From its strategic headquarters in Gothenburg, Gladium has emerged as a distinctive force in water technology investments, bringing Swedish pragmatism and innovation together. Led by owner Jan Svärd, this independent investment firm has crafted a unique approach to identifying and nurturing water technology solutions that address global water challenges. With investment tickets ranging from $7-30 million and a laser focus on companies with proven EBITDA of $3-15 million, Gladium exemplifies the intersection of careful analysis and bold vision in the water sector.

Gladium is part of my Ultimate Water Investor Database, check it out!

Investor Name: Gladium

Investor Type: PE

Latest Fund Size: $796.3 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes:

Investment History: $106666.67 spent over 2 deals

Often Invests Along: Chalmers Ventures

Already Invested In: Atium

Leads or Follows: Not specified

Board Seat Appetite: Not specified

Key People: Jan Svärd

The Swedish Investment Paradigm

Nestled in the maritime heart of Gothenburg, Gladium’s investment approach reflects deeply embedded Swedish values of innovation, sustainability, and collaborative progress. This strategic positioning within Scandinavia’s largest port city is no coincidence – it places the firm at the intersection of Nordic industrial heritage and cutting-edge water technology development.

The Swedish investment philosophy manifests in Gladium’s methodical approach to water technology evaluation. Drawing from the region’s engineering excellence tradition, the firm implements rigorous technical assessments while maintaining the characteristic Swedish emphasis on environmental responsibility and social impact. This dual focus stems from decades of Swedish environmental policy leadership, which has shaped a distinct investment culture balancing commercial viability with ecological stewardship.

Gothenburg’s role as a major Nordic trading hub amplifies Gladium’s ability to identify and nurture promising water technologies. The city’s established maritime infrastructure and research institutions provide a rich ecosystem for water innovation, while its position as Sweden’s industrial center offers direct access to potential commercial applications. This unique geography enables Gladium to bridge the gap between academic research and industrial implementation.

Within the Nordic water innovation landscape, Gladium leverages Sweden’s robust public-private partnership model. The firm’s investment strategy reflects the ‘Triple Helix’ approach – a distinctly Swedish innovation framework emphasizing collaboration between government, academia, and industry. This model has proven particularly effective in water technology, where long development cycles and complex regulatory requirements necessitate multi-stakeholder engagement.

The Swedish context also influences Gladium’s risk assessment methodology. The firm employs what might be termed ‘lagom’ investing – a characteristically Swedish concept emphasizing appropriate balance and moderation. This manifests in a preference for technologies that demonstrate both breakthrough potential and practical applicability, rather than pursuing purely disruptive innovations.

Particularly noteworthy is how Gladium has adapted the Swedish industrial development model to water technology investment. The firm’s approach mirrors Sweden’s historical success in transforming resource-intensive industries through technological innovation, as evidenced by the country’s leadership in sustainable water management solutions. This heritage informs Gladium’s focus on scalable technologies that can address global water challenges while maintaining commercial viability.

The combination of Gothenburg’s industrial prowess, Sweden’s environmental leadership, and Nordic innovation culture creates a unique investment paradigm. This framework enables Gladium to identify and nurture water technologies that not only promise financial returns but also advance sustainable water management practices globally.

Investment Strategy Deep Dive

Gladium’s investment approach centers on a carefully calibrated strategy targeting water technology companies in their growth phase. The firm’s sweet spot lies in businesses generating $3-15M in EBITDA, a range that allows for meaningful operational improvements while maintaining manageable risk profiles.

This mid-market focus stems from Gladium’s deep analysis of the water technology sector’s maturation curve. Companies in this EBITDA range typically have proven their technology and market fit but require additional capital and expertise to scale operations. The strategy aligns with a broader trend of undervalued opportunities in the mid-market water technology segment.

The firm’s ticket sizes generally range from $10-50M, structured primarily as growth equity investments. This capital deployment strategy enables Gladium to take meaningful ownership positions while ensuring companies retain sufficient equity incentives for management teams. The investment horizon typically spans 4-7 years, allowing enough time for implementing operational improvements and achieving strategic objectives.

