Elizabeth Cutler made her mark transforming indoor cycling into a cultural phenomenon with SoulCycle. Now, she’s applying that same entrepreneurial vision to water technology through strategic investments and advisory roles. As founder of LifeShop and an active angel investor, Cutler has positioned herself at the intersection of innovation and impact, focusing on decentralized treatment, smart infrastructure, and equitable access solutions. Her approach combines the community-building DNA of SoulCycle with a keen eye for scalable water technologies that can address mounting global challenges.

Elizabeth Cutler is part of my Ultimate Water Investor Database, check it out!

Investor Name: Elizabeth Cutler

Investor Type: Angel

Latest Fund Size: $ Million

Dry Powder Available: No

Typical Ticket Size: <$250k

Investment Themes: Decentralized Water Treatment and Onsite Water Reuse, Digitization and Smart Infrastructure, Decarbonization of the Water Cycle

Investment History: $3180000 spent over 2 deals

Often Invests Along:

Already Invested In: Epic CleanTec

Leads or Follows:

Board Seat Appetite:

Key People: Elizabeth Cutler

The Entrepreneurial Evolution

Elizabeth Cutler’s journey from co-founding SoulCycle to becoming a water technology investor exemplifies how entrepreneurial instincts can transcend industries. Her experience building a fitness empire that revolutionized boutique exercise has equipped her with invaluable insights that now inform her strategic approach to water technology investments.

At SoulCycle, Cutler demonstrated an extraordinary ability to identify unmet consumer needs and create compelling solutions that resonated deeply with customers. She recognized that fitness enthusiasts craved more than just exercise – they sought community, inspiration, and transformation. This understanding of human psychology and behavior now shapes her evaluation of water technology ventures, where she looks beyond pure technical innovation to consider how solutions will connect with end-users and create lasting impact.

The operational expertise Cutler gained while scaling SoulCycle from a single studio to a nationwide phenomenon serves as a powerful foundation for assessing water technology companies. She intimately understands the challenges of rapid growth, talent acquisition, brand building, and maintaining quality through expansion. This practical knowledge allows her to provide portfolio companies with guidance that extends far beyond capital investment.

Perhaps most significantly, Cutler’s experience in disrupting an established industry has given her a unique perspective on driving transformation in the water sector. She recognizes that meaningful change requires more than superior technology – it demands new business models, creative approaches to market education, and the ability to navigate complex stakeholder relationships.

As explored in a recent analysis on water entrepreneurship (https://dww.show/is-entrepreneurship-the-missing-link-to-shape-the-future-of-the-water-industry/), leaders with cross-industry experience like Cutler bring fresh perspectives that can accelerate innovation. Her transition from fitness to water tech represents a growing trend of successful entrepreneurs applying their expertise to tackle global water challenges.

Cutler’s investment thesis centers on identifying water technology ventures that combine breakthrough innovation with scalable business models and clear paths to widespread adoption. She leverages her entrepreneurial pattern recognition skills to spot opportunities others might miss, while her operational background helps her assess which teams and technologies have the highest probability of success.

This evolution from fitness pioneer to water tech investor illuminates how entrepreneurial capabilities can be powerful catalysts for transformation across sectors. As the water industry faces mounting challenges that demand innovative solutions, Cutler’s journey offers valuable lessons about the importance of bringing diverse entrepreneurial perspectives to bear on these critical issues.

