The Global Innovation Fund (GIF) stands at the intersection of impact investing and water innovation, wielding a $100 million war chest to tackle one of humanity’s most pressing challenges – access to clean water. From its London headquarters, GIF identifies and scales breakthrough water technologies that serve communities living on less than $5 per day. Through a unique blend of patient capital, technical expertise, and strategic partnerships, GIF is revolutionizing how we approach water access in emerging markets. By supporting entrepreneurs from pre-seed to scale, GIF demonstrates that solving global water challenges and generating returns aren’t mutually exclusive propositions.

GIF is part of my Ultimate Water Investor Database, check it out!

Investor Name: Global Innovation Fund

Investor Type: Impact

Latest Fund Size: $100 Million

Dry Powder Available: Yes

Typical Ticket Size: $10M – $30M

Investment Themes: Safe water purification & decentralized systems, Point-of-use/point-of-collection treatment, Tech platforms & utility engagement

Investment History: $3108333.33 spent over 3 deals

Often Invests Along:

Already Invested In: Agros, CityTaps

Leads or Follows: Follow

Board Seat Appetite: Rare

Key People: Katie Carrasco

The Investment Thesis: Bridging Water Innovation and Impact

The Global Innovation Fund (GIF) has engineered a distinctive investment approach that marries technological innovation with measurable social impact in the water sector. At the core of their strategy lies a carefully calibrated investment framework, providing funding from $15,000 to $15 million across various stages of company growth.

GIF’s investment thesis centers on identifying and accelerating breakthrough water purification and treatment technologies that can scale rapidly across emerging markets. The fund’s sweet spot lies in the pre-seed to Series A stages, where capital gaps often stifle promising innovations from reaching communities in need.

What sets GIF apart is their rigorous dual-lens evaluation process. Investment decisions weigh both commercial viability and potential for transformative impact. For water purification technologies, this means assessing factors like unit economics and market size alongside metrics such as households reached and waterborne disease reduction. This approach has proven particularly effective in supporting innovations that can demonstrate clear paths to financial sustainability while delivering meaningful improvements in water access and quality.

The fund’s portfolio reflects three primary investment themes in water technology: decentralized treatment solutions that can operate reliably in infrastructure-limited environments, low-cost purification technologies that remain affordable for bottom-of-pyramid consumers, and resource recovery systems that transform waste streams into valuable products.

To measure impact, GIF employs a sophisticated framework that tracks both direct outcomes (number of people gaining access to clean water) and systemic changes (shifts in local water management practices). Financial return expectations are calibrated according to investment stage and market conditions, with early-stage investments typically targeting 3-5x returns over 5-7 years.

A hallmark of GIF’s approach is their emphasis on patient capital. Rather than pushing for quick exits, the fund provides intensive post-investment support, helping portfolio companies navigate the complex regulatory environments and market dynamics of emerging economies. This long-term view enables entrepreneurs to build robust business models while maintaining focus on their core impact missions.

As explained in how to mitigate 4 shades of water risk through impact investing, this balanced approach to water investment has proven crucial for addressing both immediate needs and long-term sustainability challenges. The fund’s success in bridging the gap between innovation and impact has established a replicable model for other impact investors seeking to enter the water sector.

By maintaining this delicate balance between financial returns and social impact, GIF has demonstrated that water technology investments can simultaneously generate attractive returns while addressing one of humanity’s most pressing challenges – access to clean, safe water.

Geographic Focus: Following the Water Crisis

The Global Innovation Fund (GIF) strategically targets investments across regions facing acute water challenges, with a particular focus on East Africa and South Asia where water scarcity and quality issues disproportionately affect vulnerable populations.

In East Africa, GIF addresses critical water access gaps in both urban and rural settings. Ethiopia, Kenya, and Tanzania face recurring droughts that strain already limited water resources. Here, GIF’s portfolio companies deploy innovative water purification systems tailored for remote communities and develop smart metering technologies to reduce water losses in urban distribution networks. The fund’s investments help utilities extend service to informal settlements while implementing sustainable pricing models that ensure affordability.

South Asia presents a different set of challenges, where rapid urbanization and industrial growth have led to severe groundwater depletion and contamination. In India, GIF supports ventures developing arsenic removal technologies and water quality monitoring systems. Bangladesh’s coastal regions struggle with saltwater intrusion, prompting GIF to invest in low-cost desalination solutions and alternative water sourcing technologies.

Beyond these core regions, GIF maintains a flexible approach to emerging opportunities in other water-stressed markets. In Southeast Asia, the fund backs projects addressing urban flooding through nature-based solutions and smart stormwater management. Latin American investments focus on water reuse technologies for agricultural applications, helping farmers adapt to increasingly unpredictable rainfall patterns.

