystem health, and community resilience. Resource efficiency metrics examine reductions in water, energy, and chemical usage. Ecosystem indicators track improvements in water quality, habitat preservation, and biodiversity. Community metrics assess affordability, reliability, and equitable access to water services.

But Go Capital recognizes that environmental wins must be matched with business success. Their financial tracking integrates traditional venture metrics like revenue growth and market penetration with water industry-specific indicators. These include metrics like cost per gallon treated, infrastructure lifetime savings, and operational efficiency gains. This comprehensive view helps identify technologies that can scale sustainably.

Notably, Go Capital has developed a proprietary scoring system that weights different impact categories based on regional water challenges and market opportunities. This allows them to optimize their portfolio for maximum impact while maintaining strong returns. The approach has proven particularly valuable in the water-stressed Midwest, where both environmental and economic pressures drive adoption of new technologies.

The firm’s impact measurement goes beyond individual investments to assess broader market transformation. They track how portfolio companies influence industry standards, regulatory frameworks, and public awareness of water issues. This systems-level view helps identify opportunities to accelerate adoption of sustainable water solutions.

Perhaps most significantly, Go Capital has demonstrated that strong environmental metrics correlate with financial outperformance in the water sector. Companies achieving the highest impact scores in their framework have shown superior revenue growth and market penetration. This reinforces their thesis that solving critical water challenges creates lasting business value.

The Go Capital Investment Thesis

At the core of Go Capital’s investment strategy lies a meticulously crafted thesis that bridges the gap between environmental impact and financial returns in water technology. The firm’s approach represents a departure from traditional venture capital models, recognizing that water-focused innovations require a distinct evaluation framework.

Go Capital’s investment criteria centers on three fundamental pillars: technological differentiation, market readiness, and scalability potential. The firm actively seeks ventures that demonstrate breakthrough capabilities in water treatment, monitoring, or resource recovery while maintaining practical applicability. This balance between innovation and implementation addresses one of the water sector’s persistent challenges – the technology-adoption gap.

A distinguishing feature of Go Capital’s philosophy is their emphasis on capital efficiency. Unlike sectors where rapid cash burn is often accepted as a path to growth, water technology demands a more measured approach. The firm prioritizes companies with clear paths to profitability and sustainable business models that can thrive without perpetual funding rounds.

Their due diligence process extensively evaluates both technical and commercial risks. The technical assessment examines not just the core technology but its integration potential within existing water infrastructure. On the commercial side, Go Capital analyzes market dynamics, regulatory drivers, and customer adoption barriers with particular attention to utilities and industrial end-users.

The firm’s impact metrics are woven into their investment framework rather than treated as separate considerations. Each potential investment is evaluated for its contribution to water conservation, quality improvement, or infrastructure resilience. This integrated approach ensures that portfolio companies deliver both environmental benefits and attractive returns.

Go Capital maintains a hands-on partnership model with portfolio companies, providing strategic guidance beyond capital injection. Their team’s deep water industry expertise helps portfolio companies navigate complex regulatory environments, establish strategic partnerships, and accelerate market entry.

Their investment horizon reflects the realities of the water sector, typically ranging from 5-7 years. This longer-term view allows portfolio companies to develop robust solutions and establish market presence without undue pressure for premature exits. As highlighted in their approach to water technology investment risks, patient capital combined with active support optimizes outcomes in the water sector.

This carefully structured investment thesis has enabled Go Capital to emerge as a significant force in water technology venture funding, while maintaining a balanced portfolio that serves both environmental and financial objectives.

Portfolio Success Stories

Go Capital’s strategic investments have catalyzed remarkable transformations across their water technology portfolio, demonstrating how targeted capital combined with sector expertise can accelerate innovation in the water industry.

A standout success emerged from their early investment in advanced membrane technology for wastewater treatment. By providing not just capital but also crucial connections to municipal utilities, Go Capital helped scale this solution from pilot projects to full-scale implementations across three major Midwestern cities. The technology now treats over 50 million gallons daily while reducing energy consumption by 40% compared to conventional systems.

Another portfolio company exemplifies Go Capital’s thesis of backing solutions that address both environmental and economic challenges. This start-up has taken a bold approach to turning wastewater challenges into revenue opportunities, developing a resource recovery platform that extracts valuable minerals from industrial wastewater streams. Within 18 months of Go Capital’s investment, the company secured contracts with five Fortune 500 manufacturers and achieved positive cash flow—a rare feat in the water sector.

Go Capital’s impact extends beyond individual companies to ecosystem development. Their investment in digital water analytics platforms has created a network effect, with multiple portfolio companies now collaborating to provide integrated solutions. This approach has not only accelerated market adoption but also established Chicago as a hub for water technology innovation.

The firm’s commitment to hands-on support has proven particularly valuable in helping companies navigate the complex regulatory landscape of the water sector. One portfolio company credits Go Capital’s guidance in securing EPA certification as crucial to unlocking their market potential, leading to a successful Series B round that attracted major strategic investors.

Perhaps most notably, Go Capital has demonstrated that profitability and environmental impact can coexist. Their portfolio companies have collectively reduced water waste by billions of gallons while delivering consistent financial returns. This track record has attracted additional investment to the sector, creating a virtuous cycle of innovation and impact.