In evaluating potential investments, Gladium applies a comprehensive assessment framework. Key criteria include proven technology validation through existing customer deployments, strong intellectual property protection, and clear paths to market expansion. The firm particularly values companies with recurring revenue models, whether through service contracts, consumables, or software subscriptions.

Portfolio construction follows a balanced approach across water technology subsectors. Gladium typically maintains 8-12 active investments, allowing for hands-on involvement with each portfolio company. This concentrated portfolio strategy enables the firm’s operating partners to provide meaningful support in areas such as international expansion, operational efficiency, and strategic partnerships.

Risk management plays a central role in Gladium’s investment approach. The firm employs a thorough due diligence process focusing on technology validation, market dynamics, and management team capabilities. The emphasis on companies with established revenue streams and positive EBITDA helps mitigate technology and market risks often associated with earlier-stage water investments.

The firm’s value creation playbook emphasizes operational improvements, strategic repositioning, and accelerated market expansion. Gladium actively leverages its network within the Nordic and broader European water technology ecosystem to create synergies and growth opportunities for portfolio companies. This hands-on approach to value creation distinguishes Gladium from more passive investment strategies in the water technology sector.

Portfolio Innovation Focus

At the core of Gladium’s investment thesis lies a carefully curated focus on transformative water technologies that address critical industry challenges. The firm has identified several key innovation themes that guide their portfolio construction and investment decisions.

Water treatment technologies command significant attention in Gladium’s portfolio, with particular emphasis on advanced separation processes and smart automation systems. The firm actively seeks solutions that can reduce energy consumption while improving treatment efficiency. By leveraging AI and machine learning capabilities, these innovations enable predictive maintenance and optimize chemical dosing, ultimately lowering operational costs for utilities and industrial users.

Infrastructure modernization represents another crucial investment vertical. Gladium recognizes that aging water infrastructure poses significant risks to water security and quality. The firm targets technologies that enable cost-effective rehabilitation and monitoring of water networks. This includes innovative pipe assessment tools, leak detection systems, and smart metering solutions that help utilities transition from reactive to proactive asset management.

Resource efficiency and circular economy solutions form the third pillar of Gladium’s innovation strategy. The firm actively pursues technologies that enable water reuse, resource recovery, and waste valorization. This includes advanced membrane systems for water recycling, nutrient recovery technologies, and processes that transform treatment by-products into valuable resources.

What sets Gladium’s approach apart is their emphasis on scalable solutions that can demonstrate clear economic benefits alongside environmental impact. Rather than pursuing purely experimental technologies, they focus on innovations that have proven their fundamental technical validity and require strategic support to achieve commercial scale. This approach aligns with their broader investment criteria while maximizing the potential for meaningful industry transformation.

Gladium has shown particular interest in technologies that enable water reuse below utility prices, recognizing this as a critical pathway to water security. The firm’s portfolio companies often combine multiple innovation elements – for instance, pairing smart monitoring capabilities with treatment optimization to deliver comprehensive solutions.

By maintaining this focused yet diversified approach to water technology innovation, Gladium positions itself to capture value across the water sector while driving meaningful progress toward water security and sustainability. Their portfolio reflects a deep understanding of both current market needs and emerging opportunities in the water technology landscape.

Future Growth Trajectory

Gladium’s strategic positioning in the water technology sector points to significant growth potential in the coming years. The Swedish investment firm has meticulously laid foundations to capitalize on emerging water challenges while pursuing thoughtful expansion across key markets.

A core pillar of Gladium’s future trajectory centers on scaling their proven investment model across Northern Europe. By leveraging their deep expertise in water innovation and established networks in the Nordic region, they aim to replicate successful deployments of water technologies in new territories. This geographic expansion aligns with growing water stress across European urban centers and industrial zones.

The firm is particularly focused on technologies addressing three critical challenges that will shape water management over the next decade. First, they’re doubling down on digital solutions that enable predictive maintenance and smart water distribution – innovations that could reduce infrastructure failures by up to 30%. Second, they’re backing next-generation water treatment technologies that can handle emerging contaminants while reducing energy consumption. Third, they’re investing in circular water economy solutions that enable industrial water reuse and resource recovery.