GIF’s geographic strategy reflects a deep understanding of local contexts and challenges. Rather than applying one-size-fits-all solutions, the fund works with entrepreneurs who demonstrate intimate knowledge of regional water issues. This approach has proven particularly effective in Sub-Saharan Africa, where GIF has supported innovations in sustainable groundwater extraction and community-based water management systems.

The fund’s commitment to geographic diversity extends beyond capital deployment. By fostering cross-regional knowledge sharing and technology transfer, GIF helps successful water solutions scale across markets with similar challenges. This has enabled portfolio companies to adapt their technologies and business models to new contexts while maintaining their core impact focus.

As climate change intensifies water stress globally, GIF’s geographic focus continues to evolve. The fund increasingly considers climate resilience when evaluating investment opportunities, supporting solutions that help communities adapt to changing precipitation patterns and extreme weather events. This forward-looking approach ensures GIF’s portfolio remains relevant as water challenges shift and intensify across regions.

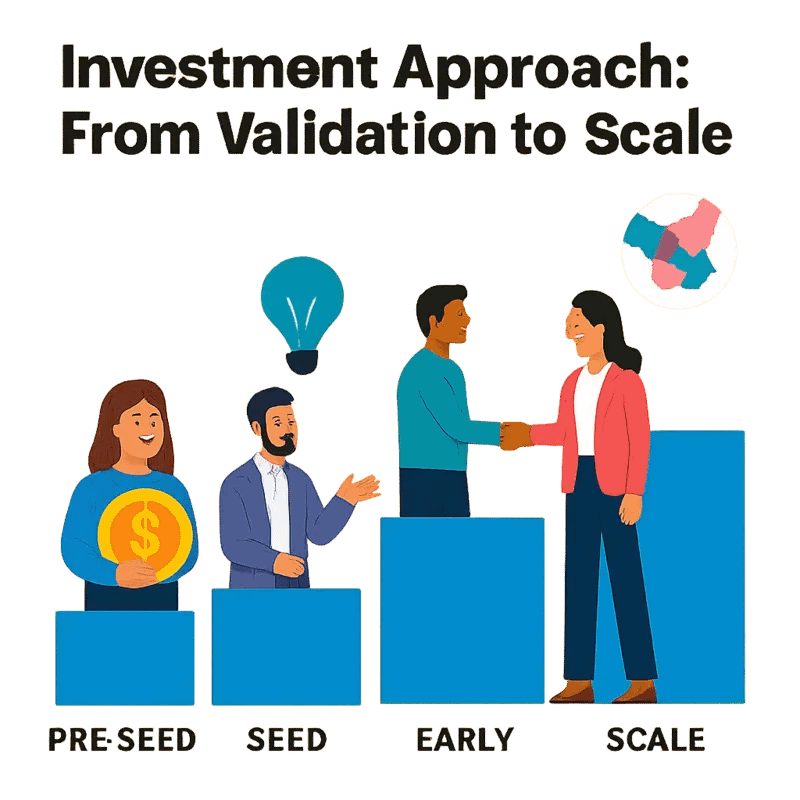

Investment Approach: From Validation to Scale

The Global Innovation Fund employs a sophisticated, multi-tiered investment strategy that combines rigorous validation with flexible capital deployment to maximize impact across the water sector. At its core, GIF’s approach recognizes that water innovations require different types of support at various stages of development.

GIF’s tiered funding model starts with pilot validation grants of up to $230,000, allowing promising water solutions to prove their concept in real-world conditions. As solutions demonstrate viability, GIF scales its support through testing and transition funding of up to $2.5 million, culminating in scaling investments that can reach $15 million. This staged approach helps de-risk innovations while building evidence of impact.

Beyond capital, GIF takes an active role in portfolio company development. The fund typically seeks board observer rights rather than full board seats, allowing them to provide strategic guidance while maintaining operational flexibility for entrepreneurs. This governance approach reflects their commitment to fostering innovation while ensuring accountability.

GIF’s co-investment partnerships amplify their impact. By strategically partnering with development finance institutions, commercial investors, and regional water utilities, GIF helps create robust ecosystems around promising solutions. These partnerships often unlock additional capital and provide vital market access for portfolio companies.

The fund’s support extends well beyond financial instruments. GIF maintains an active technical assistance program that provides portfolio companies with expertise in areas like business model refinement, impact measurement, and regulatory navigation. This comprehensive support helps bridge the gap between innovation and scaled implementation.