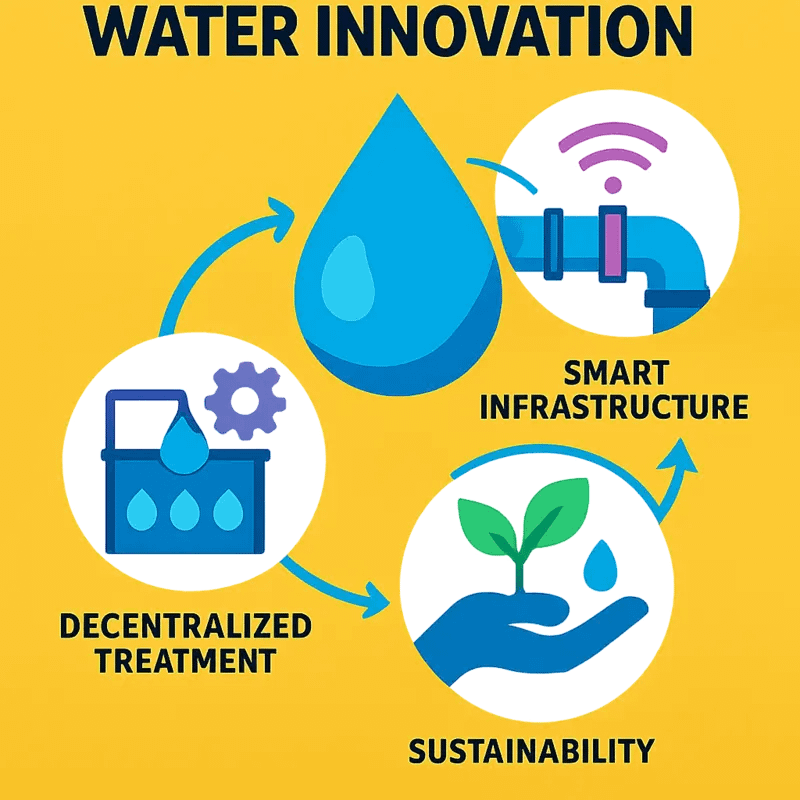

Investment Thesis: Water Innovation

Elizabeth Cutler’s strategic approach to water technology investments reflects a sophisticated understanding of the sector’s most pressing challenges and promising opportunities. Her investment thesis centers on three key pillars: decentralized treatment solutions, smart infrastructure development, and breakthrough sustainability technologies.

At the core of Cutler’s investment strategy lies a focus on decentralized water treatment systems that can operate independently of centralized infrastructure. This approach recognizes that traditional centralized systems often struggle with aging infrastructure, limited capacity, and vulnerability to climate impacts. By investing in technologies that enable on-site treatment and reuse, Cutler aims to build resilience through distributed solutions that can scale rapidly.

The second pillar emphasizes smart infrastructure and digital solutions that enhance system efficiency and performance monitoring. Drawing from her SoulCycle experience in leveraging data analytics to optimize operations, Cutler prioritizes water technologies that incorporate advanced sensors, artificial intelligence, and predictive maintenance capabilities. These innovations enable real-time monitoring of water quality and system performance while reducing operational costs.

Sustainability solutions form the third critical component of her investment thesis. Cutler targets technologies that dramatically reduce the energy intensity of water treatment processes, minimize chemical usage, and enable resource recovery. This includes innovations in energy-neutral treatment processes, water reuse systems, and technologies that extract valuable resources from wastewater streams.

What sets Cutler’s investment approach apart is her emphasis on scalability and market readiness. Rather than focusing solely on early-stage research, she seeks technologies that have demonstrated feasibility and are positioned for rapid commercial deployment. This commercially-driven perspective, shaped by her experience building scalable business models, helps bridge the gap between promising innovations and widespread adoption.

Cutler’s investment strategy also reflects a deep understanding of regulatory trends and market drivers. She prioritizes solutions that address increasingly stringent environmental regulations, growing water scarcity concerns, and mounting pressure for sustainable water management practices. This forward-looking approach positions her portfolio to capitalize on emerging opportunities while delivering meaningful environmental impact.

By maintaining a focused yet diversified approach across these three pillars, Cutler has created an investment framework that balances innovation with practical implementation. Her strategy recognizes that solving global water challenges requires not just breakthrough technologies, but also viable business models and clear paths to market adoption.

Portfolio Deep Dive

Elizabeth Cutler’s investment portfolio in water technology reveals a strategic focus on companies that combine innovative solutions with measurable social impact. Her investments reflect a keen understanding of the sector’s most pressing challenges while demonstrating remarkable foresight in identifying scalable solutions.

Epic Cleantec stands out as a cornerstone investment in Cutler’s portfolio, addressing the critical need for decentralized water treatment in urban environments. The company’s on-site water recycling systems enable buildings to reuse up to 95% of their water, significantly reducing pressure on municipal infrastructure while cutting operating costs. This investment aligns perfectly with the growing trend toward sustainable urban development and water conservation.

