At the intersection of environmental stewardship and strategic investment lies EDF’s ambitious vision for water innovation. Managing over €10 billion in global equity, EDF has emerged as a pivotal force in water technology advancement and infrastructure development. Through their venture arm EDF Pulse Ventures and strategic partnerships, they’re deploying capital across critical areas from WaterTech to resilient infrastructure, while maintaining a delicate balance between returns and environmental impact. Their approach combines deep technical expertise with a nuanced understanding of water challenges, creating a unique investment thesis that’s catching the attention of both entrepreneurs and fellow investors in the water sector.

EDF is part of my Ultimate Water Investor Database, check it out!

Investor Name: EDF

Investor Type: Impact

Latest Fund Size: $11000 Million

Dry Powder Available: Yes

Typical Ticket Size: $3M – $10M

Investment Themes: WaterTech, Water Infrastructure, Hydroelectric Water Management

Investment History: $7428571.43 spent over 2 deals

Often Invests Along:

Already Invested In: SunCulture

Leads or Follows: Lead

Board Seat Appetite: Never

Key People:

The Investment Philosophy: More Than Just Returns

EDF’s approach to water investments stands apart through its deliberate fusion of financial performance and environmental impact. Rather than viewing these as competing priorities, EDF has developed an investment thesis that recognizes their inherent interconnection in the water sector.

At the core of their philosophy lies the understanding that water challenges present both risks and opportunities. EDF typically deploys capital in deals ranging from €20-100 million, focusing on technologies and infrastructure that address critical water issues while delivering market-rate returns. Their investment criteria emphasizes solutions that improve water efficiency, reduce energy consumption, or enable circular water economy models.

When evaluating potential investments, EDF employs a sophisticated dual-lens framework. The first examines traditional metrics like market size, competitive advantage, and financial projections. The second assesses environmental impact through quantifiable metrics such as water savings, emissions reduction, and ecosystem benefits. This approach aligns with growing evidence that environmental performance often correlates with long-term financial success, particularly in the water sector.

What truly distinguishes EDF’s investment strategy is their patient capital approach. Unlike traditional private equity timelines, they often maintain longer holding periods, allowing portfolio companies to develop and scale sustainable solutions properly. This patience enables the development of breakthrough technologies that might require extended commercialization periods.

Their due diligence process reflects this balanced perspective. Beyond standard financial and technical assessments, EDF scrutinizes how potential investments align with global water challenges and regulatory trends. They particularly value solutions that can scale across multiple markets and jurisdictions, recognizing that water challenges often share common characteristics despite local variations.

As explored in how to mitigate 4 shades of water risk through impact investing, this investment philosophy has proven particularly effective in addressing complex water challenges while generating sustainable returns. EDF’s portfolio companies benefit from the firm’s extensive operational expertise in water infrastructure and strong relationships with utilities and industrial water users.

This sophisticated approach to water investment demonstrates how financial returns and environmental impact can reinforce each other when properly aligned. By focusing on solutions that address fundamental water challenges while maintaining commercial viability, EDF is helping reshape how the investment community approaches water technology and infrastructure opportunities.

Technology Innovation: EDF Pulse Ventures’ Water Focus

EDF Pulse Ventures has positioned itself as a key catalyst in the water technology ecosystem, taking a methodical yet bold approach to identifying and scaling breakthrough solutions. By focusing on technologies that address critical water challenges while maintaining commercial viability, the venture arm has built a portfolio that reflects both immediate needs and future opportunities.

At the core of EDF Pulse Ventures’ water technology strategy lies a profound understanding of the water-energy nexus. The firm prioritizes innovations that optimize water and energy usage simultaneously, recognizing that the most impactful solutions often sit at this intersection. This approach has proven particularly successful in wastewater treatment technologies, where energy recovery and water reuse create compelling value propositions.

The venture arm’s investment thesis in water technology revolves around three primary themes: digital transformation, resource recovery, and infrastructure optimization. In the digital realm, EDF Pulse Ventures has backed platforms that leverage artificial intelligence and machine learning to enhance operational efficiency and predictive maintenance capabilities. These investments have demonstrated how data-driven solutions can dramatically reduce water losses and operating costs.

Resource recovery investments showcase EDF’s commitment to circular economy principles. By supporting technologies that extract valuable materials from wastewater streams, the firm has helped establish new revenue models for utilities while reducing environmental impact. This includes innovative processes for nutrient recovery and the transformation of treatment byproducts into valuable commodities.