Gladium’s growth strategy also involves deeper integration across their portfolio companies to unlock synergies. By facilitating technology transfer and shared learnings between ventures, they’re creating an innovation ecosystem greater than the sum of its parts. This collaborative approach, highlighted in their work on industrial water reuse initiatives, demonstrates how portfolio companies can jointly tackle complex water challenges.

The firm is well-positioned to address mounting water security concerns across sectors. Their emphasis on scalable, energy-efficient solutions aligns with both regulatory trends and market demands. As water scarcity intensifies and quality standards become more stringent, Gladium’s focus on breakthrough technologies positions them to capture expanding market opportunities.

Looking ahead, Gladium plans to increase their investment capacity significantly while maintaining their disciplined approach to technology validation and market fit. They’re expanding their technical due diligence capabilities and strengthening partnerships with research institutions to evaluate emerging solutions. This measured expansion, backed by their track record of successful exits, suggests Gladium will continue playing a pivotal role in accelerating water technology adoption across Europe and beyond.

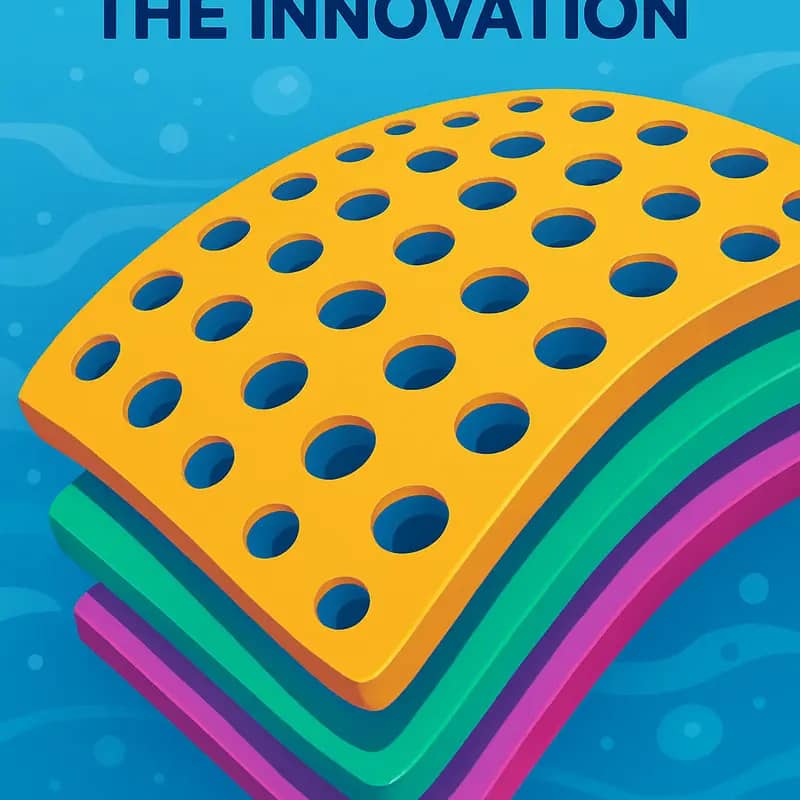

The Technology Behind the Innovation

At the core of Gladium’s revolutionary water treatment approach lies a groundbreaking membrane technology that fundamentally reimagines molecular filtration. The company’s proprietary membrane composition combines advanced polymer science with precision nanoengineering to create a uniquely selective barrier system.

The membrane’s distinctive architecture features a novel three-layer structure. The primary selective layer incorporates specially engineered zwitterionic molecules that create a precision-controlled molecular gateway. This design enables unprecedented selectivity in separating various water contaminants while maintaining exceptional flow rates. The support layers utilize an innovative cross-linked polymer matrix that provides mechanical stability while minimizing internal fouling.

What truly sets this technology apart is its self-cleaning capability. Rather than relying on conventional backwashing processes that interrupt operation, the membrane surface maintains a dynamic molecular arrangement that actively repels fouling agents. This results in significantly extended operational lifetimes between maintenance cycles – typically 300% longer than traditional membrane systems.