Cutler’s backing of CityTaps showcases her commitment to expanding water access in underserved communities. The company’s smart metering technology revolutionizes how utilities interact with customers in developing markets, enabling pay-as-you-go water service through mobile payments. This innovation addresses both financial and operational challenges faced by water utilities while ensuring consistent access for end-users.

What makes Cutler’s investment approach particularly noteworthy is how she leverages her experience from scaling SoulCycle to support water technology ventures. She applies the same principles of customer-centric design and scalable business models to her water investments, ensuring that technological innovation translates into practical, widely-adopted solutions.

As highlighted in an analysis of water technology investment strategies, successful water entrepreneurs must balance technological innovation with market practicality. Cutler’s portfolio companies exemplify this balance, developing solutions that are both technologically advanced and commercially viable.

Beyond individual investments, Cutler’s portfolio demonstrates a systemic approach to water challenges. Each company in her portfolio addresses a distinct aspect of the water crisis, from infrastructure modernization to access expansion, yet all share common threads of sustainability, scalability, and social impact. This strategic alignment creates potential synergies between portfolio companies while maximizing the overall impact of her investments.

The careful selection of these investments reveals Cutler’s commitment to fostering long-term change in the water sector. Rather than seeking quick returns, her investment strategy prioritizes companies with sustainable business models and proven technology that can drive systemic transformation in how we manage and distribute water resources.

Future Vision and Impact

Elizabeth Cutler’s long-term vision for water technology transcends traditional investment metrics, focusing on creating systemic change in how we approach global water challenges. Building on her successful portfolio of water tech investments, Cutler is positioning herself to catalyze a transformation in water infrastructure and accessibility over the next decade.

At the core of her strategy lies the recognition that water challenges require integrated solutions spanning technology, policy, and social impact. By leveraging strategic investments in companies developing breakthrough water treatment and distribution technologies, Cutler aims to accelerate the adoption of decentralized and sustainable water systems that can serve communities of all sizes.

The potential impact of this vision is far-reaching. Through investments in water technology innovation, Cutler is helping build the foundation for a more resilient and equitable water future. Her focus on scalable solutions that can be deployed in both developed and emerging markets demonstrates an understanding that water challenges are universal, though their manifestations may differ.

Significantly, Cutler’s approach emphasizes the importance of sustainability not just in environmental terms, but also in economic viability. By supporting technologies that reduce energy consumption in water treatment, minimize waste, and enable water reuse, she is helping reshape the economics of water management. This dual focus on sustainability and economic efficiency could prove crucial in driving widespread adoption of innovative water solutions.

Looking ahead, Cutler’s investment strategy appears poised to address several critical challenges in the water sector. The emphasis on digital technologies and smart infrastructure could help utilities better manage their resources and reduce water losses. Meanwhile, investments in advanced treatment technologies could make water reuse more feasible and cost-effective, addressing growing water scarcity concerns.

Perhaps most importantly, Cutler’s vision extends beyond pure technological innovation to encompass the social dimensions of water access. By supporting solutions that can be implemented at various scales and price points, she is working to ensure that advances in water technology benefit not just major utilities but also smaller communities and underserved populations.

As we face increasing water stress globally, the strategic direction of investors like Cutler becomes increasingly important in shaping how we solve these challenges. Her emphasis on practical, scalable solutions that can be deployed today while building toward more comprehensive future systems demonstrates a pragmatic yet ambitious approach to water technology investment.

The Community-First Approach to Water Innovation

Elizabeth Cutler’s transformation of SoulCycle from a boutique fitness studio into a cultural phenomenon hinged on one critical insight: community drives adoption and sustained engagement. Now, as she ventures into water technology, this same principle shapes her investment philosophy and approach to innovation.

At SoulCycle, Cutler didn’t just sell exercise classes – she cultivated an experience where members felt connected, supported, and part of something larger than themselves. This community-centric model proved that when people feel emotionally invested, they become natural ambassadors for solutions that improve their lives.

Transplanting this wisdom into water technology, Cutler champions a distinct methodology that puts end-users at the heart of innovation. Rather than pursuing purely technical solutions, she guides portfolio companies to deeply understand the human elements of water challenges. This approach has prompted the development of technologies that don’t just solve problems but create meaningful connections between communities and their water resources.