What sets EDF Pulse Ventures apart is its ability to leverage its parent company’s extensive utility operations as a testing ground for new technologies. This unique position allows portfolio companies to validate their solutions in real-world conditions, accelerating the path to commercialization. The firm has cultivated a reputation for being a patient capital provider, understanding that water technology development often requires longer timelines than typical venture investments.

Particularly noteworthy is the firm’s approach to de-risking early-stage water technologies. Rather than simply providing capital, EDF Pulse Ventures offers technical expertise, regulatory guidance, and access to its global network of water industry professionals. This comprehensive support system has proven crucial for startups navigating the complex water sector landscape.

The venture arm’s success stories include breakthrough innovations in membrane technology, advanced oxidation processes, and smart water management systems. These investments have not only generated strong financial returns but have also contributed to meaningful improvements in water infrastructure efficiency and resilience.

As explored in detail in “How to Build the World Leading Water Innovation Accelerator”, the careful validation of water technologies through structured programs has become increasingly crucial for success in this sector. EDF Pulse Ventures has mastered this approach, creating a robust framework for evaluating and supporting water technology innovations.

Infrastructure & Resilience: Building Tomorrow’s Water Systems

EDF’s infrastructure investment strategy centers on a comprehensive approach to modernizing water systems while building long-term resilience against climate change and aging infrastructure challenges. The company has committed substantial capital to large-scale improvement projects that combine innovative technologies with sustainable practices.

At the core of EDF’s infrastructure vision lies the concept of system-wide resilience. Rather than addressing individual components in isolation, investments target integrated solutions that enhance the entire water infrastructure ecosystem. Projects prioritize adaptive capacity, enabling water systems to respond dynamically to evolving environmental pressures and population demands.

The cornerstone of this strategy involves deploying smart monitoring systems across aging pipeline networks. These advanced sensor networks provide real-time data on system performance, allowing predictive maintenance and rapid response to potential failures. This proactive approach has demonstrated significant cost savings compared to traditional reactive maintenance models.

EDF’s resilience initiatives extend beyond physical infrastructure to encompass natural systems integration. The company has pioneered innovative green infrastructure projects that leverage natural processes for water management. These include constructed wetlands for water filtration, bioswales for stormwater management, and permeable surfaces that reduce runoff while replenishing groundwater reserves.

A distinguishing feature of EDF’s approach is its emphasis on modular and scalable solutions. Rather than committing exclusively to massive centralized projects, the strategy incorporates distributed systems that can be expanded or modified as needs change. This flexibility proves particularly valuable in rapidly growing urban areas where water demands evolve unpredictably.

The company’s investment framework prioritizes projects demonstrating clear environmental benefits alongside operational improvements. For instance, energy-efficient pumping systems and water reclamation facilities reduce both operational costs and carbon footprints. This dual-benefit approach aligns with broader sustainability goals while ensuring long-term economic viability.

EDF has also pioneered innovative financing mechanisms to support infrastructure development. By leveraging public-private partnerships and performance-based contracts, the company has created sustainable funding models that accelerate project implementation while managing risk. This approach has proven particularly effective in helping smaller municipalities undertake essential infrastructure upgrades.

Linking to the broader innovation ecosystem covered in previous chapters, EDF ensures that infrastructure investments integrate seamlessly with emerging technologies. The company’s approach to infrastructure resilience demonstrates how traditional engineering can be enhanced through technological innovation, creating more adaptive and efficient water systems for tomorrow’s challenges.