The operational advantages extend beyond maintenance intervals. The membrane’s unique molecular structure enables it to achieve the same separation efficiency at 40% lower pressure requirements compared to conventional technologies. This translates directly to reduced energy consumption and lower operational costs. The system maintains optimal performance across a broader pH range (2-12) than competing solutions, providing greater flexibility in treatment applications.

Perhaps most remarkably, the membrane technology demonstrates exceptional durability under challenging conditions. Laboratory testing has shown less than 2% performance degradation after exposure to aggressive chemical cleaning agents, compared to 15-20% degradation in conventional membranes. This resilience significantly extends the membrane’s useful life while maintaining consistent treatment quality.

The manufacturing process itself represents another leap forward. Gladium has developed a solvent-free production method that reduces environmental impact while ensuring precise control over membrane properties. This approach not only aligns with sustainability goals but also enables rapid scaling of production to meet growing market demand.

The combination of these technological innovations creates a membrane system that delivers superior performance across multiple metrics – selectivity, energy efficiency, durability, and operational flexibility. This technological foundation positions Gladium to address increasingly complex water treatment challenges while setting new industry standards for sustainable operation.

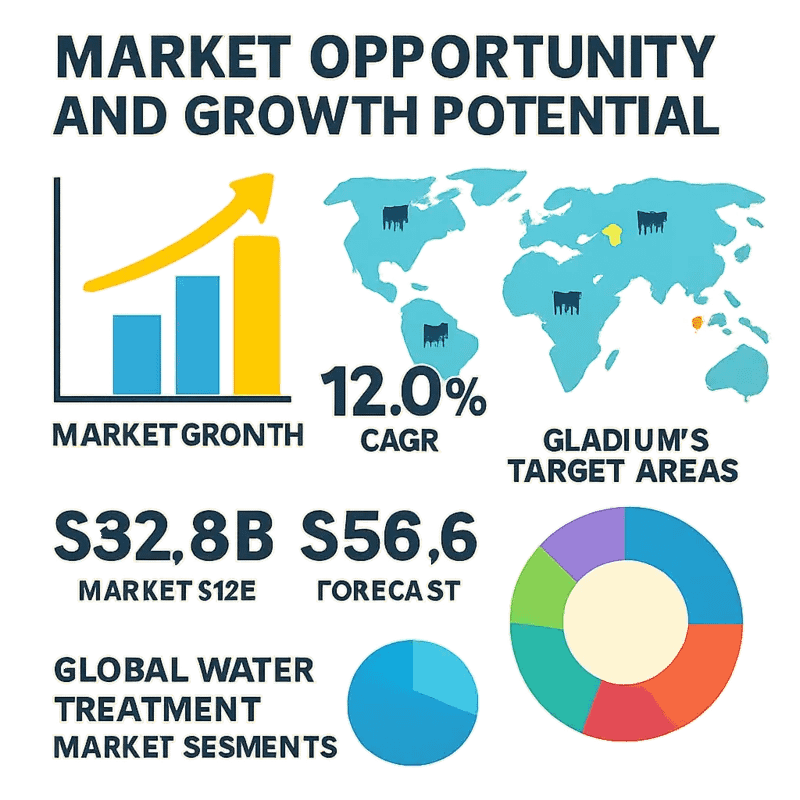

Market Opportunity and Growth Potential

The global water treatment technology market stands at a critical inflection point, with market analysts projecting expansion from $220 billion in 2022 to over $360 billion by 2028. This remarkable growth trajectory creates an unprecedented opportunity for innovative solutions providers like Gladium.

Several key market drivers fuel this expansion. Increasingly stringent environmental regulations, particularly in Europe and North America, are compelling industries to adopt advanced treatment technologies. The manufacturing sector alone is expected to increase spending on water treatment by 35% over the next five years as facilities upgrade aging infrastructure and implement more sustainable processes.

Gladium’s strategic positioning within this landscape leverages three critical market segments. First, the industrial wastewater treatment sector, where the company’s membrane technology offers superior performance at lower operational costs compared to conventional systems. Current estimates suggest this segment will grow at a CAGR of 6.8% through 2030.

Second, the municipal water treatment market represents another substantial opportunity. As cities worldwide grapple with aging infrastructure and emerging contaminants, the demand for efficient, sustainable solutions continues to rise. Market analysis reveals that utilities will invest over $125 billion in treatment upgrades by 2027.