Particularly noteworthy is GIF’s role as both lead and follow-on investor. When acting as lead investor, GIF helps structure deals and establish governance frameworks that attract additional capital. As a follow-on investor, they provide validation and help companies navigate the complexities of emerging markets. This flexibility allows GIF to support promising water innovations at their most critical growth points.

GIF’s investment approach emphasizes patient capital with clear performance metrics. Rather than pursuing quick exits, the fund focuses on sustainable growth that can deliver both financial returns and lasting social impact. This long-term perspective has proven essential for water innovations, which often require extended periods to achieve market penetration and scale.

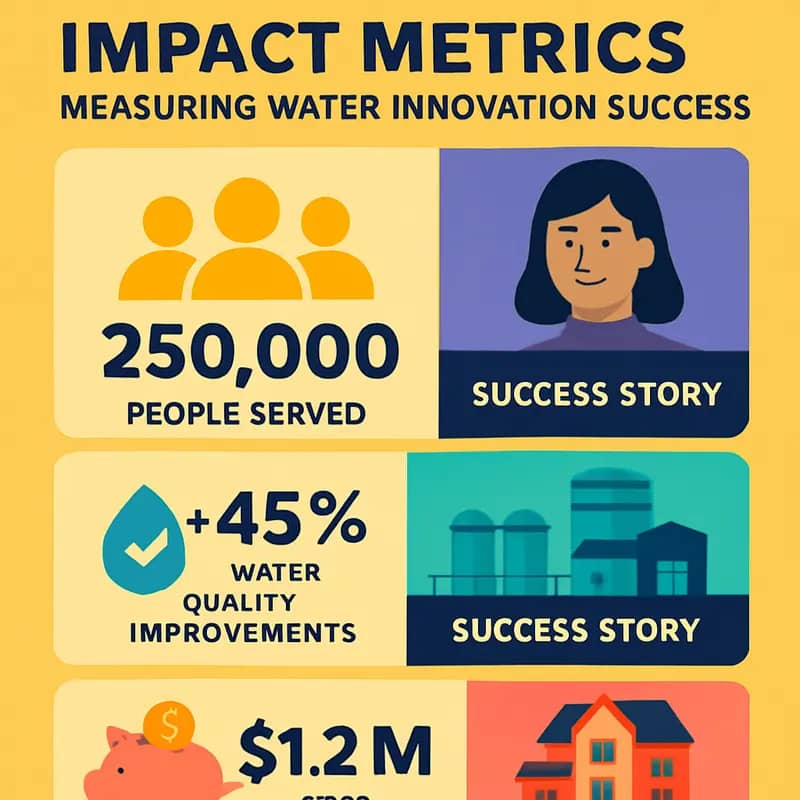

Impact Metrics: Measuring Water Innovation Success

The Global Innovation Fund (GIF) employs a rigorous framework to measure and track the impact of their water investments across emerging markets. At the core of their methodology lies a dual focus on quantitative metrics and qualitative transformation assessment.

GIF’s primary impact metrics center on three key dimensions: reach, depth, and systemic change. For reach, they track the number of individuals gaining improved water access through their portfolio companies, with current investments impacting over 2.5 million people. Depth metrics examine the quality and reliability of water service delivery, measuring factors like hours of daily access, water quality parameters, and affordability indices.

Systemic change indicators are perhaps the most critical yet challenging to measure. These evaluate how innovations transform local water markets and institutional frameworks. GIF assesses factors like policy influence, market demonstration effects, and the strengthening of local water governance systems. One particularly innovative approach is their use of randomized controlled trials in partnership with academic institutions to rigorously evaluate the causal impact of certain water innovations.

Balancing scale with sustainability requires careful consideration of financial and operational metrics alongside impact measures. GIF tracks unit economics, operational efficiency, and financial sustainability indicators for each portfolio company. This helps ensure that achieving impact doesn’t come at the cost of building viable, lasting businesses. Their approach to measuring impact investments has become a model for the sector.

Success stories from their portfolio demonstrate this holistic measurement approach in action. In East Africa, a water purification technology company not only reached 500,000 users but also achieved unit profitability while reducing waterborne disease incidence by 45% in target communities. Another investment in South Asia helped a water utility optimization company save 136 million liters annually while building a sustainable revenue model.

GIF’s measurement framework evolves continuously, incorporating emerging best practices and technological innovations. They increasingly leverage remote sensing, IoT devices, and blockchain technology to capture real-time impact data. This adaptive approach ensures their metrics remain relevant while reducing reporting burdens on portfolio companies.

By maintaining this comprehensive measurement system, GIF can demonstrate clear attribution of impact, inform future investment decisions, and provide valuable insights to the broader water sector. Their evidence-based approach has helped catalyze additional funding into promising water innovations while ensuring accountability for impact claims.