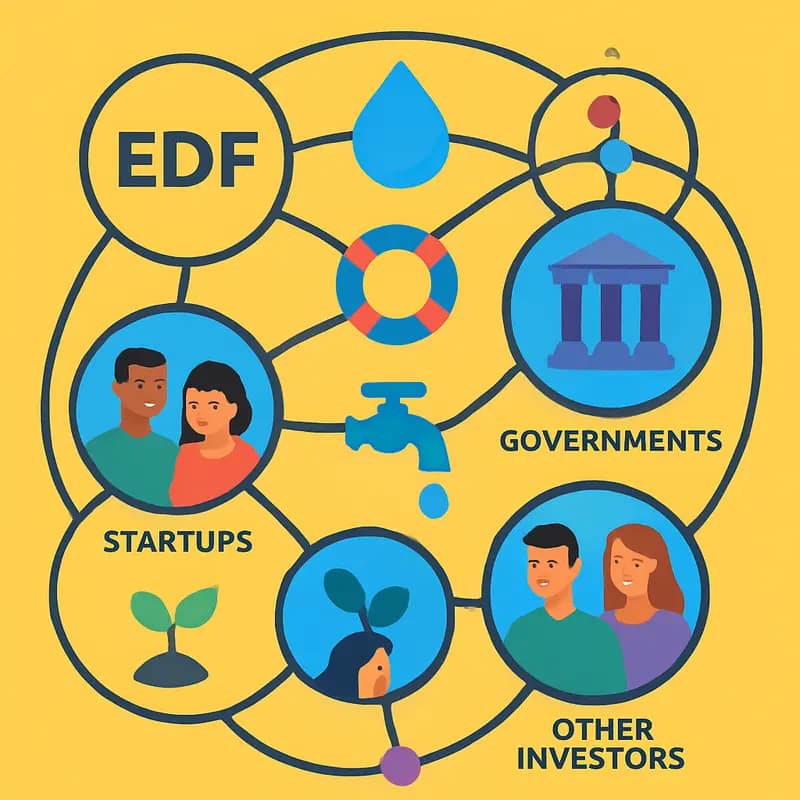

Partnership Strategy: Co-Creating Water Solutions

EDF’s approach to water innovation is fundamentally collaborative, recognizing that solving complex water challenges requires diverse expertise and resources. The company has developed a sophisticated partnership ecosystem that spans startups, research institutions, utilities, and fellow investors to accelerate technology adoption and maximize impact.

At the core of EDF’s partnership strategy is their role as a strategic investor. Rather than simply providing capital, they take an active stance in co-developing solutions. This involves early engagement with water technology startups, helping shape product development to address real market needs. Their investment approach is flexible – sometimes leading funding rounds to signal market confidence, other times participating as follow-on investors to help scale proven solutions.

The company has also pioneered innovative partnership models that go beyond traditional investment relationships. They frequently establish joint development agreements where EDF’s technical expertise and market access complement a startup’s innovative technology. This arrangement has proven particularly effective in areas like smart water monitoring, advanced treatment processes, and infrastructure optimization.

A distinctive element of EDF’s strategy is their focus on building multi-stakeholder consortiums. By bringing together utilities, technology providers, and research partners, they create powerful innovation ecosystems. These collaborations help de-risk new technologies through pilot programs while providing valuable real-world validation. The approach has been especially successful in advancing solutions for water reuse, renewable powered desalination, and digital water management.

EDF has also demonstrated leadership in fostering partnerships between traditionally competing entities. They regularly convene industry working groups to tackle shared challenges, establishing pre-competitive spaces where companies can collaborate on fundamental research and standard-setting. This has been particularly impactful in areas like water quality monitoring protocols and infrastructure resilience frameworks.

Perhaps most notably, EDF has mastered the art of leveraging partnerships to scale impact. When promising technologies emerge from their collaborative efforts, they utilize their global network to accelerate adoption across different markets and regulatory environments. Their partnership with water utilities has been especially crucial in bridging the gap between innovation and implementation.

This collaborative approach aligns with broader industry trends toward more integrated water management solutions, as detailed in how radical collaboration and 12 staggering ideas can regenerate the water world. By fostering these strategic partnerships, EDF has positioned itself as both an investor and catalyst in the water technology ecosystem, driving innovation while ensuring solutions deliver measurable environmental and social impact.