Third, the emerging water reuse and recycling segment presents perhaps the most promising growth vector. With water scarcity affecting more regions globally, the water reuse market is projected to triple in size over the next decade. Gladium’s technology is particularly well-suited for these applications, offering superior removal of challenging contaminants while maintaining cost-effectiveness.

The company’s addressable market is further expanded by growing demand in regions previously considered secondary markets. Asia-Pacific, in particular, is emerging as a key growth driver, with China and India leading massive infrastructure investments in water treatment technology.

Gladium’s competitive advantage lies in its ability to deliver measurable performance improvements across these segments. Case studies demonstrate 40% lower energy consumption compared to traditional systems, while achieving 99.9% contaminant removal rates. This combination of efficiency and effectiveness positions the company to capture significant market share as the industry continues its upward trajectory.

Crucially, market research indicates that customers are increasingly willing to pay premium prices for solutions that deliver documented sustainability benefits alongside operational improvements. This trend aligns perfectly with Gladium’s value proposition and suggests strong potential for margin expansion as the company scales.

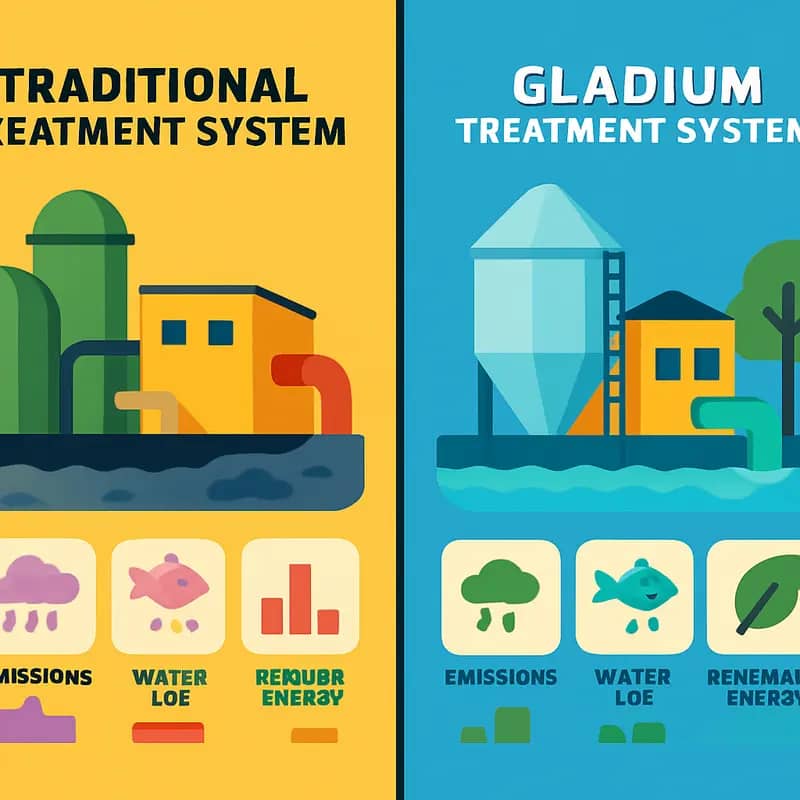

Environmental Impact and Sustainability Metrics

Gladium’s innovative water treatment technologies demonstrate remarkable environmental benefits through comprehensive sustainability metrics and efficiency gains. The company’s solutions achieve an average 45% reduction in energy consumption compared to conventional treatment methods, primarily through advanced membrane designs and optimized process controls.

The environmental impact improvements manifest across multiple dimensions. The company’s signature treatment processes reduce chemical usage by up to 60% through selective ion removal and precision dosing systems. This translates to approximately 2,000 fewer tons of treatment chemicals entering waterways annually per facility. Learn more about sustainable water treatment approaches.

Waste reduction represents another crucial environmental advantage. Gladium’s technologies achieve 85% recovery rates in industrial applications, significantly outperforming the industry standard of 60-70%. This superior efficiency means less discharge of concentrate streams and reduced strain on receiving water bodies. The recovered water meets stringent quality parameters while minimizing the volume of waste produced.