One striking example is her work with municipal water providers, where she’s advocated for user experience research before deploying new treatment technologies. By gathering community input early, utilities can better address specific local concerns, from taste preferences to cultural water use patterns. This proactive engagement helps prevent the resistance that often plagues water infrastructure projects.

Beyond individual installations, Cutler’s community-first framework has sparked innovative models for water data sharing and collaborative problem-solving. She’s fostered partnerships between technology developers and community organizations, creating feedback loops that continuously improve solutions while building trust and understanding.

Through her investments, Cutler demonstrates that water technology adoption isn’t merely about superior engineering – it’s about creating solutions that resonate with human needs and values. As she often emphasizes, the most sophisticated water treatment system will fail if the community it serves doesn’t embrace it.

This philosophy aligns perfectly with emerging trends in water innovation, as explored in the article on fostering innovation and agility in the water sector. By prioritizing community engagement alongside technical excellence, Cutler’s approach offers a blueprint for developing water solutions that are not just effective but enthusiastically adopted and sustained.

As water challenges grow more complex, this human-centered approach to innovation becomes increasingly vital. Cutler’s experience shows that when communities are active participants in water solutions rather than passive recipients, the resulting technologies are more likely to achieve lasting impact and scale effectively.

Scaling Without Compromising Quality

Elizabeth Cutler’s approach to scaling SoulCycle while maintaining quality provides a masterclass in growth management that directly applies to water technology ventures. Her core philosophy centers on standardizing excellence through systems and culture, rather than compromising standards for rapid expansion.

At SoulCycle, Cutler implemented rigorous instructor training programs and standardized operational procedures across all locations. Yet she balanced this standardization with room for local adaptation and community building. This dual focus on consistency and flexibility offers crucial lessons for scaling water technology solutions.

In the water sector, maintaining quality during rapid growth presents unique challenges. Treatment effectiveness, reliability, and safety cannot be compromised, even as solutions expand to serve larger populations. Cutler’s framework suggests focusing on three key elements: standardized quality controls, adaptable implementation processes, and strong feedback loops.

Standardized quality controls in water tech translate to rigorous testing protocols, clear performance metrics, and automated monitoring systems. These create a foundation for reliable operation at scale. However, the framework must remain flexible enough to account for varying water qualities, regulatory requirements, and local infrastructure constraints.

The feedback loop component proves especially vital in water technology deployment. Just as SoulCycle maintained quality through constant rider feedback, water solutions require ongoing performance monitoring and community input. This data enables rapid problem identification and continuous improvement of both technology and implementation processes.

Perhaps most importantly, Cutler’s experience demonstrates that scaling shouldn’t mean choosing between growth and quality – they can reinforce each other. In water technology, larger scale can actually enable better quality through increased data collection, more refined processes, and greater resources for R&D and optimization.

This approach is already showing promise in the realm of water technology ventures. Companies implementing similar frameworks have maintained or improved treatment effectiveness while expanding their reach. Their success validates Cutler’s core insight: that proper systems and culture can make quality scalable.

The key lies in viewing quality not as a fixed standard to maintain, but as an evolving benchmark to surpass. As water technologies approach commercialization, this mindset becomes crucial for sustainable growth without compromising the fundamental mission of providing clean, safe water solutions.

Investment Strategy Reimagined

Elizabeth Cutler’s innovative approach to investment management in water technology ventures represents a paradigm shift from traditional funding models. Drawing from her experience building SoulCycle, she has developed a unique framework that prioritizes sustainable growth while maintaining robust impact metrics.

Cutler’s investment strategy centers on what she calls ‘conscious capital deployment’ – a methodology that evaluates potential investments through three primary lenses: scalability potential, environmental impact, and technological innovation. This approach differs markedly from conventional venture capital models by incorporating water-specific metrics that account for resource conservation, energy efficiency, and community benefit.

A distinguishing feature of Cutler’s investment framework is its emphasis on early-stage validation through pilot programs. Rather than pursuing rapid scaling at the expense of product refinement, she advocates for thorough testing phases that ensure technology viability while building credibility with potential stakeholders. This measured approach helps mitigate the common pitfalls of water technology commercialization.