The GIF Investment Philosophy

The Global Innovation Fund’s distinctive approach to water investment represents a paradigm shift in how impact capital can catalyze transformative solutions. At its core, GIF employs a patient capital strategy that acknowledges the extended timelines required for water innovations to achieve scale and generate meaningful impact.

Unlike traditional investors who often seek quick returns, GIF embraces higher levels of risk through a flexible funding model that can support water solutions from early-stage concepts through to scaled deployment. This risk tolerance enables GIF to back potentially groundbreaking technologies and business models that might be overlooked by conventional financiers.

What truly sets GIF apart is their unwavering commitment to evidence-based decision making. Each investment undergoes rigorous impact evaluation using sophisticated frameworks that assess both quantitative metrics and qualitative outcomes. This approach ensures that capital flows to solutions with the highest potential for sustainable impact rather than those that simply promise quick financial returns.

The fund’s investment thesis rests on three key pillars: additionality, cost-effectiveness, and scalability. GIF prioritizes innovations that wouldn’t otherwise receive funding, demonstrate clear paths to affordability, and have potential for exponential growth across multiple markets. This framework allows them to identify opportunities that can deliver outsized impact per dollar invested.

GIF has pioneered an innovative blended finance approach that strategically combines grant funding, equity investments, and results-based financing. This flexible capital structure enables them to tailor support based on each solution’s specific needs and stage of development. By providing the right type of capital at the right time, GIF helps bridge critical funding gaps that often derail promising water innovations.

In line with their evidence-first philosophy, GIF maintains a rigorous approach to measuring impact and evaluating investment opportunities. Their investment committee includes both financial experts and development specialists who assess potential deals through multiple lenses – from technical feasibility to social impact potential.

This comprehensive investment approach has enabled GIF to build a diverse portfolio of water solutions targeting different aspects of the global water crisis. From innovative financing models for rural water access to breakthrough water treatment technologies, their investments demonstrate how patient capital combined with rigorous evaluation can accelerate the development and deployment of transformative water solutions.

Innovation Pipeline and Selection Process

The Global Innovation Fund (GIF) employs a rigorous, multi-stage approach to identify and evaluate promising water innovations that can deliver sustainable impact at scale. At the core of their selection process lies a stage-agnostic funding model that allows them to support solutions across the full innovation lifecycle – from early-stage pilots to scaling proven interventions.

GIF’s pipeline development starts with proactive sourcing through their global network of partners, including academic institutions, NGOs, and regional innovation hubs. Their team of investment professionals actively scouts for innovations addressing critical water access challenges in emerging markets. Rather than waiting for proposals to arrive, they take a hands-on approach in identifying technologies and business models with transformative potential.

The evaluation process follows a systematic framework that examines both the innovation’s technical merits and its potential for sustainable impact. Key assessment criteria include the scale of the water challenge being addressed, the uniqueness of the proposed solution, and evidence of effectiveness from prior implementations. GIF places particular emphasis on innovations that can achieve significant impact while maintaining commercial viability.

What sets GIF’s selection approach apart is their evidence-based methodology for assessing potential impact. Each investment opportunity undergoes rigorous due diligence that includes detailed analysis of the technology, market dynamics, and implementation capabilities. The fund leverages data analytics and modeling to estimate the potential number of lives that could be improved through successful scaling of the innovation.

Their stage-agnostic model allows for flexible capital deployment ranging from $230,000 for pilot testing to $15 million for scaling proven solutions. This enables GIF to support promising innovations through critical development phases while maintaining a long-term partnership approach. Their funding structures are tailored to each investment’s specific needs and may include grants, equity, debt, or hybrid instruments.

GIF also employs an innovative portfolio management approach that goes beyond traditional monitoring. They work closely with their portfolio companies to strengthen their business models, facilitate strategic partnerships, and overcome scaling challenges. This hands-on engagement helps maximize the likelihood of success while generating valuable insights that inform future investment decisions.

Their selection process reflects a deep understanding that solving complex water challenges requires more than just innovative technology – it demands sustainable business models and strong implementation capabilities. By taking this comprehensive approach, GIF has built a diverse portfolio of water innovations that are demonstrating measurable impact across multiple emerging markets.

Impact Measurement and Success Stories

The Global Innovation Fund’s strategic investments in water solutions have yielded remarkable impacts across emerging markets, transforming communities through measurable, scalable innovations. One of the fund’s standout success stories comes from rural India, where a GIF-backed decentralized water treatment system now serves over 100,000 people, reducing waterborne illness rates by 65% while operating at one-third the cost of traditional solutions.