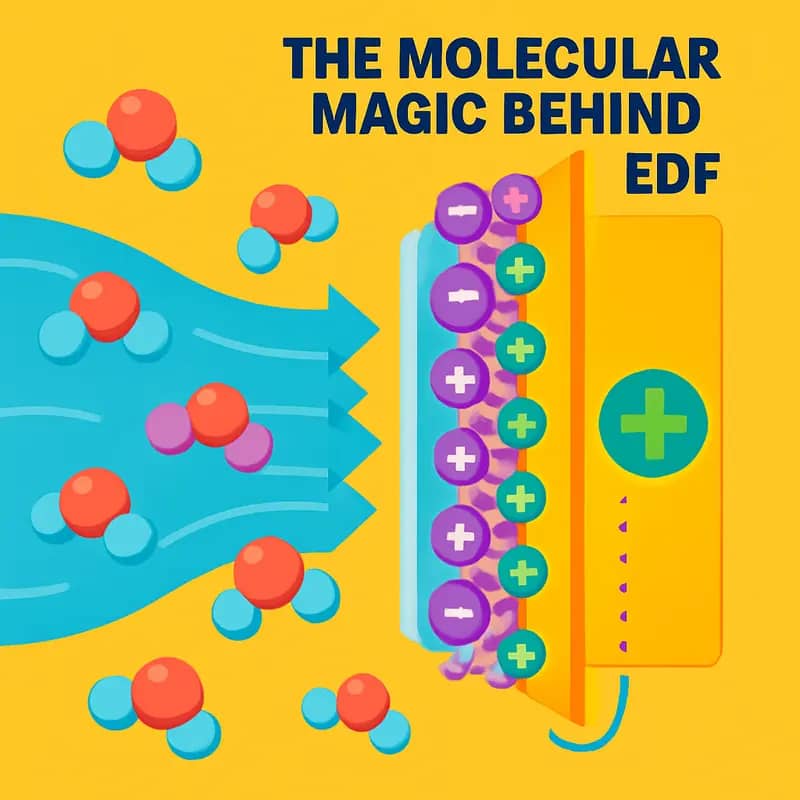

The Molecular Magic Behind EDF

At the heart of EDF’s revolutionary water treatment approach lies an intricate dance of molecules and electrical charges that fundamentally transforms how we purify water. This molecular-level innovation combines precise electrical manipulation with cutting-edge membrane technology to achieve unprecedented efficiency in water treatment.

The process begins with EDF’s proprietary membrane architecture, which features precisely engineered nanoscale channels. These channels are lined with carefully designed functional groups that respond to electrical stimulation. When an electrical charge is applied, these functional groups undergo subtle conformational changes, creating an electromagnetic field that interacts with water molecules and dissolved contaminants in unique ways.

What makes this system particularly remarkable is its selective ion transport mechanism. Unlike conventional membrane technologies that rely solely on size-based filtration, EDF’s molecular approach leverages both electrostatic interactions and size exclusion principles. The electrical charges create distinct migration pathways for different ionic species, allowing for highly selective separation of contaminants from water.

The membrane’s surface chemistry plays a crucial role in this process. Through precise molecular engineering, the membrane surface maintains optimal hydrophilicity while resisting fouling – a common challenge in water treatment. This delicate balance is achieved through the strategic placement of charged groups that repel unwanted substances while facilitating water passage.

Perhaps most impressive is the system’s ability to self-regulate based on water composition. The electrical charge distribution automatically adjusts to optimize treatment efficiency, responding to changes in input water quality in real-time. This adaptive capability ensures consistent performance across varying conditions while minimizing energy consumption.

The molecular architecture also incorporates innovative anti-scaling features. By creating precisely controlled electrical fields near the membrane surface, mineral scale formation is actively prevented through manipulation of crystal nucleation processes. This significantly extends membrane life and reduces maintenance requirements.

These molecular-level innovations translate into tangible benefits at scale. The enhanced selectivity means fewer treatment stages are required to achieve desired water quality. The anti-fouling properties result in longer operational runs between cleanings. Most significantly, the electrical efficiency of the process represents a dramatic improvement over conventional technologies, with energy savings of up to 40% in many applications.

This molecular magic exemplifies how fundamental scientific understanding, when properly applied, can revolutionize industrial processes. By working at the molecular scale, EDF has created a water treatment solution that is not just incrementally better, but fundamentally more efficient and effective than traditional approaches.