The framework also introduces a novel perspective on risk assessment that considers both financial and environmental factors. Instead of treating environmental impact as a secondary consideration, Cutler’s model integrates sustainability metrics directly into the valuation process. This includes evaluating water conservation potential, energy efficiency improvements, and waste reduction capabilities as core components of an investment’s value proposition.

Another crucial element is the focus on building strategic partnerships early in the investment cycle. Cutler emphasizes creating networks of complementary technologies and services that can enhance overall market impact. This collaborative approach helps portfolio companies access broader markets while sharing resources and expertise.

The model also incorporates flexible funding structures that align with the unique challenges of water technology development. Rather than imposing rigid milestone-based funding rounds, Cutler advocates for adaptive financing mechanisms that account for the longer development cycles often required in water technology innovation.

Perhaps most significantly, Cutler’s approach emphasizes the importance of measuring and reporting impact metrics alongside financial returns. Her investment framework requires portfolio companies to track and report both quantitative and qualitative measures of environmental and social impact, creating accountability while demonstrating the broader value proposition of water technology investments.

This reimagined investment strategy has begun to influence how other investors approach water technology ventures, suggesting a broader shift in how the sector evaluates and supports innovation. By balancing financial returns with measurable impact, Cutler’s model provides a blueprint for sustainable growth in the water technology sector.

Future-Proofing Water Ventures

Elizabeth Cutler’s experience building SoulCycle into a fitness empire offers valuable insights for water technology companies seeking long-term sustainability. Her vision principles emphasize the importance of anticipating and adapting to evolving market dynamics while maintaining unwavering focus on core mission objectives.

A cornerstone of Cutler’s approach is the concept of adaptive resilience – building flexibility into business models to respond to changing conditions while preserving fundamental value propositions. For water ventures, this means developing technologies and solutions that can evolve alongside emerging challenges like climate change impacts, regulatory shifts, and changing consumer behaviors.

The principle of strategic redundancy is equally crucial. Just as SoulCycle maintained multiple revenue streams and expansion pathways, water companies must diversify their technological applications and market presence. This could involve developing modular solutions that serve multiple industries or creating scalable platforms that can be readily adapted for different geographical contexts.

Cutler’s emphasis on community-centric innovation provides another vital lesson. Water technology firms should actively engage with end-users, regulators, and other stakeholders to ensure solutions address real-world needs while building lasting relationships that support long-term growth. This collaborative approach helps companies stay ahead of market trends and maintain their competitive edge.

Learn more about applying strategic vision to water ventures

The concept of measurable impact features prominently in Cutler’s methodology. Water technology companies must establish clear metrics for evaluating both business performance and environmental/social impact. This dual-focus approach helps attract investment while ensuring solutions deliver meaningful benefits to communities and ecosystems.

Perhaps most importantly, Cutler’s experience highlights the value of patient capital deployment. Water technology development often requires significant time and resources before achieving market success. Companies must structure their operations and funding strategies to support extended development cycles while maintaining operational stability.

By incorporating these vision principles into their strategic planning, water technology ventures can build more resilient organizations capable of navigating future challenges while delivering sustainable solutions for global water issues. The key lies in balancing innovation with stability, community engagement with scalability, and immediate needs with long-term impact.

Final words

Elizabeth Cutler’s transition from fitness empire builder to water technology investor represents more than a career pivot – it’s a testament to the power of applying proven entrepreneurial principles to solve critical environmental challenges. Through her strategic investments in decentralized water treatment, smart infrastructure, and accessibility solutions, Cutler is helping shape the future of water technology while maintaining the community-focused approach that made SoulCycle a cultural phenomenon. Her portfolio companies demonstrate a clear vision: water solutions must be both innovative and inclusive, technically advanced and practically implementable. As global water challenges intensify, Cutler’s investment thesis and operational expertise provide a valuable blueprint for entrepreneurs and investors looking to make an impact in the water sector. The combination of her business acumen and focus on sustainability suggests that her influence on water technology will likely rival her previous success in the fitness industry.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!