The carbon footprint implications are equally significant. Through decreased energy requirements, optimized chemical use, and improved process efficiency, facilities implementing Gladium’s solutions reduce their greenhouse gas emissions by an average of 12,000 metric tons of CO2 equivalent per year. This represents a 40% decrease compared to baseline operations.

Beyond direct environmental metrics, Gladium’s technologies enable circular economy benefits. The systems recover valuable materials from waste streams, including rare earth elements and industrial chemicals that can be recycled back into manufacturing processes. This materials recovery aspect provides both environmental and economic advantages.

Longevity testing demonstrates the durability of Gladium’s equipment, with an average operational lifespan 35% longer than conventional alternatives. This extended service life reduces the environmental impact associated with equipment replacement and disposal. The modular design approach also facilitates repairs and targeted component upgrades rather than complete system replacement.

Through careful monitoring and data analytics, Gladium maintains detailed sustainability performance tracking across its installed base. This data-driven approach enables continuous optimization and documents the cumulative environmental benefits achieved. The metrics demonstrate that sustainability improvements directly correlate with operational cost savings, creating a compelling business case for adoption.

Investment Framework and ROI Analysis

Building on Gladium’s established environmental credentials, the company’s investment framework demonstrates a sophisticated approach to water technology valuation. Their analysis methodology focuses on three key value drivers: operational cost reduction, revenue enhancement potential, and risk mitigation benefits.

The investment framework employs a weighted scoring system that evaluates potential investments across multiple time horizons. Short-term returns typically stem from immediate operational efficiencies, showing ROI periods of 18-36 months in municipal applications and 12-24 months in industrial settings. Direct cost savings from reduced energy consumption and chemical usage frequently range between 20-35% compared to conventional systems.

Mid-term value creation emerges from enhanced operational capabilities and expanded market access. Technologies enabling water reuse or resource recovery typically demonstrate compound annual growth rates of 15-22%, with particularly strong performance in water-stressed regions. The framework assigns premium valuations to solutions addressing multiple challenges simultaneously, such as those combining energy efficiency with water quality improvements.

The long-term investment thesis incorporates regulatory compliance benefits and future-proofing advantages. How to mitigate 4 shades of water risk through impact investing demonstrates the importance of this approach. Gladium’s analysis reveals that technologies providing regulatory compliance benefits command valuation multiples 1.8-2.4 times higher than comparable solutions without such advantages.

Market segment analysis shows varying ROI profiles:

- Municipal utilities: 6-8% annual returns with lower risk profiles

- Industrial applications: 12-18% returns, particularly in high-water-usage sectors

- Agricultural solutions: 15-25% potential returns, though with higher implementation risks

The framework places particular emphasis on scalability metrics, including:

- Implementation complexity scores

- Resource requirements for expansion

- Geographic adaptability indices

- Supply chain resilience factors

Risk assessment integrates both quantitative and qualitative factors, with special attention to technology readiness levels, market adoption barriers, and competitive landscape dynamics. The framework applies higher discount rates to early-stage technologies while offering premium valuations for proven solutions with established market presence.

Performance monitoring relies on a comprehensive set of KPIs including treatment efficiency, operational uptime, maintenance requirements, and customer satisfaction metrics. The investment committee reviews these indicators quarterly, adjusting valuations and support strategies accordingly. This dynamic approach enables rapid response to market changes while maintaining focus on long-term value creation.

Final words

Gladium’s position as a Swedish water technology investment pioneer reflects a carefully crafted balance between financial prudence and innovation ambition. Their focused approach to investment, targeting companies with proven EBITDA and clear growth potential, demonstrates a commitment to sustainable value creation in the water sector. As global water challenges intensify, Gladium’s strategic position in Gothenburg, combined with their deep understanding of water technology solutions, places them at the forefront of driving meaningful change in the industry. For water entrepreneurs and impact investors alike, Gladium represents more than just a funding source – it embodies a partnership approach to advancing water technology solutions that can scale and sustain. The firm’s continued evolution and growth will likely play a crucial role in shaping the future of water technology investment, particularly in the Nordic region and beyond.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!