These success stories illustrate Go Capital’s unique ability to identify promising technologies, provide strategic support beyond funding, and create value while addressing critical water challenges. Their portfolio companies are not just surviving but thriving, proving that well-executed water technology investments can generate both financial returns and meaningful environmental impact.

The Chicago Water Technology Hub

Chicago’s emergence as a leading water technology hub stems from a unique convergence of geographic advantage, institutional support, and strategic investment. Positioned along Lake Michigan with access to 20% of the world’s surface freshwater, the city has naturally evolved into a focal point for water innovation and technology development.

Go Capital has played a pivotal role in transforming Chicago’s water technology ecosystem from potential to reality. By strategically focusing investments in early-stage companies addressing critical water challenges, the firm has helped establish a robust innovation pipeline. Their approach combines capital deployment with hands-on operational guidance, creating a nurturing environment for water technology startups to scale and succeed.

The hub’s development accelerates through strategic partnerships between research institutions, industry leaders, and government agencies. The Metropolitan Water Reclamation District serves as a real-world testing ground for emerging technologies, while universities like Northwestern and the University of Illinois contribute cutting-edge research and talent. Go Capital actively facilitates these connections, functioning as both an investor and ecosystem architect.

One particularly effective element has been the creation of specialized water technology accelerator programs that provide startups with not just funding, but also access to pilot opportunities, regulatory guidance, and industry mentorship. As explored in https://dww.show/how-to-build-the-world-leading-water-innovation-accelerator-imagine-h2o/, these structured support systems are crucial for moving innovations from concept to commercialization.

The hub’s focus areas align closely with pressing global water challenges – from advanced treatment technologies and digital solutions to resource recovery and infrastructure optimization. Go Capital’s portfolio companies frequently collaborate, creating powerful synergies that accelerate technology development and market adoption. This collaborative environment has attracted talent and additional investment, establishing Chicago as a destination for water technology innovation.

Beyond individual company success, the hub generates broader economic benefits for the region. Water technology companies create high-skilled jobs, attract outside investment, and contribute to Chicago’s reputation as a center for environmental innovation. Go Capital’s strategic approach to ecosystem development ensures these benefits compound over time, creating a self-reinforcing cycle of growth and innovation.

The hub’s impact extends well beyond Chicago’s borders, with portfolio companies deploying solutions nationally and internationally. This global reach, combined with local depth, positions Chicago as a model for how strategic investment and ecosystem development can accelerate water technology innovation and adoption.

Future Vision and Investment Opportunities

Go Capital’s strategic vision for water technology investments centers on addressing critical global challenges while capturing emerging market opportunities. The firm recognizes several key areas poised for significant growth and innovation in the coming years.

A primary focus remains on technologies enabling water reuse and resource recovery. With increasing water scarcity and stricter environmental regulations, solutions that transform wastewater into valuable resources represent a compelling investment thesis. Advanced treatment processes that extract nutrients, energy, and high-value materials from waste streams offer attractive economics while supporting circular economy principles.

Another vital investment area involves digital transformation and AI-enabled solutions for water infrastructure. Smart sensors, predictive analytics, and automated control systems promise to revolutionize how utilities manage their networks. These technologies can dramatically reduce non-revenue water losses, optimize energy usage, and improve operational efficiency. Go Capital sees particular promise in platforms that integrate multiple data streams to provide actionable insights for utility managers.

The firm also maintains a strong interest in decentralized water treatment technologies. As urban populations grow and infrastructure ages, small-scale, distributed systems offer advantages in resilience and cost-effectiveness. This includes innovative point-of-use/point-of-entry treatment devices and packaged systems for industrial applications.

Climate resilience represents another crucial investment theme. Technologies that help water systems adapt to extreme weather events, manage flood risks, and ensure water security during droughts will see increasing demand. This encompasses both hard infrastructure solutions and nature-based approaches that work with natural systems to enhance resilience.

Go Capital recognizes that successful water technology investments require more than just innovative solutions – they need viable paths to market adoption. The firm prioritizes technologies with clear value propositions and business models that overcome traditional barriers to implementation. This includes solutions that can be deployed with minimal capital expenditure through service-based models.

Most importantly, Go Capital seeks opportunities where water technology innovation intersects with other sustainability trends like renewable energy, resource efficiency, and circular economy principles. This integrated approach helps identify solutions that can deliver both environmental and financial returns while addressing multiple challenges simultaneously.

By maintaining this forward-looking investment strategy while staying grounded in market realities, Go Capital aims to catalyze the next generation of water technology solutions that will shape a more sustainable and resilient water future.

Final words

Go Capital Chicago stands as a testament to the evolution of water technology investment in the Midwest. Their strategic focus on maritime economy solutions, coupled with a collaborative investment approach, positions them uniquely in the water technology ecosystem. By maintaining a balance between innovation and practicality, they’ve demonstrated that impactful water investments can deliver both environmental benefits and financial returns. As water challenges continue to grow globally, Go Capital’s model of thorough due diligence, strategic co-investment, and focus on measurable impact provides a blueprint for successful water technology investment. Their commitment to nurturing early-stage companies while maintaining strong partnerships with co-investors ensures a sustainable pipeline of water innovation. For entrepreneurs and co-investors alike, Go Capital represents a thoughtful partner in the journey toward water technology advancement.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!