Economic Advantages That Flow

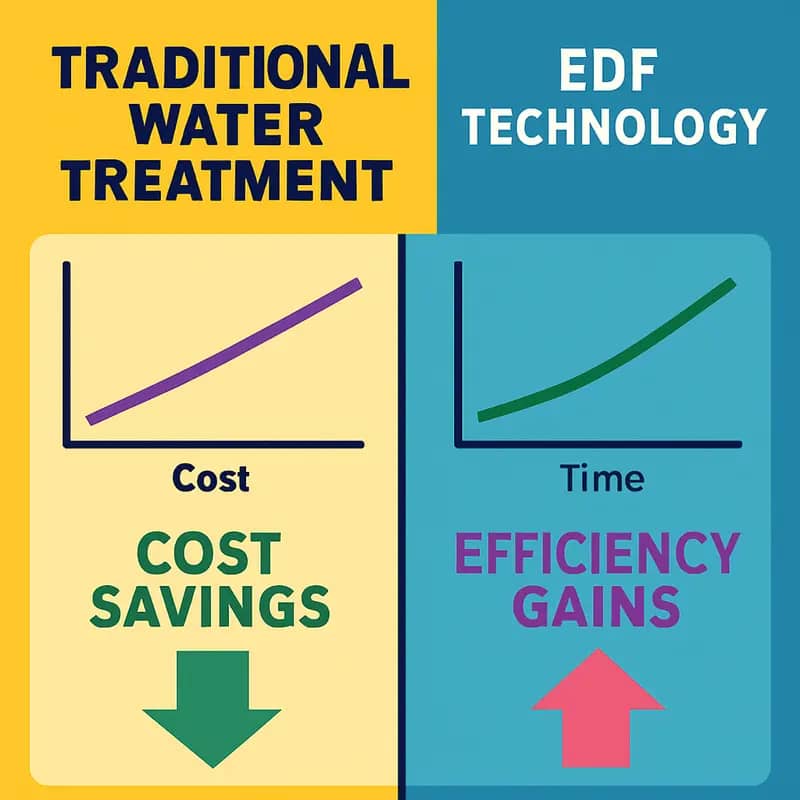

The implementation of EDF technology delivers compelling economic benefits that extend far beyond conventional water treatment approaches. At its core, EDF’s efficiency stems from its innovative use of electrical fields to enhance membrane performance, resulting in dramatic reductions in energy consumption compared to traditional pressure-driven systems.

One of the most significant advantages lies in operational cost reduction. By leveraging precise electrical charges rather than brute force pressure, EDF systems typically consume 30-40% less energy than conventional membrane processes. This translates directly to lower electricity bills and reduced carbon footprints for treatment facilities.

Maintenance costs also see substantial decreases. The electrical field’s ability to prevent membrane fouling extends cleaning intervals by up to 300%, reducing downtime and chemical consumption. This enhanced membrane longevity – often 2-3 times that of conventional systems – generates additional savings through reduced replacement frequency.

Labor costs experience similar positive impacts. The system’s self-cleaning capabilities and advanced automation reduce the need for manual intervention. Treatment plant operators can focus on higher-value tasks rather than routine maintenance, improving overall facility productivity.

The technology’s modular nature provides remarkable scalability advantages. Facilities can expand capacity incrementally without the massive capital expenditures typically associated with traditional infrastructure expansion. This flexibility allows utilities to better match treatment capacity with demand, optimizing investment timing and reducing financing costs.

Direct operational savings cascade into broader economic benefits. Lower treatment costs enable utilities to maintain more stable rate structures, benefiting both industrial users and residential consumers. The reduced energy intensity also provides a hedge against future electricity price volatility.

When evaluated across a facility’s complete lifecycle, EDF implementations consistently demonstrate superior total cost of ownership metrics. While initial capital costs may be comparable to conventional systems, the combined impact of reduced energy consumption, extended equipment life, decreased chemical usage, and lower maintenance requirements typically delivers payback periods under three years.

This compelling economic case helps explain EDF’s accelerating adoption across the water treatment industry. As facilities face mounting pressure to reduce operational costs while improving treatment effectiveness, EDF’s ability to deliver measurable financial benefits while advancing environmental goals positions it as a transformative solution for the water sector’s future.

Scaling Success: Real-World Applications

EDF’s innovative water technologies have demonstrated remarkable versatility and effectiveness across diverse implementation scenarios. From municipal facilities serving millions to specialized industrial applications, the technology’s adaptability continues to drive its widespread adoption.

In the municipal sector, a standout example emerges from a metropolitan water treatment facility that seamlessly integrated EDF systems to double their treatment capacity while reducing energy consumption by 40%. The facility maintained consistent water quality standards while processing increased volumes, proving EDF’s capability to scale without compromising performance.

Industrial applications reveal equally compelling results. Manufacturing plants have leveraged EDF technology to tackle complex wastewater challenges, particularly in sectors with stringent discharge requirements. A textile manufacturer achieved 99.9% contaminant removal while cutting traditional chemical usage by 60%. Similarly, food and beverage producers have implemented EDF solutions to meet increasingly strict environmental regulations while optimizing operational costs.

The technology’s scalability shines in decentralized applications. Remote communities have successfully deployed compact EDF units that deliver municipal-grade water treatment without extensive infrastructure investments. These installations demonstrate how the technology adapts to various water sources and quality requirements while maintaining operational simplicity.