Quantifiable metrics demonstrate the fund’s effectiveness in driving sustainable change. Across its water innovation portfolio, GIF-supported projects have collectively provided clean water access to more than 2.5 million people in the past five years. The fund’s focus on scale has enabled a 4x multiplier effect – for every dollar invested, partner organizations have leveraged an additional four dollars in follow-on funding.

“The support from GIF wasn’t just financial – their expertise helped us refine our business model and expand our reach exponentially,” shares a founder whose innovation now serves 300 communities across Southeast Asia. Their solar-powered water purification technology reduced operational costs by 75% compared to diesel-based alternatives while eliminating 12,000 tons of carbon emissions annually.

The fund’s impact measurement framework goes beyond traditional metrics, examining systemic change indicators. In East Africa, a GIF-backed water management platform has helped utilities reduce non-revenue water losses by 40%, generating $3.2 million in additional annual revenue that’s being reinvested in infrastructure improvements. This exemplifies GIF’s focus on financial sustainability alongside social impact.

Perhaps most significantly, the innovations are proving remarkably resilient. Monitoring data shows that 92% of GIF-funded water solutions remain operational after three years, far exceeding the industry average of 65%. This sustainability stems from GIF’s emphasis on local capacity building and market-driven approaches.

The fund’s portfolio companies have also demonstrated strong climate resilience impacts. In drought-prone regions, GIF-supported water conservation technologies have helped farming communities reduce water consumption by up to 50% while maintaining or increasing crop yields. This impact is particularly crucial as climate change threatens water security globally.

Looking at gender equity outcomes, women-led households accessing GIF-supported water solutions report saving an average of 15 hours weekly previously spent on water collection. This time is now invested in education, income generation, and family care, creating powerful ripple effects throughout communities.

Future Vision and Strategic Direction

The Global Innovation Fund stands at a pivotal moment in its mission to accelerate water solutions for vulnerable communities. Building on its track record of successful investments, GIF is now expanding its strategic focus to address emerging challenges while deepening its impact in established areas.

A core element of GIF’s forward strategy centers on leveraging data and artificial intelligence to optimize water infrastructure investments. By partnering with research institutions and technology firms, the fund aims to develop predictive models that can identify high-impact opportunities before they reach crisis levels. This proactive approach will help stretch limited resources further while preventing water emergencies.

Climate resilience represents another key strategic priority. GIF is actively seeking innovations that help communities adapt their water systems to increasingly extreme weather patterns. This includes technologies for water storage, purification systems that can handle varying water quality, and smart distribution networks that minimize losses. As outlined in https://dww.show/3-paths-to-reach-sdg-6-by-2050-all-our-hopes-are-on-3/, such adaptations will be crucial for meeting global water access goals.

The fund is also doubling down on its commitment to local innovation ecosystems. Rather than simply importing solutions, GIF plans to establish regional innovation hubs that nurture homegrown water entrepreneurs. These hubs will provide technical assistance, market connections, and early-stage capital to promising local startups. This approach ensures solutions are culturally appropriate and builds lasting technical capacity within communities.

Partnership development remains central to GIF’s scaling strategy. The fund is expanding its co-investment model, working with development banks, corporate partners, and other impact investors to create blended finance vehicles. These partnerships will help de-risk early-stage water innovations while creating clear pathways to scale through established institutions.

Looking ahead, GIF aims to deploy $500 million in water innovations by 2030. This ambitious target will require new funding mechanisms, including green bonds and results-based financing instruments. The fund is also exploring innovative approaches to measuring and monetizing the full spectrum of social and environmental returns from water investments.

Critically, GIF recognizes that technology alone cannot solve the global water crisis. Its future investments will increasingly focus on business model innovations and enabling infrastructure that help proven solutions reach scale. This includes digital platforms that reduce transaction costs, financial products that align incentives, and policy frameworks that accelerate adoption.

Final words

The Global Innovation Fund represents a new paradigm in water impact investing, demonstrating that technological innovation and social impact can coexist with financial sustainability. Through their strategic focus on early-stage water technologies, commitment to serving vulnerable populations, and comprehensive support model, GIF is creating a blueprint for scaling water solutions in emerging markets. Their $100M investment vehicle isn’t just funding individual companies – it’s catalyzing an entire ecosystem of water innovation. For entrepreneurs and impact investors alike, GIF’s approach offers valuable lessons in how patient capital, technical expertise, and strategic partnerships can unlock solutions to complex water challenges. As water scarcity and quality issues continue to grow globally, GIF’s model provides hope that innovative, market-based solutions can help ensure universal access to clean water.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!