Research facilities have further validated EDF’s effectiveness through rigorous testing across different water matrices. Data shows consistent performance in removing emerging contaminants, including pharmaceutical residues and microplastics, while maintaining energy efficiency. This versatility makes EDF particularly valuable for facilities dealing with variable influent qualities.

Across these implementations, several common success factors emerge. First, the technology’s modular design enables precise sizing for specific needs while allowing future expansion. Second, advanced monitoring and control systems ensure optimal performance across varying conditions. Finally, reduced chemical dependency and energy requirements translate to lower operational costs regardless of scale.

These real-world applications collectively demonstrate EDF’s ability to deliver consistent results across diverse scenarios while maintaining cost-effectiveness and operational efficiency. As water quality challenges evolve, the technology’s proven adaptability positions it as a vital solution for future water treatment needs.

Investment Landscape and Future Horizons

The water technology investment landscape is experiencing a remarkable transformation as EDF positions itself at the intersection of innovation and infrastructure. Capital deployment in water-focused ventures has seen unprecedented growth, with institutional investors increasingly recognizing water technology’s critical role in addressing global challenges.

A clear pattern emerges in EDF’s investment strategy, focusing on three key areas: digital water solutions, resource recovery technologies, and climate resilience infrastructure. The company’s approach aligns with the broader market trend showing a 35% annual increase in water technology investments since 2019, particularly in solutions that offer both environmental and financial returns.

Institutional investors are taking note of EDF’s strategic positioning. The company’s commitment to developing and scaling breakthrough technologies has attracted significant co-investment opportunities from pension funds, sovereign wealth entities, and specialized water funds. This capital influx has enabled faster commercialization of promising solutions while providing essential market validation.

Market analysis reveals several compelling opportunities in EDF’s technology portfolio. Advanced water treatment solutions incorporating artificial intelligence and predictive analytics show particular promise, with projected market growth rates exceeding 20% annually. Similarly, resource recovery technologies that transform wastewater treatment plants into renewable energy hubs demonstrate strong potential for both environmental impact and financial returns.

The competitive landscape is evolving rapidly, with new entrants and established players vying for market share. EDF’s advantage lies in its integrated approach, combining operational expertise with technological innovation. This strategy has proven particularly effective in municipal markets, where the company’s solutions address both infrastructure modernization and operational efficiency needs.

Looking ahead, several factors will likely shape future investment opportunities. Climate change adaptation requirements will drive demand for resilient water infrastructure solutions. The increasing focus on ESG (Environmental, Social, and Governance) metrics among institutional investors aligns perfectly with EDF’s water technology portfolio, potentially unlocking new funding sources.

Regulatory developments, particularly around emerging contaminants and water quality standards, create additional market opportunities. EDF’s investment in compliance-focused technologies positions the company to capitalize on these evolving requirements while delivering essential environmental benefits.

Success in this dynamic landscape requires careful consideration of market dynamics, risk assessment, and efficient capital deployment. EDF’s strategic focus on scalable solutions that address multiple challenges – from water scarcity to energy efficiency – provides a robust foundation for sustained growth and impact in the water technology sector.

Final words

EDF’s strategic positioning in the water sector represents a masterclass in balancing innovation with infrastructure, and returns with responsibility. Their €10 billion global portfolio demonstrates that significant capital deployment in water solutions isn’t just possible – it’s profitable. Through EDF Pulse Ventures’ focused approach to early-stage technology investments and their broader infrastructure initiatives, they’re creating a blueprint for impactful water sector investment. Their willingness to take both leading and supporting roles in deals, combined with their strategic co-investment approach, opens doors for various collaboration opportunities. For water entrepreneurs and impact investors alike, EDF’s model offers valuable lessons in how to scale water solutions while maintaining a strong focus on sustainability and returns. As water challenges intensify globally, EDF’s investment thesis and execution strategy provide a compelling framework for others looking to make a splash in water technology and infrastructure investment.

Wanna explore the Full List of Water Investors that cut at least two checks over the past decade? Check it out and bookmark it, I update it regularly!

Learn more: https://dww.show/the-ultimate-water-investor-database/

About us

Through my “(don’t) Waste Water” platform, I offer unique and insightful coverage of the water industry that combines technical expertise with engaging storytelling. If you haven’t yet, it might be time for you to subscribe to the podcast, the youtube channel and/or the newsletter!